NAVI Protocol: The Catalyst for Sui's Ecosystem Boom

TechFlow Selected TechFlow Selected

NAVI Protocol: The Catalyst for Sui's Ecosystem Boom

The emergence of NAVI Protocol is undoubtedly a timely and powerful support, filling the liquidity gap in the Sui ecosystem.

Written by TechFlow

The liquidity market is the lifeblood of a thriving crypto ecosystem, especially for new ecosystems.

When it comes to liquidity, DeFi's importance is self-evident. By allowing users to lend and borrow cryptocurrency assets through shared liquidity pools without intermediaries—and offering incentives—DeFi locks in liquidity and provides leverage for capital within the ecosystem.

As a new ecosystem, Sui faced one major early challenge: insufficient liquidity. This made it difficult for its native DApps to attract enough users and capital during their initial launch phase. In this context, the emergence of NAVI Protocol serves as timely and powerful support, filling the liquidity gap in the Sui ecosystem.

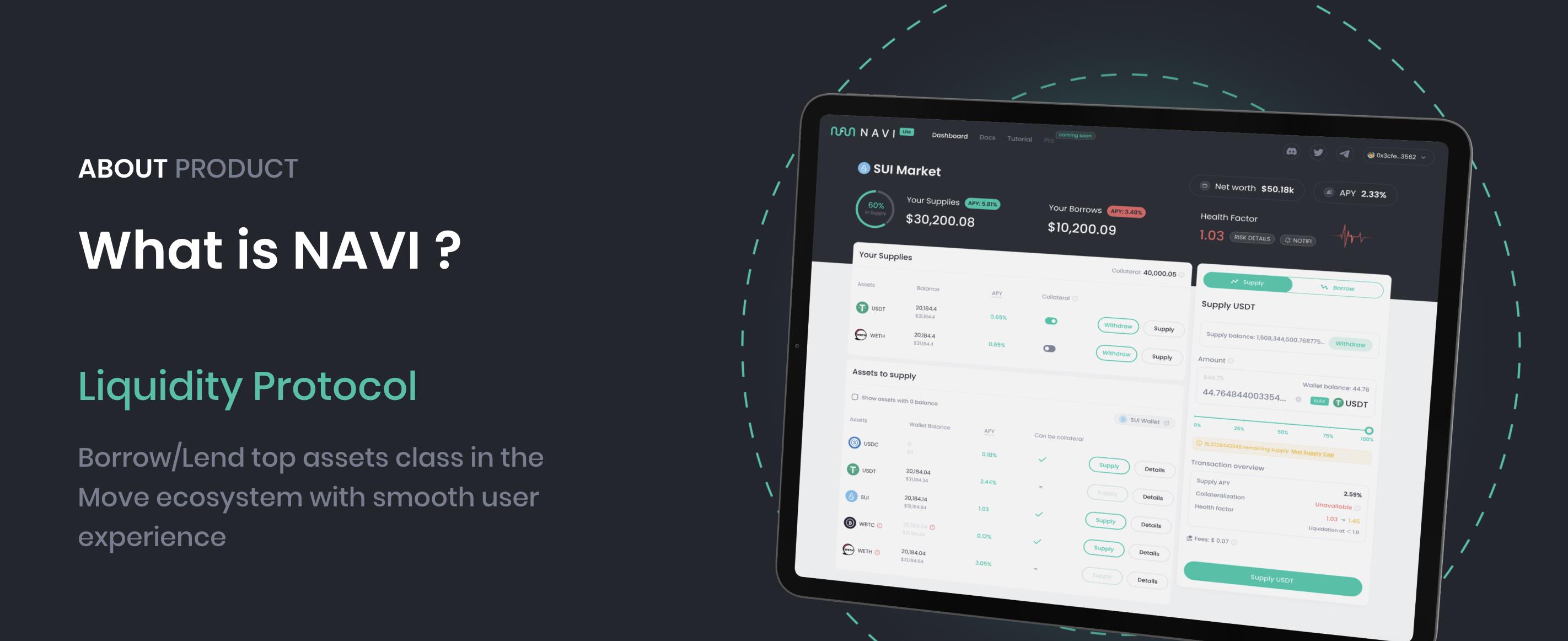

NAVI: Native Liquidity Infrastructure for the Sui Ecosystem

NAVI is the first native liquidity infrastructure on Sui, similar to AAVE. Its primary function enables users to participate in the Sui ecosystem either as liquidity providers or borrowers.

