Analyzing the crypto cycle: bull markets begin with institutional capital flowing top-down; beware market reversals caused by excessive euphoria

TechFlow Selected TechFlow Selected

Analyzing the crypto cycle: bull markets begin with institutional capital flowing top-down; beware market reversals caused by excessive euphoria

The collective is always short-sighted; the momentum of the group hinders individual decision-making.

Author: MATTI

Translation: TechFlow

In hindsight, things may seem inevitable. Sometimes the difference between inevitable and impossible is small—perhaps just a few weeks of price action. I want to explore this distinction from a retrospective perspective.

Two interacting forces shape a cryptocurrency bull market. Resources (capital) flow top-down, while products (ideas) emerge bottom-up. Combining capital with the right ideas sparks innovation—or at least imagination. At that point, exploration turns into exploitation.

I will share personal anecdotes from recent years, then discuss the difference between the exploration and exploitation phases of the cycle. In closing, I’ll outline possible future scenarios and offer personal reflections.

Resources

In crypto, we’ve rapidly shifted from extreme fear to extreme apathy to an environment of high expectations—all within about 12 months. The collective always seems short-sighted, but group momentum often overrides individual judgment.

After the deep panic at the end of 2022, most investors were unwilling to deploy capital, and some had entirely abandoned crypto. During the extreme apathy of summer 2023, many refrained from investing due to capital constraints, as macroeconomic trends painted a bleak outlook.

By late 2023, markets surged, driven by ETF sentiment and top-down narratives like Solana’s rise. When speaking with fellow investors during 2023, almost none expressed optimism. Among those who had resources, few were actually deploying them.

Across both liquidity and venture capital in crypto, many investors were caught off guard by the sudden bullish turn—many expected another six months of winter. The prospect of a golden bull run emerged almost overnight, leaving investors confused.

Those with liquidity scrambled to buy tokens they should have bought a year earlier, while resource-rich VCs chased the hottest stories—mainly L2s and AI projects. We can observe this through:

-

Over-subscription

-

KOL/angel-only rounds

-

Fierce pricing competition

-

Shares selling out quickly

Those who felt over-allocated in December 2022 now feel under-allocated by March 2024. Capital inflows into liquid funds accelerated at the end of 2023, followed by increased capital calls from VC funds (few of which still had discretionary resources).

Based on my personal experience fundraising for a crypto VC fund since mid-2023, it has been nearly impossible to find LPs actively allocating. On the fund-of-funds (FoF) side, most are struggling to raise capital, pushing back deployment schedules each quarter, while the few with resources prefer larger firms.

In summer 2023, a partner at a large FoF said they were agonizing over writing $500,000 checks. Another FoF privately admitted they’d spoken with around 100 crypto VC funds raising in 2023 (more than I could even name), but allocated to none. This isn’t unique to crypto—venture capital broadly dried up across sectors.

For crypto, however, beyond the broader macro collapse, there was an additional micro-crisis: FTX. Shortly before FTX collapsed, I spoke with a U.S. FoF that said they had committed tens of millions to crypto managers, but the FoF itself wouldn’t begin fundraising until late 2022. I haven’t heard they successfully raised. When crypto funds came calling, many LPs found they couldn’t fulfill their capital commitments.

