Crypto Industry Review and Outlook: Which Sectors Are Worth Watching in 2024?

TechFlow Selected TechFlow Selected

Crypto Industry Review and Outlook: Which Sectors Are Worth Watching in 2024?

What predictions did I have high hopes for this year that turned out to be wrong?

By: Zixi.eth

Following up on my article from last December, let’s take another look at what happened in 2023 and explore what the future may hold for 2024. 2023 was a year that started low but gained momentum, with the secondary market steadily climbing upward. However, the primary market remained sluggish—perhaps even more so than in 2022. This could be due to several factors:

1. The primary market typically lags behind the secondary market by about six months, and new entrepreneurs have yet to enter;

2. Existing founders are gradually leaving (many shifting to AI);

3. There is an extreme lack of fresh narratives—most current stories are just rehashed versions of old ones.

As before, this article is divided into three parts, discussing what expectations were proven wrong in 2023, what looks promising for 2024, and what trends we should keep an eye on next year.

1. What Were We Wrong About in 2023?

1.1 Developer Tools — Follow the Money

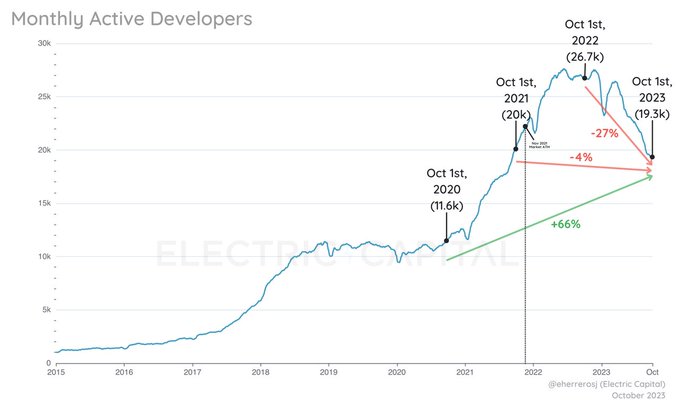

Compared to the same period in 2022, crypto MAD declined 27% year-on-year. That said, it’s still up 66% compared to two years ago. Due to fewer new developers and attrition among existing projects, the developer tools market saw some contraction this year. Additionally, given how strong the AI startup scene has been in both North America and China, many engineers have opted to join AI ventures instead.

Overall, the developer tools market contracted slightly this year—a trend reflected in private-market valuations. For example, Alchemy, previously valued at $10.5 billion, is now estimated around $3 billion. Similarly, Consensys, once valued at $7 billion, now trades around $3 billion in the secondary market. Nonetheless, we remain confident in this space for 2024–2025.

We’re also seeing growth in domestic developer tool usage—for instance, Chainbase grew its developer base from 800 last year to 6,000 by December this year. As one of the most direct beneficiaries of increased developer activity, if 2024–2025 brings the next bull cycle, the developer tools sector stands to see significant growth. I also believe M&A opportunities in this space will emerge during 2024–2025.