Liquidity providers supply assets to markets and earn passive income from yields offered by NAVI, while borrowers can flexibly obtain loans in various assets, adding leverage to their capital.

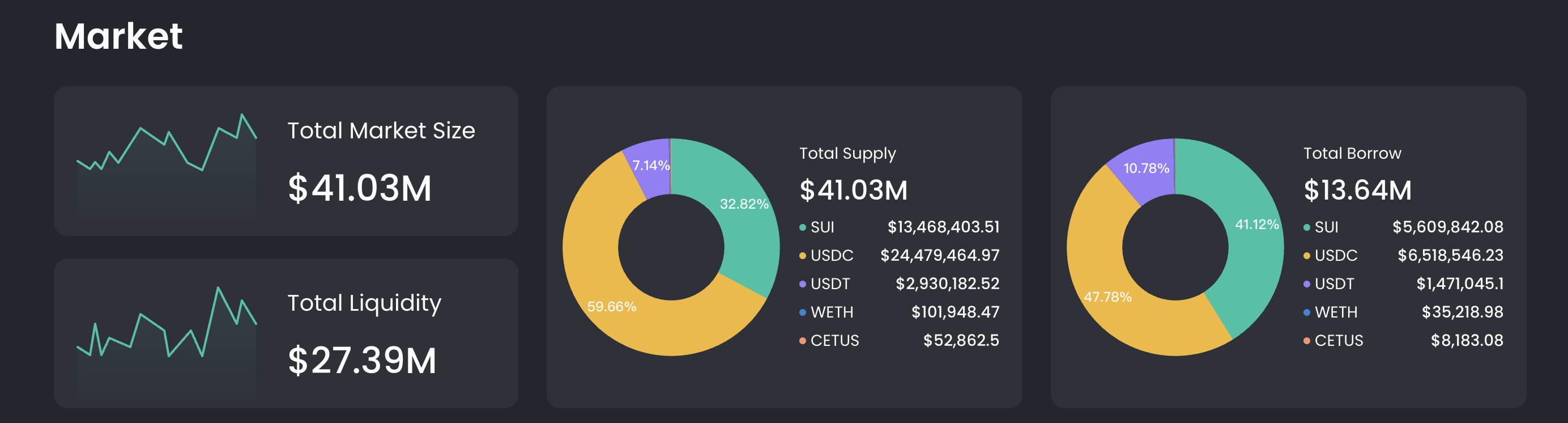

Currently, the total market size of the NAVI protocol has reached $41.03 million, with total liquidity amounting to $27.39 million. Among this $41.03 million, USDC and SUI are the dominant components, accounting for 59.71% and 32.82% respectively, while USDT, WETH, and Cetus make up the remainder. In total borrowing volume, USDC and SUI also lead, representing 47.78% and 41.12% respectively.

Why are SUI and USDC so prominent?

This is because NAVI has announced an exclusive partnership with OKX DeFi to incentivize existing users and attract new capital. The event began on December 7, 2023, at 18:00 (UTC+8) and ended on January 6, 2024, at 18:00 (UTC+8). The total reward pool for this campaign amounted to $50,000, distributed as follows:

-

Providing USDC to NAVI via OKX Wallet will receive a bonus yield boost of up to 10% APY on top of the base interest rate. The prize pool is 25,000 USDC.

-

Providing SUI to NAVI via OKX will receive a bonus yield boost of up to 10% APY on top of any base interest rate. The prize pool is 22,000 USDC.

-

Additionally, during the second week of the event, another $3,000 was allocated for providing other assets to NAVI. This activity is already live.

