Ponzi Social, Can It Recapture the Glory of DeFi Summer?

TechFlow Selected TechFlow Selected

Ponzi Social, Can It Recapture the Glory of DeFi Summer?

Questioning Ponzi, understanding Ponzi, becoming Ponzi.

Friend.Tech is hot.

The model, centered around KOLs and allowing fans to buy and sell "shares" of KOLs, isn't complicated—and carries more than a whiff of "Ponzi." Yet amid scarcity of liquidity and lack of excitement in a deep bear market, Friend.Tech has indeed sparked a SocialFi frenzy.

Take Star Arena, recently surging on Avalanche. Despite dramatic ups and downs—including endorsement from Avalanche’s founder and a complete fund drain due to a contract vulnerability—it remains a focal point of attention.

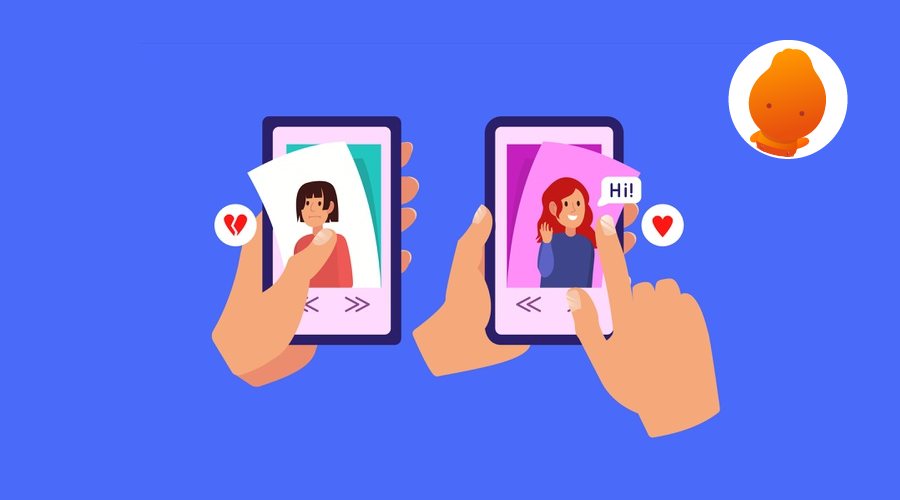

Meanwhile, the wave continues spreading:

Starting from Base, an L2 chain, FT-inspired clones have rapidly emerged across other ecosystems such as Avax, Arbitrum, Solana, Polygon, and Bnb. These projects are making various improvements and innovations based on FT, trying to capture this rare moment of momentum.

On Twitter, countless crypto-related discussions and accounts continue promoting FT and similar projects—creating a palpable FOMO sensation that if you're not involved, you might miss out on millions.

DeFi Summer, Déjà Vu?

Chasing yields, clone projects multiplying, constant buzz—does all this feel oddly familiar?

Yes, it's hard not to think of DeFi Summer in 2020.

Chris, partner at well-known VC Placeholder, said social Ponzi schemes are the new DeFi Summer, describing how current projects like FriendTech mirror the development path of DeFi Summer:

An experiment → Traffic influx → Viable model begins to sprout → Attracts more attention and improved experience → Larger-scale applications emerge → Brings everyone else in within 18–24 months.

