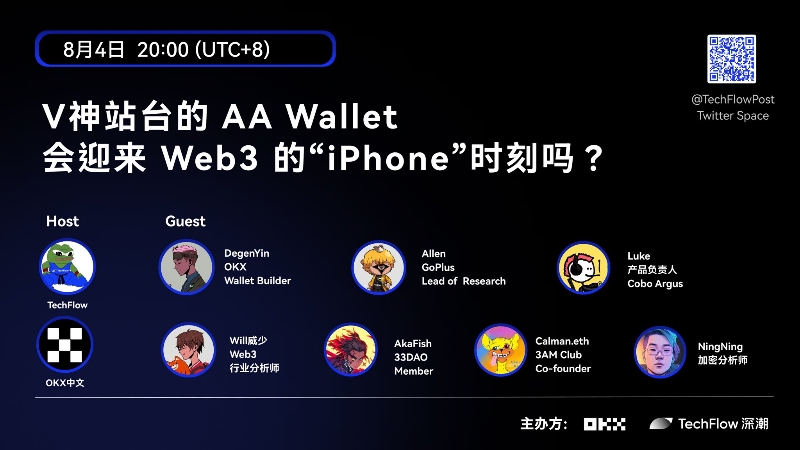

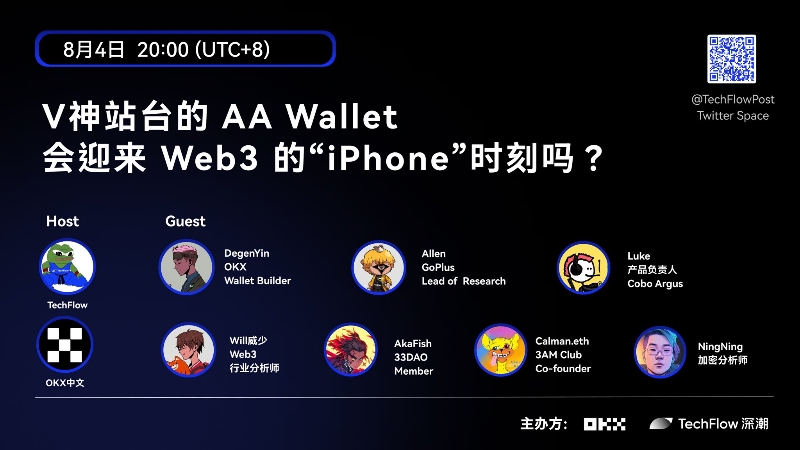

AMA Recap: Will AA Wallet, Endorsed by Vitalik, Usher in the "iPhone Moment" for Web3?

TechFlow Selected TechFlow Selected

AMA Recap: Will AA Wallet, Endorsed by Vitalik, Usher in the "iPhone Moment" for Web3?

As an AA, developers can build various extensions and plugins on it, enabling users to participate throughout the entire lifecycle of a transaction.

