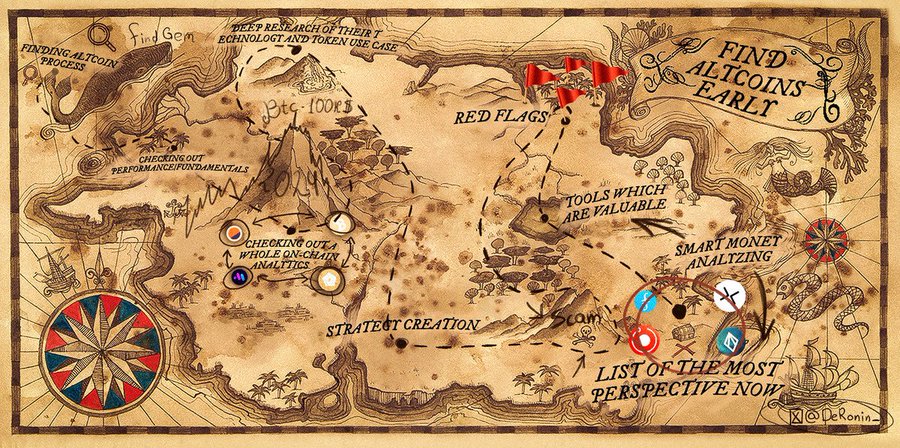

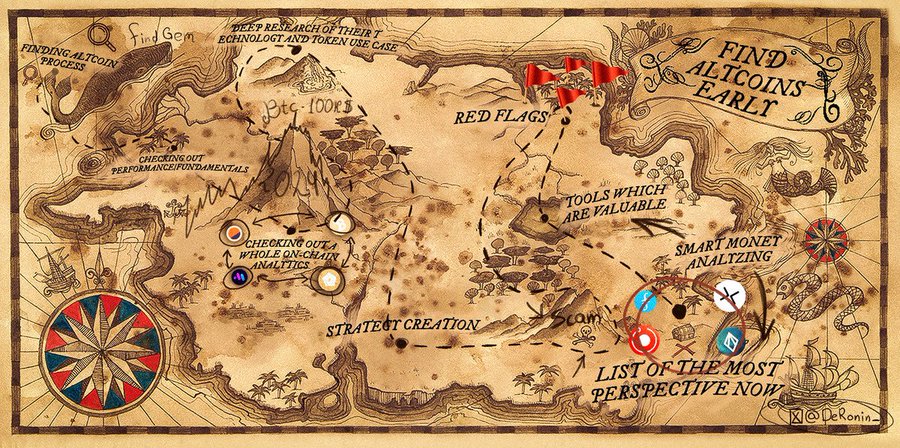

How to Identify High-Potential Projects: A Guide to Altcoin Research

TechFlow Selected TechFlow Selected

How to Identify High-Potential Projects: A Guide to Altcoin Research

Reject following the herd; build your own investment logic.

Author: Ronin, Crypto KOL

Translation: Felix, PANews

Crypto KOL Ronin shares the secrets of successful investing he learned after becoming a venture capital analyst, and has created a guide on how to research altcoins. This guide distills four years of industry experience—strategies typically used by major VC firms. Readers can follow this step-by-step guide to determine whether they should invest in a specific token.

Discovering Tokens

No token will see significant price movement without a compelling narrative. Therefore, the first step is researching the narrative.

1. How to Research Narratives?

Two of the most practical tools are:

-

X

-

Dune

Simply search "top crypto narratives" on X or visit Dune Analytics and find the dashboard on crypto narratives created by Crypto Koryo. Type "narrative" into the search bar.

2. Selecting Tokens

Visit one of the following platforms:

-

CoinMarketCap

-

Coingecko

-

DefiLlama

Go to the "Categories" section and select tokens within each narrative.

Token Research

1. Whitepaper Analysis

-

You must understand what the project is building—at least at a fundamental level.

-

Find the whitepaper of the selected project (usually available on its official website).