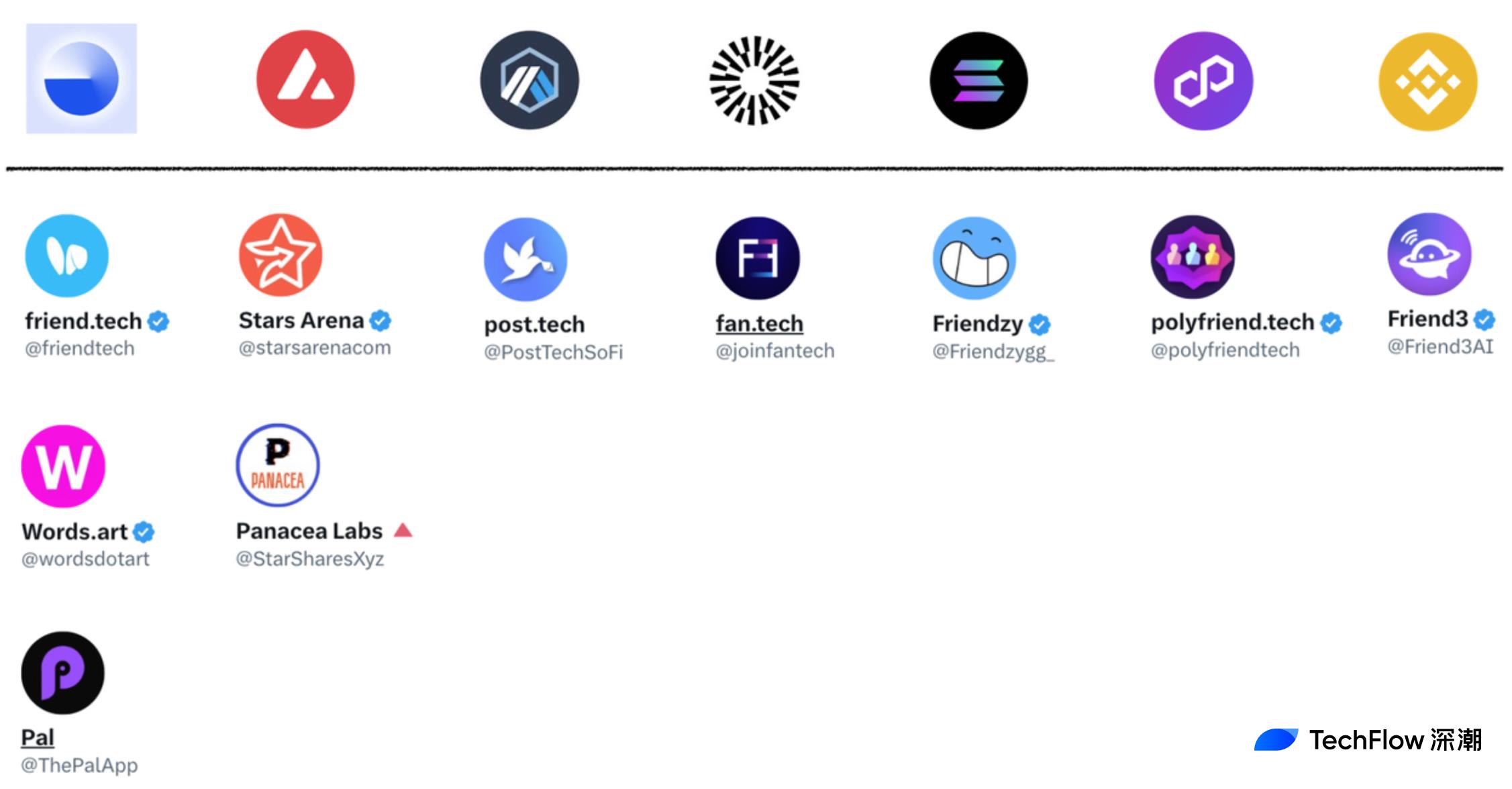

If you look back carefully at DeFi Summer three years ago, this trajectory does seem eerily similar.

In June 2020, Compound launched large-scale “liquidity mining,” attracting many users to provide liquidity. Soon after, multiple protocols found the model viable and began adapting and refining liquidity mining designs, tweaking tokens and economic models to draw even more participants.

Eventually, total value locked (TVL) in the entire DeFi sector surged from $1 billion in June to $10 billion by October, with user numbers skyrocketing. Gas fees on Ethereum also hit record highs at the time.

One concept—liquidity mining—and one leading project ignited a summer-long boom, cementing DeFi’s solid position.

