Multicoin 2024 Outlook: The Next Exchange Will Emerge in a Non-Exchange Form, and Cryptocurrency Will Become the Product Driver

TechFlow Selected TechFlow Selected

Multicoin 2024 Outlook: The Next Exchange Will Emerge in a Non-Exchange Form, and Cryptocurrency Will Become the Product Driver

Every bull market in cryptocurrency is initiated by a new token distribution method.

Author: Multicoin Capital

Translation: TechFlow

Multicoin Capital outlines its expectations and outlook for the coming year. This article marks the first public release of these ideas, covering areas ranging from cryptocurrency to social networks.

The article delves into multiple themes, such as the theory of attention value, the rise of NFT collectible social networks, and the role of stablecoins in remittances within emerging markets. It also discusses how crypto is shifting from being a product to becoming a force that powers products, along with anticipated growth in on-chain data and new forms of token distribution.

These insights not only reflect the latest developments in cryptocurrency and blockchain technology but also signal new trends and opportunities likely to emerge in 2024.

Theory of Attention Value

Shayon Sengupta (Partner at Multicoin Capital) focuses on the theory of attention value.

Exchanges are designed to trade things that are easy to price—stocks, commodities, interest rates, etc. There are standard methods to value these assets (e.g., discounted future cash flows for stocks, border prices for a barrel of oil, willingness to pay $1.05 in the future for a redeemable dollar). This is what price discovery means in liquid markets.

However, there’s another class of goods whose price discovery revolves entirely around attention. Sneakers, art, sports memorabilia, vintage furniture—these inherently have less liquidity than stocks or commodities, and their value stems purely from social consensus, not DCF models (a valuation method).

In recent years, especially due to the internet, the theory of attention value has permeated traditional markets. TSLA, GME, AMC, DOGE, and CryptoKitties all experienced meaningful price discovery under this model. The primary pricing mechanism for these assets used to be cash flows and liquidation values, but now it’s largely driven by the amount of attention they receive.

Cryptocurrency plays two crucial roles in the theory of attention value: first, the ability to rapidly create new assets; second, the ability to trade those new assets.

If attention is the core pricing factor, then cryptocurrency can issue and trade assets that track attention. The broader pattern of "financializing attention" requires two of crypto's most important properties to reach its natural end state: permissionlessness and composability.

-

Permissionless: Anyone can issue any kind of asset

-

Composable: Anyone can trade these assets anywhere

This expands the experimental design space:

-

Increases the surface area for issuing new assets (e.g., historical creator tokens, prediction market LP positions, meme coins)

-

Embeds issuance and trading into new venues (e.g., messaging bots like bonkbot or Bananagun, leaderboards like friend.tech, in-game markets)

-

Facilitates coordination among asset holders (e.g., historically, collectively funding the purchase of a copy of the U.S. Constitution)

A near-term implication of this trend is that the next big exchange won’t look like an exchange. It will resemble a live-streaming platform where creators and audiences can bet together, or a group chat where friends and communities can instantly launch crowdfunding campaigns raising millions to build a network, or a Stack Exchange-like forum where top contributors are rewarded not just with platform-specific points, but with tangible economic returns.

In 2024, we’ll see entrepreneurs experimenting across these three major patterns. We’ll witness the emergence of the first “non-exchange” exchanges, serving both liquid and illiquid assets. These platforms will climb the rankings in trading volume and take over from communities like Wall Street Bets.

Social Networks for NFT Collectors

Vishal Kankani (Partner at Multicoin Capital) focuses on social networks for NFT collectors.

In 2024, I’m excited about collectible NFTs, increased participation in collecting, and the social experience of collectors.

Collecting has deep historical roots—from monarchs in ancient Egypt and China amassing rare treasures, to European cabinets of curiosities during the Renaissance. Museums themselves evolved from these private collections.

Psychologically, collecting serves as a form of self-expression beyond mere speculation. In certain circles, collectibles become status symbols, intertwining collecting behavior with personal identity, signaling commitment and expertise. The internet has amplified this behavior, connecting previously isolated enthusiasts and fostering a new sense of belonging within their respective tribes.

