Messari's Top 10 Investment Trends for 2024: Bullish on Bitcoin, Bearish on Ethereum, Betting on Emerging Narratives like AI and DePIN

TechFlow Selected TechFlow Selected

Messari's Top 10 Investment Trends for 2024: Bullish on Bitcoin, Bearish on Ethereum, Betting on Emerging Narratives like AI and DePIN

Messari is highly bullish on the convergence of AI and cryptocurrency, as well as on three emerging narratives: DePIN, DeSoc, and DeSci.

Author: Messari

Translation: TechFlow

As expected, the well-known crypto data and research firm Messari has released its "Messari Theses 2024." We've compiled and translated the first chapter for you: The Top 10 Investment Trends of 2024.

In the author's view, Web3 is a ridiculous conceptual term. When people stopped using this word and returned to the narrative of “Crypto,” the total market cap of cryptocurrencies doubled.

In its investment outlook for this year, Messari expressed strong bullishness on Bitcoin while being bearish on Ethereum, dismissing the "ultrasound money" (referring to sustained deflation leading to continuous price increases) narrative as nonsense. Compared to Solana, Ethereum does not have an overwhelming advantage. Additionally, Messari strongly favors the convergence of AI and cryptocurrency. Based on analysts' disclosed portfolios afterward, many hold tokens such as AKT and TAO. Messari also sees great potential in three emerging narratives: DePIN, DeSoc, and DeSci.

Read on below:

1.0 Investment Trends

Last December, I abolished the term "Web3" on behalf of everyone in the crypto space.

It’s a stupid, PR-driven phrase that ruins every interesting thing we’re trying to build.

NFT PFP collections are Web3, "DeFi 2.0" is Web3, Sam Bankman-Fried was Web3...

In the world of crypto, I want more things like personal wallets, transaction privacy, infrastructure progress, DeFi, DePIN, and DeSoc—things that don’t entirely rely on Ponzi schemes.

This year didn’t disappoint.

Since cold-bloodedly murdering the word Web3 (translation note: referring to the collapse of scams associated with Web3), the market cap of crypto has nearly doubled. Our industry’s biggest fraudsters are either already in prison or soon will be.

Great products with smooth design have been launched. And I’m even more excited about the prospects of crypto in 2024.

In short, the state of the crypto market is strong.

I realize some newcomers are reading this, so let me remind you: this is advanced material, not beginner-level content.

I assume you already have background knowledge, and I’ll keep it concise because time is a critical factor.

This opening section on "investment trends" is for those who want to tell their friends they read the entire report. I see no need to start a victory lap over the first three sections of last year’s report, but we’ve seen tailwinds across various market segments, with evidence supporting the much-needed optimism following the long crypto winter.

We’ll begin this article with the bull case for Bitcoin in 2024.

1.1 BTC and Digital Gold

“Where are we now? It feels a bit like January 2015, or December 2018—definitely the kind of feeling where you’d consider selling a kidney to buy more Bitcoin.”

That was my view on Bitcoin back in December 2022.

While predicting Bitcoin’s exact trading range in the short term is difficult, its long-term appeal is almost indisputable.

We don’t know if the Fed will raise rates further or abruptly reverse course and start serious quantitative easing. We don’t know if we’ll face a commercial real estate-driven recession or successfully achieve a “soft landing” after post-COVID monetary and fiscal stimulus. We don’t know whether stocks will fall or consolidate, or whether Bitcoin will prove correlated with tech stocks or gold.

On the other hand, Bitcoin’s long-term thesis is straightforward. Everything is going digital. Governments are overly indebted and profligate—they will continue printing money until complete failure. Only 21 million Bitcoins will ever exist. The most powerful meme in the market is the upcoming Bitcoin halving in 2024, kicking off its quadrennial marketing campaign.

Sometimes you just need to keep it simple!

For consistency year-over-year, let’s revisit the MVRV chart I wrote about last year—the one that makes you want to sell your kidney to buy in. Recall that this chart compares Bitcoin’s current market value (MV, i.e., price × total supply) with realized market value (RV, i.e., sum of price × supply per unit when each unit last moved on-chain).

