What Kind of Price Curve Does SocialFi Need? An Expansion on friend.tech's Economic Model

TechFlow Selected TechFlow Selected

What Kind of Price Curve Does SocialFi Need? An Expansion on friend.tech's Economic Model

The biggest difference between Fi and Ponzi lies in whether the assets exist and have value.

Author: Loki

I. Pricing Curve Comparison & The Cost of Changing Slope

Since October, the competitive landscape of SocialFi has gradually become clearer, with some competitors already fading from market view. Looking back at Friend.tech's development, the economic model—especially the pricing curve—played a critical role. Specifically, FT’s pricing curve has several key characteristics:

-

The differential's sign ensures that prices rise as membership increases, and accelerate over time, guaranteeing early participants can profit;

-

A cap of 16,000 enables a relatively reasonable community size capacity;

-

As numbers grow (especially beyond 100–200), the curve becomes steeper, price volatility rises, and carrying capacity weakens progressively;

-

The far left portion of the curve represents the most profitable buying zone, but this segment is monopolized by bots, creating an income stream akin to "MEV."

For more detailed explanation, see:Understanding Friend.tech's Economic Model: Illusions of Game Theory, Expected Value, and Demand Curves

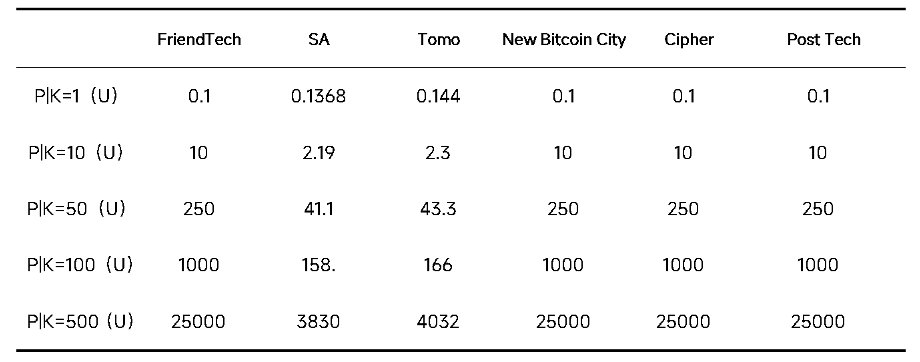

On the competitor side, Cipher, PostTech, and NewBitcoinCity fully retain FT’s formula. All protocols still build on quadratic functions preserving first derivative > 0, second derivative > 0, third derivative = 0. This property ensures FT’s FOMO/profit effect persists.

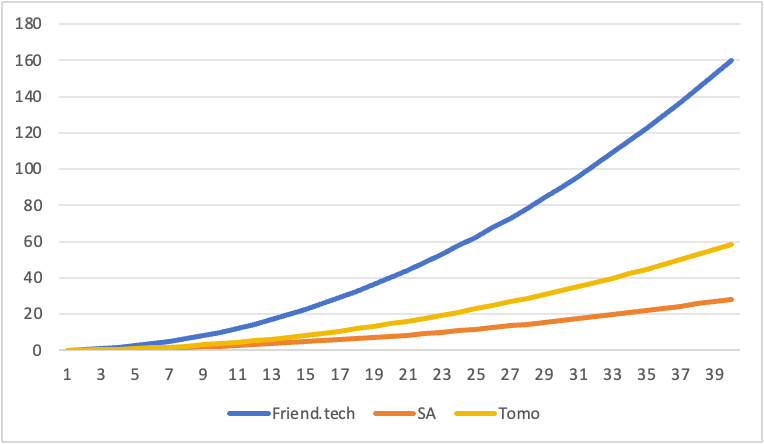

New Bitcoin City’s curve changes mainly stem from shifts in denomination currency and BTC price fluctuations. SA and TOMO have made adjustments to the curve form. SA adds linear and constant terms atop the quadratic term (K²), while reducing the coefficient of the linear term. Theoretically, this makes the overall curve flatter (slower growth) and raises initial prices. However, since SA’s constant term is extremely small, the change is barely noticeable. TOMO’s modification is simpler—reducing the quadratic coefficient by about 73%.

