Understanding NFT Futures: A New DeFi Primitive for Cultural Assets

TechFlow Selected TechFlow Selected

Understanding NFT Futures: A New DeFi Primitive for Cultural Assets

Futures trading could dominate the NFT market.

Author: GCR Team

Translation: Luffy, Foresight News

Overview:

-

Dominance of futures ("perps") trading: At the time of writing, crypto futures trading dominates, accounting for over 60% of total trading volume compared to spot trading. This phenomenon is not unique to cryptocurrency and also exists in traditional financial markets.

-

NFT 1.0 transactions dominated by spot trading: Initially, NFT trading was driven by spot transactions, generating massive volumes with over $20 billion in total transaction value. However, it created inefficiencies: only long positions were allowed, and mid- to small-sized collectors had limited or no access to high-value collections.

-

NFT communities are culture-driven organizations: NFT collections successfully bring together users who share interests, beliefs, and values, creating social structures enjoyed globally. These cultural elements are reinforced through virtual or real-world events around the world, much like other communities (e.g., anime) have done for decades.

-

NFT futures aim to solve current inefficiencies in spot NFT trading: NFT perpetual futures ("NFT Perps") address inefficiencies in spot NFT trading. They allow nearly any trade size, both long and short positions, and leveraged trading.

-

Spot trading will remain significant but evolve: We expect spot trading and collecting itself will continue to be important, especially for accessing utilities tied to NFTs and for community and digital identity layers. Collectors seeking utility and community engagement may still buy on the spot market. Meanwhile, futures markets can serve other types of participants, as well as collectors looking to hedge or pursue different trading strategies.

Futures Dominate Markets

For much of early crypto history, markets only offered spot trading, where users exchanged fiat money, other cryptocurrencies, or stablecoins for tokens. This led to several inefficiencies:

-

Long-only exposure: With spot trading, users could only go long (profit when prices rise). This prevented market participants from hedging losses or profiting from price declines.

-

Limited leverage: Relying solely on spot trading limited investors' leverage. While one could borrow assets, sell them, and hope to repurchase later at a lower price to establish a short position, this method is capital-inefficient (requires collateral) and may be difficult or costly for illiquid tokens (high borrowing rates).