Under this framework, a ratio below 1 is the golden zone. Ratios above 3 always mark cycle peaks.

After a 150% gain this year, is Bitcoin still a good “buy”?

The answer is actually somewhat yes.

Maybe we’re no longer deep in value territory, but given institutional tailwinds we now have (ETF approval, FASB accounting changes, new sovereign buyers, etc.—see Chapter 4.1), buying Bitcoin at an MVRV ratio of 1.3 is clearly no longer a blind leap of faith.

Keep in mind that as more Bitcoin inevitably gets locked into ETF products, the MVRV ratio will be artificially inflated, since new buyers won’t appear on-chain as frequently as trades on NYSE or Nasdaq. A ratio slightly above 1 sits just below the historical median.

You know what’s even more compelling—if you're interested in crypto as an asset class.

Bitcoin tends to lead recoveries. We’ve recently seen multi-year highs in Bitcoin dominance, yet still far from the levels reached at the start of the 2017 and 2021 bull runs. In 2017, Bitcoin dominance dropped from 87% to 37%. In 2021, before consolidating and rising to $40,000, it reclaimed 70% market share, then fell to 38% at the peak of the bubble. We’ve just hit 54%. There’s room for consolidation.

Frankly, it’s hard to imagine another crypto boom without Bitcoin continuing to surge first.

DeFi faces ongoing regulatory headwinds that will limit growth in the near term. NFT activity is essentially dead. Other emerging sectors (stablecoins, gaming, decentralized social, infrastructure, etc.) are more likely to grow steadily rather than spike sharply.

Large fund managers agree. Binance recently conducted excellent research showing that during the summer, "Bitcoin" sentiment among asset allocators outweighed "crypto" sentiment (though this may be shifting as ETHBTC underperforms).

With this momentum, I bet that Bitcoin dominance will return to 60%—either through an ETF-driven rally (leading the ascent) or severe macro stress (consolidating on the downside).

Even if I’m wrong and we’ve already seen the peak of Bitcoin dominance this cycle, I believe the likelihood of Bitcoin falling significantly—either nominally or relatively—is extremely low.

In the early stages of a crypto bull market, the highest-expected-value play has always been betting on the leader, and this cycle is no different (and will remain so).