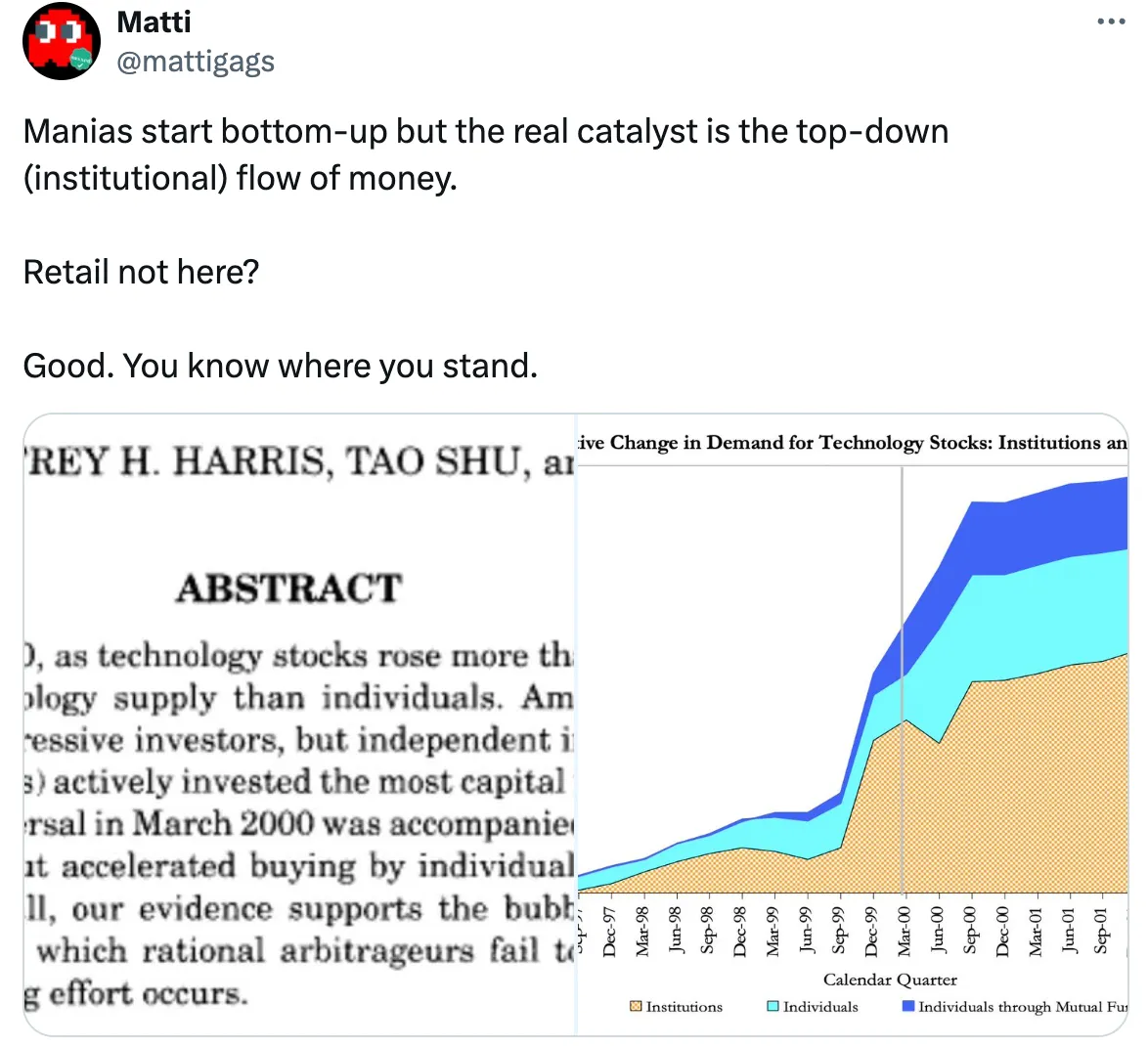

The FTX fallout also delayed new capital entering crypto, as many family offices and funds—both small and large—that were eager for exposure lost interest. Few investors truly think independently—that’s why we get manias and disillusionment.

Yet comparing the 2018 and 2022/23 crypto winters, the outcome shows significantly greater confidence in crypto from traditional finance. Before FTX, I spoke with nearly everyone in traditional finance who hadn’t entered or only dabbled in crypto—they believed it was here to stay. That wasn’t the case in 2018.

In summary, based on my limited personal experience, venture and liquidity allocators have been sidelined by rapid shifts in sentiment. This means a funnel has formed around existing narratives, and the market is accelerating.

The bull market catalyst is capital flowing into ETFs and liquid crypto funds, repricing the secondary market (already underway). On the primary side, I expect resources flowing into crypto venture to increase in the second half of 2024, but mostly in 2025, further intensifying an already competitive landscape.

Ideas

Following the Luna crash and FTX collapse, the bear market swiftly turned into a purge—sellers dumped quickly, and those still active remained stunned. If they did allocate assets, they did so uneasily. Founder activity declined as many turned their attention to the AI boom.

Narrative reset arrived fast. The disillusionment phase of crypto helps explore new ideas, selecting the best ones for development when narratives shift toward mania. The exploration phase sets the stage for later imitation races. Exploration is about finding the mythical “innovation trigger.”

Throughout 2023, deal flow was most diverse, as no single dominant narrative emerged. There were clusters—intent, ZK, rollups/L2s, ordinals—and others, mainly infrastructure-related.

Founders were forced to think before exciting risk investors. At this stage, both founders and investors were eager to explore. This is when crypto is at its most creative. Marginal improvements on hot topics didn’t matter much, as there weren’t enough hot topics in bear markets, and excitement rarely lasted long.

With the market surge at the end of 2023, the search for the “innovation trigger” ended—the cards were dealt. I believe the Overton window for this bull run has opened. But that doesn’t mean the best-performing companies have already emerged and are ready for investment.

(Editor’s note: The Overton window is a theory describing the range of policies politically acceptable to the mainstream at a given time.)

Uniswap might have been one of the most copied products in the last cycle, but OlympusDAO—the progenitor of DeFi 2.0—only appeared months after the DeFi summer. There’s still room for innovation, but it must build upon existing narratives.