Readers interested in the event can learn more at https://www.okx.com/cn/activities/defi-navi-bonus-event

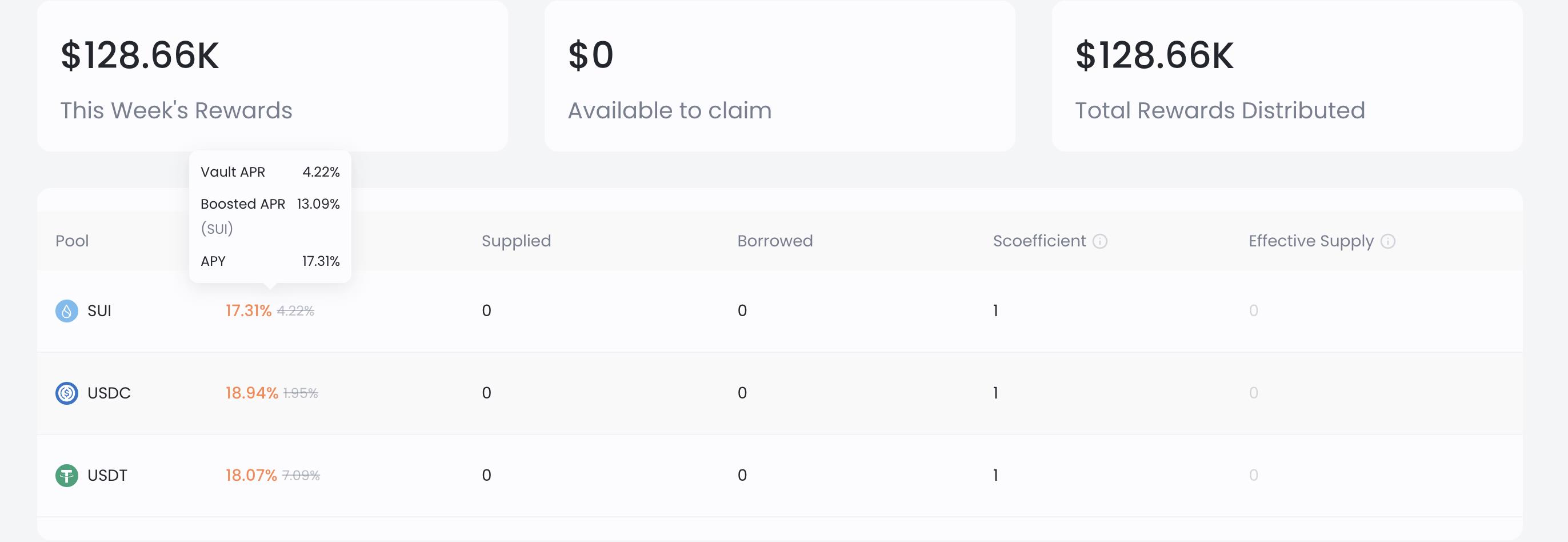

In addition, NAVI has received investment support from Mysten Labs, Coin98 Ventures, Galxe, Gate.io, and ViaBTC, and has jointly launched its own liquidity incentive program—Liquidity Xplorer—with the Sui Foundation to increase user deposit yields and encourage borrowing at lower rates. Based on current TVL ratios, NAVI has distributed SUI worth $18,000 over the past five months. The specific weekly distribution schedule is shown in the figure below:

Leverage Vaults and Isolation Mode: Guardians Ensuring Fund Safety

Innovative Features

To ensure user fund safety and mitigate systemic risk, NAVI Protocol has introduced two key innovations: Leverage Vaults and Isolation Mode. The Leverage Vault offers the following features:

-

Automated Leverage: Traditionally, leveraged long or short positions require repetitive borrowing actions that are technically complex and tedious. This feature eliminates such manual repetition, making the process more intuitive and user-friendly.

-

Borrow low-yield assets and earn high mining returns;

-

Leverage strategies for native APY-generating assets (such as staked tokens and LP tokens).

