Is Solana Profitable? Financial Analysis Shows Annual Profits Could Reach $2 Billion

TechFlow Selected TechFlow Selected

Is Solana Profitable? Financial Analysis Shows Annual Profits Could Reach $2 Billion

If SOL succeeds, it will be valuable.

Written by: mhonkasalo

Compiled by: TechFlow

A common critique of Solana right now is the viability of $SOL as an (investable) asset. Some phrases you might hear in crypto circles on Twitter/X include:

-

Solana might be useful, but it doesn't capture value.

-

Solana validators are subsidized, so the system isn't sustainable.

-

Optimizing for low fees will always mean $SOL has no value.

Assuming the Solana network is resilient and decentralized, the goal within these systems is to minimize costs as much as possible.

Fast and cheap equals utility. And given that there's no settlement failure within these systems, calling something a settlement or execution layer doesn't mean much.

Our goal is to maximize utility. This is how we maximize end-user value.

If we're aiming for billions of DAU, extracting rent from a user base of roughly 10,000 active users isn't what we're optimizing for.

In any case, the point of this article isn't to argue which scaling path is optimal, but rather to point out that if product-market fit is achieved, hitting exciting profit/income numbers is quite easy.

If SOL succeeds, it will be valuable.

The Math Behind SOL as an Asset and Its Value Capture

A few facts:

-

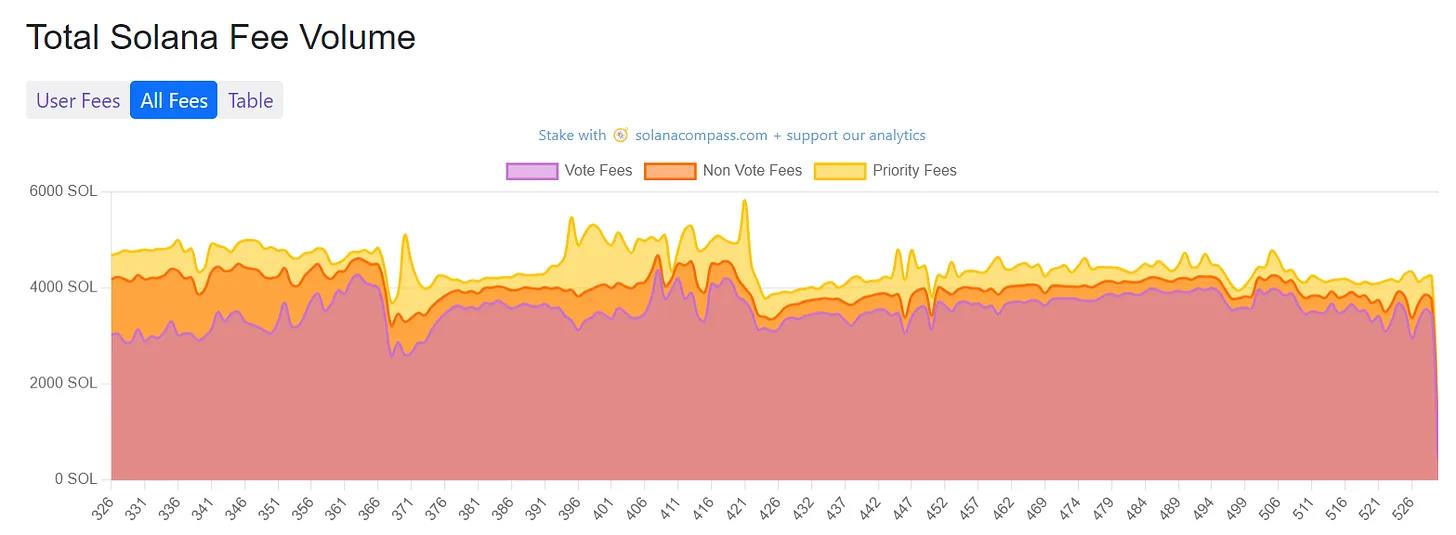

Solana users paid around $100,000 in gas fees yesterday.

-

50% goes to validators, 50% is burned: $50,000 for service provision. $50,000 distributed to token holders. A mechanism similar to ETH burning.

-

Solana’s inflation rate is about 5.7%. Starting from 8%, decreasing by 15% annually. Long-term target is 1.5%.

It's important to note that for all blockchains, these parameters are adjustable. The key is having sufficient incentives for validators to remain honest, after which you can begin "paying" token holders via:

-

Base fee per transaction (in addition to which priority fees always exist).

-

Revenue sharing (dynamic, algorithmic, fixed).

-

Inflation rate (i.e., subsidy).

Today, Solana is unprofitable (similar to pre-merge Ethereum):

-

Solana supply = 562,119,561 SOL

-

5.7% inflation = 32,040,814 SOL = $1,440,875,405

-

Annual revenue = $100,000 x 365 = $36,500,000

-

Net loss = -$36,500,000 = $1,404,375,400

-

Required to break even = $1,440,875,405 / $36,500,000 = 39.48x

This means Solana needs approximately 40x more transactions at today's fee levels to reach breakeven.

Like any other blockchain, once block space fills up—or in Solana’s case, access to specific parts of state like NFT mints—priority fees will start to dominate.

However, let’s run through this exercise with some parameters:

-

Solana currently does 3,000 TPS, with over 100,000+ expected post-Firedancer. Assuming half the block space gets filled, we get a 15x increase from current fees.

-

Assume additional priority fees double total fees—we’re now at 30x.

-

Honestly, Solana could double base fees without impacting users, so we’re already at 60x.

-

Overall, under this scenario, Solana would be about 2x profitable.

Note that this is a completely conservative way to run this exercise. Solana could earn significantly more:

1M Firedancer TPS, half-full blocks = 150x fee increase.

-

4x boost from extra priority fees = 600x fee increase.

-

Keep base fees unchanged (after all, Solana transactions are cheap).

-

Cut emissions down to long-term 1.5% = 2000x profitability increase.

-

Solana earns 70x its emissions, generating ~$22 billion in annual revenue. Look at that P/E ratio.

Seems straightforward—post-subsidy, before paying validators, Solana could generate over $2 billion in annual profit (from which you can decide appropriate burn levels).

The point of this article isn’t the math—it’s that if Solana successfully serves large-scale end-user applications, it will make a lot of money. You just need to be bullish on blockchains, optimize for users, and then address rent-seeking later.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News