2023 Annual Survey of the GameFi Industry: Acquiring New Users is the Biggest Challenge, While the P2E Model Still Has Room for Growth

TechFlow Selected TechFlow Selected

2023 Annual Survey of the GameFi Industry: Acquiring New Users is the Biggest Challenge, While the P2E Model Still Has Room for Growth

This article aims to evaluate blockchain gaming professionals' views on the current state of the industry.

Text: BGA

Translation: Zen, PANews

The Blockchain Game Alliance (BGA) State of the Industry Report is now in its third consecutive year. Initiated by the Blockchain Game Alliance and authored by Web3 consulting firm Emfarsis, this year's report includes insights from 526 blockchain gaming professionals who participated in the survey. It serves as a comprehensive resource for industry stakeholders, offering critical perspectives on the current state, potential growth, and emerging trends within the sector.

Compared to the peak of the 2021 bull market, activity across all Web3 games has significantly declined. However, projects have shifted focus toward improving onboarding and player retention, while blockchain infrastructure continues advancing in security, scalability, and smoother transactions. Based on data collected through an online survey, the report aims to assess how blockchain gaming professionals perceive the current state of the industry—reflecting collective sentiment after two years of the ongoing crypto winter—and identifies key challenges and opportunities facing the sector in 2024.

Advantages of Blockchain Gaming

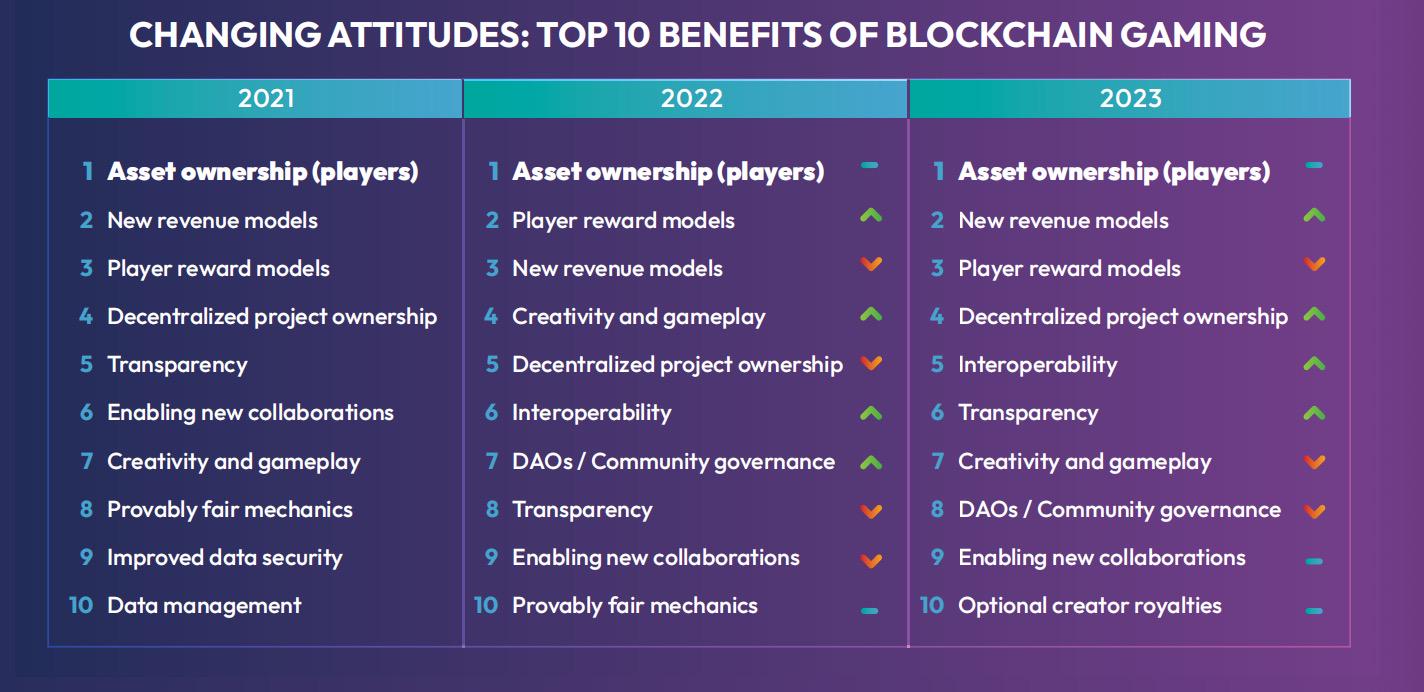

In interviews conducted during the 2023 survey, 76.2% of respondents identified player ownership of assets as the greatest benefit blockchain technology offers gamers. This has consistently been the prevailing consensus among industry professionals since the survey began in 2021.

In Web2 games, although players can own in-game items and trade them on dedicated marketplaces, the terms of service and technical limitations typically prohibit exchanging these items for real-world value outside the game. With blockchain technology, players can truly own, trade, and collect in-game resources, skins, and other digital items rather than merely renting them from developers or publishers. This grants players genuine property rights—an area traditionally controlled by game studios—and opens up numerous possibilities such as interoperability between games, composability of gameplay elements, new business models, and innovative monetization strategies.

