The Underrated Web3 Frontend Service: MEV Rise, User Behavior Monetization, and Brand Moats

TechFlow Selected TechFlow Selected

The Underrated Web3 Frontend Service: MEV Rise, User Behavior Monetization, and Brand Moats

It's wrong to say that frontend doesn't accumulate defensible value. On the contrary, we expect frontends to become some of the most valuable businesses in Web3.

Author: Trace

Translation: TechFlow

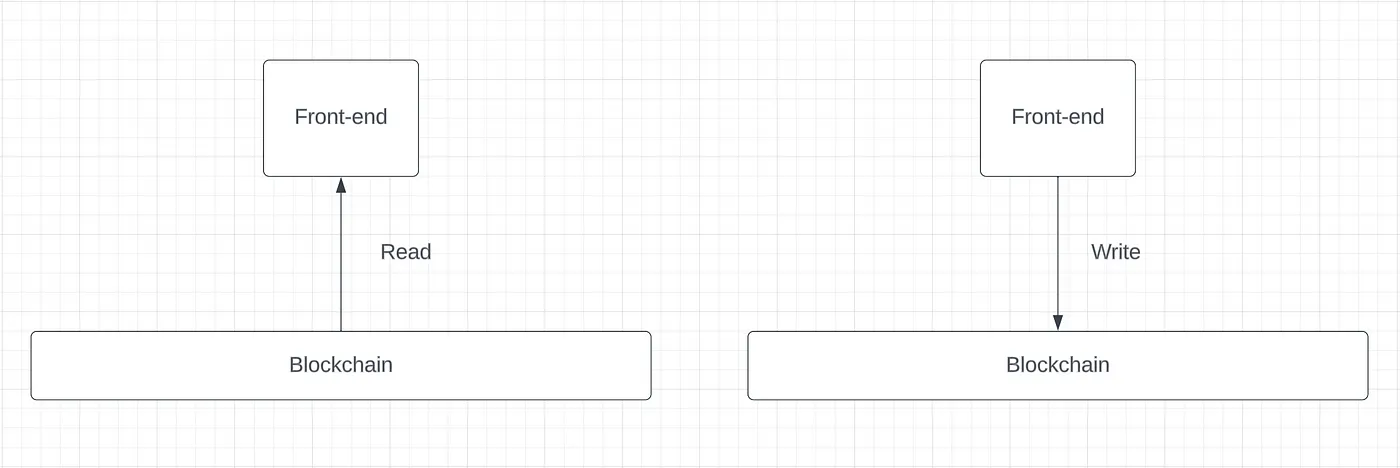

Web3 frontends provide two services: enabling users to read data from and write data to blockchains. Frontends can monetize both reading and writing activities.

