A Brief Look at Crypto Traffic Entry Points: Telegram, Discord, and PWA

TechFlow Selected TechFlow Selected

A Brief Look at Crypto Traffic Entry Points: Telegram, Discord, and PWA

This article will analyze why Discord had the potential to become a traffic gateway and the reasons it failed, as well as the possibility of PWA serving as a traffic gateway.

Author: Turbo Guo

Reviewers: Mandy, Joshua

TLDR

Telegram, with its potential to become a crypto traffic gateway, has already attracted significant attention. This article summarizes crypto-related applications within Telegram, analyzes their strengths and areas for improvement, examines why Discord had the opportunity to become such a gateway but failed to do so, and explores the possibility of browsers (PWAs) serving as entry points. Key takeaways include:

-

Telegram hosts a wide range of crypto-related applications with strong user experience, making it an excellent platform for crypto apps. However, the lack of separation between app centers, bots, and chat channels may lead to usability issues.

-

Telegram is not limited to the TON ecosystem—various chains and protocols can integrate seamlessly. Examples include EVM-based trading bots and multi-chain wallet tracking tools.

-

Discord could have played a role similar to Telegram’s current position, given its powerful bot system. However, due to resistance from core gaming users, widespread crypto scams threatening user safety, and unclear regulatory conditions, Discord has refrained from full crypto integration.

-

Browser-based applications (PWA) are well-aligned with the existing crypto ecosystem. On mobile, however, traffic gateways may shift from MetaMask to specific apps—Friend Tech being a prime example.

-

The ultimate gateway will depend heavily on user experience and regulation. Apps like Telegram and Friend Tech, which embed crypto functionality (including built-in wallets), offer compelling UX advantages. Meanwhile, lighter regulatory scrutiny gives native or less-regulated platforms a strategic edge over traditional social giants.

Telegram as a Traffic Gateway

Telegram already hosts numerous crypto applications. First, let's examine how these apps exist and how users access them.

