September Market Outlook: On-Chain Liquidity and Catalysts Overview

TechFlow Selected TechFlow Selected

September Market Outlook: On-Chain Liquidity and Catalysts Overview

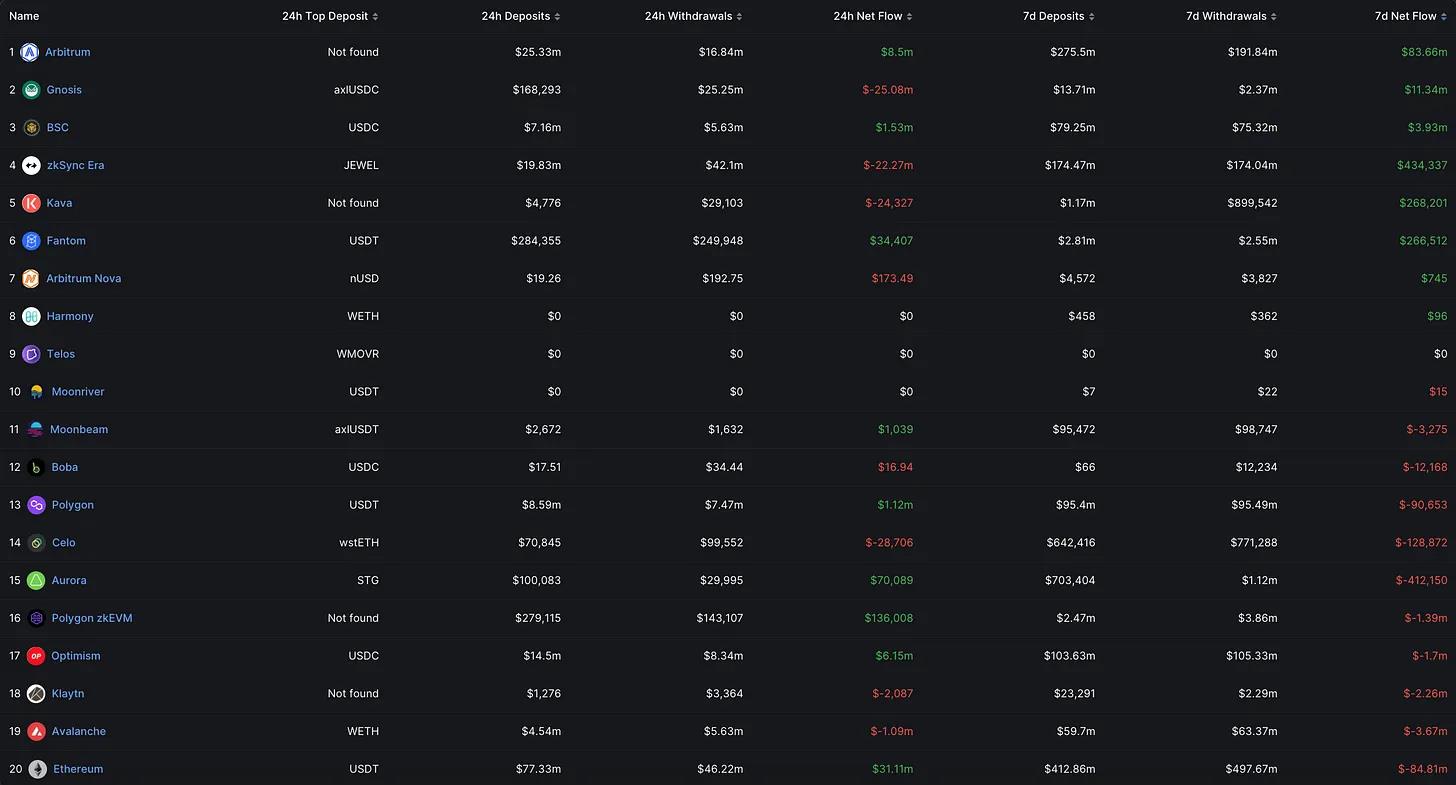

It's not surprising that Arbitrum has clearly emerged as the winner here, with $83 million bridged to its ecosystem over the past week.

Written by: DEGEN SENSEI

Compiled by: TechFlow

Historically, September has been one of the worst months in crypto, and so far this month is proving no different—it’s crushing whatever hope remains among market participants. More and more are exiting, and now it seems only the same group of survivors from the last bear market remain, along with a few key new entrants. Retail participation has completely vanished, and the crypto winter is truly setting in.