Following asset ownership, new revenue models and player reward systems were ranked second and third respectively as the top advantages of blockchain gaming. These two benefits have consistently placed second or third across all three surveys since 2021. There are subtle regional differences in how these advantages are perceived. Respondents from the U.S., Europe, and Oceania ranked new revenue models as the second most important advantage, whereas respondents from Asia and Latin America placed greater emphasis on player reward models. More than half (52.1%) of respondents believe that within 12 months, at least 20% of the gaming industry could be leveraging blockchain technology in some form.

Challenges Facing Blockchain Gaming

Over half of the respondents indicated that acquiring new users remains the biggest challenge for the industry. Despite improvements in accessibility via free-to-own and free-to-play (F2P) models—with blockchain features offered as optional—the difficulty of attracting new players continues to hinder industry momentum.

Poor gameplay is another significant issue. Compared to Web2 games, Web3 titles often fall short in functionality and playability. However, in 2023, several Web3 games began breaking this mold and challenging existing perceptions. Games like *My Pet Hooligan* and *Illuvium* received attention for their high quality. *Star Atlas*, currently under development using Unreal Engine 5, is highly anticipated and may rival established titles like *Star Citizen* and *EVE Online*. Other well-received Web3 games include the card game (CCG) *Cross the Ages*, which features both story mode and PvP gameplay similar to Web2 CCGs like *Hearthstone*, and the simulation game *Upland*, where players buy and trade virtual properties representing real-world landmarks.

Regulation re-emerged as a major concern in 2023, rising from 10th place in 2022 to 5th. Given the frequent regulatory dialogues and disputes in the cryptocurrency space over the past year, renewed attention to this issue is unsurprising. In fact, during the first industry-wide survey in 2021, regulation was considered the number one challenge, with fears that stricter policies or compliance requirements could slow adoption. Moreover, Web3 founders often struggle to maintain clarity or confidence amid uncertain regulatory environments—a natural reaction given that early blockchain games were heavily financialized.

For two consecutive years, respondents have consistently identified the "crypto winter" as having the most negative impact on blockchain gaming. As bear markets took hold, public and media interest in Web3 waned. Even those who continued playing actively may have felt fatigue due to stagnant market conditions. According to DappRadar, active players in Web3 gaming slightly decreased in 2023 compared to 2022, with average monthly active users (MAU) dropping 15.4% from 2.6 million in 2022 to 2.2 million in 2023. Nevertheless, companies are using this time to build solutions that enhance gameplay and improve user onboarding. The rebound in MAU to 2.6 million by October 2023 signals positive developments ahead for the coming year.

