Meme coins surge as Dogwifhat and BONK stand out — who let the dogs loose?

TechFlow Selected TechFlow Selected

Meme coins surge as Dogwifhat and BONK stand out — who let the dogs loose?

Smart money has been consistently flowing into newly launched meme projects on non-Ethereum (ETH) platforms.

Welcome to this week's crypto market update. Bitcoin is currently consolidating below $44,000, while Ethereum trades under $2,300. However, the spotlight this week has largely been on meme coins—particularly those based on Avalanche and Solana, with Husky and Bonk standing out.

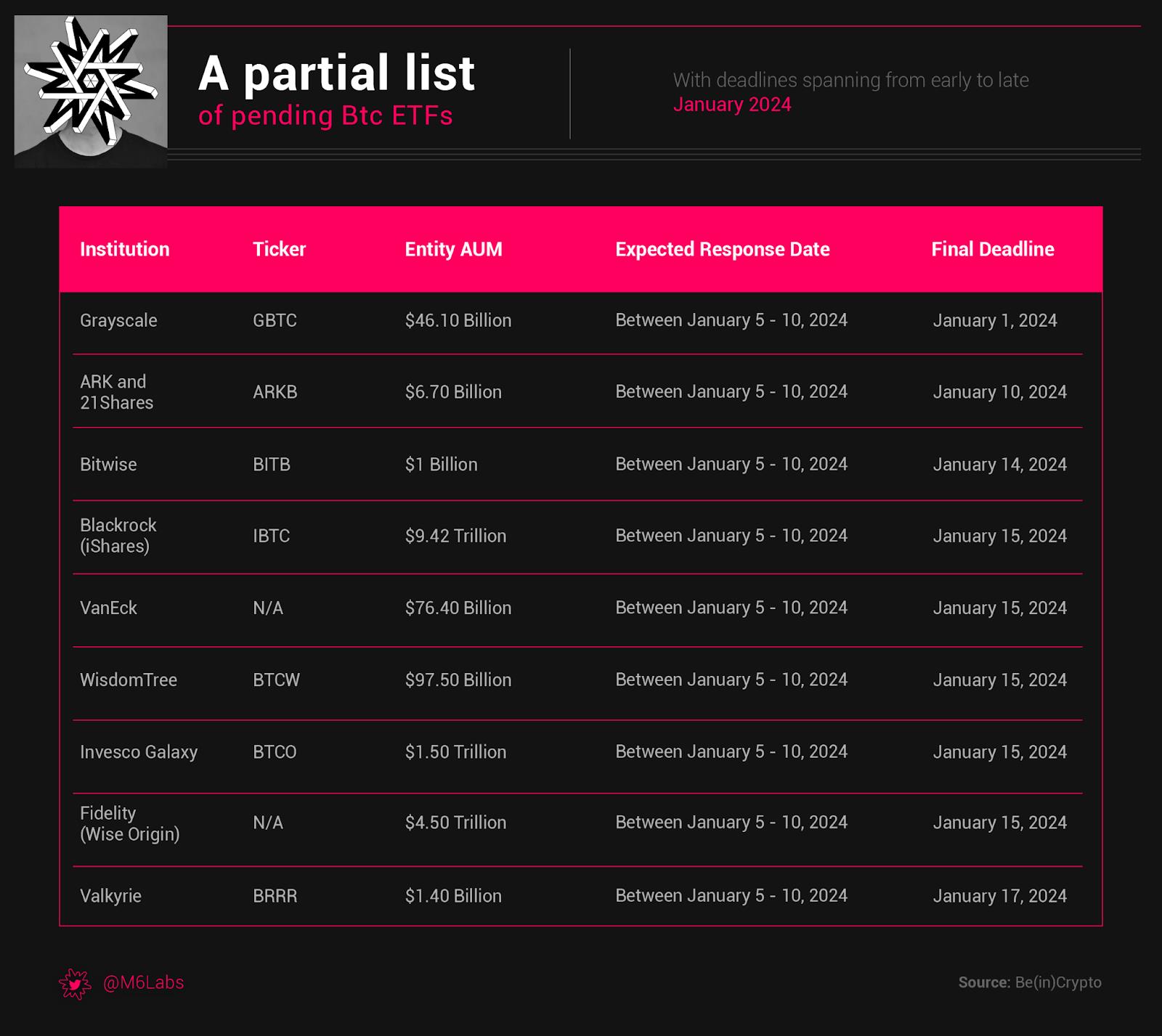

Market Overview: Pre-ETF Market Momentum

The crypto market remains notably resilient, driven by expectations surrounding the approval of Bitcoin ETFs. Investors are closely watching market movements while awaiting regulatory decisions. Although the SEC has delayed several Ethereum ETF proposals, major players like BlackRock are actively amending their Bitcoin ETF filings, intensifying market anticipation. Experts predict that multiple ETF approvals could significantly impact the market.

Inflows and Outflows: Altcoins such as Solana, Cardano, XRP, and Chainlink have performed against the broader trend, attracting $21 million in inflows, with Solana leading at $10.6 million. Bitcoin saw a significant outflow of $33 million, while Ethereum and Avalanche experienced minor outflows. Staking activity remains strong, with staking inflows surging to $122 million, bringing the nine-week total to a record high of $294 million.

Bitcoin Transaction Fees and Volatility: Bitcoin transaction fees have reached their highest level in two and a half years, averaging around $37.58, driven by increased Ordinals minting activity. Despite the fee surge, Bitcoin’s annualized volatility has hit a historic low of 41.53%, indicating stability and maturation amid regulatory challenges and market fluctuations.