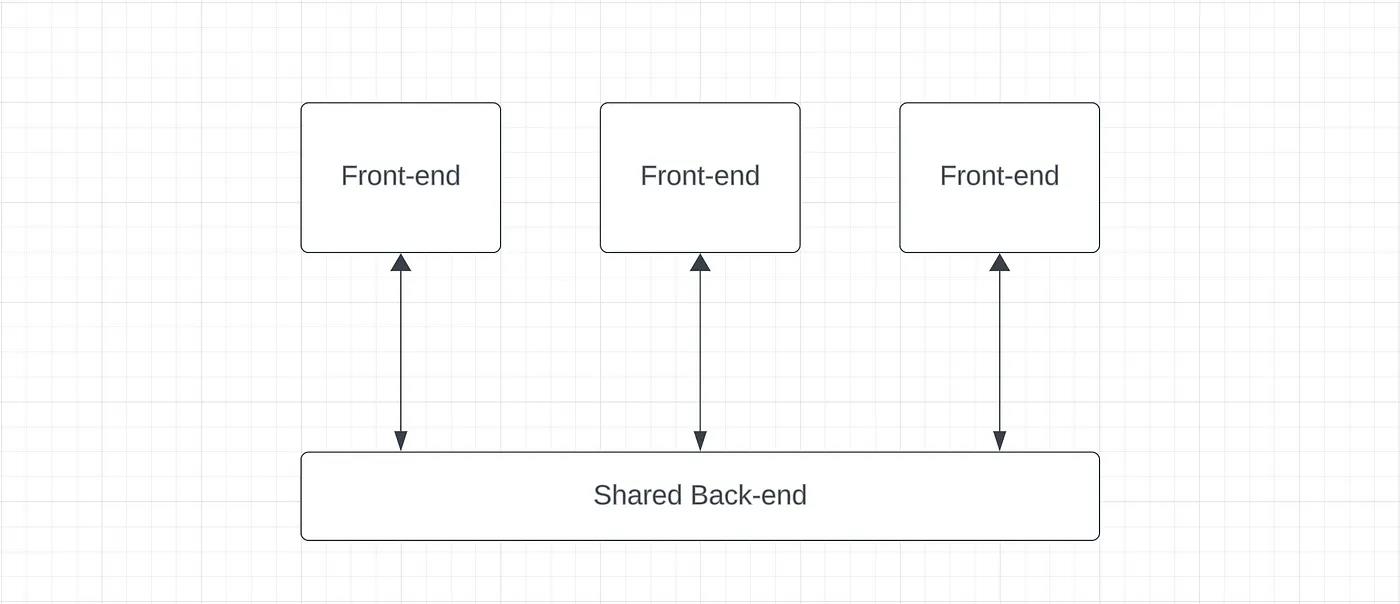

We’ve long been skeptical about value capture in frontends. Their main challenge lies in limited differentiation; every frontend offers merely a different view into the same shared backend.

Switching costs between frontends are low: users simply import their private keys into another wallet or log into another web application— all their information remains on the shared backend. This gives users significant leverage over frontends, driving prices toward zero in competition for user attention. Similarly, blockchain explorers and analytics platforms extract data from a common, transparent backend. Data can be displayed differently, but it’s difficult to achieve an order-of-magnitude better user experience than competitors who share the same infrastructure.

These arguments are valid. However, we believe their conclusion—that frontends won’t accumulate defensible value—is wrong. Instead, we expect frontends to become some of the most valuable businesses in Web3. Our conviction is shaped by new developments in the transaction supply chain, recent innovations in frontend user experiences, and observations of user behavior.