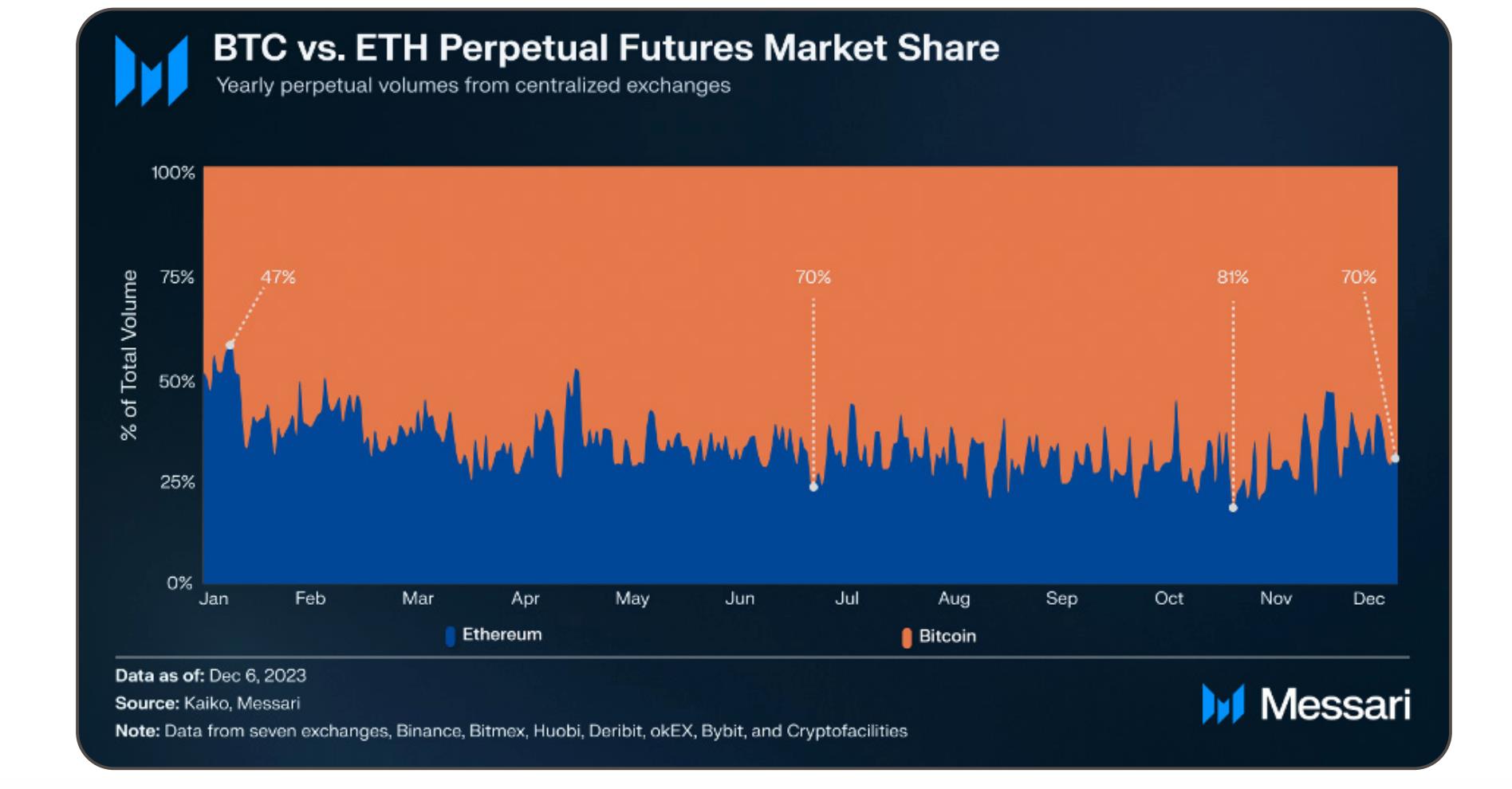

I’ll reiterate what I said last year: I find Ethereum’s “ultrasound money” (note: referring to sustained deflation driving price increases) argument completely unconvincing. If this meme had any strength, liquidity data wouldn’t look like this, even after ETH futures ETFs were approved:

We might never see another 100x on Bitcoin, but this asset can easily outperform other mature asset classes again in 2024. Parity with gold would put each BTC above $600,000. Remember: gold benefits from many of the same macro tailwinds, so that price isn't necessarily a ceiling.

If a monetary crisis is severe enough, crypto will prove its worth: 1 BTC will be worth 1 BTC.

[Related Reading : Bitcoin Q3 Report]

1.2 Ethereum

Ethereum successfully completed the “Merge” in September 2022 and the “Shapella” upgrade in April 2023—among the most technically impressive upgrades ever. The Merge also ushered in a new era of Ethereum as a net deflationary digital asset. I love Ethereum and everything it has spawned. Without Vitalik’s ecosystem, Messari itself wouldn’t exist. But long-term, the investment case for ETH resembles Visa or JPMorgan, not Google or Microsoft, nor commodities like gold or oil. ETH is caught between two stools. BTC outperforms ETH in digital currency due to institutional appetite for “pure-play” digital gold, while widely available Ethereum alternatives (L0s, L1s, L2s) may perform better by absorbing on-chain transaction volume away from Ethereum’s mainnet. I don’t see ETH outperforming Bitcoin or delivering high beta returns. That said, I’m not opposed to ETH nominally. It has weathered multiple technical challenges and market cycles. It arguably has better supply dynamics than Bitcoin today. I agree that ETH bridged to other rollups may be gone forever—“not coming back to take bids.” Being bearish on ETH isn’t a critique of Ethereum; it’s a sober recognition that ETH, despite its dominance so far, will find it difficult to maintain over 60% market share among peer network tokens.

