Interpreting CoinList's latest project BitsCrunch: Using AI for data analytics, aiming to be the police of the NFT world

TechFlow Selected TechFlow Selected

Interpreting CoinList's latest project BitsCrunch: Using AI for data analytics, aiming to be the police of the NFT world

As the NFT market recovers and potential trading activity increases, "the police of the NFT world" may have their moment to shine.

By TechFlow

On December 1, CoinList announced that it will launch the BitsCrunch (BCUT) token sale at 1:00 AM Beijing time on December 15. But what exactly is this project?

According to CoinList, BitsCrunch is a decentralized, AI-enhanced data network providing analytical and forensic data for NFTs, wallets, and other digital assets on public blockchains.

That description might leave you confused.

BitsCrunch is a startup based in Munich, Germany, founded in 2021 during the peak of the NFT boom. Founder Vijay Pravin Maharajan said that while everyone was hyped about NFTs, they discovered the dark side — rampant "wash trading" in the NFT market. Bad actors were exploiting their knowledge of blockchain technology to artificially inflate NFT or token trading volumes and prices, luring consumers into scams. In response, Vijay developed an idea: building a fair AI-powered price estimation tool for NFTs and using AI/ML to automatically analyze all NFT transactions and detect malicious behavior. Thus, BitsCrunch was born.

In short, BitsCrunch aims to become the ecosystem guardian (the police) of the NFT space.

In February 2022, BitsCrunch announced a $3.6 million private placement round led by Animoca Brands, with participation from Coinbase Ventures, Crypto.com Capital, Polygon Studios, Borderless Capital, Mapleblock, Morningstar Ventures, Bison Funds, Shima Capital, and GravityX.

Currently, BitsCrunch's flagship product is Unleash NFTs, an AI-powered NFT analytics platform offering comprehensive market overviews, rich infographics, in-depth market reports, key statistics, and insights into wash trading patterns to help users:

-

Make critical decisions such as buying, selling, or holding NFTs;

-

Understand NFT valuations and collection performance;

-

Distinguish between genuine trading volume and fake wash-traded volume;

-

Discover fair pricing and originality of NFTs.

Beyond its current offerings, several features are still under testing:

-

NFT Authenticity Checker: Verify the authenticity of NFTs to prevent counterfeits.

-

NFT Copyright Protection: Protect NFT copyrights.

-

NFT Collection Ratings: Provide essential ratings for NFT collections to support listing and purchasing decisions.

-

NFT Market Index: An accurate NFT market index reflecting real market conditions.

Such solutions would clearly be beneficial if successfully implemented. But what makes BitsCrunch stand out compared to existing NFT market analysis tools?

According to BitsCrunch, the core issue lies in the fragmentation of current NFT data providers. The highly scattered nature of these suppliers leads to several problems:

-

Lack of forensic tools: The current market lacks effective tools for NFT data forensics and analysis.

-

Missing advanced metrics: Existing solutions do not offer sufficient advanced indicators, which are crucial for deep market understanding.

-

Limited community contribution: Current solutions in the NFT space restrict opportunities for community members to contribute algorithms and features.

Therefore, solving these issues is vital for building a reliable, secure, and collaborative NFT ecosystem. To address this, BitsCrunch plans to tackle NFT sales data analysis challenges through its decentralized network.

As outlined in its whitepaper, this network will be community-driven, allowing developers to contribute algorithms and features, thereby enhancing its robustness and diversity. By delivering reliable statistics, accurate valuations, and fraud detection, the network empowers users to make informed decisions.

Notably, BitsCrunch’s solution is not closed off. The official documentation already provides API integration guides, meaning other NFT-related marketplaces, projects, or analysts can leverage these capabilities via API calls to gain deeper insights for their own operations.

