Friend.tech and Its Friends: What Made Friend.tech a Phenomenon?

TechFlow Selected TechFlow Selected

Friend.tech and Its Friends: What Made Friend.tech a Phenomenon?

More user-friendly (lower entry barrier), highly engaging, with better UI/UX; continuous iteration by the team, and choosing the right infrastructure is crucial for long-term development.

Author: Wendy, IOSG Ventures

Friend.tech is a decentralized social application built on the Base chain that combines fan economy with on-chain speculation. Users purchase tokens called "KEYs" to access specific rooms and view content. As more users buy keys, the price increases. Transaction fees are split evenly between the platform and the room owner.

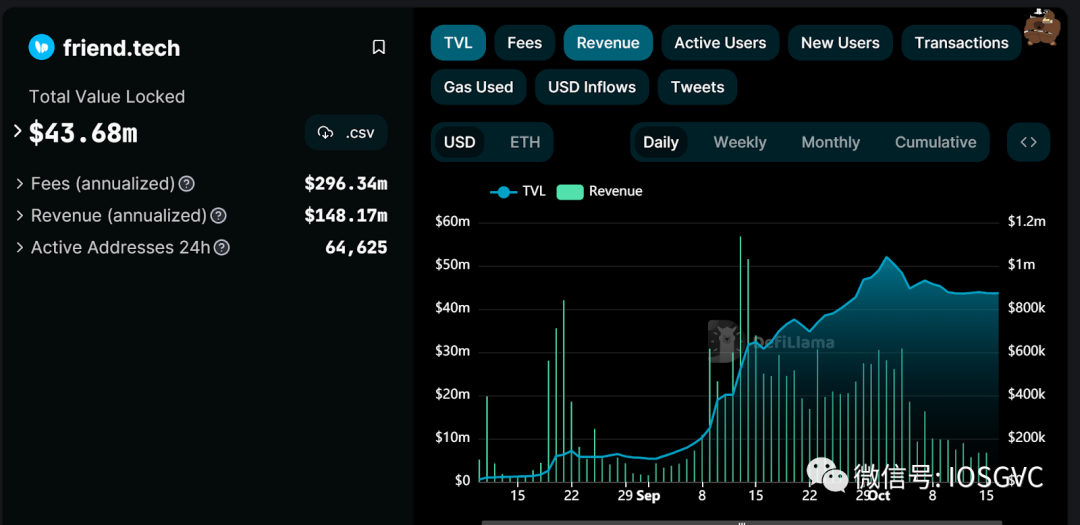

On August 11, Friend.tech announced its official launch via Twitter and shortly after revealed it had secured seed funding from Paradigm. Despite a bearish market, it quickly captured significant traffic. To date, Friend.tech has recorded over 11 million transactions and attracted more than 500,000 unique user addresses. Its innovative design has enabled the project team to earn over $21 million in just two months.

