How to Bet Early on Hot Projects? A Look at the Current State of Pre-Launch Protocols

TechFlow Selected TechFlow Selected

How to Bet Early on Hot Projects? A Look at the Current State of Pre-Launch Protocols

2024 will be the "golden year" of airdrops.

Authors: THOR, HYPHIN

Translation: Luffy, Foresight News

Speculation is the lifeblood of the cryptocurrency market, and savvy opportunists often find new ways to bet on assets. In most cases, people invest in things that already exist because there is data available to make informed decisions. However, recent market trends indicate increasing trading volumes around airdrop allocations and unreleased assets.

Introduction

The surge in pre-market trading interest is largely attributed to countless airdrop campaigns and highly anticipated projects aiming to leverage bullish market conditions and positive sentiment to launch their tokens into the public markets.

With all the necessary catalysts for a new narrative now in place, protocols such as Aevo, Hyperliquid, and Whales Market have moved quickly to seize this opportunity. These platforms offer perpetual futures contracts on tokens that have not yet been issued.

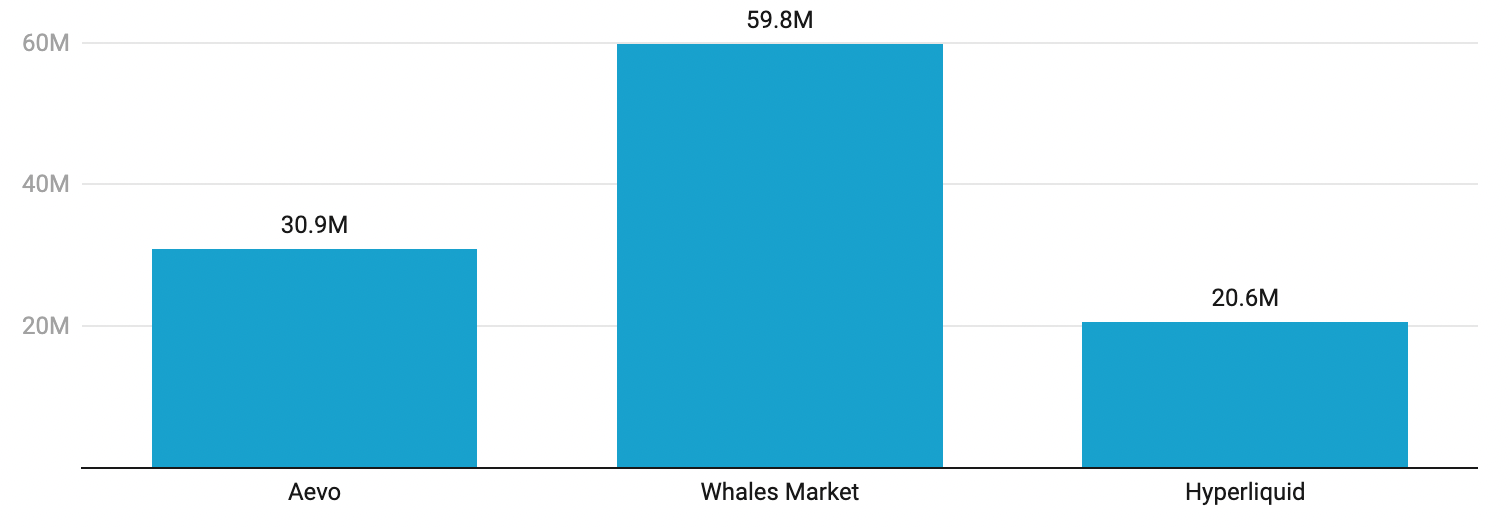

Pre-market trading volume on Aevo, Whales Market, and Hyperliquid

Keep in mind that these instruments are extremely volatile and should be used with caution due to questionable liquidity and the difficulty of determining the fair value of their underlying assets.

Given the highly speculative and risky nature of these financial products mentioned above, what value and opportunities do they offer traders? We will attempt to answer this question in this article by analyzing market data.

