MT Capital Research Report: Opportunities and Challenges at the Intersection of AI and Crypto

TechFlow Selected TechFlow Selected

MT Capital Research Report: Opportunities and Challenges at the Intersection of AI and Crypto

"The development of the AI x Crypto赛道 is sustainable, not just a passing trend."

By Xinwei, Ian

TLDR

-

We believe the development of the AI x Crypto sector is sustainable, not just a passing trend. As AI technology advances over time, we expect to see continued inflows of capital and attention into this space, generating multiple waves of growth opportunities. Therefore, positioning in the AI x Crypto sector is not only feasible but also a necessary strategic move.

-

Within the AI x Crypto landscape, several sub-sectors are emerging, including AI Agents, decentralized computing, data, oracles, ZKML, FHEML, coprocessors, memes, universal basic income, generative art platforms, and gaming applications. Among these, decentralized computing stands out—whether for GPU computation or algorithmic models—representing vast innovation potential with extremely high demand for computational power. Compute has become a form of consensus whose value potential rivals that of major Layer 1 blockchains. We are also bullish on early-stage yet high-potential areas such as ZKML, FHEML, and coprocessors.

-

Considering current market liquidity, project fundamentals, and community influence, Worldcoin, Arkham, Render Network, Arweave, Akash Network, Bittensor, and io.net stand out as leading projects with strong development potential.

Introduction

Over the past few years, the AI x Crypto field has undergone unprecedented development and transformation. This emerging domain combines two of the most transformative technologies—blockchain and artificial intelligence—with the goal of exploring how decentralized methods can empower AI applications, enhancing transparency, security, and user control. With rapid advancements in AI, especially the rise of generative AI, and growing demand for decentralized solutions, AI x Crypto has become one of the most exciting frontiers of technological innovation.

New Assetization Landscape in AI x Crypto: The Evolution of Compute, Models, and Data

The most direct use case of crypto is assetization. In the AI x Crypto space, the three main scenarios are "compute assetization," "model/agent assetization," and "data assetization."

Compute assetization primarily takes two forms: decentralized computing and decentralized inference via AI agents. Decentralized computing focuses on leveraging distributed networks for training AI models. AI agents, on the other hand, utilize pre-trained models to perform decentralized inference. These agents can be deployed across decentralized networks to deliver intelligent services such as automated trading, knowledge assistance, or security audits.

From a technical standpoint, training large AI models today involves massive data processing and requires high-bandwidth communication, placing extreme demands on hardware infrastructure. Training Transformer-based large models typically requires high-end CPUs like NVIDIA’s H100 or A100 GPUs, NVLink technology for GPU interconnectivity, and specialized fiber-optic switches supporting over 100Gbps network speeds across data centers. These models contain billions to hundreds of billions of parameters, demanding immense computational power and VRAM. To rapidly feed data and minimize I/O bottlenecks, high-speed storage and networking are essential. Parallel computing strategies such as model and data parallelism require high internal and external bandwidth for effective synchronization across GPUs. These requirements make fully decentralized AI training highly challenging under current technological and cost constraints.

In contrast, AI inference performed by agents has lower compute and bandwidth demands, making decentralized deployment more practical and feasible. This explains why many current compute-related projects focus on inference rather than training. Nevertheless, centralized solutions still generally outperform decentralized ones in terms of cost-efficiency and reliability at this stage.

Model/agent assetization is another significant direction, gaining momentum with the rise of large language models like GPT. Users can interact with AI-powered virtual characters, which can be tokenized as NFTs, enabling ownership, trading, and collection akin to digital art. However, many projects in this area have low technical barriers and limited innovation, with shallow integration between AI and crypto. Simply converting AI models into NFTs without deeper synergy results in homogenized competition. Moreover, these agents are mostly hosted on centralized cloud servers, with only ownership proofs stored on-chain—indicating superficial blockchain integration.

Data assetization is another key frontier in AI x Crypto, focusing on unlocking vast private data resources—including personal and enterprise data—through decentralized technologies and incentive mechanisms. Once transformed into usable training or fine-tuning datasets, this data can significantly enhance AI model performance across vertical domains. However, challenges around data diversity, quality, privacy, and use cases complicate standardization efforts. While non-standardizable data can be NFT-ified, building a liquid, easily tradable market remains difficult.