Now, however, is the best time to take advantage of these opportunities for potentially massive returns in the future—but it will require immense patience.

Enough preamble—let’s dive into this week’s headlines.

Market Summary

-

The long-awaited protocol Gammaswap has finally launched on Arbitrum mainnet;

-

Daniele Sesta launched his new token WAGMI;

-

ARB incentives officially went live following the approval of the governance proposal;

-

Mark Cuban had $870,000 stolen from his wallet;

-

Optimism conducted a second airdrop to delegates and sold 119 million OP tokens in a private sale;

-

TON entered the top ten in crypto market cap (but nobody is talking about it);

-

As monetary crisis deepens, Nigeria turns to crypto;

-

The SEC announced plans to crack down on more crypto platforms.

Cross-Chain Bridge Liquidity

It's no surprise that Arbitrum emerged as the clear winner here, with $83 million bridged into the ecosystem over the past week, while a similar amount of $84 million flowed out from Ethereum mainnet.

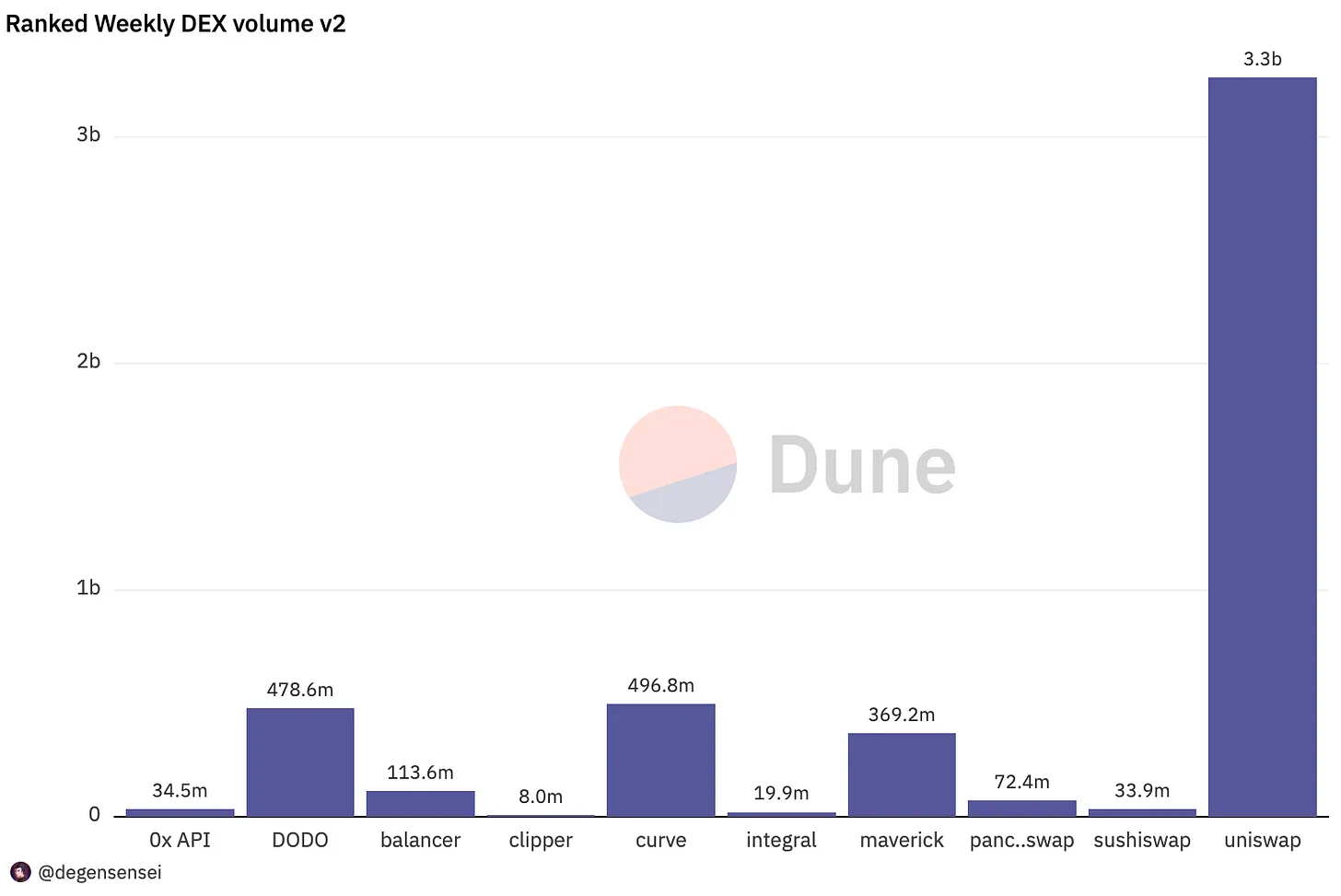

DEX Trading Volume

Let me be clear: despite sector rotation, trading volume is far from recovering. In fact, it continues to shrink. Here’s the prevailing market philosophy worth adopting right now: earn or get rekt. If you’re profitable, take your money and exit. There’s currently no need to actively trade. The only things worth considering are tokens that may have already bottomed, and if you're skilled at it, on-chain sniping. Everything else is food for the sharks.