Aevo's Pre-launch Market

Historical Performance

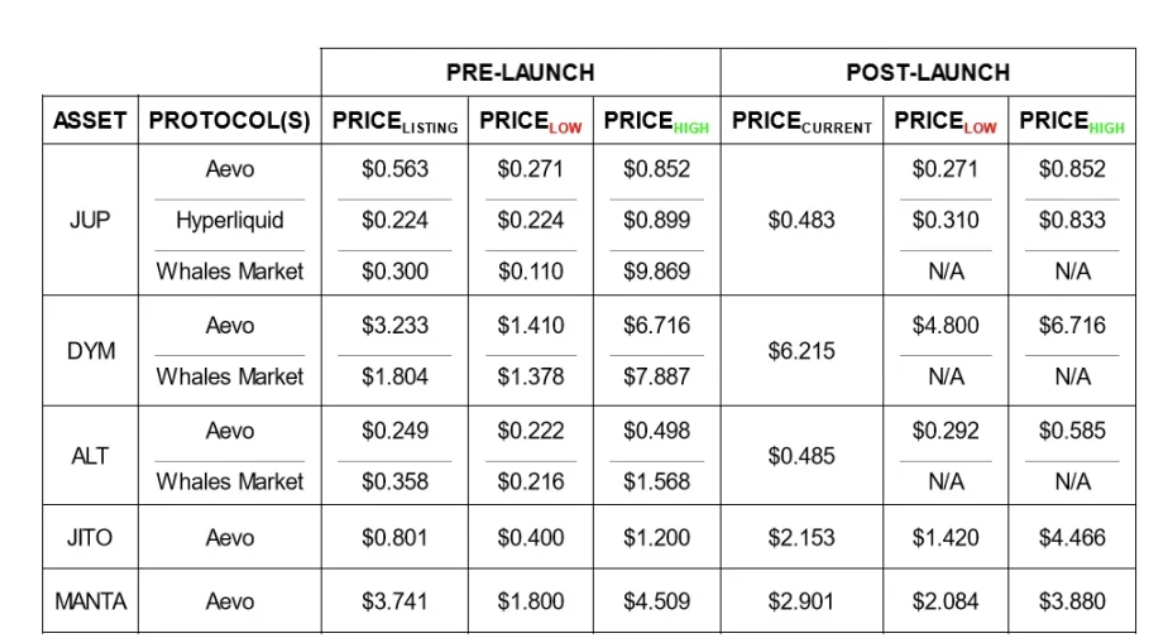

Using exchange APIs and historical data, we can observe the price performance of all assets previously traded in pre-market and understand how they performed after official listing.

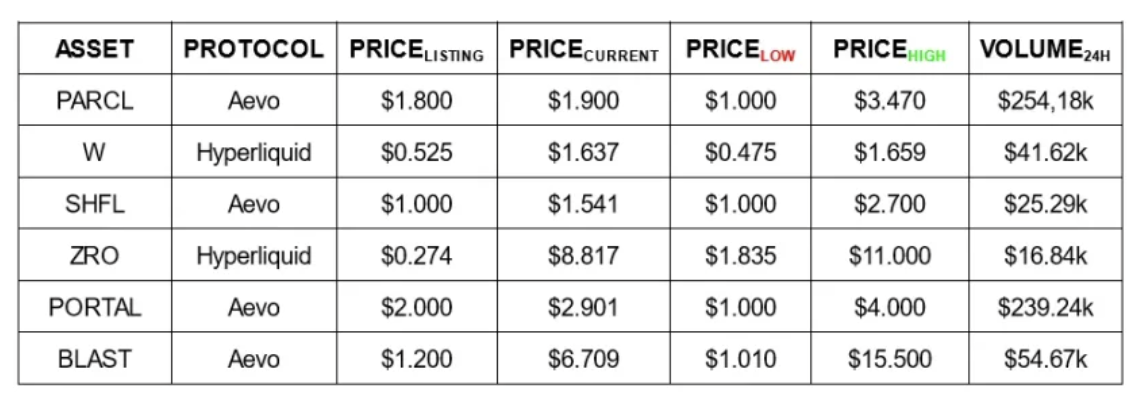

Comparison of asset prices before and after launch for several protocols

A common pattern among most of these assets is relatively low trading volume after listing, with volatility and trading activity peaking as the release date approaches, followed by a decline in activity.

Objectively speaking, the initial listing price of each asset in the table was not its price peak. Airdropped tokens have performed exceptionally well over the past six months, despite the general belief that airdropped tokens would significantly impact prices once tradable.

