CoinGecko Report: The RWA Wave is Rising, Tokenized US Treasuries Grew Over 6x Last Year

TechFlow Selected TechFlow Selected

CoinGecko Report: The RWA Wave is Rising, Tokenized US Treasuries Grew Over 6x Last Year

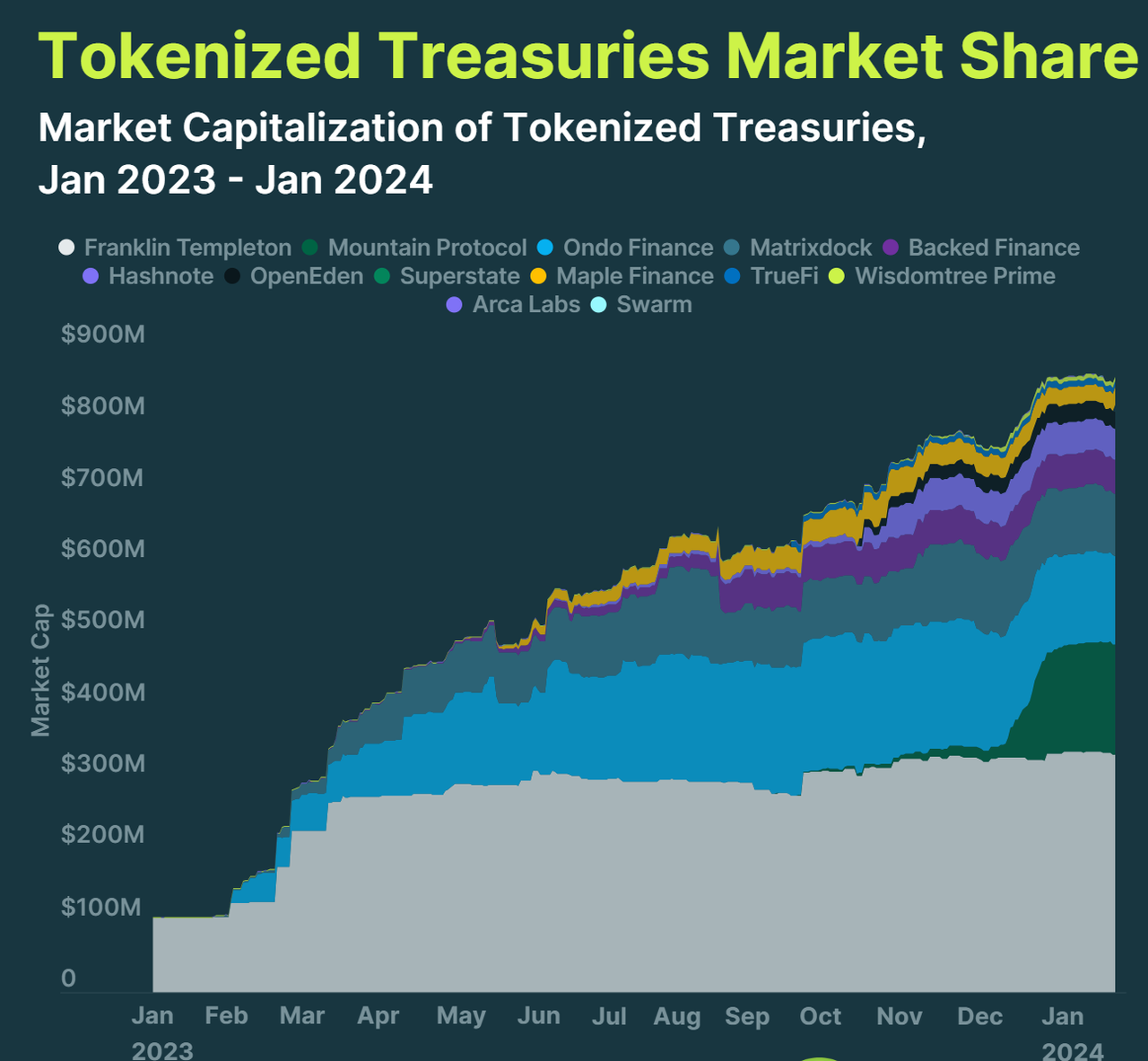

The total TVL of tokenized U.S. Treasuries surged from $114 million in January 2023 to $845 million by year-end.

