KOLs Debate GameFi: Bull Market Engine or False Demand?

TechFlow Selected TechFlow Selected

KOLs Debate GameFi: Bull Market Engine or False Demand?

Not resisting, not opposing, and actively trying new games is the right choice.

With the recent market recovery over the past one to two months, discussions have reignited about which sectors hold greater growth potential.

Among these, GameFi is undoubtedly a topic that cannot be ignored.

From the explosive popularity of play-to-earn games during the last bull cycle, to the emergence and struggles of so-called AAA Web3 titles, and now to heightened expectations for mainstream breakthroughs in this cycle—GameFi has experienced ups and downs, yet continues evolving.

You may love it or dislike it, but you can't ignore it.

Is GameFi truly an engine to bring in new users during a bull market, or merely a pseudo-demand disguised as entertainment?

Recently, KOLs with diverse backgrounds, experiences, and preferences have engaged in a debate around GameFi. As truth emerges through discussion, let’s examine their differing perspectives.

Bull Case: More Funding, Higher Quality, Broader Audience

Summarizing the arguments from supporters of the GameFi sector, we see a clear focus on both supply-side and demand-side dynamics.

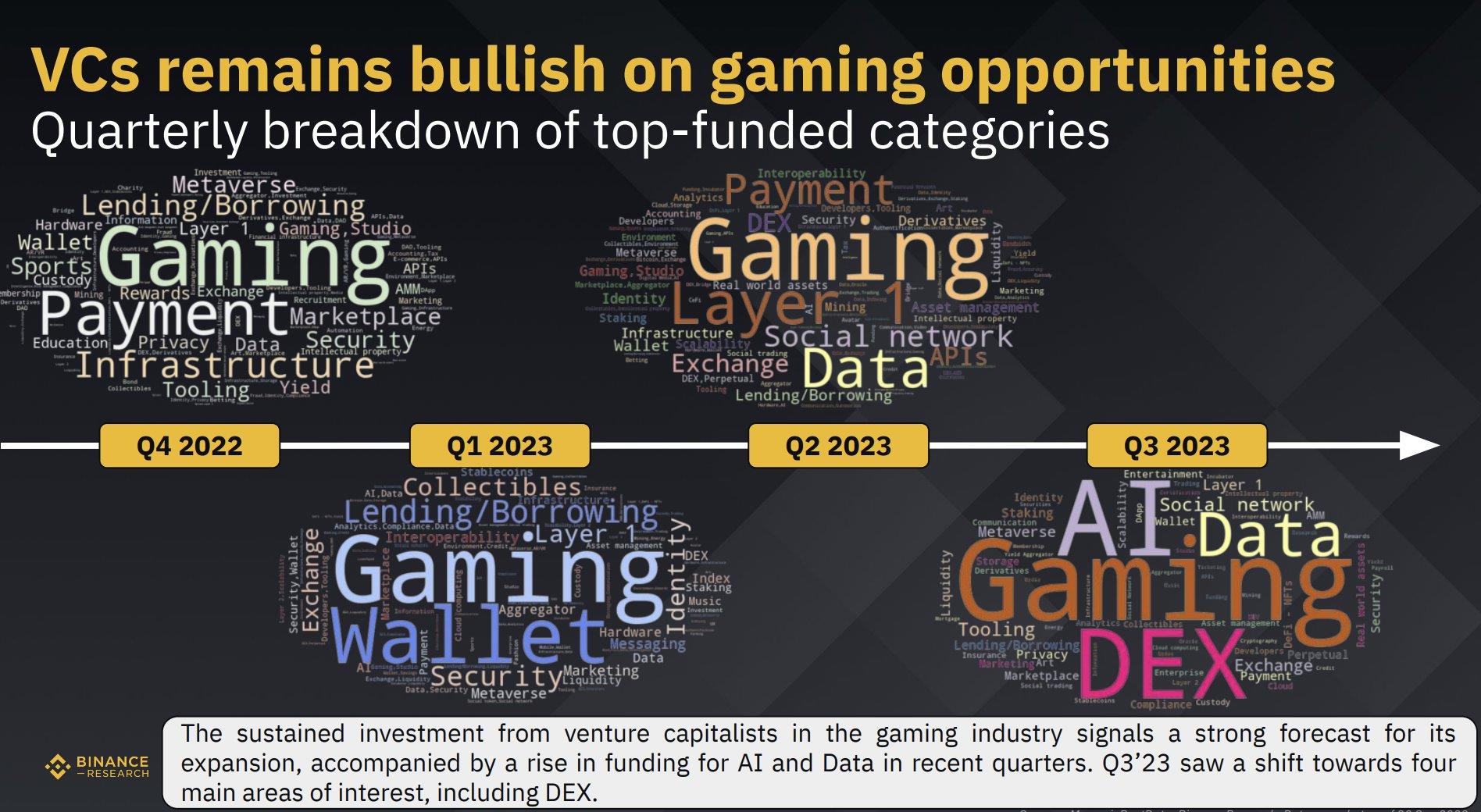

On the supply side, the most obvious and intuitive bullish signal is the increasing amount of capital flowing into the GameFi space.