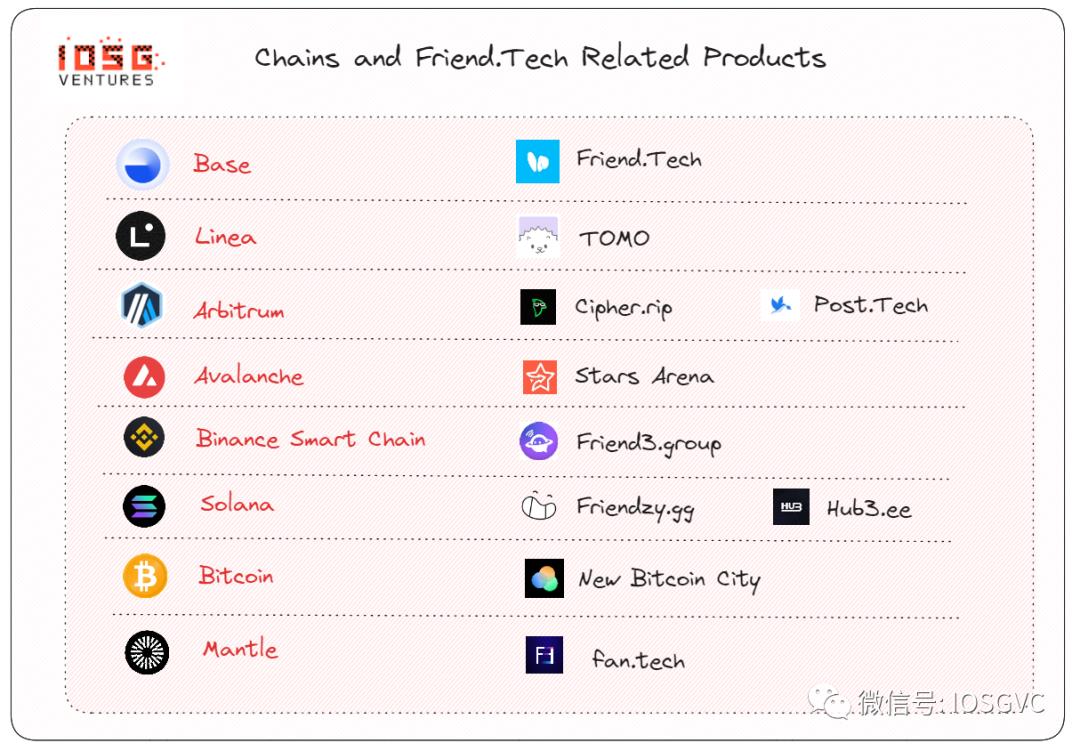

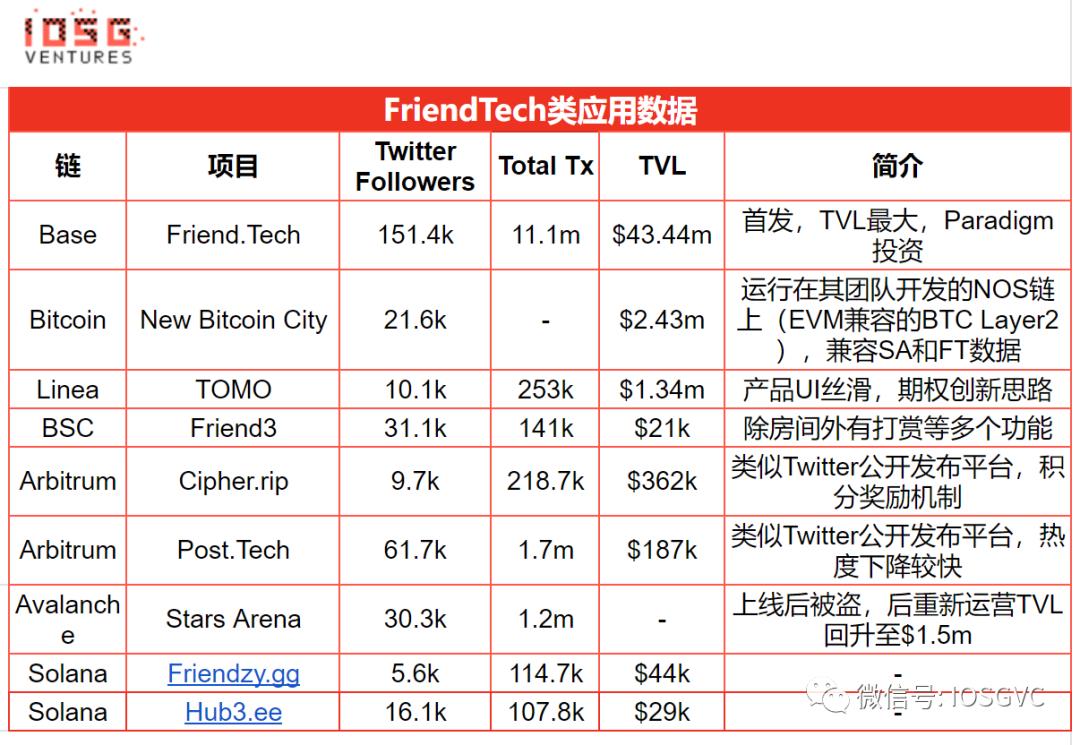

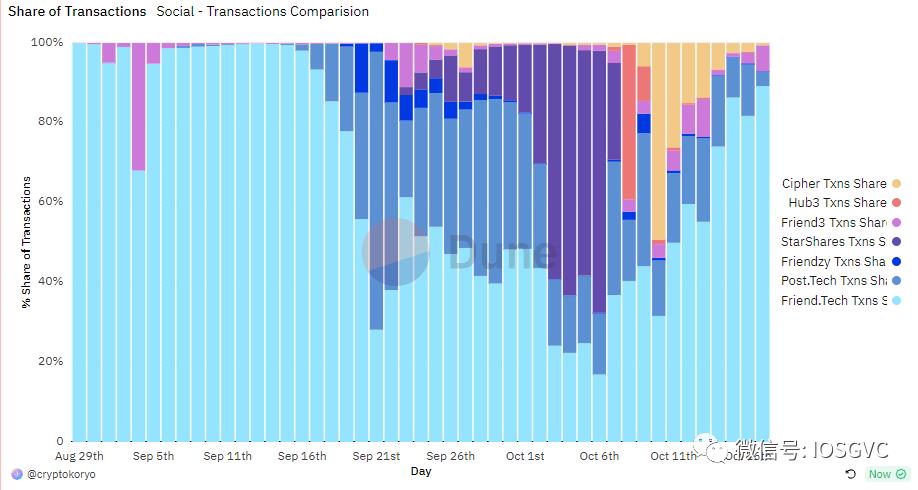

Following Friend.tech’s surge in popularity—and given the team's short-term high returns along with its impressive impact on Base’s TVL—similar products have emerged rapidly across other L2s and public blockchains.