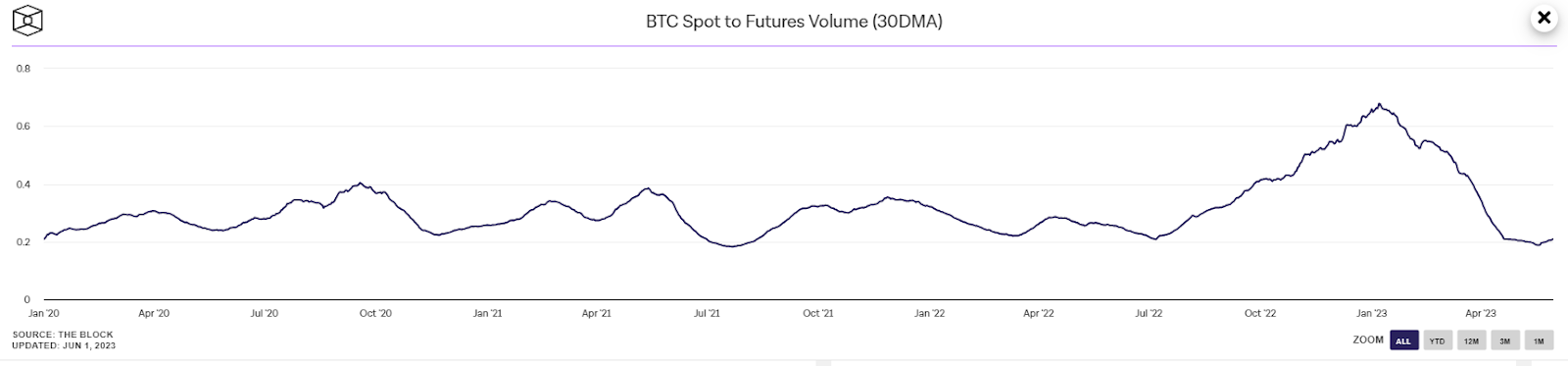

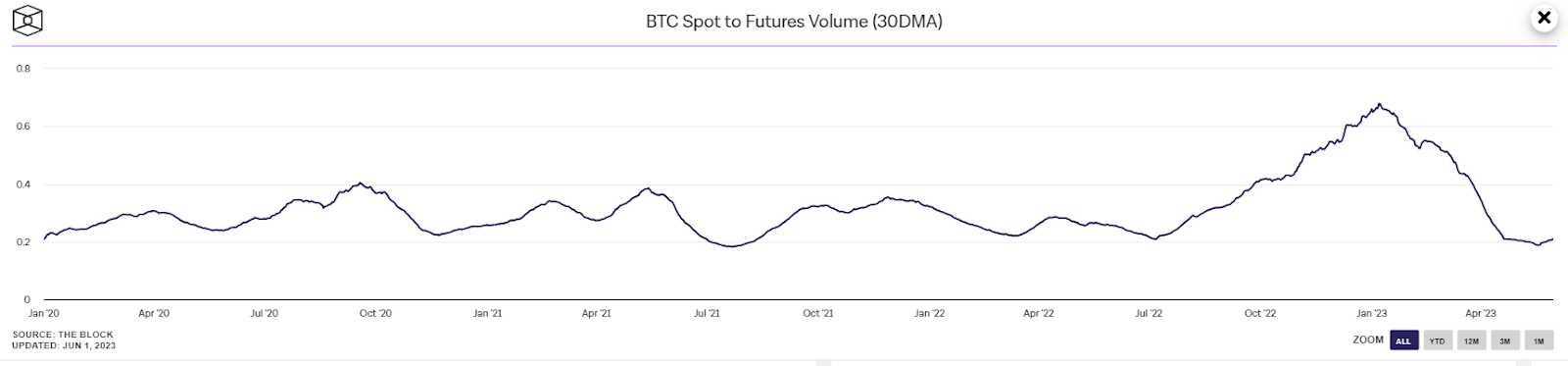

However, everything changed when BitMEX launched perpetual futures markets ("Perps") and the Chicago Mercantile Exchange (CME) introduced its first BTC futures in December 2017: perpetual futures began to dominate. As of writing, perpetual futures dominate crypto trading activity. For BTC and ETH, spot trading volume represents only a fraction of perpetual futures: 20%-70% for BTC and 16%-44% for ETH.

Source: The Block

NFT Markets: History Repeats Itself

2021 marked the beginning of the NFT bull run. During this period, NFT technology began gaining global attention and adoption. NFTs were used not only for generative art and photography but also as credentials for accessing communities and became key components of our digital identities via profile pictures, among many other uses.

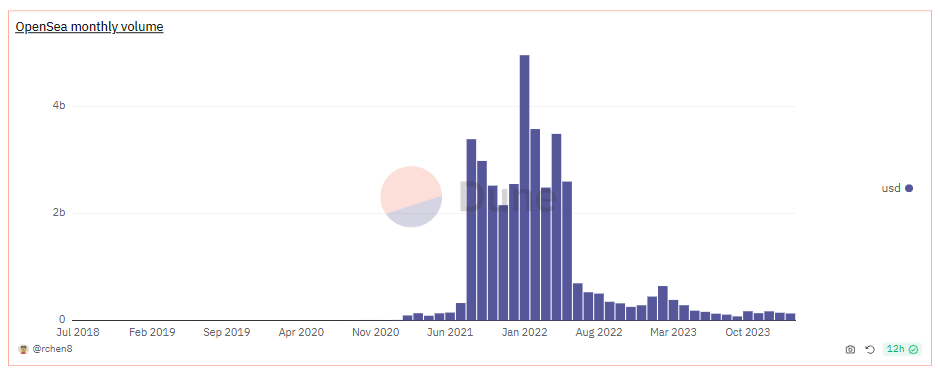

All these use cases helped push Web3 into the spotlight—drawing in large numbers of users, builders, collectors, speculators, and traders. Massive capital flowed into the NFT ecosystem, with on-chain NFT trading volume exceeding $21 billion in 2021 (a 20,000% year-over-year increase) and $24.7 billion in 2022 (17% growth), according to Dune Analytics and DappRadar. This growth was fueled by popular NFT launches such as Otherside, Metaverse, Azukis, and Moonbirds.

Source: Dune

Despite the influx of capital, the non-fungible nature of NFTs and the lack of infrastructure at the time restricted individuals to only spot NFT trading. This created friction and prevented collectors from easily entering or exiting positions. Collectors had to wait for someone to accept their listing price or match the current ask. Moreover, as collection values rose, it reduced smaller investors’ ability to acquire high-priced items. Additionally, similar to the 2017 fungible crypto token market, only long positions were permitted.