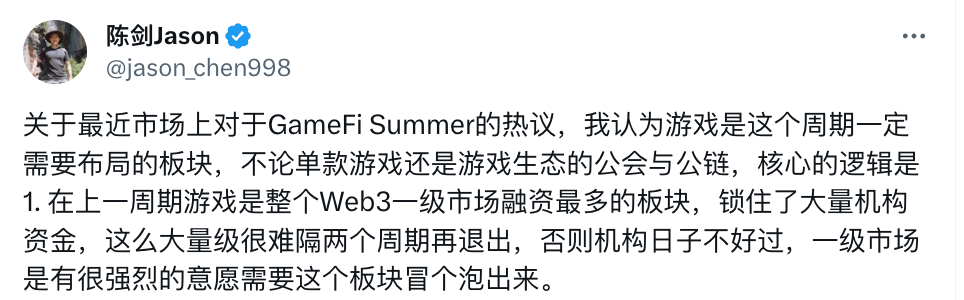

For example, according to a report cited by Chen Jian (@jason_chen998) from Binance Research, VCs have consistently invested in gaming projects since the last quarter of last year, reflecting optimism about the opportunities this sector may offer.

Where there is investment, there must also be an exit strategy. Given that the GameFi sector has absorbed significant early-stage funding, major institutional VCs will naturally seek timely exits to realize returns.

Moreover, exits are difficult without market热度—because no热度 means no counterparty. Therefore, from a financing and investment perspective, it's reasonable to expect significant activity and noise in the GameFi space.

Another significant shift on the supply side lies in narrative evolution and improved quality.

In the previous cycle, terms like "gold farming," "mining games," and "GameFi" were constantly repeated. But in today’s renewed interest in blockchain gaming, those phrases seem to have faded from common use.

Replacing “GameFi” is the newer narrative of “Web3 gaming.”

Researcher NingNing (@0xNing0x)敏锐ly pointed out that this year, Western Web3 game industry players have reached a consensus to replace “GameFi” with “Web3 Game,” making the former a taboo term within the industry.

Industry insiders understand why—it’s an unspoken joke.

The games might still be fundamentally the same, but the old narrative left behind a trail of wreckage. With a fresh concept, new mechanics and distribution methods emerge, naturally drawing in new attention.

And this conceptual shift isn’t just superficial: fully on-chain games are being built, the conflict between playing and earning is being addressed in certain Web2.5 hybrids, and long-delayed “AAA” titles are gradually revealing their high production value…

Everything seems poised for revival, slowly getting better.

Additionally, on the demand side, KOLs generally believe in the inherent appeal of the genre—games are entertainment products, and when well-made, they naturally have a lower barrier to user adoption.

It's hard to find another crypto product category where users willingly and seamlessly experience NFTs, tokens, and economic model design—all while simply playing a game and organically encountering various aspects of crypto.

Therefore, if we’re talking about breaking into the mainstream and capturing new demand, the gaming sector stands out as a natural candidate.

Bear Case: Poor User Acquisition & Retention, Incompatible Play-and-Earn Model

While the bull case centers on narratives, expectations, and funding trends, critics take a more practical and grounded approach.

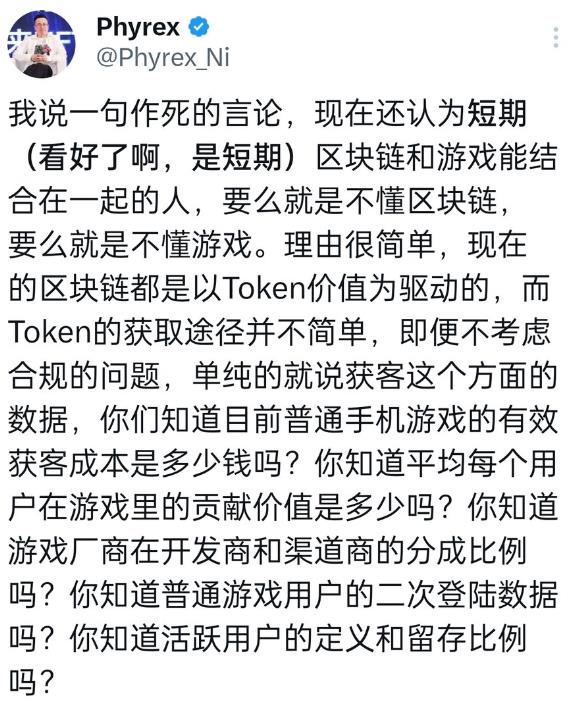

For instance, Ni Da @Phyrex_Ni clearly distinguishes between current “game products” and “Ponzi schemes”:

If we're discussing actual game products, we must consider how users consume game content. Viewed as an internet product, this involves classic metrics such as user acquisition, engagement, retention, and revenue contribution.