However, this does not mean one should buy immediately after an asset lists on pre-market. Price movements could lead to liquidations, and returns are not guaranteed due to unknown listing criteria.

In terms of trading volume, it is clear that sought-after assets—rather than those merely circulating on Twitter due to incentives—receive far more attention than other upcoming tokens, most of which fail to exceed $100,000 in daily trading volume.

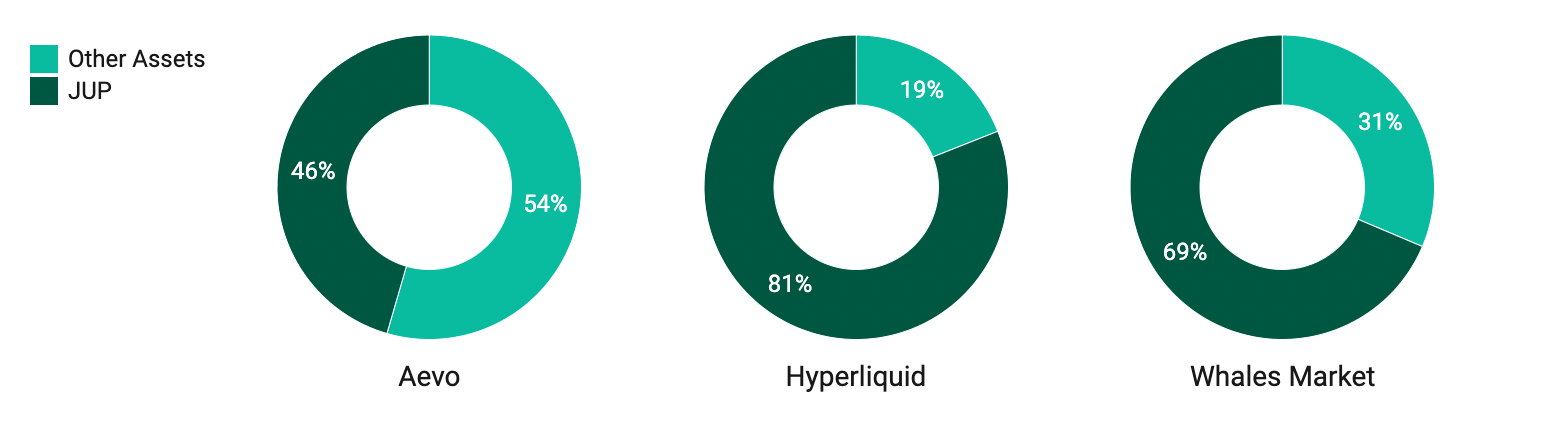

JUP's share of trading volume across different pre-markets

In the case of Jupiter, after being hyped during Solana’s expansion period, they gained significant attention by absorbing substantial liquidity.

