Solana Reborn from the Ashes: Building Paradise in Hell

TechFlow Selected TechFlow Selected

Solana Reborn from the Ashes: Building Paradise in Hell

Today's opportunity for Solana is undoubtedly the best.

Authors: Ryan Watkins, Wilson Withiam, Daniel Cheung

Translation: Block unicorn

Key Takeaways

Solana is a blockchain reimagined from first principles, with the potential to become a foundational technology on par with Bitcoin and Ethereum. Inspired by cellular networks, its technical architecture includes several novel components that work together to maximize hardware potential, unlocking unprecedented performance levels—giving Solana the highest probability of enabling the next wave of breakthrough applications. As such, as on-chain economic activity accelerates, we believe SOL has the greatest likelihood of accumulating monetary premium alongside BTC and ETH.

Although the smart contract platform space exhibits extreme power-law dynamics, it’s highly unlikely that a single ecosystem can support every application. Trade-offs exist—while many blockchains converge toward similar technological endgames, path dependency plays a crucial role in determining product-market fit across different use cases. Solana has a significant opportunity to gradually erode Ethereum’s dominance by offering differentiated, integrated solutions and cultivating a large enough developer ecosystem.

Solana’s current trajectory echoes Ethereum’s rebirth following the 2018 ICO boom collapse. Although the Solana ecosystem bottomed out and is now on a recovery path post-FTX collapse, SOL remains overly punished. As continued tech upgrades propel Solana forward and momentum builds among enterprises and crypto-native developers, the pricing error for SOL continues to widen—currently valued at roughly 13% of Ethereum’s market cap.

This is a rare opportunity—one where we rarely witness a project capable of scaling on par with Bitcoin and Ethereum while opening entirely new possibilities. We know this because Syncracy was specifically created to back such era-defining winners, and we deeply understand how rare it is for a project to meet this standard. After years of research and monitoring, plus months of patiently waiting for an attractive entry point, we believe we’ve found one of these rare opportunities in Solana—the first blockchain we’ve identified with foundational platform potential comparable to Bitcoin and Ethereum. Therefore, in Q2 2023, Syncracy established a large position in SOL.

Post-FTX collapse, Solana faced an existential crisis, purging the ecosystem of all but the most loyal participants. Sentiment hit rock bottom, leaving behind what would become a generational opportunity over subsequent quarters. While stabilization took time, the ecosystem has since found a new foundation and activity is rebounding. The shadow of FTX is fading, and today the Solana ecosystem is stronger than ever, with accelerating momentum among developers and enterprises. Increasingly, Solana’s industry-leading scalability and unit economics are becoming impossible to ignore.

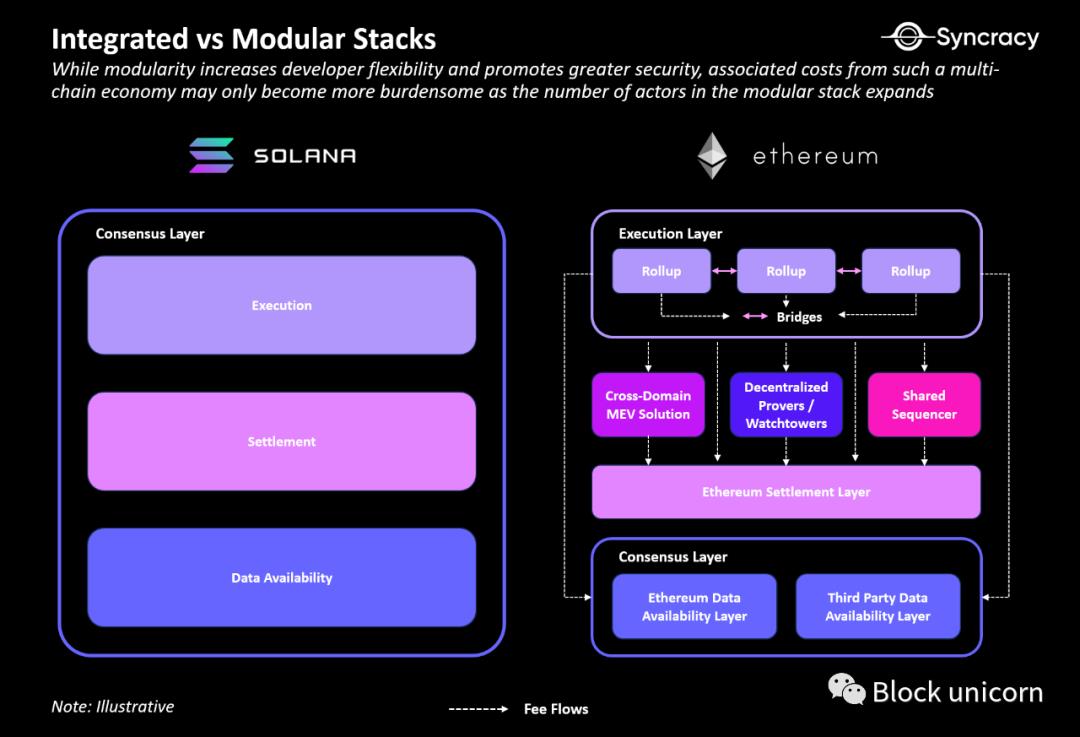

In reality, Solana’s opportunity today is undoubtedly the best it’s ever been. While many smart contract platforms are moving toward similar technological endgames, it’s becoming increasingly clear that the paths taken involve meaningful functional trade-offs. These trade-offs are so profound that it’s evident a single tech stack cannot efficiently support every application. This is where Solana comes in. As “integrated” and “modular” emerge as two ends of the blockchain design spectrum, Solana is poised to become the industry’s leading standard—an integrated system of choice in the cryptoeconomy, complementing Ethereum as it progresses further down the modular path.

Ahead lies boundless possibility. Below, we share our thesis.

Solana Vision

The Genesis of Solana

Solana’s story began in 2017 when co-founder Anatoly Yakovenko set out to build a blockchain designed to match the performance of a single machine and overcome the scalability constraints of existing solutions. His key insight was that if software didn’t hinder hardware, it might be possible to create a blockchain whose overall performance scales linearly with hardware improvements. He believed the core to achieving this vision lay in designing an efficient way for nodes to communicate, eliminating bandwidth as a bottleneck.