Meanwhile, Isolation Mode is designed to:

-

Safely onboard new assets;

-

Only allow collateralization of new assets after approval by NAVI governance;

-

Eliminate systemic risks.

Together, these two features enable users to fully utilize their assets while minimizing risk and unlocking new trading opportunities.

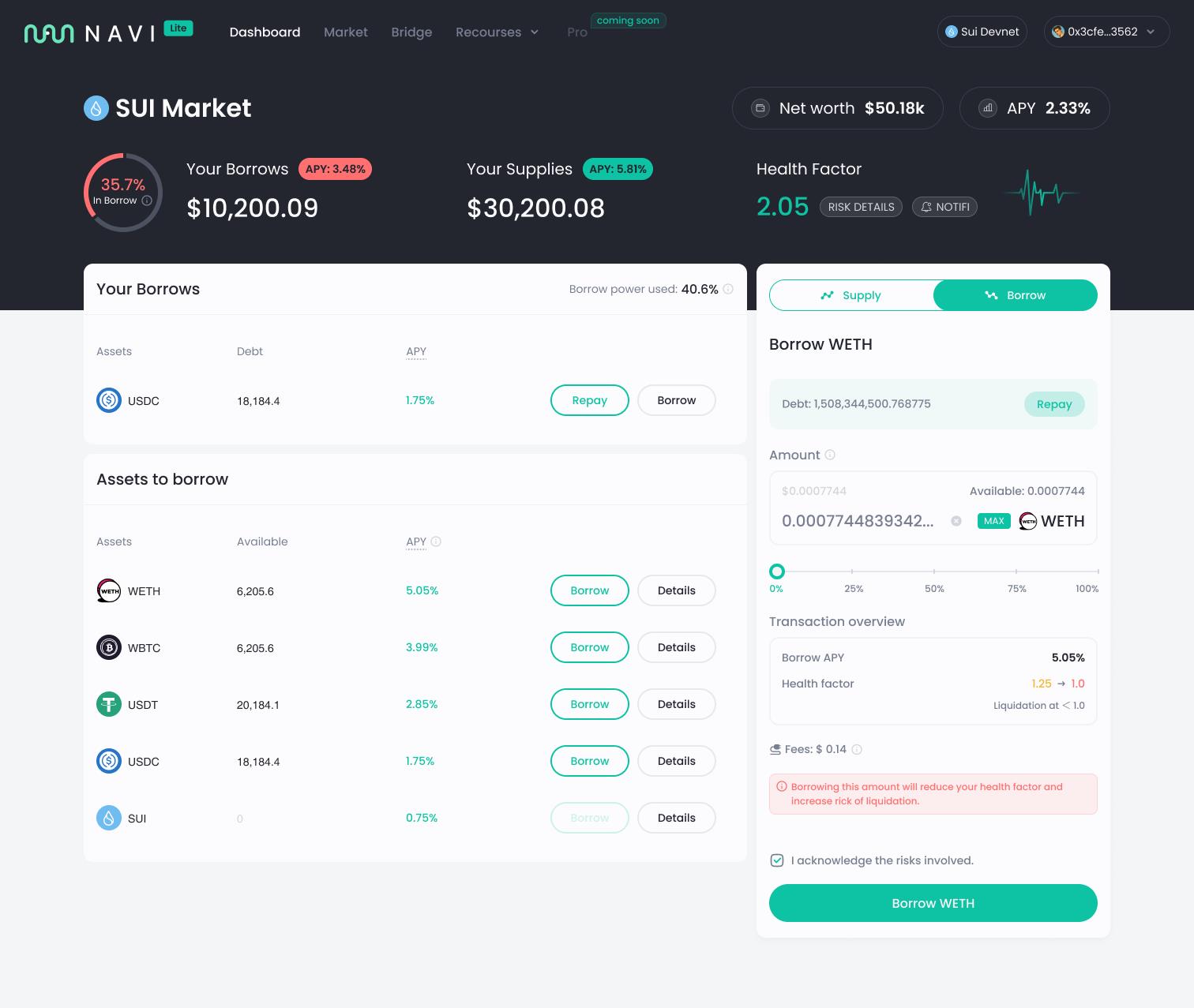

Borrowing

Over-collateralized lending has been thoroughly tested in today’s market. Prioritizing fund security, NAVI’s lending module adopts this model.

