Interview with Wintermute: We are liquidity providers, not market makers

TechFlow Selected TechFlow Selected

Interview with Wintermute: We are liquidity providers, not market makers

Behind all the controversies—regarding regulation, liquidity, and competition—what exactly is going through market makers' minds?

Interview and editing: Jack, BlockBeats, Vision, Metastone

Market Makers (MM), or Liquidity Providers (LPs), specialize in supplying market liquidity to ensure the healthy development and stable operation of projects. In traditional finance, market makers are strictly regulated; however, within the crypto industry, their growth has been notably "wild," leading this niche sector to be criticized for "participating in and accelerating project collapses," "profiting as middlemen," and "creating false appearances of prosperity."

The collapse of FTX and the subsequent damage to a series of major platforms made market making and lending particularly vulnerable areas. For retail investors, discussing market makers often feels like playing a game of blind men and elephants. Behind all the controversy—regarding regulation, liquidity, and competition—what exactly do market makers think? At TOKEN 2049, BlockBeats sat down exclusively with Yoann Turpin, co-founder of Wintermute, one of the most prominent crypto market makers.

Wintermute is one of the best-known market makers in the cryptocurrency space, having provided liquidity for projects such as dYdX, OP, BLUR, ARB, and APE. Yoann Turpin graduated from EDHEC Business School and previously served as co-founder and CFO at Innovify, and founder at Kaifuku Capital.

Maintaining “Market Neutrality”

