Pantera Capital Investment Methodology: How to Evaluate the Crypto Market Through Fundamentals and Macroeconomic Environment?

TechFlow Selected TechFlow Selected

Pantera Capital Investment Methodology: How to Evaluate the Crypto Market Through Fundamentals and Macroeconomic Environment?

The maturity level in the digital asset field may resemble an inflection point in stock market development.

Authors: Cosmo Jiang, Erik Lowe

Compiled by: TechFlow

Over the past several months, there have been some positive developments in the U.S. cryptocurrency regulatory environment. We all know about the U.S. District Court for the Southern District of New York’s ruling in the three-year legal battle between the Securities and Exchange Commission (SEC) and Ripple Labs, which determined that XRP is not a security. We refer to this as a “positive” black swan event that few anticipated.

Cryptocurrency has recently scored another unexpected victory. On August 29, a U.S. appeals court ruled in favor of Grayscale in its lawsuit against the SEC over the denial of its spot Bitcoin ETF application last year. We believe this significantly increases the likelihood that spot Bitcoin ETF applications from BlackRock, Fidelity, and others will be approved.

While the U.S. may seem behind many other regions in embracing digital assets, numerous countries have taken actions toward crypto that are just as restrictive or even harsher. The U.S.’s redemption lies in its court system, which upholds due process and ensures there is a corrective path when boundaries are crossed.

“The denial of Grayscale’s proposal was arbitrary and capricious because the Commission failed to explain its different treatment of similar products. Therefore, we grant Grayscale’s petition and vacate the order.”

— Opinion delivered by Circuit Judge RAO

We’ve long emphasized the need for trustless systems. In our industry, this means users can rely on blockchain-based architectures to execute designs fairly. Being able to rely on the U.S. court system to do the same helps shape a promising regulatory environment for the future of crypto, encouraging more innovation to occur onshore.

We’ve long discussed the potential of spot Bitcoin ETFs—and now, we see a glimmer of hope.

Crypto Industry Maturity Comparable to Equities

The maturity level in the digital asset space may resemble an inflection point in the development of equity markets.

Tokens represent a new form of capital and could potentially replace equity for an entire generation of companies. This means many companies may never list on the New York Stock Exchange but instead only issue tokens. It reflects a realignment of incentives among companies, management teams, employees, token holders, and potentially other stakeholders unique to digital assets—such as customers.

There are currently around 300 liquid tokens publicly traded with market capitalizations exceeding $100 million. As the industry expands, this investable universe is expected to grow. An increasing number of protocols now feature product use cases, revenue models, and strong fundamentals. Applications like Lido or GMX didn’t exist two or three years ago. In our view, sifting through this vast landscape could be a significant source of alpha, just as in the stock market—not all stocks are created equal, and neither are tokens.

Pantera focuses on identifying protocols with product-market fit, strong management teams, and attractive, defensible unit economics—a strategy we believe is widely overlooked. We think we’re at an inflection point for this asset class, where traditional and more fundamental frameworks will increasingly be applied to digital asset investing.

In many ways, digital asset investing resembles major inflection points seen in the evolution of equity markets. For example, fundamental value investing is now taken for granted, but it didn’t gain traction until the 1960s when Warren Buffett launched his first hedge fund. He was an early pioneer in applying Benjamin Graham’s principles in practice, paving the way for the long/short equity hedge fund industry as we know it today.

Crypto investing also parallels emerging market investing in the 2000s. It faces similar criticisms once leveled at Chinese equities—that many companies were small firms in a retail-driven, irrational market. You couldn’t always trust whether management was misleading investors or misappropriating funds. While some of that was true, there were also many high-quality companies with strong long-term growth prospects offering excellent investment opportunities. If you were a discerning, fundamentals-focused investor willing to take risks and put in the work to uncover these gems, you could achieve incredible investment success.

Our main thesis is that digital asset prices will increasingly trade based on fundamentals. We believe the rules applicable in traditional finance will apply here too. Today, many protocols generate real revenue and demonstrate product-market fit, attracting loyal customers. A growing number of investors are applying fundamental analysis and traditional valuation frameworks to price these assets.

Even data providers in this space are beginning to mirror those in traditional finance. Instead of Bloomberg and M-Science, we now have Etherscan, Dune, Token Terminal, and Artemis. Their purpose is essentially the same: tracking key performance indicators, income statements, management actions, and changes within companies.

