Players and shareholders alike: the multiple values behind L3E7 gaming NFTs

TechFlow Selected TechFlow Selected

Players and shareholders alike: the multiple values behind L3E7 gaming NFTs

In L3E7, NFTs are not only game entry tickets but also shareholder equity certificates—holding NFTs allows sharing in the game's revenue.

By TechFlow

The overall crypto market has been steadily recovering recently, with small bull runs emerging across various sectors.

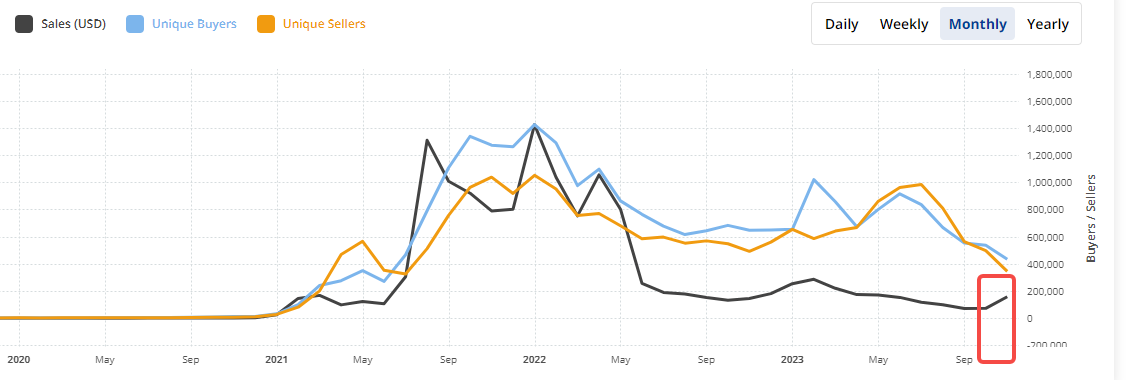

Even the NFT market, previously cooled to near-zero trading volume, has seen a 64% increase in sales over the past month. Meanwhile, token prices of multiple game-related projects linked to NFTs have gradually climbed out of their lows.

But does this mean that game-related NFTs are regaining their value?

After cycles of boom and bust, market participants may be re-evaluating the value of NFTs. In the previous cycle, countless PFP (profile picture) NFTs rose purely on concepts and consensus, but such models are unlikely to sustain in the new cycle. As the NFT market warms up, competition will intensify—NFTs without continuous value input will naturally lack competitive advantages.

When players become more cautious, savvy, and comprehensive in assessing NFT value, what stories can NFTs still tell? What new values can be assigned?

In the neighboring DeFi space, the narrative of "real yield" gained traction in the last cycle—projects backed by actual revenue streams provided stronger utility for their tokens, leading to faster price appreciation under positive expectations.

What if an NFT project also generated real revenue, allowing NFT holders to share in the profits? Would that be more attractive?

Currently, NFT projects indeed need multi-layered value propositions. An NFT can simultaneously serve as a status symbol, an access pass, and a rights凭证. NFTs with multiple utilities naturally attract greater market attention.

