A Decade in the Making: Reflections Following the U.S. Approval of Spot Bitcoin ETFs

TechFlow Selected TechFlow Selected

A Decade in the Making: Reflections Following the U.S. Approval of Spot Bitcoin ETFs

A new era for the crypto market will begin tonight.

Author: Hedy Bi, OKLink Research Institute

Two days ago, we argued that the U.S. would not easily let go of the Bitcoin spot ETF market. After a decade-long wait, this milestone has finally arrived. The U.S. Securities and Exchange Commission (SEC) has approved 11 Bitcoin spot ETFs, which will be listed on the Chicago Board Options Exchange (CBOE), the New York Stock Exchange (NYSE), and the NASDAQ. This means Bitcoin is now officially connected to the global financial system.

This journey has been far from easy. Even today, there remain many doubts—not only about the approval decision itself but also regarding the future challenges facing these newly approved Bitcoin ETFs.

Avoiding the "Circus Atmosphere": First, Treat Bitcoin "Normally"

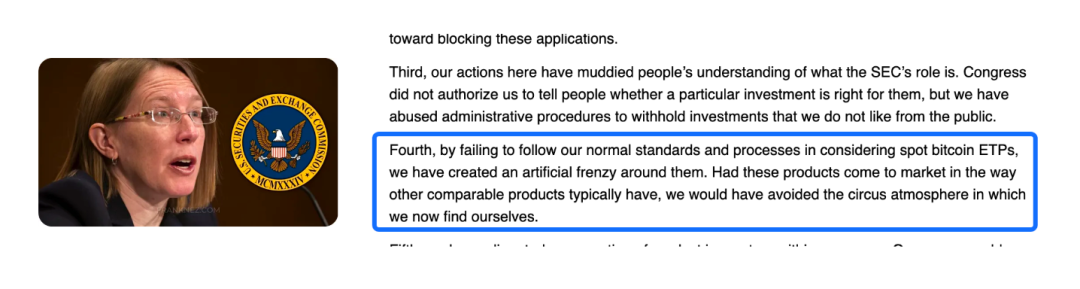

Following the release of the SEC’s approval documents, commissioners issued statements reflecting differing positions. Hester Pierce, a long-time crypto advocate and SEC commissioner, voiced her support and reflected on the past decade of rejections, sharing her personal views on the SEC: “By failing to follow our normal standards and processes when considering spot Bitcoin ETPs, we created an artificial frenzy around them. If these products had entered the market in the way other similar products typically do, we could have avoided the circus atmosphere we are in today.”

Figure: “The SEC created an artificial frenzy”

Even the SEC, which strives most to remain “market-neutral,” has now become part of the market's grand celebration.

Bitcoin is groundbreaking—like gold mined from the earth thousands of years ago. Only now, in the digital age, the tools for mining have changed, and the precious metal has become a digital asset. Just as with gold ETFs, the approval of Bitcoin spot ETFs allows investors to gain exposure to Bitcoin’s returns by purchasing ETF shares, without needing to directly hold or manage Bitcoin.

If Bitcoin were viewed “normally,” the market might not have had to wait ten years.