In October 2017, Anatoly had a eureka moment when he realized blockchain networks shared many similarities with cellular networks he was familiar with from his time at Qualcomm. He recalled how telecom companies overcame bandwidth limitations of radio towers by introducing "multiple access technologies," allowing multiple phone calls on the same frequency. The key was the concept of a globally available clock, enabling towers to divide each radio frequency into time slots and assign them to individual calls, thus supporting multiple simultaneous data channels efficiently.

Shortly after, in November 2017, Anatoly published a whitepaper introducing "Proof of History" (PoH)—a mechanism for keeping time across untrusted computers. Though seemingly simple on the surface, having a global clock prior to consensus has profound implications. Unlike other blockchains where validators must coordinate to agree on elapsed time, each Solana validator maintains its own clock. This independently verifiable global clock simplifies network synchronization and enables Solana to process transactions almost instantly upon arrival. With PoH, Anatoly laid the foundation for a novel blockchain that could propagate data more efficiently between nodes, bringing him closer to his vision—a blockchain whose software scales at the speed of hardware.

Block unicorn note: Multiple access technology refers to multiple devices sharing the same frequency by allocating different time slots to different users, preventing interference during communication.

Proof of History (PoH): A proof mechanism demonstrating the order and timing of events or data.

In Solana’s context, the innovation of Proof of History lies not just in recording timestamps, but in providing an efficient way for nodes to reach consensus without frequent communication. It's as if each node has its own clock, operating within distinct time slots to avoid conflicts and chaos, thereby enhancing the entire blockchain system’s performance.

Solana Architecture Overview

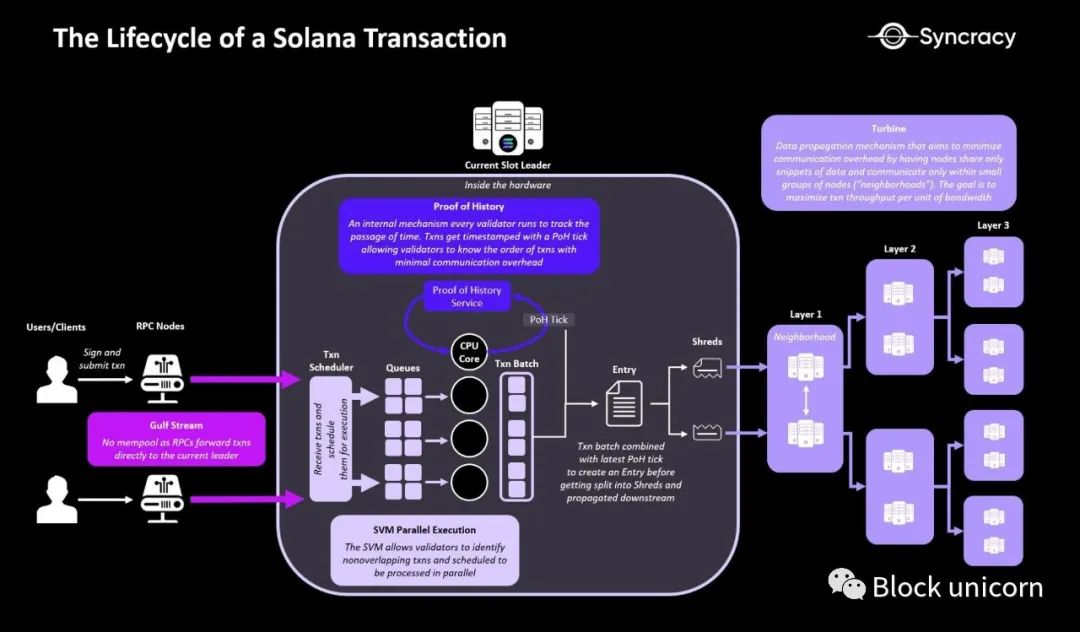

As discussed above, Proof of History (PoH) is a critical feature of Solana’s architecture. Technically, PoH works by running a recursive SHA-256 algorithm, where each output hash marks the passage of time, as generating it requires validators to spend a certain amount of time computing. Validators continuously run Solana’s PoH algorithm on one of their CPU cores, enabling each validator to independently track time and execute transactions almost immediately upon receipt.

This intra-block timestamping process plays a key role in Solana’s ability to scale throughput.

PoH allows block producers to execute and propagate transactions as if they were being streamed. Unlike other blockchains, block producers don’t need to wait to create and forward complete blocks, as PoH timestamps provide canonical ordering. With pre-propagated defined order, downstream nodes can receive transactions in correct sequence even if received out of order; execution and approval can begin before full block data arrives. For users, this means soft confirmations for transactions arrive faster—around 400 milliseconds—compared to blockchains that couple time and state simultaneously.

A transaction’s lifecycle begins with Gulfstream—a transaction forwarding protocol that enables RPC nodes to directly forward incoming transactions to block producers, eliminating the need for a mempool. Once a block producer receives a transaction, it schedules execution using a multithreaded scheduling algorithm. At this point, Solana’s Sealevel runtime (the Solana Virtual Machine) comes into play. In Solana, programs are stateless, and state is stored separately in accounts. This separation enables embarrassingly parallel execution, as transactions touching different contracts don’t need sequential processing—only those writing to the same account require ordering. The multithreaded scheduler allows block producers to detect which transactions write to the same account. Those writing to different accounts are processed in parallel, while those writing to the same account are executed sequentially. After execution, block producers timestamp all concurrently processed transactions using a PoH tick (called an "entry," Solana’s unit of time), then split these entries into "shreds" for transmission to downstream consensus validators.

Block unicorn note: RPC is a remote procedure call technology. For example, if you forget to do laundry before going to work, you can call your mom to start the washing machine, or ask her to cook for you. By delegating tasks remotely, you don't have to handle them yourself.

After executing transactions, block producers use a mechanism called "Turbine"—a BitTorrent-inspired data propagation protocol designed to maximize throughput per unit bandwidth. At a high level, Turbine organizes downstream validators into subgroups called "neighborhoods." The topology resembles a tree. Upstream neighborhoods provide data to downstream ones, and adjacent neighborhoods share data. Solana assigns validators to these neighborhoods based on their stake weight—validators with higher weight occupy upper neighborhoods (closer to the leader), while those with lower weight occupy lower neighborhoods. The result is significantly reduced validator overhead—minimized direct peer-to-peer connections and fewer redundant packet transmissions—leading to more efficient bandwidth utilization and higher transaction throughput.

