POW Coin Exchange SafeTrade's Exit Scam Becomes a Rashomon-Style Controversy, POW Coins Face Liquidity Crisis

TechFlow Selected TechFlow Selected

POW Coin Exchange SafeTrade's Exit Scam Becomes a Rashomon-Style Controversy, POW Coins Face Liquidity Crisis

This exchange named "Safe" doesn't seem to be as secure as its name suggests.

Written by: TechFlow

If there were a year-end review, PoW would undoubtedly be one of the most notable sectors this year. First came the sustained rise of KAS, capturing the attention of many investors. Then Binance listed KAS futures pairs, fully igniting market sentiment around PoW-related tokens.

Where there is profit, there is business.

As KAS prices climbed higher, people began turning their attention to other PoW sector tokens such as DNX, SMH, QUBIC, and ZEPH. In this context, these mining tokens did see significant gains—but they share one common trait: extremely inconvenient trading, initially limited only to OTC transactions with miners.

At this point, a dedicated mining token exchange became a shared aspiration among retail investors, and Txbit and SafeTrade successively seized this opportunity.

Txbit was one of the first exchanges to list KAS. After recognizing the growing popularity of PoW tokens, it gradually launched other mining tokens like early-stage DNX, becoming a primary liquidity exit venue for miners at the time.

But good times didn't last long. On August 14, Txbit announced it would shut down on September 14, 2023—an abrupt message that caught everyone off guard. Fortunately, Txbit did not engage in a malicious exit scam; users simply needed to withdraw funds before September 14.

Even so, this move cast a shadow over the community: “What if next time a small exchange doesn’t announce closure but just runs away—how should we respond?”

SafeTrade, Enveloped in Security Concerns

This anxiety leads us to the main subject of this article—SafeTrade.

SafeTrade is a recently popular mining token exchange. Unlike Txbit’s focus on KAS, SafeTrade centers its main trading pairs around SMH, QUBIC, and others.