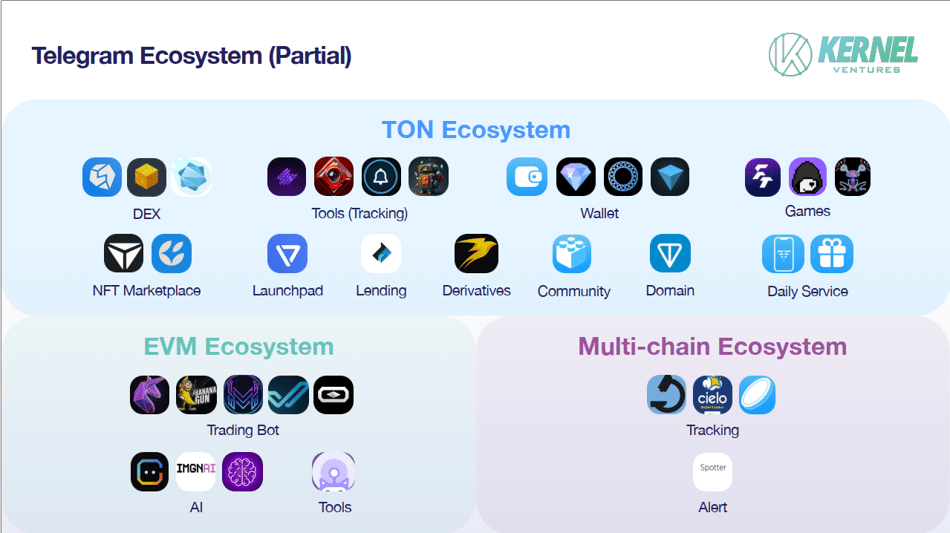

Image source: Kernel Ventures

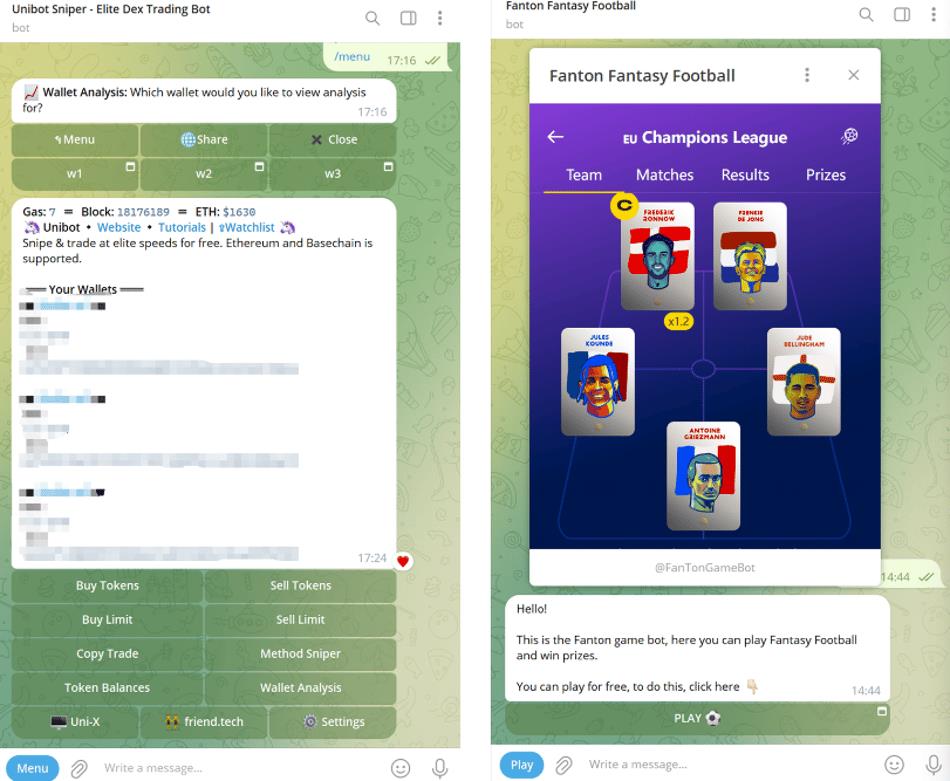

There are two types of "apps" in Telegram: Telegram bots, which interact via chat interfaces, and Telegram Web Apps (TWA), which open small web windows. In the image below, Unibot on the left is a typical bot, while the football game on the right—and many blockchain games on Telegram—are TWAs. Technically, TWAs use JavaScript, HTML, and CSS, running functionalities through mini-browser windows within Telegram.

There are three ways to access apps in Telegram: via links, searching the app name, or entering the Telegram Apps Center. Link and search methods resemble joining a channel, while accessing the Apps Center works similarly—via link or by searching @tapps_bot.

Image source: Unibot and Fanton Fantasy Football interface

Telegram hosts not only projects from the TON ecosystem but also apps based on other public blockchains. These will be discussed separately.

TON Ecosystem Applications

First, wallets: Telegram previously hosted several wallets such as Tonkeeper, MyTonWallet, and Tonhub. However, the launch of the official custodial Wallet and the non-custodial built-in Ton Space poses a major challenge to earlier wallets.

Wallet is a custodial solution supporting payments in USDT, TON, and BTC. Within Wallet, the experimental non-custodial TON Space is being tested. In the future, users will access DeFi applications like DEXs, staking, and lending protocols directly through TON Space, along with third-party dApps on the TON blockchain. Notably, TON Space allows wallet recovery via email—an extremely user-friendly approach despite potential security risks.

In DeFi, the TON ecosystem remains early-stage. DEXs include Megaton Finance, STON.fi, DeDust.io, and cross-chain experiment STON; lending protocols include Evaa; derivatives offerings include Storm Trade. The ecosystem also includes launchpad Tonstarter and domain service TON DNS.

