Bitcoin Protocol Ecosystem Evolution: From the Explosive Growth of Inscriptions to the Flourishing Development of Diverse Protocols

TechFlow Selected TechFlow Selected

Bitcoin Protocol Ecosystem Evolution: From the Explosive Growth of Inscriptions to the Flourishing Development of Diverse Protocols

We are still on the eve of Bitcoin ecosystem's explosive growth.

Author: Ling He Yi Interview

2023 was a landmark year for the Bitcoin ecosystem, with its price rising from $16,500 to $40,000, pushing the Bitcoin ecosystem to new heights. The first quarter of 2023 saw rapid development in the Bitcoin protocol, and by the fourth quarter, the market exhibited a thriving landscape. By year-end, amid significant challenges facing both digital assets and traditional markets, the ecosystem emerged from dormancy into revival.

The explosive growth of inscriptions further fueled innovation across the Bitcoin network. Beyond Bitcoin itself, capital began spilling over into its broader ecosystem. Most notably, enthusiasm for inscriptions spread to other public blockchains as well.

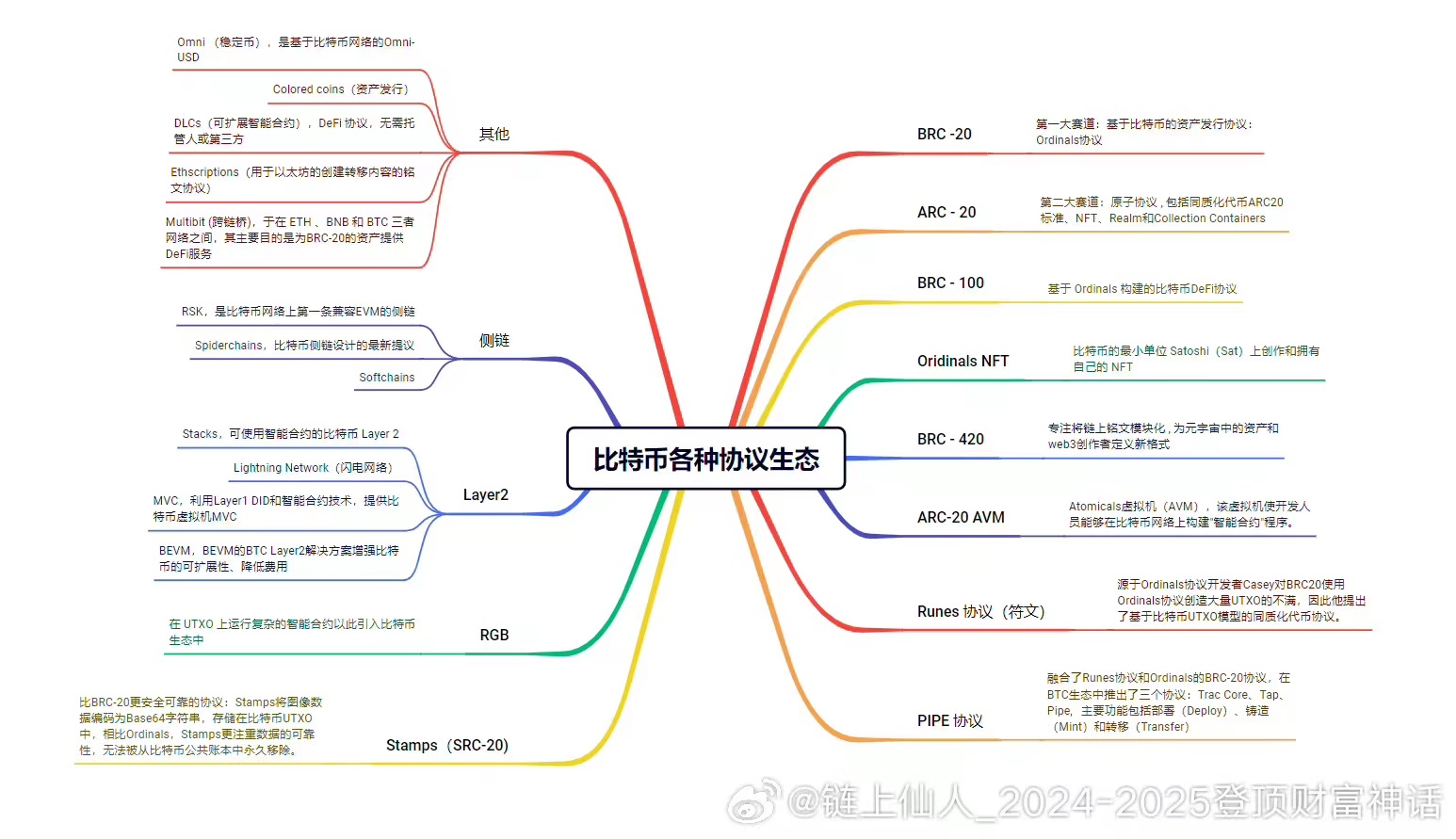

Popular Protocols in the Bitcoin Market

The Bitcoin ecosystem's breakout moment began when major platforms started listing ORDI. Starting last October, boosted by news around Bitcoin ETFs, Bitcoin’s value gradually rebounded, leading to a flourishing expansion across various Bitcoin protocols.