2. Check Basic Information

The best platform for this is Defi Llama. Search for a project and examine the following metrics:

-

Review the "Information" tab, precise TVL, and its trend.

-

Check unlock schedules, potential sell pressure, allocation details, and whether holders intend to hold long-term.

3. Team and Advisors

Only two steps required:

-

Visit LinkedIn and locate their profiles.

-

Analyze each team member’s professional background and previous projects.

4. Partnerships and Collaborations

Search on Twitter: "{project name} partnership / collaboration / engagement".

Or

Visit the project's official Twitter account and review all listed partnerships.

On-Chain Analysis and Researching Technology and Token Use Cases

Go to "Categories" on Coingecko and select tokens within your chosen narrative:

-

New tokens launched after May 2022 (post previous bull run)

-

Overall upward price trend

-

Low MCAP (higher growth potential)

-

MCAP/FDV close to 1 (fully diluted valuation)

Visit the token’s website and go through this checklist by asking yourself:

-

What problem does this token solve?

-

Can the token’s use case scale to a larger market?

-

Does the roadmap clearly outline short-term and long-term goals?

Use Defi Llama to check if the token has shown consistent growth over 7 to 30 days in:

-

TVL

-

Trading volume

-

Stablecoin MCAP (new money entering the chain)

Check token unlocks via Token Unlocks or the whitepaper, paying attention to:

-

Major unlock events or "one-time unlocks"

-

High FDV relative to market cap

Avoid tokens with large unlocks scheduled within the next 60–90 days.

Developing a Strategy

Answering these three questions is critical:

-

Why?

-

When?

-

At what price to enter?

Here’s how to find answers:

1. Assess Social Media Hype

Look for three key indicators:

-

Widely followed by KOLs, projects, and VCs

-

Strong community sentiment

-

High potential for acquiring new users

2. Evaluate Competitors

Analyze projects that are at least 90% similar in product offering to the target project.

3. Entry Plan

-

Use a "laddering" strategy to buy tokens (dollar-cost averaging)

-

Or wait for a market crash to accumulate

Identifying Red Flags

This is the most crucial step—because in crypto, risk avoidance is key to long-term profitability.

No losses = Profit made (Golden Rule)

Diversify Investments

-

Invest in 10–20 different projects you've researched thoroughly or have strong convictions about.

-

Ideally, spread investments across different narratives and sectors.

Valuable Tools

On-chain analysis:

-

Dune (monitor all relevant metrics in projects and narratives)

-

CryptoRank.io (news aggregator, funding and unlock tracker—find comprehensive project data)

-

Nansen (track smart contract tokens and VC holdings—to monitor wallets and detect relevant purchases)

-

ApeSpace (100+ technical analysis indicators, including price alert bots and token purchase bots)

-

Bubblemaps (investigate token holders, track wallets, discover new meme coins)

Trading:

-

Etherdrops Bot: tool to track wallets and their activity (degens, VCs)

-

Mest: track smart money (holdings, purchases)

-

AlphaScan AI: AI-powered DeFi sentiment analysis to identify undervalued early-stage tokens → discover and speculate on new degen tokens

DeFi:

-

DropsTab: crypto aggregator for funding data, token unlocks, etc.

-

Blockpour: access all relevant metrics and statistics for dApps

-

Token Metrics: use AI to accurately predict and rank cryptocurrencies → assist intelligent buying decisions

-

DustSweeper: app to clean token balances and redeem ETH, extract and consolidate ETH from multiple wallets

Analysis:

-

Token Terminal: track market segments (liquid staking, derivatives)

-

Arkham: track wallet activity and market maker / VC holdings

-

Santiment: explore emerging narratives and reports

-

DappRadar: analyze dApp and NFT data across ~55 blockchains, interact with non-tokenized projects and qualify for airdrops

Others:

-

Web3 Antivirus: browser extension to prevent scams and wallet drain attacks

-

LunarCrush: connects brands, enterprises, and creators through measurable social engagement and verifiable rewards

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News