It’s evident that both SA and TOMO essentially alter the curve’s growth rate. Under these modifications, given the same Key supply, SA and TOMO will have lower prices. SA’s price level remains around 15%-20% of FT’s, while TOMO’s stands at 37% of FT’s.

Overall, such changes lack significant innovation. A flatter price curve is a double-edged sword for clone projects. On one hand, FT provides a value anchor: it's logical for a user’s Key on a clone platform to be priced lower than on FT. Lower prices improve acceptance and allow greater user scalability. But on the other hand, a flatter curve means weaker wealth effects—the very factor that attracted hundreds of thousands of users to FT.

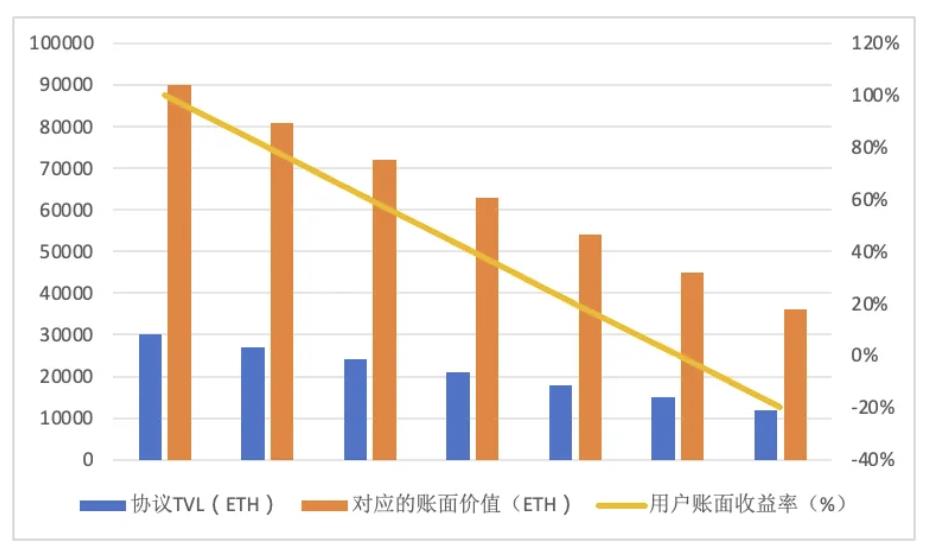

Of course, steep price curves come at a cost. The flip side of a spiral ascent is a spiral descent. Over the past week, Friend.tech’s TVL dropped from 27,000 ETH to 21,000 ETH—a decline of less than 20%—but the resulting price collapse and the 33 betrayal were far more severe.

II. FT’s Gray Rhino: Net Outflows

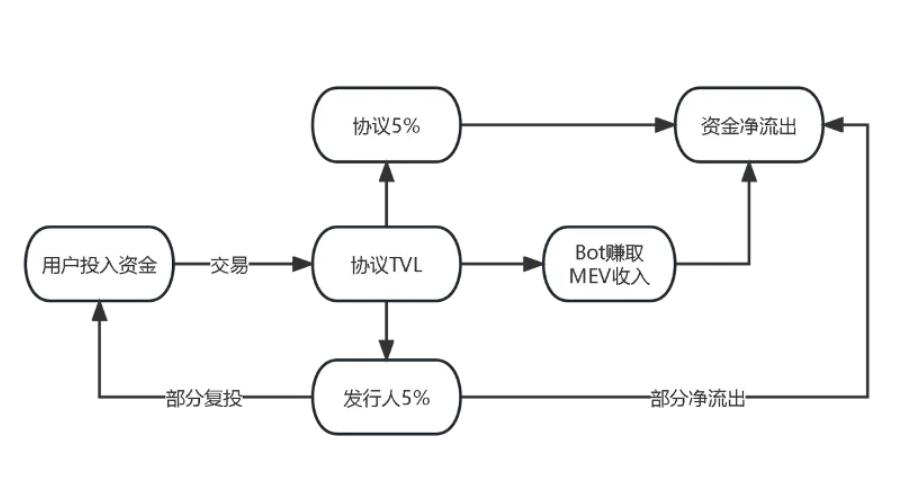

Bots and high fees on FT are visible problems for everyone, and the resulting net outflows are killing Friend.tech. As shown below, all of Friend.tech’s TVL comes from user deposits. User trading PnL and royalties earned by issuers remain within the protocol if reinvested instead of withdrawn. However, bot-generated “MEV income” and protocol fees directly constitute capital outflows.