Despite this progress, several barriers still困扰collectors:

-

Fraud related to authenticity and provenance

-

Trading and interchangeability

-

Security, damage, and loss

-

Space and storage issues

Blockchain fundamentally breaks down these barriers and attracts more people into collecting. Blockchain is particularly appealing to younger generations already enthusiastic about collecting digital items—like Pokemon Go cards, virtual sneakers, and in-game skins. These are precursors to truly digital-native collectibles living on public blockchains.

Even as digital collectibles move from private databases to public blockchains, certain collector behaviors will remain unchanged: the desire to showcase collections, easily swap items, and connect and interact with their tribe. These behaviors will lay the foundation for the rise of social experiences built on ownership graphs.

Stablecoin-Powered Remittances in Emerging Markets

Spencer Applebaum (Partner at Multicoin Capital) focuses on stablecoin-powered remittances in emerging markets.

After interning at Bitspark—one of the earliest companies using BTC as a remittance channel, primarily in Southeast Asia and Africa—I became deeply fascinated by cryptocurrency. Cryptocurrency-powered cross-border payments remain one of the most exciting use cases since I discovered crypto.

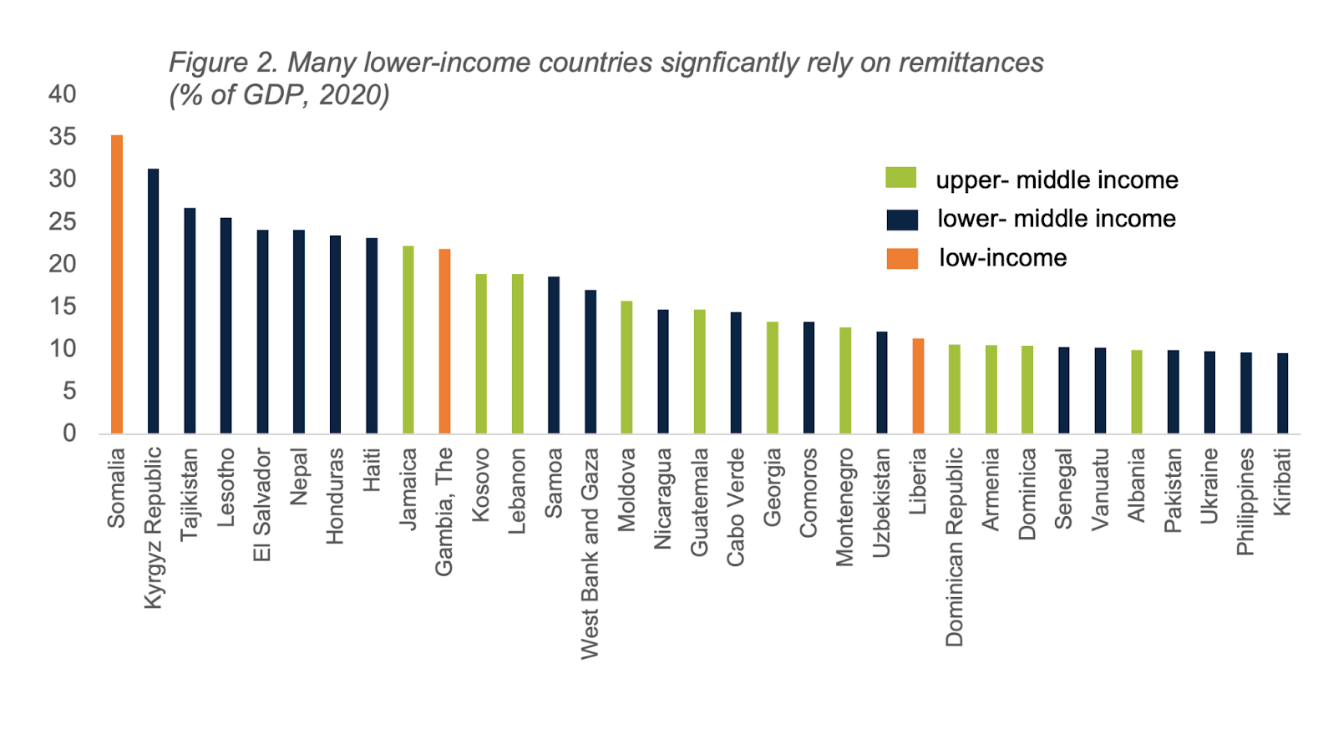

In many low-income countries, remittances are one of the largest drivers of GDP and a lifeline for many economies:

Data based on World Bank Development Indicators

Historically, the challenge with remittances has been high costs, and only a few fiat currencies (like USD, EUR, JPY, GBP) are exchangeable and tradable outside their issuing countries, making many remittance corridors slow and difficult to use. According to the World Bank, the average cost of sending remittances is around 6.2%, but this rises significantly for less common corridors. For example, sending money from South Africa to China costs over 25%.

Against this backdrop, I’m excited about the emergence in 2024 of two types of products:

-

Consumer-facing remittance apps

-

B2B SaaS opportunities for physical remittance operators (MTOs), especially those using stablecoins in traditionally hard-to-access or costly remittance corridors

The operational flow for these products is:

-

Convert local currency to USDC/USDT via local P2P payment methods (e.g., oRamp or El Dorado)

-

Send USDC to another country

-

Either hold USDC or convert it back to local currency via familiar domestic payment methods through another broker or liquidity provider

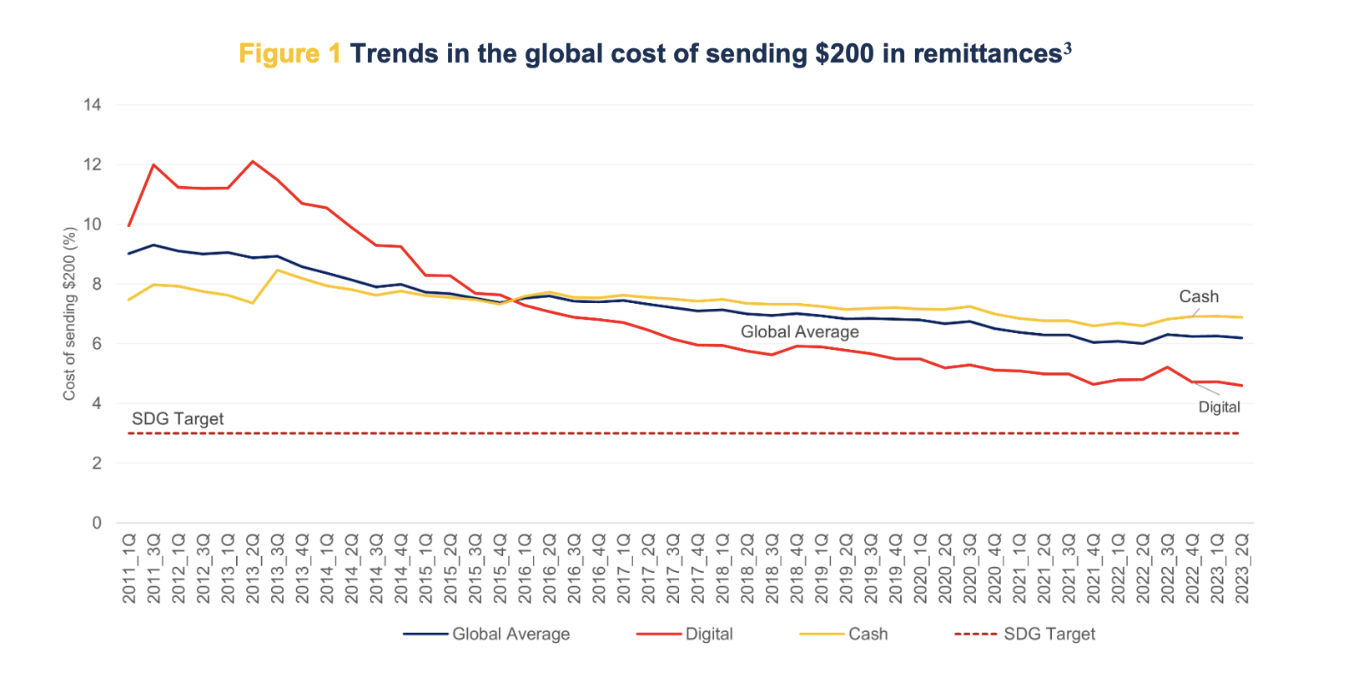

Over the past 12 years, digital payments have profoundly impacted global remittances:

World Bank Quarterly Remittance Prices Worldwide Report

Stablecoins will accelerate this trend and further reduce remittance costs. With the rapid adoption of stablecoins in 2023, 2024 will be a breakout year for stablecoin-powered remittances.

Crypto Transitioning from Product to Powering Products

Matt Shapiro (Partner at Multicoin Capital) believes that in 2024, crypto will shift from being a product to powering other products.

By 2024, we’ll see the trend of crypto evolving from a standalone product into an engine that drives other products. Signs of this are already visible, and I believe new sprouts are about to emerge.

Last year, crypto incubated new markets that were either impossible or extremely inefficient before. Hivemapper created an entirely new map, capturing location views 24 to 100 times more frequently than Google Street View, mapping nearly 10% of Earth in under a year, using crypto mechanisms to incentivize permissionless contributions at scale. During global GPU shortages, Render Network created a brand-new GPU supply market—a domain we expect to face persistent supply-demand imbalances in the coming years. Helium Mobile is attempting to fundamentally change the cost structure of the telecom industry by leveraging user-owned infrastructure and devices enabled by crypto.