Two Factors That Held Back the SEC

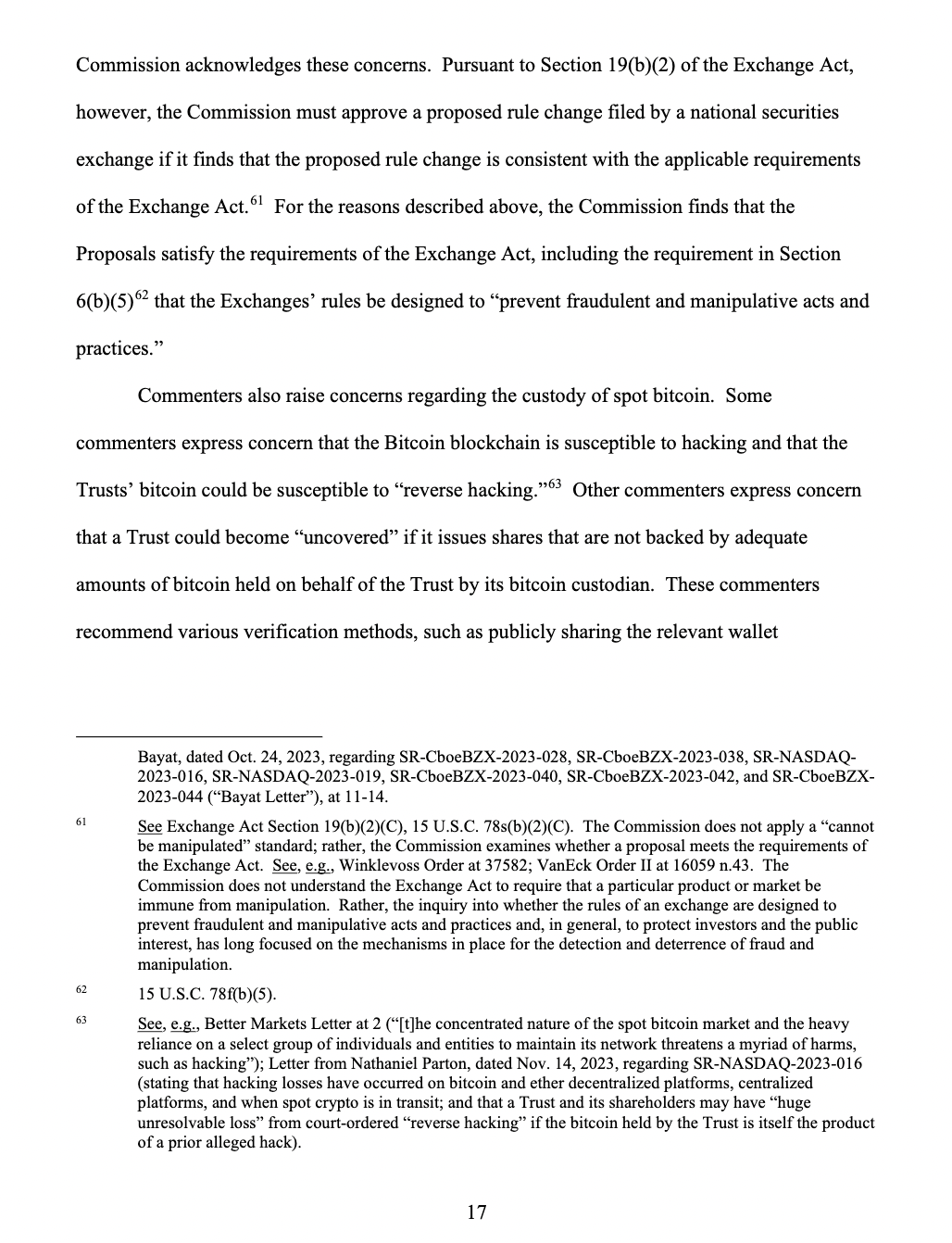

Over the past decade, two main concerns have dominated discussions: “Bitcoin custody security” and “the potential for manipulation of Bitcoin ETFs,” both of which were reiterated in the approval documents.

As mentioned earlier, just like gold ETFs, Bitcoin spot ETFs aim to provide investors with convenient, low-barrier access. But who exactly are these “investors”?

ETFs are designed for funds, institutional investors, and retail investors who cannot directly hold the underlying asset. In such cases, custodians provide centralized custody on behalf of those unable to hold the asset themselves. From a technical standpoint, existing leaders in Web3 wallet services can serve as reference models or direct partners in addressing Bitcoin custody security.