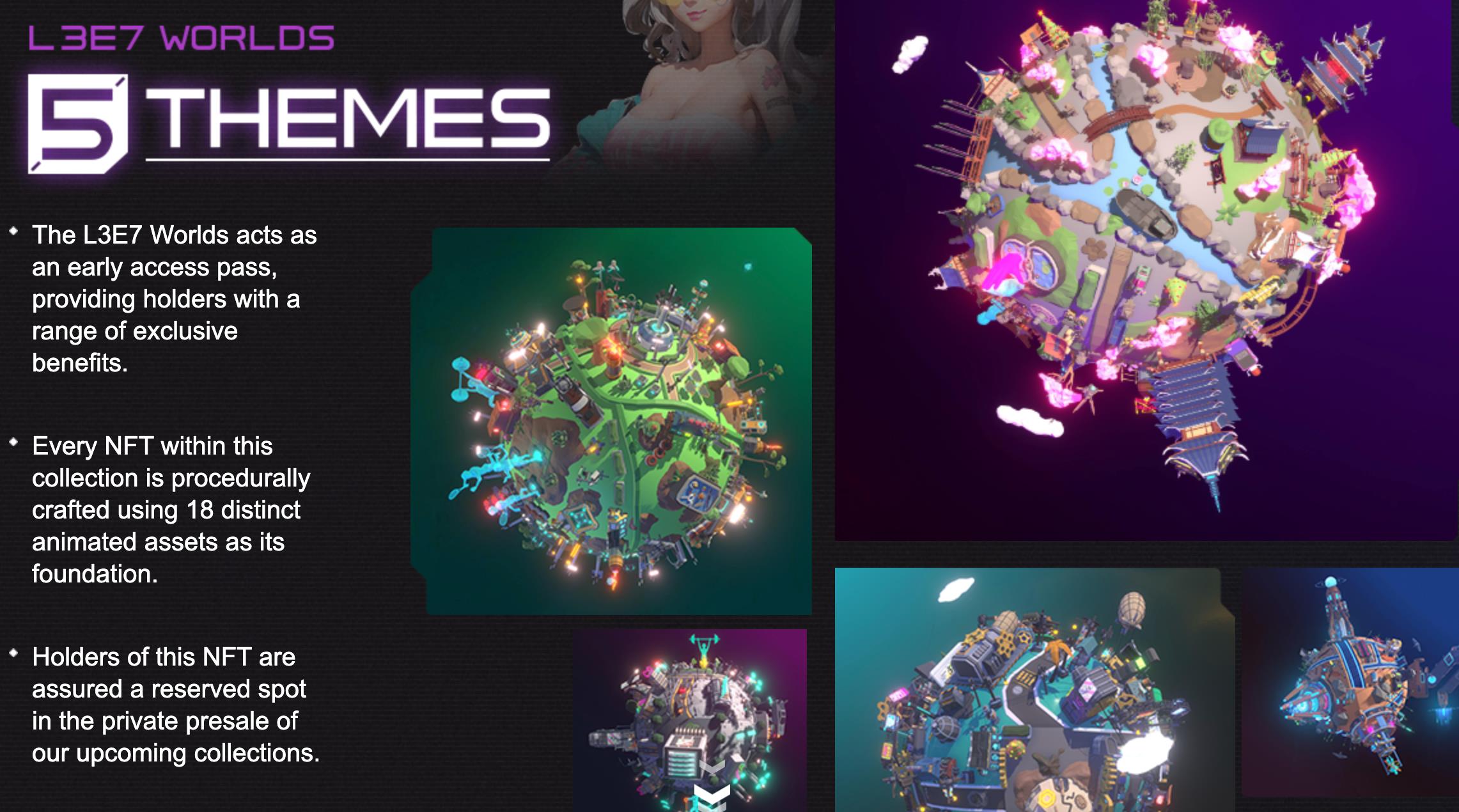

Recently, a gaming project called L3E7 sold out its initial 600 NFTs within hours. At the time of writing, its floor price remains close to 6 ETH.

On the surface, the reason for its popularity appears to be that holding an L3E7 NFT grants long-term benefits from the game, including airdrops, in-game rewards, and testing privileges.

But how exactly is “sharing game revenue” implemented behind the scenes?

We've seen too many projects where participation decisions are based on vague, abstract bullish narratives, while the underlying business model and profit distribution remain poorly understood.

L3E7 has already gained traction in the heating NFT market, so it's worth investigating: what exactly is the gameplay like? And what key factors determine the profits NFT holders can receive?

There is currently little information available about L3E7, and even less research into this type of gaming business model. Therefore, in this article, we use L3E7 as a case study to clarify the operational mechanics behind the concept of "NFT utility," exploring the feasibility of NFTs receiving revenue shares from game income.

NFT Holder as Shareholder

Every NFT transaction reflects the digestion of known information and future expectations. What do we know about L3E7?