When I think of Ethereum vs. Solana, I think Visa vs. Mastercard, not Google vs. Bing. Even giving ETH maximalists a fair chance, I must point to relevant data metrics and note ETH’s poor cost-performance ratio against BTC.

I’ll discuss technology later, but I know you’re not here to sit around the fireplace drooling over my views on sharding. You want simple bullish/bearish takes—and betting on ETH sits right in the middle of the bell curve. I’ll surely argue this with the guys at Bankless soon. (Note: While I hate making guarantees, since I first drafted this section, that firm stance has weakened. With BTC up ~150% and SOL up over 6x YTD, we’re at a point where ETH needs some mean reversion, having acted like a stablecoin for many months and lagging badly.) [Must-read: Ethereum Q3 Report]

1.3 (Liquid) Markets

Bitcoin (BTC), Ethereum (ETH), and USD-backed stablecoins now account for 75% of the $1.6 trillion crypto market. But this won’t stay the same forever.

I founded a company based on the premise that over the next decade, the remaining 25% of the crypto market will grow 100x, requiring investors to use more sophisticated due diligence tools to analyze thousands of crypto assets—not just two. At current market size, a 100x expansion of these “other areas” would make the liquid crypto capital market slightly larger than the private capital market ($20–25 trillion), representing 30–35% of global bond and equity markets.

More importantly, if you agree with my view that blockchains are fundamentally an innovation in accounting, eventually all assets will become “crypto” assets traded on public blockchains instead of relying on traditional clearing and settlement systems—whether they’re “utility tokens” or “equity tokens.” Over time, the relationship between crypto and traditional finance (TradFi) will grow tighter, eventually merging almost completely.

Of course, there are advantages to sticking with a market-cap-weighted index investing in BTC and ETH.

First, historically, this has proven successful. If you attended the North American Bitcoin Conference in Miami in 2014 and bought what Vitalik recommended (the Ethereum ICO and Bitcoin), you’d have captured 75% of the market’s growth over the past decade. These blue-chip assets are now the most solid “hard investments” in crypto because you don’t have to worry about supply dilution over time.

In contrast, many other top projects have large treasury reserves that insiders may gradually sell over time. So while their “market cap” may rise, token prices could remain flat or even decline.

Of course, this isn’t investment advice. But as a historian, I understand:

A. While BTC and ETH may be market leaders today, they aren’t invincible;

B. Since 1926, although 26,000 stocks have traded, only 86 have contributed over half of U.S. market gains.

Many stock market leaders of the 1920s no longer exist—crypto won’t be an exception. So what should someone like me, who loves passive indexing, do?

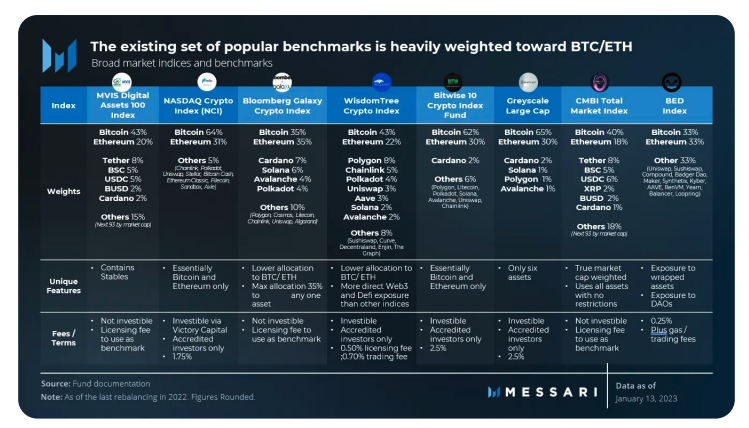

Honestly, not much can be done right now. Existing crypto index product alternatives aren’t attractive, and I doubt this will change in 2024.

A low-cost, auto-rebalancing index that accounts for token oversupply and market liquidity would be an excellent investment tool. But to get index exposure today, your choices are paying excessive AUM fees (e.g., 200–250 bps for Grayscale products), trading fees (active crypto funds), or complex methodologies (implementing on-chain operations correctly involves major regulatory and technical risks).