Bot “MEV income” is hard to quantify, but DWF founder AG’s entry into FT in September serves as a typical case. The first buy price displayed on FT’s frontend was 0.4 ETH, implying bots bought over 80 Keys at an average price of 0.135 ETH. These Keys were sold off gradually within the next 48 hours at prices between 1.1–1.5 ETH. Based on this, bots earned approximately 100 ETH from AG’s Room—all profits derived from user losses.

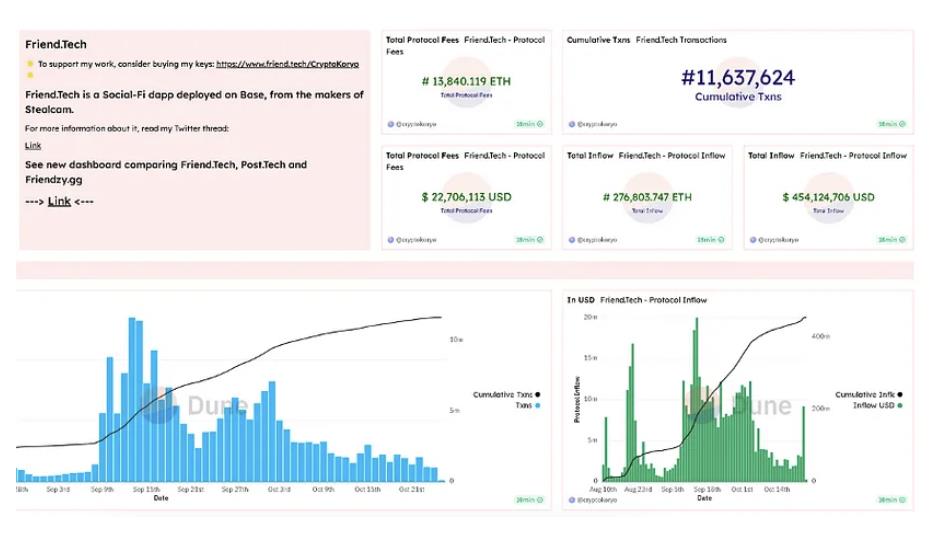

Fees, however, are easier to quantify. According to Dune data, cumulative fees collected by the project team reached 13,840 ETH by October 25. At its peak TVL of 27,000 ETH, total user deposits must have been at least 40,000 ETH. Even without considering bot MEV income, KOL royalty withdrawals, or scam accounts, FT has already extracted over 30% of users’ principal—achieved in just three months.

When TVL rises, users don’t feel the impact strongly. But once TVL enters a downtrend—or even stagnates—the shock becomes intense. Protocol withdrawals, bot MEV income, KOL royalty net withdrawals, and scam account outflows are all non-trading related outflows. If we conservatively estimate the latter three at 5,000 ETH, then users’ total cumulative deposits amount to 45,000 ETH.

As previously mentioned, Key book value is roughly triple the actual TVL. Thus, when TVL was 27,000 ETH, Key book value was about 81,000 ETH. Compared to 45,000 ETH in principal, users enjoyed an average 80% positive return. When TVL fell to 21,000 ETH, total Key book value dropped to 63,000 ETH, reducing average returns to 40%. Clearly, Key book yield is inherently leveraged. If TVL continues to fall to 15,000 ETH, total book value would equal total invested capital. Factoring in transaction fees and bid-ask spreads, users would enter an overall loss state.