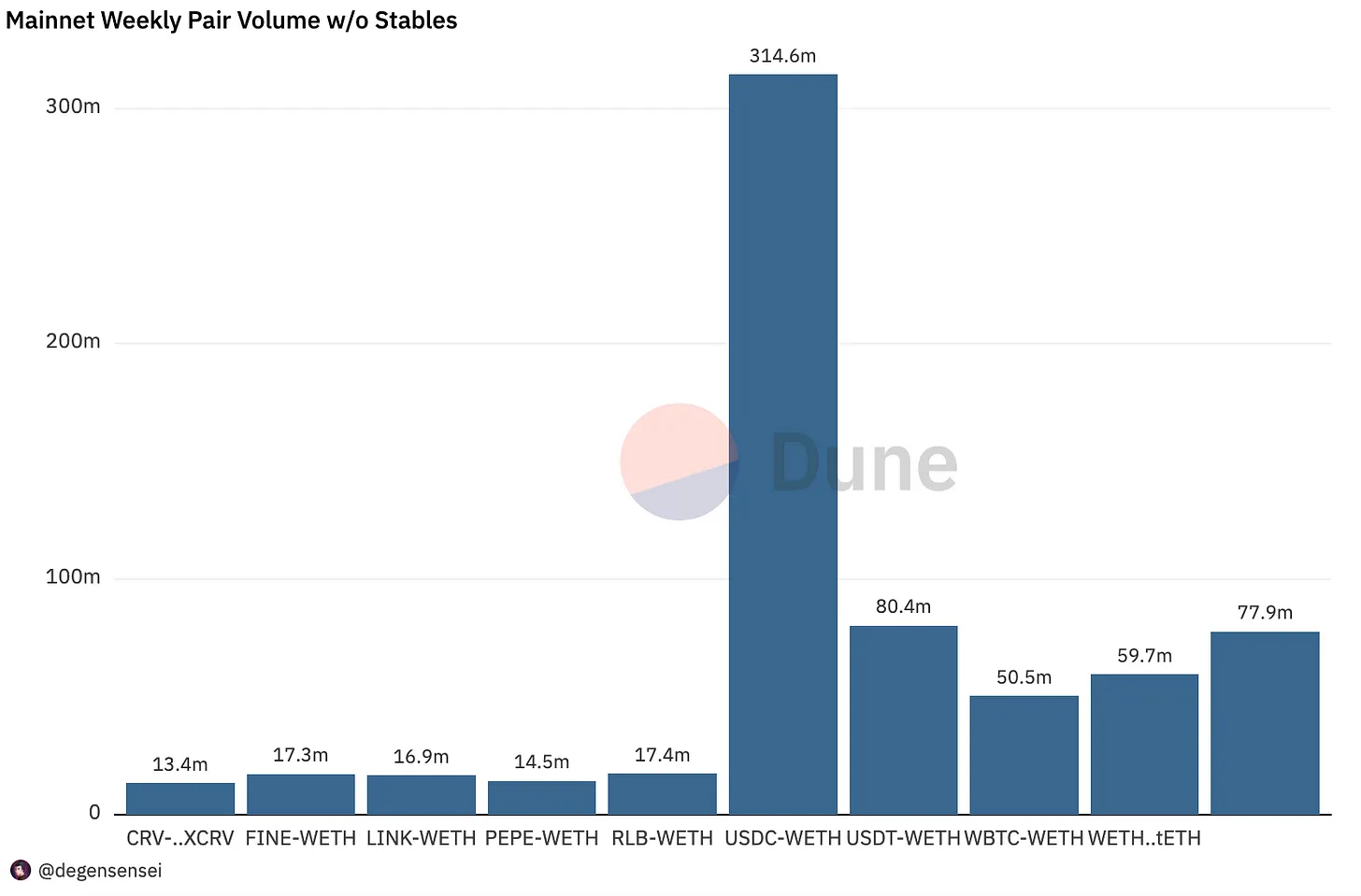

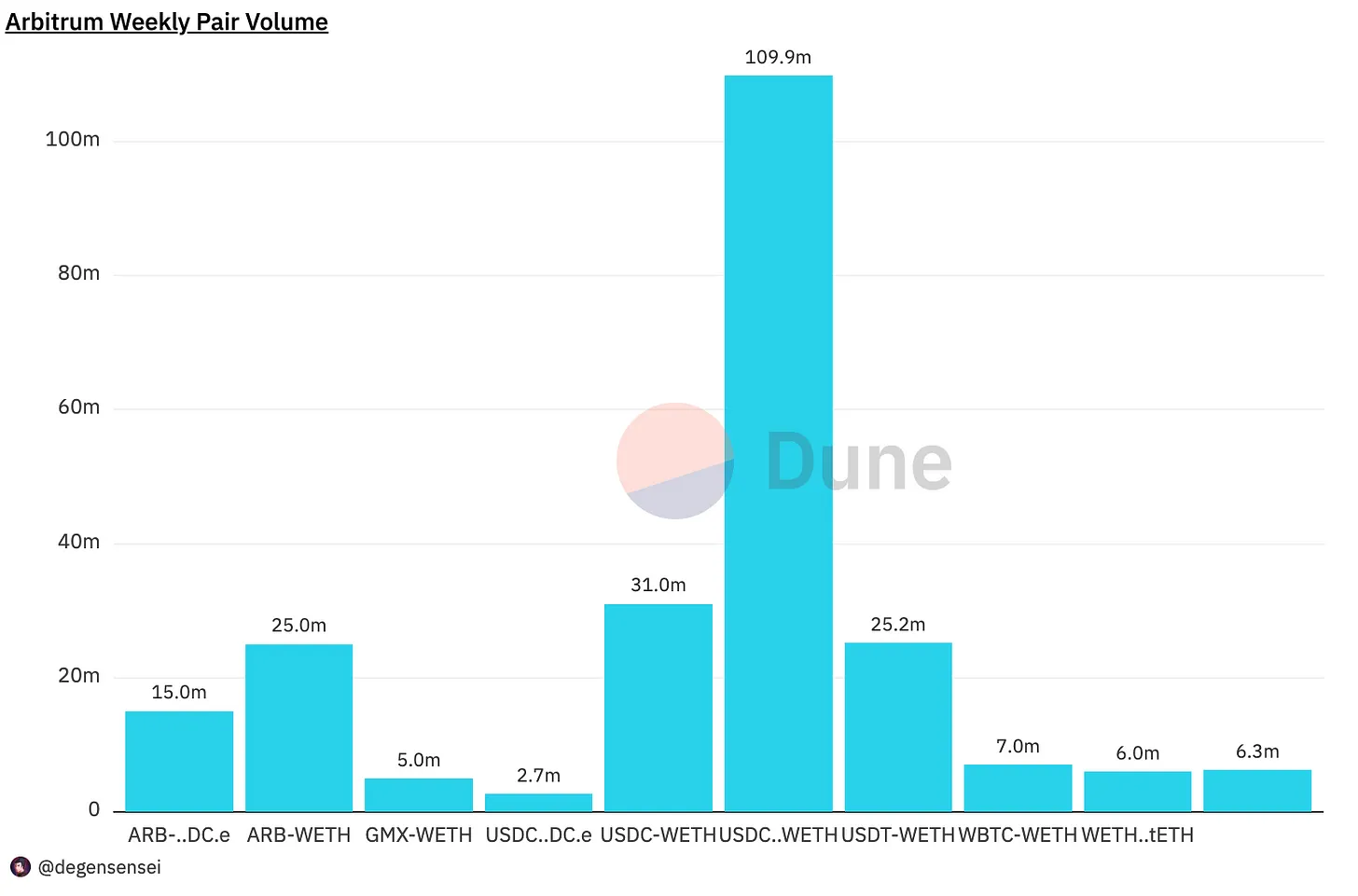

Trading Pair Volume

Trading activity between tokens continues to decline. When LINK starts seeing significant bids and gets pumped, it's often a signal that distribution is beginning—and that’s exactly what happened this time. Despite price weakness, RLB continues to receive considerable attention. People are hunting for post-pump memecoins, with FINE being a recent example.