After executing transactions, block producers use a mechanism called "Turbine"—a BitTorrent-inspired data propagation protocol designed to maximize throughput per unit bandwidth. At a high level, Turbine organizes downstream validators into subgroups called "neighborhoods." The topology resembles a tree. Upstream neighborhoods provide data to downstream ones, and adjacent neighborhoods share data. Solana assigns validators to these neighborhoods based on their stake weight—validators with higher weight occupy upper neighborhoods (closer to the leader), while those with lower weight occupy lower neighborhoods. The result is significantly reduced validator overhead—minimized direct peer-to-peer connections and fewer redundant packet transmissions—leading to more efficient bandwidth utilization and higher transaction throughput.

Block unicorn note: Think of "neighborhood" as a community. Neighborhoods can be organized based on validator weight, similar to how members in a community may be grouped according to certain criteria. In Solana, this organizational structure helps improve network efficiency and optimize data dissemination.

Collectively, these novel technical components pioneered by Solana work in concert to achieve Anatoly’s vision of a blockchain whose software scales at the speed of hardware. By more fully utilizing available hardware, Solana achieves significantly higher scalability compared to previous blockchain designs, without increasing hardware requirements. The result is a truly innovative system that expands the design space of the cryptoeconomy.

Solana Thesis

1)

Solana’s superior scalability and unit economics position it to win long-term share of on-chain economic activity in the coming years, as competitors remain constrained by performance limits while Solana consolidates its lead through a series of upcoming upgrades.

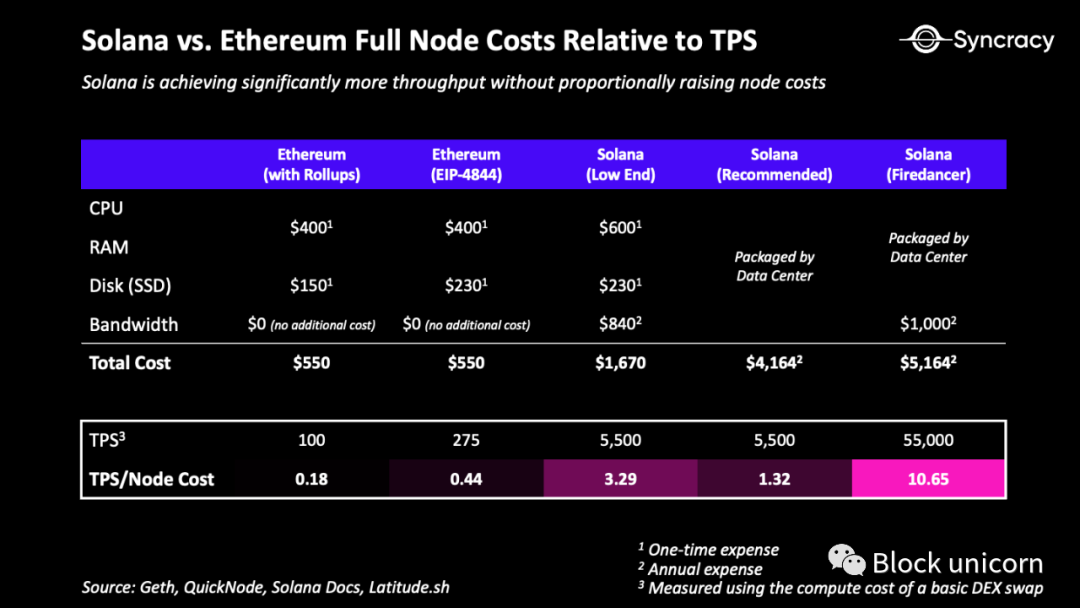

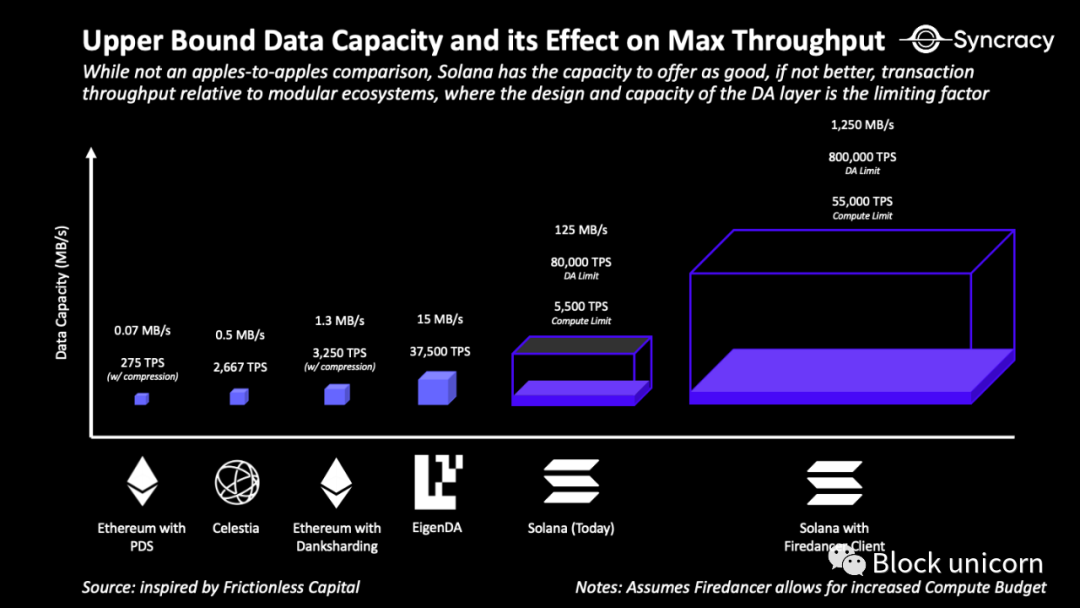

As discussed in the architecture overview, Solana features several novel technical components that work together to maximize the potential of available hardware in nodes, achieving extremely high performance levels. Thanks to recent upgrades like state compression—a mechanism that drastically reduces application storage costs—Solana now also boasts the best unit economics for on-chain transactions across the industry, with data results that are striking. Today, Solana offers a peak transaction throughput of 5,500 TPS and will soon reach 55,000 TPS with the upcoming Firedancer client. Meanwhile, state compression has reduced NFT minting costs on Solana by 1,000x, and many teams are exploring applying these advantages to other use cases. As Solana leverages further hardware advancements, these performance metrics will compound over time—a unique trait enabling Solana’s performance to double every two years even without additional upgrades. Crucially, Solana achieves this performance not by simply raising hardware requirements, but through genuine software innovation. The result is that Solana achieves 1–2 orders of magnitude higher throughput per dollar spent on hardware (10–100x improvement).