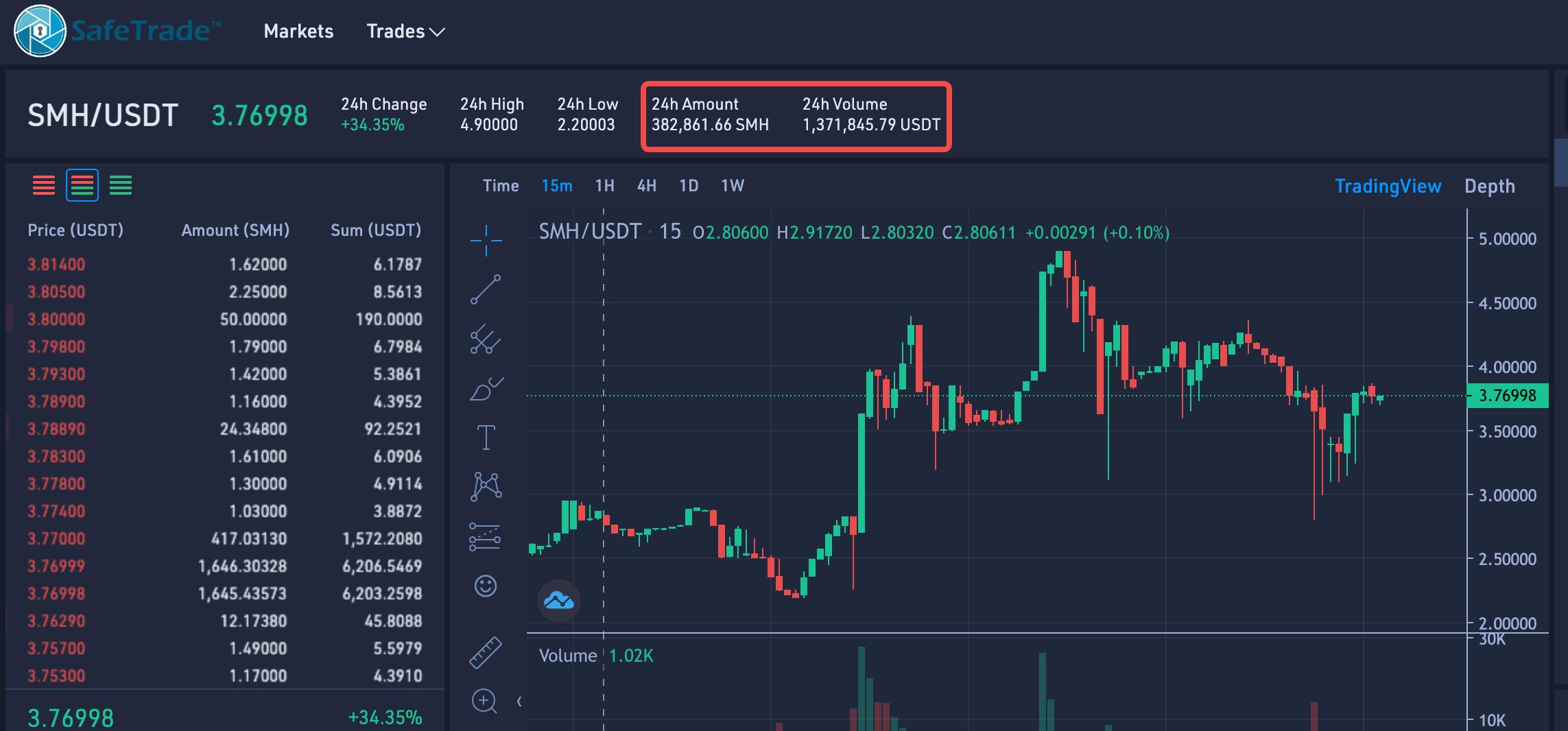

Currently, SafeTrade supports 53 cryptocurrencies and 102 trading pairs. Take the SMH token as an example—it trades actively, with daily volume exceeding $1.3 million on the platform.

High trading activity inevitably attracts more participants—and increases the likelihood of problems arising.

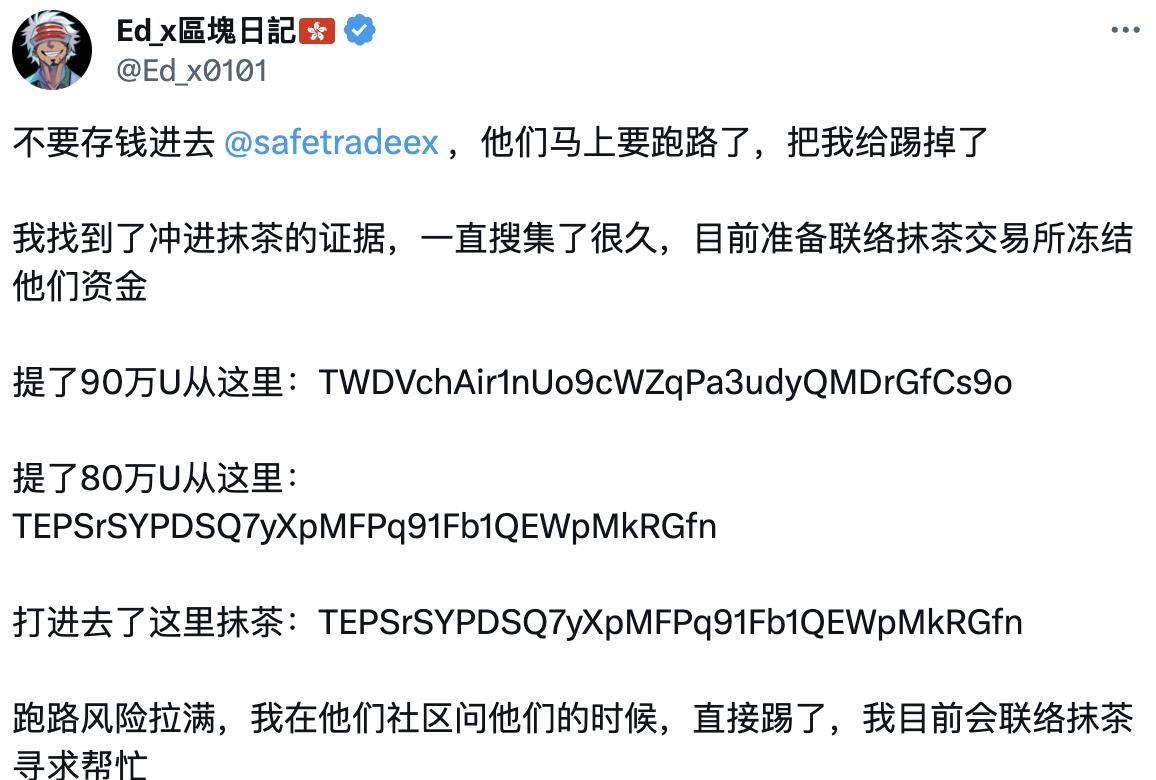

Yesterday, a crypto KOL tweeted that SafeTrade may be preparing to run away, quietly transferring funds into MEXC (formerly MXC), and claimed to have gathered sufficient evidence.

The trigger stemmed from the KOL stating they had previously communicated amicably with SafeTrade, but were suddenly kicked out of a group chat. Moreover, the exchange allegedly allowed deposits but blocked withdrawals, angering the KOL who then mobilized resources to trace fund flows and uncover further potential issues.

Subsequently, the KOL reportedly uncovered specific details about SafeTrade’s responsible parties, indicating they are based within China. With this leverage, the KOL continued pressuring SafeTrade to restore withdrawal functions for certain tokens.

At the time of writing, this exposé has yet to reach a conclusion. Before obtaining more information, and adhering strictly to factual accuracy, the truth and validity of these claims remain undetermined.

Regardless, this alleged exit scam scenario surrounding SafeTrade casts a cloud of doubt over an already overheated mining token market.

In fact, this isn’t the first time SafeTrade has crossed user red lines. Prior to this incident, reports surfaced about QUBIC deposits failing to credit, and community members complained the exchange wallet wouldn’t open, making both deposits and withdrawals impossible.

An exchange named for “safety” seems anything but secure.

