These 3 Key Indicators Will Determine BTC's Development in the Coming Months

TechFlow Selected TechFlow Selected

These 3 Key Indicators Will Determine BTC's Development in the Coming Months

In the coming weeks and months, a large amount of capital will flow into ETFs linked to BTC.

Source: Bitcoinist

Compiled by: Blockchain Knight

Samson Mow, CEO of JAN3, has identified a series of key indicators that could influence BTC's trajectory in the coming months.

Among the various metrics, Mow highlighted capital flows into BTC through spot ETF issuers, real inflation, and computing power evolution.

On January 28, Mow stated on X that he believes substantial inflows into ETFs linked to BTC over the coming weeks and months could play a crucial role in driving BTC adoption and price appreciation.

The CEO particularly emphasized the importance of the spot BTC ETF inflow metric. The SEC recently approved several spot BTC ETFs—the first such approvals in over a decade.

Top Wall Street firms including BlackRock and Fidelity have been leading the charge, purchasing increasing amounts of BTC over the past three weeks. As of January 26, eight spot BTC ETFs had acquired 4,160 BTC. Meanwhile, Grayscale Investments, the issuer of GBTC shares, sold off 9,932 BTC.

As more institutional investors enter BTC via regulated ETFs, its price may rise accordingly.

For now, however, traders are closely watching the pace at which Grayscale sells GBTC shares, redeems BTC, and potentially reallocates it to spot BTC ETF issuers.

The conversion of GBTC holdings back into BTC could impact prices, creating additional selling pressure and dampening overall holder optimism.

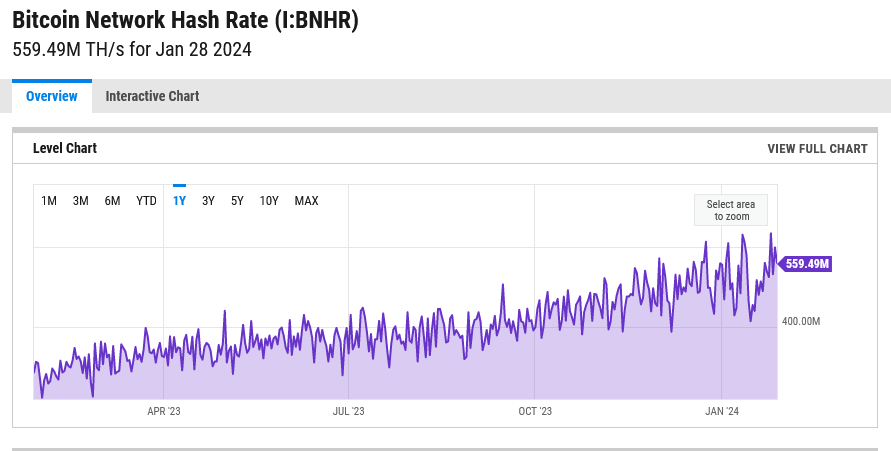

Ahead of the BTC halving event expected in early April 2024, Mow is also monitoring network hash rate. Hash rate measures the computational power directed toward securing the blockchain.

Generally, a higher reading indicates a healthier industry ecosystem, which can boost investor confidence, signaling that miners remain optimistic about the network’s outlook despite expecting significantly lower revenues over the next three months.

As of January 29, BTC's hash rate exceeded 559 EH/s, slightly down from the all-time high of approximately 632 EH/s reached in January 2024.

Despite the rising hash rate, miners have consistently sold their holdings at spot prices. Over the past week, miners offloaded thousands of BTC, contributing to downward price pressure.

Whether this liquidation trend will continue in the coming weeks remains to be seen. Typically, the more assets miners unload through major exchanges, the weaker the price performance, negatively affecting market sentiment.

In addition, the CEO tracks macroeconomic indicators such as the U.S. M3 money supply, the pace of BTC adoption across countries, and real inflation rates in major global economies.

In the United States, both money supply and real inflation rates have moderately declined due to relatively high interest rates.

However, this situation could change if the Federal Reserve lowers interest rates in the coming months.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News