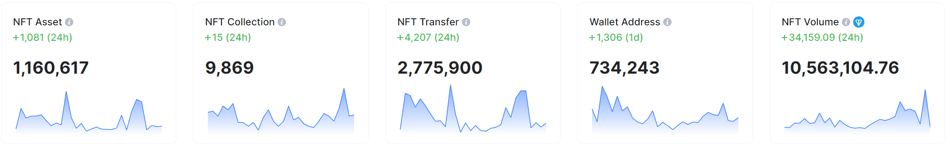

The TON NFT ecosystem is also taking shape. Marketplaces include Fragment and Getgems. Users can purchase Telegram usernames and anonymous numbers on Fragment, while Getgems allows trading of usernames, anonymous phone numbers, and other TON-based NFTs—though Fragment currently sees higher trading volume. In terms of total volume, TON's NFT market showed solid growth as of September 25. Project content closely mirrors Ethereum’s ecosystem, including initiatives like TON Diamonds and TON Punks.

Image source: nftscan, 2023/09/25

Another category consists of games integrated with TON, such as Fanton Fantasy Football—a P2E idle football card game where players earn tokens and seamlessly connect with the TON ecosystem; Punkcity, a turn-based combat game rewarding winners with tokens; and Tongochi Game, a P2E MMORPG currently in demo phase.

Numerous utility tools also exist. For example, TON Wallet Tracker and TON Notify Bot monitor token and NFT flows for specific addresses in the TON ecosystem; NFT TONificator tracks listings and offers for specific NFT collections; Community serves as an onboarding bounty tool; Ton Gifts Bot enables gifting to friends. Friends All-in-One BOT aggregates various functions—though many remain unlaunched. The team plans to prioritize delivering translation features, new NFT mint alerts, and NFT floor price notifications, each to be provided by separate dedicated bots.

An interesting case is Mobile, a lifestyle service allowing users to purchase eSIM cards for easier internet access during international travel. More importantly, it supports both credit card and TON wallet payments.

Ethereum Ecosystem Applications

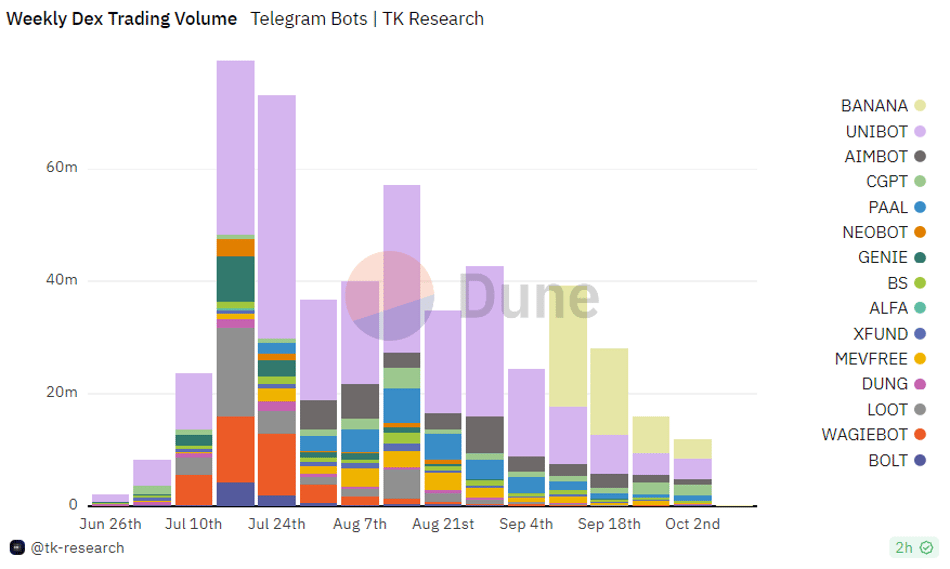

Image source: DUNE @tk-research

This section covers popular trading bots. Abstracting away backend details, these bots essentially operate as proxy-based fee-charging services. Weekly trading volumes indicate that after an initial surge, TG bots are now experiencing declining popularity.