Now, will a social-Ponzi concept led by Friend.Tech spark a similar wave across different ecosystems and ignite a SocialFi revolution? Industry players seem to sense a similar vibe, collectively anticipating an upcoming market turning point.

Craving Traffic, Igniting Traffic

While this SocialFi surge may follow a path similar to DeFi Summer, it faces a harsher market environment—the entire market seems hungrier for traffic than ever before.

As the market turns bearish, numerous L2s are launching simultaneously. With little meaningful technical differentiation, each L2 hopes to find a traffic hook to stand out and gain visibility and liquidity in an intensely competitive landscape.

Thus, we saw Friend.Tech cause Base’s TVL to skyrocket, quickly rising through the ranks among L2s and securing a stable foothold.

This hunger for traffic is even more evident on L1 chains that appear to be "fading."

Avalanche’s founder, Professor Gun, has publicly expressed support and optimism for Star Arena since its launch. Even after SA lost all funds due to a smart contract vulnerability, he urged the community to give new applications room for error and wait for recovery and rebuilding.

Regardless of whether SA was officially developed by Avalanche or is a so-called "Chinese project," the founder’s public endorsement clearly reflects the desperate need for traffic on major L1 blockchains.

A breakout application offers a chance to revive a previously stagnant blockchain ecosystem—an increasingly precious opportunity when the spotlight is overwhelmingly on L2s.

