CoW Protocol: A Promising Project with High Revenue Potential and MEV Business Support

TechFlow Selected TechFlow Selected

CoW Protocol: A Promising Project with High Revenue Potential and MEV Business Support

CoWSwap currently holds only 13% of the DEX aggregator market share but has been growing at a rate of 70% over the past 12 months.

Author: rbp

Compiled by: TechFlow

CoW Protocol, a decentralized finance infrastructure provider with a current valuation of $250 million, is reevaluating its fee structure, business model, and token economics as it could generate over $80 million in revenue and potentially reach a market cap of $1.2 billion.

CoW Protocol is best known for its product CoWSwap, but its other product, MEV Blocker (http://mevblocker.io), remains relatively unknown. It is precisely this MEV Blocker that has the potential to become CoW Protocol’s highest-revenue-generating product.

CoWSwap is a fully permissionless decentralized exchange (DEX) aggregator whose core innovations include batch auctions that enable fair, uniform clearing prices and trade protection against various types of MEV (such as sandwich attacks or front-running).

MEV Blocker is a free remote procedure call (RPC) endpoint that protects users from harmful MEV, prevents transactions from being executed at unfavorable exchange rates, and saves users money.

So how are these two products performing?

CoWSwap currently holds only 13% of the DEX aggregator market share but has been growing at a rate of 70% over the past 12 months. Meanwhile, the largest DEX aggregator in the space, 1inch, has seen its market share decline from approximately 68% to 53%.

MEV Blocker was launched in May 2023, yet its transaction volume has already surpassed that of the existing Flashbots solution by 72%. As of today, MEV Blocker has reached 450,000 unique users, adding an average of 64,000 new users per month, with year-over-year transaction volume growth exceeding 99%.

Additionally, MEV Blocker has recently been integrated into Rabby, Uniswap, and Brave wallets, though it has not yet fully penetrated these user bases.

But what about revenue?

If CoW Protocol were to activate fee collection on both products today, conservative estimates suggest annual revenue could reach $8.4 million.

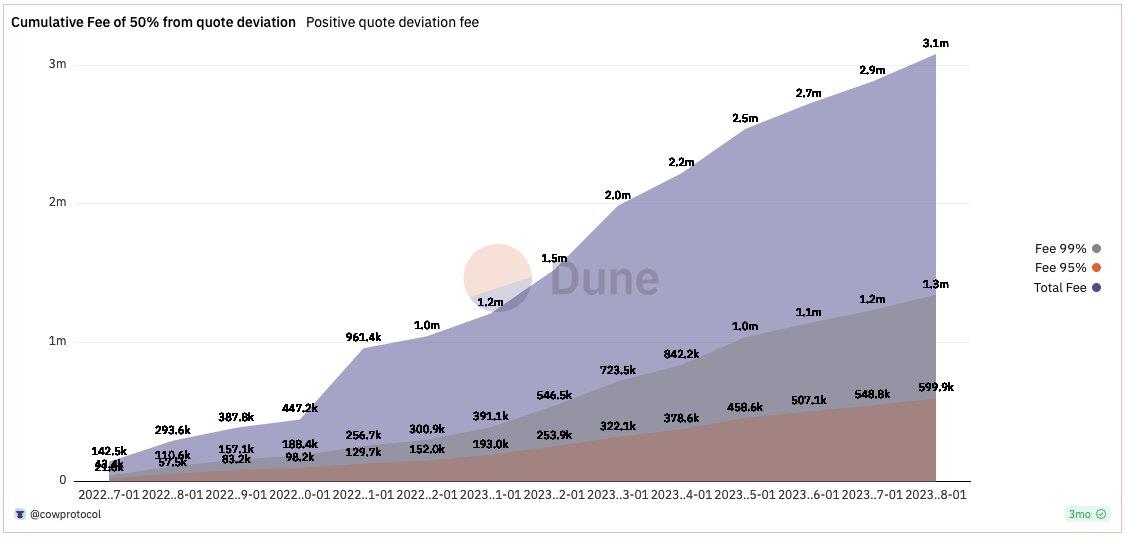

CoW Protocol might adopt a model capturing 50% of positive quote slippage. Over the past 12 months, such a mechanism could have generated more than $3.1 million in revenue.