Payment for Order Flow

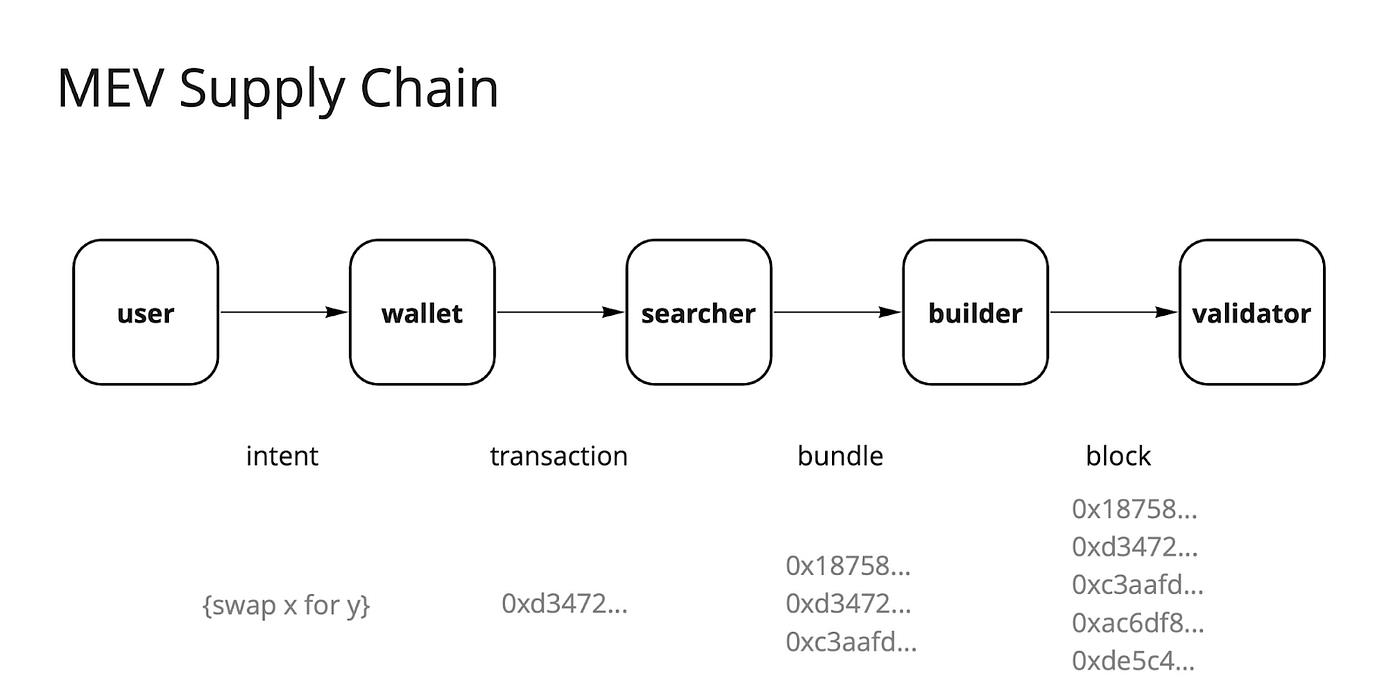

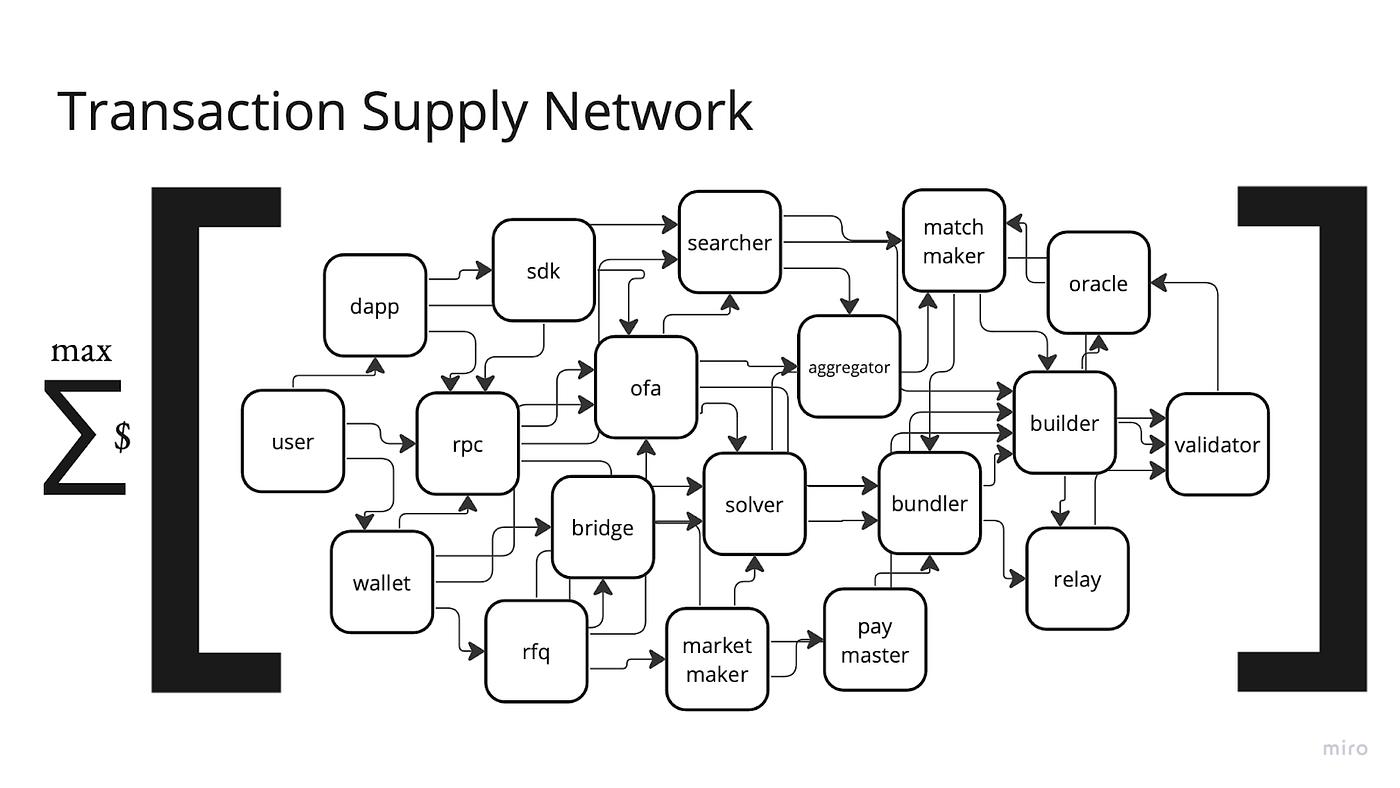

Before Flashbots and The Merge, MEV was a quiet, shadowy corner of Ethereum known only to a few searchers and miners. Flashbots brought sunlight into this space, increased its competitiveness, and ensured fairer distribution of MEV revenue. As the MEV industry evolved, a supply chain emerged to facilitate better extraction and execution. Driven by the separation of proposers and builders, this supply chain outlines intermediaries between users and the on-chain registration of their transactions. In theory, each intermediary has an opportunity to extract value.

In the coming years, this supply chain will evolve into a more complex network of intermediaries as MEV extraction becomes increasingly specialized.