In our view, the next trillion dollars entering this space will come from institutional asset allocators trained in these fundamental valuation techniques. By applying these frameworks today, we believe we are at the forefront of this long-term trend.

Fundamentals-Based Investment Process

The fundamentals-based investment process for digital assets closely mirrors that of traditional equity-like assets. This may be a pleasant surprise—and a key misconception—for investors familiar with traditional asset classes.

The first step is fundamental due diligence, answering the same questions used in public equity analysis. Does the product have market fit? What is the total addressable market (TAM)? What is the market structure? Who are the competitors, and what differentiates them?

Next comes business quality. Does this business have competitive moats? Does it have pricing power? Who are its customers? Are they loyal, or likely to churn quickly?

Unit economics and value capture are also critical. While we are long-term investors, cash ultimately matters—we seek to invest in sustainable businesses capable of eventually returning capital to token holders. This requires sustainable, profitable unit economics and effective value capture.

Another layer of our due diligence involves researching the management team. We assess their background, track record, incentive alignment, and strategic and product roadmaps. What is their go-to-market strategy? Who are their strategic partners, and what is their distribution strategy?

Compiling all this fundamental due diligence forms the first step for each investable opportunity. This ultimately leads to building financial models and investment memoranda for our core holdings.

The second step is translating this information into asset selection and portfolio construction. For many of our holdings, we build multi-year three-statement models with capital structures and forecasts. These models and memoranda are central to our process-driven investment framework, enabling us to make informed decisions on investment selection and position sizing based on event-path catalysts, risk/reward profiles, and valuations.

After making investment decisions, the third step is ongoing monitoring. We have a systematic data collection and analysis process to track key performance indicators. For example, for Uniswap, the decentralized exchange we’ve invested in, we actively collect on-chain data in our data warehouse to monitor Uniswap’s trading volume relative to its competitors.

Beyond tracking KPIs, we strive to maintain dialogue with protocol management teams. We find field research calls with management, their customers, and competing projects highly valuable. As a seasoned investor in this space, we also leverage Pantera’s broader network and connections within the community. We see ourselves as partners, committed to supporting management teams through insights on reporting, capital allocation, or operational best practices, contributing to these protocols’ growth.

Fundamentals-Based Investment in Practice: Arbitrum

A major criticism of Ethereum is that during periods of high activity, transactions on the base layer can become slow and expensive. While the roadmap for scalable platforms has long been debated, Layer 2 solutions like Arbitrum are emerging as viable answers.