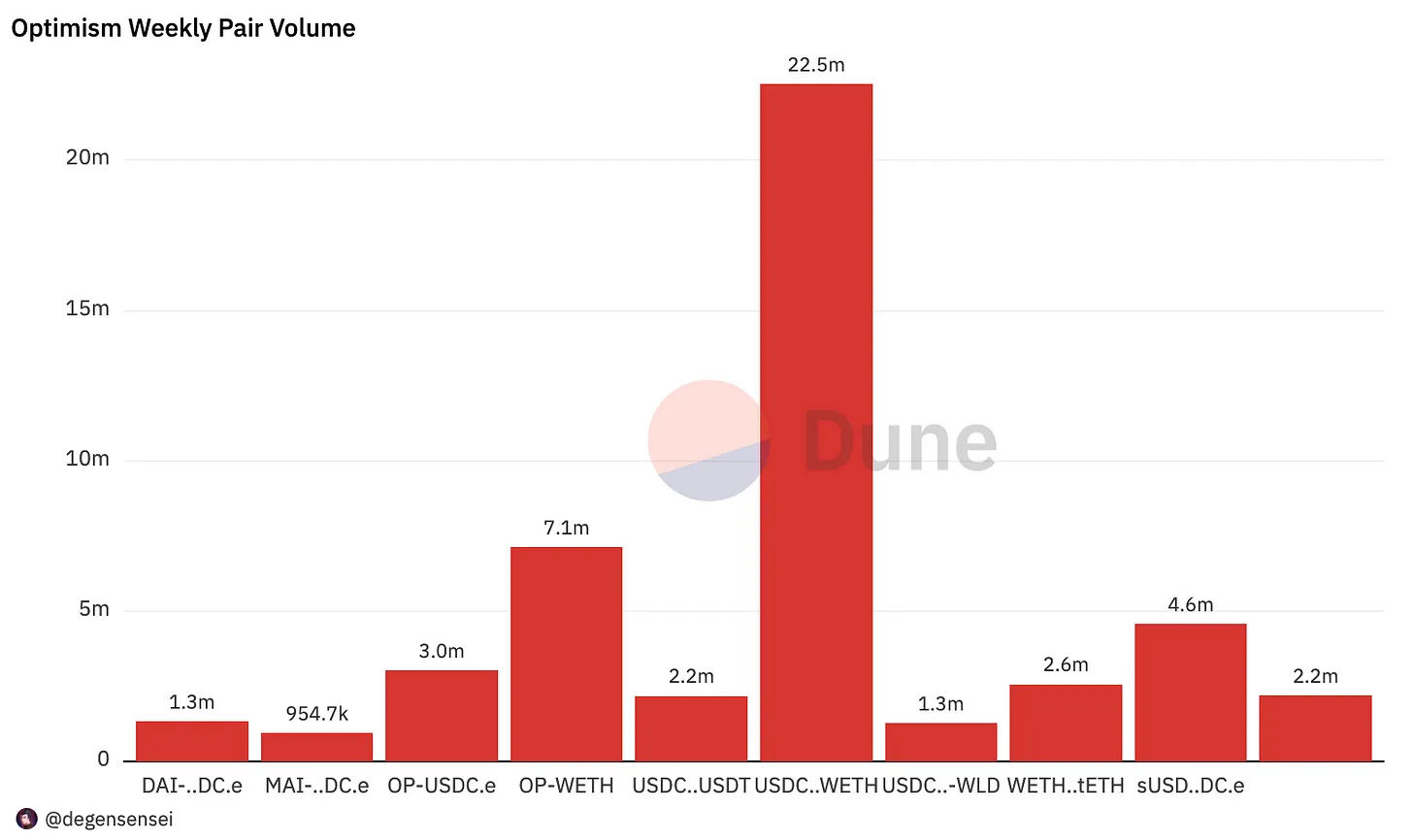

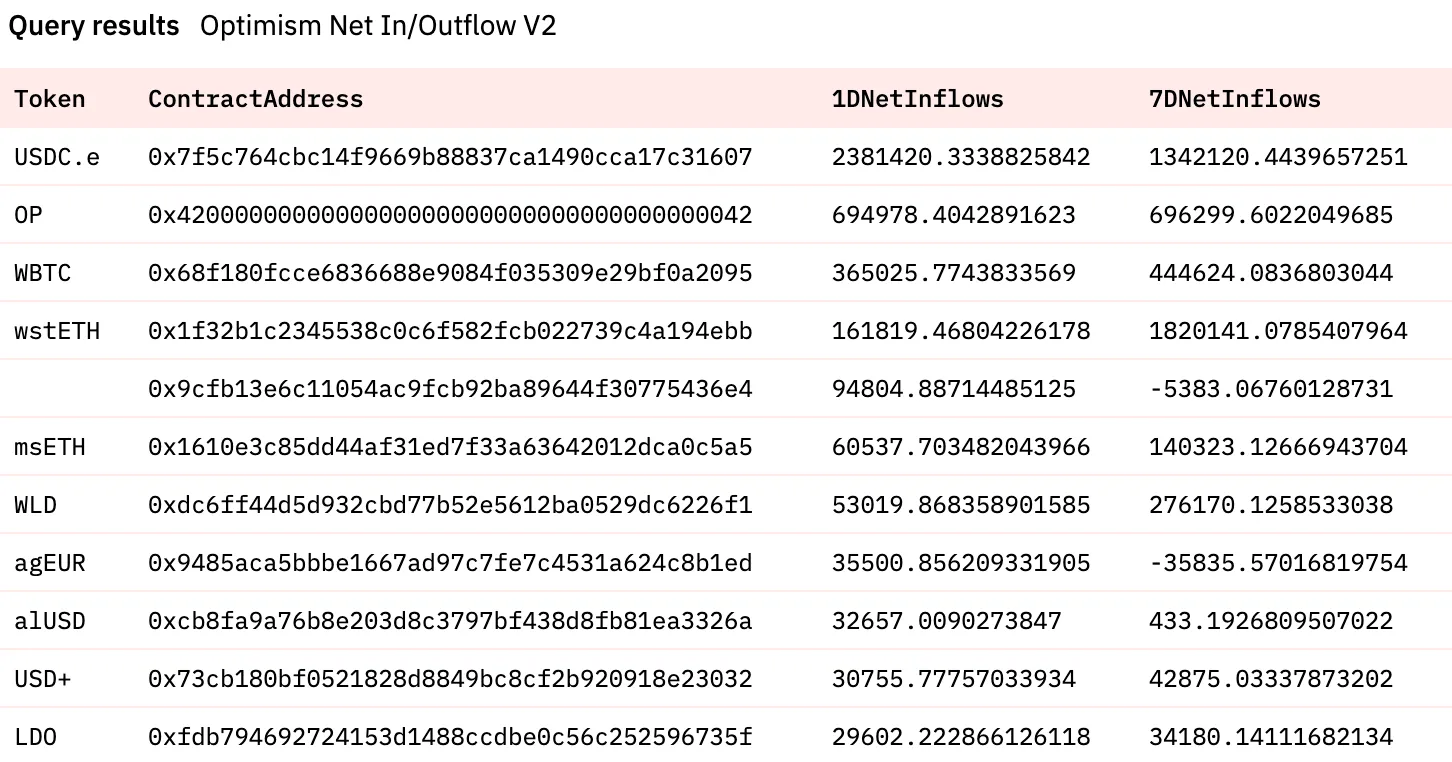

After some short-term pressure, Optimism saw a nice bounce last week, but it has since reverted to its usual pattern, with another bearish catalyst emerging as the foundation sells tokens. It will take time to recover. All eyes are now on its direct competitors.

Arbitrum’s trading volume isn’t high yet because incentives have just launched. I expect this to pick up over the next week as liquidity mining rewards begin to be distributed across the ecosystem.

NFT Trading Volume

For much of this year, Milady NFT was the strongest-performing NFT collection, but it is now among the hardest hit by the downturn.