All this occurs against the backdrop of competitors facing performance constraints in the foreseeable future. While Ethereum’s rollup ecosystem has begun to demonstrate strength, often processing more transactions than Ethereum itself, its near-term reality remains unsatisfactory. The challenge is that rollups remain limited by Ethereum’s mainnet, and upgrades won’t provide substantial relief in the short term. The much-anticipated EIP-4844 upgrade (expected in Q1 2024) will offer only about 0.375 MB of data availability capacity per block—equivalent to roughly 275 transactions per second (using basic DEX swaps) for the entire Ethereum rollup ecosystem. Danksharding, likely not arriving on mainnet until 2025 or later, will offer about 1.3 MB per block—around 3,250 TPS for the entire rollup ecosystem. These figures fall far short of Solana’s current levels and may fail to meet mainstream activity demands.

While some rollup options can bypass Ethereum’s limits, they all involve significant trade-offs around security. The most popular method for achieving higher throughput involves third-party data availability providers like Celestia and EigenDA, offering 1–2 orders of magnitude more DA capacity than current solutions. However, integrating these into specific rollup setups introduces new counterparty risks for applications and users. Instead of relying solely on Ethereum’s security, rollups outsource much of their security to newly launched, unproven networks.

While theoretically final forms of rollups offer strong security guarantees, most today remain at what Vitalik calls “Stage 0”—full-stack reliance. Currently, leading rollups on Ethereum are effectively operated by their operators. Optimistic rollups lack permissionless fraud proofs, and even when present, they may not function properly. ZK rollups typically rely on off-chain data availability committees to scale beyond base throughput. Nearly all rollups have upgradable contracts, usually via multisig setups without time delays. Many have a single sequencer and lack escape hatches for users to withdraw assets when operators act maliciously. All these issues may eventually be resolved in coming years—we certainly believe they will—but at some point, one must question: Compared to Solana, is this tech stack as secure and decentralized as rollup advocates claim, or is this a classic case of double standards?

In summary, given its current performance level, the Solana ecosystem is fertile ground for innovation. Over time, we observe a strong correlation between flexibility in blockchain design space and the potential for breakthrough applications—given Solana’s advantages in cost, speed, and composability, this is clearly its hallmark. With Solana, it’s now possible to develop various high-throughput, consumer-facing applications that would be impossible to run in resource-constrained environments like Ethereum. This is a net gain for the cryptoeconomy, increasing the entire industry’s chances of mainstream adoption.

Ultimately, Ethereum is not a panacea. Recognizing this reality allows the cryptoeconomy to evolve better. A world with multiple blockchain infrastructures is more resilient than one with a single point of failure.

2)

Although many smart contract platforms are converging toward similar technological endgames, path dependency plays a key role in determining product-market fit across use cases—Solana’s integrated design offers a structurally simpler, more cost-efficient development environment compared to modular stacks, making it more likely to capture the growing developer base of the cryptoeconomy in the coming years.

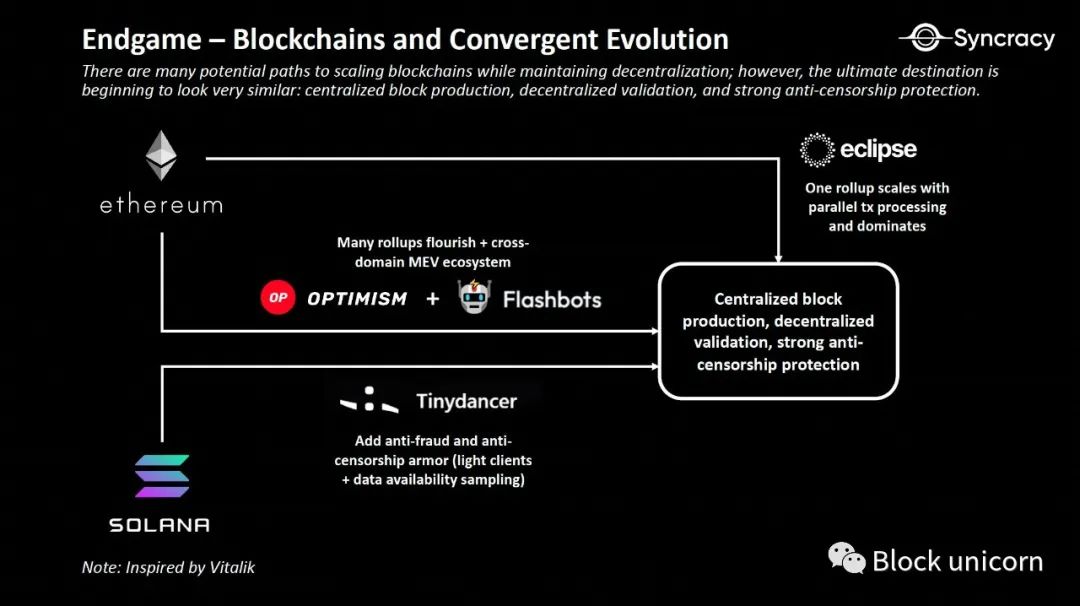

In Vitalik’s visionary “endgame” essay, he discusses potential pathways to scale blockchains while maintaining decentralization. He suggests that although many such paths exist, the end goal starts to look very similar: centralized block production, decentralized validation, and strong anti-censorship protections. Whether a blockchain starts integrated or modular doesn’t matter. The key issue is that scaling a blockchain with low validator hardware requirements is impossible, so ensuring cheap verifiability is essential. That way, even with high validator requirements, users can still verify and maintain chain security.