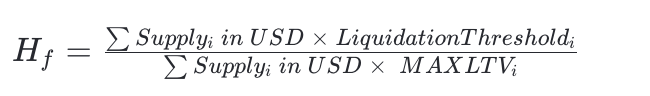

The assets provided by users affect the maximum loan value. Here, NAVI introduces the concept of Health Factor (Hf)—a numerical representation of the safety of a user’s deposited assets relative to their borrowed assets and underlying values. The higher this value, the safer the user’s position against liquidation.

Maximum loan amounts are calculated based on the Health Factor (over-collateralization).

When clicking the MAX button, the system calculates the minimum Health Factor the user can reach, using the formula:

According to the above formula, when a borrower’s Health Factor drops below 1, liquidation occurs, as the value of their collateral no longer adequately covers their loan/debt position.

Therefore, to avoid liquidation, users must take measures to maintain a healthy factor—such as repaying part of their loan or depositing additional assets to increase their Health Factor.

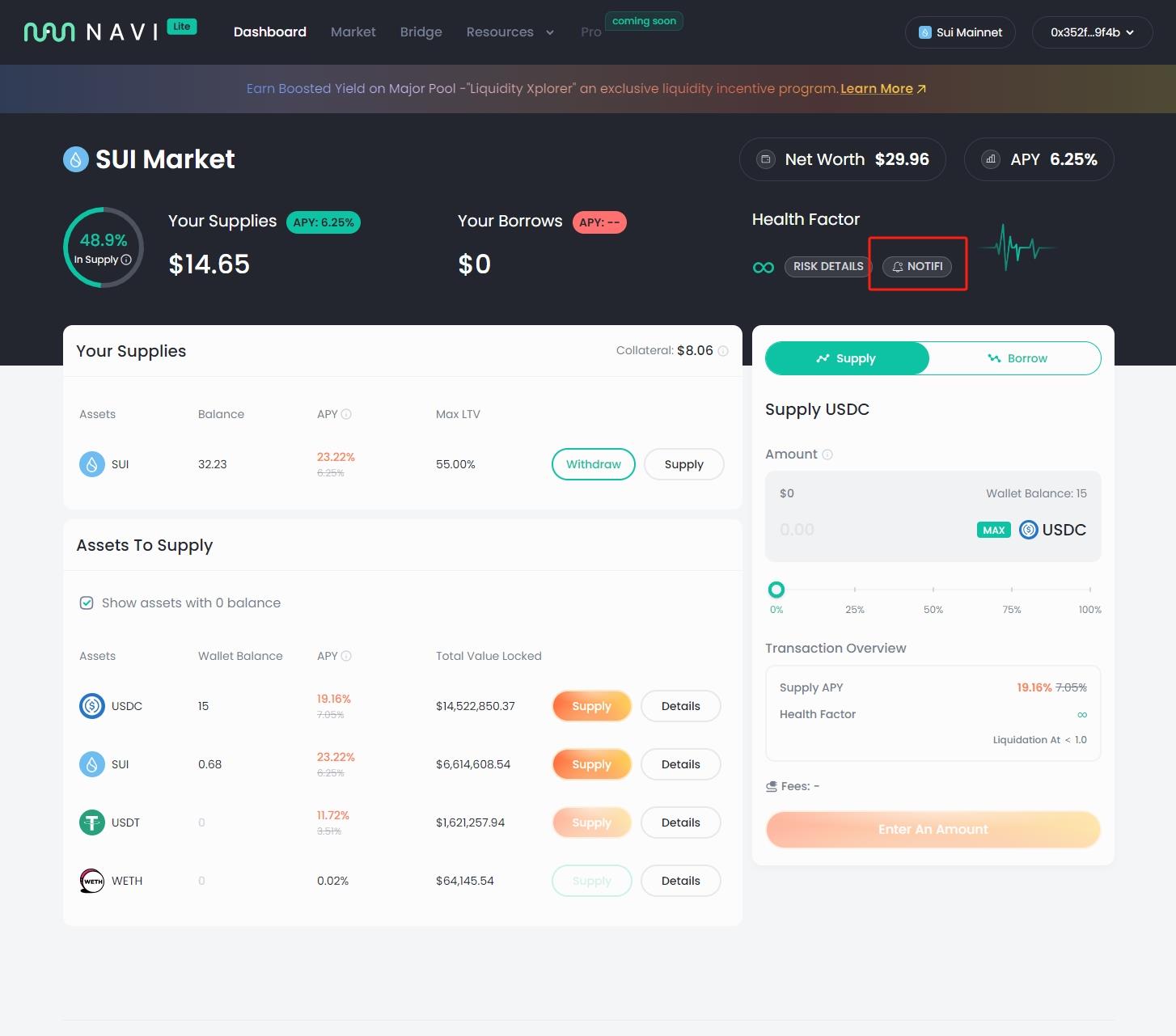

Notifications

However, users cannot remain active in crypto 24/7. During periods of extreme market volatility, some users may react too slowly and face liquidation.

To minimize such occurrences, NAVI has partnered with Notifi to help users receive real-time alerts about fluctuations in their Health Factor. Users simply need to enable the Notifi button on the main interface and enter their email, Telegram, and Discord addresses/usernames to monitor changes via all three channels.

Overall, while pursuing yield and capital efficiency in lending, NAVI’s multiple design elements emphasize risk management, minimizing the potential negative impact of risks.

Tokenomics