1.2 NFTs — Beyond PFPs, What Else Can They Be?

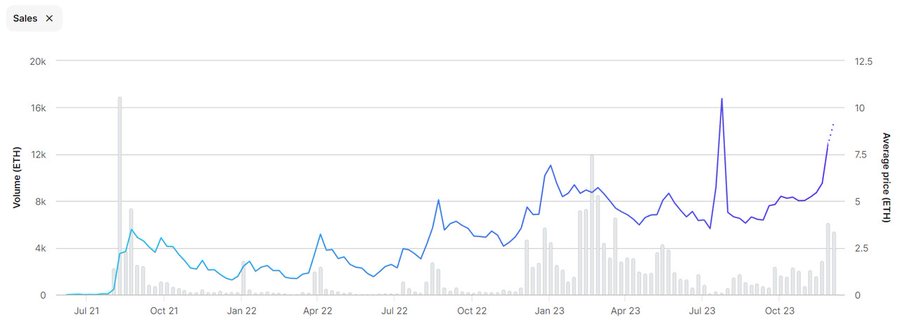

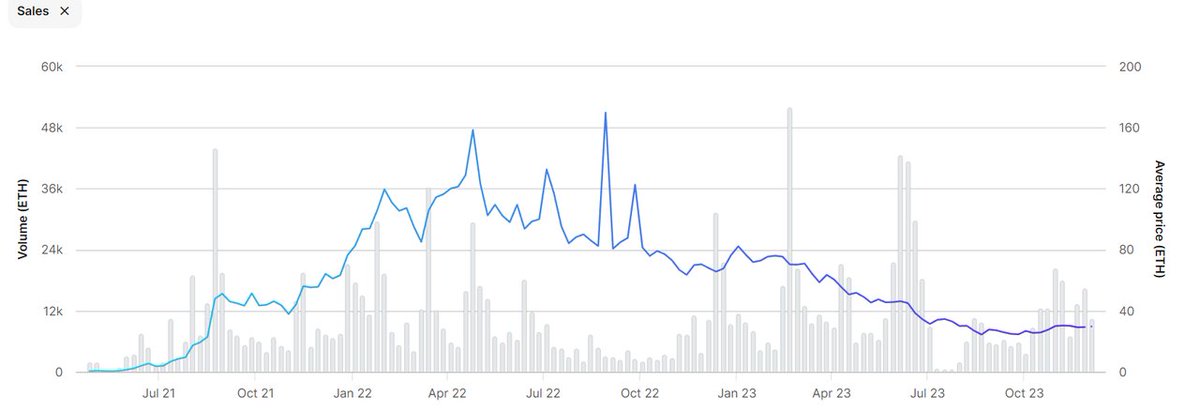

The traditional PFP narrative is no longer compelling. The chart below shows BAYC’s price trajectory over the past couple of years. In 2022, Yuga Labs successfully fueled market FOMO with APE tokens combined with Bored Ape lands. But this year, the NFT market has been quiet. It's increasingly rare for big players to pay tens or hundreds of thousands of dollars for NFTs. Azuki further disappointed the market with releases like Azuki Elemental, which felt like copy-pasted, mass-produced mints with little creative effort.

That said, there have been some interesting developments. For example, Pudgy Penguins’ strategy combining NFTs with physical toys earned strong praise in the North American market, showcasing a new path forward for PFP-based NFTs.

Although NFTs have cooled down in popularity this year, we’re beginning to see use cases beyond profile pictures—such as merging physical goods with NFTs (e.g., Li-Ning/adidas + apes), brand membership passes (Starbucks Odyssey), and ticketing for concerts and operas. In the coming years, NFTs may gradually evolve into a “technology” adopted by traditional industries.

2. What Looks Promising in 2024?

2.1 AI + Crypto — B2B or B2C?

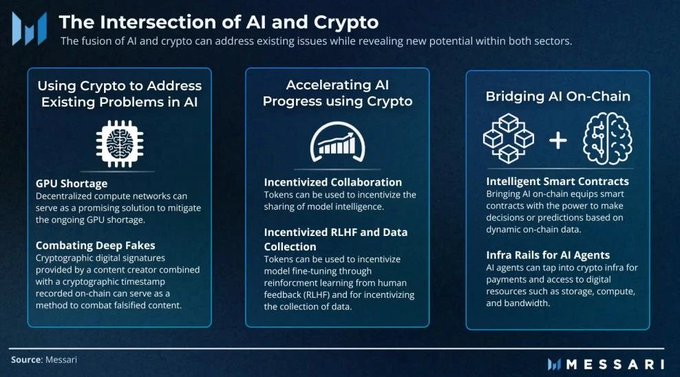

Here’s an interesting thought: If a bull market arrives in 2024–2025, we might see a wave of consumer-facing (B2C) games, social apps, C.AI, and chatbot-focused Web2 AI startups transition into Web3 by launching utility tokens. This idea stems from observing that many B2C AI products today suffer from high homogeneity, limited revenue ceilings, and rising compute costs that make profitability difficult. After raising capital, these startups naturally begin exploring exit strategies.

When user growth, monetization, or product innovation stalls, issuing utility tokens to introduce new mechanics becomes an attractive option. Not only can token launches serve as powerful marketing tactics, but they also offer a way to bring Web2 users into Web3—especially since wallet infrastructure and account abstraction have improved significantly. This could create a win-win scenario across both ecosystems. Moreover, many of these AI entrepreneurs are young and open-minded, making them more receptive to experimenting with token models.

To clarify, I categorize AI + Crypto into two broad buckets: B2C and B2B. Examples of B2C include MyShell, NFprompt, and Worldcoin. B2B examples are more numerous: Modulus Labs, ChainML, EZKL, Questlab, http://Flock.ai, Gensyn, etc. B2C AI applications—whether games or http://C.AI-like services—have already proven successful in Web2, and we're seeing early traction in Web3 too.