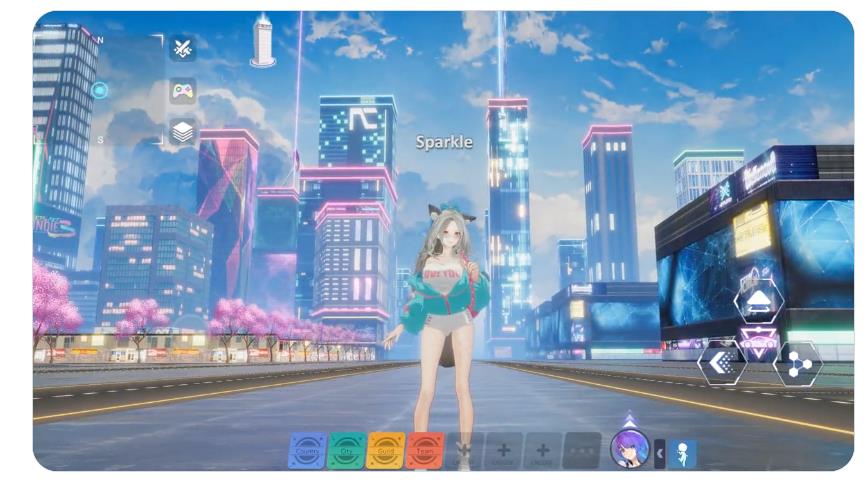

Based on current social media and official project announcements, L3E7 is a location-based service (LBS) open-world RPG game that uses map rendering technology to immerse players in a 3D metaverse world.

The most interesting aspect is that L3E7’s metaverse is built upon real-world cities, allowing players to experience famous landmarks and urban landscapes, all rendered through a cyberpunk art style.

The combination of letters and numbers “L3E7” actually hints at the game’s sci-fi universe:

In astronomy, L3 refers to the third Lagrange point, located beyond Earth but aligned with the Sun. Near this point lies planet E7—the “twin Earth”—represented at a 1:1 scale. The L3 designation implies a central symmetry between the two planets around the Sun.

Clearly, the project aims to recreate real-world environments through the game.

For example, player-controlled characters can freely explore, battle, and level up beneath iconic structures like Tokyo Tower or the Eiffel Tower within the L3E7 world. Accompanying the game, the 600 freeminted NFTs—called L3E7 Worlds—with varying rarity levels, serve as the highest-tier access passes in the L3E7 ecosystem.

Beyond these basic facts, the additional value of the NFT is the focus of this article:

In L3E7, NFTs are not just entry tickets—they are shareholder rights instruments. Holding an NFT entitles you to a share of the game’s revenue.

But how exactly does revenue sharing work?

To answer this, we need to address two critical questions:

First, what is the business model and revenue logic of games like L3E7—how does it generate income?

Second, how is the generated revenue distributed to NFT holders—in what form and proportion?

For clarity, let’s examine traditional entertainment and Web2 gaming models:

-

For an amusement park, revenue equals “number of visitors” multiplied by “ticket price.” The more people visit and the higher the ticket price, the greater the revenue.

-

For a Web2 game, revenue equals “active users” multiplied by “user spending.” More active players and higher individual spending lead to higher total revenue.