Decentralized data labeling, as part of data assetization, leverages “Label-to-Earn” models or crowdsourced platforms to incentivize community participation. This improves data usability and quality while reducing costs and time. This decentralized labor approach ensures fair compensation and opens new pathways for data monetization.

Source: MT Capital

As seen above, the number of viable use cases in the current AI x Crypto space is limited. Most directions have low entry barriers, and recent market enthusiasm is largely driven by capital plays and FOMO sentiment. Key pain points in the AI x Crypto sector include:

Immature business models: The AI x Crypto space is still in its infancy. Many attempts to merge the two fields remain immature, failing to fully leverage the strengths of either. As teams with deep expertise in both domains enter the scene, we anticipate more solutions that truly showcase AI capabilities while deeply integrating crypto-native features.

Dual challenge of cross-disciplinary expertise and talent preferences: Teams in AI x Crypto projects often excel in either AI or Web3/crypto, rarely both. This limits innovation and business model exploration. It also reflects a broader trend: top AI talent tends to avoid the crypto industry. This gap between required interdisciplinary knowledge and talent preferences remains a major obstacle. Future breakthroughs will likely come from teams capable of bridging AI and crypto with deep insights in both.

Internal empowerment technical hurdles: When crypto seeks to empower AI internally—via technologies like ZKML and FHEML—the main issue is poor scalability, limiting real-world applicability. Conversely, when AI aims to empower crypto, the challenge lies not only in complex engineering for system integration but also in ensuring performance isn’t compromised. Both sides highlight the need for innovative technical solutions and overcoming complexity and scalability issues in deep AI-crypto integration.

Despite these challenges, we firmly believe AI x Crypto is one of the most important sectors of this cycle. The convergence of AI and crypto demonstrates strong technological potential and occupies a unique and critical position in the current tech and investment landscape:

1. AI’s role in the next tech revolution: AI is widely seen as the driving force behind the next wave of technological revolution. Unlike the previous metaverse hype—which struggled with practical applications and user data validation—AI delivers tangible impact. After companies like Roblox and Meta saw their valuations plummet, metaverse interest faded quickly. Meanwhile, pre-revenue AI firms like OpenAI don’t need immediate revenue to justify their worth. AI’s real-world applications span healthcare, education, transportation, and security, driving broad innovation across the tech stack. Decentralized compute further amplifies AI’s potential by providing distributed resources for training and inference, accelerating adoption and progress.

2. **Importance of Compute Power:** In AI x Crypto projects, compute power is paramount. It directly affects AI model training efficiency and effectiveness and serves as a key metric of technical strength and market consensus. Higher compute implies stronger consensus and potentially higher market cap. As more individuals and enterprises contribute to decentralized compute, resource optimization becomes possible, enabling new economic models such as compute mining and AI compute staking.

Key Projects

Worldcoin

WLD’s recent outperformance has a simple explanation. On February 15, OpenAI launched Sora, a text-to-video model capable of generating up to 60-second high-definition videos with realistic environments, complex multi-angle shots, emotionally expressive characters, and deep understanding of real-world physics. While the market awaits GPT-5, Sora’s release had an impact comparable to one.

This reignited excitement in AI. Everyone knows Sam Altman, founder of Worldcoin, is also CEO of OpenAI. With coordinated market activity, WLD quickly became the standout performer of early 2024.

Worldcoin operates in two main areas: identity verification and digital currency distribution. Rumor has it OpenAI is developing agent robots capable of deeply understanding human instructions and acting autonomously—seen as the final step toward AGI. Once achieved, nearly all jobs could be automated, leaving most people unemployed. To prevent societal collapse, OpenAI may use Worldcoin to distribute Universal Basic Income (UBI), allowing users to claim 6WLD monthly via iris scan.

However, deeper analysis reveals WLD lacks fundamental utility and functions more like a speculative meme coin. If WLD were actually used for UBI payments, its volatility as a non-stablecoin would create numerous problems. This ambiguity is why Worldcoin’s whitepaper and founders speak vaguely about WLD’s purpose.