During the 2022–2023 bear market, the NFT ecosystem saw many innovations and new entrants, including Blur (with its incentivized bidding pool and lending feature Blend) and NFT AMMs (like Sudoswap). These platforms aimed to deliver seamless trading experiences and improve liquidity. However, as we'll see later, these models still fail to enable seamless shorting or resolve capital efficiency issues.

Notably, this does not mean NFT AMMs or lending lack strong value propositions. In our view, NFT AMMs are fully capable of helping collectors build and incentivize community-owned marketplaces, creating an economic loop that benefits the entire collector ecosystem: trading fees flow back to collectors, creating value for holders and enabling better relationship management.

History Doesn't Repeat, But It Rhymes: NFT 2.0

NFT perpetual futures (NFT Perps) are a new type of derivative that allows investors to trade NFTs with improved liquidity. Similar to traditional crypto perpetual futures, NFT perpetuals differ in that they track the price of NFT collections. NFT perpetuals offer several advantages over traditional NFT spot markets, enhancing the trading experience:

-

Fast access: NFT futures allow investors to enter and exit positions instantly without purchasing the underlying asset or listing an NFT on NFT marketplaces, aggregators, or NFT AMMs. This is beneficial because it reduces the overhead of storing or transferring NFTs.

-

Hedging opportunities and two-way markets: Until now, NFT investors could only "go long" on NFT markets. With NFT perpetuals, investors can establish "market-neutral" positions by shorting perpetual contracts while still enjoying the utility, community, and other benefits of owning NFTs. Additionally, it enables them to profit from negative catalysts affecting a collection.

-

Leverage: Until now, NFT investors could only use leverage by borrowing NFTs on platforms like Arcade or Paraspace. However, besides introducing friction (users must deploy borrowed funds into other trading activities), NFT lending may lack capital efficiency in certain cases, as it requires holding a full NFT asset in inventory to gain leverage.

-

Scalability flexibility: NFT perpetuals allow users to gain exposure to desired NFT collections at any scale, as they don’t need to acquire a specific NFT or pay its asking price. Users can thus trade $100 worth of BAYC or just $0.1 worth. This gives small holders access to positions in NFT collections they otherwise couldn't afford through spot trading. It also allows institutions and large collectors to trade at larger scales without impacting prices through floor sweeps.

-

Attracting new users: The availability of small-scale trading mentioned above may attract more retail collectors and traders to the space, which can then bring them deeper into the broader blockchain ecosystem.

As previously mentioned, the 2023 "bear market" brought innovation to the NFT space, and some might argue that other verticals and participants could solve the problems listed above. Let's dive deeper:

On-chain NFT options: They address hedging possibilities, directional NFT market risk, and can offer varying contract sizes. However, options are a more complex product than perpetual contracts, which are widely known due to their popularity on centralized exchanges. Furthermore, different strike prices or expiration dates may suffer from low liquidity, creating friction.

Fractionalized NFTs: Fractionalization lowers the entry barrier for high-value collections and enables trading at any scale. However, fractional NFTs come with pitfalls:

-

Capital inefficiency: The fractionalization process requires users to buy an NFT and lock it in a contract to initiate the process, making it capital-inefficient.

-

Fungibility limitations: A fraction of one NFT does not equal a fraction of another, even within the same collection.

-

Limited liquidity and scale: As noted earlier, building a liquid trading pool for a specific NFT can be challenging.

-

Governance and redemption issues: NFT redemptions may face friction due to the need for consensus among holders.

NFT AMMs: NFT Automated Market Makers (AMMs) address liquidity incentives, create more liquid markets, and support trading NFT collections at any scale. However, they still suffer from capital inefficiency since they require depositing NFTs into pools. Additionally, NFT AMMs do not allow shorting.