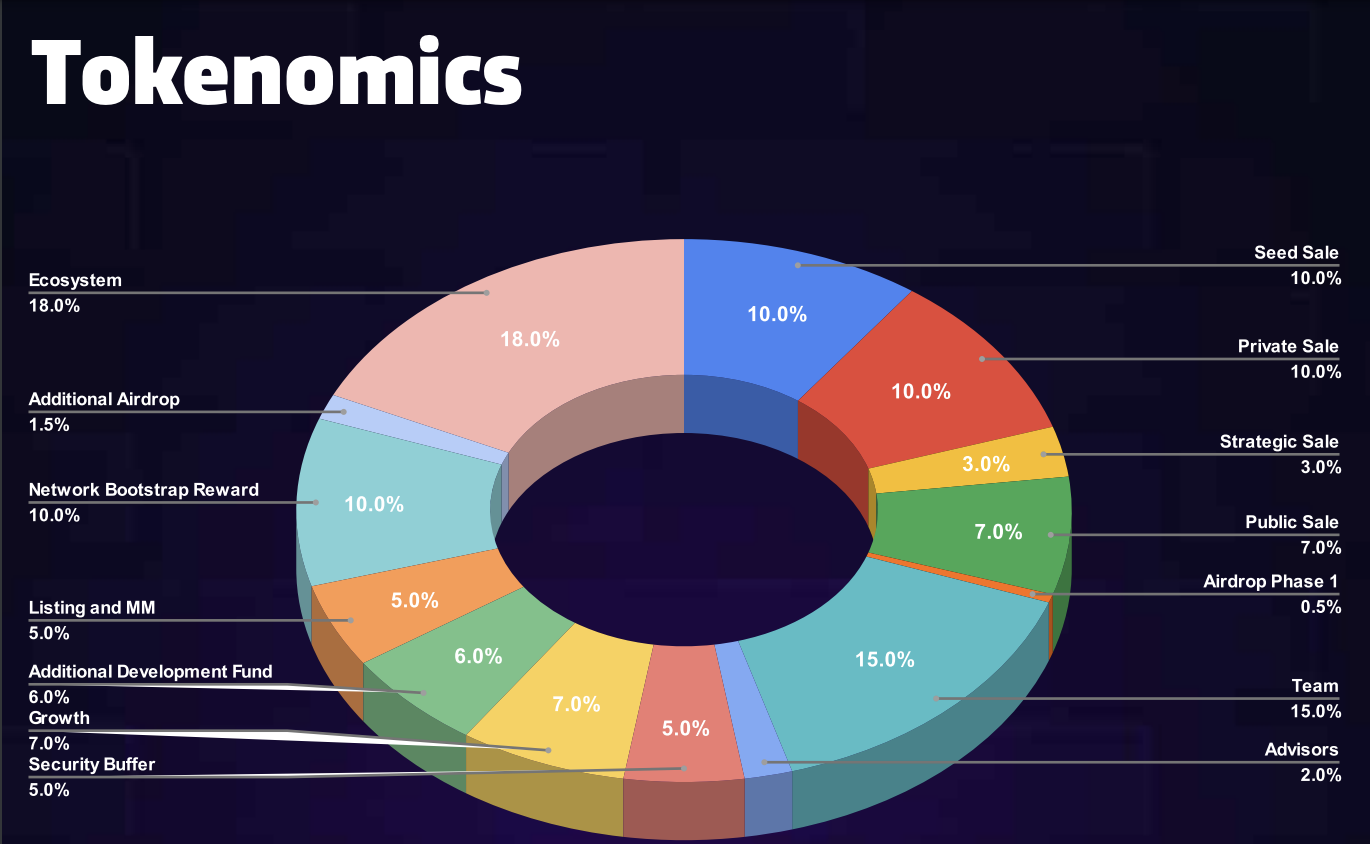

According to the tokenomics model published in the whitepaper, the token distribution is as follows:

-

Ecosystem: 18%

-

Team: 15%

-

Seed Round: 10%

-

Private Round: 10%

-

Network Incentives: 10%

-

Public Sale: 7%

-

Growth: 7%

-

Development Fund: 6%

-

Exchange Listing & Market Making: 5%

-

Security Buffer: 5%

-

Strategic Round: 3%

-

Advisors: 2%

-

Airdrop: 2%

Regarding specific utility, BCUT is the native digital token of the network, primarily used to access rich NFT data within the BitsCrunch ecosystem.

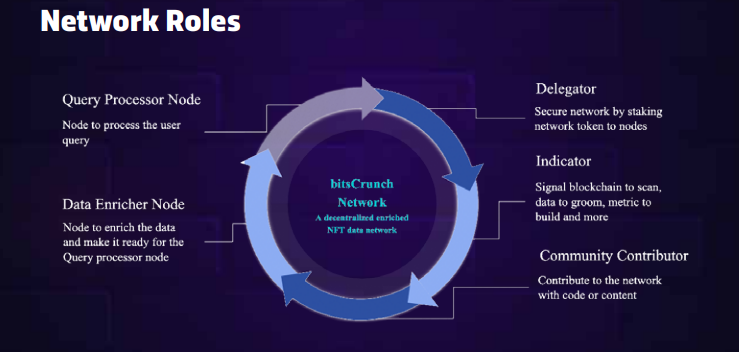

Additionally, BCUT facilitates smooth operations within the BitsCrunch network by implementing economic incentives to guide different participant roles and ensure overall network security.

For example, multiple network roles have been preliminarily defined, including node operators, query processors, and consumers — each requiring token holdings to participate.

From the perspective of common crypto project token design, BCUT follows similar principles: service users must spend BCUT tokens, while service providers receive BCUT rewards.

Finally, BitsCrunch’s roadmap indicates a gradual transition from semi-centralization toward a fully decentralized network. As the NFT market recovers and trading potentially picks up again, the “police of the NFT world” may well find its moment to shine.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News