Delphi Researcher: Solana is the best choice for crypto to have its ChatGPT moment

TechFlow Selected TechFlow Selected

Delphi Researcher: Solana is the best choice for crypto to have its ChatGPT moment

Cryptocurrency urgently needs to enter its "ChatGPT moment," and we don't have much time left.

Author: Teng Yan, Researcher at Delphi Research

Translation: Luffy, Foresight News

I've been thinking about the Ethereum vs. Solana debate—a hot topic in crypto.

Rather than diving into their technical differences—there are already many in-depth analyses out there, such as Syncracy Capital’s Solana thesis, which I highly recommend—I’d like to share a personal perspective on where our industry is headed.

I believe Solana could become one of the most valuable human inventions of the future, standing alongside Ethereum and Bitcoin.

We don't have much time

Crypto has existed for over a decade. It has attracted hundreds of billions in capital from investors. It has become a magnet for some of the smartest talent. We may be one of the most talent-concentrated industries (perhaps only rivaled by artificial intelligence).

Yet we still haven’t discovered that elusive killer use case—the application people cannot live without, whose absence would cause widespread public distress. Only then will governments find it impossible to shut down crypto.

We desperately need crypto’s "ChatGPT moment." ChatGPT reached 100 million users faster than any app in history—just two months.

As time passes, the pressure mounts. While crypto currently enjoys some political and social support, these favorable sentiments will fade if we fail to deliver impactful results. We stand at a crossroads—over the next few years, it will be decided whether crypto becomes a pivotal, world-changing technology.

We can't wait anymore. The time must be now.

For us to achieve a killer application, the infrastructure layer must be ready.

Two philosophies

Ethereum and Solana adopt two different philosophies but aim toward the same end state.

Solana's philosophy is to first build a useful blockchain, then gradually increase decentralization and censorship resistance over time. It was designed for high performance and aims to be the best execution layer.

-

Low fees, low latency, high throughput

-

Solana optimizes for atomic composability, viewing it as blockchain’s most useful feature

-

Improved UX over EVM (e.g., no token approvals required)

-

Solana scales with hardware—Moore’s Law has worked for decades

-

After three years of real-world testing, tools and partnerships are already in place.

Toly succinctly outlined his vision here:

In contrast, Ethereum’s philosophy is to first build a decentralized and censorship-resistant blockchain, then gradually improve usability over time.

This gives ETH a monetary premium. Ethereum’s roadmap (Surge, Verge, Purge, Splurge) focuses on scalability improvements—this is a journey unfolding over years, not immediately. Today, transaction costs remain high and throughput is low.

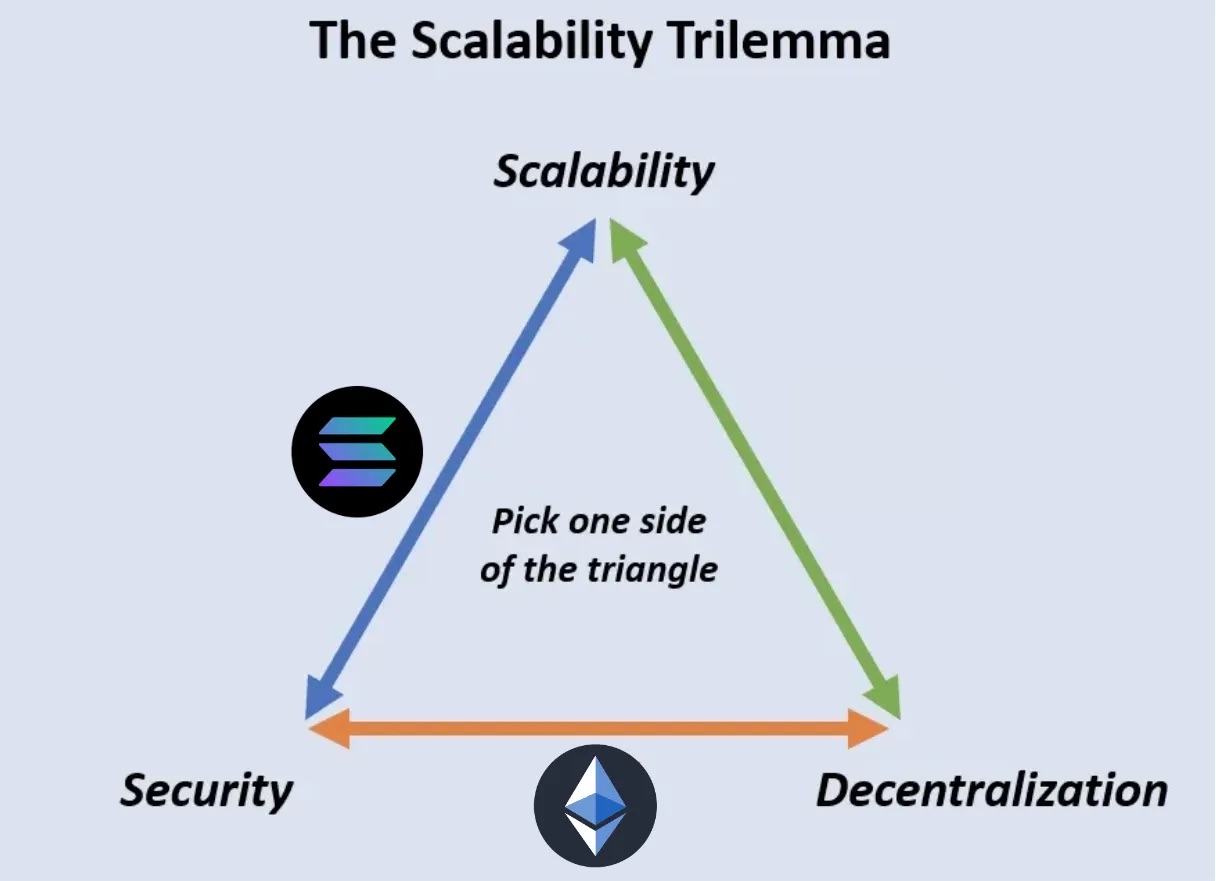

The well-known blockchain trilemma states that achieving optimal scalability, security, and decentralization simultaneously within a single chain is extremely difficult. Improving any two typically comes at the expense of the third.

There is no perfect blockchain—trade-offs are inevitable.

Most debates between Solana and Ethereum revolve around the nature and extent of these trade-offs. The core question is how to balance them: How much decentralization can be sacrificed for scalability? Should security take priority even at the cost of performance and fees?

Key questions

We need to clarify: What do builders, entrepreneurs, and society actually want from blockchain technology?

Decentralization isn’t binary—it exists on a spectrum.

Some use cases require more decentralization than others. For money and finance: yes, I need assurance that I control my assets, and no single entity can take them away. Otherwise, I’d just use a bank. But for gaming? Social media? These can deliver incremental improvements over existing platforms through greater user ownership and aligned incentives—even without full decentralization.

With this in mind, here is my current mental model for the future of blockchains:

-

Power law: A small number (<5) of general-purpose chains will capture most attention;

-

Multiple chains will coexist, many specializing in specific use cases—app-specific chains will be ubiquitous;

-

There is no one-size-fits-all solution

Ethereum and Solana will coexist. Both may thrive and become massive technological platforms. Yet I find myself leaning toward Solana’s philosophy, despite its flaws—weak censorship resistance, urgent need for fee market reform, light clients, etc.

Because today, Solana is ready to support large consumer-facing applications—for example, compressed NFTs are only available on Solana.

We need to find crypto’s ChatGPT moment—now, not five or ten years from now. Solana might be our best shot.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News