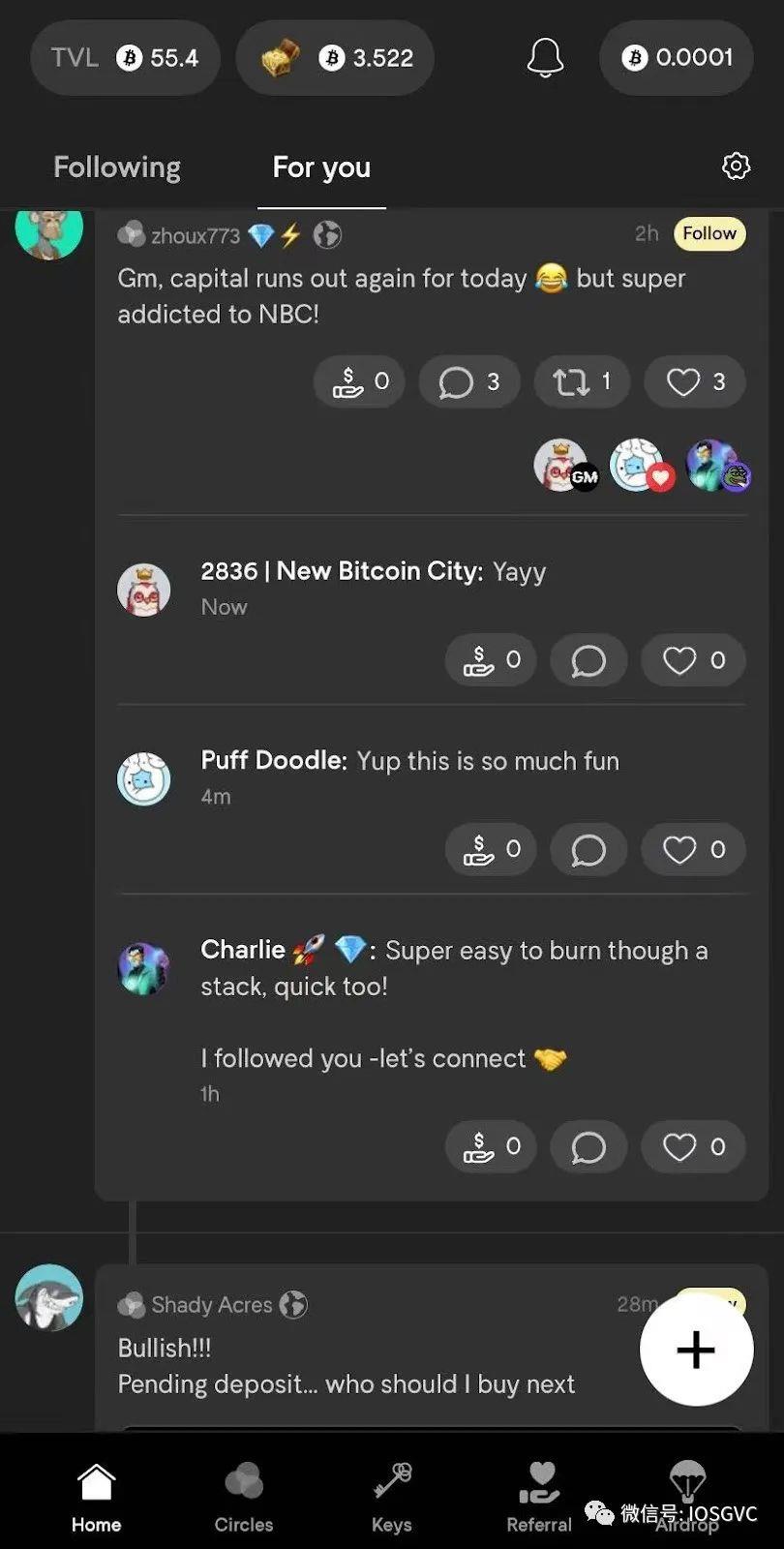

In terms of user data and revenue, Friend.tech remains unmatched. However, user experience issues such as long loading times, lagging, and delayed data updates have frequently drawn criticism. That said, competing projects on other chains have introduced notable improvements. For example, TOMO and New Bitcoin City each now boast TVL exceeding one million dollars. Though launched later than Friend.tech, they reflect independent thinking and iterative enhancements, earning loyal followings of their own.

So how did Friend.tech evolve from concept to a viral phenomenon? This article analyzes Friend.tech and similar on-chain projects through multiple dimensions—including product design, operational strategy, and pricing models—tracing their development lifecycle to uncover core underlying mechanics. Let’s dive in:

Rise: Relationship Migration and Simplified Design

After logging in via Apple ID or email, Friend.tech prompts users to link their Twitter accounts—a crucial step for early-stage social graph formation. Building new social relationships from scratch is extremely difficult due to high user migration costs. Looking at Web2 social media launches, we see similar patterns. When Meta launched Threads as a Twitter competitor, it integrated registration with Instagram—the company’s established social platform—allowing users to sign up using existing Instagram credentials, thereby reducing friction for user acquisition.

Initially, Friend.tech used an invite-code system to create scarcity and generate buzz. Early users received fewer than ten invites each; as the number increased later, mass user onboarding followed. Invite codes were primarily shared on Twitter, underscoring the importance of Web2 platforms during the initial traction phase of socialfi products.

