Key indicators in the crypto market: Coinbase stock hits new high, U.S. institutions drive up whale holdings

TechFlow Selected TechFlow Selected

Key indicators in the crypto market: Coinbase stock hits new high, U.S. institutions drive up whale holdings

Coinbase stock outperforms Bitcoin and NVIDIA in annual gains, potentially benefiting from rising trading volumes and the recovery of USDC market capitalization.

Author: Lucas Outumuro, Head of Research at IntoTheBlock

Translation: Felix, PANews

This article delves into key indicators covering current dynamics in the crypto market, including the strong performance and underlying reasons behind Coinbase stock (COIN), Bitcoin holders' profitability levels, and institutional accumulation continuing to push prices higher.

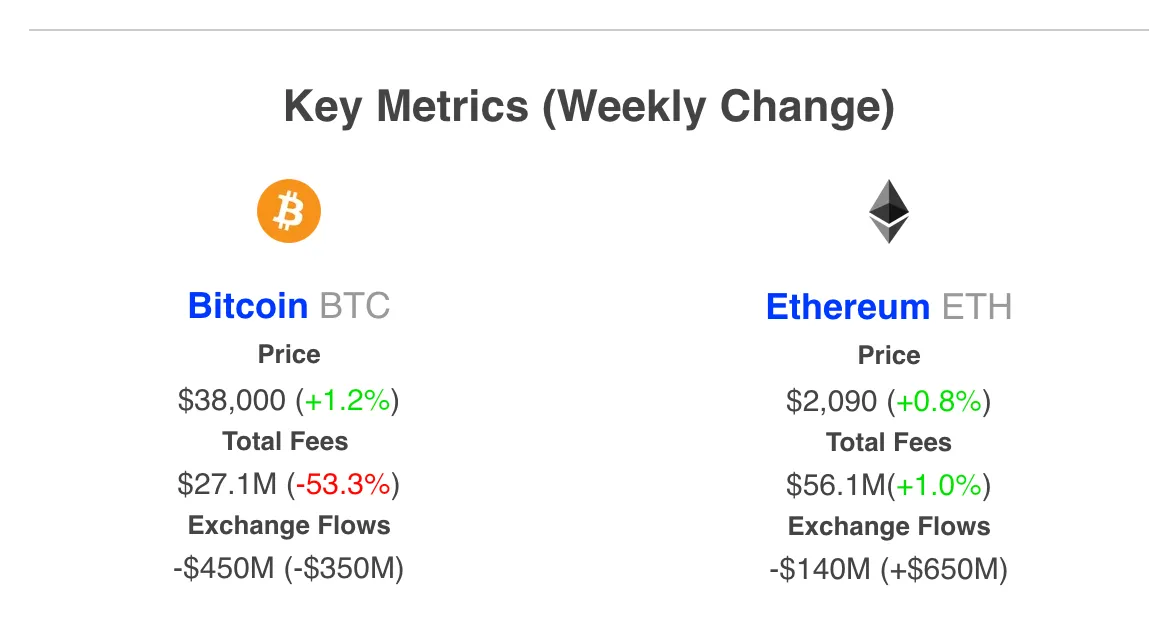

Network fees — the total cost of using a specific blockchain. Here we track willingness to pay and demand for using Bitcoin or Ether.

-

Bitcoin network fees have dropped by half as transaction volume related to Ordinals declines

-

Ethereum network fees have slightly increased, remaining at relatively high levels, leading to ETH being deflationary for the fourth consecutive week

Exchange net flows — inflows minus outflows of a specific cryptocurrency asset to/from centralized exchanges

-

Last week saw $450 million worth of Bitcoin withdrawn from CEXs

-

Last week saw $140 million worth of Ethereum withdrawn from CEXs

Hitting Yearly Highs: What’s Behind Coinbase’s Stock Surge?