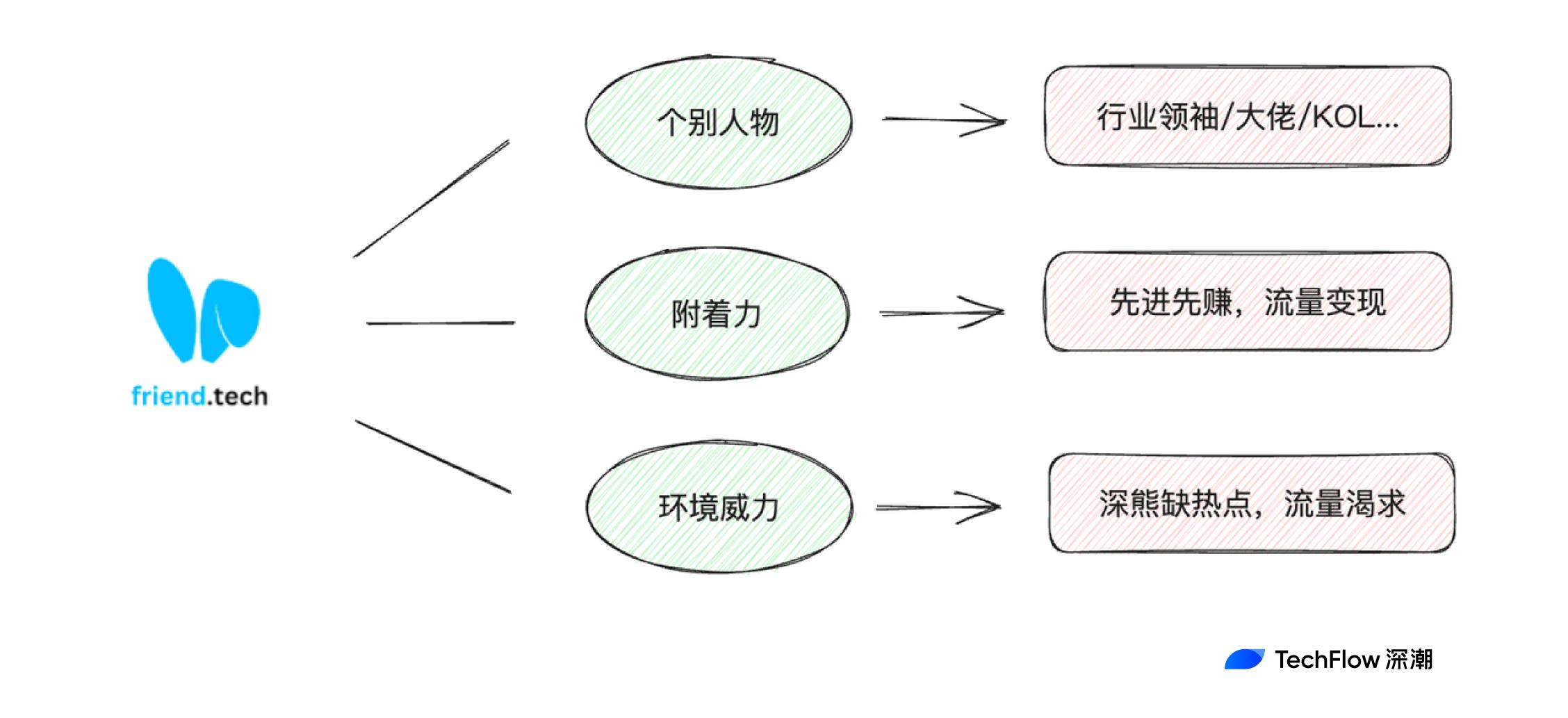

And it is precisely such key figures stepping forward that further confirm the fundamental logic behind traffic explosions driven by products like FT and SA:

Attract traffic via appealing expectations or incentives to bootstrap the product; then use effective distribution strategies to amplify inflows, enhancing network effects for social products.

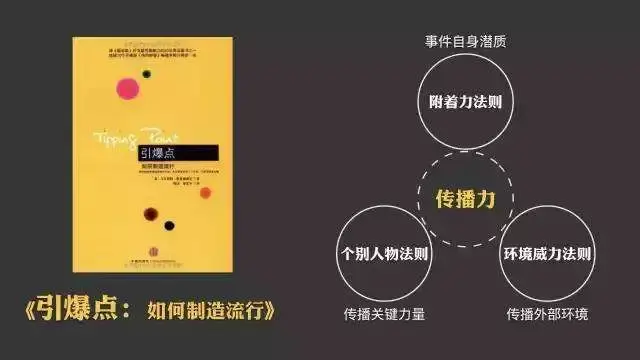

Drawing from the classic book *The Tipping Point*, a product or idea becomes popular by following three rules:

-

The Law of the Few: Information spreads through the social skills, energy, enthusiasm, and charisma of certain special individuals.

-

The Stickiness Factor: Once information becomes practical and personally relevant, it becomes memorable.

-

The Power of Context: The spread and popularity of information require favorable external conditions.

When applied to SocialFi products like Friend.Tech, these three principles become more concrete:

Under this diffusion logic, we see increasing numbers joining Friend.Tech. Players who were initially hesitant and analytical eventually jump in under sustained influence from early adopters and compelling incentives, becoming exceptionally active in a bear market starved of highlights.

At the same time, users exit FT due to declining returns caused by bot competition, naturally creating space for clone projects to absorb this overflow of traffic.

Clearly, Friend.Tech is just the first—not the last. Clones introduce minor innovations, improve UX, or add new mechanics—all aiming to continuously attract traffic, much like Sushiswap did with Uniswap back in the day.

Doubt the Ponzi, Understand the Ponzi, Become the Ponzi

Friend.Tech and similar projects got off to a strong start in terms of user acquisition, but can they sustain momentum like DeFi Summer?