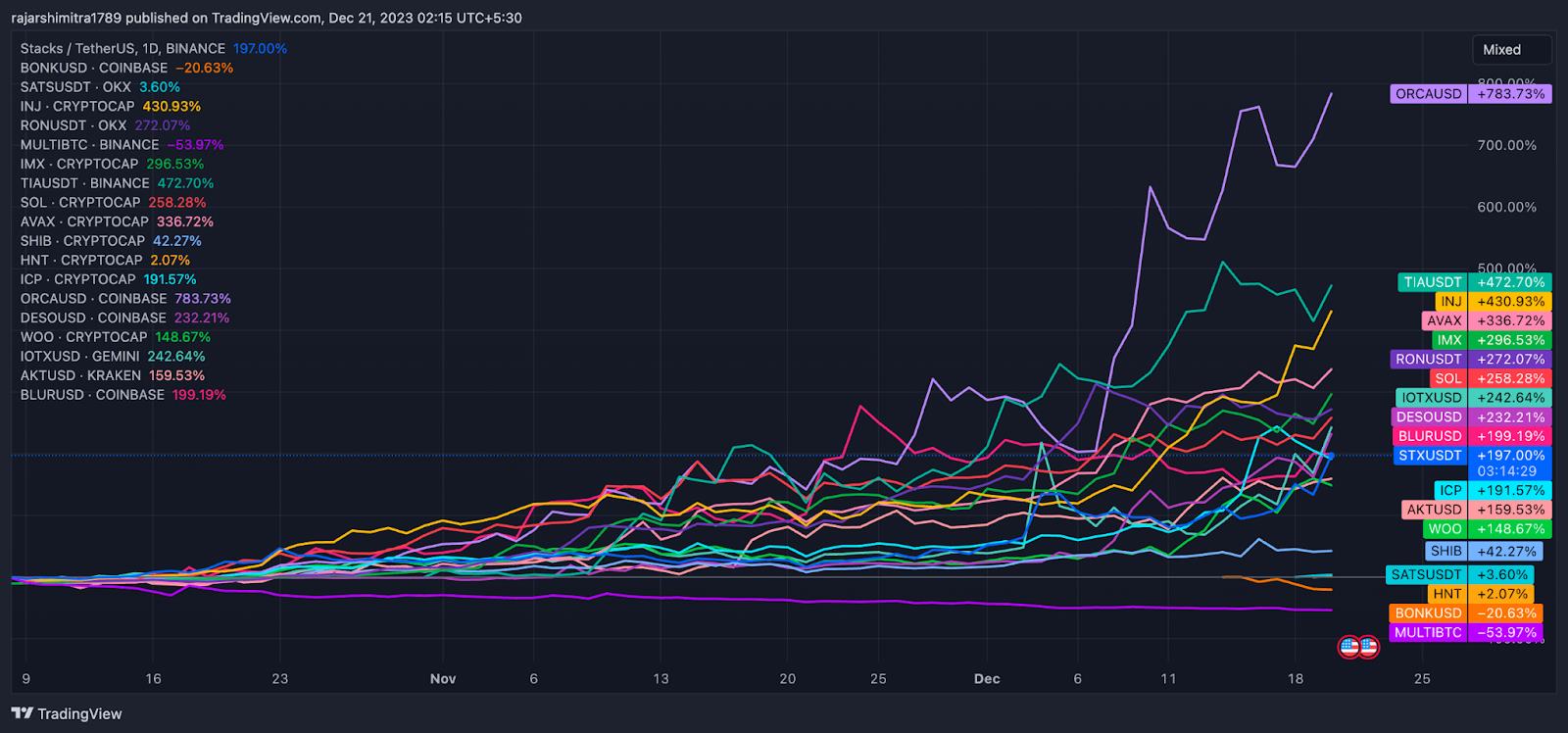

Layer 1 Blockchains, AI Projects, and Meme Coins: Layer 1 blockchains such as Solana, Avalanche, and Cosmos-related projects have maintained strong market positions, experiencing notable price swings. Crypto projects tied to artificial intelligence—a convergence of advanced technology and finance—continue to attract attention. Meme coins including $BONK, $COQ, $TOSHI, and $HUSKY have surged on the Solana and Avalanche chains, highlighting the unique blend of humor and investment opportunity within crypto culture.

The Rise of Inscriptions and BitcoinFI Tokens: Inscriptions, originally a Bitcoin-exclusive feature, have gained traction across various blockchains. BitcoinFI tokens such as $MUBI, $DOVA, $BSSB, and $TURT have seen substantial gains, marking new entrants into the market that could play important roles in the next bull run.

Bitcoin’s current market behavior shows stable consolidation between $40,000 and $44,000. With weakening bullish momentum, expectations are growing for a potential downside correction below $40,000.

This trend is further emphasized by a significant bearish divergence in the daily Relative Strength Index (RSI), expected to persist until a breakout above the key red resistance level occurs. This reflects cautious market sentiment, suggesting potential shifts if resistance levels change.

Blue-Chip and Mainstream Highlights

Bonk

BONK experienced a significant surge, reaching a valuation of over $2 billion after its listing on Coinbase, where more than $500 million worth of BONK was traded—doubling its value since initial confirmation. BONK later pulled back, with its current market cap around $1.16 billion. The excitement around BONK also boosted sales of the Solana Saga phone, driven by hopes of receiving free airdrops.

Husky

HUSKY faced a sharp correction this week, with prices dropping over 36%. Its overall market cap remains above $75 million, while the price has fallen to a support level of $0.000000085 per unit. HUSKY has been the top-performing meme coin within the Avalanche ecosystem.

-

Sats (SATS) rose 45% following its listing on OKX, with current trends around $0.00000070 per unit.

-

Coq Inu (COQ), a meme coin on Avalanche, exploded with a 640% gain last week before pulling back below $0.000003 per unit. One lucky trader turned a $450 bet on COQ into $2 million.

