MEME Craze: A Pinduoduo-style victory in the downgrade of crypto consumption

TechFlow Selected TechFlow Selected

MEME Craze: A Pinduoduo-style victory in the downgrade of crypto consumption

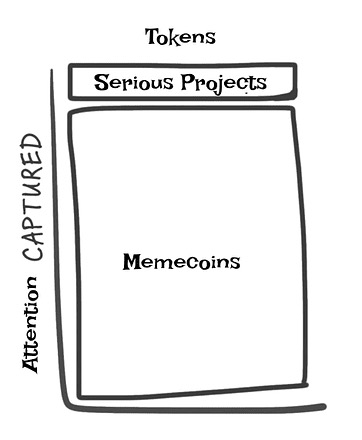

False Mass Adoption: ZK, AA wallets, gaming, social; True Mass Adoption: MEME shitcoins.

Author: jiucaidog, TechFlow

My memory isn't great, but I vaguely recall that during the 2022 crypto bear market, crypto VCs were envisioning narratives for the next bull run and generally expected the following:

1. Ethereum would be the engine of the bull market — the most certain bet;

2. ZK technology would enable massive L2 scaling, bringing blockchain infrastructure to maturity;

3. AA wallets and MPC wallets would lower the barrier for ordinary people entering the crypto world;

4. Gaming and social applications would drive mass adoption;

……

With these beliefs, even during the bear market, many VCs placed bets on ZK/L2 and other Ethereum infrastructure at valuations exceeding $1 billion. To them, this investment had extremely high certainty.

Was there anything wrong with this investment thesis?

Actually, not really. Around 2016, Alibaba similarly doubled down on消费升级 (consumption upgrade) and new retail. Under normal assumptions, people would naturally grow wealthier and spend more on premium products.

Crypto VCs thought the same way — betting on an upgrade in crypto consumption, cutting-edge technology, real-world mass adoption, and users' evolving awareness. After all, the world always moves forward.

But reality is often absurd. As we now know, consumption didn’t upgrade; instead, Pinduoduo — which bet on consumption downgrade — emerged from outside the Fifth Ring Road to center stage, even surpassing Alibaba in market cap and completing a flip.

Similarly, in crypto, the meme coin WIF surpassing Ethereum L2 ARB in market cap was equally shocking.

And in the crypto world, an even more blatant "consumption downgrade" has unfolded.

The anticipated advancements in ZK technology and widespread application deployment never materialized. Instead, capital chose to enter the bull market via Bitcoin memecoin inscriptions, then expanded into the full-scale explosion of memes across the Solana ecosystem.

Does the crypto world need better user experience? Theoretically yes, but practically, not so much.

In 2017, everyone traded quickly on centralized exchanges, then transitioned by 2020 to using expensive, slow DEXs. In this cycle, many retail investors simply participated in inscription trading via WeChat groups using EXCEL — extremely primitive, yet remarkably joyful.

In 2017, retail investors queued up on slick ICO websites for token launches. Today, one can simply post a wallet address on Twitter and receive tens of millions of dollars within half an hour.

Previously, every NFT/meme project felt compelled to "do something" — build games, launch products, emphasize real-world use cases. Now, retail investors beg projects: "Please, don’t do anything, don’t build anything — just stay as a pure meme, floating in the air is fine." Even oracles have proactively removed their price-feeding functions to join the meme trend.

Previously, a project had to hustle for funding, constantly pivot narratives, work overnight on products, pull strings to get listed on exchanges, suffer through three years of hardship, only to achieve under $100 million market cap and face relentless community criticism. Today, a meme project needs no website, reaches $1 billion market cap in three days, and gets rapidly listed on Binance... So tell me, what’s the point of hard work?

So where did things go wrong?

I believe the market is always right.

Consumption downgrade in the traditional economy stems from demand — people's wallets simply haven't kept up; the middle class is shrinking.

In crypto, the consumption downgrade results from a complete misalignment between supply and demand.

On the supply side, what truly compelling infrastructure or consumer applications exist today? After all this time zero-knowledge proving — what exactly has been proven?

On the demand side, wealth effect remains the primary driver. Trading is the real刚需 (must-have), and the simpler and easier to understand, the better.

Under these conditions, memes have taken on the重任 (important mission) of driving crypto mass adoption — no cognitive barriers, no product promises, culture and community impossible to value with traditional metrics, widely distributed tokens, fair launches — retail investors, wash-trading whales, exchanges, and market makers alike can all profit from the frenzy...

The high-performance blockchain Solana, known for its low transaction fees, has become key infrastructure for memes.

Solana’s rise is likewise a Pinduoduo-style victory — cheapness reigns supreme.

Stake Pinduoduo, understand Pinduoduo, embrace Pinduoduo.

Will the crypto world remain forever flooded with memes and shitcoins? Of course not. Crypto will eventually achieve true mass adoption — but not now.

Remember: in this cycle, memes *are* the real mass adoption. Even popular AI tokens are本质上 (essentially) just memes disguised as AI.

Solana and Robinhood will be crucial meme infrastructure in this cycle.

In this cycle, every serious project team should appoint a CMO — Chief Meme Officer.

As Doge’s godfather Elon Musk once said, "Whoever controls the memes, controls the world."

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News