While the total amount of MEV is not zero-sum—and expected to grow with increased on-chain activity—the distribution of MEV among entities in the transaction supply chain is zero-sum. Since The Merge, most MEV has been captured by validators. Under full competition, searchers and builders must bid up their entire profit margin to validators to have their bundles and blocks included.

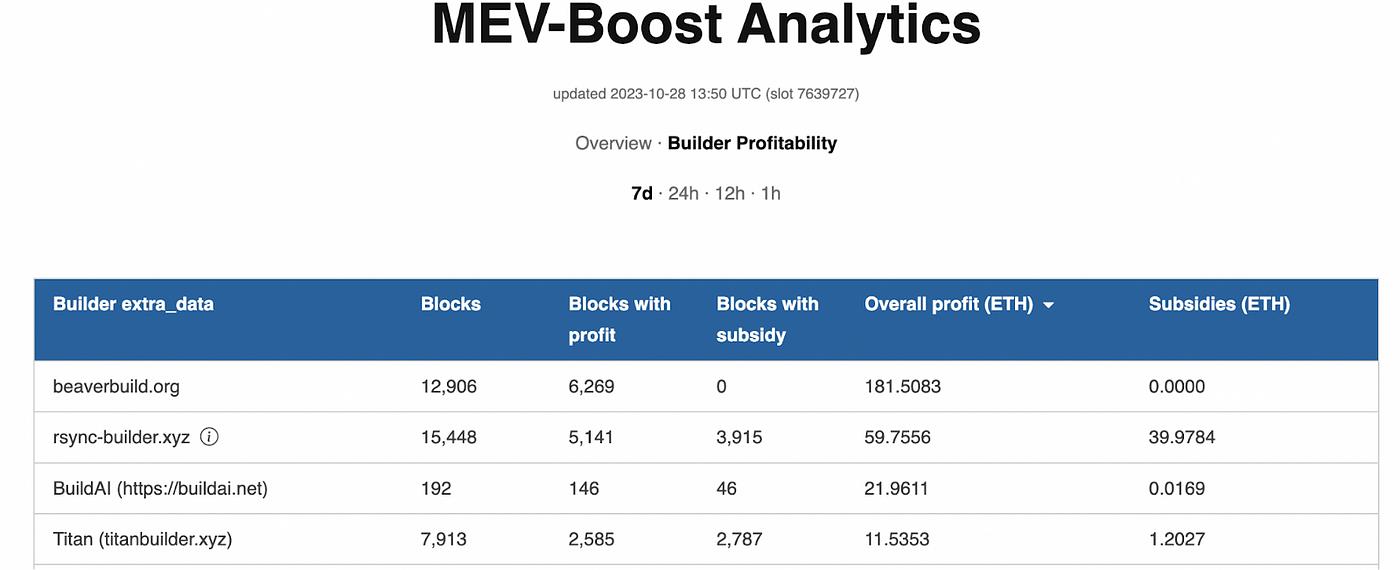

To sustain profits, searchers and builders seek exclusive order flow to gain a competitive edge over rivals. The impact of exclusive order flow is most evident when comparing integrated builders (i.e., searcher-builders) like BeaverBuild and Rsync against neutral builders.

