The Past, Present, and Future of Appchains

TechFlow Selected TechFlow Selected

The Past, Present, and Future of Appchains

One can envision a future where every application has its own customized chain, meeting its specific needs while remaining interconnected with other applications.

Author: NAIROLF AND THOR

Translation: TechFlow

Introduction

Ethereum has become a foundational platform for numerous innovations ranging from blockchain gaming and NFTs to DeFi protocols for lending, asset management, and trading.

However, as projects mature and find their positioning in the market, they encounter a critical challenge: pressure on Ethereum's network resources. Projects like AAVE, Uniswap, and dYdX coexist within Ethereum, each relying on its computational resources to serve users. This dependence leads to competition over network capacity, negatively impacting both applications and their users.

Users increasingly bear the burden of rising transaction fees, reducing accessibility and affordability for small-capital participants. Meanwhile, these growing costs constrain dApps' ability to expand their user base, hindering their potential growth.

But the challenges extend beyond transaction fees. While revolutionary, Ethereum’s mainnet lacks the flexibility necessary for sustained innovation. One example is the EVM: it has inherent design limitations unsuitable for many use cases, yet applications must work around them.

In essence, these applications’ growth is constrained by Ethereum’s own limitations—a reality we cannot ignore.

Key Takeaways

-

Limited Solutions

-

Appchains

-

Rollup-as-a-Service

-

Case Studies

-

Looking Ahead

-

Conclusion

Limited Solutions

Facing this challenge, projects have several options:

First, a project could launch initially on another high-performance chain outside of Ethereum. One might consider Solana or Sei. However, it's important to recognize that these chains may lack Ethereum’s broad user base and often require learning new programming languages beyond Solidity. Moreover, projects would still be limited by the capacity of these chains and must compete with others for computational resources.

Alternatively, expanding across multiple other chains can unlock access to different user groups while offering lower fees on certain networks. However, this diversification also fragments liquidity across multiple chains, potentially leading to suboptimal outcomes. Examples of this approach include AAVE, Uniswap, and Curve.

Yet, the limitations presented by these options may not meet every project’s requirements. Thus, appchains emerge as a third alternative.

Appchains

The term “appchain” refers to blockchains dedicated to a specific application. Unlike general-purpose blockchains such as Arbitrum or Ethereum, which host thousands of applications, appchains are purpose-built for a single application.

Appchains come in various forms—Layer 1, Layer 2, or even Layer 3—depending on infrastructure and customization needs.

Regarding customization, the potential for innovation within an appchain is virtually limitless. Tired of the EVM? Explore alternatives like Cartesi VM or MoveVM. Prefer allowing users to pay fees using native tokens or WIF? Entirely feasible.

These are just a few examples. Additionally, various stacks are available for building appchains, including Cosmos SDK, OP Stack, Arbitrum Orbit, zkSync’s ZK Stack, and more. Data availability layers also offer significant customization options, such as Celestia, NearDA, AvailDA, EigenDA, among others.

The sky’s the limit.

This approach completely eliminates performance issues, as resources are fully dedicated to your application, removing competition. By tuning block space, block time, and other parameters, transaction fees can be optimized to minimal levels.

Finally, appchains can provide additional revenue streams for projects. Instead of paying fees to Ethereum, users pay directly to the appchain. As a result, applications no longer need to pay to "rent" Ethereum’s infrastructure, enabling them to capture all generated revenue.

You get the idea—choosing an appchain means choosing flexibility and scalability.

Building Appchains Easily with Rollup-as-a-Service Platforms

These benefits naturally attract numerous projects in the space. As you can imagine, building a blockchain can be complex and requires substantial technical and financial resources.