Two years later, Vitalik’s prediction seems increasingly likely to come true, with many projects emerging in both Ethereum and Solana ecosystems to realize this future. Yet, despite many leading blockchains moving toward similar end states, meaningful trade-offs exist based on their initial path choices.

Ethereum

Ethereum’s origin traces back to Blizzard Entertainment nerfing Vitalik’s character in World of Warcraft (WoW). This experience was pivotal for Vitalik, as it gave him firsthand exposure to the “terrors of centralized services.” This profoundly influenced Ethereum’s design—Ethereum was conceived as a minimally trusted world computer. Settlement assurance became a critical design goal, evolving from Bitcoin’s argument for minimally trusted money. Trusted neutrality—that Ethereum wouldn’t discriminate for or against any party—became a guiding principle.

Because settlement assurance is paramount for Ethereum, the developer community adopted an ideological decentralization philosophy. The rationale is that while ideological decentralization leads to slower evolution, it creates greater stability and predictability. Similarly, the Ethereum community embraced a hardware philosophy centered on end-user validation. The logic is that if more users can run full nodes and monitor the system, Ethereum becomes more decentralized, thus offering stronger settlement assurance.

The combination of ideological decentralization and hardware philosophy led the ecosystem to modularize, addressing the scalability trilemma. Today, execution is gradually pushed to higher-hardware-rollups that leverage Ethereum for settlement and data availability. The idea is that Ethereum can maintain low hardware requirements and focus on security, while rollups outsource security to Ethereum and optimize for higher performance. This division of roles creates a win-win—allowing Ethereum’s underlying infrastructure to stabilize as innovation in minimally trusted computation matures.

Ethereum’s commitment to trusted neutrality from day one was crucial for launching vital monetary and financial applications—among the most challenging yet critical traits for any smart contract platform. Monetary premium (an asset’s utility as a unit of account, medium of exchange, and store of value) not only gives native blockchain assets the highest valuation multiples but may be the only way for a blockchain to ensure its long-term sovereignty and security. Blockchains like Ethereum have circular security arrangements where validators are paid in the blockchain’s issued asset. Since sovereign blockchains, by definition, cannot rely on external currencies (like USD) to pay validators, intrinsic value in the base asset is essential. Ensuring this base asset is valuable enough to protect the blockchain from any plausible global adversary likely means making it one of the world’s most valuable assets—money.

However, Ethereum’s approach isn’t without trade-offs. While Ethereum kickstarted vital monetary and financial apps by emphasizing security, it did so at the expense of higher-throughput, cost-sensitive applications. Moreover, while modularity increases developer flexibility, enhances security, and creates new monetization avenues for apps, the associated costs from such a multi-chain economy deserve scrutiny. Again, while Ethereum will likely solve these performance issues eventually, it will take years—leaving ample room for alternative systems on different paths to capture market share.

Solana

Solana’s origin story begins with Anatoly’s day trading, where he realized his trades were being front-run by high-frequency trading firms. This experience was pivotal—it made him realize blockchains could ensure fairer information flow between users and exchanges. So crucial was this realization that fair and affordable global state access became a key design goal for Solana. Thus, Solana was envisioned as a globally programmable order book, synchronized at light speed. Performance would be paramount—Solana would position itself first as a tech platform, differing from the monetary arguments that guided earlier blockchain designs. Software shouldn’t hinder hardware—Solana would fully utilize all available computing and bandwidth in modern multicore machines to maximize system performance. This became the guiding principle.

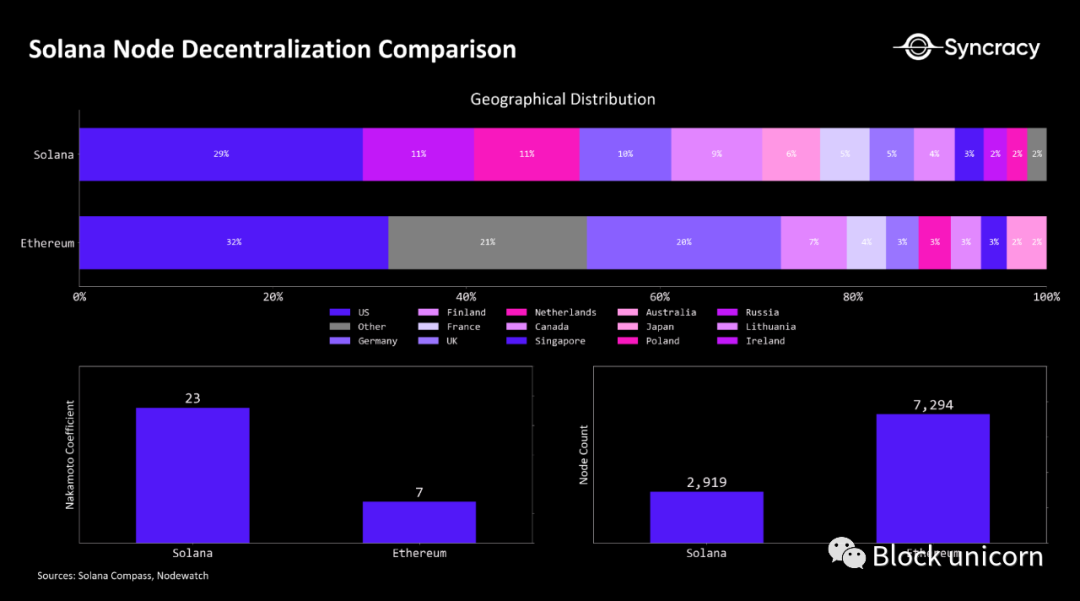

Because performance is paramount for Solana, the developer community adopted a pragmatic philosophy. An engineering-driven culture took root. While more aggressive than Ethereum, the idea is that while this “move fast, break things” mindset may lead to greater instability, it accelerates product evolution. Similarly, the Solana community adopted a hardware philosophy centered on practical decentralization—the core idea being that not all nodes are equal, and node count is a lagging indicator of product-market fit.