1. The Rise of Ordinals and BRC20

Before the surge of Ordinals, the Bitcoin inscription market remained largely unknown to the general public. However, the emergence of the BRC20 standard changed this dynamic. As ORDI skyrocketed in value, Bitcoin NFTs were revitalized in tandem.

BRC20 is a protocol built on top of Ordinals that enables fungible tokens to operate on the Bitcoin blockchain. Inscriptions refer to the technology that uses Ordinals to embed specific information—such as images or text—into individual satoshis (sats), the smallest unit of Bitcoin. Currently, BRC20 tokens like ORDI and rats lack practical utility beyond trading. Yet after Ordinals became viable, renewed interest emerged in Bitcoin’s blockchain capabilities. Developers across the crypto space began exploring the network’s potential, ultimately giving rise to the BRC-20 standard.

Similar to Ethereum’s ERC-20, BRC-20 is an experimental token protocol that allows for the minting and transfer of interchangeable tokens on the Bitcoin network via Ordinal inscriptions. This enables users to store script files on Bitcoin and assign tokens to individual sats. Unlike ERC-20 tokens, BRC-20 tokens exist natively on the Bitcoin network and do not rely on smart contracts, meaning their functionality is more limited compared to their Ethereum counterparts. Nevertheless, BRC-20 offers better compatibility and interoperability than traditional token standards, earning growing recognition and adoption.

2. Atomicals Protocol (ARC-20)

The ARC-20 token standard is provided by the Atomicals protocol, which mints and transfers tokens based on Bitcoin’s UTXO model. This marks a significant innovation within the Bitcoin ecosystem. The protocol is ingeniously designed to facilitate the creation, transfer, and updating of digital objects—akin to a new form of non-fungible tokens (NFTs)—that can now be directly managed on the Bitcoin blockchain.

ARC-20 strictly adheres to the principle championed by Bitcoin OGs: “Not your keys, not your coins.” Both in design philosophy and practical implementation, it aligns more closely with Bitcoin purism. In essence, ARC-20 tokens are indistinguishable from BTC itself, setting them apart significantly from tokens on other protocols.