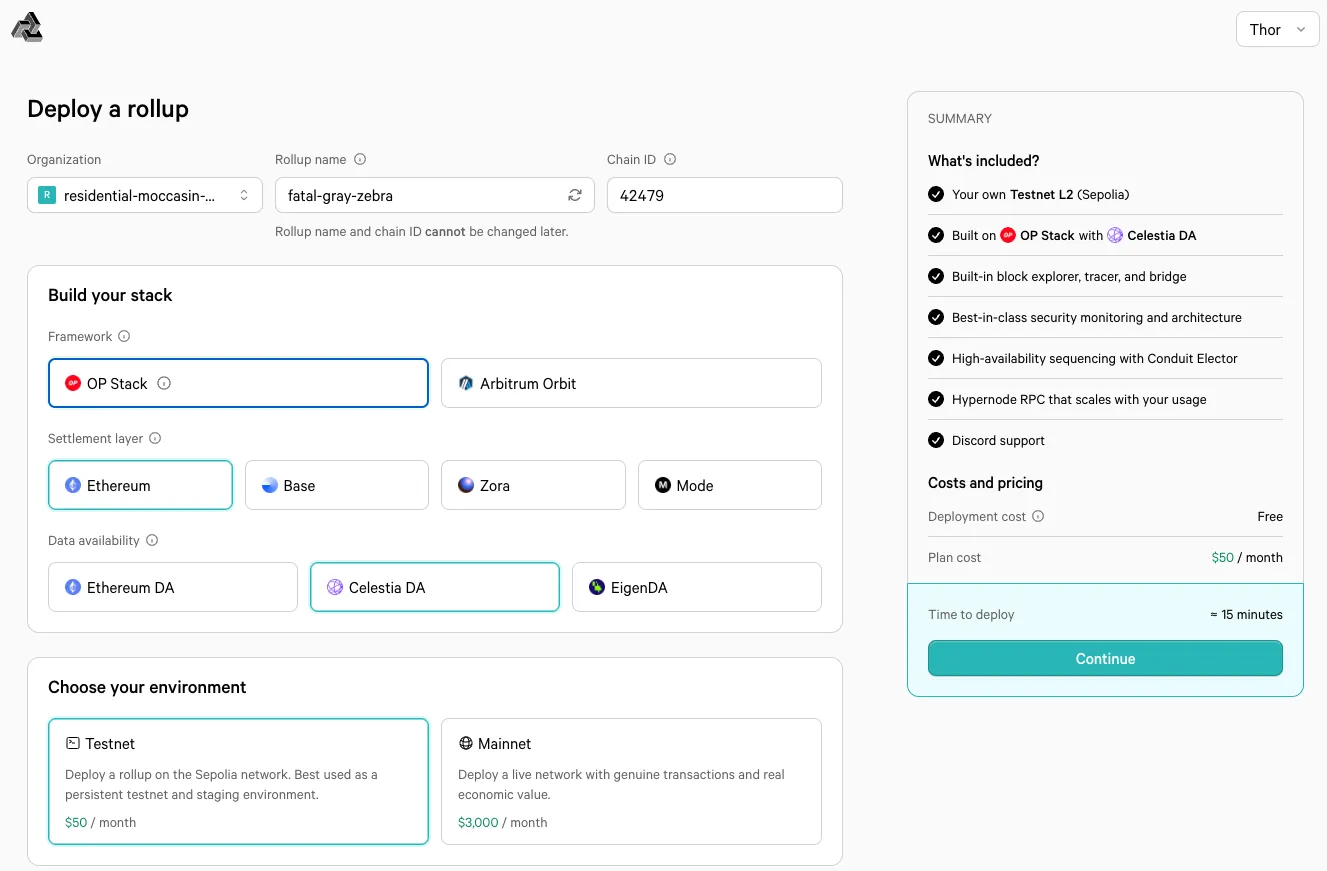

This has led to the emergence of Rollup-as-a-Service (RaaS) platforms like AltLayer and Conduit. Essentially, these platforms simplify rollup deployment and operations, reducing the process to just a few clicks and minutes. Notably, this service applies not only to standalone blockchains but also to rollups.

Take Aevo, one of the leading decentralized derivatives exchanges. By leveraging Conduit, a RaaS provider, they deployed their own rollup atop Ethereum. Shortly after, they partnered with Celestia, cutting their monthly data availability costs by tens of thousands of dollars while retaining Ethereum as the settlement layer. This strategic shift perfectly highlights the themes introduced earlier in our discussion. By adopting the appchain model, Aevo reduced costs and enhanced overall performance, paving the way for unlimited growth opportunities.