Source: CoinGecko

Compiled by: 1912212.eth, Foresight News

RWA sits at the intersection of the real world and blockchain, issuers and investors. The ability to serve effectively as an intermediary at this crossroads will be key to its success. While reliance on third parties—such as oracles, custodians, and credit rating agencies—is inevitable, efficiently utilizing and managing these entities remains crucial for sustainable operations.

In 2021 and 2022, uncollateralized lending platforms such as Maple, Goldfinch, and Clearpool gave rise to private credit markets, allowing large institutions to borrow funds based on their creditworthiness. However, these protocols suffered severe defaults due to the collapses of Luna, Three Arrows Capital, and FTX. As DeFi yields sharply declined in 2023 and users flocked to rising U.S. Treasury rates, tokenized Treasuries experienced explosive growth. With total value locked (TVL) in tokenized Treasuries surging from $114 million in January 2023 to $845 million by year-end, providers such as Ondo Finance, Franklin Templeton, and OpenEden saw significant capital inflows.

The 2024 RWA development report highlights four main points:

1. Most RWAs are USD-pegged stablecoins

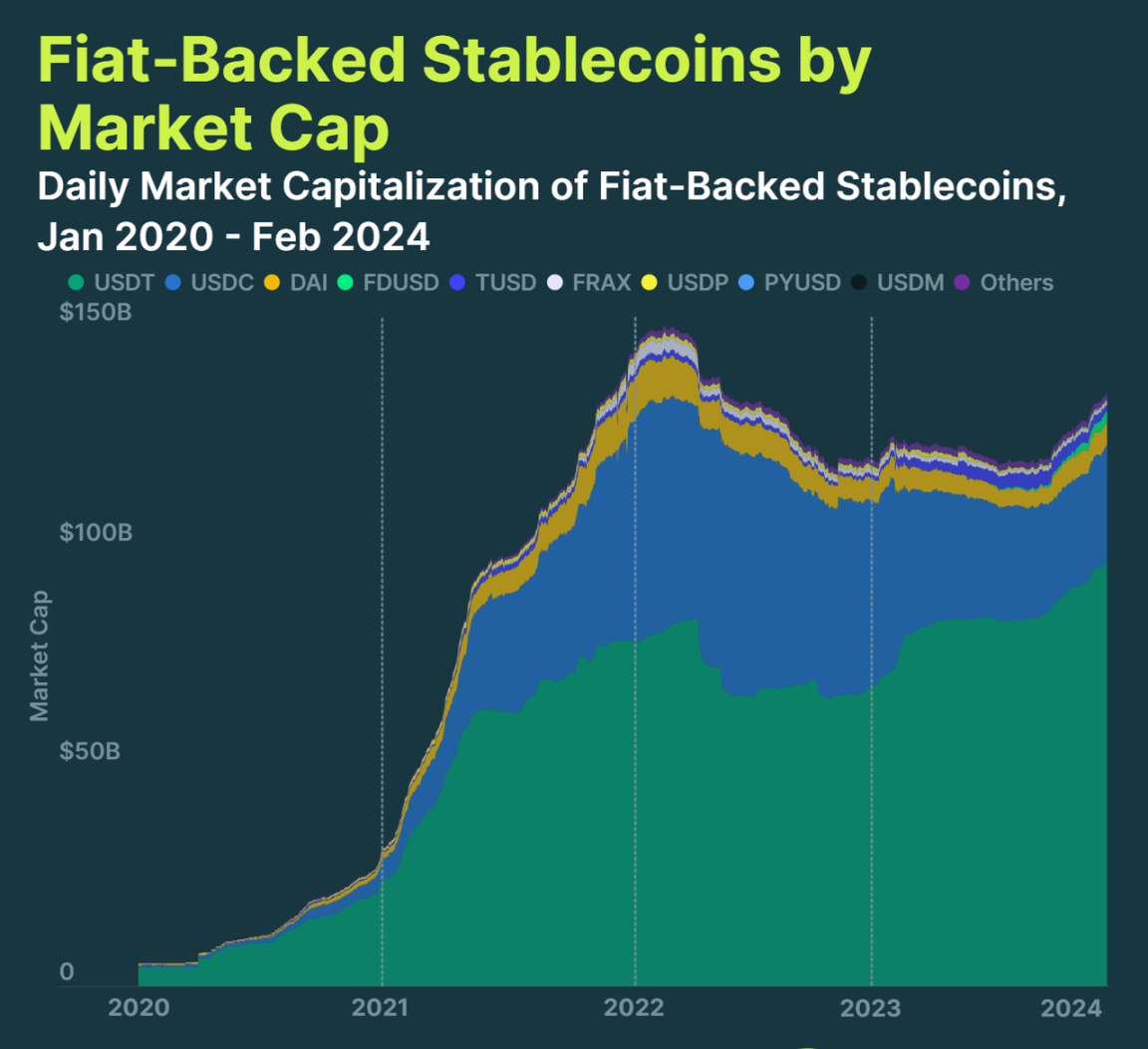

The top three USD-pegged stablecoins alone account for 95% of the market, with USDT at $96.1 billion, USDC at $26.8 billion, and DAI at $4.9 billion. USDT continues to dominate, holding a 71.4% market share. Meanwhile, USDC’s market share dropped significantly after briefly de-pegging during the U.S. banking crisis in March 2023 and has yet to recover.

Stable assets pegged to non-USD fiat currencies make up just 1% of the market. These include other fiat currencies such as Euro Tether (EURT), CNH Tether (CNHT), Mexican Peso Tether (MXNT), EURC (EURC), Stasis Euro (EURS), and BiLira (TRYB).

The market cap of stable assets rose rapidly from $5.2 billion in early 2020 to a peak of $150.1 billion in March 2022, then gradually declined throughout the bear market. However, by 2024, it grew 4.9%, increasing from $128.2 billion at the start of the year to $134.6 billion on February 1.