-

Ronin (RON) surged over 95% in the past month, with its overall market cap just under $40 million. According to Nansen, active addresses on Ronin increased significantly in November, signaling rising activity.

-

Injective (INJ) spiked to $39.15 on Tuesday, achieving a 3,000% gain in 2023. Despite a total value locked (TVL) of only $18 million, Injective recorded a staggering $600 million in trading volume over the past 24 hours.

-

Immutable (IMX) market cap rose 20% last week, reaching $300 million.

-

Multibit (MULTI) surged over 150% last week, with its market cap nearing $265 million.

-

Solana (SOL) reached a 20-month high, surpassing XRP to become the fifth-largest cryptocurrency, with a market cap of $33.7 billion, driven by a thriving DeFi ecosystem and popular meme coins. This week, its total value locked (TVL) surpassed $1 billion for the first time since the FTX collapse.

-

BitStable Finance (BSSB) is currently priced at $7.19, down 7.20% in the past 24 hours but up a significant 159.10% over the past week. The cryptocurrency recorded over $5.5 million in trading volume within 24 hours.

-

Turt (TURT) rose 170% last week and 1,200% over the past month. Currently, TURT is attempting to break through the $0.10 resistance level.

-

ORDI (ORDI) surged from $2.82 in September to a peak of $69.76 in early December, an astonishing 2,370% increase. Since then, the price has pulled back below $55.

-

Avalanche (AVAX) has emerged as a major force in the crypto market, with AVAX recently rising above $40, highlighting growing investor confidence in its ecosystem—largely attributed to the rise of AVAX-based meme coins.

-

Shiba Inu (SHIB) welcomed a massive investor wallet holding 4.8 trillion SHIB, increasing 375% within 24 hours, according to IntoTheBlock’s large holder inflow metric. Additionally, Shiba Inu launched a new '.shib' domain for SHIB holders.

-

Helium (HNT) surged nearly 80% in the past week, approaching the $10 level—the highest since June 2022. This rally is primarily due to high interest in the newly launched Helium Mobile service, which offers unlimited access to the Helium network for U.S. users at $20 per month.

-

Bounce (AUCTION) is currently trading at $44, up 118% over the past week. The token has a market cap of approximately $285 million and is undergoing a 1:100 token swap from its original Bounce "BOT" token.

-

Aleph Zero (AZERO) is currently priced at $1.77, up 37% over the past week, with a market cap of around $445 million. The token’s rise is attributed to growing interest in its privacy-focused features.

-

Orca (ORCA) has reached $8, up over 1,821% from its yearly low, primarily due to its close ties with the rapidly expanding Solana ecosystem. Orca’s TVL is also nearing $175 million.

-

ALEX Lab (ALEX) rose 80% in the past week, bringing its price to $0.466 and market cap to approximately $300 million. This growth coincided with ALEX’s recent listing in Bitget’s BTC Ecosystem Zone on December 15.

Smart money has been flowing into newly launched non-Ethereum meme projects, particularly $SIZE on ARB, which attracted $41,000 in buys (with 80% of smart money still holding). From a non-Ethereum smart money holdings perspective, some currently popular projects include $NOLA with $234,000 in smart holdings, $WOLF with $82,000, $KIMBO with $47,000, and $SIZE with $208,000. Overall, smart money favorites (measured by number of wallets holding $5,000 or more) include $OLAS, $GEC, $VAULT, $MUBI, $BANANA, $AGRS, $AEGIS, $RVST, $MN, and $BSSB.

Smart Money Movements

-

Smart money is appearing in $ROKO, an artificial intelligence layer investment. Investors are closely monitoring potential developments and opportunities from this AI-focused project.

-

Additionally, smart money has been actively buying $HIGH, showing interest in a metaverse project aiming to redefine retail experiences in virtual worlds. The growing focus on metaverse projects is evident in this strategic move.

-

Another intriguing discovery is $Nola on Arbitrum, a new meme coin. The token has drawn considerable attention, and tracking smart money flows provides insights into emerging trends within the Arbitrum ecosystem.