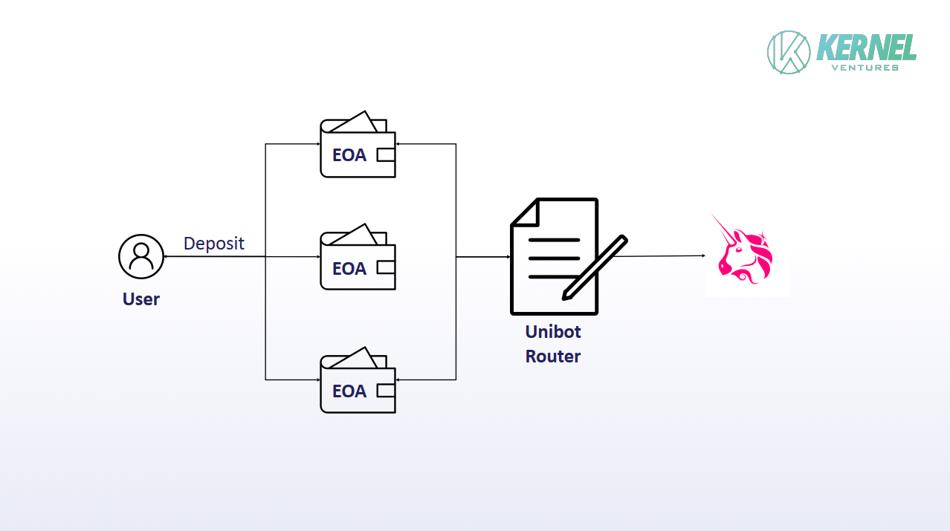

Unibot functions as a scientific agent: users deposit funds into an official wallet, then trigger limit orders, copy trades, and instant buy commands via Telegram chat. Technically, Unibot first creates an externally owned account (EOA) for the user and deposits funds. When a trade is initiated (e.g., selling tokens on Uniswap), instead of the EOA interacting directly with Uniswap, it routes through Unibot’s contract, which then calls Uniswap’s contract. This extra step allows Unibot to charge fees. Each time Unibot updates its contract, it may add new features—the current version is not open-sourced.

Unibot Transaction Flow Image source: Kernel Ventures

Similar trading bots include Banana Gun, Maestro, and DexCheck. Banana Gun requires either private key input or generates a new address via its official bot. Its standout features include transaction cancellation upon detecting sandwich attacks and optimized block bribery. Maestro, another trading bot, offers whale tracking and token trading. DexCheck provides wallet tracking, sniper detection for new token contracts, and trading capabilities.

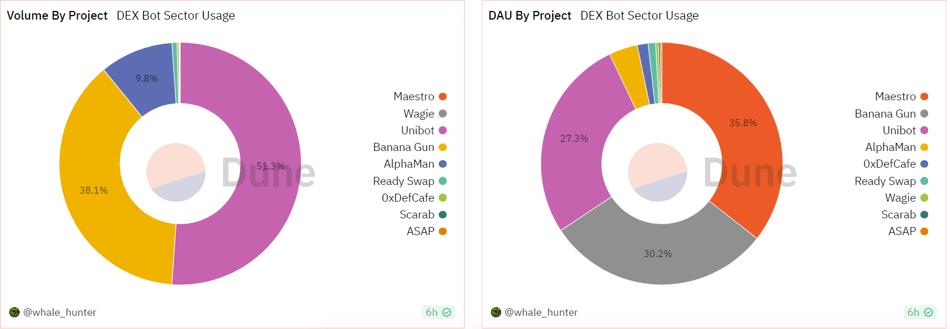

In terms of trading volume, Unibot leads, followed by Banana Gun. Based on DAU, Maestro ranks highest, though only slightly ahead of Banana Gun and Unibot.

Image source: DUNE @whale_hunter, 2023/09/25 1:10

Other Ethereum-based service projects include LootBot, which automates airdrop farming—holders of $LOOT tokens receive profit shares. IMGNAI offers a bot that generates images from messages posted in channels, with future governance rights promised to token holders; its token resides on Ethereum. ChainGPT offers diverse services, including a Telegram bot acting as a general-purpose LLM for generating smart contract code and auditing contracts. $CGPT is used internally to purchase ChainGPT services, with staking rewards available; the token is also issued on Ethereum. This represents leveraging Ethereum for token issuance where tokens serve multiple utility functions beyond speculation.