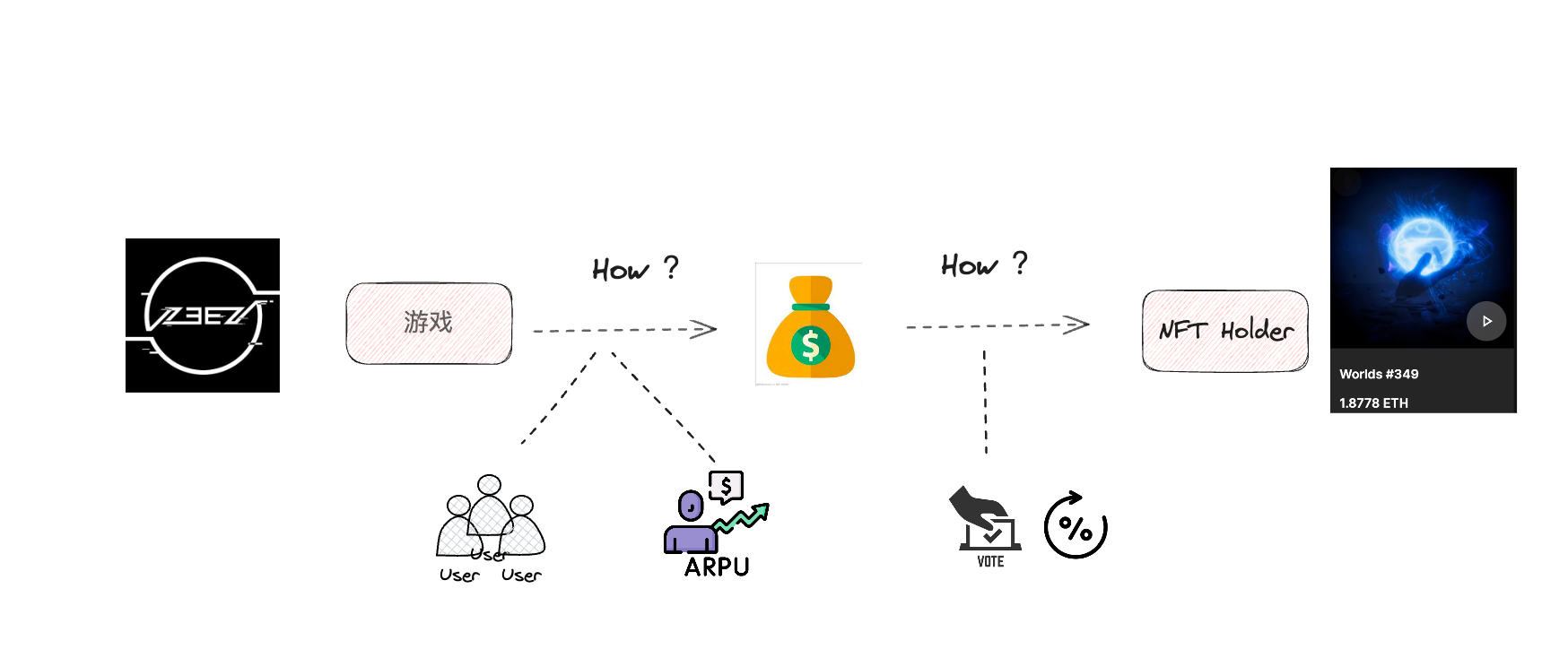

Web3 games, although featuring different asset ownership and representation, follow the same revenue logic—L3E7’s income depends on how many users play and how much each user spends.

Although the game hasn’t launched yet, we can still analyze and estimate potential outcomes.

-

User base: Location-based services (LBS) games, such as the well-known Pokémon Go, leverage smartphone GPS functionality to expand gameplay. According to recent App Annie statistics, Pokémon Go has 30 million daily active users. Theoretically, a similar game like L3E7—which supports PC—can be accessed via mobile by both Web2 and Web3 users, giving it a significantly larger user base than pure browser or PC-based play-to-earn games (as seen in the contrast between StepN and traditional mining games).

-

Per-user spending: Based on L3E7’s revealed mechanics, common elements like loot boxes, weapons, items, and experience systems are present—typically tied to in-game resource consumption. Web2 players can top up using fiat currency (common "pay-to-win" model), while Web3 players can purchase assets using tokens.

-

Profit distribution: The specific revenue-sharing ratio for NFT holders may vary with market conditions. However, leveraging Web3 tokenomics and governance, L3E7 could allow the community to vote on distribution details—whether in ETH, game tokens, or rare NFTs.

Therefore, rather than calling L3E7 NFT holders “players,” it might be more accurate to call them “shareholders”: by holding NFTs, they are granted profit-sharing rights, participating directly in the financial success of a proven gaming business model.

This design gives NFTs tangible value beyond mere storytelling, governance, or abstract consensus.

In practice, on-chain data provides visibility into active addresses (users), transaction records, and total asset value—ensuring that profit distributions are based on objective metrics rather than opaque, centralized decisions.

In short, existing NFT Worlds holders and potential investors don’t need to understand every detail of this complex business model—they only need to monitor post-launch metrics like active user count and average spending to assess the NFT’s value.

If you're a “shareholder” in this game, your next question would naturally be: Is this market large enough to ensure substantial, sustainable profit sharing?

Reviving the LBS Gaming Market – Revenue Potential Ahead

If you’re a “shareholder” in this game, entitled to profit sharing via NFT ownership, your next concern must be: Is this market big enough to deliver significant and sustained returns?

