Celestia Countdown: 60M $TIA Airdrop and the Future of Modular Blockchains

TechFlow Selected TechFlow Selected

Celestia Countdown: 60M $TIA Airdrop and the Future of Modular Blockchains

Will modular blockchain Celestia become the next hotspot after L2s (layer-2 networks)?

Compiled by: Web3 Map

As the first modular blockchain, Celestia's upcoming launch marks a major breakthrough in blockchain technology. This article dives deep into how Celestia’s innovative modular design enables simple scaling and high flexibility for DApps, offering a more optimized solution than traditional monolithic chains. Celestia also stands out through its strong development team, robust tokenomics, and continuously expanding DApp ecosystem, demonstrating its immense potential and market competitiveness in the crypto space.

Introduction

With a $TIA airdrop of 60 million and a substantial $55 million funding round from renowned institutions such as Binance Labs Fund, Jump Crypto, and Coinbase Ventures, the project has successfully captured attention across the crypto community.

Could modular blockchain Celestia become the next big trend after Layer 2 (L2) networks?

Let us explain it in detail here 🧠🧵

First, we recommend you bookmark or share this article for future reference.

This article is not sponsored by any party and is intended solely for educational and informational purposes.

This article will cover the following topics:

-

🧠 What is Celestia?

-

🧠 Monolithic vs Modular Blockchains

-

🧠 Development Team

-

🧠 Tokenomics

-

🧠 Ecosystem Overview

🧠 What is Celestia?

Celestia is a modular blockchain that provides simple scalability for DApps. By decoupling data availability from execution and consensus layers, it aims to enhance speed and scalability.

Let’s explore modular blockchains and their advantages over monolithic chains.

🧠 Monolithic vs Modular Blockchains

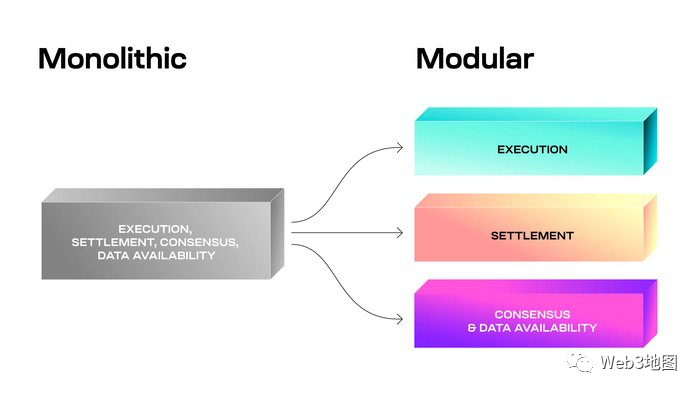

Essentially, every on-chain action (swaps, transfers, staking...) follows four key steps:

-

Execution: Initiating the transaction

-

Settlement: Validating data & resolving disputes

-

Consensus: Ensuring all nodes agree

-

Data Availability: Synchronizing data with the chain

Most blockchains use a monolithic model, handling all transaction steps within a single unified layer.

However, this approach can slow things down and impose limitations on DApps built atop monolithic blockchains, such as:

-

DApps may lack the creativity or flexibility they desire due to shared resource constraints.

-

Fees can spike, making it difficult for many DApps to operate sustainably.

-

Running a full node on a monolithic chain often requires heavy-duty hardware.

In the diagram below, imagine all steps of a blockchain transaction being processed within a single layer (indicated by uniform colors).

Monolithic Chain

🧠 Advantages of Modular Blockchains

🧠 So, what are modular blockchains, and why are they better than monolithic ones?

Think of it like an assembly line where each department specializes in one or two tasks, in contrast to monolithic chains where every layer handles everything.

Monolithic vs Modular

Modular blockchains aim to independently separate processing tasks within the blockchain system, making scalability much easier.

-

👉 Other ecosystems can easily integrate and innovate.

-

👉 Modular blockchains are like Lego blocks, enabling different models to be built based on specific needs.