But today’s GameFi projects face customer acquisition costs up to 10x higher than traditional games, lack sustained user engagement curves, and show very low average revenue per user.

The root cause? GameFi isn’t content-driven—it’s token-investment-driven. Every user action serves profit motives, and the game itself becomes merely a vehicle for a financial scheme.

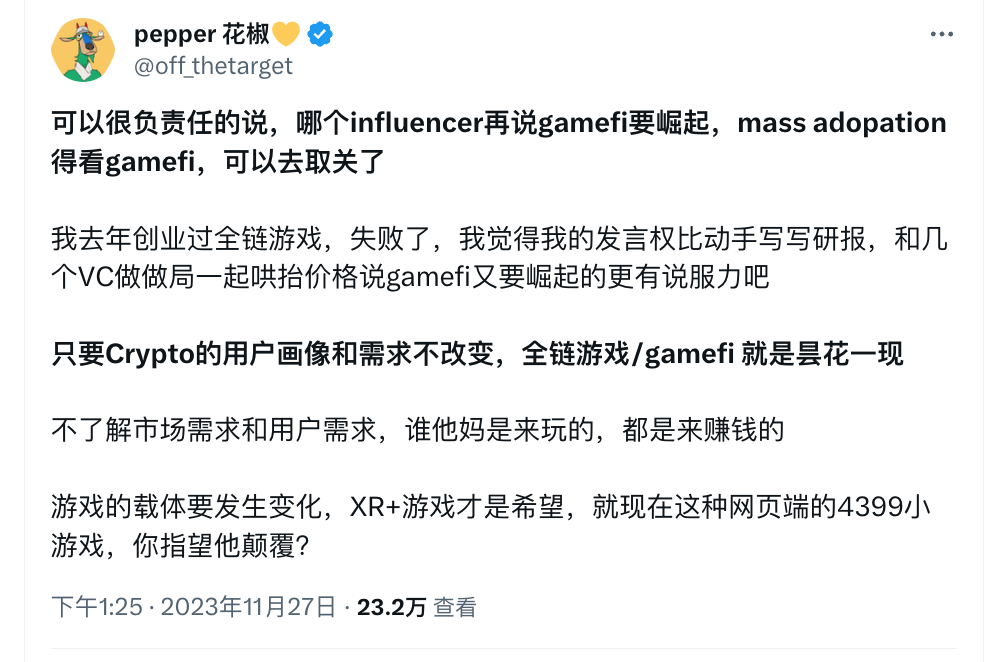

Meanwhile, Hua Jiao @off_thetarget draws from personal failed entrepreneurial experience to argue that the profile of crypto users determines the fate of the gaming sector:

As long as users are here primarily to earn money, the core demand won’t change—and play-to-earn will forever remain incompatible.

To shift users’ primary motivation—or to attract outsiders—requires truly competitive game designs. Yet if Web3 games compete solely on quality and gameplay, they clearly cannot match top-tier traditional Web2 titles. Without meaningful innovation in game design, talk of “breaking into the mainstream” or “mass adoption” remains theoretical.

Wait and See

Clearly, this wave of discussion has been cordial—no hostility, no intent to convince anyone. Instead, participants share views based on their own understanding, assessing whether this sector could heat up further.

Beyond the pro and con arguments, one thing becomes apparent amid all the noise:

The gaming sector remains an unavoidable part of the crypto landscape. You need to keep an eye on it.

From the perspective of an ordinary crypto user focused on investment, we naturally hope to see more success stories like Axie Infinity and StepN. More wealth effects mean more attention and liquidity, increasing the likelihood of market recovery.

From the perspective of an ordinary gamer seeking entertainment, we also hope GameFi or Web3 games can offer an additional option among mainstream game genres.

But it’s important to note: this doesn’t mean we should expect these games to immediately replace established, mature titles. Rather, they serve as a good distraction during the long, dull, and somewhat tedious wait for the next crypto cycle.

After all, playing regular games might make you feel like you’re wasting time—but trying Web3 games occasionally reminds you of potential asset appreciation.

No resistance, no opposition—just actively trying new games—is the right mindset.

As for distant dreams of mass adoption and mainstream breakthroughs—wait and see.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News