For investing in crypto assets ranked #3 to #1000, a “cheap” way is to rely on your own skill—I’ll give an example.

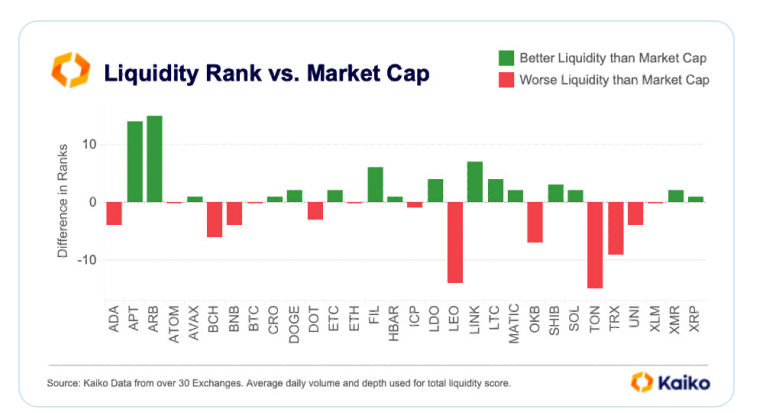

A simple at-home indexing strategy could involve monitoring Kaiko’s liquidity rankings and rebalancing quarterly. If you buy green assets where liquidity rank beats market cap rank, and sell red assets where market cap rank beats liquidity rank, you’d essentially replicate my large-cap long/short list so far this year (of course, not investment advice).

Source: Kaiko

1.4 Is the Private Crypto Market Recovering?

A few years ago, I wrote that many crypto fund managers’ business models amounted to “losing alpha” on behalf of clients, which upset them quite a bit. Turns out I was right.

(Not bragging—I’m just convincing myself I made the right decision abandoning what was possibly the most profitable business model in the world, though I could’ve collected 2% management fee plus 20% performance fee since 2017 without worrying about Bitcoin/Ethereum yields.)

Many crypto investors not only performed poorly but have exited the market entirely. Some liquid investors got trapped by bad leverage positions (like 3AC), bad counterparties (like Ikigai), or both (we discuss DCG in detail in Chapter 6). You probably know all this—I won’t rehash last year’s crises.

So what happens in 2024? The liquid crypto market remains a jungle full of tech and counterparty risks, high trading costs, and fierce competition. Adjacent to this jungle lies a true “valley of death”—the private crypto venture capital market.

Overall, the VC market has been severely damaged over the past few years due to shocking monetary policies by the Fed. Crypto infrastructure suffered even greater damage due to fraud and widespread regulatory crackdowns. New users and customers are excluded from accessing “long-tail” crypto assets until they get much-needed legal clarity, while existing ones cut spending and hunker down through the winter. This led to brutal demand destruction: declining service revenue, faster burn rates, further budget cuts, etc.

Worse, AI has become tech’s new darling. Once again, we’re sidelined. (As I explain in Section 1.8, I think this is a silly meme and a wrong choice—AI and crypto actually go well together.)

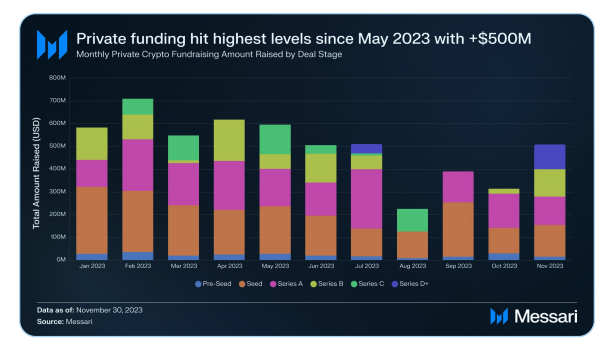

Despite this, I remain optimistic about new crypto first-time investors. Funds raised in 2023 are likely to outperform the S&P index over medium to long horizons, and many may even beat BTC/ETH benchmarks thanks to unusually low entry prices this year. The liquid market has revived, and there are signs of VC market recovery.