Next, macroeconomic events ranked highest among remaining concerns. Global macro issues such as economic recessions create financially unstable environments that limit capital access, exacerbating existing challenges. Geopolitical tensions further complicate matters, making it harder for startups to navigate and grow in global markets. The crypto winter and global macroeconomic factors are external forces affecting the industry. Combined, they represent the strongest pressures on blockchain gaming, cited by 51.3% and 45.2% of respondents in 2022 and 2023 respectively. This suggests that industry professionals believe their companies and projects will surge once market conditions improve.

The only internal challenge within the Web3 space recognized by respondents was the ban on NFTs by traditional game studios. It ranked third in both 2022 and 2023, accounting for 8.7% and 11.0% of responses respectively. Notable bans over the past year included Mojang Studios, developer of *Minecraft*, citing concerns that NFTs might undermine the inclusivity of the game’s community experience since not all players would have equal access; and Rockstar Games, creator of *Grand Theft Auto*, prohibiting NFTs and cryptocurrencies over fears that game assets could be distributed and monetized without publisher consent. South Korea has also explicitly banned NFT-based games due to the speculative nature associated with them.

Misconceptions About Blockchain Gaming

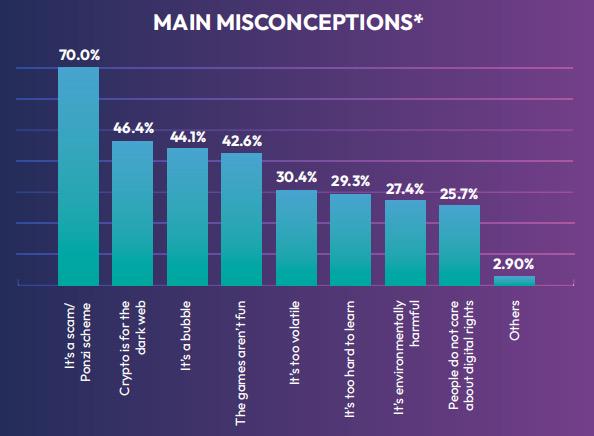

Since 2021, respondents have consistently pointed to the perception that blockchain gaming is a scam or Ponzi scheme as the biggest misconception surrounding the industry. In 2023, 70.0% of respondents still viewed this as the primary falsehood about the sector—up from 69.5% in 2022 and 59.0% in 2021—indicating growing concern among blockchain gaming professionals about this misperception.

While there have been fraudulent projects in the space, these bad actors do not represent the entire blockchain gaming ecosystem. Unfortunately, their malicious actions have tarnished the reputation of the broader industry. As with any investment or emerging technology, individuals should exercise caution, conduct thorough research, and understand potential risks before participating. Equally important is the need for the industry to adopt best practices and regulatory frameworks to build trust among users.

Another misconception highlighted by 46.4% of respondents in 2023 was the persistent association between cryptocurrency and the dark web. This appears to be an increasing concern among blockchain gaming professionals, as only 38.0% raised it in 2022 and 38.2% in 2021. Mainstream media reports linking crypto to crime and terrorism financing may have reinforced this view. The industry must strengthen educational efforts to demonstrate blockchain’s transparency and its utility for law enforcement in tracking illicit transactions, thereby promoting broader understanding of blockchain’s benefits to mainstream audiences.

Transition of Web2 Game IPs and Professionals to Web3

Poor gameplay was seen as the second-largest challenge facing the industry in 2023, supported by 36.7% of respondents. This perception likely stems from comparisons between newly funded Web3 games and titles developed over decades by established Web2 studios. When asked what had the most positive impact on the gaming industry in 2023, 19.8% cited traditional game studios launching NFT games, while 15.2% pointed to the transition of Web2 (or traditional) games into Web3. Combined, these figures suggest that 35.0% of respondents believe the shift of Web2 studios into Web3 brings valuable talent, experience, brand recognition, and massive mainstream audiences—contributing positively to the sector.

Major game studios are actively exploring and experimenting in this space, recognizing the potential of blockchain gaming to advance the entire industry. Several Web2 studios are developing Web3 versions of popular IPs or launching new Web3 games under their banners—including but not limited to CCP Games (*EVE Online*), Nexon (*MapleStory*), Ubisoft, Square Enix, and Bandai Namco. Over one-third (37.8%) of blockchain gaming professionals believe that large-scale adoption of blockchain by major Web2 studios could drive meaningful industry progress.