There are two rationales. First, increasing the number of sophisticated node operators actively monitoring the network enhances security more than simply counting passive users. Second, growth in node count over time depends more on demand to run nodes than on how low the cost is to run them—the more activity hosted on Solana, the more individuals, companies, and organizations are incentivized to run nodes as part of their operations. Today, this philosophy appears to have positively impacted Solana.

In the limit, Solana’s pragmatism rests on the argument that while Solana may not achieve nuclear-level decentralization, it may deliver 99% of what users ultimately need, all within a single-stack architecture. This “integrated” approach was crucial in positioning Solana as the preferred platform for mainstream, speed- and cost-focused applications, even if it initially sacrificed vital monetary and financial apps. Yet Anatoly believes this may not be an issue—settlement is just a feature, a byproduct of maintaining state sync. If Vitalik’s endgame is correct, Solana will achieve sufficient anti-censorship properties in the long run, and at that point, the scale of economic activity will be the key differentiator in which smart contract platform’s base asset accumulates the greatest monetary premium.

In this regard, Solana has levers to pull. Beyond serving as a medium of exchange (gas payment) and unit of account (NFT pricing), SOL is the primary store of value within the Solana economy. As a proof-of-stake asset, SOL directly captures fee revenue and MEV generated from on-chain activity. While Solana aims to keep user fees per transaction low, it can compensate by increasing transaction volume and expanding dimensions of its fee market (more revenue streams). Additionally, SOL serves not only as the toll rate of the Solana economy but also as the lowest-risk asset on Solana, making it the purest form of collateral within its financial system.

Moreover, while Ethereum is often praised for its sound monetary policy, Solana may not be far behind in credibility. While Solana must grow transaction activity by several orders of magnitude to make SOL deflationary like ETH, Solana’s supply schedule may be more predictable—Solana has never changed its issuance schedule, whereas Ethereum has altered it three times. Regardless, it’s important to remember these attributes are largely outcomes and lagging indicators of product-market fit—couldn’t a competitor reach similar adoption levels?

In aggregate, Solana’s integrated design may be key to accelerating its economic growth. Compared to modular stacks, integrated systems offer a structurally simpler, more cost-effective development environment. First, integrated systems abstract away the low-level infrastructure complexity and economic intricacies required for minimally trusted computation, allowing developers to focus on their core product. In contrast, modular stacks exponentially increase developer complexity by forcing them to consider a broader range of critical technical components and spend resources on unrewarded work like cross-chain deployment. Furthermore, modularity imposes immeasurable UX costs due to inter-layer incompatibilities and immature abstraction mechanisms. Practically, this means Solana app developers can spend more time and resources refining their applications and user adoption paths, relative to modular peers who must spend comparatively more time on infrastructure.

Most importantly, hosting all logic and data in a single layer also minimizes the time and cost involved in cross-contract (or composable) exchanges, which form the basis of financial transactions in the cryptoeconomy. Economies built across multiple chains inevitably incur hidden costs like latency, slippage, cognitive load, and extra fees. Over time, as participant numbers grow in modular stacks, these costs may become more apparent. Today, modular stacks already involve rollup chains, settlement layers, third-party bridges, external data availability providers, cross-domain MEV solutions, decentralized sequencer generators, and watchtowers/prover networks—each demanding a cut. At some point, one must ask: Is a multi-rollup economy worth it, especially when the most common reason for launching a dedicated app-specific rollup is “dedicated blockspace,” which Solana’s parallel execution environment and native fee market explicitly solves—without added costs?

Ultimately, when faced with building choices, where will developers choose to build? Remember, there’s no absolute best solution—only trade-offs.

3)

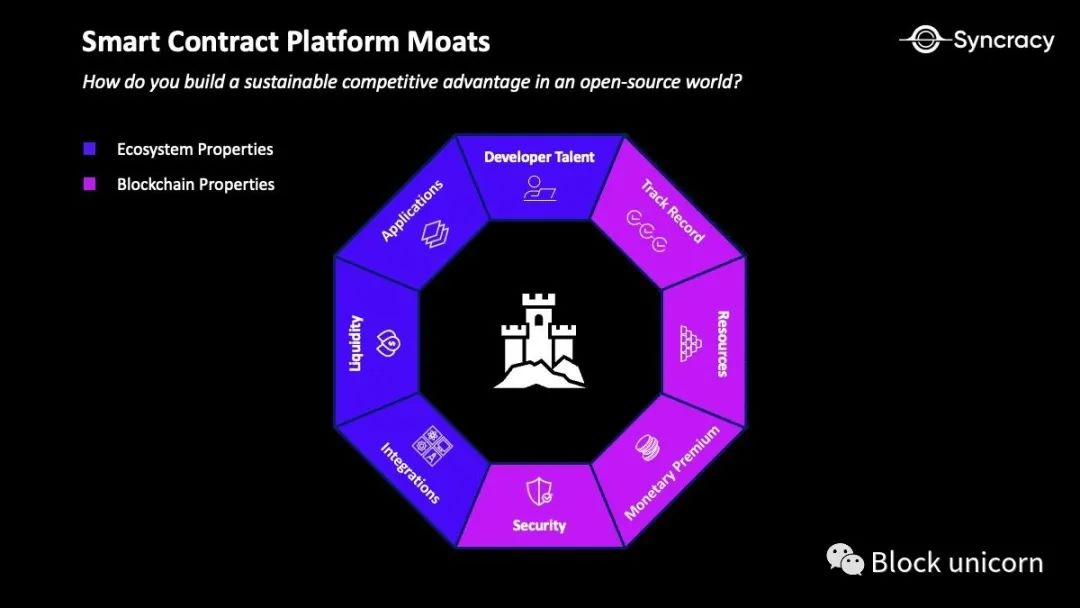

Smart contract markets represent the largest total addressable market (TAM) in the cryptoeconomy. They follow a power-law distribution—where a few entities capture most of the value, while the majority cluster around small shares—consolidating top leaders through combined ecosystem and blockchain attributes, enabling them to continue capturing most attention and economic activity. By offering highly differentiated, integrated solutions and fostering a sufficiently large developer ecosystem, Solana has a massive opportunity to become one of these entrenched players.