The NAVI native token holds strong utility within the NAVI ecosystem. Token holders can:

-

Stake: Users can stake the native token to earn rewards from transaction fees and interest income generated by the lending platform. These rewards are distributed proportionally to the amount staked, aligning user incentives with the long-term development of the ecosystem;

-

Fee Discounts: When users stake the native token, they gain tiered fee discounts on transactions. The more tokens staked, the greater the discount, encouraging increased staking and active participation;

-

Governance: Token holders can participate in the governance of NAVI Protocol by voting on proposals and upgrades. The governance process is decentralized, ensuring the platform’s direction is driven by its users.

For native token emissions, NAVI takes inspiration from Curve’s ve model, introducing veNAVI to incentivize liquidity provision and align user interests.

When users stake their native tokens, they receive veNAVI tokens, which grant them voting power to influence the allocation of emissions across different liquidity pools. The number of veNAVI tokens received is proportional to both the quantity of NAVI staked and the duration of the lock-up period.

When users vote with their veNAVI tokens on a specific pool, they directly influence the incentive distribution for that LP pool. The more veNAVI tokens allocated to a pool, the higher the emission share for that particular asset.

This system encourages users to provide liquidity for popular or high-demand assets and ensures fair reward distribution, while also promoting broader ecosystem participation to sustain the utility of the native token.