Multi-Chain Ecosystem Applications

Telegram also hosts multi-chain applications, primarily data or auxiliary tools. Four representative examples include:

-

Cielo is a comprehensive wallet tracking bot with robust multi-chain support. It monitors activities across dozens of chains—including swaps, lending, and NFT mints—for individual wallets, and tracks large transactions for specific tokens. Notably, Cielo delivers strong user experience.

-

Pessimistic Spotter detects whether a contract has been compromised, supporting contracts on Ethereum and BSC such as Uniswap.

-

CoinCrackerBot tracks cryptocurrency prices and sends price alert notifications. Its user experience stands out, as receiving updates directly within a messaging app is inherently convenient.

-

Crypton Research helps track project developments. Users can subscribe to projects like 1inch or Aave and choose to receive all news or only highlights, after which the bot pushes relevant updates.

Telegram’s Strengths and Areas for Improvement as an Entry Point

Telegram’s seamless user experience is a major advantage. Transfers, app launches, and interactions with bots are smooth—surpassing most web3 products and even competing favorably against web2 platforms like Discord.

However, accessing the Telegram Apps Center remains inconvenient. There is no direct entry point within Telegram’s interface—it requires using an external link or manual search, just like joining a new channel. Furthermore, the Apps Center and associated apps mix with regular chat channels, making them easy to lose. Even if users pin them, they compete visually with important conversations. Additionally, many apps create separate bots for each function, leading to cluttered management. A dedicated interface for apps—with better discoverability and organization—would greatly improve usability.

Currently, Telegram effectively meets basic user needs like transfers, while EVM-based bots cater to retail demand for new token launches. How TON will scale DeFi and other complex applications remains to be seen.

Trading bots suggest a new direction: Telegram could serve as a unified frontend for diverse blockchain applications. Not only could DeFi protocols share a common interface, but various protocols could be integrated directly within Telegram. If managed properly, users might not even need to know which chain they're using—greatly lowering the barrier to crypto adoption. That said, challenges remain, such as simplifying signature requests directly within Telegram.

Currently, Telegram is actively promoting the TON ecosystem, while non-TON bots like Unibot continue advancing. The future trajectory remains to be determined.

Discord’s Opportunity as a Gateway

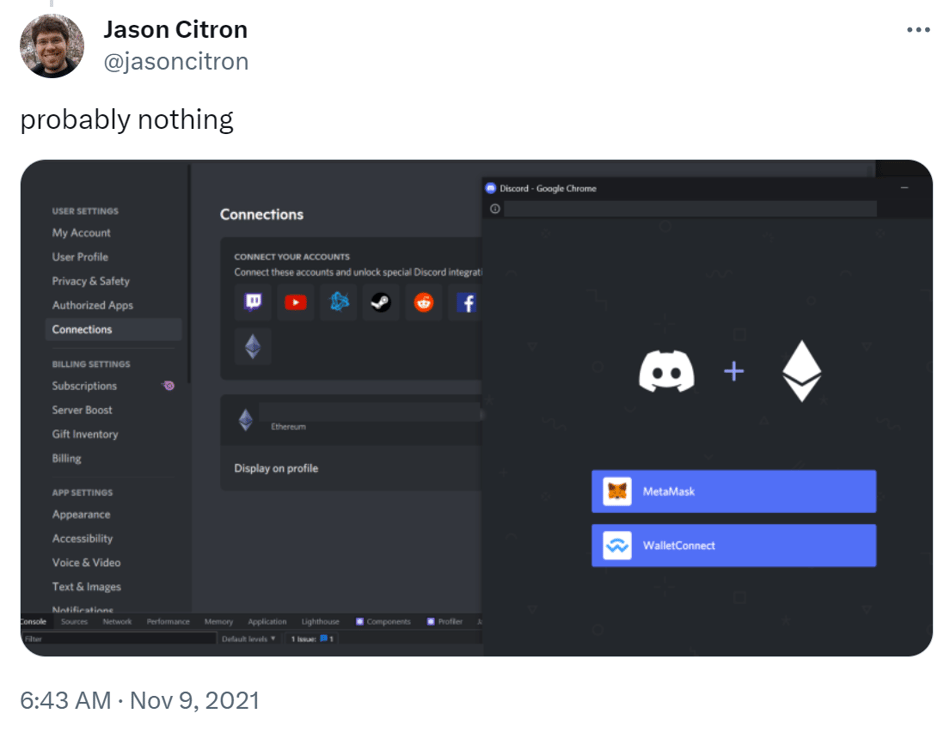

Image source: Tweet from Discord CEO

As early as 2021, Discord experimented with MetaMask integration. Had this been scaled, users could transfer and pay directly within Discord. Individual dApps could develop their own channels or bots to enable swapping, lending, and more—turning Discord into a universal crypto frontend.