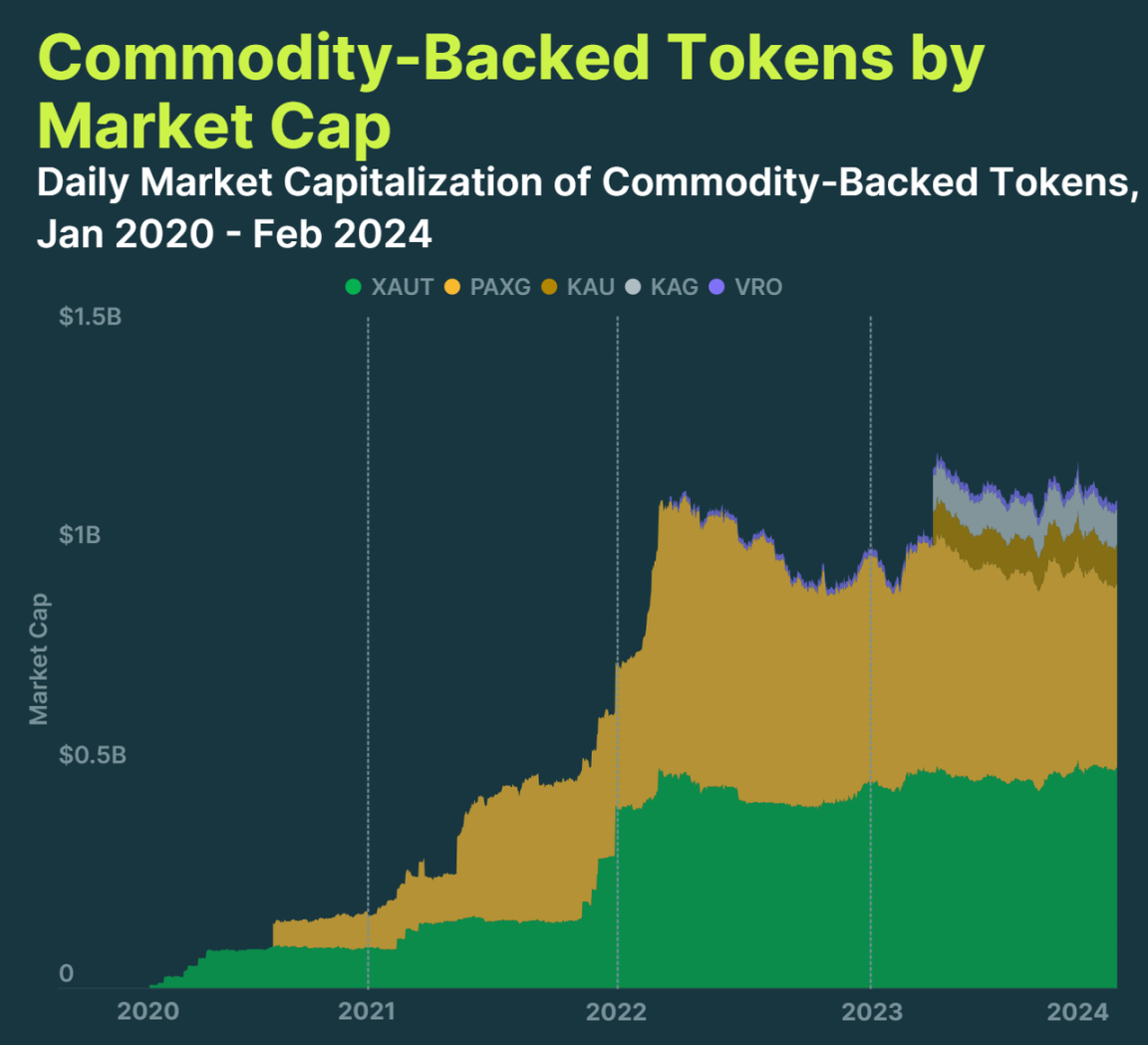

2. Commodity-backed tokens reach $1.01 billion in market cap, with gold remaining the most popular asset

Tokenized precious metals such as Tether Gold (XAUT) and PAX Gold (PAXG) account for 83% of the market cap of commodity-backed tokens. XAUT and PAXG are backed by one troy ounce of physical gold, while Kinesis Gold (KAU) and VeraOne (VRO) are backed by one gram of gold.

Although tokenized precious metals dominate, tokens backed by other commodities have also been launched. For example, the Uranium308 project issued tokenized uranium, whose price is linked to that of one pound of U3O8 uranium compound. It can even be redeemed, though only after passing strict compliance procedures.

While commodity-backed tokens have reached a market cap of $1.1 billion, this represents only 0.8% of the market cap of fiat-backed stablecoins.

3. Tokenized U.S. Treasury products grew 641% in 2023, now valued at over $861 million

Tokenized U.S. Treasuries surged in popularity during the bear market, growing from $114 million in market cap in 2023 to $845 million—an increase of 641%. However, momentum stalled starting in 2024, with a 1.9% increase in January bringing the market cap to $861 million.

Franklin Templeton is currently the largest issuer of tokenized U.S. Treasuries, having issued $332 million worth of tokens through its on-chain U.S. government money market fund, giving it a market share slightly above 38.6%.

Yield-bearing stablecoin issuers such as Mountain Protocol and Ondo Finance are also popular. Since launching in September 2023, Mountain Protocol had minted $154 million of USDM tokens by February 2024, while Ondo's yield-bearing stablecoin USDY reached a market cap of $132.4 million.

Most tokenized treasuries are built on Ethereum, capturing 57.5% of the market. However, companies such as Franklin Templeton and WisdomTree Prime have chosen to issue on Stellar, where they now hold a dominant 39% share.