Private fundraising (from seed to Series D+) has reached its highest level since May, with announced deals exceeding $500 million (you can track them in our funding screener):

Here are some crypto funds I’m watching this year:

Multicoin: I wrote a trilogy about their legendary 2021 performance. But it’s unclear how their LPs handled the brutal reality of SOL dropping 96% in 2022. Even if Multicoin’s AUM rebounds sharply this year, I’m not sure which fund LPs went through a bigger rollercoaster.

1confirmation: Nick Tomaino is one of the most honest crypto investors I’ve met. He openly discusses the benchmark issues I mentioned, the need for greater accountability in crypto investing, and was one of the few contrarian investors questioning Sams—first SBF, then Altman. His actions back his words—he even shared his fund’s DPI, which is rare in venture capital.

There are also “bottom-callers” whose tweets proved prescient in hindsight. Framework (Vance) and Placeholder (Burniske) are two examples who offered specific views and weren’t just perpetual bulls. (Even those calling tops can turn out to be prophets in the long run.)

a16z and Paradigm may be disadvantaged in valuing their private portfolios depending on how much capital they deployed at the 2021 market peak, but I wouldn’t bet against Chris Dixon, Matt Huang, and their teams. In fact, I’m somewhat glad they (possibly) had mediocre or temporarily negative investment returns in certain years—it makes them strong fighters for the industry in Washington, where their policy team excels.

Syncracy Capital has vastly outperformed the crypto market since inception. The team includes three former Messari analysts, including co-founder Ryan Watkins. Full disclosure: I’m an LP in this fund, and I won’t hesitate to promote those who helped build Messari and continue making me money after leaving. They’re one of the few new liquid funds I know that have consistently outperformed BTC/ETH benchmarks since launch.

1.5 IPOs and M&A

In the crypto world, three companies stand out due to positioning, team, and access to capital: Coinbase, Circle, and Galaxy Digital.

Coinbase remains the most important company in crypto. As the most valuable and best-regulated crypto exchange in the U.S., Coinbase deserves special mention. Next year, Coinbase is unlikely to face major competitors in the U.S. market, but its key partner Circle may go public in 2024.

Circle CEO Jeremy Allaire shared on Mainnet that Circle generated $800 million in revenue and $200 million in EBITDA in H1 2023—matching its full-year 2022 figures—and revenues could grow further in a “higher for longer” interest rate environment.

Circle is well-positioned to benefit from U.S. stablecoin policy progress or international stablecoin growth booms. The company’s valuation depends almost entirely on market trust in its product and technological growth, not on its economics of “earning interest from your float” (*Tether is financially even stronger—since SVB collapsed in March, Tether has regained market share—but don’t expect its S-1 anytime soon).

I once thought DCG, with its diversified service portfolio, would be the first IPO candidate. But DCG is under siege and unlikely to go public anytime soon. At minimum, DCG faces a tough road rebuilding institutional reputation after Genesis’ bankruptcy filing (public scandal) and rapid liquidation of core assets over the past 12 months (GBTC, CoinDesk spin-off, etc.).

Meanwhile, another New York-based crypto financial conglomerate is rising—both figuratively and literally. Galaxy Digital’s venture portfolio, trading desk, mining operations, and research arm could help it replace DCG in the crypto industry narrative: Mike Novogratz’s company is already listed on the Toronto Stock Exchange with a $3 billion market cap.

If they choose, Novogratz’s team could pursue aggressive consolidation strategies in 2024. Under continued venture pressure, some major assets will inevitably struggle, and Novogratz already has a full investment banking advisory team.

Beyond these, I won’t place much hope on IPOs from other crypto firms. I doubt other listings will be allowed before the 2024 U.S. election. So under current regulations, crypto’s path to liquidity remains through token markets.

1.6 Policy

(Editor’s note: This section mainly discusses the possibility of the U.S. succeeding in the global crypto market and current challenges. The author references key historical events and trends, including the 1990s crypto wars, government regulation of digital privacy, and shifts in America’s global standing, emphasizing that younger generations may differ from previous ones in attitudes toward digital privacy and personal freedom, potentially impacting crypto policy. Contains ideological content, somewhat dry—feel free to skip.)