Compilation: 0xcbk

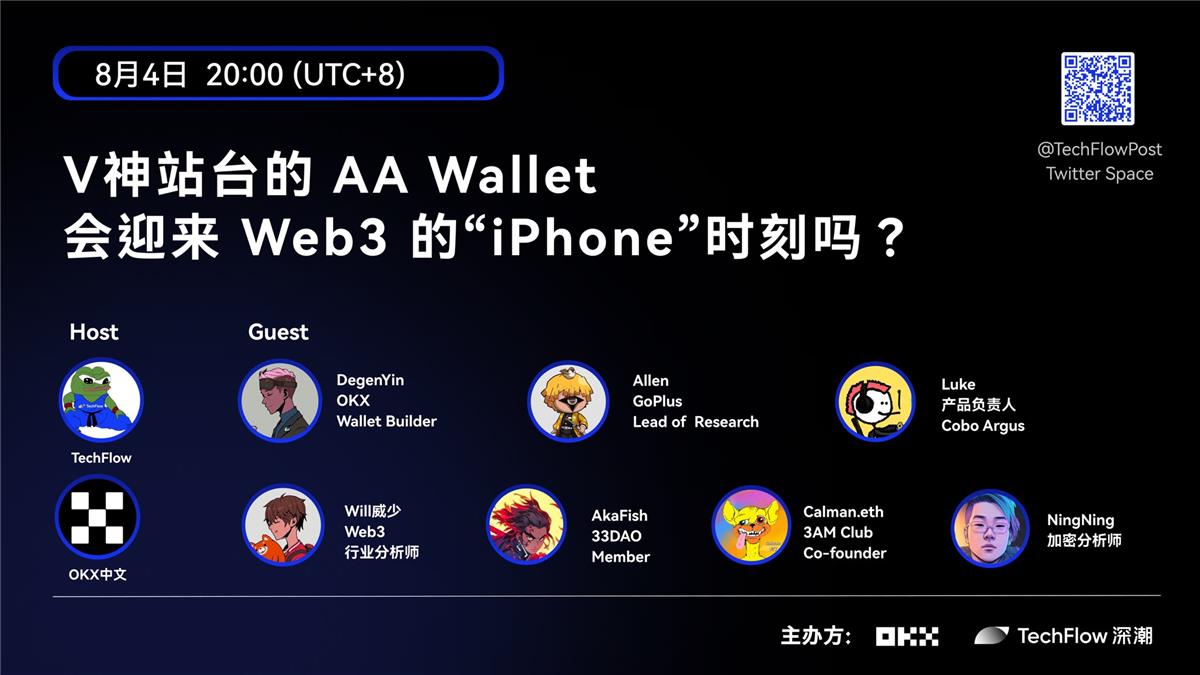

Guests of This Episode:

-

Host: David, TechFlow

-

DegenYin, OKX Wallet Builder

-

Allen, Lead of GoPlus Research

-

Luke, Product Lead at Cobo Argus

-

Will, Web3 Industry Analyst

-

AkaFish, Member of 33DAO

-

Calman.eth, Co-founder of 3AM Club

-

NingNing, Crypto Analyst

Introduction and Advantages of AA and EOA

TechFlow: Account Abstraction (AA) wallets have been widely discussed in public forums and described as an "iPhone moment" that could fundamentally change how end users interact with Web3. However, many listeners may have only heard the term without fully understanding what AA truly means. From a business perspective, what exactly are AA and EOA accounts, and what are their respective pros and cons?

DegenYin:

From my personal view, AA is like shifting from manual transmission to automatic transmission—a new type of account system. Just as cars gradually evolved from manual to automatic, AA wallets initially had slightly clunky user experiences, but over time they've become mainstream.

The push for AA was an initiative that existed even before 2017, aiming to use smart contract accounts for on-chain interactions. However, earlier proposals failed because they required changes to Ethereum’s consensus layer, which would affect existing stakeholders on the network.

Differences Between AA and EOA:

-

Most mainstream wallets today use EOA (Externally Owned Accounts). With EOA, each transaction requires a separate signature—for example, in yield farming, you first add liquidity, then authorize the farming controller, then stake your LP tokens. For multiple farming operations, this can involve 6–8 steps.

-

In contrast, AA wallets allow users to perform batch on-chain operations with one click, offering a Web2-like user experience. This is one of the key benefits of AA or smart contract wallets—they enable ordinary users to transact easily without needing to understand complex concepts. Additionally, AA ultimately allows gas fees to be paid in any token, not just the native chain token.

Integration and Outlook of MPC and AA

TechFlow: There's ongoing debate about the advantages and disadvantages between MPC wallets and AA wallets. In fact, our previous conclusion was that these two aren't particularly mutually exclusive. What are your thoughts on both technologies, and how do you assess their future potential and development possibilities?

Allen:

Vitalik might be more skeptical of MPC solutions. MPC and AA can achieve similar things—like social recovery and alternative authorization/signing methods—using different technical approaches.

I believe these two technologies can complement each other very well. Products in the market—including UniPass and OKX—are already working to provide users with combined MPC+EOA or MPC+AA solutions.

An AA wallet is essentially an abstraction layer, enabling developers and service providers to add features beyond those available in native accounts.