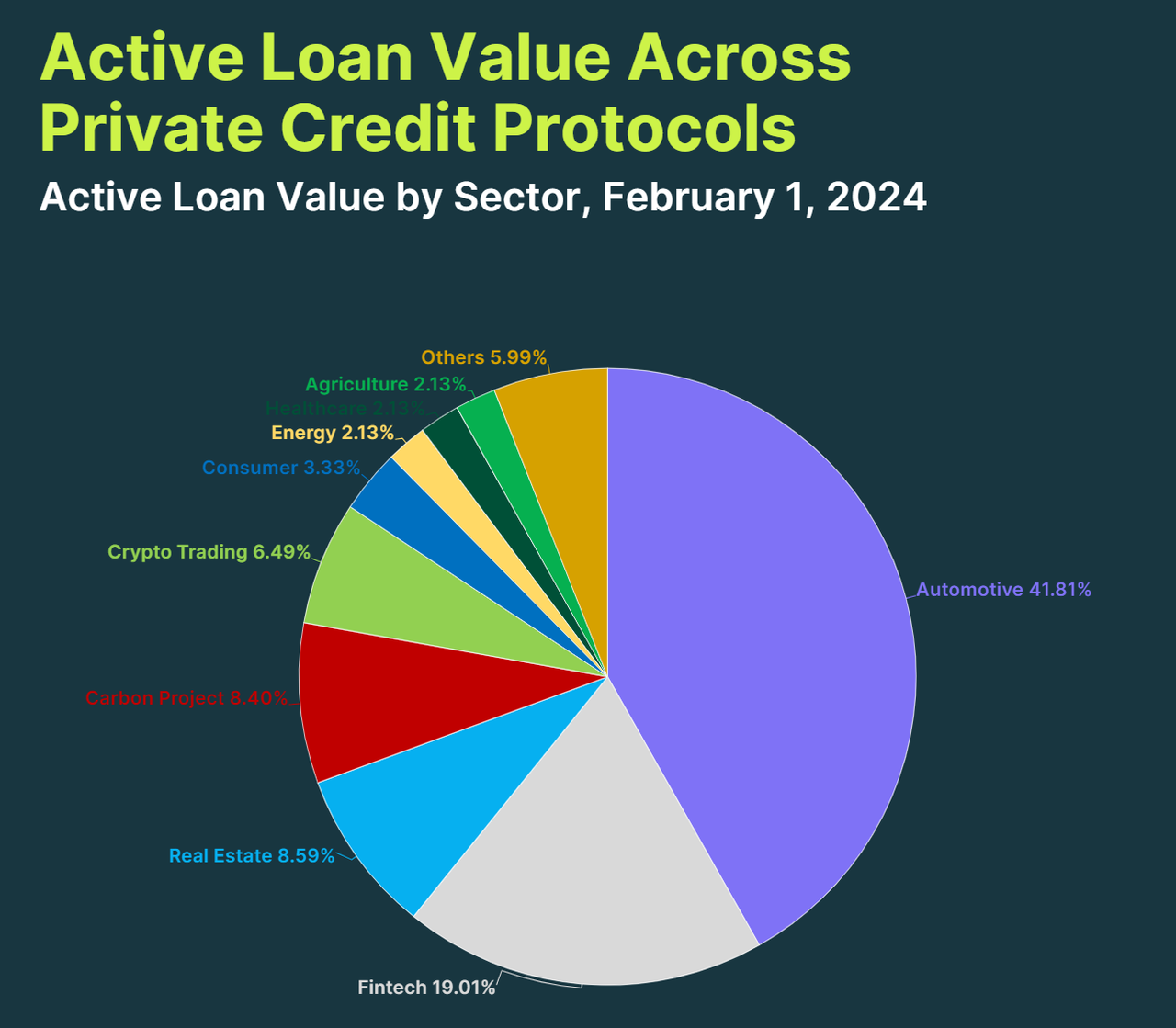

4. Private credit demand is heavily concentrated in the automotive sector, accounting for 42% of all loans

Of the $470.3 million in outstanding loans issued by private credit protocols, 42% ($196 million) were allocated to auto loans. In contrast, fintech and real estate sector debt accounted for only 19% and 9% respectively.

Auto loans saw significant growth in 2023, with 60 loans disbursed totaling over $168 million.

The real estate and crypto trading sectors received a combined 840 loans, but only 10% of these remain active. The rest have either been repaid or defaulted. Notably, the crypto trading sector experienced 13 loan defaults following the collapses of Terra and Three Arrows Capital.

Borrower data shows that most companies originate from emerging markets such as Africa, Southeast Asia, Central America, and South America. African borrowers alone accounted for 42 loans, representing 40.8% of all loans.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News