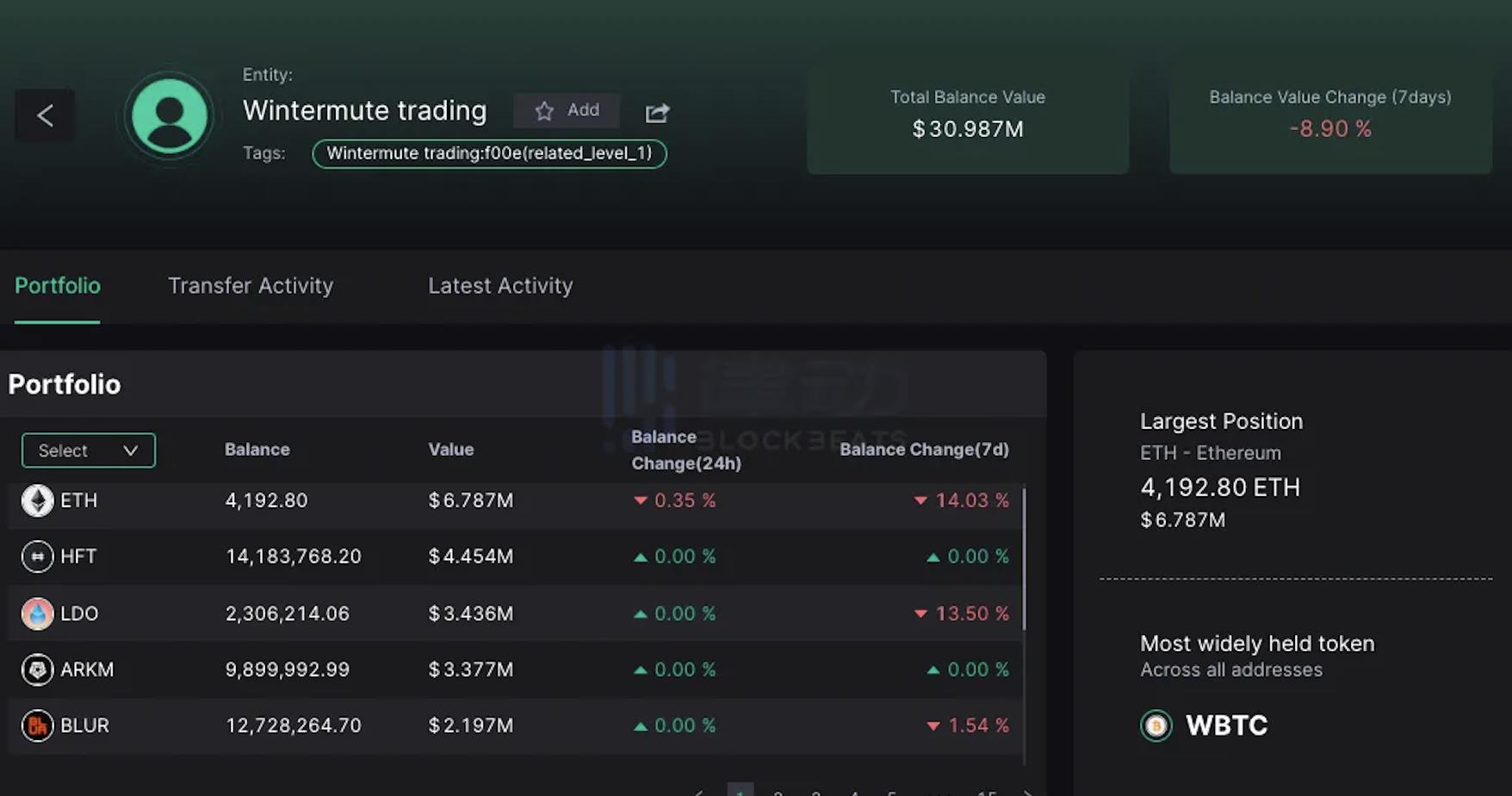

How large is Wintermute today? According to its official website, Wintermute has facilitated over $2 trillion in cumulative trading volume to date. Data from Watchers shows that Ethereum accounts for Wintermute’s largest single asset trade, yet it still represents less than 1% of its overall token portfolio.

Image source: Watchers

BlockBeats: Please introduce yourself and Wintermute.

Yoann: We founded Wintermute together in 2017, and now we have a team of fewer than 100 people. Compared to our 20-person team in 2021, we’ve grown significantly, reflecting some changes in Wintermute’s structure. We’re striving to become an increasingly diversified platform, focusing more on trading markets. In 2021, we entered Singapore’s derivatives market.

We’re increasingly active in over-the-counter (OTC) trading, serving more clients, though we primarily trade through proprietary accounts. Wintermute has grown into the world’s largest spot market maker, accounting for 16% to 20% of total trading volume. In derivatives, we rank among the top five in options. We’re highly active investors, with around 100 investment positions, totaling approximately $100 million across various venture portfolios.

We’ve also incubated several projects, such as Bebop. Additionally, we’re increasingly involved in public investments. Wintermute aims to keep its core operations relatively small to maintain focus. When you run two or three businesses under one roof, things can get messy, so we believe it's better to spin off initiatives or let others execute them. You’ll see some results in the coming weeks, including new frameworks around incubation and discovery.

As a founder, I now focus mainly on venture capital deals and business development, especially in Asia, meaning I spend significant time exploring opportunities in Korea. I visited Japan and Peru earlier this year and will go to New York next year. We travel frequently to Hong Kong and plan to explore Southeast Asian markets, including Indonesia, over the next few years.

Avoiding Overexpansion

BlockBeats: How did you survive the bear market? What strategies does Wintermute employ during DeFi cascading liquidations? And what impact do DeFi on-chain derivatives have on future markets?

Yoann: When markets fall, we typically start buying because market participants push us into long positions—we're essentially forced into being long, then we buy and sell. The idea is that even if we lose money on long positions, we can earn enough from bid-ask spreads to offset those losses. That’s how we navigate bear markets.

Regarding DeFi, it’s an interesting question because people sometimes misunderstand that we’re selling on DeFi protocols. What they see online is often CeFi purchases moved into DeFi, where liquidity is deeper. For example, we might buy a large amount of tokens on Binance or another exchange and then need to exit somewhere—DeFi allows P2P-style exits. Overall, we remain very “market neutral.” Market neutrality means we don’t profit from going long or short, but rather from millions of daily trades capturing tiny spreads.

BlockBeats: Following up on that, I recall a major market crash months ago, with rumors suggesting either clearing providers or market makers pulled out—possibly including Wintermute. What’s your take?