WLD may forever remain a meme coin. That said, this doesn’t negate its investment potential. In market cap terms, WLD resembles DOGE. If Altman’s fame surpasses Musk’s, WLD could reach DOGE-like valuations. However, its high per-unit price somewhat limits its appeal as a top-tier meme coin. A more accessible price point would greatly enhance its attractiveness. As a leading figure in AI, every public statement Altman makes—or major AI event—can significantly impact Worldcoin’s market, adding both allure and uncertainty.

A future coin split—redefining WLD with a lower unit price and higher supply—could trigger rapid price appreciation.

While Worldcoin’s current positioning and use cases remain ambiguous—leading some to view it as a meme coin—Altman’s influence and AI’s rapid evolution provide unique market momentum. With smart strategies like a coin split, Worldcoin could emerge as a significant market force.

Source: https://foresightnews.pro/article/detail/53744

Arkham

Founded in 2020 and headquartered in the U.S., Arkham is led by founder and CEO Miguel Morel, with team members including COO Zachary Lerangis, BD lead Alexander Lerangis, and institutional relations expert John Kottlowski. Arkham has raised over $12 million, including a $2.5 million public round from Binance Labs. The founders are crypto veterans who previously launched Reserve, a stablecoin project for high-inflation economies, backed by Peter Thiel, Sam Altman, Coinbase, and Digital Currency Group.

On July 10, 2023, Binance announced $ARKM would launch on Binance Launchpad—the first tool-based product ever featured—sparking widespread interest.

Arkham is a platform using AI algorithms to analyze blockchain data, linking wallet addresses to real-world entities and offering full visibility into underlying actors. Recently, Arkham launched Arkham Intel Exchange, a blockchain intelligence marketplace where users can request information via bounties and earn rewards for providing data. It also offers powerful tools for searching, filtering, and sorting crypto transactions to uncover the identities behind market activity.

Beyond Binance, $ARKM is listed on Kraken, OKX, Hotbit, and other exchanges.

Arkham introduced an “Intel-to-Earn” model, matching buyers and sellers of on-chain intelligence. The native token $ARKM is used to pay for analytics, governance voting, and user incentives. With a total supply of 1 billion ARKM and 150 million (15%) initially circulating, the testnet attracted 200,000 registered users. Post-listing, daily trading volume is expected to reach $100 million.

Arkham consists of two core components: blockchain analytics tools and an intelligence marketplace. The analytics suite includes entity pages, token dashboards, and network mapping for comprehensive data insights. Using its proprietary AI engine Ultra, Arkham de-anonymizes blockchain data and matches addresses to real-world entities. The marketplace enables info trading via bounties, auctions, and data sharing. Arkham sustains operations by charging fees—2.5% creation fee on listings/auctions and 5% acceptance fee on successful bounties and auctions.

Compared to competitors, Arkham offers unique advantages: creating utility for its token via an intelligence exchange, enabling data monetization for analysts; self-sustaining economics through fee-sharing; portfolio archiving for tracking historical investments; and visual data graphs that reduce research costs. Challenges include limited chain support, functional gaps compared to platforms like Nansen, limited replicability of token use cases, a professional-heavy user base, weak in-house data processing reliant on external teams, and associated operational risks.

Arkham holds first-mover advantage in blockchain intelligence with broad market potential, but remains in early stages. Its business model needs validation, and ecosystem growth will take time. Risks include slow adoption of on-chain analytics, high user education costs, limited business model replicability, reliance on skilled personnel, high operating costs, inconsistent data quality, reputational risk, and uncertain regulatory shifts.

https://foresightnews.pro/article/detail/48222

Render Network

Since launching in April 2020, Render Network has emerged as a leading decentralized rendering platform, connecting users needing GPU power with suppliers possessing idle compute resources. It primarily serves AI, VR, and multimedia content creation—domains requiring heavy computation—using dynamic pricing based on task complexity, urgency, and resource availability to create a fair and competitive marketplace. GPU owners connect devices to the network and run rendering tasks via OTOY’s OctaneRender software. In return, users pay RNDR tokens to those completing tasks, while OTOY takes a small cut to support operations.

Headquartered in the U.S. and founded by Jules Urbach—who is also CEO of OTOY—Render Network benefits from deep expertise in 3D rendering and decentralized computing.

