Orb Land: Can a 600% Harberger Tax Enable Personal Consulting Services?

TechFlow Selected TechFlow Selected

Orb Land: Can a 600% Harberger Tax Enable Personal Consulting Services?

How much ETH would you be willing to pay to ask a question to Taproot Wizards founder Eric Wall?

By LINDABELL

Eric Wall, founder of Taproot Wizards, has launched a crypto-economic experiment called "Orb Land," aiming to tokenize personal consulting services as NFTs. Buyers of an Orb gain the right to ask questions of its creator and to resell that right. Technically, Orb is an enhanced ERC-721 that supports the ERC-721 interface, with all transfer-related functionalities preserved. While Orbs can be displayed on OpenSea, they cannot be listed for sale on NFT marketplaces such as OpenSea, Sudoswap, or Blur. Additionally, Orb uses auctions and the Harberger tax system to manage ownership.

(Eric Wall is a cryptocurrency researcher, critic, and investor who previously served as Chief Investment Officer at Arcane Assets. He currently sits on the StarkNet Foundation board and is the founder of the Bitcoin Ordinals project Taproot Wizards and the Bitcoin NFT project Quantum Cats.)

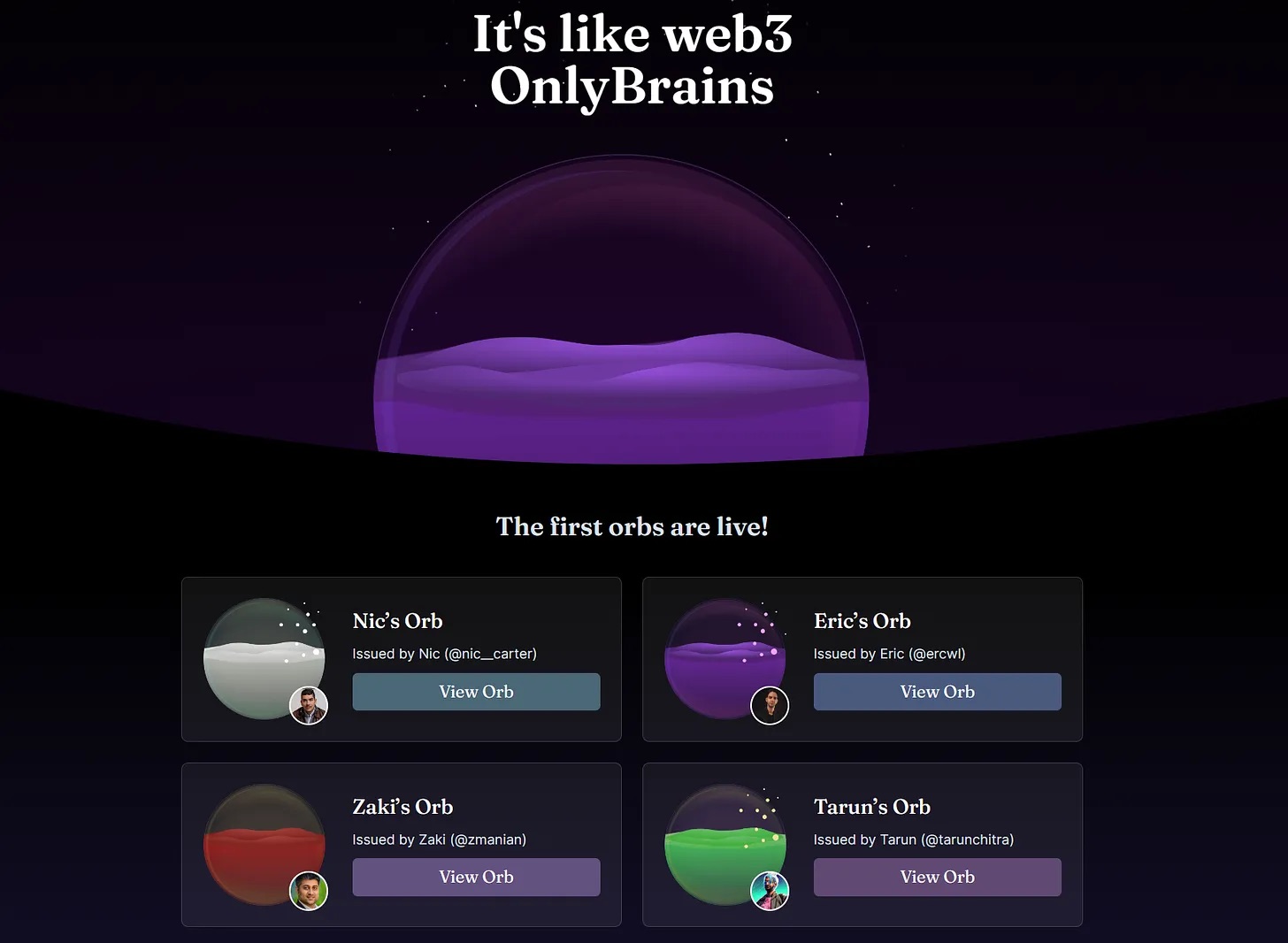

On the Orb Land website, users can browse Orbs created by various individuals. Different Orbs offer different functionalities, with question-and-answer Orbs currently dominating. This means Orb holders have the right to submit a question to the Orb’s creator and receive a text response within a specified timeframe (cooldown period). These interactions are recorded and submitted on the Ethereum blockchain. Notably, only one question may be submitted per invocation. The liquid inside the Orb represents the remaining time a holder can retain ownership, while the glow emitted by the Orb corresponds to the cooldown period. As the cooldown nears completion, the glow intensifies.

Harberger Tax

The Harberger tax, proposed by economist Arnold Harberger, is a radical economic policy that redefines ownership through two core principles:

-

Asset owners self-assess their asset's value and must pay taxes based on this declared value;