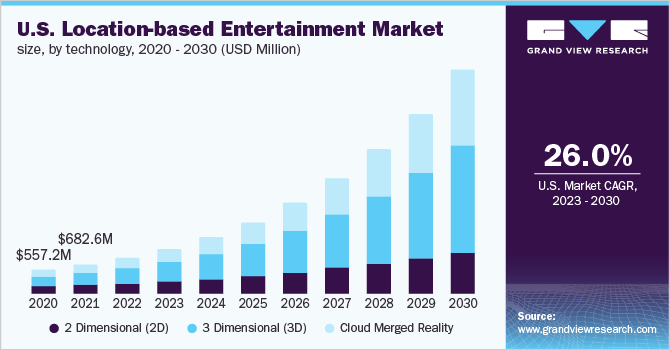

For an LBS-based game, the number of potential players is closely tied to infrastructure. The trend toward mobile entertainment is undeniable—most people spend their leisure time on smartphones. With improvements in network speed (e.g., 5G) and smarter mobile devices, the LBS gaming and entertainment market continues to grow.

Industry research shows that the LBS entertainment market in the U.S. alone exceeds $500 million, with a compound annual growth rate above 26%. A well-operated Web3 game capturing even a tiny fraction of this market could bring transformative changes to both the project and the industry.

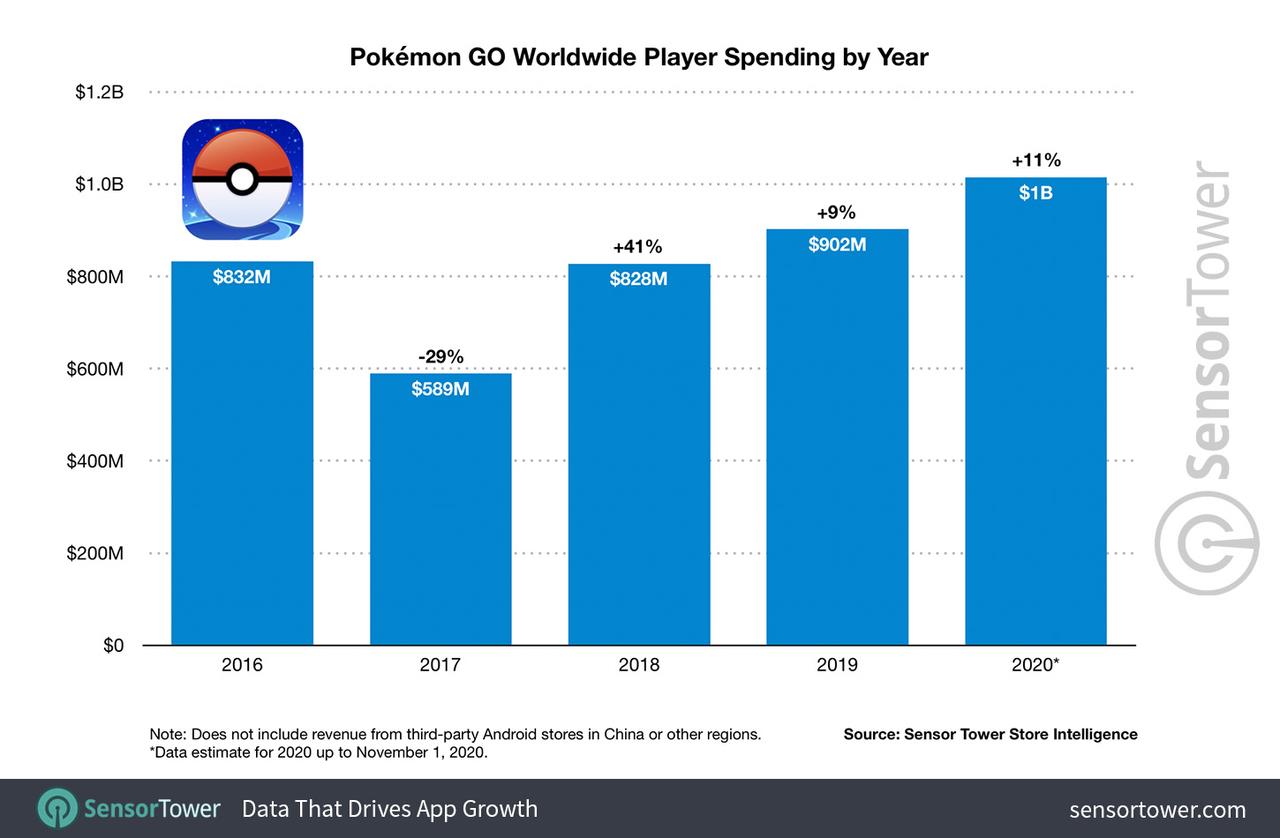

Skeptics of Web3 gaming might question whether such games can truly succeed, but successful Web2 counterparts have already demonstrated strong demand and monetization potential. For instance, Pokémon GO, powered by a massive IP, saw year-on-year increases in user spending before the pandemic, reaching $1 billion in global player expenditure in 2020.