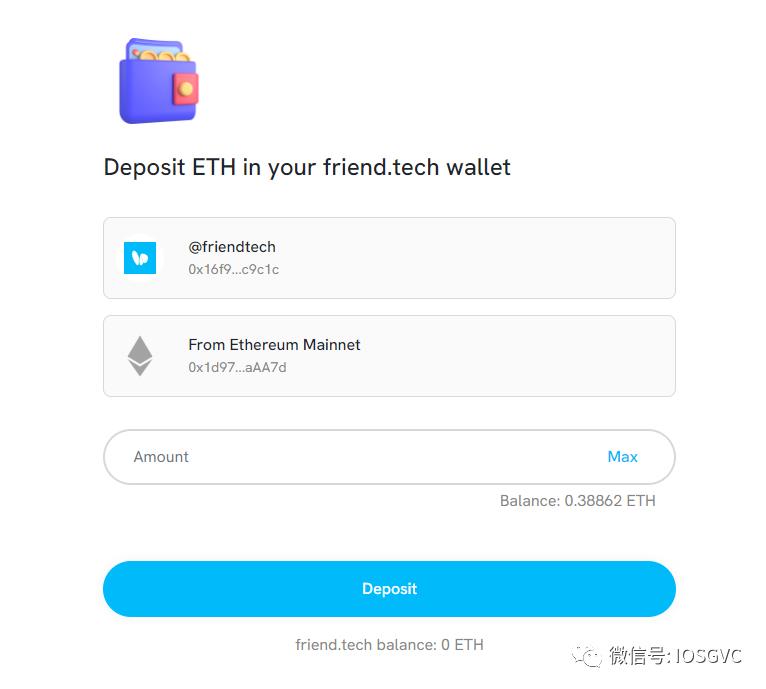

Beyond migrating social relationships, Friend.tech also innovated in lowering user entry barriers. On its second day of launch, the app embedded Base’s official bridge, enabling users to connect wallets like MetaMask and transfer funds directly from Ethereum Mainnet—all within the app. This significantly simplified onboarding and reduced transaction complexity. In contrast, Farcaster, another Web3 social protocol, requires users to pay a $12 annual fee via fiat upon registration—an extra hurdle that inevitably deters some newcomers.

Friend.tech adopted a PWA (Progressive Web App) architecture, allowing users to save the web page to their desktop without downloading a standalone app. This approach simplifies development and avoids potential regulatory or App Store distribution hurdles. On the wallet front, Friend.tech partnered with Privy to implement MPC wallets—ensuring the team never holds user private keys—while eliminating the need for repeated transaction signing.

Growth: Speculative Drive Through Social Financialization

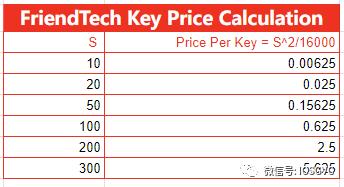

Once users join Friend.tech and deposit at least 0.001 ETH to activate their account, they can buy their first key for free. The price for subsequent buyers follows this formula: (S^2)/16000, where S is the total number of keys sold. This quadratic pricing curve ensures every new buyer raises the price, with later entrants driving larger increases. Since key purchases are discrete integers rather than continuous values, actual buying prices tend to be higher while selling prices are lower. The constant 16,000 was chosen by the team based on estimated market participation and liquidity. Over 95% of rooms have fewer than 50 members, with prices below 0.156 ETH—keeping entry accessible.

On August 15, the team announced plans to distribute 100 million points over the next six months. Anticipation of future token airdrops further boosted user engagement, causing TVL to spike and making Friend.tech the top application on Base by total value locked. However, due to unclear and opaque point allocation rules, users sparked discussions across social platforms. By analyzing early point distributions, it became evident that total holdings carried the most weight, aligning with Friend.tech’s original vision of a personal DEX. Key factors believed to influence point allocation include:

-

Total holding amount

-

Transaction frequency

-

Number of keys held

-

Activity level

-

Number of follows

-

Self-holding ratio of keys

Regarding transaction mechanics, each trade incurs a 10% fee—half (5%) goes to the Friend.tech team, the other half (5%) to the room owner as incentive. This revenue-sharing model disproportionately benefits the platform and top-tier KOLs. For instance, Racer, a popular Friend.tech developer, earned over $440,000 in referral fees within just two months.

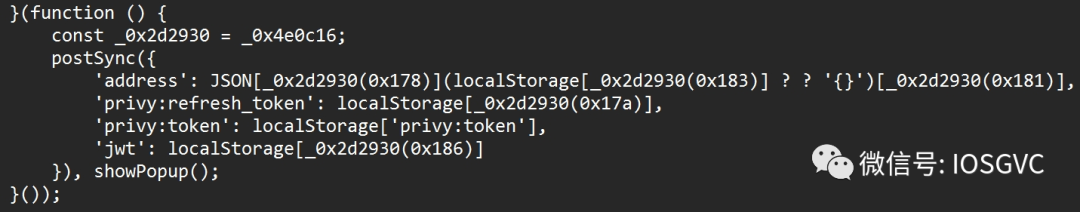

However, as user numbers grew and hype intensified, phishing attacks and rug pulls began to surface. On September 30, froggie.eth tweeted that he lost over 20 ETH after falling victim to a SIM-swapping attack. By October 5, four FT users collectively lost 234 ETH. Attackers typically used SIM swaps to gain access to FT accounts and dumped all keys. Even with 2FA enabled, attackers deployed malicious JavaScript scripts disguised as bookmarks. Once clicked, these scripts could intercept 2FA codes, compromising both Friend.tech and the embedded Privy wallet—resulting in full asset theft. A similar product on the AVAX chain suffered a smart contract exploit that drained its entire TVL. Eventually, the hacker agreed to return $2.9 million worth of AVAX tokens (~90% of stolen funds).