Render Network has completed multiple funding rounds. In December 2021, it raised $30 million in a strategic round led by Multicoin Capital, Alameda Research, Sfermion, Solana Ventures, Vinny Lingham, and Bill Lee. Earlier, in January 2018, it raised $1.16 million via ICO—funding that supported technical development and market expansion, signaling investor confidence in decentralized rendering.

Using RNDR’s peer-to-peer network, Render efficiently distributes workloads among idle GPU providers and incentivizes node operators to share unused compute. This maximizes resource utilization and creates value, fueling the growth of a decentralized rendering ecosystem.

In December 2023, Render made a major technical leap by migrating its infrastructure from Ethereum to Solana. This enabled real-time streaming, dynamic NFTs, and state compression—greatly improving performance, scalability, and opening diverse new application scenarios.

DePIN (Decentralized Physical Infrastructure Networks) represents a new paradigm combining digital and physical resource networks. Using Proof-of-Physical-Work (PoPW), DePIN incentivizes individuals to contribute to real-world infrastructure, promoting efficient resource use. DePIN introduces innovative solutions to traditional ICT challenges, heralding a more decentralized and efficient infrastructure model.

Despite high barriers and inefficiencies in the current ICT sector, DePIN leverages P2P models to reuse idle resources, reduce intermediaries, lower entry barriers, and boost competitiveness.

Render’s successful upgrade and deep integration with Solana highlight its advantages in real-time responsiveness and low transaction costs, reinforcing its leadership in DePIN and paving the way for future growth.

As Render continues advancing technologically and expanding its ecosystem, its potential in decentralized rendering, AI, and digital rights management grows increasingly evident. Render is more than a rendering service—it’s a powerful engine driving innovation, connecting supply and demand, and accelerating decentralization and digital transformation. With ongoing tech progress and rising demand, Render Network is poised to become a key driver of the digital economy.

Source: https://dune.com/lviswang/render-network-dollarrndr-mterics

Arweave

Arweave is an innovative decentralized data storage protocol designed for permanent data preservation. Through its permaweb, Arweave enables human-readable access to stored data (e.g., via web browsers), creating a durable, immutable internet. This permanence is revolutionary for applications requiring unalterable and perpetually accessible data—such as legal documents, academic archives, and copyright protection.

Arweave uses its native token AR to incentivize storage providers, creating a sustainable economic model that supports network growth. Originally named Archian and founded in 2017 in Germany, Arweave is led by co-founder and CEO Sam Williams, COO Sebastian Campos Groth, and legal lead Giti Said—experienced leaders in tech, operations, and law.

Since its mainnet launch in June 2018, Arweave has gained significant traction, attracting top investors like a16z Crypto, Coinbase Ventures, and Union Square Ventures. Its May 2018 public sale raised $1.57 million. Subsequent rounds in November 2019 and March 2020 brought in $5 million and $8.3 million respectively from the same backers.

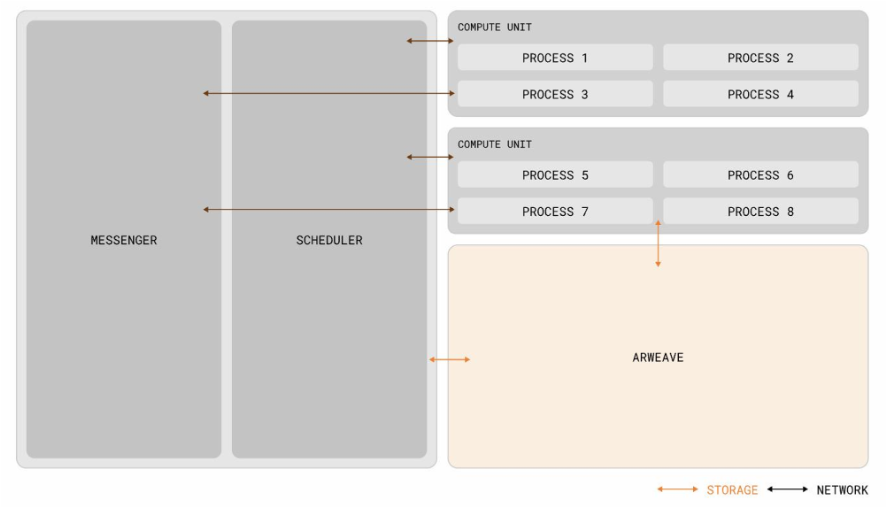

Arweave’s AO initiative marks a major blockchain innovation—an ultra-parallel computer architecture enabling unlimited concurrent processes in a decentralized environment, dramatically boosting computing efficiency and scalability. AO’s core features include massive compute capacity, verifiable computation, and a tripartite subnetwork design (messaging, scheduling, computation units) built atop Arweave’s base layer for high parallelism and extensibility.