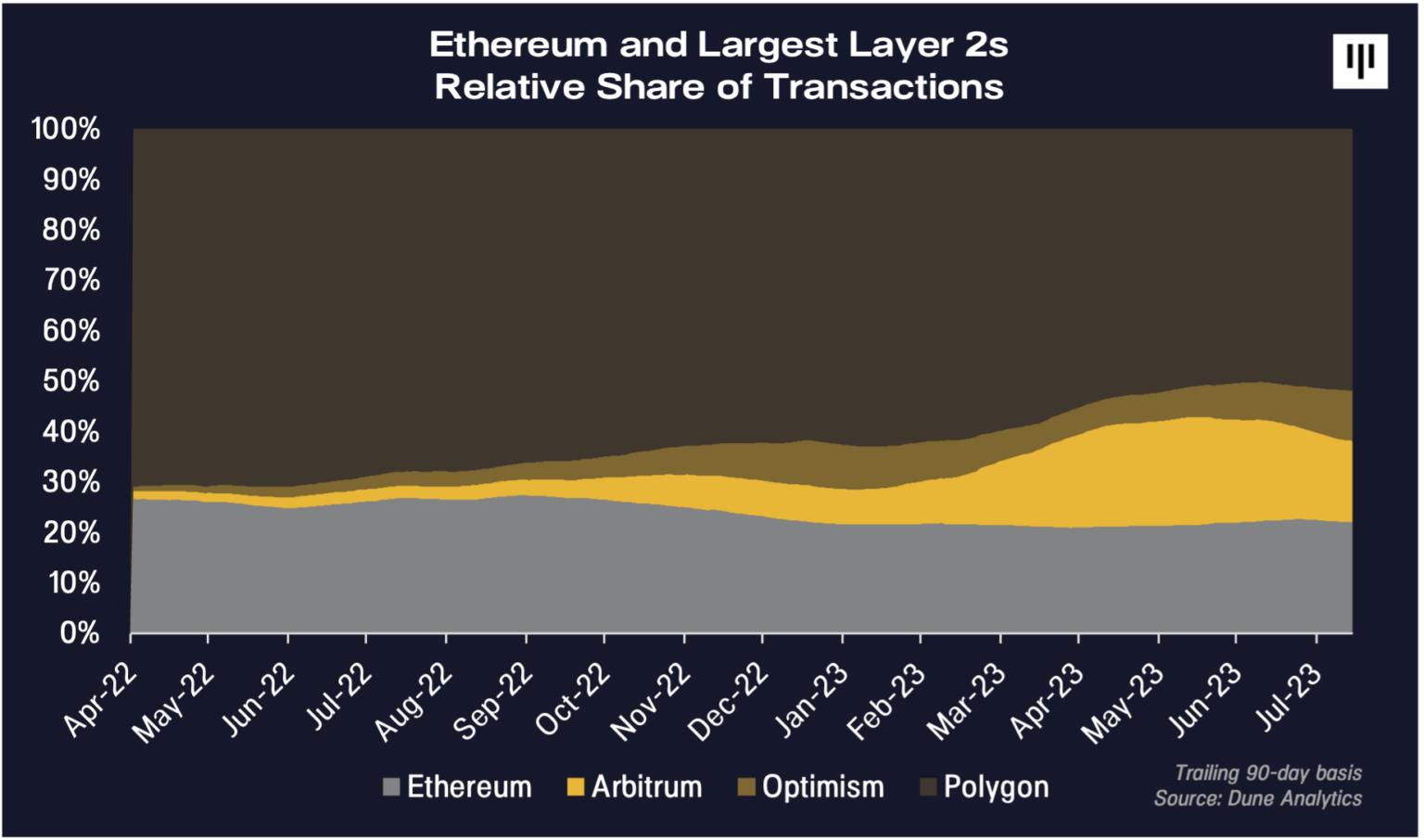

Arbitrum’s primary value proposition is simple: faster, cheaper transactions. It offers transaction speeds 40x faster and costs 20x lower than Ethereum, while supporting the same applications and maintaining equivalent security. As a result, Arbitrum has achieved strong product-market fit and demonstrated robust growth both in absolute terms and relative to peers.

For fundamentals-focused investors seeking evidence of traction-driven growth, Arbitrum ranks highly. It is one of the fastest-growing Layer 2 solutions on Ethereum and has captured a significant share of the transaction market over the past year.

To elaborate further, Arbitrum is one of the few chains to show rising transaction volume throughout the bear market, despite relatively weak overall usage. In fact, if you isolate the data, you’ll find that Arbitrum alone accounted for 100% of the growth in the Ethereum ecosystem this year. Arbitrum holds a substantial share within the Ethereum ecosystem, which itself commands a dominant position across the broader crypto landscape.

Arbitrum’s network is in a virtuous cycle. According to our field research, developers are attracted to Arbitrum’s growing user base and usage. This is a classic positive network effect: more users attract more developers interested in building new applications on Arbitrum, which in turn draws more users. But as fundamental value investors, we must ask: does any of this matter unless there’s a way to monetize this activity?

Answering that question is why we believe this is a compelling fundamentals-based investment opportunity—Arbitrum is a profitable protocol with multiple upcoming potential catalysts.

In this space, many casual investors may not realize that some protocols actually generate profits. Arbitrum earns revenue by charging transaction fees on its network, batching those transactions, and then paying Ethereum’s base layer to publish these large batches. When a user pays 20 cents for a transaction, Arbitrum collects that fee. It then bundles thousands of transactions and posts them to Ethereum Layer 1, paying roughly 10 cents per transaction. Simple math shows Arbitrum earns about 10 cents in gross profit per transaction.

We’ve identified a protocol with clear product-market fit and sound unit economics—this ultimately gives us confidence in its valuation.

Arbitrum’s Growth Across Key Operational Metrics

Below are some charts illustrating key fundamentals.