Case Studies

dYdX is a well-known decentralized order book exchange backed by Paradigm, a16z, and Polychain. In 2022, it launched its own L1 using the Cosmos SDK and Tendermint consensus mechanism. Prior to transitioning to an appchain model, dYdX maintained its order book off-chain, making it not truly decentralized. The reason was that the underlying blockchain had block times lasting several seconds, while trade latency needed to be only a few milliseconds—far from ideal for trading markets. Thanks to the appchain model, dYdX achieved true decentralization by hosting the order book within validators instead of adding it on-chain, something impossible without becoming an appchain.

Hyperliquid is a perpetual DEX with an order book built on its own chain, Hyperliquid L1. We spoke with the Hyperliquid team about their decision to build an appchain, and they justified the choice:

“Solutions built on general-purpose L1s cannot scale to replace centralized exchanges as the default venue for price discovery.” They further explained, “Appchains allow dedicated L1 functionality, enhanced scalability, and greater transparency.” They also pointed out the competition for block space on blockchains like Ethereum or Arbitrum: “These chains have gas fees and other protocols, meaning users compete with others during high volatility periods to get their transactions processed. That’s simply not sustainable or scalable.”

Hyperliquid clearly underscores the limitations of general-purpose blockchains and demonstrates how choosing the appchain model helps protocols scale effectively.

Lyra is a decentralized options protocol. Recently, Lyra launched its appchain—a rollup built using Optimism’s tech stack. This move enables Lyra to deliver high throughput, low latency, and low costs while still benefiting from Ethereum as the settlement layer. Additionally, Lyra uses Celestia as its data availability layer, reducing its data availability fees from 42 ETH in December 2023 to just 0.5 ETH in January 2023.

Zora is a decentralized NFT platform built on the Zora Network—an Ethereum Layer 2 constructed using Optimism’s technology stack. Through the Zora Network, Zora makes NFT minting faster, cheaper, and more scalable. At the time of writing, Zora has attracted over 900,000 unique collectors and generated over $300 million in secondary market sales.

Stride is a Cosmos-based appchain focused on liquid staking. Leveraging Interchain Accounts, Stride interacts with other chains like Celestia and Dymension to stake users’ tokens and create liquid representations of those tokens. As of March 13, Stride’s TVL exceeds $180 million.

These are just a few examples—there are many more projects, with essentially all Cosmos chains being appchains.

Looking Ahead

Appchains undoubtedly have a bright future. Nevertheless, several key areas remain ripe for improvement, with interoperability being one of the most crucial. While building their own chain offers significant performance gains and customization capabilities, it also implies isolation within their own domain. While this may not be an issue for some, it could severely hinder the growth of many applications. Ideally, appchains should seek ways to access data from other chains or facilitate cross-chain interactions. To address this, numerous projects now focus specifically on interoperability, such as Hyperlane and IBC.

Hyperlane is the first interoperability layer enabling appchains or other networks to connect to any blockchain permissionlessly. For instance, they facilitated connections and bridging between the aforementioned Stride appchain and other rollups.

While these efforts are far from perfect, they mark the beginning of a frictionless interchain future—one where users may not even realize which chain they’re interacting with.

Another compelling narrative is the modularity that appchains can leverage. Thanks to their flexible design, appchains can customize their infrastructure and integrate various modular components. For example, an appchain might incorporate Celestia for data availability, Hyperlane for interchain connectivity, and Espresso as a shared sequencer. The potential combinations are nearly endless.

Ethereum’s recent Dencun upgrade marks a significant milestone for appchains aiming to position themselves as Ethereum L2 solutions. As previously observed with Lyra and Aevo, leveraging alternative data availability layers drastically reduces their costs. With anticipated dramatic reductions in Ethereum rollup fees, it’s easy to envision applications shifting back to Ethereum as their data availability layer.

Conclusion

Given their numerous advantages, appchains will continue attracting many projects in the future. One can envision a world where each application runs on its own customized chain tailored to its specific needs, while remaining interconnected with others. In this scenario, Ethereum would serve as the ultimate settlement layer, securing the entire ecosystem. While such predictions are speculative, their feasibility remains entirely plausible.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News