-

For example, AA wallets can implement advanced security features through risk control engines that evaluate transactions and help users avoid risks—this is one of the biggest strengths of AA wallets.

-

On the other hand, the main strength of MPC wallets lies in multi-party custody mechanisms, making them ideal for institutional asset management and exchanges.

Overall, these two technologies are not mutually exclusive—they can be combined effectively.

-

For retail (C-end) users aiming for mass adoption, MPC+AA solutions may be superior.

-

But for B-end institutions like asset managers and exchanges, MPC+EOA may be more suitable.

Luke:

To discuss whether MPC and AA wallets are mutually exclusive, we must recognize that MPC is a lower-level concept—it's a key-sharding technology that can manage both EOA and AA wallets.

AA and EOA, by contrast, are account-level concepts. AA wallets use on-chain smart contracts to enable programmable logic, while EOA wallets require manual signing for every transaction.

-

Most MPC wallets can easily implement features like social recovery and transfer risk controls. MPC combines non-programmable setups with centralized control, achieving advanced functions such as social recovery and transaction monitoring via centralized entities.

-

AA wallets, however, decentralize these same functions directly on-chain instead of relying on centralized control, giving them access to many powerful capabilities.

MPC and AA technologies can indeed be integrated—for example, OKEx and UniPass use MPC-related techniques in permission management within their AA wallets.

In the short term, MPC wallets are better suited for rapid large-scale user adoption, solving common concerns like private key loss. They also offer low transaction fees and strong compatibility with DeFi, making them highly attractive to average users. By contrast, the fully transparent, on-chain programming logic of AA wallets may not appeal much to regular users.

However, when it comes to features like social recovery or transfer risk control, there's little that AA can do that MPC cannot. The standout advantage of AA is its highly programmable account model, enabling advanced "black tech" features like delegation—allowing others to execute transactions or manage assets on your behalf, something impossible with EOA. Thus, AA wallets may be more appealing to professional users, such as experienced DeFi traders or institutions.

In the long run, AA wallets may become dominant, as they abstract the account layer and hold significant implications for the entire blockchain ecosystem.

Will:

When I first learned about MPC wallets, I saw their main selling point as being similar to multisig wallets—both are special types of EOA wallets. Multisig requires multiple private keys to sign a transaction; for instance, a 2-of-3 multisig needs two out of three keys, increasing security since attackers must compromise multiple keys.

MPC, however, works differently—it splits a single private key into multiple parts, each held by different parties, technically achieving multi-party custody. This gives MPC a clear security advantage, which is its primary benefit. For users unfamiliar with blockchain, MPC is especially suitable because it eliminates the need for complex seed phrases, simplifying account management.

As for AA wallets, I see their strength in high flexibility and ceiling. In terms of user experience, AA offers greater potential because users can predefine smart contract rules—customizing asset management, setting time delays for transfers, or configuring multisig approvals. So while AA suits professionals, it can also serve non-technical outsiders. For someone outside crypto, using an EOA wallet can feel overwhelming due to the need to manage private keys and seed phrases.

Additionally, for everyday crypto users, AA wallets offer greater convenience. Smart contracts can enable one-click swaps or one-click yield farming, significantly reducing costs.

Therefore, I believe MPC and AA wallets are not mutually exclusive—they can complement each other in different scenarios. We’re likely to see more hybrid wallets in the future, combining the strengths of both MPC and AA to meet diverse user needs.

AkaFish:

MPC wallets solve the problem of private key storage by splitting the key into multiple fragments, enhancing security. AA wallets, on the other hand, address inherent flaws in Ethereum’s current account model. Vitalik has advocated full account abstraction, indicating that AA represents the future direction of Ethereum’s account system.

Many projects now support AA wallets, viewing them as a crucial direction for Ethereum’s future. AA’s key advantage lies in customizable execution logic—enabling various added functionalities and protective measures. Compared to EOA, AA is far more flexible. Complex logic can be hidden behind simple interfaces, making front-end interactions more intuitive and intelligent, delivering a smoother, Web2-like experience.