Regarding Senator Elizabeth Warren and SEC Chair Gary Gensler, we’ll touch on these outstanding figures later. Don’t worry—we’ll get to them soon.

But first, we need to step back and see the big picture. The U.S. has the talent, financial markets, and regulatory capacity to win the global crypto race, ensuring its status as a financial and tech superpower in the 21st century. But I think this time, we don’t have enough cypherpunks to save us.

The past 30 years weren’t just the coming-of-age of millennials—they offer clues and context for the crypto policies we can expect in the short and medium term. Among the most impactful events and shifts in crypto over recent decades, one historical analogy and two major trends are particularly relevant:

1. The original 1990s crypto wars involved an unfair fight against NSA hardliners, legislative proposals to install literal government chips in all devices for on-demand unlocking, and a popular grassroots rebellion led by developers against government overreach. This is where the term “cypherpunks write code” originated. You should read this book on the crypto wars, or at least this paper.

It accelerated crypto history. It’s a classic underdog story, though a repeat seems unlikely today due to profound cultural changes in America.

2. Complacency and awakening curse: Unfortunately, Gen X (born 1964–1980) grew old and teamed up with Baby Boomers to do some truly awful and unconstitutional things. Today’s “crypto” poses a major threat to the “surveillance and control” state order. Looking at our young protagonists—Millennials and Gen Z (born 1995–2009)—the question is whether they care about fighting at all. They’re accustomed to civil liberties erosion in the post-Patriot Act, post-COVID era. After 20 years and a $7 trillion global military disaster, they’ve never lived under a security apparatus focused inward. Many even shrug at Twitter Files and Big Tech’s censorship-industrial complex. Peter Thiel and David Sacks wrote a predictive essay in the early 90s about dangers of campus cultural conformity—SBF merely reminded us of what we already knew: that conformity might be performative, but now it’s harmful.

3. End of American hegemony: When you combine #1 and #2, what you really need to grasp is that many government officials genuinely believe 1990s tech policy was a mistake—that the miracle of an open internet and its economic growth had net-negative effects on American society. Tech became the scapegoat.

While concerns about losing manufacturing base and excessive financialization have merit, many envy China’s closed internet, seeing only “missed opportunities to curb misinformation”—which is terrifying. We’re no longer the sole superpower, and as rivals like China show bureaucratic effectiveness in certain areas, our leaders want more control too.

Our culture is weakening, domestic gerontocracy is paranoid, and this time we face strong adversaries. We must play a different game—focus on “Moneyball” elections (Moneyball, a film about how small-market teams compete with wealthy giants). Good news: we’re going to win. (Chapter 5 will explain how.) (I know you might think these trends are irrelevant or barely related to crypto, but they said the same about Pepe Silvia. We’re in a life-or-death information war.)

1.7 What Can Developers Do?

Despite two years of crypto market downturn, declining volumes, and heavy regulatory resistance, developer activity remained strong this year. Mid-year, Alchemy found that smart contract deployments on EVM chains grew 300% quarter-over-quarter, and crypto wallet installations hit record highs.

Electric Capital found that monthly active contributors to open-source projects declined sharply year-on-year as of October, but this stems from multiple factors: regulatory chill in open-source ecosystems after the Ooki DAO ruling this year; more innovation at application and infrastructure layers; and increased caution toward competitive threats during bear markets.

a16z’s State of Crypto Market Index may be the best overall health indicator. It similarly shows a 30% drop in open-source developers but also records positive signals: developer library downloads hit record highs in Q3, while active addresses and mobile wallet activity hit record lows. Is this the spark igniting a 2024 crypto app explosion? If I were to blindly invest in crypto based on a single chart, it would be this one:

The real turnaround begins when AI developers realize crypto is their other battlefield.

1.8 AI & Crypto

In this digital age marked by abundant AIGC, reliable, global, mathematically guaranteed provenance and digital scarcity technologies are crucial.