The most promising narratives today are:

-

Crypto AI/agents

-

Restaking

-

Layer 2s

-

ZK

-

Infrastructure

-

DeSci

-

SocialFi/Web3 social

These are highly uncertain categories—more like rough labels for what people are building. Many products may combine two or more of these. Winners will be those who master traditional user acquisition tools: yield and leverage. “Digital gains” remain the best UX.

Exploration vs. Exploitation

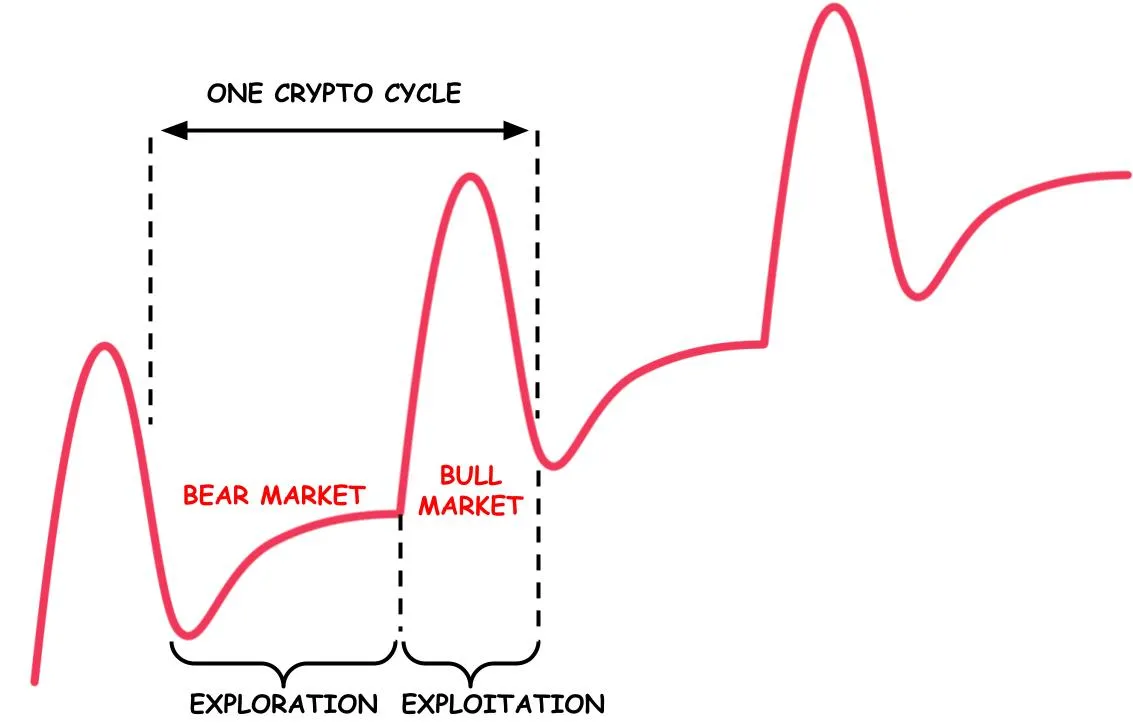

Let’s briefly discuss the game theory of exploration vs. exploitation. Crypto cycles involve two behaviors. One is where people are forced to come up with seemingly new things; the other is where people exploit those novelties through exaggerated narratives.

