HashKey Capital 2024 Web3 Investment Sector Full Analysis

TechFlow Selected TechFlow Selected

HashKey Capital 2024 Web3 Investment Sector Full Analysis

Focus on toC scenarios and markets where hardware has not yet been widely adopted, as revolutionary changes may emerge.

Authors: Arnav Pagidyala, Harper Li, Jack Ratkovich, Jeffrey Hu, Junbo Yang, Stanley Wu, Sunny He, Xiao Xiao, Yerui Zhang, Zeqing Guo

As one of the most active crypto VCs, HashKey Capital regularly conducts internal analysis and梳理 across various Web3 sectors.

On the occasion of the 2024 New Year, we are "open-sourcing" our internal sector insights and understanding as a contribution to the industry.

ZK

In 2023, the ZK sector expanded beyond earlier use cases like scaling and cross-chain, branching into more diverse applications and further fragmenting into sub-sectors.

zkEVM

Progress has been made in zkEVM across Type-0, Type-1, and Type-2 implementations. In terms of categories, Type-0 is fully equivalent to Ethereum but still faces technical challenges related to block production speed, deployment, and state verification due to its strong emphasis on equivalence. Type-1 improves upon the EVM with trade-offs and currently offers the best overall application experience and opcode compatibility. Type-2 and similar variants have launched their mainnets earlier and are each cultivating ecosystems around their respective models.

Current project specifics vary significantly and must be analyzed based on individual development roadmaps—for example, Polygon's CDK or StarkNet’s full-chain gaming initiatives.

zkVM

The dominant technical direction within zkVM is currently zkWASM, which offers greater architectural scalability and is thus being applied in high-performance DEX collaborations with exchanges. Key projects in the zkWASM space include Delphinus Labs, ICME, and wasm0.

On the RISC-V architecture front, RISC0 is leading exploration efforts. Compared to WASM, RISC-V is more friendly to both frontend languages and backend hardware, though potential issues remain around efficiency and proof generation time. Application scenarios are expanding—for instance, simulating Ethereum execution environments (e.g., Reth), running FHE workloads, and Bitcoin rollups.

Another emerging area is zkLLVM. =nil; recently launched a Type-1 zkEVM using this technology, enabling rapid compilation of high-level languages into zkSNARK circuits via zkLLVM.

ZK Mining

In the ZK mining space, GPU and FPGA efficiencies are currently comparable. However, GPUs are more expensive while FPGAs are closer to prototype validation. ASICs may gradually differentiate, especially for specialized chips or new demands such as FHE support.

Additionally, Prover DAOs are increasing in number, with computational power serving as a core competitive advantage—teams building provers will likely have a distinct edge.

ZK Middleware

ZK middleware encompasses various verifiable computing applications such as zkBridge, zkPoS, ZK Coprocessor, zkML, and zk trusted computing. The use case for ZK Coprocessor is particularly clear, with most projects now entering testnet phases. The zkML sector remains hot, though differentiation in progress and competition has begun to emerge. Additionally, a new niche—ZK proof sharing (aggregating proofs sent to a single network and splitting revenue post-batch processing)—has started to appear.

MEV

- Focus on early stages of the transaction supply chain, particularly intent layers

- Next-generation DEX designs and infrastructure addressing LVR and improving LP economics will attract increasing capital

- Private auctions/private mempools, if effectively implemented, could dramatically improve the transaction supply chain. Watch developments in FHE, MPC, and ZKPs

- Currently, most systems rely on centralized relays, permissioned solvers, and trusted builders. We believe the endgame will be permissionless systems to enable the most competitive markets

- MEV supply chains will evolve through APS, atomic order execution, PEPC, etc.

OFA

Order Flow Auctions (OFA) gained traction in 2023. High-value trades will increasingly bypass public mempools and flow through OFAs, allowing users to reclaim value they generate. From RFQ-based auctions to blockspace aggregators, various OFA implementations can meet diverse needs around price discovery and execution quality. Looking ahead, an increasing share of ETH transactions are expected to go through OFAs.

Blockbuilder

As observed via relayscan, the builder market is concentrated among a few players, some of which are high-frequency trading firms serving their own orders. As CEX/DEX arbitrage volumes decline in the future, the advantages of HFT may also diminish.

Relay

The relay market faces two fundamental issues: (1) concentration among a small number of companies (e.g., BloXroute and Flashbots); (2) lack of incentive mechanisms for relays.

We anticipate rapid development and adoption of optimistic relays, along with proposals introducing incentives for relay operators.