While integrated builders have consistently been profitable, relays are not. In fact, Blocknative recently shut down its relay and neutral block builder, citing lack of economic sustainability. Relay incentives remain an open research area. What explains this difference in value capture?

The key factor determining which entities capture value in the transaction supply chain is exclusivity. Integrated builders capture value because they create exclusive order flow. Validators capture MEV because they exclusively control the right to propose the next block. Relays do not capture value because they lack exclusivity.

Flashbots emerged to address issues in MEV extraction, including systemic exploitation of users through sandwich attacks and other economic attacks. To solve this, they introduced MEV-Share, shifting MEV away from intermediaries and validators toward the frontends and users who generate it. This is achieved via Order Flow Auctions (OFAs). Frontends can direct their order flow into these auctions, where searchers bid on the orders. Auction revenues are then returned to the transaction originators. With OFAs and MEV-aware frontends, MEV flows back to frontends and users. SUAVE will accelerate this trend. Intent-centric protocols like UniswapX also return MEV to users by running auctions among solvers competing to offer the best execution price, thereby improving prices for users.

Beyond returning MEV to users, frontends inherently hold influence within the transaction supply chain: all frontend order flow is inherently exclusive. Thus, once mature OFAs and other MEV rebate infrastructures exist, frontends and their users will capture the vast majority of user-generated MEV.

Of course, not all order flow is equally monetizable, nor can all frontends facilitate high-MEV activity. However, MEV is more widespread than most realize. We expect any frontend capable of meaningfully monetizing its order flow—such as trading platforms and app-agnostic wallets—to do so. In Web3, the PFOF (*payment for order flow*) business model popularized by Robinhood in traditional finance will become widespread. *(Note: under PFOF, retail trades on zero-commission brokers like Robinhood are not sent directly to exchanges such as NYSE or NASDAQ, but are instead routed to high-frequency trading market makers.)*

Networks beyond Ethereum currently lack the MEV infrastructure needed to monetize order flow. As these ecosystems mature, MEV will inevitably emerge, creating similar monetization opportunities for frontends.

Unique User Experience

Frontends share the same blockchain backend, which historically limited their ability to differentiate user experience. But this is changing. We’ve observed three recent innovations in frontends that can unlock network effects in user experience: fine-tuned LLMs (large language models), wallet extensions, and application partnerships.

With the rise of LLMs and intent-based architectures, new frontends can build AI-powered experiences tailored to individual users. Proprietary LLMs allow frontends to maintain a moat in user experience through data network effects. We’re uncertain how much AI will enhance frontend capabilities, but we believe it will be a significant differentiator.

MetaMask Snaps reveal another opportunity for differentiated user experience: frontends can become platforms where third-party developers add extensions, offering an app-store-like experience. Snaps build a network effect around MetaMask, solidifying its position as the dominant wallet. Independent frontends will struggle to match the functional breadth offered by an entire developer ecosystem.

Finally, frontends can capture pricing network effects. Frontends with large user bases can leverage their distribution channel to negotiate discounted fees or sponsored transactions with applications to promote them.

User Monetization and Behavior

The most compelling evidence for frontend value comes from observing user behavior. If switching between wallets is cheap and their user experiences are largely undifferentiated, how did MetaMask manage to earn $200 million in revenue from its built-in Swap feature in 2021?

The answer is brand.

Not all users are the same. Although technically switching costs between frontends are low, there remains complexity and uncertainty for users who don’t fully understand or audit the technology. Despite the crypto industry’s emphasis on trustlessness, when users interact with technology they don’t fully comprehend or personally audit, they are effectively operating within a trust relationship. For example, users must trust that their wallet is secure. Given the financial risks involved in crypto transactions—fraud, irreversibility, no room for error—users place high value on a frontend’s brand and reputation. As one wallet founder told us, “When it comes to wallets, users don’t care about maximizing advantages through extra features—they care about minimizing disadvantages.”