In fact, Discord already hosts numerous crypto use cases. Bankless DAO uses Discord as a governance tool, implementing governance bots and workflows—such as verifying NFT ownership for identity assignment and granting channel access based on token holdings. During the NFT summer, Discord became the most critical community tool for NFT projects—users farmed roles, claimed whitelist spots, launched AMMs, and built massive communities. Discord even solicited user feedback on NFT-related features, indicating serious consideration of product adjustments for NFT communities. In theory, Discord bots can support many functionalities, and existing tools already allow wallet tracking, NFT transaction monitoring, and whitelist management.

Image source: Bankless DAO Discord

So why didn’t Discord proceed? Three likely reasons:

-

Resistance from core gaming users;

-

Widespread fraud threatening user safety;

-

Unclear regulatory environment.

Discord’s original vision was “Chat for Gamers,” and it grew from serving gamers. According to a 2021 CNBC report, 70% of users joined Discord for gaming or related purposes. Although the company later broadened its mission to “Chat for Communities and Friends,” serving gamers remains central. When Discord began supporting NFT communities, many users protested, canceled Nitro subscriptions, and expressed strong aversion toward NFTs. The gaming community has long harbored resentment toward crypto—during the PoW mining era, GPU shortages drove up hardware costs, and post-mining, players often ended up buying used mining cards (GPUs degraded from intensive mining). It’s likely some gamers extended this historical frustration into today’s skepticism toward crypto.

Additionally, the founder stated that crypto is rife with spam and fraud, and Discord prioritizes user protection—thus having no plans for full crypto integration. As a compliant platform, minimizing fraud is a rational choice. With unclear government regulations at the time, prematurely embracing crypto and risking widespread user losses would have been too great a liability for Discord.

This highlights a core difference between Discord and Telegram: differing user demographics and platform positioning. Discord’s primary users are compliant, often gamers, whereas Telegram attracts more gray-market users. Hence, Telegram’s aggressive push into crypto does not provoke backlash from its core base. Discord positions itself as a community tool, while Telegram embraces characteristics like spam and operates under looser oversight—giving Telegram greater freedom to innovate in crypto.

Browser (PWA) as an “Entry Point”

The trend of browsers/web apps replacing native apps in certain scenarios is worth noting. Friend.tech uses PWA; Photoshop offers a web version powered by cloud storage enabling cross-device workflow; cloud gaming is also gaining traction. As cloud computing advances, web apps can support increasingly complex functions. PWAs offer distinct advantages.

For instance, PWAs support offline operations, dynamic content updates, push notifications, cross-platform compatibility, and access to device hardware like cameras and GPS—similar to native apps. Convenience-wise, the debate between web and native apps continues. Some argue web apps are easier to access via links without installation; others prefer launching pre-installed apps from the home screen. With PWA, the distinction fades. On desktop, browser wallet extensions are mature—enabling wallet usage during web gaming or interaction with DeFi apps. Moreover, PWAs bypass platform fees from companies like Apple, a crucial benefit for crypto apps.