Nubank, one of the largest neobanks with over 80 million customers, is actively entering crypto by launching Nucoin as a loyalty reward. Starbucks is also entering crypto through its Odyssey program. Blackbird is using crypto as an entry point into the restaurant industry (which could pioneer strong payment businesses, generating additional profits for restaurants).

BAXUS is leveraging crypto to build a marketplace for trading and investing in whiskey and other premium spirits, opening the market to new participant groups. oRamp is using crypto to build new markets for local and regional foreign exchange, narrowing spreads and reducing customer costs.

All these examples, while diverse, share a core principle: they use crypto technology to power products, generating meaningful economic outcomes. In some cases, like Starbucks, Nucoin, and Blackbird, crypto operates mostly behind the scenes. In others, like Hivemapper and Render, crypto is tightly integrated, highly visible, and a critical component of the product itself. Infrastructure built over the past five years has paved the way for crypto to power everyday use cases. By 2024, experimentation in this space will explode.

On-Chain Data

Eli Qian at Multicoin Capital focuses on on-chain data.

By 2024, he expects the volume of on-chain data to grow by several orders of magnitude. As new users join, use cases and functionalities of decentralized applications (dApps) and protocols will expand accordingly. Data from decentralized social protocols will be especially rich—people do far more and generate much more data on social products than on financial ones.

How will we handle such explosive data growth? Historically, on-chain data has been viewed through the lens of advertising and personalization. However, I hope to see teams adopt more first-principles thinking and recognize that when building social products, contextualizing on-chain data isn’t just a luxury—it’s a necessity.

Currently, our on-chain social data and identities are built on a unified graph (e.g., Farcaster), making it difficult to build social products for different social contexts. People are multifaceted and live in various social environments. Depending on context, our behaviors and needs differ. We use Facebook, Twitter, LinkedIn, and Snapchat for different reasons—the social graph creates specific environments and experiences on each platform.

The launch of Threads provides a case study. There are many reasons why Threads didn’t replace Twitter, but one key reason was environmental uncertainty. Threads imported its social graph from Instagram—a network primarily tied to real-life relationships—but the interaction patterns on Threads came from Twitter, an online-first, often anonymous environment. Due to this product-environment mismatch, Threads users were unclear about how to behave.