This is why MetaMask remains the dominant wallet. Users stick with MetaMask because they trust it—not necessarily because it offers a richer feature set. Minimizing downside risk means brand and reputation are crucial for wallet providers and other frontends.

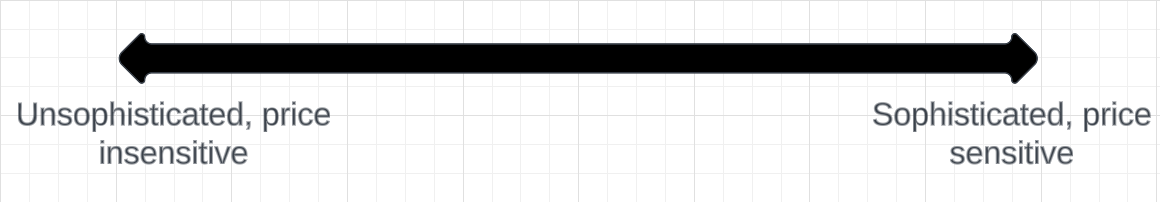

Users vary in sophistication. The more sophisticated a user is, the more willing they are to engage with different frontends, moving to wherever they get the best UX or lowest fees. In contrast, less sophisticated users are price-insensitive—they may willingly pay MetaMask’s 0.875% in-wallet swap fee rather than use cheaper alternatives. To some extent, we can define user sophistication by their price elasticity. The lower a user’s sophistication, the more they rely on brand trust regardless of associated fees. This even applies to some large investors; there is very weak correlation between investor size and sophistication.

Frontend Monetization

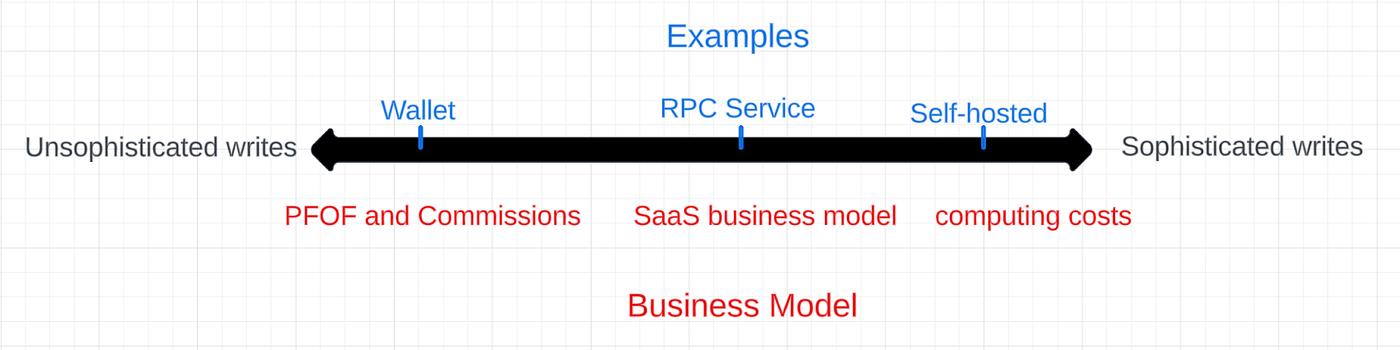

As previously noted, frontends provide two services: read and write. Some frontends offer only read services, such as analytics platforms. Others offer both read and write. For each service, their monetization depends on the sophistication level of their customers.