For instance, voice bot communities like MyShell are flourishing. Since AI + Crypto is still in its infancy, most activity remains B2B-focused—for example, building on-chain agents for projects, providing ZKML verification, offering data labeling services for LLMs or text-to-video models, or enabling crowdsourced datasets for AI companies.

An interesting aspect of B2B AI firms, especially those focused on data and compute, is their platform-like nature: upstream demand comes from model companies needing compute/data labeling; midstream platforms distribute these tasks; downstream participants range from large institutions to individual contributors. Blockchain incentivizes participation by mobilizing long-tail retail users via token rewards. Currently, data labeling is easier to coordinate, and teams have secured contracts with major AI labs. Compute coordination—especially involving heterogeneous GPU clusters—remains far more challenging.

We’re seeing solid progress across various B2B AI+Crypto verticals and look forward to how these ventures perform—and potentially launch tokens—in 2024.

2.2 Regulation & Compliance — Institutional Onboarding Begins

Regulation and compliance remain evergreen themes. Much of the rally at the end of 2023 was driven by market anticipation of BlackRock’s BTC ETF approval—the recent surge clearly demonstrates that “just imagining traditional capital entering can drive massive gains.”

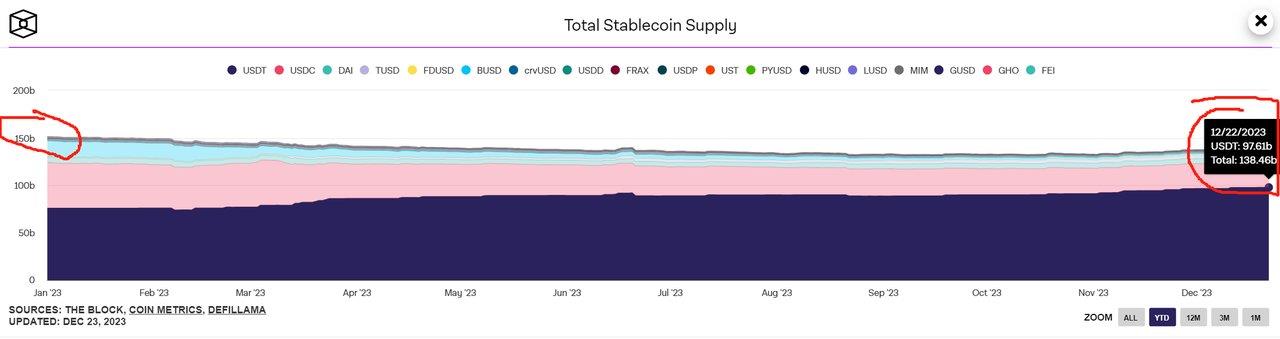

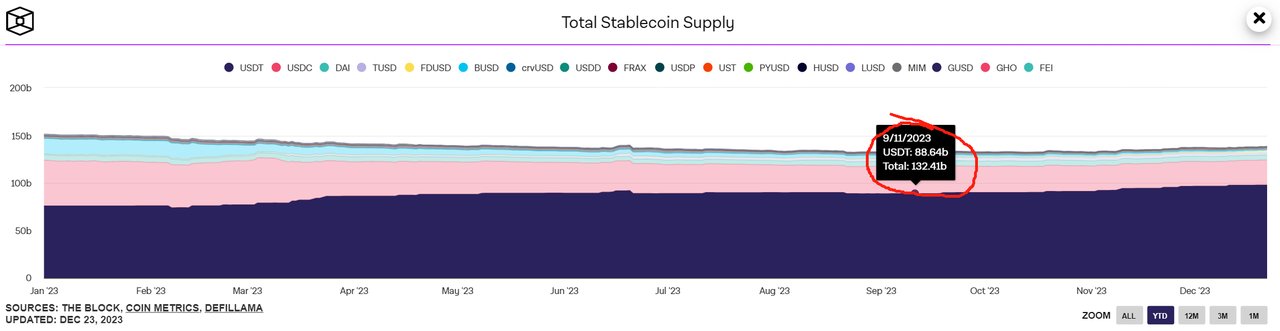

At the start of 2023, stablecoin market cap stood at $150 billion. By September, it had dipped to $132.4 billion—the lowest level in nearly two years—indicating about $18 billion had exited the ecosystem. During this time, BTC rose from $17,000 to $26,000, suggesting mainstream money pulled out while liquidity flowed from altcoins to Bitcoin. Yet between September and December, despite only $4 billion in new stablecoin inflows, BTC surged from $26,000 to $44,000.