Figure: Screenshot from SEC approval document

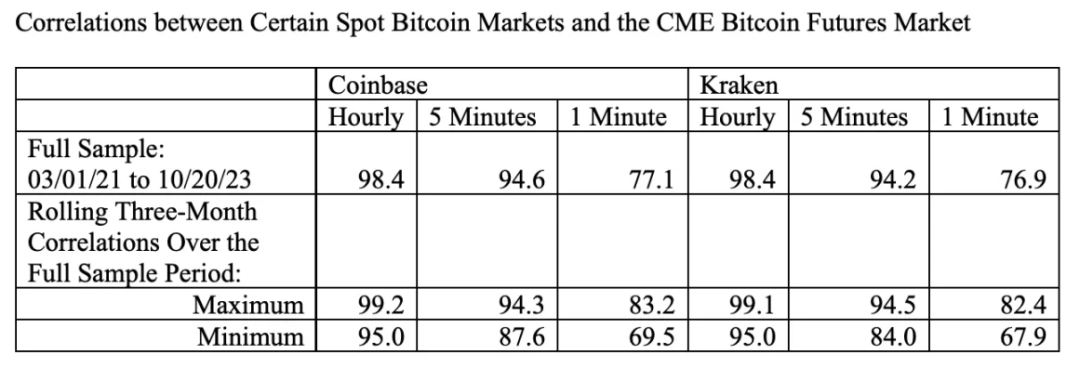

Concerns about potential manipulation of Bitcoin ETFs were also addressed in detail by SEC Commissioner Caroline A. Crenshaw. She stated that the global spot market underlying Bitcoin ETPs remains troubled by fraud, manipulation, concentration, and insufficient oversight.

Figure: “Correlation does not protect investors”

Although the approval documents calculated the correlation between BTC spot prices on Coinbase and Kraken and CME futures prices starting from 2021, showing a high hourly correlation of 95% to 99%, this means that if manipulation occurs, the SEC could detect it via the futures market.

Figure: Screenshot from SEC approval document

However, using futures market monitoring as a proxy for predicting spot market behavior can serve as an investor data indicator, but cannot fully substitute for comprehensive regulatory surveillance of market manipulation. Futures and spot markets are fundamentally different. The futures market involves contracts fulfilled at a future date, while the spot market involves immediate trading of actual assets.

The Bitcoin spot market is akin to the first gold nuggets unearthed in ancient Mesopotamia and Egypt around 4000 BC, gradually gaining value across regions like ancient Greece—a globally dispersed, multi-centered market formed over time.

Relying solely on one regulatory body—or attempting to monitor this already vibrant spot market through the futures market—is insufficient for investor protection. The real solution lies in using technology to solve problems created by technology. Only through on-chain data analysis and monitoring large, unusual movements can we detect early signs of market manipulation.

Three Outlooks for the Future

-

Web3 companies offering technical solutions will enter their moment of opportunity.

The SEC’s approval documents reveal widespread public concern over technological security, custody safety, and lack of monitoring. Market concerns represent massive market demand. As the cryptocurrency market and traditional financial markets continue to integrate, this demand will only grow.

Companies like Chainalysis, OKLink, and Elliptic—providers of data analytics tools—and firms with mature cold and hot wallet security technologies—are poised to seize this opportunity. Leaders in the Web3 wallet space can serve as references or direct collaborators in solving Bitcoin custody security issues.

-

ETFs and decentralization are not mutually exclusive.

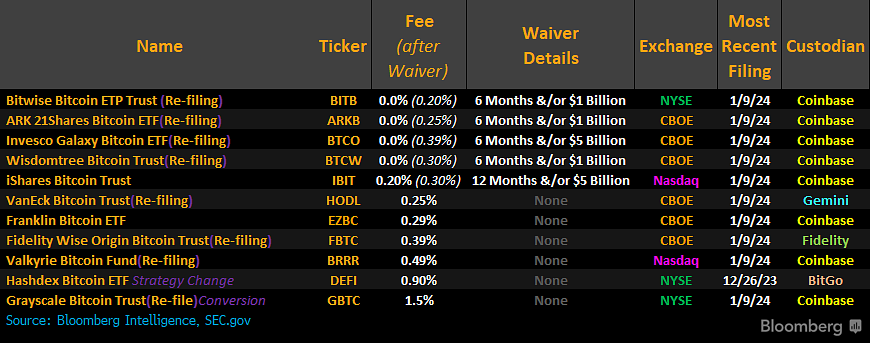

Prior to the introduction of ETFs, the Bitcoin spot market had already begun to take shape. Otherwise, institutions wouldn’t be competing to attract investors through lower fees. Beyond attracting investors, fee structures benefit from economies of scale: as ETF assets grow, management and operational costs are spread across a larger base, reducing per-share fees. This also reflects strong confidence from financial institutions.