AA

The AA (Account Abstraction) sector primarily consists of two categories: smart contract wallets and modular service providers.

Regarding smart contract wallets, the competitive landscape mirrors that of the broader wallet market. Differentiation purely by features is becoming increasingly difficult, making wallet factory solutions more noteworthy.

For modular services, Bundler and Paymaster functionalities have become standard offerings required by all infrastructure providers.

Current trends in the sector include:

- Most infrastructure is already built, with stable ongoing development. Overall data shows the sector is on a fast growth trajectory—wallet adoption began rising from June onward, and by November had surpassed 6 million UserOps with approximately 200K MAUs.

- AA adoption on L2s outpaces that on L1s, and the EF is considering native L2 support.

- Lack of DApp support for AA remains a serious issue, alongside unresolved challenges in cross-chain and cross-rollup account management, requiring innovative solutions.

- Private mempools will converge with MEV and intent layers to optimize user experience.

Intents

After gaining attention this year, intents have developed rapidly despite facing issues like solver misbehavior and trust in order flow—though feasible solutions exist.

For better development, intents must address order flow acquisition and user onboarding. Architecturally and commercially, intents align well with MEV and AA frameworks—for example, builders and searchers are natural candidates for matching and solving roles.

Telegram bots are likely to evolve toward intent-based models. Their advantage in order flow gives them significant bargaining power over builders and even SUAVE, potentially exceeding that of larger wallets.

DA

The DA sector has limited participants besides Ethereum, including Celestia, Eigenlayer, and Avail, with varying project timelines. A clear head-and-tail effect exists, leaving little room for mid-tier or smaller players. Key evaluation criteria for DA projects include security (data integrity, consensus), customizability and interoperability, and cost. With Celestia’s launch and rising price, overall valuations in the DA space have increased. However, DA is fundamentally a B2B business—the revenue of DA projects is closely tied to the quantity and quality of ecosystem projects.

From a customer perspective, publishing DA on Ethereum offers the highest security but at the highest cost. Following proto-danksharding, Ethereum’s fees have dropped significantly, so major rollup teams still prefer Ethereum as their DA layer. Currently, DA clients outside of EigenDA mainly come from Cosmos ecosystem projects and RaaS platforms. EigenDA occupies a unique position—related to, but not directly dependent on, Ethereum—and may attract customers in intermediate segments. Additionally, early-stage DA projects and those targeting specific niches (e.g., Bitcoin DA) may capture solid market shares in specialized domains.

Rollup Frameworks & RaaS

The rollup market is largely saturated, awaiting new breakthroughs. Over 30 VC-backed RaaS projects and infrastructure providers are now entering the space. It’s important to identify which use cases succeed on RaaS and which interoperability solutions prove effective.

Some L2/L3 frameworks (e.g., OP Stacks) have received substantial public goods funding and developer adoption.

Certain applications, such as DePIN, could leverage customized execution environments on Ethereum rollups.

Recently, several new rollup technologies have emerged—for example, Risc0 Zeth and other projects that change how rollups verify state without relying on validators or sync committees. When combined with primitives like ZKP and MPC, FHE rollups could enable fully private, general-purpose DeFi.

Cosmos

Cosmos Hub will continue strengthening its ecosystem position through multiple avenues—for example, Partial Validator Security (PSS) allows a subset of validators to provide Inter-Chain Security (ICS) without requiring all Cosmos Hub validators to participate, reducing operational burden and easing adoption. Additionally, Cosmos Hub plans to enable multi-hop IBC to enhance UX. Protocol upgrades aim to introduce Megablocks and Atomic IBC, enabling atomic cross-chain transactions and forming a unified MEV market akin to Ethereum’s shared sequencer or SUAVE.

Within the Cosmos ecosystem, the appchain development path has seen reduced new project inflows recently due to influence from L2 development frameworks. However, thanks to its highly customizable base layer, the ecosystem remains flexible and adaptable, capable of evolving alongside shifting narratives and identifying chains with tailored modifications.

Security

Security projects have made progress across multiple layers, offering tools and protocols ranging from on-chain detection and interception, tracking tools, manual audits and bounty programs, development environment utilities, and various technical methodologies (e.g., fuzz testing).

Each tool excels at detecting specific vulnerability types and employs particular methods (static analysis, symbolic execution, fuzzing, etc.) for smart contract auditing. However, combining tools still cannot fully replace comprehensive manual audits.