Since launch, active user counts have grown consecutively, approaching 90 million transactions per quarter. Revenue reached $23 million in Q2, with gross profit nearing $5 million in the same period—annualizing to $20 million. These are key performance indicators we can track and verify daily on the blockchain to monitor whether Arbitrum aligns with our investment thesis and financial projections.

Currently, Arbitrum averages around 2.5 million monthly users, each conducting approximately 11 transactions per month—about 350 million transactions annually. Based on this, Arbitrum is nearly a $100 million annual revenue business, generating around $50 million in normalized gross profit. Suddenly, this becomes a very interesting business.

Regarding catalysts and timing, a key part of our research process involves tracking Ethereum’s broader technical roadmap. The next major upgrade, EIP-4844, will dramatically reduce transaction costs for rollups like Arbitrum. Arbitrum’s primary cost—10 cents per transaction—could drop by 90%, to just 1 cent. At that point, Arbitrum will face a choice: pass these savings directly to users to accelerate adoption, retain them as profit, or do both. Either way, we anticipate this will be a major catalyst boosting both Arbitrum’s usage and profitability.

Valuation discipline is crucial in fundamental investing. Based on issued shares, Arbitrum currently has a market cap of $5 billion. In our view, this is quite attractive compared to other Layer 1 and Layer 2 protocols with similar valuations but only a fraction of the usage, revenue, and profit.

To contextualize this valuation against growth, we believe Arbitrum’s transaction volume could exceed 1 billion annually within the next year, with a 10-cent profit per transaction. That implies ~$100 million in earnings, meaning a forward P/E of roughly 50x at a $5 billion valuation. In absolute terms, this may seem expensive, but for an asset still growing at triple-digit rates, we consider it reasonable. Compared to real-world enterprise valuations, popular software companies like Shopify, ServiceNow, or CrowdStrike—with double-digit revenue growth—trade at average multiples of around 50x, despite growing far slower than Arbitrum.

Arbitrum is a protocol with strong product-market fit, rapid growth (both absolutely and relative to the industry), clear profitability, and a valuation that is reasonable relative to its own growth trajectory, other crypto assets, and traditional financial assets. We continue to closely monitor these fundamentals, hoping our thesis will be validated.

Macro-Level Catalysts

Several macro-level catalysts are on the horizon that could significantly impact the digital asset market.

Although institutional investment interest has cooled over the past year, we’re watching for upcoming events that could reignite investor enthusiasm. Foremost is the potential approval of a spot Bitcoin ETF. In particular, BlackRock’s application is significant for two reasons. First, as the world’s largest asset manager, BlackRock operates under intense scrutiny and only makes deliberate, well-considered moves. The fact that BlackRock continues to deepen its commitment to digital assets—even amid regulatory uncertainty and current market conditions—signals to investors that crypto is a legitimate asset class with enduring potential. Second, we believe ETFs will drive exposure and demand for this asset class faster than most anticipate. Recent news that the U.S. appeals court sided with Grayscale in its lawsuit against the SEC over the rejection of its spot Bitcoin ETF application greatly increases the likelihood that applications from BlackRock, Fidelity, and others will be approved—possibly as early as mid-October.

Although the regulatory environment is beginning to clarify, it remains perhaps the biggest obstacle to market progress, especially for longer-tail tokens. The courts pushing back against the SEC’s “regulation by enforcement” appears to be a rebuke of the SEC’s approach. Beyond the Grayscale spot Bitcoin ETF ruling, the court’s decision in favor of Ripple in its case against the SEC provides a positive interpretation that digital assets should not automatically be deemed securities. This is a pivotal moment, signaling that crypto regulation can and should be more nuanced. Regulatory clarity is essential—not only to protect consumers but also to give entrepreneurs the proper frameworks and guidance needed to confidently build new applications and unlock innovation.

Finally, crypto is at what we call the “dial-up to broadband” moment. As we’ve mentioned in previous letters, crypto is at a stage similar to the internet two decades ago. Ethereum scaling solutions like Arbitrum and Optimism are making tremendous strides, delivering faster transaction speeds, lower costs, and enhanced capabilities. Just as we couldn’t imagine the breadth of internet businesses that emerged after broadband replaced dial-up, we believe the same transformation awaits crypto. In our view, we have yet to see the full wave of new use cases enabled by this massive improvement in blockchain infrastructure and speed.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News