Where did people who left the crypto circle go?

TechFlow Selected TechFlow Selected

Where did people who left the crypto circle go?

Once you've made some quick money, it's hard to walk away completely.

Written by: 0xmin & Freya

Edited by: 0xmin

In the world of crypto, people come and go. Have you ever wondered: where do those who leave the crypto space end up?

With this question in mind, we interviewed numerous former industry insiders and received a wide range of answers: studying abroad, getting married and having children, retiring early, launching AI startups, selling insurance, tech-driven agriculture...

Leaving here doesn’t mean they no longer hold crypto assets—it refers to stepping away from working within the crypto industry. Some have earned enough to retire; some exited during bear markets; others remain unemployed...

As the gears of the crypto cycle turn, everyone gets swept forward—helpless and carried along.

What are the old-timers of crypto doing now?

In 2011, a pivotal moment in the history of Chinese cryptocurrency occurred—the founding of the community “8btc” (Babite).

Within the industry, the two co-founders of 8btc—ChangJia and QQagent (Wu Jihan)—are well known. But there was actually a third co-founder: financial writer Lao Duan.

In 2011, Lao Duan wrote several influential articles on Bitcoin, including “What Can Appreciate 3,000-Fold in a Year?” and “Bitcoin: A Great Innovation or a Giant Bubble?” In July 2012, he established the “Lao Duan Bitcoin No.1 Fund,” the first Bitcoin fund in China.

A few months later, the Cyprus banking crisis erupted. Bitcoin surged more than tenfold within eight months. However, this rapid rise created immense psychological pressure for Lao Duan. Facing redemption demands, he chose to liquidate his Bitcoin fund in April 2013, believing the rally had peaked.

Then, in November 2013—just five months after Lao Duan’s exit—Bitcoin unexpectedly surged again. Missing out on the rally, Lao Duan gradually shifted from being a Bitcoin evangelist to one of its harshest critics.

“The biggest value of Bitcoin right now is fulfilling Chinese people’s fantasy of ‘getting rich overnight.’”

From then on, Lao Duan parted ways with the Bitcoin world, diving into the stock market instead. He became a stock commentator and published books such as *Investment Magic Book*, *Positive Energy Investing*, and *Actually, You Still Don’t Understand Women*.

In March 2021, Lao Duan mentioned Bitcoin once again.

He revealed that at his peak, he held a four-digit number of Bitcoins—worth billions of RMB today. However, most were sold after gaining tens of times in value. What remained was still a three-digit amount—but these coins were trapped in a now-bankrupt exchange: Mt. Gox.

After Wu Jihan and Lao Duan left 8btc, ChangJia found new partners: Song Huanping, Chen Yurong, and Lang Yu.

Song Huanping was once titled “Co-founder of 8btc.” Today, his public profile reads: Founder of Happy Tiger Capital, the first angel investor in China’s food and beverage sector, with investments in Lelecha, Chen Xiangui, Huliu Ju, Jasmine Milk Tea, and Chef Huzi.

In 2013, Song learned about Bitcoin through a QQ group and was introduced to ChangJia by a friend, joining 8btc to help drive commercialization. But this journey lasted only four months.

In early 2015, using his first fortune from crypto, Song left the industry and entered venture investing, focusing on the food and beverage sector. He founded Happy Tiger Capital.

In a 2017 media interview, Song expressed frustration—and even sadness—about the crypto space:

“A surge brings a wave of attention, which quickly fades. Then when prices break another ‘unthinkable’ level, interest returns even stronger.”

“Bitcoin is a great thing, but the crypto space is too dirty.”

Since Bitcoin’s inception over a decade ago, countless grassroots individuals have seen their lives transformed. Most of the early crypto pioneers have now “retired,” fading from public view.

An early adopter who joined the Bitcoin community in 2013 told TechFlow: the old-timers he knows have either moved overseas, returned to family life raising kids, or become obsessed with ‘immortality,’ investing in peptide-related industries.

Once hailed as the “richest man in Bitcoin,” Li Xiaolai was long seen as the face of the Chinese crypto scene—until the 2018 leaked audio scandal led him to gradually step back. Post-crypto, Li Xiaolai continues writing books, but his main focus has become fatherhood—he now has multiple children and has taken on a new identity: educator.

After 2022, Li launched the “Family Growth Annual Community” (1,999 RMB/year) and in 2023 released a new course on Get: “Li Xiaolai on AI-Era Family Education,” which received widespread acclaim.

The Miners Who Retired

Once considered the apex of the crypto food chain, miners were abruptly severed from China by a single government directive banning crypto mining. So, where did the miners go after quitting mining?