Smart contract platforms are vital to the cryptoeconomy. At their core, they are markets for blockspace on blockchains—space usable for storing information and running code. Users pay fees to access this blockspace, where all economic activity on the chain settles. This blockspace will one day underpin global money, finance, and commerce. Indeed, as smart contract platforms continue growing their “GDP,” their economies may eventually surpass dominant sovereign nations. In this context, given that the base assets of these platforms are the most deeply integrated and widely held assets within their economies, they are likely to become world reserve currencies in the long run.

While the smart contract platform market is highly concentrated around Ethereum today, due to Ethereum’s constraints limiting the number of use cases it can support, this market structure may continue evolving toward greater oligopoly. To be clear, we’re not suggesting Ethereum won’t remain a dominant player—it will. But competitors have opportunities to erode Ethereum’s share and expand the market by offering highly differentiated solutions and nurturing a large enough developer ecosystem. While many still lack development tools and middleware to support application-layer innovation and experimentation, as incentives to build on these chains grow, so too will motivation to solve their remaining development challenges.

From a technical standpoint, the smart contract platform market is perfectly competitive—all code is open-source. Yet, despite competitors forking the code, they cannot replicate the emergent properties of a smart contract platform. Ecosystem attributes—including developer talent, applications, integrations (bridges, exchanges, wallets), and on-chain liquidity—and blockchain attributes—including monetary premium, security, resources, and track record—make smart contract platforms nearly unforkable. Once a protocol becomes a standard, powerful network effects emerge—a thriving ecosystem rapidly accumulates, allowing winners to stay winning. Code can be copied, but communities cannot.

These attributes deserve deeper examination. Ecosystem attributes like developer talent, applications, integrations (bridges, exchanges, wallets), and on-chain liquidity are key factors underpinning a smart contract platform’s economic potential. Each platform faces a daunting cold-start problem—not just launching these attributes, but doing so sustainably. Once a chain reaches critical mass in developer adoption and on-chain activity, it can trigger a powerful flywheel effect, setting conditions for years of economic growth. A deep pool of developer talent leads to more useful applications, driving greater economic activity, which increases network revenue, attracts more investor interest, and provides more capital for developers to build within the ecosystem.

Blockchain attributes—such as security, track record, resources, and monetary premium—may be even more powerful. For instance, despite its scalability constraints, Ethereum remains the dominant smart contract platform primarily because it was first to market—enabling it to develop superior security, a proven track record of overcoming adversity, and monetary premium for its base asset ETH, as previously noted, one of the hardest attributes for a blockchain to achieve. Collectively, these blockchain attributes reinforce the ecosystem flywheel—most developers will always choose the platform offering the greatest financial opportunity and strongest sustainability assurances, leaving the most economically significant blockchain as the logical choice.

Given the trade-offs between integration and modularity discussed earlier, an integrated blockchain is highly likely to meaningfully erode Ethereum’s market share. As the undisputed leader in the integrated blockchain space, Solana is well-positioned to become a major player in the smart contract platform landscape. This market structure isn’t historically uncommon—the latest example in computing being Android and iOS competing in mobile over the past decade. In truth, the question isn’t whether there will be more than one winner—it’s clear that a single tech stack cannot efficiently support every application. The real questions are whether current participants reflect this opportunity fairly in price, and whether new winners will emerge.

4)

Solana’s current trajectory mirrors Ethereum’s rise following the 2018 ICO boom collapse. Although the Solana ecosystem has bottomed out post-FTX and is on a recovery path, SOL remains overly punished. As tech upgrades continue advancing Solana and momentum grows among enterprises and crypto-native developers, SOL is undervalued in market cap—roughly 13% of Ethereum’s.

Though perhaps forgotten today, Ethereum’s dominance wasn’t inevitable. It first endured a speculative phase known as the “ICO craze” in 2017, where over 90% of projects failed to generate meaningful economic value, and many didn’t even deliver. This caused many to lose faith in Ethereum and the potential of smart contract applications.

In hindsight, this speculative frenzy was crucial to Ethereum’s success—it put the network in the spotlight, capturing attention from developers and investors. This was vital for attracting mission-driven contributors who continued innovating on Ethereum even as sentiment declined in 2018 and 2019. Their work eventually paid off. After years of building critical financial infrastructure, the 2020 innovation of “yield farming” reignited institutional and developer interest in Ethereum, revealing a rich, practically useful application economy. This DeFi revolution helped cement Ethereum’s status as the leading smart contract platform in the cryptoeconomy.

Today, Solana finds itself in a position similar to Ethereum post-ICO boom. The recent bull market saw Solana swept up in a massive speculative wave, pushing its fully diluted valuation to around $140 billion. This boom was largely driven by FTX’s involvement in guiding the application ecosystem and providing liquidity for Solana tokens. However, over 90% of applications built on Solana were near-copies of their Ethereum counterparts, with little organic usage,大量 hired capital, and terrible token supply schedules—leading to a collapse in activity, price, and committed developers, worsened by FTX’s implosion.

Over the past few quarters since FTX’s influence faded, the ecosystem has successfully moved on. Today, with renewed developer optimism and rising community leaders with stronger ethical values, and with all mercenaries purged, missionaries once again control Solana. With new use cases emerging, uptime issues potentially behind us, and unique DeFi primitives being built, Solana’s chances of success in the coming years are greatly increased.

Similar to how Ethereum took six years to reach escape velocity, we believe Solana is headed in the same direction—albeit faster. Despite being only 3.5 years old, its recent enterprise and ecosystem momentum positions it well to produce breakthrough use cases in the next cycle. On the enterprise side, Solana recently partnered with Visa and Shopify, signaling it still commands institutional attention despite last year’s events. Continued support and validation from Visa and Shopify could generate significant downstream network effects when other enterprises seek to collaborate with them in exploring crypto initiatives.

In the cryptoeconomy, Solana sentiment continues improving, with many significant product announcements in recent quarters. Eclipse recently announced its SVM Rollup mainnet—though not directly benefiting Solana itself, it lowers risk for developers launching apps on Solana and increases contributor count in the Solana ecosystem. Similarly, Maker’s founder Rune proposed forking Solana’s codebase to launch Maker’s upcoming chain. This proposal is not only a major validation of Solana’s tech stack but also another sign of an expanding Solana contributor ecosystem from one of Ethereum’s most respected builders.