Drivers of Blockchain Gaming Growth

Beyond adoption by major Web2 studios, game quality improvement emerged as another key driver, nearly capturing one-third of survey responses. Since 2021, these two factors have consistently ranked first and second—and they are mutually reinforcing: established studios bring expertise and talent that can elevate more Web3 games to match the standards of Web2 counterparts.

Outside the top three, considerations around improving onboarding and accessibility rose sharply to fourth place, accounting for 27.8% of responses—up from 10th in 2022—indicating growing prioritization of making blockchain games easier to access. Another notable trend is the belief that releasing more blockchain games is a crucial catalyst, jumping from 12th in 2021 to 6th in 2023. In total, one in four respondents (25.7%) believes that launching more online games will help drive industry growth, as increased variety caters to broader preferences.

Play-to-Earn (P2E) mechanics have lost prominence as a growth driver, falling to eighth place in 2023 after ranking first in 2021 and fifth in 2022. In 2021, millions of new players entered Web3 through “play-to-earn” games, treating them as jobs because they earned tokens redeemable for cryptocurrency and fiat money. However, the sustainability of these virtual economies quickly came into question as token prices dropped and economically motivated players exited first.

Still, interest in P2E persists, particularly in Asia, where gaming culture is more open to financialization. Yet skepticism remains regarding how to balance P2E tokenomics against the volatility of crypto markets. Developers must figure out how to make their games sustainable in the long term.

Regarding growth drivers, reducing transaction costs and lowering NFT expenses have declined in priority, ranking 12th and 15th respectively. One possible reason is improved scalability on Layer 1 and Layer 2 networks. For example, Polygon’s transition to zkEVM rollups has significantly reduced transaction latency and bundled multiple transactions into one, cutting fees. In 2021, many blockchain games required players to purchase at least one NFT to start playing. As NFT prices surged during the bull market, the cost for new players to acquire NFTs on secondary markets became prohibitively high. Today, most games adopt free-to-play models allowing players to begin without purchasing NFTs upfront. Consequently, NFT cost is no longer a barrier, as most Web3 games no longer require mandatory NFT purchases to start.

Achieving Web3 Growth: UA, Distribution, and Scaling

A game’s success hinges on two metrics: user acquisition (UA) and user retention. For decades, Web2 games have relied on centralized platforms to gather personal data such as age, gender, and location. Through advertising on Facebook, Twitter, YouTube, and Twitch, along with in-app recommendations and email promotions, Web2 games have used proven methods to launch and scale products and attract new players.

In contrast, Web3 games prioritize user privacy and operate on decentralized platforms, making it difficult to collect the conventional data needed for traditional user analytics. However, unlike traditional analytics strategies, native Web3 approaches often emphasize verifiable community engagement, decentralized governance, and token incentives. Users are not just consumers but active contributors to network development and sustainability. This model aims to foster ownership and collaboration by redistributing value and decision-making power among participants, creating more inclusive and equitable digital ecosystems.

User Acquisition Challenges in Web3

In 2022, acquiring new users and accessibility were the industry’s biggest challenges, with 51.0% of respondents identifying it as the top issue. This trend continued into 2023, with 55.1% again listing it as their primary concern. Numerous barriers prevent blockchain games from going mainstream. For instance, Steam, the largest PC game distribution platform, prohibits any form of cryptocurrency or NFT transactions. Web3 games must redirect transactions off Steam or use third-party tools, complicating the process. While not permanent, this ban harms the industry by closing off discovery channels through a major Web2 gateway.

App stores also impose restrictions. Apple’s App Store treats all Web3 and NFT projects the same as traditional apps, charging a 30% commission on all transactions processed through its marketplace. On the other hand, Google Play has been slow in supporting Web3 games. Although Google itself supports blockchain technology and recently changed its policy to allow blockchain apps on Google Play, this shift only occurred mid-2023, meaning many developers are only now beginning to build blockchain games for Android devices.