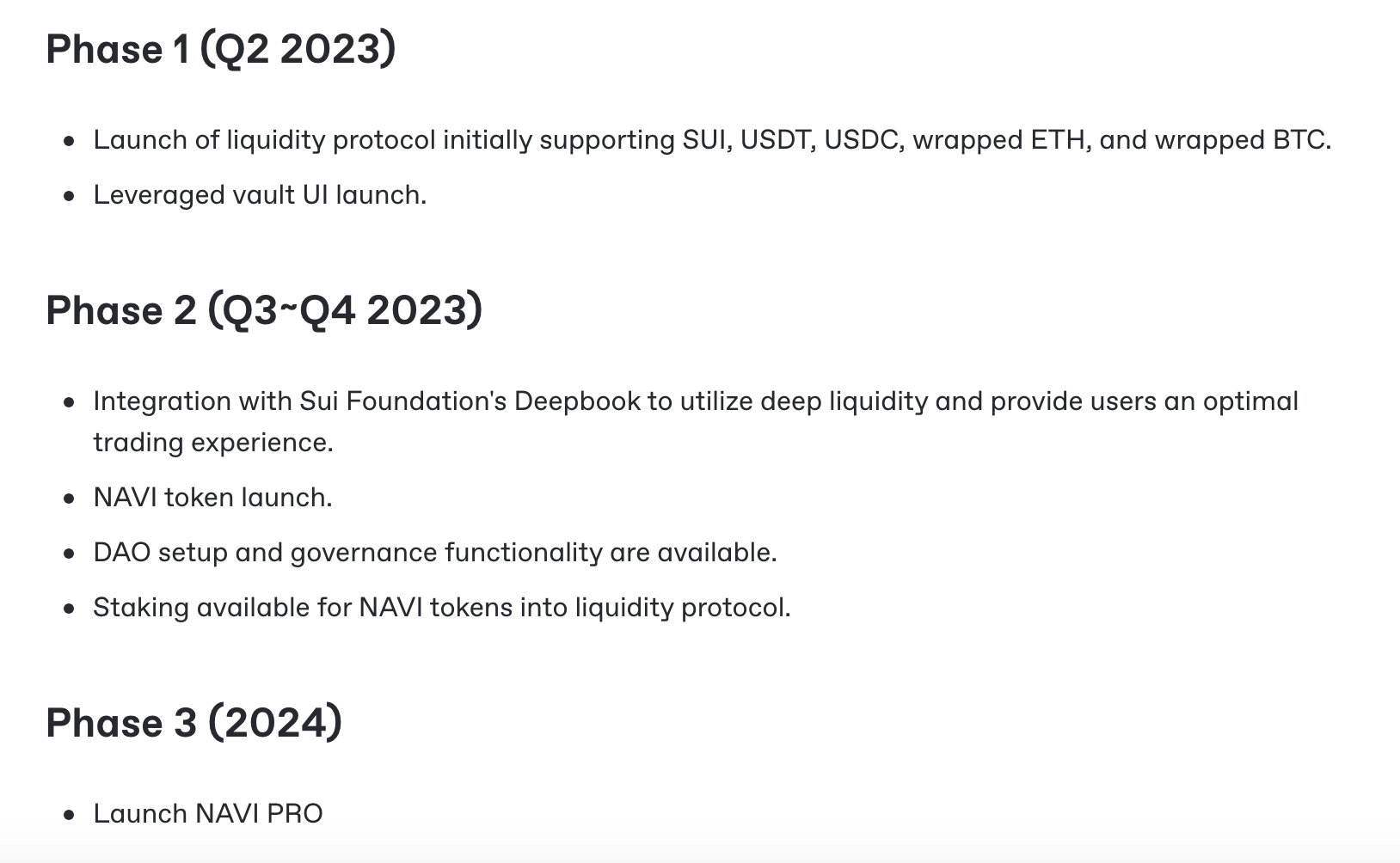

Roadmap

NAVI has completed all objectives of Phase One of its roadmap:

-

Launch the liquidity protocol supporting SUI, USDT, USDC, WETH, and WBTC.

-

Launch the Leverage Vault UI.

Currently, NAVI is advancing into Phase Two:

-

Integration with Sui Foundation's Deepbook to leverage deep liquidity and deliver optimal trading experiences.

-

The NAVI native token is expected to be publicly launched in early Q1 next year.

-

Enable DAO and governance functions.

-

Allow staking of NAVI tokens within the liquidity protocol.

This phase is expected to be completed between Q3 and Q4 of 2023.

Overall, as the first native all-in-one liquidity protocol on Sui, NAVI has attracted significant attention. With its collaboration with OKX, NAVI has entered a period of rapid growth. The key challenge now—for NAVI and the broader Sui ecosystem—is how to retain these newly acquired funds.

Will NAVI spark a DeFi explosion on Sui? Only time will tell.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News