(Image source: @evilcos)

Maturity: Positive Externalities and Value Construction

Improvement of Trading Infrastructure

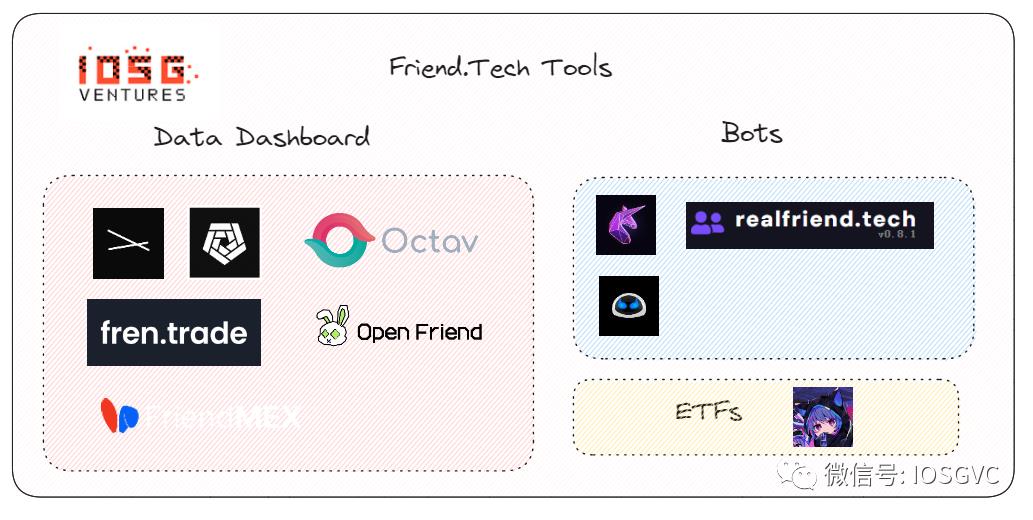

As trading activity on Friend.tech increased, the lack of intuitive data visibility created demand for supporting tools. An ecosystem began forming around the platform, with developers creating dashboards and utilities. For example, engineers from Paradigm built FriendMEX, a data dashboard visualizing KOL token prices, tracking new users and trades. Parsec and Arkham also developed specialized analytics platforms for Friend.tech, alongside bots designed for frontrunning. Unibot launched a “Snipers Bot” for FriendTech supporting two modes: User Snipe (set a list of usernames to automatically buy keys when they’re created), and Auto Snipe (automatically target new keys if creators meet minimum follower thresholds). Notably, no transaction fees apply. The emergence of ETF-style funds further enriched the ecosystem. Herro, for instance, raised 120 ETH as seed capital to invest in top-tier keys, aggregated room content, and promised future airdrop rewards for fund holders. This allows smaller investors to benefit from blue-chip key appreciation and shared airdrop yields, reducing volatility and risk exposure.