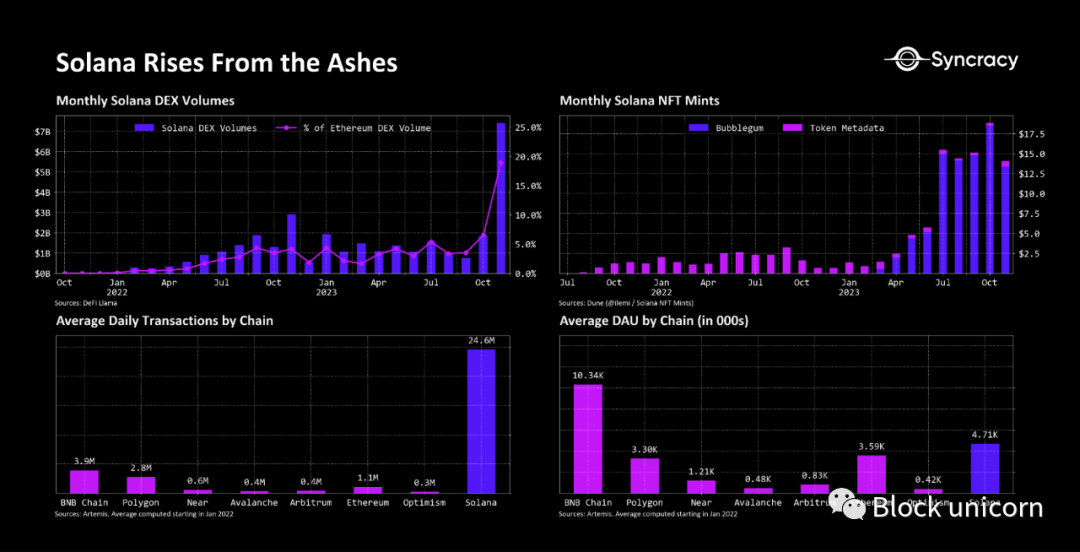

This evidence is also reflected in data—Solana’s newest generation of DeFi protocols, aptly called “DeFi 2.0,” are driving on-chain financial activity to heights not seen since the bull market. Solana’s decentralized exchange (DEX) volume is growing at the fastest monthly rate in history, surpassing 2021 bull market peaks. Total Value Locked—best proxy for user trust in storing wealth in the chain’s core financial infrastructure—has nearly quintupled since the beginning of the year, reaching $1.5 billion. Most importantly, Solana’s DeFi efficiency, measured as volume divided by TVL, is growing at ~4x the rate of Ethereum’s, approaching nearly an order of magnitude higher. As major projects launch their tokens, these numbers may grow further, adding more high-quality assets to the Solana ecosystem.

Solana’s non-financial sectors are also thriving. Although Solana’s NFT trading volume dropped 80% since January 2023, the introduction of compressed NFTs (cNFTs) has reignited growth in the sector, positioning Solana to become a sustained share gainer in the NFT market. On Solana, cNFT minting and distribution costs are about 1,000x cheaper than any Ethereum environment—meaning cNFTs can be distributed to 10 million users on Solana for hundreds of dollars, versus tens of thousands on Ethereum L2 and hundreds of millions on Ethereum L1. Since Metaplex launched its cNFT standard in April 2023, the number of NFTs issued on Solana has surpassed the sum of its first three years. The cost reduction offered by cNFTs is so dramatic that large brands can now reasonably experiment with on-chain assets at scale, greatly increasing Solana’s appeal to enterprises and raising its probability of becoming home to the industry’s next breakthrough application.

Beyond Solana’s NFT revival, its low latency and low fees have also made it a popular choice for decentralized physical infrastructure networks (DePIN). Notably, decentralized wireless network Helium migrated to Solana in April 2023, citing Solana’s ability to enable larger scale. Render has since completed a similar migration, stating that Solana’s unmatched performance and state compression capabilities will improve node operator margins and expand its market potential.

At some point, investors must ask themselves: Is Solana’s probability of success really as low as the market implies? Solana’s current valuation—about 13% of Ethereum’s—suggests the market assigns Solana only about a 13% chance of becoming a top-tier smart contract platform. Despite accelerating ecosystem growth post-FTX lows, gaining momentum among enterprises and crypto-native developers, and preparing for the Firedancer upgrade—which amounts to “Solana 2.0” in all but name—we believe Solana’s risk-reward profile is exceptionally favorable. As the market recognizes Solana as a foundational platform alongside Bitcoin and Ethereum, we believe its market cap could reach at least 25% of Ethereum’s—comparable to its peak market cap ratio relative to Ethereum in the previous cycle. And if the market begins to favor Solana’s long-term potential to surpass Ethereum, this ratio could go even higher.

Rising from the Ashes, Building Heaven in Hell

“If heaven rises in hell now, it is because in the suspension of order and the failure of most systems, we have the freedom to live and act differently.” — From “Building Heaven in Hell”

In the cryptoeconomy, the greatest projects triumph repeatedly over the greatest adversities. Bitcoin survived the infamous Mt. Gox hack, despite Mt. Gox handling 70% of Bitcoin transactions at the time and losing 6% of all Bitcoins in circulation. Ethereum survived the infamous DAO hack, despite the DAO raising $150 million and ironically losing 6% of all Ether at the time. In both cases, recovery proved their resilience—the lasting impact being hardened resolve and crystallized core propositions. Decentralized money and autonomous programs will endure.

Today, Solana is writing its own history. Despite FTX being one of Solana’s largest ecosystem contributors—holding about 8% of Solana’s supply through its now-bankrupt, fraudulent Alameda entity—the Solana ecosystem is rising from its worst nightmare. Just as Bitcoin and Ethereum reached new heights after strengthening their resilience and identity, we believe Solana is poised to become the next successful ecosystem. After all, in the cryptoeconomy, legends are born in hardship. In a permissionless world, only those projects that survive disaster can reach the promised land.

As stated earlier, we rarely encounter a project capable of unlocking new possibilities at a scale comparable to Bitcoin and Ethereum. Finding such a project at a special moment like Solana’s is even rarer. And for a project of Solana’s caliber to remain so liquid is exceptionally uncommon.

We are incredibly excited about Solana’s resurgence from the ashes, steadily paving the way forward once again.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News