Take deepfakes as an example: crypto is vital for timestamping and verifying devices and data. Without crypto, it’s hard to verify whether certain images or texts came from AI or non-AI sources, or from Washington or Beijing. Moreover, without blockchain transaction fees, preventing generative DDoS attacks would be a huge challenge.

Viewing AI’s rise as a “threat” to crypto is as absurd as once viewing mobile tech as a threat to the internet. Advances in AI will only increase demand for crypto solutions. While we may debate whether AI is good or bad for humanity (just as we debated whether iPhones were good or bad… but we still know they’re clearly beneficial), AI is fantastic for crypto.

Personally, I welcome our machine overlords, bringing the perfect machine money: Bitcoin.

No need to overthink this, but Arthur Hayes (BitMEX founder) wrote a notable piece this summer. For any AI, the two most critical elements are data and computing power. Thus, it seems reasonable that “AI will trade a currency that preserves its purchasing power for energy over time,” perfectly describing Bitcoin.

Critics argue this view is oversimplified, especially considering two potential AI applications—micropayments and smart contract execution—which haven’t significantly developed on Bitcoin. Some suggest AI agents will choose the cheapest blockchain, not necessarily Bitcoin, due to PoW’s transaction friction.

Dustin (Messari researcher) believes the “energy-denominated currency” idea might be inverted: AI agents may prefer directly buying gas tokens (computational resources).

1.9 DePIN, DeSoc, DeSci

I’m permanently bullish on decentralized finance (DeFi), but I don’t necessarily “overweight” it, as I believe other market segments will perform better over the next year.

I do think some top-tier DeFi protocols (especially in decentralized exchanges) will rebound after a year of flat volumes, but I’m unsure whether DeFi’s unit economics and product-market fit are strong enough to withstand looming harsh regulation.

Moreover, the type of assets driving DeFi volume is questionable. This year’s trading peaks were driven by meme coins, not breakthroughs in new applications. Maybe I’ve thought too much about DeFi doomsday scenarios in D.C. (more in Chapter 8).

My attention turns to several key non-financial sectors in crypto. I like DePIN (physical infrastructure networks), DeSoc (social media), and DeSci (yes, science!), because they seem less driven by rampant hype and more centered on essential solutions beyond finance.

Last year, Sami (Messari researcher) helped popularize the term DePIN, and no one maps these hardware networks or explains how they scale and compete with Big Tech better than him.

Cloud infrastructure services represent a $5 trillion market traditionally, while DePIN accounts for just 0.1%. Even assuming 0% (note: editor thinks this should probably be 1%) of online services adopt DePIN as primary stack, demand could explode simply from the need for decentralized redundancy. To hedge Big Tech platform risk, a 1% “insurance premium” could increase DePIN usage tenfold. Not much is needed to shift the status quo, especially with AI-driven demand for GPUs and compute resources.

Social media presents similar opportunities. Last year, major players in this space generated $230 billion in revenue (half from Meta family), yet only a tiny fraction of creators earn enough from content creation.

We’re already seeing change (YouTube’s steady growth, Elon’s revenue sharing) and potential breakout DeSoc apps (Farcaster, friend.tech, Lens)—this looks more like the barely perceptible beginning of a J-curve rather than a false start.

Friend.tech shared $50 million with creators in months after launch—a way to attract users. I believe 2024’s DeSoc will follow 2020’s “DeFi Summer” hype.

Finally, decentralized science. Half of the DeSci projects we track were built in the past year. One of the sharpest OG crypto investors I know now spends 100% of his time here.

In this space, crypto incentives make sense: public trust in scientific institutions may be at an all-time low, and the current system suffers from bureaucratic inefficiency, flawed data methods, and poor incentives (tenure via peer-reviewed papers), while crypto has proven its ability to fund... scientific experiments.

To scale, token sales and DAOs aim to transform how we conduct research, and interest in longevity, rare disease treatments, and space exploration is strong enough to drive the field forward.

You can invest directly in DePIN, start using DeSoc apps now. But I don’t yet know a lazy way to express the DeSci investment thesis. (VitaDAO?)

If you have ideas, DM me.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News