Beyond functional positioning, additional evaluation dimensions include maintenance/update frequency, vulnerability database size, deployment scope, and alignment with partner needs.

AI

Current convergence points between crypto and AI include foundational compute infrastructure, training on specific data sources, chat tools, and data labeling platforms.

Projects in compute infrastructure and compute networks show innovation at various levels, though most remain early-stage and must consider sustainable commercial expansion paths beyond creating different agent types.

Data labeling platforms transform traditional human annotation into Web3 models, where securing orders becomes critical. Given that low-barrier data labeling may soon be replaced by AI, focus should shift toward high-value, high-threshold datasets to secure more orders.

Additionally, many new AI-integrated projects are consumer-facing, such as chatbots.

As a crypto fund, we prioritize ZKML, projects with advantages in crypto-native vertical data, and tightly integrated AI-to-C products—rather than large language models or infrastructure outside our expertise.

DeFi

One notable shift in 2023 is investor demand for real yield products—preferably from LSDfi or RWA—rather than emission-based returns. Meanwhile, as centralized exchanges face mounting regulatory pressure and assets seek liquidity, DEXs have immense opportunities, especially with L2 launches enabling high-performance applications—making L2-based DEXs particularly worth watching.

Concurrently, projects enabling non-crypto-native users—including institutions—to access Web3 yields hold massive potential. Platforms abstracting blockchain complexities and offering secure environments for non-native users can attract significant capital.

Specifically, according to Messari, perpetual DEXs—including prominent projects like dYdX, GMX, Drift, and Jupiter—generated the highest fees among DeFi subcategories.

Liquid staking continued growing throughout 2023. Nearly 22% of all ETH is staked, with Lido holding about 32% of the ETH staking market share (as of writing). Liquid staking tokens remain the largest DeFi segment, with $20 billion in TVL.