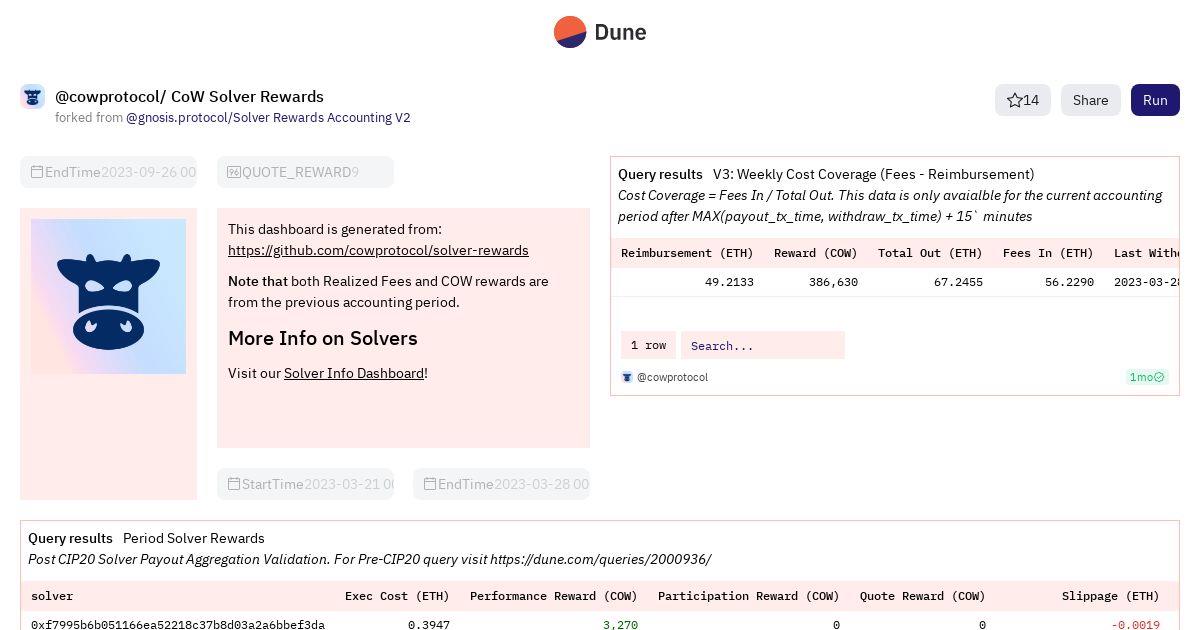

MEV Blocker would likely capture 10% of validator fees. A 10% extraction rate over the past 12 months would have earned $5.2 million. Note that these fee models are hypothetical; the exact mechanisms have not yet been finalized.

Over the past 18 months, the $COW token has underperformed relative to $ETH. One reason for this is the inflationary rewards paid to solvers.

Over time, CoW Protocol should be able to reduce the issuance of $COW by over 40% by using earned revenue—paid in ETH or stablecoins—to compensate solvers after turning on the fee switch.

Note that reducing token issuance is a possible solution, and we expect the team to gradually decrease $COW emissions over time.

We’ve covered CoW Protocol’s strong market adoption, a sound revenue model, and its ability to significantly reduce token issuance. But how large is the total addressable market (TAM), and how big can CoW Protocol grow?

Several factors favor CoW Protocol’s market potential:

1) Digital asset trading volume is expected to continue growing at a compound annual growth rate (CAGR) of approximately 20%.

2) On-chain exchanges will continue to gain market share over off-chain exchanges, growing at a CAGR of approximately 58%.

3) CoW Protocol may expand cross-chain and support new token types (i.e., ERC-721 and ERC-1155), increasing market potential at a CAGR of approximately 12%.

Note that cross-chain expansion or support for new token types has not been officially announced and is currently only an assumption for future growth. The base case assumes CoW Swap captures 30% market share. For MEV Blocker, the base case assumes 3.5 million users conducting 25 million transactions annually, with validator revenue around $450 million.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News