Current Pre-Launch Market

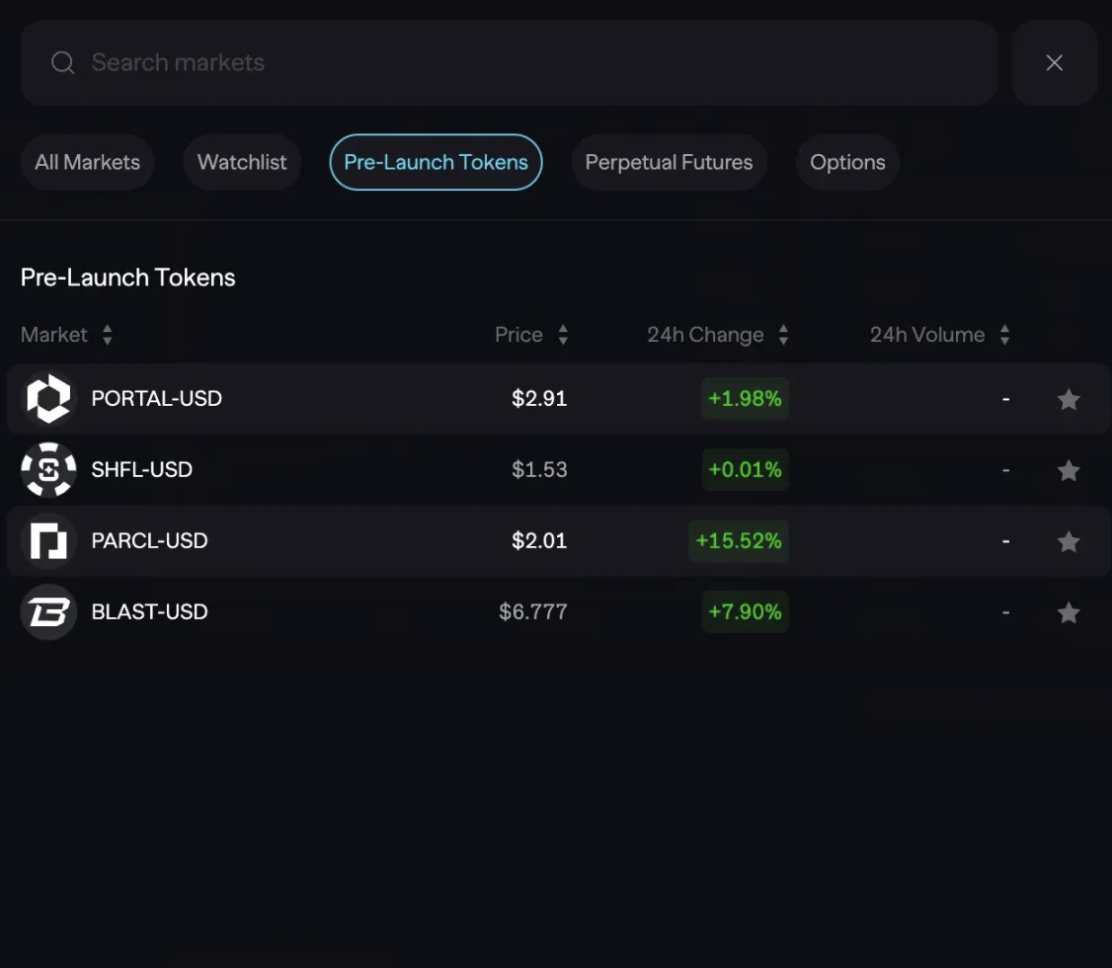

Having reviewed historical data, let’s now examine current opportunities. As of today, numerous unreleased tokens are available for trading on Aevo and Hyperliquid.

Currently active pre-launch assets on Aevo and Hyperliquid

Aside from recently launched Parcel and Portal, little active trading has occurred. From a price performance standpoint, most tokens have performed well, with a few multiplying several times over months.

Let us select some interesting projects from the list to assess whether their valuations are comparable to similar protocols:

Wormhole (W)

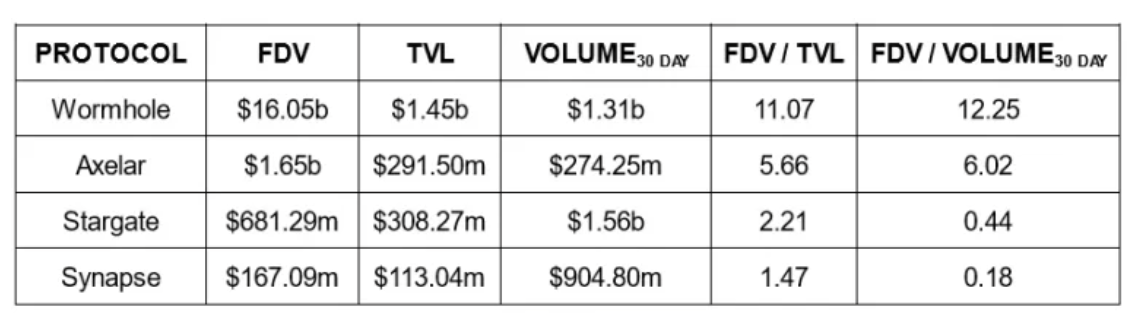

Wormhole's FDV derived from Hyperliquid's W/USD mark price multiplied by total token supply (10 billion)

Compared to alternative solutions in the market, Wormhole's current theoretical valuation may be inflated. Unless groundbreaking developments are announced, token prices could trend downward after the token generation event ends, as trading volume reflects minimal investor interest.

BLAST

Blast's FDV derived from Aevo's BLAST-USD mark price multiplied by total supply (1 billion)

Although speculation causes the FDV to fluctuate by billions at any moment, TVL metrics suggest clear interest in the Blast ecosystem (likely driven by airdrop expectations).