Assuming institutional inflows were minimal (after all, most traditional investors still view blockchain skeptically, and primary investments remained light), this rally likely came from seasoned crypto insiders and early movers anticipating the ETF. If the ETF gets approved, imagine $10–20 billion in institutional capital flowing in annually over the next few years—where could crypto prices go? We’ll revisit this analysis in our 2024 year-end review.

Key regulatory/compliance themes to watch:

1. Stablecoins 2. Exchanges (on-chain/off-chain, especially perpetuals) 3. Asset management

More details on these areas will follow in future updates.

2.3 DePIN — How Can Crypto Enable Distribution?

Among the most exciting trends lately is DePIN—essentially “XX + Crypto,” where XX represents the core service and Crypto acts as the distribution mechanism. For example: Helium’s main business is wireless connectivity, using tokens for distribution; Hivemapper collects map data from users and sells it to clients, leveraging crypto incentives; Questlab provides data labeling for AI firms, coordinated through token rewards.

Why use crypto for distribution? It mirrors the psychology behind trading and speculation: rather than telling users they’ll earn $100/year, you give them the *hope* of earning much more. Plus, token-based settlements are often more efficient than cash—especially for cross-border payments involving large numbers of micro-contributors.

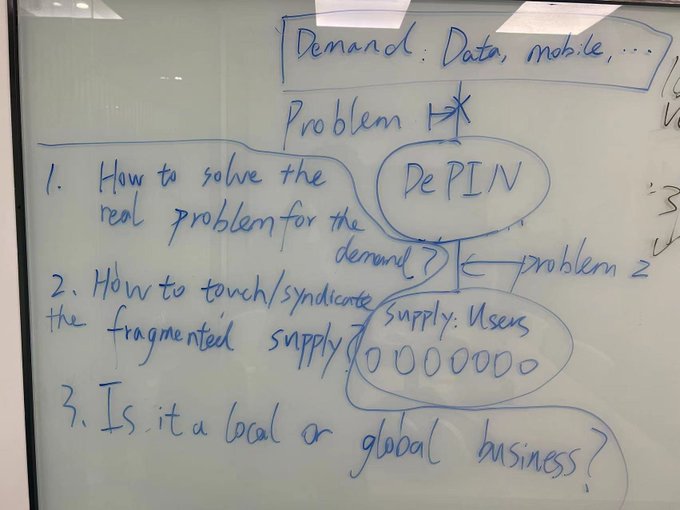

To evaluate any DePIN project, I ask three fundamental questions:

First: What real problem exists in the upstream demand? For Helium and Helium Mobile, cellular data is expensive and coverage poor—building traditional 4G/5G towers is costly, and no centralized U.S. company dominates the space, creating room for decentralized alternatives. Data labeling is a genuine need for AI companies. Rendering, inference, and training require vast compute resources—idle GPUs and distributed systems can help meet this demand.

Second: How do you acquire and aggregate fragmented resources onto your DePIN platform to serve enterprise clients? Historically, scaling consumer-side adoption (C-side) required heavy VC spending—seen in e-commerce, ride-hailing, community group buying, etc. In Web3, however, Ponzi-like incentive structures replace VC funding: early adopters are rewarded with tokens funded by later entrants. This model has proven effective in Axie, YGG, StepN, and Helium.

Moreover, simpler user actions lead to faster adoption—playing GameFi, running with StepN, doing data labeling, installing smart plugs—all relatively easy. But introducing entirely new hardware (e.g., home signal boxes) faces steeper adoption hurdles.

On resource coordination: Some tasks like offline rendering, data labeling, or bandwidth crawling can be efficiently scheduled. Others—like coordinating heterogeneous GPUs for AI inference/training—are far more complex and technically challenging.

Third: Is this a local or global business? Global businesses scale faster in reaching both consumers and enterprises, directly impacting total addressable market size and ultimate scalability.

3. What Should We Watch in 2024?

3.1 GameFi √ / SocialFi?

It’s important to recognize that crypto and token valuations act as powerful emotional amplifiers and marketing tools.