Earlier this year, another AR + LBS game based on the popular Monster Hunter franchise, *Monster Hunter Now*, earned $20 million within just two weeks of launch—highlighting strong market acceptance when combining LBS mechanics with major IPs.

From these trends, we see that the LBS gaming market is broader than traditional PC gaming—and has already been awakened by major IPs.

Yet in the Web3 space, similar games remain largely unexplored.

As pandemic restrictions ease and certain economies face downturns, Web3 games—backed by new asset models and incentive-driven economics—can tap into this vast LBS entertainment market. StepN, which went viral in the last cycle, wasn't even a full-fledged LBS game—it merely incorporated basic location tracking and still achieved mainstream attention.

This suggests that Web3 games can indeed capture mainstream market share—especially when addressing universal player needs: combining solid entertainment value with income-generating assets.

Judging from L3E7’s promotional materials, its graphics and quality appear superior to both Pokémon GO and Monster Hunter Now. While it lacks the powerful brand recognition of those franchises, effective marketing could help it reach long-tail markets and even attract mainstream players.

For Web2 users, seamless gameplay experiences—even without awareness of crypto assets—can be achieved through smart operations and user acquisition strategies.

For Web3 users, after cycles of market volatility, players have become sharper and more discerning. Driven by yield-seeking behavior, they naturally gravitate toward higher-quality games.

Moreover, the unique traits of Web3 users during bull markets further boost revenue expectations.

Though smaller in absolute numbers, Web3 users have repeatedly shown—through products like StepN sneakers or Axie pets—that their yield-driven mindset leads to higher willingness and capacity to spend.

Finally, based on the above logic, let’s make a theoretical calculation.

The profit received by L3E7 NFT holders depends on: active players × average spending;

Taking Genshin Impact as a reference, public data shows its average revenue per user (ARPU) is around $15. Assuming L3E7 achieves only $5 ARPU (less than $1), with a conservative estimate of just 10,000 daily active users, daily game revenue would still reach $50,000;

If L3E7 captures 20% of Pokémon Go’s user base—6 million DAUs—and maintains a $5 ARPU, daily revenue would hit $30 million. After deducting operating costs, allocating 20% of profits to NFT holders would generate a substantial passive income stream.

Overall, considering the size of this niche gaming market combined with Web3 users’ high spending propensity, I believe the profit-sharing expectations for L3E7 NFT holders have a solid floor.

As for the revenue ceiling, it will depend on how effectively the project expands into the Web2 market—an outcome that remains to be seen.

When Empowering NFTs Becomes the Trend

In the next phase of competition among games and NFT projects, the trend toward granting more utility and earnings to NFTs is unmistakable.

It’s not just L3E7—other NFT projects are exploring similar models. For example, The Grapes, built on a well-known IP, also offers revenue sharing to NFT holders, maintaining a stable floor price.

However, purely Web3-native PFP projects typically spread influence from within the crypto community outward, requiring time to penetrate broader audiences—not necessarily a Day 1 goal. In contrast, games like L3E7, designed for seamless Web2 user experiences from the start, must impact both crypto and non-crypto communities from day one, making market expansion relatively easier.

Additionally, gaming inherently benefits from economies of scale—marginal costs decrease as user numbers grow. Adding more users doesn’t require proportional cost increases; instead, larger user bases can generate disproportionately higher profits.

Linking NFT revenue sharing directly to total game income means the scale of market profits determines NFT holder benefits. Once market growth materializes, gains become visibly tangible. Thus, combining LBS gaming with NFT-powered revenue sharing is—at least narratively—a promising direction, with a testable business model and access to a sufficiently large market.

From narrative to execution, we look forward to seeing how L3E7 performs operationally and whether it can ignite another wave of excitement in the gaming sector.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News