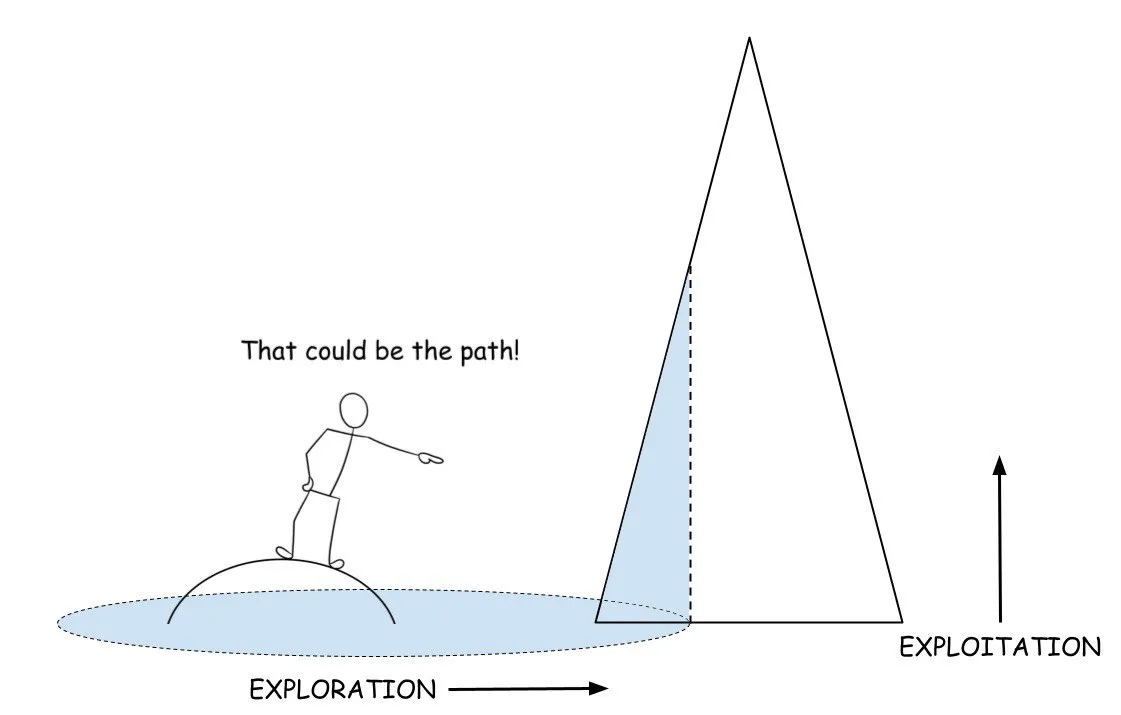

During bear markets, we’re stuck at a local maximum. With old narratives collapsed and unable to sustain the market, founders are forced to explore, and investors reluctantly follow. The “innovation trigger” is the foothill of a new global maximum. This becomes the target of exploration—a foundation for new narratives.

As previous ideas become dead ends, founders return to square one, expanding the exploration space. As prices keep falling or stagnating, the incentive grows to abandon the safety of old narratives and explore potentially larger novel territories.

At some point, explorers spot the foothills that could lead to a new global peak. Typically, foothill formation is a function of novelty and price recovery. While this may be more correlation than causation—it’s enough to start climbing and forming a unified narrative.

The climb signals the end of exploration—we’ve established a base camp and begin exploiting market momentum. Here, the reflexive relationship between novelty and price starts pushing the global peak higher. Price becomes a leading indicator of adoption.

As of March 2024, we appear to have found the foothills, and everyone is rushing to climb the new peak, as it promises better returns than further exploration.

What Comes Next?

The exploration phase has ended. Given that most investors are passive, they won’t waste time exploring—they’ll double down instead, as they must make up for lost ground. Funding rounds are becoming oversubscribed, indicating investors are now in full exploitation mode.

2024 resembles 2020 and 2016—a year dominated by internal hype. The active retail base in crypto is already larger than in 2020, meaning we’re starting from a higher baseline. Despite limited innovation over the past two years, we’re now mobilizing resources.

Developers focus on resources; explorers focus on ideas. There’s a subtle difference between being an investor and “being in the investment business” (investors versus allocators).

Exploitation strategy is also a function of scale. Most well-resourced funds focus solely on exploitation, because innovation or exploration doesn’t require as much capital as competing along the exploitation axis. Dumb money is far more prevalent than outsiders believe or insiders admit.

Given that during any mania, vast amounts of capital chase scarce genius, many will compromise to meet deployment targets. Or as Hobart and Huber put it: “While genius is scarce, the demand for credulity is always met by an ample supply of fraud.” Expectations are inflated, founders are incentivized to join the resource war, subsidizing yields for exotic variants.

As the VC fundraising machine kicks into gear, top-down capital flows will gradually increase. Competitive early insider rounds mean that before mass retail participation, insiders and institutional capital will support the market. Moreover, retail is not a homogeneous group, but rather waves of adoption throughout the cycle.

Those once most fearful are turning into fearless bulls. But this is just the other side of insecurity. Remember, insecurity is the mother of greed, and today’s market is brimming with insecurity.

The truth is, crypto hasn’t seen much innovation over the past two years, making it hard to view this bull run as independent from the last. Thematically, it appears to be a continuation of the prior cycle—but larger in scale, as yield arbitrage becomes more profitable and institutional doors open with ETF approvals.

For a runaway mania, imagination triggers are more effective than innovation triggers. Reflexivity is unleashed again, and most in the space are supporting kayfabe. The role of credit has yet to play out in this cycle.

(Editor’s note: “kayfabe” has evolved into a code word for maintaining this “reality” in the presence of the public, directly or indirectly.)

A few months ago, I wrote in an investor letter:

Each crypto cycle tends to destroy itself through excesses in its foundational principles. 2017 was destroyed by excessive enthusiasm for ICOs; 2021, by the over-leveraging of DeFi narratives. Each mania’s core principle is an imitative scramble for immediate wealth.

This rally began with top-down institutional capital flows. No truly shiny new thing emerged. The potential mania ahead rests on institutional inflows (and credit?) and price action itself. Will this cycle be destroyed by overexposure to institutions? Let’s wait and see.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News