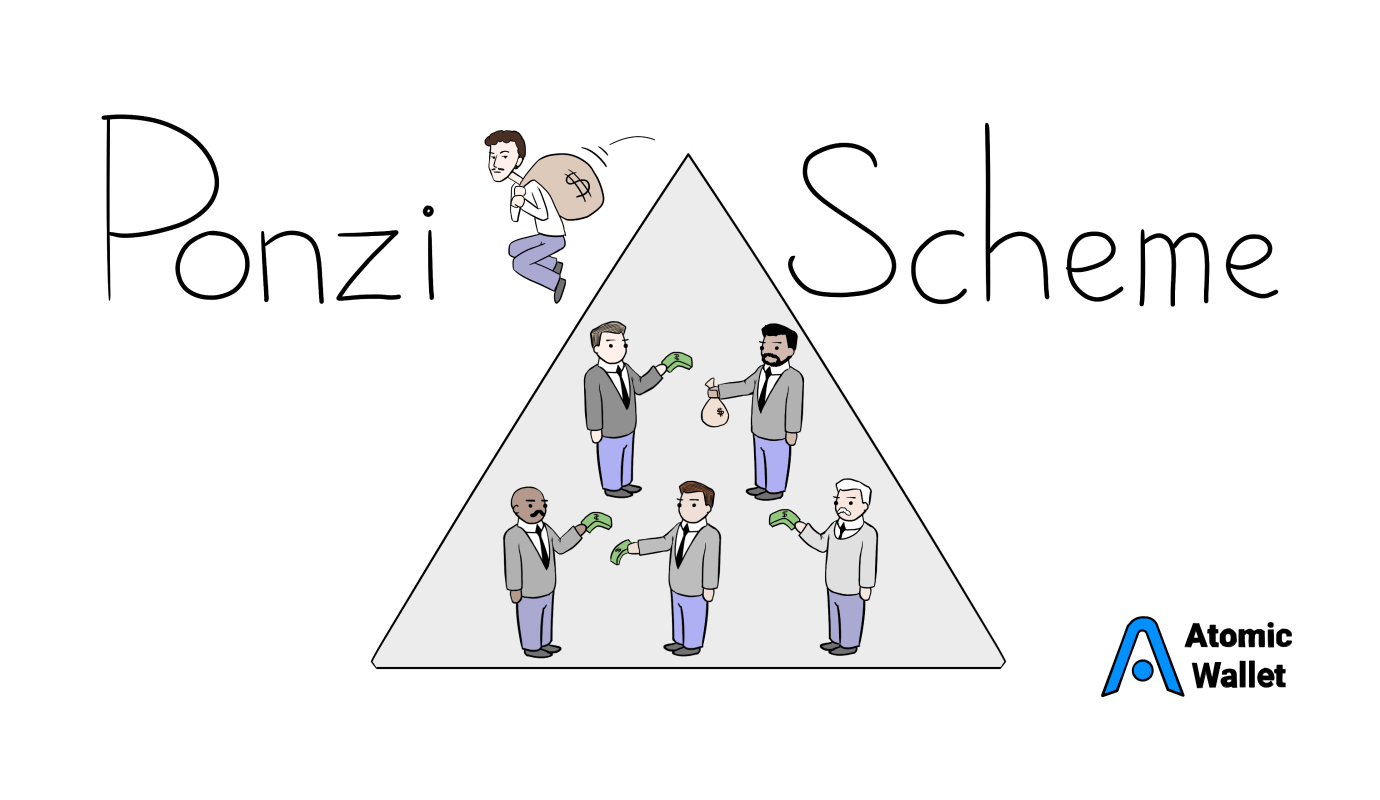

Compared to DeFi’s liquidity mining—which also attracts users via yield incentives and favors early entrants—DeFi protocols and LPs earn revenue from transaction fees generated by actual usage, rather than simply profiting off later entrants.

In contrast, social products like FT exhibit very clear Ponzi characteristics: early participants easily profit from latecomers, who often face higher entry costs.

From an economic design perspective, then, FT-like platforms resemble StepN more than DeFi. Without continuous new users joining, could the entire system collapse, spiraling into death like most GameFi projects?

But remember: StepN, as a consumer-facing crypto app, once broke through into mainstream awareness, achieving massive popularity. Since then, the crypto industry hasn’t seen another consumer app reach that level.

From this angle, the Ponzi structure in StepN’s economic model actually served a positive role in rapid user acquisition: move fast, earn first. If you don’t believe, you won’t come.