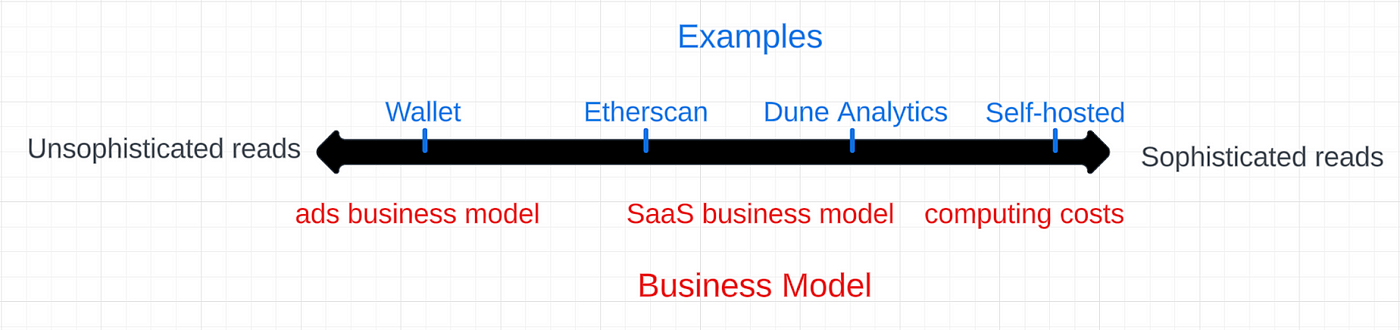

Read Monetization

Assuming read services can be monetized, they primarily follow two business models. Mass-market services like block explorers can scale via advertising revenue. More sophisticated enterprise platforms like Dune Analytics adopt a SaaS model. The most advanced users may host their own full nodes or infrastructure, completely bypassing third-party frontends.

Platforms providing simple read services (presenting basic blockchain information to retail users) resemble Web2 businesses. They focus on high traffic and monetize user attention through ads. We expect some Web3 social platforms and games—low-MEV frontends—to primarily monetize via advertising rather than order flow. Alternatively, they may monetize only at the application level.

As Web3 adoption grows, the number of users reading information from blockchains—and the time they spend doing so—will increase. This trend will make ad-based Web3 businesses more common. In Web2, capturing user attention has proven highly profitable. To continuously capture attention, read-only frontends must again offer differentiated user experiences. However, compared to write-enabled frontends, brand matters less for read-only frontends, since users face lower risks than when interacting with write-capable interfaces.

Write Monetization

Business models for write-enabled frontends are similar. Developers and enterprise customers typically pay SaaS subscription fees. Top-tier users may self-host. Retail-focused write frontends will monetize via their users’ order flow. Like advertising, PFOF (payment for order flow) revenue is largely abstracted from the user.

Beyond PFOF, another path to monetizing order flow is commissions. Commissions are per-trade fees charged by the frontend to users. These have proven profitable. Uniswap Labs’ recent adjustment to frontend fees is a clear example: a 0.15% fee seems small, but annualized revenue reaches $17 million. Since these fees are avoidable—users can use other frontends without paying them—it’s best to view commissions as convenience fees. Users may either be unaware of the fee, willing to pay a premium for better UX, or prefer using a trusted frontend.

This is also why MetaMask earned $200 million in 2021—because for many users, convenience and security outweigh cost competitiveness.

Resolving the Equilibrium

Frontends with large user bases are extremely valuable. But is this stable? Over time, users become more knowledgeable. Frontends become more secure, reducing reliance on trust and thus weakening the value of brand moats. New competitors will emerge with lower prices and comparable user experiences, sufficient to win over segments of users.

Although these arguments hold merit, despite all frontends reading and writing to the same network, we expect brand moats to persist for years. If frontends can establish network effects in user experience, their defensiveness could be even stronger. Our base case is that frontend competitive dynamics will roughly mirror those of online brokers—businesses with strong brand moats where competition gradually erodes fees over time.

Conclusion

The transaction supply chain is undergoing transformation. With increasing competition and the development of OFAs, more MEV will flow to frontends and their users. Frontends serving retail customers will leverage their distribution to monetize via PFOF and convenience fees. As the crypto user base grows over the next few years, these revenues will become highly profitable—especially given users’ price insensitivity. Frontends can also defend their fees through proprietary AI and other user experience network effects. The long-term equilibrium is more complex and may see MEV revenue gradually shift from frontends to users. Convenience fees will also decline due to competition among frontends. These fee reductions can be offset by higher transaction volumes.

We believe read-only and read-write frontends designed for retail markets hold tremendous potential. By monetizing user attention and order flow, they have the potential to become among the most valuable businesses in Web3.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News