Product Functionality and User Experience Enhancements

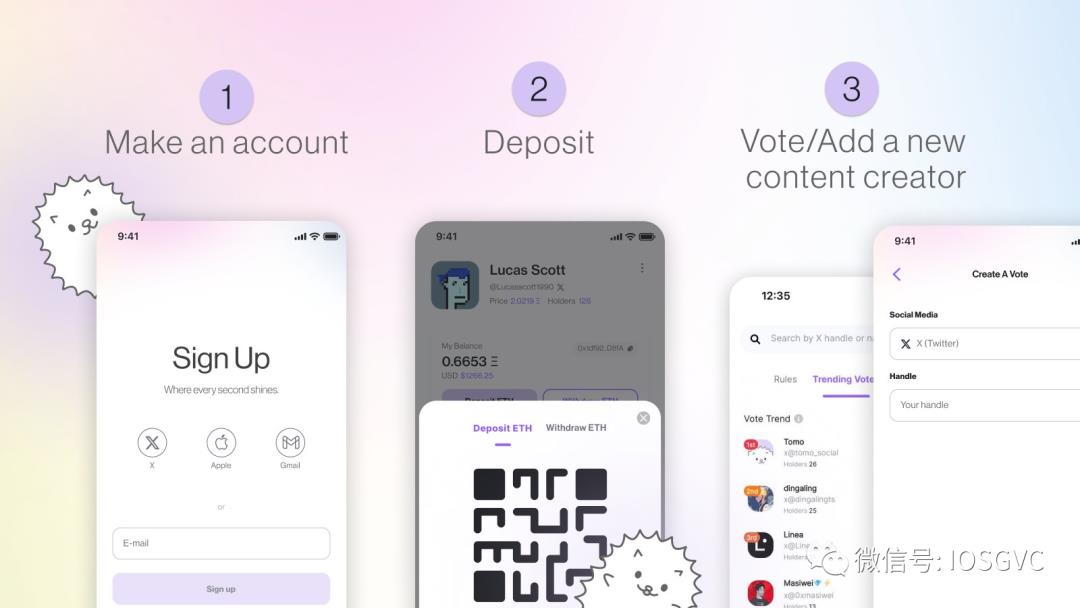

Tomo is a socialfi platform on Linea similar to Friend.tech but built as a native app instead of a PWA, offering smoother performance. It divides chat into private and group sections: holding someone’s key grants access to one-on-one chats with the KOL, while group channels are fully public. Tomo’s price curve is much flatter, leading to slower price growth. One major difference lies in pre-KOL activation: before a creator joins, their “vote” tokens can already be traded. Of the 10% transaction tax, half goes to the KOL (claimable upon login), incentivizing early adoption; the other half goes to the protocol, boosting revenue. After joining, “votes” become “keys,” and feeds display trending votes and keys. If a KOL doesn’t join within six months, taxes go to current holders. A downside is that this encourages sniping, discouraging room owners from managing prices or investing effort. For security, Tomo uses AA wallets and integrates the Linea official bridge. It enjoys strong backing from the Linea team, which promoted Tomo on Twitter and even joined the platform to show support.

New Bitcoin City positions itself as “Friend.tech on Bitcoin.” Also built as a PWA, it supports BTC, ETH, and AVAX payments, and migrates holdings and social graphs from Friend.tech and Star Arena—meaning balances on those platforms remain valid and aggregated upon login. Compared to Friend.tech, NBC offers richer features: voice messages, red packets, GIFs, image uploads in group chats, public square posting, content tipping (like Twitter posts), and five built-in mini-games. To address trust issues arising from Friend.tech’s “(3,3)” gameplay, NBC enforces a 30-day lockup in its contract to prevent immediate resale. Room owners can set minimum entry thresholds and fractionalize keys—for example, setting access at 0.1 key if full key price is too high. They can also customize fee splits (default is 8% to owner, 2% to platform) and batch-buy keys or send mass (3/3) requests—similar to Blur’s bulk-purchase feature. Beyond invite codes, NBC adds exchange-style commission rebates to attract users. However, its overall design is overly complex, and as one of several products under the NBC team, long-term development sustainability remains uncertain.

Other chains have seen similar experiments. Friend3 (@Friend3AI), a socialfi game on BNB Chain, is open-source and audited by PeckShield. It currently supports tipping creators in BNB and USDT. As of September 18, it achieved over 12k MAU and more than 20,000 transactions. Cipher on Arbitrum has surpassed 50,000 total users, with over 270,000 transactions and a volume of ~2,500 ETH. Yet due to network effects and stickiness inherent in social products, truly successful ones are hard to replicate. Without innovation in UX or reward mechanisms, most clones will remain short-lived.

Conclusion and Outlook

Short-Term Traffic vs. Long-Term Value

Since its first day, Friend.tech has faced relentless debate over whether it’s a Ponzi scheme. Critics argue the upward price trajectory is unsustainable, driven largely by speculation or token incentives. While trading activity is vibrant today, sustaining long-term user retention remains questionable. Admittedly, from a purely financial perspective, a quadratic pricing model rarely sustains longevity. Yet user behavior on Friend.tech isn't solely speculative—many room owners actively add value: sharing alpha, building tools, hosting offline meetups, distributing gifts. These efforts realize real knowledge monetization and fan economy functions. Some events are even organized entirely through Friend.tech connections. Drawing parallels to Web2, Knowledge Planet generates hundreds of millions annually by charging a 20% fee on similar services. In such contexts, Friend.tech demonstrably enables genuine social interaction and creates tangible value beyond price fluctuations—delivering clear positive externalities.