Today, when infrastructure is homogenized and oversaturated, and everyone hopes for a true consumer-grade crypto app to emerge from the social sector, outright dismissing or questioning the Ponzi elements in Friend.Tech may not be practical.

Doubt the Ponzi, understand the Ponzi, become the Ponzi.

Understanding that a Ponzi mechanism is not synonymous with a Ponzi scam, leveraging such dynamics to attract traffic has become an inevitable step for crypto apps seeking growth.

In terms of user experience, crypto apps can't compete with mature Web2 products; in compliance, they operate in gray zones; in real-world needs, they lack a mass-market, must-have utility.

So how do you make users take that first step—from non-user to user?

Right now, the answer still seems to be incentives and yield. The earlier you join, the higher your rewards—using profit potential to lure more users in. Yes, it smells like a Ponzi, but for crypto, this is an unavoidable phase in application development.

Live by the Ponzi, die by the Ponzi.

History shows that apps or projects relying solely on Ponzi mechanics without delivering ongoing external value fail to sustain user engagement—either pulling a rug pull or fading away passively.

In this sense, Ponzi is a means, not an end.

Whether Friend.Tech or Star Arena can offer more functionality and gameplay beyond yield—retaining users post-launch through useful features to offset the “latecomer disadvantage” inherent in Ponzi structures—remains to be seen.

Can the Boom Be Repeated?

Can social Ponzi schemes recreate the glory of DeFi Summer? In the short term, I believe it’s unlikely.

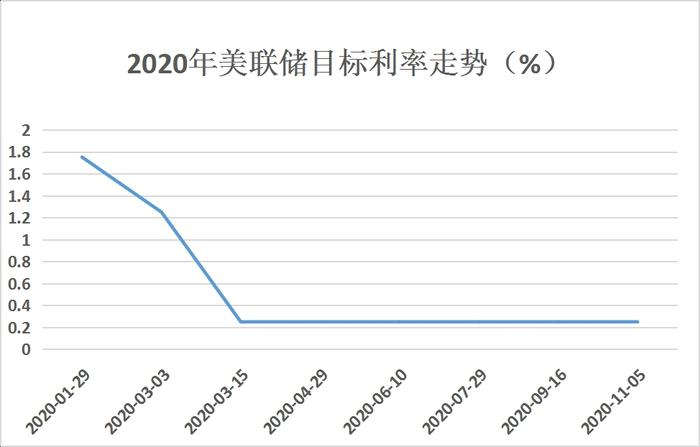

First, the macroeconomic environments differ. In 2020, the Fed slashed rates twice in March down to zero and launched a $700 billion quantitative easing (QE) program, flooding markets with liquidity and fueling the crypto boom. As shown below, the period of low interest rates aligns closely with DeFi Summer.

Today, we face tightening liquidity, capital flight, and a Fed hiking cycle. VCs are increasingly shifting focus toward AI. SocialFi lacks the same宽松environment that fueled DeFi’s rise.

Second, their revenue sources differ. As mentioned, DeFi protocols and LPs earn from transaction fees generated by real usage—not merely profiting off new entrants. Friend.Tech, however, exhibits overt Ponzi traits. The presence of automated bots dramatically increases entry costs for latecomers, making it far from a healthy earning model—closer to zero-sum gaming.

Without continuous feature updates and new users, internal collapse becomes more likely.

Finally, demand intensity differs. DeFi is inherently financial, oriented toward freer, more efficient, and convenient ways to generate yield—making it somewhat of a “trading necessity.”

SocialFi, theoretically, should emphasize Social over Fi. But stripped of financial incentives, average users have little reason to choose a crypto app that lags behind mainstream social platforms in both function and experience. The current reality—Fi overshadowing Social—is unlikely to change soon. Once speculative fervor fades, mass exodus becomes more probable.

That said, today’s social Ponzi schemes have succeeded in user acquisition, and their current forms are far from final.

Rather than expecting them to replicate DeFi Summer’s glory, perhaps we should hope they forge a new path—to create their own kind of boom.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News