Whether it’s VanEck founder Jan van Eck’s announcement this morning that 5% of proceeds will go directly to the Bitcoin developer community, or the growing number of Bitcoin holders who have overcome transaction costs, the idea that Bitcoin and blockchain technology are public goods is now deeply rooted.

-

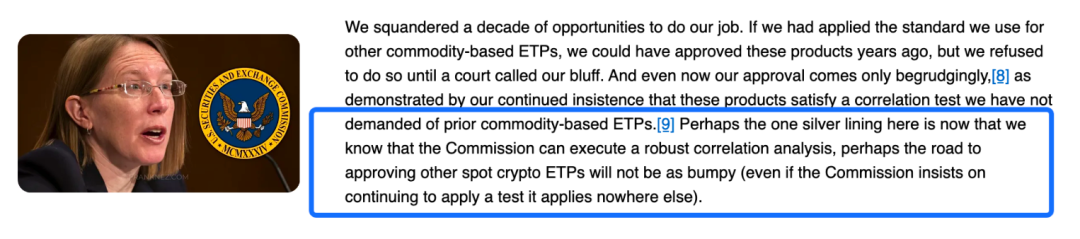

The Bitcoin spot ETF sets a groundbreaking precedent for other non-security crypto ETPs.

Hester Pierce noted in her statement: “Now that we know the Commission can conduct robust correlation analyses, perhaps the path to approving other spot crypto ETPs won’t be so rocky.”

Figure: “The path for other spot crypto ETPs won’t be so rocky”

However, it’s important to note that this approval applies specifically to non-security crypto spot ETFs. As stated by the SEC Chair: “Today’s action by the Commission is limited to ETPs holding a non-security commodity, Bitcoin.” Therefore, any future “other” crypto assets must first be clarified as to whether they qualify as securities.

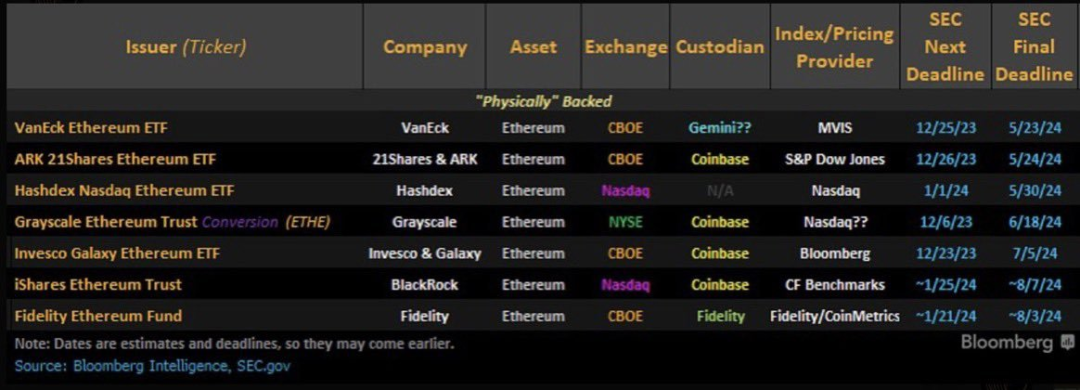

Ethereum remains in a gray area. Nevertheless, major financial players have already positioned themselves. According to the table below, the SEC’s final decision deadline for VanEck’s application is May 23, 2024.

Despite all the “concerns,” this accelerated approval was ultimately issued. Even the SEC, which least wanted to fuel a market frenzy, has been absorbed into this inclusive market—becoming part of the very “circus atmosphere” it sought to avoid. As compliant, low-barrier investment channels expand and supporting tools and technologies mature, the market will gradually mature and ultimately transcend the “circus atmosphere.”

This time, the market wins! Tonight, a new era for the U.S. crypto market begins.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News