Currently, the breakdown of FT’s 33 consensus shows signs of spreading to Tomo. If high extraction rates from protocols and bots persist, it's only a matter of time before FT and other SocialFi platforms collapse—and as book yields decline, the disintegration will accelerate. We had hoped Friend.tech would address protocol leakage and bot issues, but so far no meaningful changes have occurred. Moreover, recent changes to the points system have objectively encouraged farming-related trades, further increasing transaction friction; founder 0xRacer also withdrew substantial fees earned from his own Key.

III. How Else Can the Curve Be Improved?

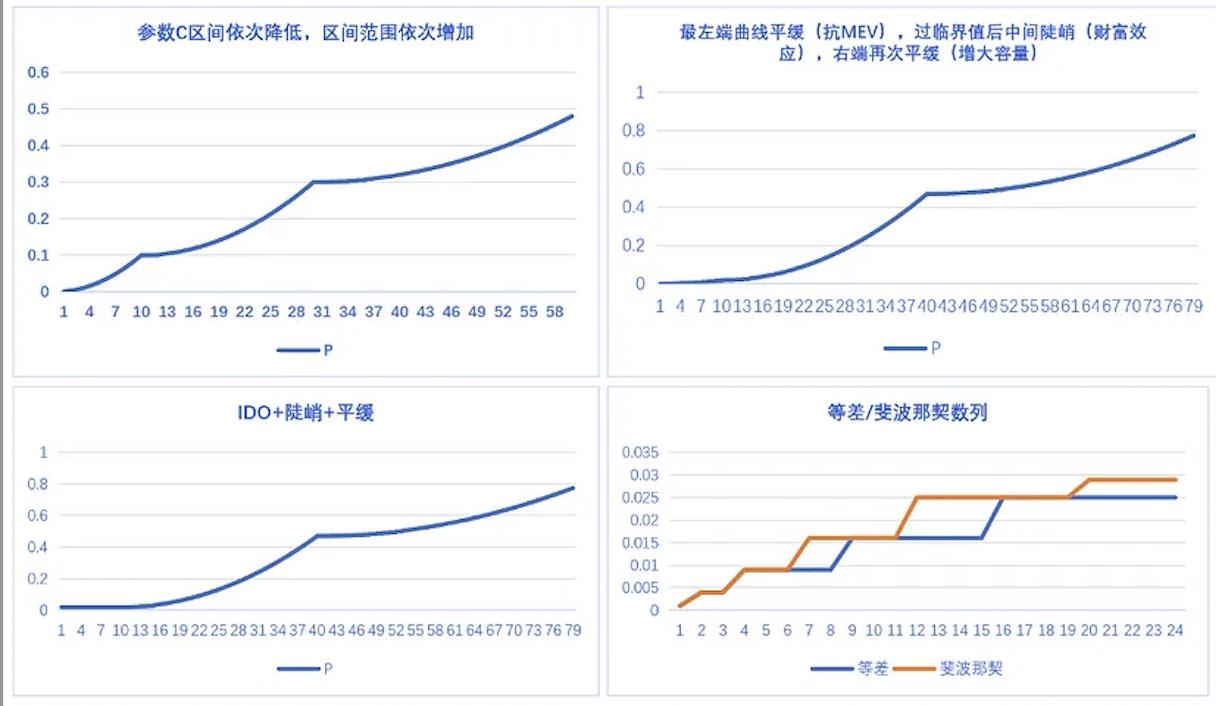

Further thinking: under the assumption that we maintain the form P = K²/C + D (where C and D are constants), setting a pricing formula requires consideration of the following factors:

- Growth Rate & Price

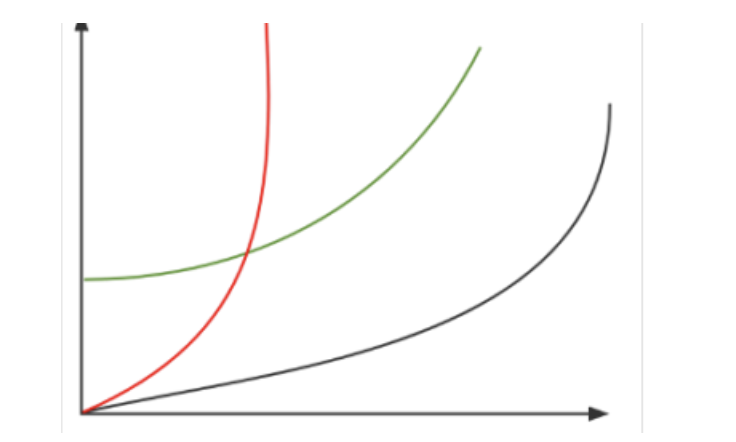

Faster growth leads to stronger FOMO, primarily achieved by decreasing constant C. Competitors generally reduce growth rates to flatten the curve. But their main motivation is often simply maintaining a low Key price—clone platforms will naturally have much smaller TVLs compared to FT, so lower prices per Key holder are reasonable.

- Community Capacity

Growth rate also determines maximum community size. To support larger communities, the curve needs to be flatter:

(1) Increase constant C

(2) Use piecewise functions, with later segments being flatter

(3) Calculate the proportional relationship between P and FT-Key’s P under identical X conditions

MEV value at the far left of the curve

- Solving Bot “MEV Issues”

(1) Add a positive intercept D so initial price > 0 (Tomo set D but its value is negligible). Drawback: reduces wealth effect multiples

(2) Add a flat or horizontal section at the far left of the curve

(3) Fixed-price IDO (pre-sale model—differs from #2 in being first-come-first-served vs. fair launch)

(4) Allow room owners to pre-purchase

From a curve-shape perspective, there are two improvement approaches. One involves directly adjusting parameters C and D—the most common current method. Adjusting constant D can also partially solve MEV issues.

The second approach uses piecewise functions. This allows different parameters across price ranges to achieve varied goals. For example, a flatter or even flat curve in the early stage could mitigate MEV risks or enable IDO-like launches. The IDO model holds promise in addressing bot-driven MEV and failed launches (a notable issue on Tomo).

This too comes at a cost. Using a flat curve at the start significantly weakens opening-day wealth effects. Additionally, one must carefully consider initial supply volume—excessive supply might absorb potential demand or dilute wealth effects.

IV. Beyond KOLs: What Else Can Keys Represent?

An objective reality is that most Room Owners provide insufficient "services" or "information" to justify Key valuations—meaning Key prices are generally overvalued. This stems from speculative and points-farming demands distorting true utility demand on Friend.tech, while FT and clones make pricing curve choices based on business objectives.

Most people treat Keys merely as social tokens, but in fact, Keys can represent any asset. Friend.tech offers a new idea: integrating asset issuance and trading ("Fi") into "Social" to complete the final loop of SocialFi. For FT and most clones, Keys represent a KOL’s personal brand or reputation—but this doesn't define what SocialFi must be. Even within the FT framework, any asset can be embedded into a Key—for instance, equity or tokens of Web3 projects (some are already doing this), where Keys then represent tokens or shares. Or using FT to conduct IDOs, where Keys represent investment stakes or future claims (perhaps soon to emerge).

Currently, FT and clones are overly simplistic, failing to meet various derivative needs. Another approach is introducing 【asset issuance】into existing Web3 social/content platforms (such as DeBox, CrossSpace, etc.). For example, DeBox positions itself as a native DAO governance platform and has built a social ecosystem based on DID, encompassing chat, feeds, and community features, along with functional modules like voting, proposals, token authorization checks, and trading. With 1.5 million registered users, over 100 million daily messages, robust social connections, information tools, management systems, and transaction capabilities, DeBox boasts strong extensibility and is naturally suited to integrate an effective asset issuance solution paired with tailored economic models and pricing curves.

DeBox Interface

These assets include but are not limited to specific content, decentralized groups, or even meaningless yet collectively embraced MEMEs; supported by a suite of social tools and infrastructure, the value of Keys can finally close the loop.

Finally, the key difference between Fi and Ponzi schemes lies in whether real, valuable assets exist—we must never overlook this point.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News