Named AO (Actor-Oriented), inspired by the Actor model in computer science—ideal for concurrent, distributed, fault-tolerant systems—Arweave’s team demonstrates deep insight into the future of decentralized computing.

Source: https://foresightnews.pro/article/detail/54511

AO is built on Arweave’s base layer, using its on-chain storage as a permanent host for runtime data, enhancing decentralized computing and enabling unlimited parallel processes—similar to data centers or Internet Computers working in tandem. A key component is AOS, an operating system based on AO that allows developers to build apps using Lua, increasing usability and flexibility.

AO aligns with Arweave’s long-term vision: supporting a highly scalable blockchain network via its storage platform. Despite challenges, the team’s persistence made AO possible—enhancing Arweave’s functionality, enabling more smart contracts and protocols, and offering a powerful new solution for decentralized computing.

AO breaks traditional blockchain limitations by decomposing the chain into independent, communicative components that execute massive transactions in parallel—achieving unprecedented horizontal scalability. This innovation opens new possibilities for Arweave and inspires the broader blockchain and decentralized tech space.

Ultimately, Arweave aims for AO to become a stable, low-maintenance system like Bitcoin, ensuring continuity of core functions and user rights. Such stability and transparency foster trust and deeper protocol understanding. As AO evolves, it could become a major player in decentralized smart contract platforms, competing strongly with existing chains like Ethereum.

Akash Network

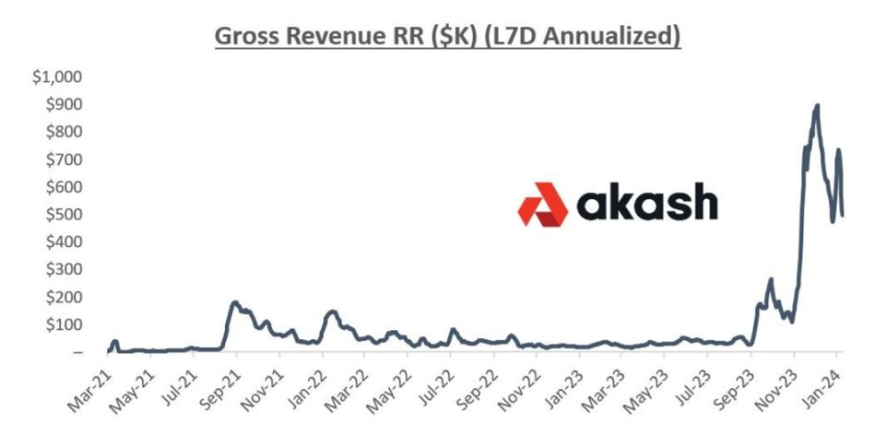

Akash Network’s core value lies in being a decentralized computing platform that connects global underutilized GPU resources with users who need them. It enables GPU owners to profit while offering users a more cost-effective alternative. As of September 2023, Akash had successfully deployed 150–200 GPUs on its network, achieving 50%–70% utilization. This translated to $500K–$1M in annual transaction volume, demonstrating the market potential of shared decentralized compute.

Analyzing Akash’s business model, its analogy to Airbnb in real estate is apt. Akash creates a marketplace where GPU owners can rent out idle compute power like Airbnb hosts, while users access needed resources at lower costs. This model increases GPU utilization and lowers barriers to entry in AI and machine learning.

With AI’s rapid growth, demand for high-performance computing like GPUs has surged. Nvidia, the GPU leader, is projected to grow revenue from $27B in 2022 to $60B in 2023 and ~$100B by 2025. This reflects intense global demand for compute power and presents a vast opportunity for Akash Network.

Akash’s decentralized model fits well in today’s environment of rising cloud demand and underused global GPU capacity. Suppliers offer idle GPUs; demanders get affordable compute. This optimizes resource allocation and democratizes access, enabling more individuals and businesses to participate in AI and HPC innovation.