The NFT bear market continues to deepen. What do you think will be the catalyst for its next recovery? Personally, I believe it will be gaming—but I’m open to other opinions.

Net Inflows

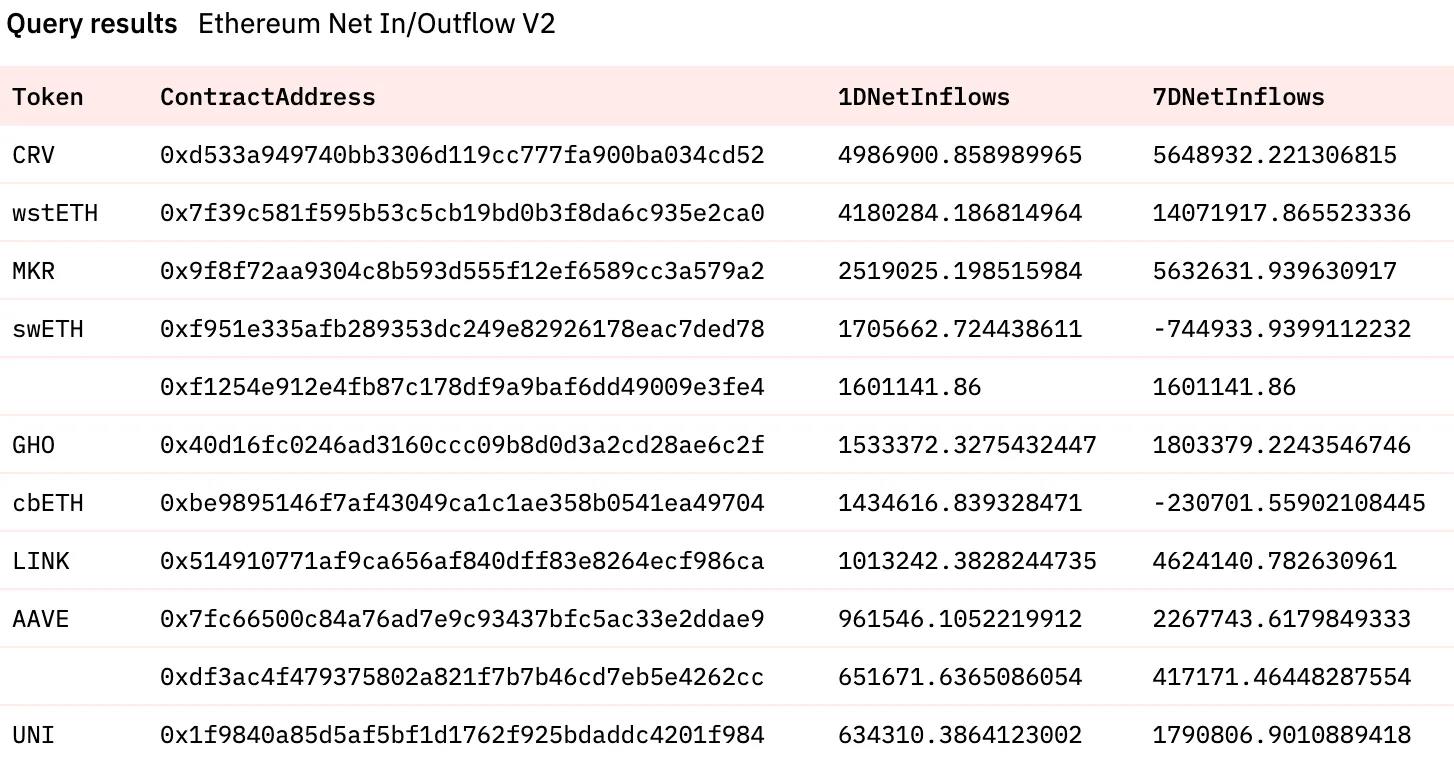

Attention is returning to old-school DeFi, with CRV and MKR leading in capital inflows. Despite sell-offs from venture firms and Vitalik, MKR continues to show strength thanks to one of the most sustainable token models. This is a clear signal of resilience. It also appears people are betting Aave will fix GHO’s peg—if successful, that would offer a risk-free 3% arbitrage opportunity.