Yoann: As the largest spot liquidity provider, people naturally associate us with such events, but in reality, we performed well. Markets go through cycles, and there's always a wealth effect. Imagine operating efficiently with fewer than 100 people while competitors employ 200–500 staff. I suspect their market opportunities are similar or even smaller. We manage cash prudently and avoid overexpansion. While we may not have outperformed others during the crypto summer, we didn’t overextend in 2021, allowing our business model to endure the winter far better than many peers.

Token Selection Based on Scale and Longevity

BlockBeats: What criteria do you use when selecting tokens to trade? Do we need to borrow assets from foundations to begin trading? Which tokens do you prefer? What kind of assets do you choose to make markets for?

Yoann: It’s more like a partnership—we borrow assets from foundations, and we want alignment of interests without taking too high a percentage of fully diluted valuation (FDV). We need to borrow at least $2–3 million worth of a given token to make a meaningful impact. But we also don’t want to borrow more than 2–3% of FDV, so the projects must be large enough. Typically, we only consider projects with FDVs above $100 million. If already listed, they should have strong visibility across exchanges. Often, teams approach us because they need a reputable market maker to help them list elsewhere.

Our trading volume share on certain exchanges can reach 10%, 20%, 30%, or even 60%. This reflects close partnerships with exchanges. The standard is that most Tier-1 teams provide liquidity. We just need to ensure the team meets solid standards and is committed to long-term building. There’s also a commercial aspect—we look for sufficient trading potential or existing volume.

BlockBeats: Can you still profit in extreme conditions, such as sharp price drops?

Yoann: During sharp price declines, we usually have structures in place to benefit, but drastic drops are generally bad for everyone. Sharp falls mean liquidations and actual loss of capital. Still, you see similar dynamics in traditional finance—governments expand balance sheets during crises. So, the better we perform, the less disruptive liquidations become. It’s a balancing act, but it can also lead to better entry prices for the market.

Ethical Self-Regulation

The Rivalry with DWF Labs

In the market-making niche, aside from Wintermute, one cannot overlook its rival DWF Labs. Earlier this year in March, the two engaged in a public spat: DWF accused Wintermute of orchestrating negative coverage via blockchain media outlet The Block, while Wintermute questioned DWF’s intentions and raised concerns about security risks. Yoann responded, criticizing DWF Labs for treating OTC trading as investment—a fundamental flaw in his view.

Read more: DWF Labs vs. Wintermute: A Public Feud Between Two Major Market Makers

BlockBeats: What’s your opinion on DWF Labs? I know you have strong objections to their methods. Is this market manipulation? Do you consider them market makers?

Yoann: By our definition, they are not market makers. Where they confuse many people is by labeling what is essentially OTC trading as “investment.” People usually assume investments are long-term, whereas trading is more short-term. But if you announce an investment and immediately sell after the announcement, it’s hard to justify calling it an investment. This reflects the nature of our open, almost permissionless system. There are even clearer cases involving sanctions or fundraising—like seeing random crypto transfers meant to influence outcomes without sufficient justification.

I think it's best to keep the system open, while users gradually learn where to send their funds. I believe the space needs slight regulation—you definitely don’t want bad actors. Ultimately, it’s repeating some traditional finance mistakes, like excluding many from banking. Crypto needs to strike a balance, which will eventually emerge over time. That’s why we started down this path—ethical self-regulation?

The biggest criticism against market makers is that many engage in “market manipulation” rather than genuinely “providing liquidity to guide healthy market development.” Wintermute prefers to identify as a “liquidity provider” rather than a “market maker,” and currently practices company-wide ethical self-regulation.

Steering Clear of the U.S. Market to Avoid Regulatory Issues

BlockBeats: Next, regarding regulation—if the SEC tightens oversight on tokens or NFTs, would that fundamentally change Web3? What are your thoughts?