Gaming & Entertainment

Studio

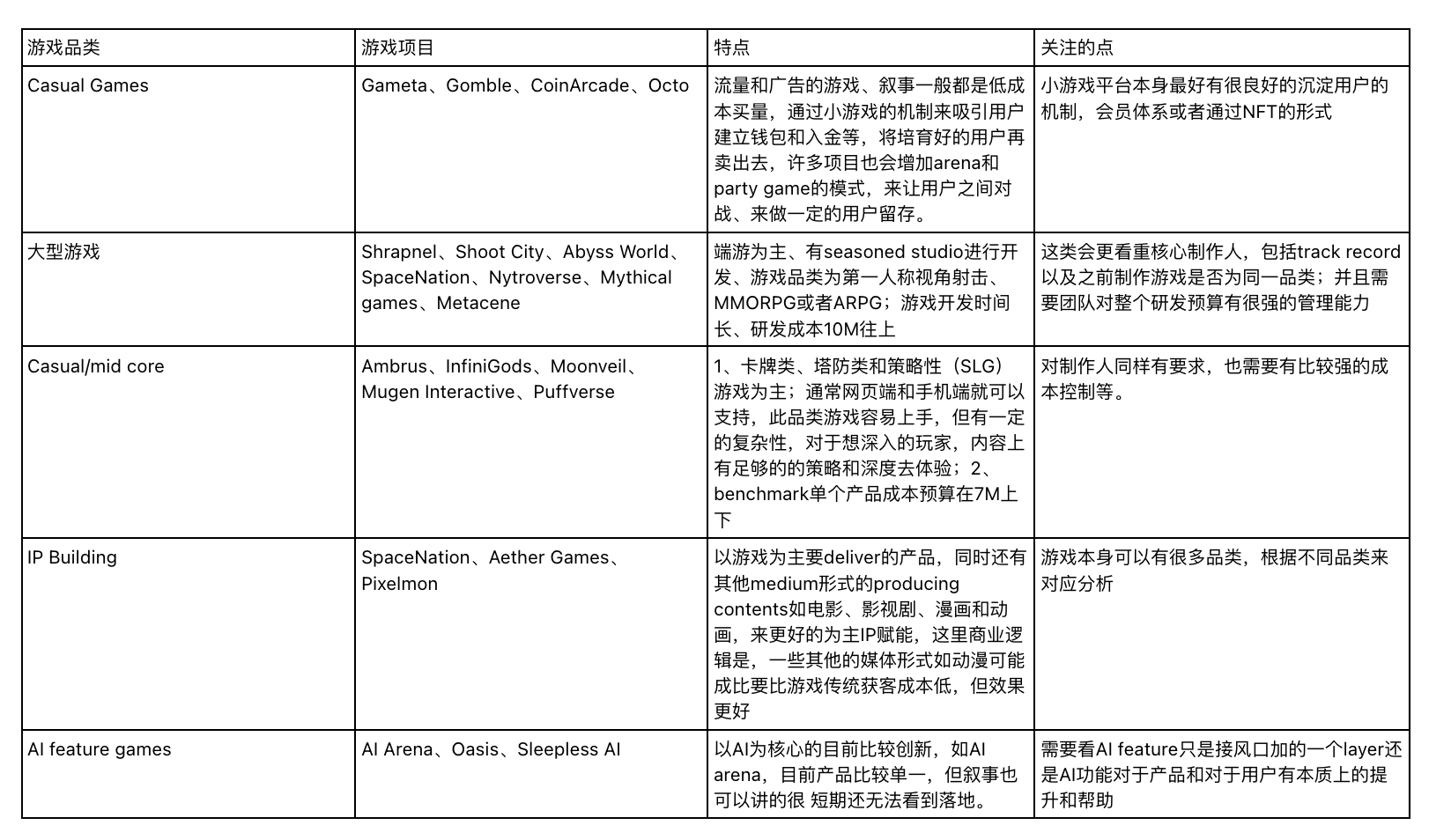

Studio-type projects differ significantly by category in characteristics and key evaluation metrics, as summarized below:

Overall, the gaming sector can be broadly categorized as above. Both game quality and team professionalism have improved dramatically compared to the previous cycle. Going forward, we expect more studios to enter Web3 with mature product development and operational experience, seeking hybrid founders who combine game development expertise with strong learning ability, crypto awareness, community sensitivity, and willingness to engage. In Web3 gaming, given its short history and lack of established best practices, we place greater emphasis on whether a team’s vision aligns with Web3 principles and their learning agility, rather than prior Web3 experience.

We will continue monitoring UGC. Current Web2 UGC suffers from unsolvable centralization issues. Beyond providing content creation tools, UGC platforms should offer fully transparent reward mechanisms and free asset tradability—decentralization offers a viable solution, delivering added value. Teams with existing Web2 creator resources are favored, especially those capable of attracting creators to Web3 UGC platforms through transparency and higher earnings.

Game UA

Game UA projects generally center on user profiling, integrating on-chain, off-chain, and social dimensions. They fall into two categories: user acquisition (e.g., Carv) and operational strategy (e.g., Helika). However, all user acquisition platforms face retention challenges. That said, player data holds inherent value, which grows superlinearly with user count. If mass adoption occurs, game analytics platforms can capture part of this value.

Extending to game distribution platforms, last cycle’s infrastructure- and tool-focused distributors are losing competitiveness. Today, successful publishing hinges on having flagship games that drive large-scale user acquisition.

User/Fan Engagement

Projects primarily operate in entertainment, sports, and film industries. Based on IP collaboration models, they fall into two broad types: direct operation by IP holders or licensed co-operation. The licensing model reduces platform operational burden but depends heavily on resource allocation from IP owners. Direct IP operation requires heavier lifting but enables tighter integration between IP content/events and end products, often enhancing fan engagement through NFT-granted privileges. Observations across several projects suggest platforms with existing communities (e.g., Karate Combat) find it easier to convert current users into IP fans than starting from scratch solely based on IP followers. Moving forward, we’ll focus on platforms with high-value IPs, overlapping user/viewer/fan demographics with gaming/betting profiles, and deeper IP partnerships.

Institutional Service

The institutional services sector can be divided into the following sub-sectors:

- Trading/Brokerage Services: including exchanges, liquidity providers, brokers/dealers, clearing and settlement.

- Asset Management: including fund management, high-frequency trading, arbitrage, custody.

- Banking/Payments: payment processors/on-ramps/off-ramps, card issuance, banking-related services.

- Other Services: including trading tech providers.

Overall trends in the sector include:

- The institutional services sector is expected to maintain steady growth over the coming years.

- Compliance is a key trend, with firms actively building compliant operations.

- Roles among service providers are becoming increasingly defined, with each participant focusing on core competencies, creating checks and balances across niches that promote market integrity and efficiency.

- Prime brokerage (PB) service providers are poised to gain market share. Companies offering services that are currently absent in crypto but mature in traditional finance—such as ECNs, fully regulated clearing houses, and cross-margin capabilities—are worth watching.