Judging from how L2s are typically priced, Blast appears undervalued on paper—but reaching definitive conclusions requires additional context. Unfortunately, beyond TVL, information about its on-chain status is scarce, making evaluation difficult.

Points Trading

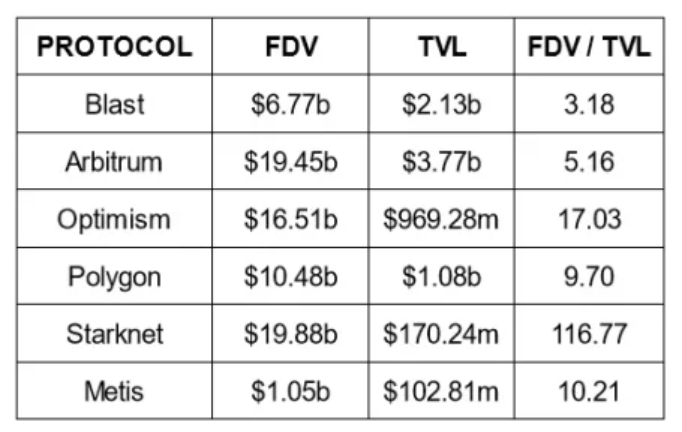

Whales Market Points Trading

Points can now be traded on Whales Market, a decentralized OTC trading platform.

“2024 will be the ‘golden year’ of airdrops” – @CC2Ventures

One of the most prolific airdrop farmers in crypto says farming airdrops has perhaps never been more profitable. The sheer number of protocols announcing points programs has brought us to a stage where user interactions are monetized—so if you want attention as a project, incentives are mandatory.

It’s natural that markets for trading these points have emerged. Such channels allow airdrop farmers to cash out their earnings early.

To date, Whales Market has facilitated $6.3 million worth of peer-to-peer points trading and continues to grow as more listings come online.

Currently, points from nine protocols are tradable on the platform: Parcl, Kamino, Ethena, Magic Eden, Hyperliquid, EigenLayer, friend.tech, and ether.fi. Marginfi, Drift, and Blast are expected to go live soon.

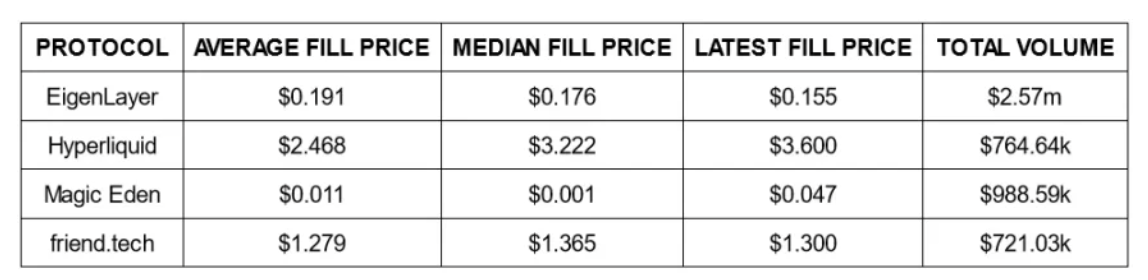

Below is an overview of the most popular points trading pairs currently:

Looking at average order prices and median order prices, it is evident that in some cases, price distribution is not tightly clustered.

So far, fair values for some of these points appear to have been established—but what exactly does a point’s value signify?

The price of a point might reflect market expectations regarding the current valuation of an upcoming protocol. As more points are distributed, their value may decrease due to reward dilution—unless market sentiment shifts and expected valuations rise.

Let’s test this idea using EigenLayer as an example.

Price per point = 0.155

Total points = 1,963,113,523

Airdrop value = price per point × total points = 304,282,596

(Theoretical) airdrop allocation = 0.1 (10%)

Fully diluted valuation = airdrop value / airdrop allocation = 3,042,825,960

Since snapshot dates are usually kept strictly confidential, we cannot determine the final total number of points that will be generated.

Conclusion

Through historical observations and consideration of recurring trading patterns, these pre-market assets continue to perform well even after listing during bullish trends, with peaks typically occurring on the day of token release. Protocols like Aevo, Hyperliquid, and Whales Market provide users with alternative methods to speculate on airdrops.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News