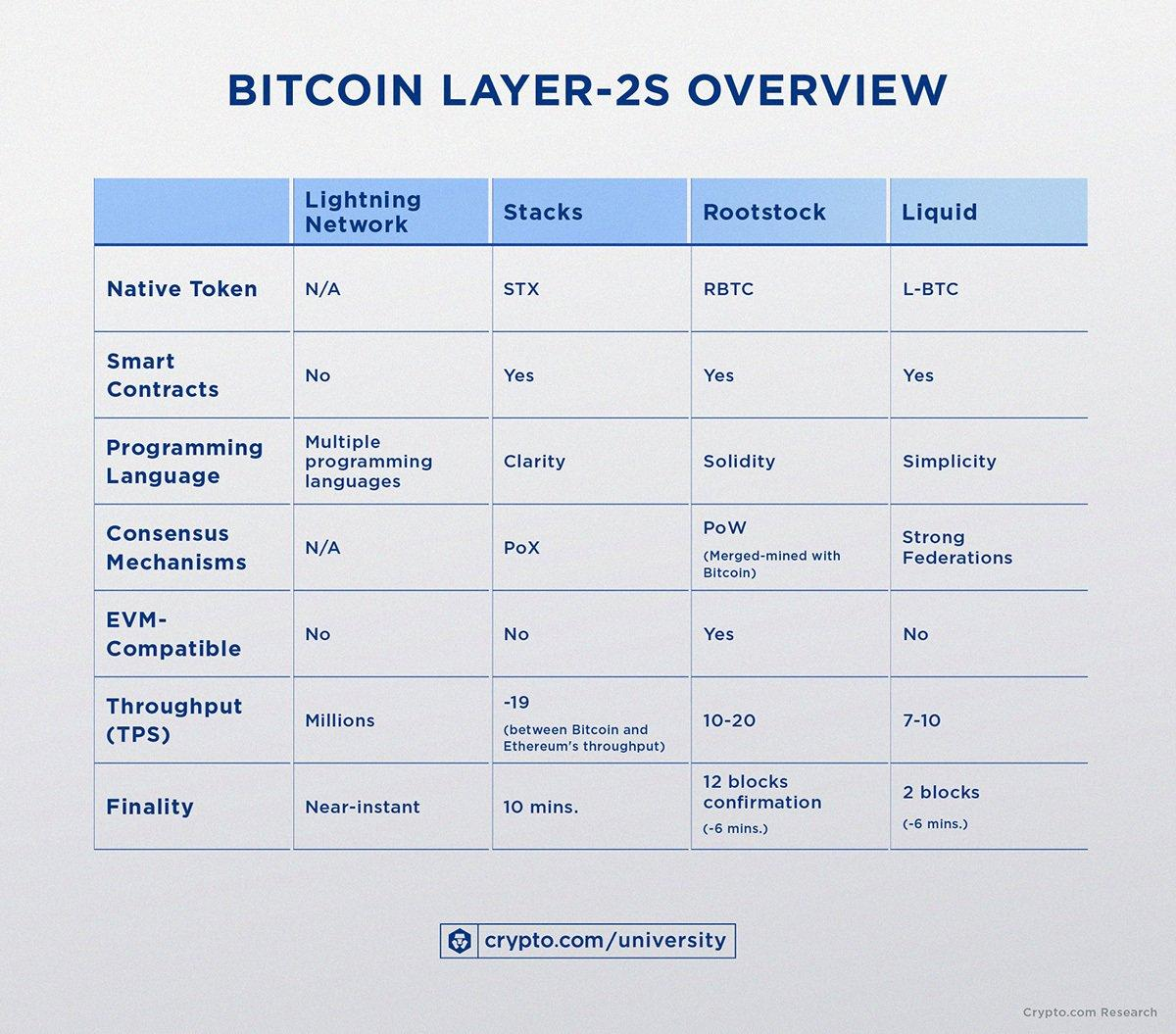

3. Bitcoin Layer2

Bitcoin’s inherent lack of native smart contract support has constrained the complexity of its ecosystem. To overcome this limitation, numerous sidechains and Layer2 solutions have emerged. Bitcoin Layer2 refers to protocols built atop Bitcoin’s base layer, designed to enhance scalability by processing transactions off the main blockchain (mainchain). These protocols also address other technical limitations and add extended functionalities to Bitcoin, improving overall performance while leveraging Bitcoin’s security and network effects.

Protocols built on Bitcoin—such as the Lightning Network, Rootstock, Stacks, Liquid Network, and Bitcoin rollup projects—bring scalability and programmability to the Bitcoin network. Collectively, they offer a glimpse into what the next phase of Bitcoin’s growth might look like. The Lightning Network, first launched in 2016, is a Layer-2 payment protocol operating on top of the Bitcoin blockchain. It leverages Bitcoin’s native smart contract features to enable near-instant payments. Comprised of multiple bidirectional payment channels, it processes transactions in parallel with the main blockchain, aiming to solve Bitcoin’s scalability issues such as long block times, limited throughput, and high transaction fees.

4. Runes Protocol

Runes aims to address inefficiencies found in earlier protocols, particularly BRC-20. Unlike multi-layered approaches used by some protocols, Runes features an elegant and simple design. By utilizing OP_RETURN in transactions, it assigns tokens to specific UTXOs, specifying output index, token amount, and token ID. This streamlined mechanism is not only easy to understand but also highly efficient in operation. The protocol clearly defines token flow and allocation, reserving a special message format for initial token issuance, ensuring clarity and transparency in token operations. While Runes appears promising, its practicality and long-term viability remain to be tested.

Beyond the aforementioned protocols, others such as PIPE, ARC-20 AVM, BRC-420, RGB, and Stamps (SRC-20) are also gaining traction within the Bitcoin protocol ecosystem.

Bitcoin Protocol Tokens and Inscription Tools

Selected Bitcoin protocol tokens:

-

BRC-20: Ordi, sats, rats

-

ARC-20: ATOM, Realm

-

SRC-20: stamp, kevin, utxo

-

Rune: Pipe

-

Rune Alpha: COOK, PSBTS

Selected inscription tools:

-

Wallets: Ordinals Wallet, Xverse, OKX Web3 Wallet, Unisat Wallet

-

Marketplaces: OKX Ordinals Marketplace, Unisat Marketplace, Ordinals Market, EVM.ink

-

Data analytics platforms: Dune, whatscription, GeniiData

The most commonly used tools are wallets, many of which now integrate marketplace functions. For most newcomers, a single wallet app is sufficient to get started.

Future Market Outlook

2023 can be seen as the year of comprehensive growth for the Bitcoin ecosystem. The emergence of inscriptions has reinvigorated the Bitcoin ecosystem, attracting a large number of developers and investors. Perhaps it is still early days—we may be standing at the dawn of an ecological explosion. Under current conditions, the protocols that manage to stand out deserve our attention and exploration, as the circulation and evolution of digital gold are far from complete.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News