Not much excitement on Optimism, though OP did see some bidding despite negative sentiment following its private token sale. WLD was the token welcomed by the market last week, with Andrew Kang supporting it and publicly endorsing it as a solid altcoin to buy.

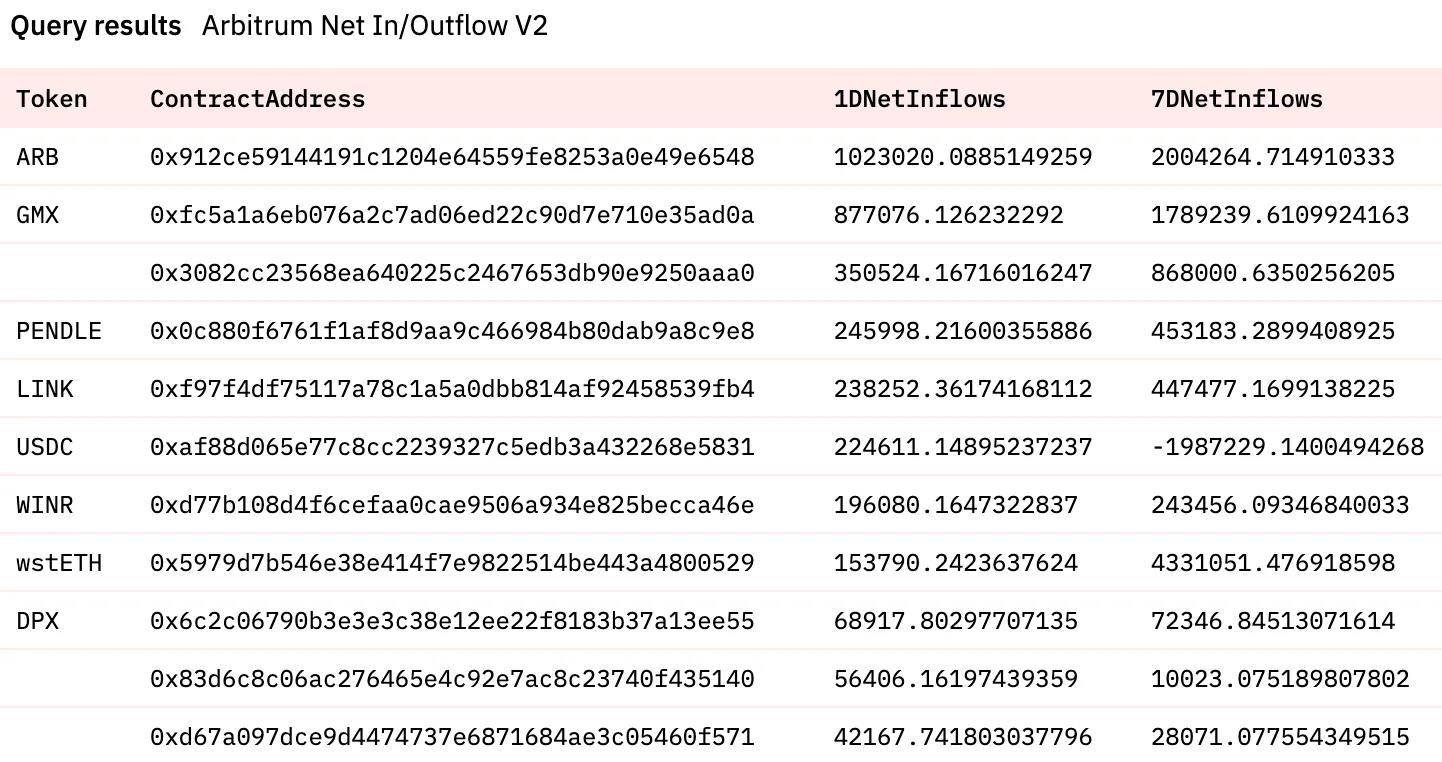

Interestingly, this table clearly shows what people rushed to buy on Arbitrum ahead of the proposal vote. It’s no surprise to see ARB and GMX leading, as they are the native token and blue-chip protocol commanding the largest share. RDNT followed closely in third place, with PENDLE in fourth. The only surprise on this list is the absence of MAGIC, as all other large-cap protocols made the cut, while degens opted for WINR as a high-beta, low-market-cap play. DPX represents a contrarian bet, receiving relatively modest bids relative to its size, although potential catalysts could work in its favor.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News