In 2022–2023, we’ve seen strong teams from both East and West enter the gaming space—Funplus/Xterio, Matr1x from Asia, BigTime from the West. Combined with China’s sudden draft regulations on online games released on December 22, I believe this will (forcefully) push Eastern game developers overseas—an enormous positive for Web3 gaming. We’re excited to see whether 2024 brings another Axie- or StepN-level breakout hit from the East.

Previously, we argued that social apps aren’t well-suited for Web3 because social graphs are already entrenched in Web2, and people don’t want to rebuild their relationships. However, Friend.tech introduced an intriguing mechanic—trading keys to friends—which isn’t so different from IEOs or inscriptions (both are essentially speculative plays). Still, we remain cautious about Web3 social overall.

3.2 L2s — Internal Struggles and External Threats

In 2022, the infrastructure narrative centered on modular blockchains—people believed in the composability of execution, consensus, settlement, and data availability layers. From 2020–2022, L2s had high technical barriers, leading to sky-high valuations for Arbitrum, Optimism, and top ZK projects. Back in 2021, when analyzing L2s, we thought first-mover advantage would mirror L1 dynamics—favoring OP-based L2s in the short term (3–5 years), while ZK rollups would dominate longer-term due to tech evolution.

But technological progress has outpaced expectations: OP Stack now allows one-click deployment of OP L2s; Rollup-as-a-Service providers can even spin up ZK L2s instantly. Composability is now extremely high, drastically lowering development barriers. While only four ZK L2s existed in 2022, over a dozen launched in 2023, alongside at least five RaaS providers. The L2 landscape in 2024 will be fiercely competitive. Even platforms like Blur and Blast showed VCs and retail investors that NFT marketplaces can not only vampire attack OpenSea—but also raid other L2s.

Additionally, surviving EVM competitors now each have unique strengths: Tron in payments, BSC in gaming, Solana in DePIN. How L2s survive internal competition and external pressure from non-EVM chains will be an intense battle—one potentially rivaling historical wars like the group-buying boom, e-commerce rivalry, or the current large-model race.

We’re no longer in 2020–2021, when public chains had high technical moats. In 2024, it’s no longer a chain-dominated world: top dApps can freely choose leading chains, but leading chains struggle to attract top dApps (unless they pay). The current path to chain validation is clear: leverage unique strengths, forge new paths, avoid copying others—only differentiation leads to victory.

3.3 Bitcoin Ecosystem — Value Return or Bubble?

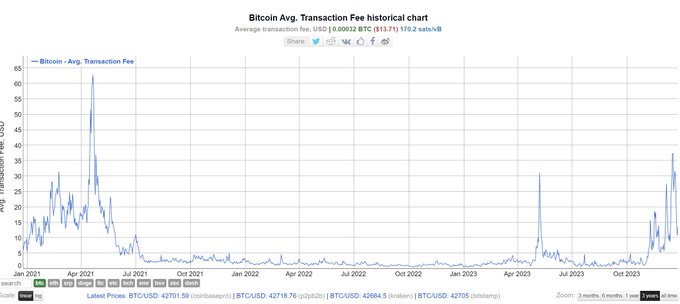

I fully agree with a senior figure from Singapore: even a 1% overflow from Bitcoin capital could fuel an entire ecosystem. And due to network congestion on Bitcoin, the speed and impact of such capital spillover could be amplified.

In 2023, we witnessed a frenzy around the Bitcoin ecosystem—its development in one year recapitulated nearly four years of Ethereum’s journey. But can it build something truly unique, rather than simply replicating Ethereum’s playbook (DeFi trifecta + oracles + meme coins)? Institutions should remain cautious; for individuals, feel free to speculate.

This year was all about rebounding from rock bottom. By the end of Token2049 in September, I genuinely felt the industry might be dying—especially after investing through a full cycle of AI+crypto projects, with hardly any meaningful new narratives emerging. But starting October, the market warmed up again, and price gains restored confidence.

Looking back, 2022–2023 brought immense innovation: DeFi evolved from spot DEXs to derivatives, gaining broader institutional acceptance; major Web2 studios completed Web3 game development, with launches expected in 2024; L2s solved key technical hurdles, enabling one-click deployment of OP and ZK rollups; AI+Crypto opened new frontiers in data and compute; Friend.tech redefined social interaction; Bitcoin attracted renewed developer interest; Solana reborn, accelerating DePIN adoption.

2024 could surpass the 2020–2021 bull run in excitement. Stay tuned for next year’s update.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News