Former miners interviewed by TechFlow emphasized the diversity within the mining community—large-scale and small-scale miners made very different decisions.

Some large miners relocated both their mining rigs and themselves overseas to continue operations, while others pivoted to AI, offering computing power to enterprises.

Most interviewees used the same phrase: “retired”—with savings, unwilling to work regular jobs, now enjoying life, traveling, and focusing on wellness.

Miner Wang Lei is now in full retirement mode. Having been burned by the crypto world, he’s extremely cautious—avoiding risky investments and distancing himself from the crypto community. He stakes ETH, earning nearly 4% annual yield, generating close to 80 ETH per year—enough to cover all his living expenses.

This is already a favorable outcome. After the last bull run, countless small and medium miners went bankrupt.

“During the last market cycle, many small miners got overconfident and failed to cash out. Some went from driving Porsches to driving for Didi afterward,” said former miner Li Xiaoming.

Many miners blindly invested during the bull market, got trapped in various primary and secondary market projects, and were further hit by the FTX and PayPal collapses—joining the ranks of claimants seeking compensation.

In Yunnan, Liang You—you a female miner who entered the Bitcoin community in 2012—turned to organic tech agriculture after the mining ban.

Shrimp farming, other seafood, orchards… she now enjoys her new life.

Prawns raised by Liang You

After thorough research, Liang You concluded that under China’s current economic conditions, agriculture offers a relatively stable and long-term business opportunity. Beyond tech agriculture, she also invests in other physical industries.

Though no longer mining, former miners like Liang You still follow crypto market trends. They share a common goal: accumulating and holding crypto assets.

Where Do Founders Go After Leaving?

Before entering crypto, Saul spent years in internet investment.

In the summer of 2021, the emergence of STEPN caught his attention—convincing him that blockchain gaming might be the future of the gaming industry.

This time, instead of just investing, he decided to launch his own startup. Compared to younger founders who grew up in crypto, he believed his edge lay in having experienced full market cycles and possessing deeper product and user expertise.

So, inspired by STEPN, Saul launched a similar move-to-earn project, securing funding from several prominent crypto VCs.

During the brief x-to-earn hype cycle, Saul’s project gained traction through marketing campaigns and partnerships with major blockchain ecosystems. NFT sales were strong initially. But like a flash in the pan, the collapse of STEPN’s sneakers plunged the entire x-to-earn sector into winter.

Saul’s project didn’t survive the crypto winter. After one year, he disbanded the team.

Saul partly attributes the failure to “market cycles”: “Web3 startups are highly cyclical—even more so than traditional finance. Web3 is a retail-driven, irrational market. The bigger issue is that Web3 struggles to acquire and retain real users. User growth is much slower than expected, especially in volatile markets.”

After winding down the project, Saul left the crypto industry and jumped into the booming AI wave, starting anew.

To Saul, crypto and AI are fundamentally different industries with distinct underlying logics. AI is primarily technology-driven, whereas crypto remains capital-driven. Blockchain products still fail to solve real-life problems effectively.

Still, he plans to keep an eye on crypto, believing there’s significant potential for synergy—especially in gaming. One day, he may even return to the space in a new role.

“Life is about experiences. If I could do it all over again, I’d still choose to start a company in crypto.”

Saul is just one example of the broader “Web3-to-AI” migration trend during the bear market. Will Wang, partner at Generative Ventures, noted: “To date, every mobile internet portfolio company I previously invested in that pivoted toward Web3 has now fully shifted back to AI.”

In June 2023, China’s oldest crypto media outlet, 8btc, announced a complete pivot to AI. Its founder, ChangJia, rebranded himself as the founder of Wujie AI, aiming to build China’s version of Midjourney.

A new question arises: When the next crypto bull market arrives, will these departing founders return?

Comings and Goings of Industry Professionals

Personnel turnover in the crypto industry often follows the boom-and-bust cycle: during bull markets, everyone returns; during bear markets, teams disband rapidly.

Xiao Jun originally worked in post-investment management at a top-tier crypto VC. Early this year, she received a layoff notice. After careful consideration, she chose not to seek another role in the industry, leaving crypto altogether to join a domestic healthcare firm.

For Xiao Jun, who comes from a wealthy family, work isn’t essential. She now has a higher priority: finding a partner and getting married—something that crypto industry jobs seem to complicate.

Xiao Jun is far from alone. From 2022 to 2023, the crypto bear market devastated investors’ portfolios and triggered a wave of layoffs across exchanges, VCs, and projects—all cutting costs to survive the downturn.

Antoniayly runs a Web3 job-seeking and recruitment community and has clearly felt the impact of the bear market unemployment wave.