Although SafeTrade promptly issued announcements restoring QUBIC and USDT withdrawal channels, user suspicion remains unavoidable. Fund accessibility is paramount—after all, even FTX couldn’t escape behind-the-scenes manipulation, let alone given the precedent set by Txbit.

PoW is now at its peak. The massive traffic influx is indeed tempting—will SafeTrade choose short-term greed or sustainable growth? At this critical juncture, rebuilding user trust is the most urgent challenge it faces.

Opportunity Amid Crisis?

The allegations of an exit scam represent a crisis for SafeTrade—but an opportunity for another mining token exchange, Xeggex.

Open Twitter, and you might not even need to search for “Xeggex”—promotion tweets flood your feed.

SafeTrade’s turmoil, combined with the explosive price surge of mining tokens led by TAO and KAS, has driven a wave of organic traffic that overwhelmed Xeggex’s servers—even KYC processes suffered due to system lag.

Indeed, Xeggex offers numerous get-rich-quick opportunities, with tokens regularly surging tenfold or hundredfold. Even its native platform token $XPE has seen minimum ten-bagger returns, naturally drawing intense market attention.

A crisis can also be an opportunity—this is the true nature of the mining token market. While Xeggex may offer attractive turnaround prospects, the associated risks must not be overlooked.

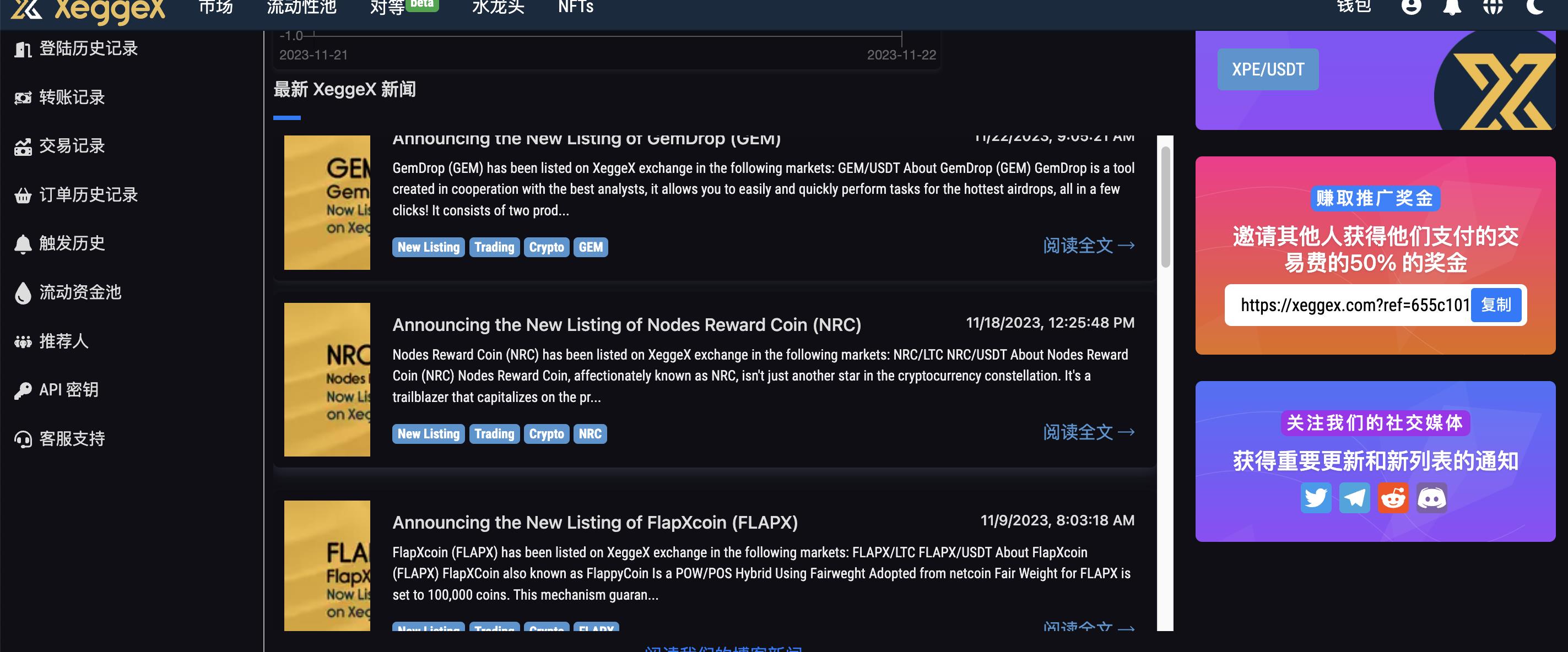

Compared to established exchanges, these emerging platforms carry significantly higher trading risks. As seen in the image below, Xeggex’s UI appears extremely “simple,” lacking refinement and design polish.

Behind this crude interface could lie deeper issues related to qualifications, security, audits, and compliance. Sometimes, simplicity in design does not indicate elegance, but rather reflects lack of resources, technical capability, and accountability.

When one mining token exchange faces danger, another may seize the opportunity—but it could also bring greater risk.

If you're a gold miner looking to enter the mining token market, cautious participation and protecting principal safety should be your top priorities.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News