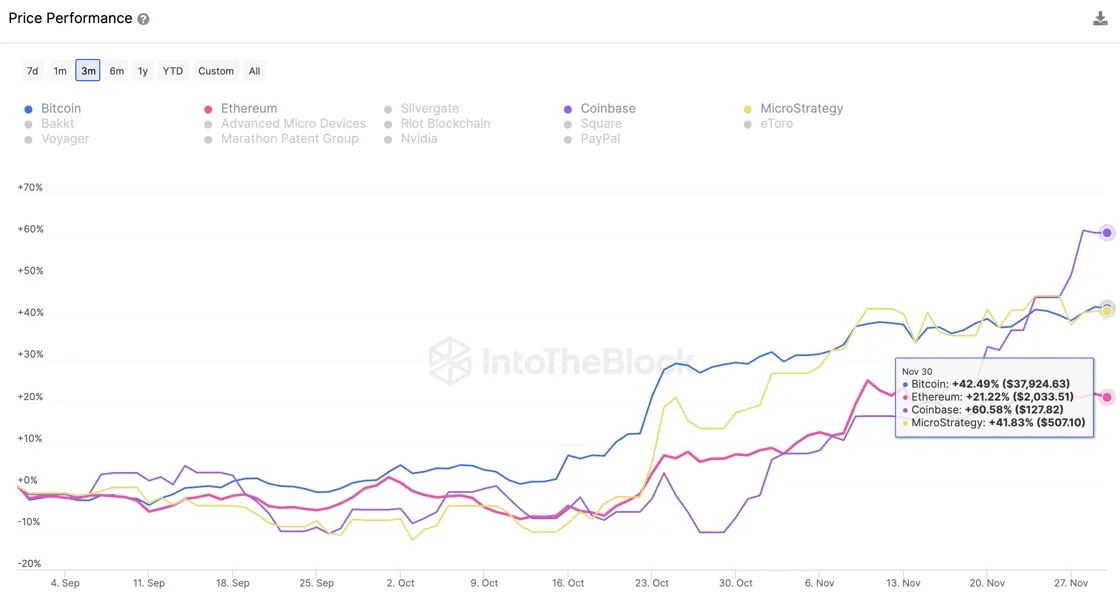

Momentum in the crypto market during Q4 appears set to continue into December. With declining yields and rising risk appetite, many crypto assets and stocks are on an upward trend. Trading volumes have also been rising steadily, which particularly benefits Coinbase's stock.

Source: IntoTheBlock

Coinbase stock performs strongly: COIN has risen 60% over the past three months

-

Year-to-date, COIN has risen approximately 250%, outperforming Bitcoin’s 130% gain and Ether’s 75% rise.

-

COIN has also outperformed Nvidia stock (NVDA), which gained 220% this year — impressive considering AI trends have driven the semiconductor giant’s growth. This makes COIN’s performance all the more remarkable.

A key factor behind Coinbase's rising valuation may be its trading volume, which has already surpassed last quarter’s figures with one month left before the end of Q4. In addition to trading volume, Coinbase may also benefit from a slight recovery in USDC market cap after prolonged decline, along with continued adoption of the Layer 2 network Base.

Over 80% of Bitcoin Addresses in Profit, Whale Holdings Hit New Yearly High

Source: IntoTheBlock

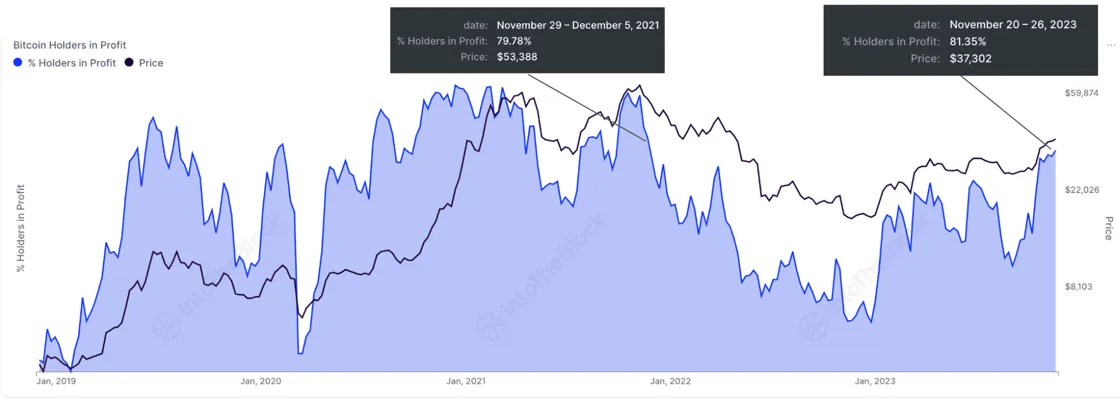

Bitcoin holders have reached their highest profit level since December 2021, with over 80% of Bitcoin addresses now in profit.

-

This figure has reached its highest point since December 2021, when Bitcoin price exceeded $50,000.

-

The reason Bitcoin holders’ profitability exceeds that of December 2021 is that, following the bear market, the average purchase price of Bitcoin held by investors has significantly decreased.

-

With over 80% of addresses in profit, Bitcoin’s overall profitability level resembles that seen at the end of 2020 and mid-2021.

Source: IntoTheBlock

Institutional accumulation — whale holdings reached a one-year high last week:

-

The amount of Bitcoin held by addresses owning 1,000 BTC or more has reached its highest level since December 2022.

-

After the collapses of FTX and Genesis, whale holdings declined sharply. A year later, Bitcoin whale holdings have recovered, with whales currently holding a total of 7.66 million Bitcoin (approximately $290 billion).

-

This institutional accumulation appears primarily driven by U.S. institutions. Tracking Bitcoin futures reveals a higher premium for CME contracts compared to international exchanges, especially in late October. Elevated futures premiums not only reflect bullish sentiment among U.S. institutions (which dominate CME trading volume) but also help drive demand for Bitcoin spot markets.

Overall, the crypto market continues to accelerate. Capital is flowing into crypto assets and stocks, and holders are enjoying substantial profits. As December begins, it remains to be seen whether crypto momentum can carry through to Christmas.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News