By 2024, edges and nodes in social graphs will be segmented and categorized into more specific and relevant environments. Some in-protocol solutions already exist (e.g., channels on Farcaster), but I expect out-of-protocol solutions to emerge as developers demand data more aligned with the products and social experiences they aim to build. I’m excited for the next wave of data infrastructure and developer tools that will support a new generation of social apps.

New Token Distribution Mechanisms

Tushar Jain (Managing Partner at Multicoin Capital) focuses on new token distribution mechanisms.

Every crypto bull run has been initiated by a new method of token distribution. Examples include:

-

PoW chain proliferation — 2013/2014

-

ICO — 2017

-

IEO — 2019

-

Liquidity mining — 2020

-

NFT minting — 2021

During the recent bear market, two new token distribution mechanisms emerged that may ignite the next bull run:

-

DePIN — rewarding individuals who help build productive capital assets (e.g., Helium, Hivemapper, Render)

-

Points — incentivizing product usage before finalizing tokenomics. Launching a token is a heavy lift, and once live, changing its economic model becomes even harder. Points have no units, no max supply, and carry lower regulatory risk due to non-transferability.

New token distribution methods are powerful ways to bring new users into the crypto ecosystem. I believe the next wave of mass users will come from those who earn rather than buy crypto assets. Both DePIN and points offer novel ways for new users—those who’ve never owned a crypto wallet—to acquire crypto assets.

UI-Layer Composability and Client-Side Zero-Knowledge Proofs

Kyle Samani (Managing Partner at Multicoin Capital) focuses on UI-layer composability and client-side zero-knowledge proofs.

UI-Layer Composability

In my talk at the 2021 Multicoin Summit, I explored the concept of composability. At the time, I focused more on atomic on-chain composability. However, in recent years, I've grown skeptical of atomic on-chain composability (hence changing my name on X from “Composability Kyle” to “Integrated Kyle”). Lately, I'm more interested in permissionless UI-layer composability. In 2023, we saw the first major breakthrough in UI-layer composability: Unibot. Unibot is an on-chain terminal and DEX bot on Telegram. Previously, people would get information somewhere on the internet (X, Reddit, news, Bloomberg, Telegram chats, etc.) and then navigate to a separate UI to trade (e.g., Drift, Binance, Coinbase). Unibot brings trading directly into Telegram—the place where people already socialize and exchange information.

By 2024, beyond Telegram group chats, there’s a massive opportunity to embed trading activities into many environments across the web.

Building on this idea, I hope to see more UI-layer composability—not just for capital accounts, but also for social products, especially Farcaster. Farcaster’s vision is bold: a single event feed, each event signed by a person, with countless user interfaces reading and writing to that feed.

We often discuss X as if it offers unique product experiences for different use cases: crypto Twitter, finance Twitter, sports Twitter, politics Twitter, etc. Building Farcaster clients from first principles to realize this vision is a real opportunity. In 2024, this design space will open up to the public.

Client-Side Zero-Knowledge Proofs

Over the past few years, discussions around zero-knowledge (zk) have mostly focused on zk rollups and zk coprocessors for scaling asset ledgers. However, I believe the most interesting design space for zk lies in client-side privacy. Recently, I’ve learned about two client-side zk setups that I find highly compelling:

-

Zk.me, as the name suggests, is a system for generating zk proofs about oneself, particularly for KYC and AML compliance. Without stricter on-chain KYC, I struggle to imagine DeFi growing tenfold. Under this assumption, I’d prefer users not to leak their data, and zk proofs will be key to achieving that vision.

-

Brave Boomerang. Traditionally, ad auctions run on centralized servers—whether Google, Facebook, or other online ad exchanges. Brave is flipping this model. Users run ad auctions locally on their devices and submit proofs of correct execution to the blockchain. This ensures no personally identifiable information is leaked, while still giving advertisers the precise targeting they seek (zk proofs can ensure Honda ads are shown to 16-year-olds, not 6-year-olds).

As these two examples show, the greatest opportunity to reshape internet trust and build new business models using zk lies on the client side.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News