Akash’s native token AKT plays multiple roles. It pays for compute resources (GPU, storage, bandwidth), enables governance (holders vote on upgrades), and incentivizes network participation (providing resources, validating transactions).

To encourage more suppliers, Akash employs two incentive mechanisms: token rewards and transaction fees.

- Token Rewards: New tokens are minted and distributed to resource providers as incentives to join the network. Validators and governance participants also receive AKT rewards for securing and governing the network.

- Transaction Fees: Akash charges fees in AKT for service usage. A portion is distributed to nodes providing compute as direct compensation.

Akash charges a 4% fee on transactions paid in AKT and a higher 20% fee on USDC (a stablecoin) payments—a structure designed to promote AKT circulation and fund network development.

Akash also maintains a community pool funded by inflationary emissions and transaction fees. This pool finances development initiatives—tech upgrades, marketing campaigns—allocated via community votes.

Through this sophisticated and effective token economy, Akash ensures network vitality and offers users opportunities to participate and benefit. These incentives attract more providers and users, fostering long-term success and growth of the decentralized compute platform.

Despite its promising outlook, Akash faces significant challenges. Beyond competing with traditional cloud providers, it must continuously optimize its platform for efficiency and security. Building and maintaining a decentralized marketplace also requires constant attraction of new participants and sustained activity.

Source: https://www.modularcapital.xyz/writing/akash

Bittensor

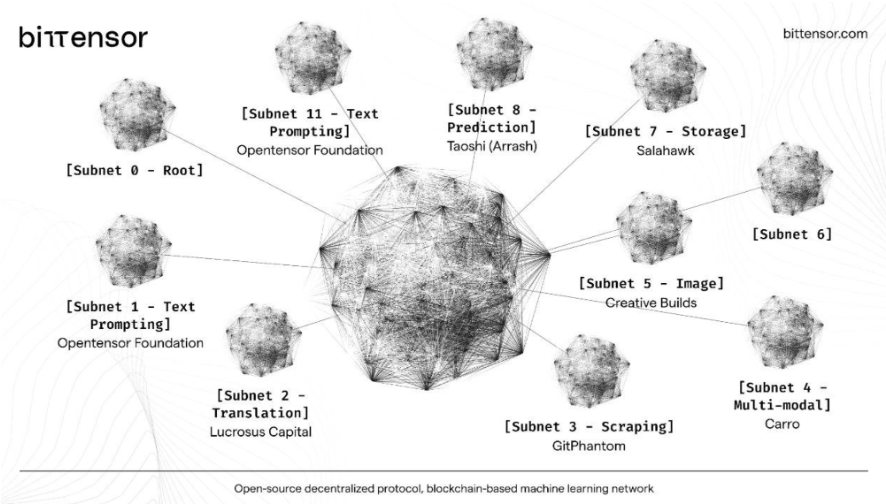

Founded in 2019 by AI researchers Ala Shaabana and Jacob Steeves, Bittensor was initially conceived as a Polkadot parachain. In March 2023, it pivoted strategically to develop its own blockchain, aiming to decentralize AI development by incentivizing global machine learning nodes with cryptocurrency. By enabling these nodes to collaboratively train and learn, Bittensor introduces a new paradigm: enhancing collective intelligence through incremental resource integration, expanding individual contributions to the whole.

Bittensor introduces novel concepts like Mixture-of-Experts (MoE) and Proof-of-Intelligence, rewarding useful ML models and outcomes to foster a decentralized AI ecosystem. Its tokenomics and ecosystem design aim to fairly reward participants and encourage network engagement through TAO tokens.

Bittensor’s architecture reflects its ambition to build a robust AI ecosystem. Its layered structure—miners, validators, enterprises, and consumers—supports end-to-end AI innovation. Miners drive model innovation, validators ensure network integrity, while enterprises and consumers bridge technology with real-world applications.

Core participants include miners and validators. Miners submit pre-trained models for rewards; validators verify output validity. This incentive mechanism creates a positive feedback loop, encouraging competition and continuous model refinement.

Though Bittensor doesn’t directly train models, it provides a platform for miners to upload and fine-tune their own. This allows integration of diverse models across specialized subnets—for tasks like text and image generation.