Opportunities with Key Web3 Participants

The Epic Games Store has already launched dozens of Web3 games on its platform and plans to release more in the future. Titles include *Illuvium*, *GRIT*, and *My Pet Hooligan*. Amazon Prime Gaming has partnered with WAX studios and the game *Brawlers* to offer exclusive in-game items and physical prizes. *Mojo Melee* also collaborated with Amazon Prime Gaming for a six-month campaign, distributing rewards monthly.

New Approaches to User Acquisition

Blockchain technology enables unique possibilities for user experience. One of the earliest and most popular attempts was the “play-to-earn” (P2E) model that gained traction in 2021. Players could earn reward tokens and receive airdrops while playing. At the time, as many as 67.9% of respondents believed P2E was the biggest industry driver. This model was novel and attracted many curious players when the industry first emerged.

Although “play-to-earn” is no longer seen as the primary growth engine, it does open doors for new user acquisition strategies. Many BGA members are now exploring the following Web3-native methods for user acquisition, distribution, and analytics:

-

On-chain targeting: Visibility into on-chain activity allows developers to track wallets involved in Web3 games or NFTs. Marketing directly to these addresses aids in user acquisition and scaling. Companies and developers can also leverage data derived from player on-chain behavior to gain deeper insights—for example, identifying player preferences for “play-to-earn” or RPG-style games.

-

On-chain reputation: Blockchain enables players to build verifiable reputations online. Others can view in-game achievements permanently linked to a player’s wallet, providing opportunities to showcase credibility.

-

Web3 launches: Releasing on dedicated Web3 platforms increases visibility and helps reach target audiences. Additionally, many large Web3 and Web2 companies now offer programs to support ecosystem development.

Outlook for 2024

More Web2 Studios Adopting Web3

Many Web2 studios are experimenting with blockchain technology. Some, like Square Enix and Ubisoft, are doing so more openly, while others remain cautious. As these studios consider technological evolution, gradual entry into Web3 seems likely. According to survey respondents, mobile and multiplayer games are the most likely candidates for adoption. Web2 studios bring talent and experience that could improve key areas such as onboarding and user experience. Some may experiment with on-chain assets, though due to lingering negative sentiment toward NFTs and blockchain, developers might integrate them as underlying technologies without explicitly branding them as NFTs, blockchain, cryptocurrency, or Web3.

Artificial Intelligence in Blockchain Gaming Becomes a Hot Topic

Artificial intelligence dominated discussions across many industries this year, including blockchain gaming. With the rise of generative AI and large language models like ChatGPT, some respondents believe blockchain games are already testing AI applications in Web3 gaming. For example, behavioral AI can enrich NPC dialogue, create more engaging interactions, and enhance decision-making capabilities. However, some worry that AI-powered game creation could flood the market with low-quality assets and collectibles. On the flip side, AI also holds unprecedented creative potential.

Development and Launch of Major Web3 Games

After two years of continuous development, a breakout blockbuster blockchain game could emerge in 2024, triggering a ripple effect that draws millions of new players into Web3 and shifts public perception. Historically, such games tend to gain initial traction in the East before being embraced in the West—similar to how free-to-play models like *League of Legends* were widely adopted in Asia in the early 2000s long before gaining global acceptance.

Blockchain Games Will Simply Be Called “Games”

Currently, there is a distinction between Web2 and Web3 games, but this is expected to change. As more Web2 studios explore blockchain integration, they may seamlessly incorporate the technology into existing game mechanics—making it nearly invisible to players—so it becomes part of the core experience rather than an added feature, ensuring appeal to existing player bases.

End of Predatory Monetization Models

Free-to-play eliminated entry barriers and revolutionized the gaming industry. However, it also led some developers down predatory paths—extracting maximum profits through paywalled features or time-limited offers designed to trigger fear of missing out (FOMO). As more games adopt blockchain technology, 2024 marks a shift toward transactional ecosystems where both developers and players benefit. With this new model, we will see the end of exploitative practices in gaming.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News