-

Continuing this trend, smart money is actively accumulating $EMP, a leading project in the account abstraction narrative. This reflects a strategic investment approach aligned with the potential growth of this narrative.

-

Moreover, MAP has also attracted smart money attention. As a new Bitcoin Layer 2 and peer-to-peer full-stack infrastructure, its appeal to investors is evident. Tracking smart money movements in these projects offers valuable insights for market participants.

-

Notably, AUCTION has drawn smart money interest as a launchpad project, gaining increased visibility after BSSB launched on its platform.

-

Additionally, smart money has been accumulating $HIGH, demonstrating interest in a metaverse project designed to redefine retail experiences in virtual worlds. Growing interest in metaverse projects is clearly visible in this strategic move.

-

Furthermore, another intriguing discovery is $Nola, a new meme coin on Arbitrum. The token has drawn considerable attention, and tracking smart money flows can provide insights into emerging trends within the Arbitrum ecosystem.

-

Notably, $AUCTION has attracted smart money attention as a launchpad project, gaining greater exposure after BSSB launched on its platform.

Intriguing On-Chain Dynamics:

-

Turning to on-chain dynamics, the $INSP team has executed a major move by transferring 13.5% of circulating supply to two new addresses. Monitoring such transactions may offer clues about the project’s future direction. Transaction 1 / Transaction 2.

-

In a major acquisition, GSR purchased $9.4 million worth of $BEAM from CitizenX, depositing half into Binance. GSR’s prior involvement in GameFi tokens like $BIGTIME led to significant price rallies, adding further intrigue. Transaction link.

-

The $Pendle team’s transfer of tokens to a new Gnosis Safe has raised questions about potential incentives, while smart money has also shown interest in this particular development.

-

Observing buy pressure on $TRB from new wallets withdrawing from Coinbase highlights significant market activity. Today’s 16% rise in TRB suggests a possible correlation with these movements.

-

In some intriguing moves, new wallets are accumulating $STORJ at significant scale, indicating growing interest in this specific token and warranting further investigation into potential catalysts.

Farming Strategies:

-

Turning to yield farming strategies, smart farmers are increasingly participating in rsETH farming on Kelp Dao. The platform offers the dual benefit of earning EigenLayer points and Kelp Miles, showcasing the multifaceted appeal of this ETH restaking platform.

-

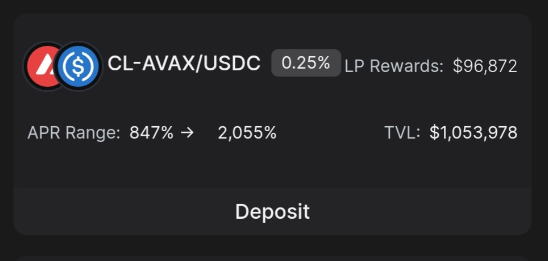

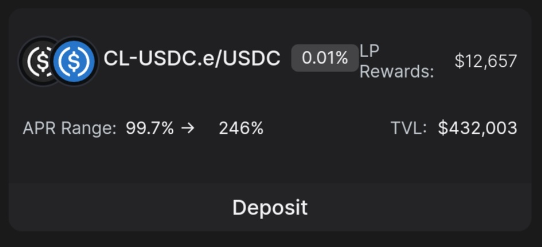

In response to growing interest in AVAX, smart farmers are adopting various strategies on Avalanche. Farming in Pharaoh’s USDC and AVAX pools, which offer attractive APRs, is one such method.

-

Additionally, borrowing $AVAX using BENQ against stablecoins and subsequently farming on Pharaoh minimizes direct exposure to AVAX, offering a risk-mitigated strategy.

-

Farming wstETH/LDO on Velodrome has become a popular choice among smart farmers, highlighting the diverse opportunities within decentralized finance.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News