- During the current ETF application window, native crypto service providers face disruption from traditional financial institutions, driving higher demand for compliance-grade products and reshaping market dynamics.

- Europe is a hotspot for institutional service development, while emerging markets like Latin America also show potential.

Bitcoin

Although Bitcoin has recently drawn attention due to inscriptions, its on-chain model lacks globally shared state and differs significantly from Ethereum in architecture (state, accounts, computation). Therefore, medium- to long-term development of Bitcoin infrastructure and applications will require fundamentally different approaches.

On this basis, Taproot Assets, rollups, and the Lightning Network warrant attention, along with newer technical paths like Statechain.

Sidechains

Sidechain approaches like Stacks have long dominated Bitcoin Layer 2 narratives due to lower technical overhead—enabling high programmability off-chain and easier ecosystem growth. However, reliance on cross-chain anchoring may make them vulnerable to newer technical approaches that could draw more traffic and attention.

Layer2

Many so-called Bitcoin Layer2s still resemble sidechains in core technical design but follow Ethereum’s model to build full-stack frameworks covering execution, settlement, verification/challenge, and DA. Differences among Bitcoin Layer2 projects lie mainly in their choice of tech stack across layers—for example, execution layers using Cosmos SDK, OP Stack, Polygon zkEVM, or Taiko; DA layers either leveraging third-party solutions or self-built. Most also integrate a layer of “account abstraction” or multi-chain wallet support to accommodate both Ethereum and Bitcoin address formats, simplifying user interaction.

Client-side Validation

Client-side validation technologies such as RGB and Taproot Assets enable asset issuance and trading with minimal on-chain footprint—worth continued monitoring.

Lightning Network

Lightning Labs plans to launch stablecoins and other assets on Taproot Assets next year. Additionally, innovations like LSPs (Liquidity Service Providers) could facilitate native-yield-bearing asset products—worth anticipating.

BRC20-like

BRC20-style assets heavily depend on specific infrastructure such as indexers. These infrastructures, along with new token standards like ARC20, deserve attention—though technical implementation risks should be monitored.

DLC

Though proposed early, DLCs faced limited demand and slow adoption. As the ecosystem expands, DLC applications may become more widespread, especially when integrated with oracles. However, centralization risks in certain DLC implementations must be carefully evaluated.

DePIN

DePIN is a sector prone to rapid growth during bull markets. Like gaming, DePIN has strong potential to onboard traditional users, making it highly attractive to the industry. Key factors in DePIN include: 1) decentralization and incentive design—the lifeline of any DePIN project, making mechanism evaluation paramount; 2) timing—optimal mechanisms must align with favorable market conditions. Projects launching early in a bull run benefit from easier user acquisition, demanding market sensitivity from teams; 3) industry fundamentals—hardware selection and target user profiles critically impact success. Below is a classification by hardware type:

Focus on ToC scenarios and markets where relevant hardware isn’t yet mainstream—potential for revolutionary shifts: For high-frequency ToC hardware (e.g., wearables), Web3 mechanics offer superior and more efficient crowdfunding channels, lowering barriers for both users and vendors. In DePIN, clear token incentives strengthen user motivation to purchase hardware (with quick payback periods), enabling pre-sales before production. With flexible cash flow, vendors can later focus on fundamentals—such as enriching software ecosystems, enabling cross-device integrations, and empowering tokens within the ecosystem. In underdeveloped regions, certain hardware might never see adoption without DePIN, but early speculative mining incentives could drive widespread real-world hardware distribution.

Approach improvement-focused hardware with caution: For ToC devices that are stationary or low-frequency but essential (e.g., routers), user base and penetration are large. DePIN presents an opportunity to improve user experience. In theory, DePIN reallocates resources and demand between suppliers and users, rebalancing costs and revenues to achieve better unit economics and cheaper services. However, challenges exist:

- Whether decentralized solutions can truly outperform centralized ones—many decentralized compute or storage solutions are actually more expensive and less efficient;

- Whether DePIN solutions threaten entrenched interests of major centralized firms. High necessity and large installed base mean this space is dominated by big players with deep user, brand, and capital advantages. Unless DePIN delivers a fundamental breakthrough or unites forces surpassing incumbent brands, competing against Web2 rivals remains difficult.

Monitor special-purpose mining hardware cautiously: For low-frequency, non-essential hardware—or devices bought solely for mining—DePIN may offer short-term returns but unlikely sustained user engagement. While DePIN might serendipitously cultivate new user habits, this outcome is unpredictable. Each project requires individual assessment.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News