NFT Perpetual Protocols

nftperp: The Pioneer

Founded: 2022 | Stage: Private Alpha | Funding Raised: $4.7 million

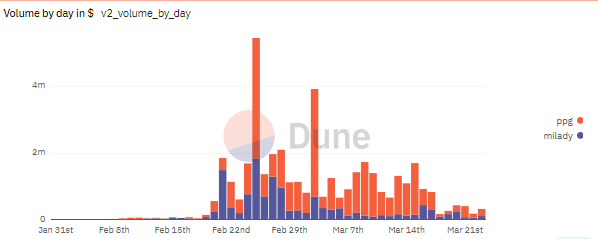

nftperp is the pioneer in the NFT perpetual protocol space. The platform offers a seamless trading experience integrated into a simple and thoughtfully designed user interface. At the time of writing, the protocol is rolling out v2, allowing users to trade collections such as Miladies and Pudgy Penguins—all through a DApp running on Arbitrum to reduce gas fees.

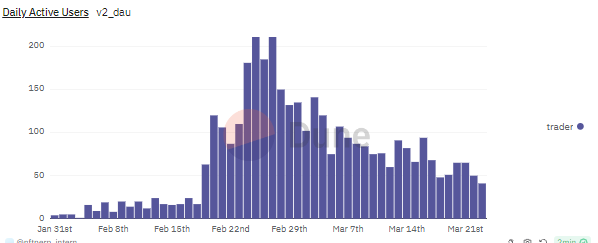

According to nftperp’s Dune dashboard, the protocol has achieved over $8.3 million in trading volume during its v1 launch, serving more than 800 traders (whitelisted users).

Source: Dune

Tribe3: Gamified and Social Trading

Founded: 2022 | Stage: v2 Testnet | Funding Raised: $2.1 million

Tribe3 is an NFT futures DEX that integrates social and gamification elements into its trading platform. Beyond NFT futures trading, users can engage in battles with others (community vs. community trading) and earn in-game items based on trading behavior. The platform allows users to trade multiple NFT series with up to 5x leverage.

The platform completed its v1 public test with $71 million in trading volume and over 840 active traders. At the time of writing, the platform is testing its updated protocol design on the v2 testnet.

Wasabi: A Full-Fledged and Thriving NFT Derivatives Platform

Founded: N/A | Stage: Public | Funding Raised: N/A

Wasabi has built a comprehensive suite of derivatives for NFTs. The protocol initially offered put and call options for specific NFT series, allowing users to go long or short before a specific date without facing liquidation risks.

To expand its offerings, Wasabi launched:

-

BNPL: Wasabi partnered with various NFT lending protocols to allow users to seamlessly purchase NFTs with "buy now, pay later" functionality

-

Perpetual contracts: Recently, Wasabi partnered with Flooring Protocol to launch an index-based perpetual contract product, enabling users to trade any whitelisted NFT collection with up to 5x leverage.

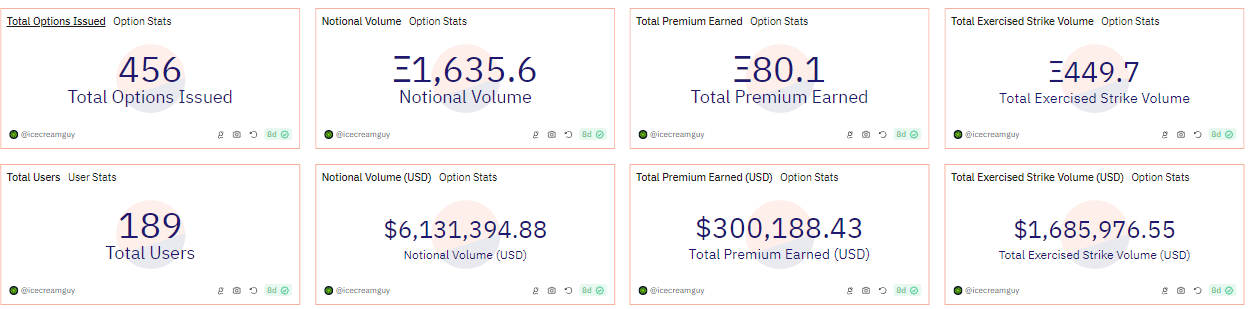

According to Wasabi’s Dune dashboard, the nominal value traded on its options product reached $6.1 million, with liquidity providers earning $300,000 in fees.

Source: Dune

The perpetual futures product has achieved over $40 million in trading volume, with approximately 470 active traders.

Source: Dune

Conclusion

NFT futures apply the concept of perpetual trading to NFTs, unlocking a more accessible and two-way trading experience previously unavailable in NFT spot markets. While it may be too early to draw definitive conclusions, the potential value proposition of NFT futures holds strong growth potential within the NFT market.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News