Monolithic vs Modular

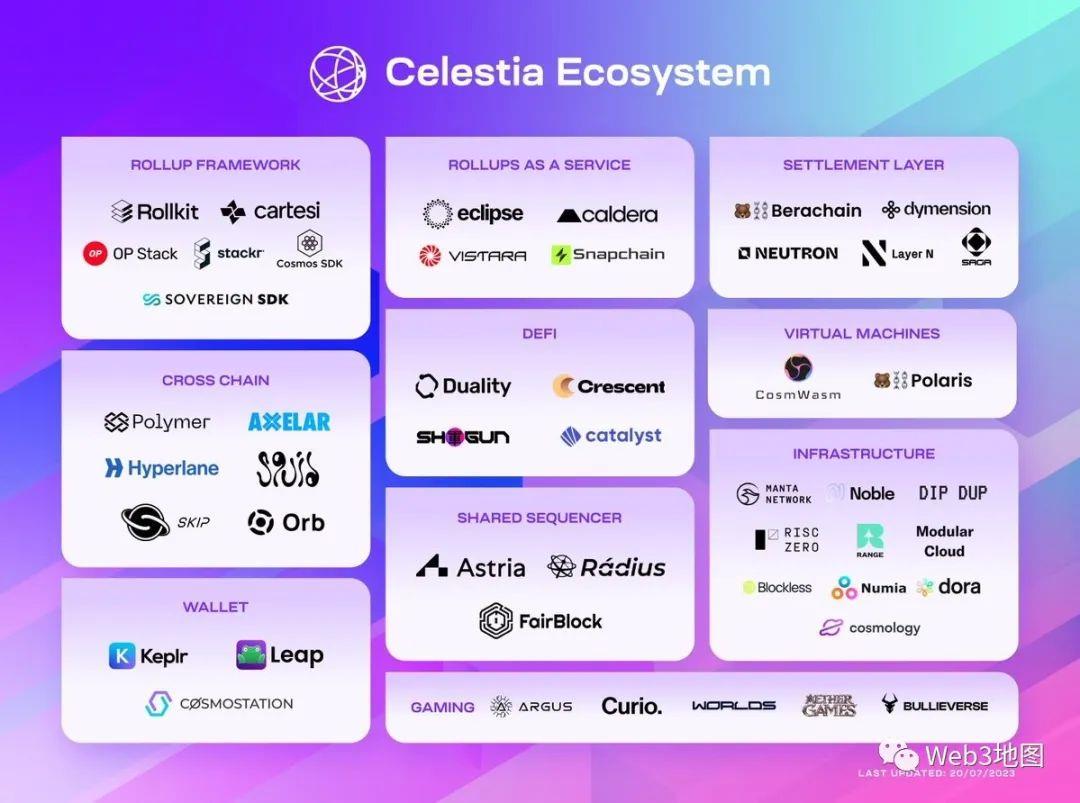

Although not many DApps have been developed on the Celestia ecosystem yet, it appears they already possess all the foundational components required for a thriving ecosystem, including infrastructure, DeFi, cross-chain, wallets, gaming, and more.

Celestia Ecosystem

🧠 Development Team

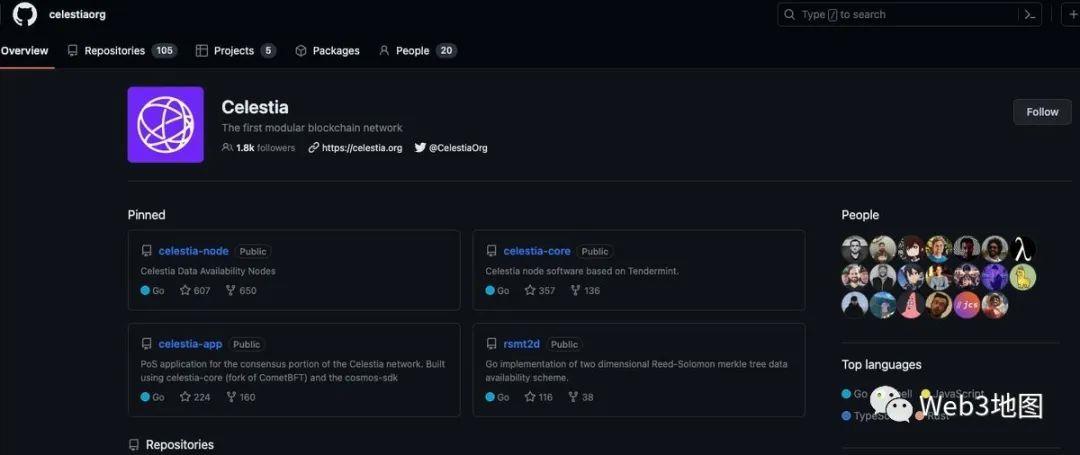

Celestia developers release new versions weekly, continuously improving and fixing issues. This demonstrates their dedication and hard work.