Much like the NFT summer of 2021, when NBA star Stephen Curry and pop icon Justin Bieber made headlines purchasing BAYC NFTs—and brands like Li-Ning joined the trend—Friend.tech may achieve mainstream breakout and onboard new users. According to iResearch’s report on China’s influencer economy, the fan economy-related market exceeded 4.1 trillion yuan in 2020 and is projected to surpass 6 trillion yuan by 2023. Under Friend.tech’s product framework, fan economy could serve as a powerful engine for mass adoption. With only 500,000 users, Friend.tech has already generated $20 million in protocol revenue and $40 million in TVL. As technologies like AA and MPC wallets mature, further lowering barriers to Web3 social apps, the vast fan economy market looms ahead—offering ample room for growth and innovation in the Friend.tech model.

Balancing Social and Financial Attributes

Friend.tech-type products have reinvigorated industry imagination around socialfi. Compared to protocols like Lens and CyberConnect, Friend.tech offers stronger engagement and entertainment value. Its pricing mechanism and on-chain trading create a fair, transparent speculative arena, while point-based incentives effectively guide and adjust user behavior, encouraging broader liquidity and value exchange. Undoubtedly, its strong financial layer drives massive traffic—user speculation and profit-seeking act as key accelerators. Beyond speculation, the revenue-sharing model (via trading fees) gives room owners incentives to curate quality content and foster social connections, reinforcing user retention and token value in a virtuous cycle.

On the other hand, chat content within rooms is not stored on-chain—suggesting that ideal socialfi products need not store all data on-chain. Balancing data ownership with good user experience is a challenge all application-layer builders must confront.

A New Opportunity for Web3 Application Layer

In 2016, Joel Monegro published “Fat Protocols,” arguing that blockchain and internet differ in value capture: in the internet era, value concentrates at the application layer (e.g., Google, Facebook, Alibaba, Tencent), while foundational protocols like TCP/IP and HTTP capture little. Blockchain flips this: value accumulates at the shared protocol layer, leaving only thin margins for applications—hence “fat” protocols and “skinny” apps. This idea fueled the rise of infrastructure-focused investments.

Looking back, the “fat protocol” thesis gained traction in the last cycle. But as blockchain infrastructure matures, the relationship between protocols and applications is less about “fat” vs. “skinny” and more about “front” and “back”—infrastructure first, then application prosperity. Infrastructure needs compelling use cases to showcase its strengths. Today, attention has shifted toward how to build viable Web3 applications and bring in users.

With Friend.tech’s breakout success, the team’s short-term windfall, and its dramatic impact on Base’s TVL, similar projects have sprouted across L2s and public chains. As major L2s mature, their technical advantages and narratives are well understood—making user and application acquisition the next frontier. Consequently, many L2 teams now actively welcome and promote new applications on social media. Linea officially joined TOMO and promoted it publicly; AVAX founder Emin Gün Sirer personally endorsed Stars Arena (a Friend.tech-like project), even managing crisis communications after it was hacked and drained. These actions reveal infrastructure providers’ eagerness for breakout apps within their ecosystems.

Friend.tech’s rise prompts deeper reflection on what constitutes a good Web3 application: low entry barriers, engaging experiences, superior UI/UX; continuous iteration; strategic choice of infrastructure for sustainable growth. Web3 founders should consider how to transition from early paradigm pioneers to long-term innovators—how to achieve legitimacy and capture protocol-level value, successfully cold-starting the first generation of Web3 social apps and extending their lifecycle. We support, encourage, and welcome more experimentation and innovation at the application layer. While many products still face challenges, ongoing exploration brings us closer to discovering the right formula for Web3 applications—until we finally achieve mass adoption, broad impact, and lasting success.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News