-

Anyone can purchase the asset at any time at the owner’s self-declared price, immediately acquiring ownership.

Under the Harberger tax system, owners are incentivized to set relatively low sale prices to minimize tax obligations, effectively enabling market-driven pricing. In Web3 projects, integrating Harberger taxes can enhance NFT liquidity, as every NFT remains in perpetual auction—holders must set a public sale price allowing anyone to buy it instantly.

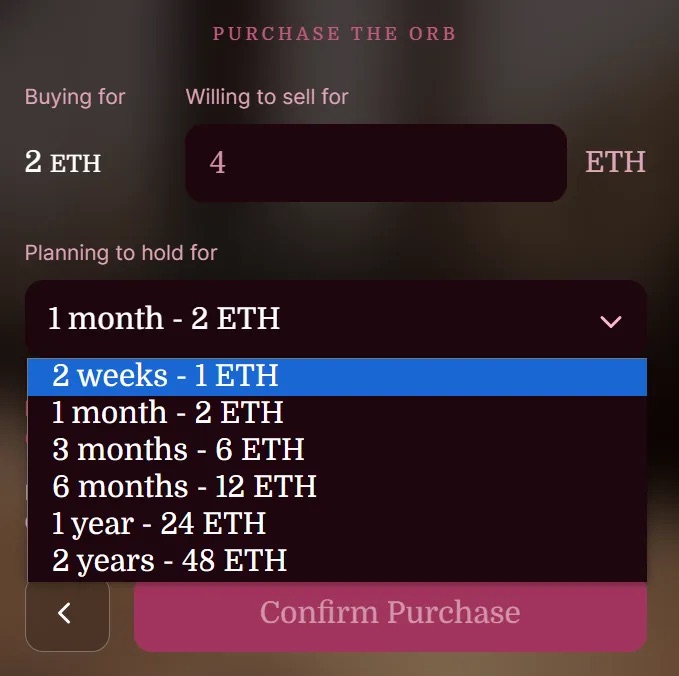

Orb Land is a crypto use case incorporating Harberger taxation. When purchasing an Orb, users must set a desired sale price and pay a percentage of fees to the Orb smart contract to maintain ownership. For example, if you buy an Orb for 1 ETH and set a sale price of 2 ETH, with a Harberger tax rate of 150% per year, you must pay 2 × 150% = 3 ETH annually to retain ownership. If someone purchases the Orb for 2 ETH, you receive the payment minus applicable fees.

Benefits of using Harberger tax in Orb include encouraging fair pricing and enhancing asset circulation. On one hand, it strengthens Orb utility—if initial buyers neither use nor sell the Orb, its purpose is undermined. On the other hand, Harberger tax ensures sale prices remain reasonable; excessively high prices would require prohibitively expensive monthly tax payments to maintain ownership.

How Does Orb Work?

Currently, Orbs cannot be freely created, but applications are open. Once approved, an Orb is sold via auction. During creation, the creator defines key parameters including Harberger tax rate, cooldown period, privacy settings, exclusivity conditions, and duration.

The auction winner becomes the Orb holder. Per Harberger rules, the holder sets a sale price and pays corresponding taxes based on that price and holding duration. Anyone can purchase the Orb at any time to become the new owner, while current holders can adjust the sale price anytime. If no one buys and funds are depleted, the system automatically triggers a new auction; if no bids emerge, the Orb returns to its creator.