Source: https://futureproofmarketer.com/blog/what-is-bittensor-tao

The subnet model is central to Bittensor’s design, with each focused on specific tasks. This approach aims to achieve composability and decentralized intelligence—though still challenging under current technical and theoretical limits.

Bittensor’s tokenomics mirror Bitcoin’s, adopting similar issuance and incentive structures. TAO tokens serve as network rewards and access keys to Bittensor services. The long-term vision is AI democratization—decentralized iteration and learning across a broad community.

Compared to centralized AI models, Bittensor’s key advantage is fostering open, shared AI development, enabling broader community-driven optimization and faster progress. Its decentralized architecture could lower AI adoption costs, empowering individuals and small businesses to innovate.

io.net

io.net is an innovative decentralized GPU network addressing the challenge of accessing compute resources in machine learning (ML). By aggregating GPUs from independent data centers, crypto miners, and contributors to Filecoin and Render, it creates a vast compute pool. Founder Ahmad Shadid conceived the idea in 2020 while building GPU networks for Dark Tick, a ML quant trading firm, facing high costs and resource scarcity. Later, the project gained recognition at Austin’s Solana Hacker House.

io.net tackles limited availability, lack of choice, and high costs in compute access. By pooling underutilized GPUs, it offers a distributed solution enabling ML teams to build and scale model workflows across a decentralized network. It leverages advanced distributed computing libraries like RAY to support data and model parallelism, optimizing task scheduling and hyperparameter tuning.

Product-wise, io.net offers IO Cloud, IO Worker, and IO Explorer. IO Cloud deploys and manages decentralized GPU clusters with seamless IO-SDK integration, providing full scalability for AI and Python apps. IO Worker offers a comprehensive UI for managing compute supply, including account controls, real-time metrics, temperature, and power monitoring. IO Explorer delivers full visualization of network activity and key stats, improving monitoring and insight.

To balance supply-demand and incentivize participation, io.net introduced the IO token, used to reward sustained AI/ML deployments, price IO Worker units, and enable community governance. Due to crypto volatility, io.net also developed IOSD, a USD-pegged stablecoin, to stabilize payments and incentives.

Source: https://io.net/

io.net demonstrates strong innovation and market potential in both technology and business model. Through partnerships like Filecoin, it aims to expand capabilities in model storage and compute, strongly supporting decentralized AI development. By offering a cost-efficient, accessible platform, io.net strives to compete with traditional cloud providers like AWS, driving innovation across the AI landscape.

On the funding side, io.net completed a $30 million Series A at a $1 billion valuation. Investors include Hack VC, Multicoin Capital, Delphi Digital, Animoca Brands, Solana Ventures, Aptos, OKX Ventures, and Amber Group—reflecting strong market confidence in its innovation and potential in decentralized computing and AI.

Conclusion

As AI and blockchain technologies advance, the AI x Crypto space shows immense potential alongside significant challenges. Analyzing the three core themes—compute assetization, model/agent assetization, and data assetization—reveals both paths forward and existing barriers. Decentralized compute opens new possibilities for AI training and inference, though dependency on high-performance hardware remains a hurdle. Model and agent assetization via NFTs enhances ownership and interaction but requires deeper technical integration. Data assetization unlocks private data value but faces standardization and liquidity challenges—yet offers new routes to improve AI efficiency and specialization.

Notably, as AI continues evolving, it will periodically attract attention and capital to AI x Crypto, creating recurring waves of development rather than a one-time opportunity. The enduring value and innovation potential of AI x Crypto mark it as a pivotal sector in tech and investment.

Looking ahead, the growth of AI x Crypto will depend on technological breakthroughs, cross-disciplinary collaboration, and market-driven use case discovery. By overcoming technical limits, deepening AI-blockchain integration, and building practical applications, this field can achieve sustainable progress toward more secure, transparent, and equitable AI services. Throughout this journey, decentralization principles and practices will continue pushing AI x Crypto toward greater openness, efficiency, and innovation—enabling dual leaps in technological advancement and value creation. Thus, the current cycle’s AI x Crypto wave is an unmissable opportunity—not only representing the cutting edge of innovation but also signaling a defining trend for future technological and investment landscapes.