Celestia GitHub

The developers have shown extremely active participation, bringing years of experience from major software development companies.

Team highly active

🧠 $TIA Tokenomics

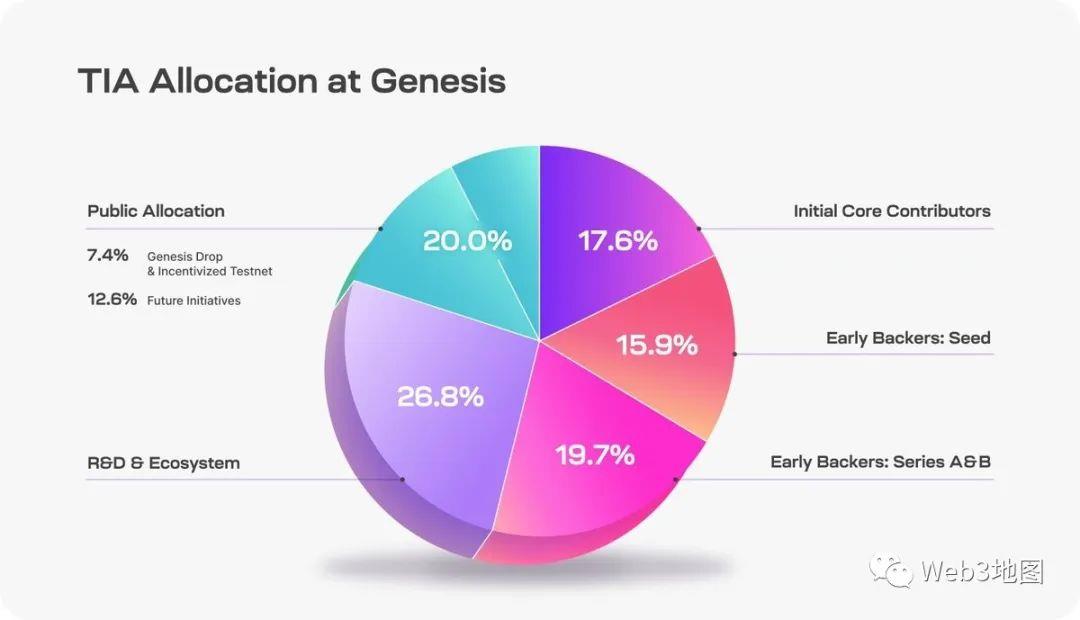

$TIA Genesis Allocation:

-

57% of tokens allocated to the project team, including future plans, R&D, and core initial distribution.

-

35.6% allocated to supporters and investors from various funding rounds.

-

7.4% reserved for airdrops and testnet rewards.

$TIA Genesis Allocation

According to the release schedule, at $TIA launch, 250 million tokens will be in circulation (25% of total supply).

-

Only 74 million $TIA will be distributed to eligible airdrop participants and developers.

-

The team holds 176 million $TIA.

$TIA Release Schedule

Token Utility

-

$TIA tokens are used as gas fees within the Celestia ecosystem.

-

Used for voting in DAO governance.

-

Features a mechanism to reduce annual inflation rates.

-

Stakable in Celestia pools to earn 2% transaction rewards.

🧠 Summary

Why Care About Celestia?

-

A Layer 1 blockchain with modular architecture backed by top-tier VCs.

-

Strong development team with proven reputations.

-

Continuously expanding DApp ecosystem.

-

Already implemented an annual mechanism to reduce token inflation.

What Should You Be Concerned About?

-

The project team's token release schedule for early investors is not well-structured, creating high continuous sell-off pressure starting from year two.

-

They currently have not released a clear roadmap.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News