Orb holders have the right to ask the creator a question, which must be answered within the predefined cooldown period. Failure to respond disqualifies the creator from collecting Harberger tax revenue and future royalty payments. Additionally, the Orb contract allows holders to flag low-quality responses on-chain, with flagged answers displayed on the Orb Land website.

Throughout this process, Orb Land collects a 5% platform fee. Beyond that, initial auction proceeds and Harberger tax revenues go entirely to the creator, who also earns royalties from secondary sales and auctions. Orb holders may generate income not only through resale auctions but also potentially earn tips by asking insightful questions. In theory, if tip earnings exceed Harberger tax costs, net gains are possible. From this perspective, Orb Land resembles a strategy game where holders attract buyers by posing intriguing questions and withholding answers.

Interesting Questions and Answers on Orb Land:

Currently, there are four Orbs on Orb Land, owned by Nic Carter (General Partner at Castle Island Ventures), Eric Wall (founder of Taproot Wizards), Zaki Manian (founder of Sommelier Finance), and Tarun Chitra (founder of DeFi risk management firm Gauntlet).

-

Nic's Orb: priced at 6 ETH, Harberger tax rate of 150% per year, 7-day cooldown.

-

Eric's Orb: priced at 4 ETH, Harberger tax rate of 600% per year, 7-day cooldown.

-

Zaki's Orb: priced at 2 ETH, Harberger tax rate of 600% per year, 14-day cooldown.

-

Tarun's Orb: priced at 2 ETH, Harberger tax rate of 150% per year, 10-day cooldown. All of Tarun Chitra’s responses are set to private.

These creators have shared insights on various cryptocurrency and blockchain topics. Below are some highlights:

Responding to a question about the performance outlook for ETH, BTC, and SOL, Nic Carter stated: “Although 2024 brings multiple tailwinds for Bitcoin such as ETF approvals, I still believe Ethereum will ultimately outperform both BTC and SOL. The market needs to recognize that Ethereum has a unique and executable roadmap. The short-term pain caused by pursuing a multi-track approach is worth it to achieve Vitalik’s rollup-centric vision. In my view, ETH is the only platform that has truly figured out how to capture Layer 1 fees and return value to token holders. Despite current uncertainty around whether to prioritize capital returns or lower overall fees for competitiveness (the trend now appears to favor lower fees), Ethereum’s execution on its roadmap surpasses every other project.”

When asked which seed-stage projects he’s involved with, Eric Wall responded: “There are many seed rounds emerging in the Bitcoin Layer 2 and Ordinals space, with valuations ranging from $15M to $40M—for example, Alpen Labs, Xverse, and Chainway.”

Regarding Chainlink’s potential role in solving Ethereum consensus overload, Eric Wall said: “Chainlink itself doesn’t solve anything, but if you allow Chainlink oracles to determine truth within a separate system—like a drivechain or Ethereum L2—then those systems become Chainlink-permissioned sidechains. Take drivechains: we could design them so miners need approval from Chainlink oracles to move funds, using oracles as a backstop. While I wouldn’t recommend relying on Chainlink algorithms for drivechains, adding Chainlink oracles as watchtowers in provably fraudulent systems isn't necessarily harmful. However, what happens when Chainlink fails?”

On ensuring PoS chains’ impact on Bitcoin’s security budget, Zaki Manian noted: “Bitcoin’s strength as a timestamping system is closely tied to emission volume, meaning it must evolve into a valuable data availability system to secure itself post-emission. I think if PoS chains begin anchoring timestamps onto Bitcoin, Bitcoin’s relevance will grow in an increasingly high-throughput chain ecosystem.”

On whether only DA layers and consensus chains can achieve sustainability, Zaki Manian added: “Unless there are significant network effects between multiple applications sharing a DA layer, pure DA systems face sustainability challenges. Staking derivatives offer pure DA systems a path toward monetary properties, while restaking enables exploration of higher-value services like oracles and sequencers. New tokens like TIA have limited ability to capture opportunities at the application layer—vertical integration being the best-case scenario.”

Summary

By integrating Harberger taxation, Orb enhances NFT utility and market liquidity while providing creators with sustained monetization. However, the Harberger tax model may impose heavy financial burdens on holders. Eric Wall’s Orb began auctioning in April 2023; Pawle.eth initially purchased it for 10 ETH but eventually relinquished ownership due to the requirement of paying Eric Wall approximately $3,700 monthly under the Harberger tax scheme. In response, the Orb Land team introduced a new feature called “relinquishWithAuction,” encouraging holders wishing to exit to conduct Dutch auctions, thereby facilitating smoother ownership transitions and maintaining market liquidity.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News