First Class仓 Pandora Report: NFT Fractionalization Project Based on ERC404 Token Standard

TechFlow Selected TechFlow Selected

First Class仓 Pandora Report: NFT Fractionalization Project Based on ERC404 Token Standard

Pandora achieves NFT fractionalization through the ERC404 format, featuring a relatively novel mechanism.

Author: TopVault Blockchain Research Institute

*Originally published on February 5

Concise Summary

Pandora is an NFT fractionalization project launched on February 2, built on the ERC404 token standard. Users can purchase its namesake token PANDORA on Uniswap V3 to obtain ERC404 tokens—effectively holding fractionalized ownership of its NFTs, known as Pandora Replicants—or they can directly buy Pandora Replicants on OpenSea.

The current price of PANDORA is $2,375.76 with a 24-hour trading volume of $5.365 million; Pandora Replicants have recorded trading volume of 48 ETH.

Fundamental Overview

Team: Pandora was developed by an anonymous team, and the number of team members is unknown. Three developers—Acme, ctrl, and Searn—can be identified from public information. Acme operates the Pandora project’s GitHub and appears to be an engineer at Coinbase based on his social media accounts. Another developer, ctrl, is one of the investors in Syndicate and runs his own Web3 community. Little public information is available about the third developer, Searn.

Funding: Pandora has not disclosed any fundraising details.

Business Mechanism

Fractionalization Mechanism

Pandora is an NFT fractionalization project centered around the ERC404 token standard—an experimental standard bridging ERC20 and ERC721. ERC404 tokens can be traded on platforms like Uniswap similarly to fungible tokens. Meanwhile, each full ERC404 token corresponds to one NFT (called a Replicant NFT). The mathematical relationship is expressed as follows:

nReplicant NFT = [nERC404]

Here, nReplicant NFT denotes the number of Replicant NFTs owned, nERC404 represents the quantity of ERC404 tokens held, and [n] refers to the largest integer less than or equal to n.

In simple terms, users receive one NFT for every whole ERC404 token held. For example: holding 0.5 tokens grants 0 NFTs; holding 1 token grants 1 NFT; holding 1.5 tokens still grants only 1 NFT; holding 2 tokens grants 2 NFTs; holding 2.5 tokens grants 2 NFTs, and so forth.

In the Pandora project, the ERC404 token is called PANDORA, and the corresponding Replicant NFTs are named Pandora Replicants. Users first acquire PANDORA tokens via Uniswap V3 using ETH or other tokens. Holding PANDORA tokens equates to fractional ownership of Pandora Replicants, with the number of NFTs determined by the amount of PANDORA held.

Through the ERC404 standard, Pandora achieves an effect similar to NFT fractionalization. When bullish on a particular NFT collection, users can choose to hold partial positions via tokens instead of purchasing entire NFTs—offering greater flexibility in capital allocation and lowering the financial barrier to NFT investment.

NFT Burning and Re-minting Mechanism

However, Replicant NFTs differ from standard ERC721 NFTs due to their burn-and-re-mint mechanism, which activates when users transfer or trade ERC404 tokens. As previously noted, whole-number ERC404 tokens are linked to Replicant NFTs, meaning changes in token holdings trigger corresponding changes in NFTs. There are two scenarios:

1) When a user sells ERC404 tokens, the associated Replicant NFT in their wallet is burned (destroyed).

2) During a transfer, the sender's Replicant NFT is burned, and a new one is re-minted in the receiver’s wallet.

Each re-minting refreshes the attributes of the Replicant NFT, potentially altering its rarity. Therefore, if a user is dissatisfied with their NFT, they can repeatedly transfer their tokens to regenerate new NFTs until they obtain one they prefer. Conversely, if a user wishes to sell or send their Replicant NFT without changing it, they should transact directly with the NFT—either selling it on OpenSea or transferring the NFT itself. In short: operate on the ERC404 token if you want the Replicant NFT to change; operate on the Replicant NFT directly if you wish to preserve its current state.

Pandora Replicants

Pandora Replicants are the Replicant NFTs of the Pandora project—depicted as boxes in five different colors, each representing a distinct rarity level. The official team has not disclosed exact quantities per rarity tier, but the descending order of rarity is: Red, Orange, Purple, Blue, Green. Future updates may allow these boxes to unlock new NFTs.

Operational Data

Pandora launched on February 2. The current PANDORA token price is $2,375.76, with a 24-hour trading volume of $5.365 million.

Figure 1 PANDORA Price, Source: DEX Screener

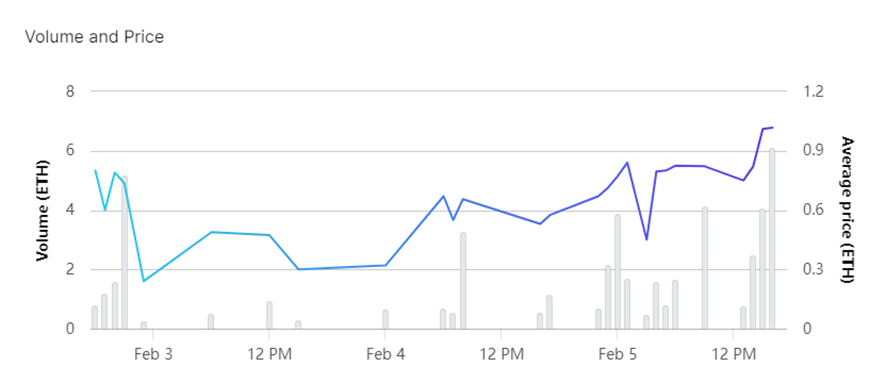

Currently, the floor price of Pandora Replicants is 1.2 ETH, with a total trading volume of 48 ETH and 670 holders.

Figure 2 Pandora Replicants Trading Data, Source: OpenSea

Economic Model

Pandora has not publicly released its economic model, but both the PANDORA token and Pandora Replicants share a fixed maximum supply of 10,000 units each. Approximately 5,000 tokens are currently in circulation. At launch, the team purchased 5,000 tokens from the market for use in operations and team incentives. Additionally, the team reserved 700 tokens to be distributed linearly over one month via Sablier. On the first day of launch, the team spent approximately 400 ETH repurchasing tokens, primarily to rebalance liquidity provider (LP) positions on Uniswap V3 after price fluctuations.

Overall Assessment

1. Pandora implements NFT fractionalization through the ERC404 mechanism, which is relatively novel.

2. The ERC404 token enhances NFT liquidity, allowing users to directly sell tokens on decentralized exchanges (DEXs) rather than waiting for buyers on NFT marketplaces.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News