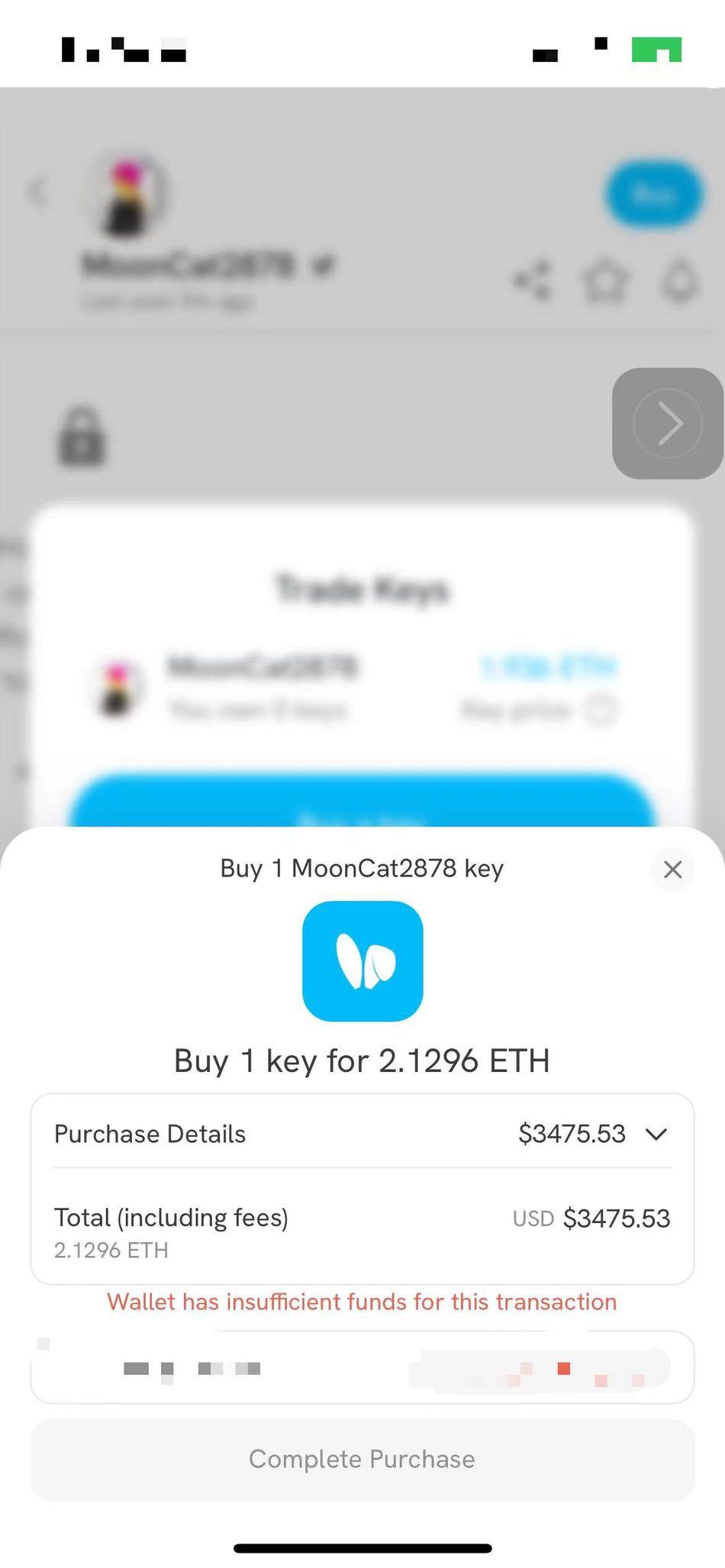

But will wallets remain the primary gateway in browsers? On mobile, Friend.tech suggests otherwise—users accept embedded wallets. Depositing funds into an app (which may operate as an L2 or even custody assets) and managing them internally is acceptable because users don’t care about wallet specifics. Launching MetaMask separately on mobile is cumbersome. Therefore, standalone social apps can replace MetaMask as traffic gateways—the economic loop hinges not on the wallet, but on integrated services, with providers like Friend.tech embedding wallets directly.

Image source: Friend.tech key purchase interface

Conclusion

Comparing Telegram, Discord, and browser-based (PWA) solutions reveals that the dominant traffic gateway will largely depend on user experience and regulation. In UX, Telegram outperforms many native crypto apps—a key strength. On mobile, apps like Friend Tech with built-in wallets reduce MetaMask’s competitive edge as a gateway. From a regulatory standpoint, traditional social media giants face intense pressure adopting crypto, creating opportunities for lighter-regulated or native platforms like Telegram or Friend Tech.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News