“The talent pool grows by a dozen each week, but we’re lucky to see one new job posting per week. I check international job boards weekly—few companies are hiring. Mostly it’s big Western firms posting roles, but even their actual headcount is questionable.”

Leo, a founder who recently posted a job opening, told TechFlow: “As soon as I posted, I received a flood of applications—including many with impressive backgrounds.” In his view, this isn’t unique to crypto but reflects broader economic hardship. Many applicants came from major internet companies—they want to enter Web3 because the internet industry is more exhausting and cutthroat.

Whether in Web2 or Web3, everyone affected by layoffs is searching for a way out.

Xiao V, a journalism graduate, previously covered fintech at a leading tech media outlet. In 2018, she accidentally entered the crypto space by joining a blockchain media outlet as a lead writer—not chasing overnight wealth, but simply drawn to the novelty.

At the end of 2019, invited by a major internet company, she chose to “exit” crypto and “change environments,” moving into brand and marketing roles. But she quickly sensed the downsides of internet corporate culture: a general downward trend and the looming age-35 crisis.

“In a big company, you feel like just a screw in a machine—little room for personal expression or sense of value, and nowhere near as free as working in media.”

In mid-2023, amid waves of layoffs, Xiao V proactively accepted the “optimization package” and embraced a new path: insurance broker.

“From my observation, this is a highly promising field. Insurance penetration typically rises when a country’s per capita GDP reaches a tipping point. Young Chinese today have completely different views on insurance compared to the past.”

Another reason for her choice: the insurance industry rewards experience accumulation, which greatly benefits long-term career development. Modern insurance products are complex, requiring knowledge beyond the product itself—including law and medicine. Unlike the internet sector, ageism is far less prevalent; many successful brokers treat insurance as a lifelong career.

Recently, Xiao V will rejoin another major internet company as her main job, while continuing insurance brokerage as a side hustle.

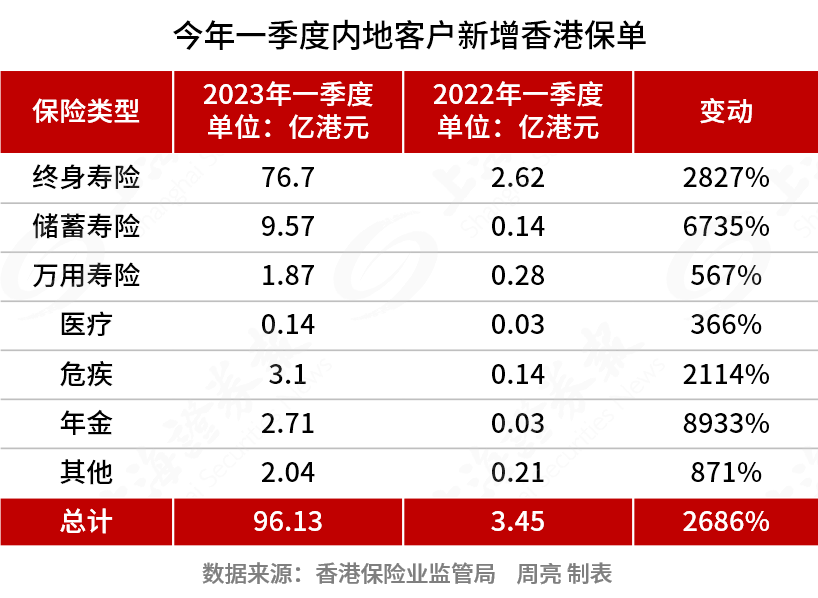

Notably, the author observed that many Hong Kong friends formerly active in crypto began, in 2023, turning their social media feeds into “Hong Kong insurance” sales platforms—either going full-time at insurers or becoming licensed managers.

In 2023, with border reopening, Hong Kong’s new Web3 policies, and relaxed high-talent immigration schemes, a large influx of mainland personnel and capital flowed into Hong Kong—applying for residency, launching startups, and buying insurance. This became a key 2023 “to-do list” for many crypto professionals, creating a fresh wave of financial opportunities.

At the end of our interviews, we usually ask one final question: “Would you consider returning to the crypto industry?”

Nearly everyone answered yes—most citing the appeal of decentralized, remote work and greater personal freedom.

Coco left crypto for a big tech firm in 2019 but returned in 2022. In her view, compared to traditional internet jobs, crypto work is significantly lighter—giving her time for side projects. Moreover, crypto changes one’s mindset and expectations.

“Losing money isn’t important. Once you’ve made quick gains, it’s hard to truly walk away,” Coco said.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News