Yoann: In 2021, we deliberately chose not to engage with the SEC. We registered in the UK as a spot trader; since UK regulators explicitly discourage offering derivatives to retail investors, we placed our derivatives operations in Singapore to fully mitigate risk. In the U.S., we have almost no business presence—all commercial activities occur outside the U.S. So we intentionally sidestep SEC-related issues, and we’ve actually shifted greater focus to Asia, relocating to Singapore.

Positioning as “Liquidity Provider” Rather Than “Market Maker”

BlockBeats: On regulation—while traditional finance tightly regulates market makers, in crypto, many operate unregulated and collaborate closely with exchanges. Could you discuss regulatory challenges specific to crypto market makers?

Yoann: Generally, unethical players—whether in branding or expansion—are eventually exposed and don’t fare well. We’ve chosen to build a consciously ethical company, doing everything possible to meet high moral standards—going beyond mere legality. Everything we do is legal, but just because something isn’t illegal doesn’t mean it’s right. We emphasize long-term alignment and integrity.

There’s a lot of education needed in crypto—it’s time-consuming and difficult. Part of my role now is ensuring we aren’t misunderstood. We’ve largely stopped describing ourselves as “market makers” and now only use “liquidity provider,” a term fully applicable in traditional finance.

In crypto, there’s some confusion because liquidity providers are sometimes seen as passive DeFi AMM LPs. But what we do involves extensive liquidity provision and price discovery—striving to determine the true price of a token at any given moment. Some who claim to be market makers don’t actually work to establish accurate pricing, which harms the ecosystem. I believe these issues will resolve over time, driven by core technical competence and the ability to run honest, principled businesses.

Of course, you can’t expect everyone to uphold high ethical standards or follow rules. We hold our own team to those standards—internally, we enforce high expectations. But for other participants? For competitors, we have a simple rule: we categorize them as good or bad, avoiding quick judgments since reality is often complex and gray.

So for good competitors, we sometimes co-invest. For instance, if we borrow from a foundation and they need another LP for their token, we occasionally refer other reputable competitors. There’s competition, yes—but only those with proven track records, capable of delivering real results and creating synergies, qualify as “good competitors.” Even among them, our services differ significantly. We prioritize engineering and building first, which is why we have only about eight people—nine including me—in business development.

Solana May Succeed Polkadot

During this interview, Yoann also shared his views on the future of blockchains. According to defiLlama data, Ethereum remains the leader by total value locked (TVL). However, Yoann believes Solana could surpass Polygon to become the second-most influential blockchain after Ethereum.

Image source: defiLlama

BlockBeats: Final question—we’ve seen ConsenSys launch Linea and Coinbase roll out Base, with Layer 2s gaining momentum. Modular blockchains have become key to scaling Ethereum. What’s your take on this trend? Do you have any strategic positioning in Layer 2s or other blockchains?

Yoann: Regarding Layer 2s, our position is clear—we’ve invested in nearly every major project except StarkWare. Not because StarkWare is a poor solution, but because when we evaluated it, it was already valued at $20 billion, and we prefer earlier-stage investments. Also, due to our activity in DeFi, we’re frequently invited to integrate with various Layer 1 and Layer 2 projects, as much value today stems from trading activity.

As for Coinbase, I think they’ve long supported DeFi intentionally, so their move isn’t surprising. For us, the ongoing challenge is choosing which chains to integrate and trade on. We’re commercially successful but face the same industry-wide issue: a severe shortage of reliable smart contract developers.

BlockBeats: We’ve seen a reversion toward Ethereum, and EVM compatibility seems crucial—largely due to Ethereum’s massive developer community. I remember Polkadot once had the second-largest developer base, but that’s changed. Which chain do you think will be next in terms of influence?

Yoann: After Polkadot, I’d say Solana. But even with Solana, numbers are hard to verify. Many teams join hackathons, build initial apps on Solana, but then pivot if the application lacks specificity.

Last year, we invested in three teams participating in Solana hackathons who went on to develop there. So you see many cases where data authenticity is questionable. But Ethereum remains the leading platform for app development, despite other efforts—like many teams trying to extend Bitcoin’s functionality. That’s another dimension. We see engineering progress, but not necessarily trading progress.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News