Sui and Aptos Ecosystem Hidden Dark Horses: Early Investment Guide for Navi and Amnis

TechFlow Selected TechFlow Selected

Sui and Aptos Ecosystem Hidden Dark Horses: Early Investment Guide for Navi and Amnis

Allocating Sui and Aptos tokens from an asset allocation perspective, depositing them into LST protocols to earn APR, while simultaneously farming protocol token airdrops, is a good way to maximize multiple benefits.

Author: dt

In the previous bull cycle, the rotation among Layer 1 public blockchains created numerous wealth opportunities. The successive rise of EVM-based L1s—from Ethereum to BSC, then Fantom and Polygon, followed by Avalanche—not only delivered remarkable price gains for the native tokens themselves but also lifted all ecosystem protocols along with them. However, in this current cycle, EVM L1s are no longer the dominant narrative. Instead, various L2 rollup chains have sprung up like mushrooms after rain, while capital-favored high-performance Move VM blockchains such as Sui and Aptos now represent the most promising public chains in the market.

In previous episodes of CryptoSnap, Dr.DODO introduced many projects within the L2 Rollup space. This week, we’ll spotlight two promising yet-to-launch token projects built on the Move VM ecosystem—Sui and Aptos—and help you position yourself early!

Navi Protocol

The first project is Navi Protocol, currently the top protocol in the Sui ecosystem by TVL—nearly $100M. After acquiring Volo, another leading liquid staking token (LST) protocol in the Sui ecosystem, Navi now offers both lending and liquid staking services.

Navi’s lending platform stands out for capital efficiency, security, and user experience. Its innovative “Leverage Vault” uses automated leverage to boost yields, while the “Isolation Mode” reduces risks associated with new assets and enables 24/7 real-time account monitoring. Navi continuously refines its operations, adding features like reward management and transaction history to deliver seamless lending services.

Volo holds the largest share—30%—of the liquid staking market in the Sui ecosystem and was the winner of the Sui Foundation’s Liquid Stake Hackathon. With Navi’s acquisition of Volo, users now benefit from a one-stop solution for lending and LST services, better meeting their needs.

Additionally, Navi is currently running a points campaign. The points system includes earning rewards through native token staking, fee discounts, and participation in protocol governance. It also draws inspiration from Curve’s ve economic model by introducing the concept of veNavi.

Amnis Finance

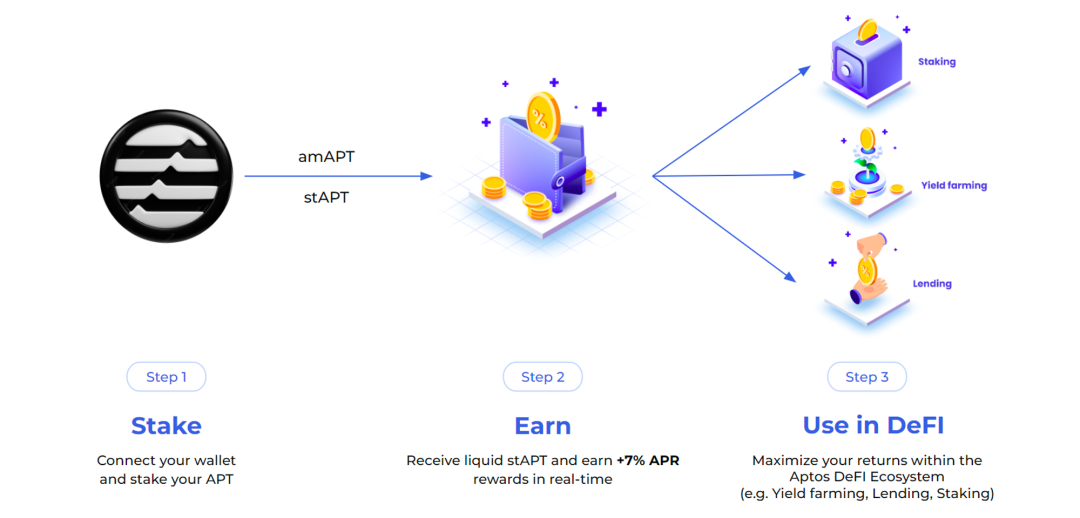

The second project is Amnis Finance, a liquid staking protocol on Aptos, currently ranking second in Aptos ecosystem by TVL at $38M. Amnis provides users with a secure, easy-to-use, and innovative liquid staking solution that allows them to maximize returns on APT tokens while unlocking liquidity.

Amnis has launched two APT derivative tokens: amAPT and stAPT. amAPT is a 1:1 stablecoin pegged to APT, usable for trading, liquidity provision, and more. stAPT is a yield-bearing asset representing APT staked with Amnis, allowing holders to earn staking rewards.

Unlike other LST protocols, Amnis features an embedded yield-tokenization product. It packages yield-bearing assets into standardized yield tokens (SY), which are then split into principal tokens (PT) and yield tokens (YT), giving users maximum control over their earnings. This innovation grants users greater flexibility in asset control and yield management.

Author’s View

As I write this, $SUI continues to reach new highs, yet the on-chain ecosystem remains in a very early pioneering phase. Similarly, on the other Move-based chain Aptos, aside from Thala’s leading position in the ecosystem, most other projects are still in their infancy.

Both protocols covered here offer LST products. From an asset allocation perspective, holding SUI and APT tokens and depositing them into these LST protocols to earn APR while positioning for potential protocol token airdrops is, in my view, a smart multi-benefit strategy.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News