AA wallets can also ease private key management challenges by introducing protection mechanisms—such as email, phone number, or Google Authenticator verification—to secure the wallet. As a result, AA wallets are smarter and more accessible, attracting more Web2 users and driving mass adoption of Ethereum.

In summary, AA wallets represent a major evolutionary path for Ethereum’s ecosystem and a core component for mass adoption. They will make Ethereum smarter, attract broader participation, and drive further ecosystem growth.

Calman.eth:

I believe MPC solves private key custody issues, while AA addresses certain limitations of Ethereum accounts. These improvements are vital for industry growth, helping attract more Web2 users and capital into Web3.

From the perspective of an average Web2 user entering Web3, AA wallets are particularly compelling. For example, imagine a Dogecoin holder wanting to invest in an NFT project and stake it on an NFT marketplace to earn fees. An AA wallet makes this seamless. The user simply registers a wallet on OKX, gets an AA wallet, transfers Dogecoin into it, uses Dogecoin to buy NFTs and pay gas fees, then stakes the assets. This kind of flow can bring more users and capital into Web3.

But for most users, distinguishing MPC from multisig wallets is difficult. From conversations with fans and community members, I’ve found that registering a wallet via a platform like OKX is simpler and friendlier than traditional wallets.

DegenYin:

Simply put, MPC and AA wallets aren’t mutually exclusive. At least in the short term, combining MPC and AA improves user experience. OKX plans to offer light versions of its exchange in certain countries, especially regulated ones, and also wants to provide a wallet specifically designed for beginners.

Users can register an account on the CEX, move to the wallet side, and automatically receive both an MPC wallet and a deployed AA wallet. This way, they don’t need to understand complex private key concepts, yet still enjoy the convenience of paying gas with Dogecoin or any other token.

Long-term, we align with Vitalik’s vision—EOA wallets have design flaws and may eventually become obsolete. While this transition may take time, OKX will continue investing in both areas to deliver a user-friendly experience across both models.

Impact of ERC-4337 on AA

TechFlow: Technological shifts and emerging trends influence product strategies. Ethereum’s ERC-4337 proposal supports the development of AA wallets. Many Layer 2 solutions already natively support AA wallets. How does this impact product planning in the wallet space?

DegenYin:

Julia, founder of Argent (the “flip-flop” wallet), mentioned that her wallet now holds 80% market share on Starknet. It supports Ethereum, Starknet, and zkSync. On Starknet, only AA is natively supported—there are no EOAs—and developers must build for AA. Under these conditions, users love paying gas in stablecoins via 4337 and enjoying one-click, seamless experiences.

However, Argent has also deployed on zkSync. He told me that 95% of developers don’t support AA because developing for AA is more expensive than for EOA—requiring backend and frontend rework. This means users can’t truly experience AA benefits when using DApps that don’t support it, as it falls back to EOA behavior.

Therefore, if a blockchain supports both AA and EOA, AA adoption will be a slow process due to limited developer support.

We may see more chains like Starknet emerge—chains focused solely on AA and excluding EOA. On such chains, AA-based applications could perform better. Meanwhile, EOA wallets face barriers—MetaMask, for example, still doesn’t support Starknet. Transitioning to AA wallets may take time.

OKX’s strategy includes both AA and EOA, but the AA entry isn’t prominently featured—making it easy for knowledgeable users to create AA wallets while not disturbing those unfamiliar with it.

Allen:

AA wallet development heavily depends on the developer ecosystem. As an AA platform, developers can build extensions and plugins, allowing users to participate throughout the transaction lifecycle.

Our security data primarily serves speculative traders who check whether token contracts contain backdoors or malicious traps (“pig-butchering” scams). Currently, once an EOA transaction is sent, it cannot be stopped—it’s a single-step process.

By contrast, AA transactions go through a risk control layer that can detect whether a token contract contains malicious behavior or prevents selling. Even after a user sends a transaction, plugins can block it, protecting the user seamlessly. This is critical for onboarding large numbers of Web2 users.

AA wallets are ideal for bringing in Web2 users, who are used to platforms like Alipay and WeChat, which have robust risk control systems. In terms of security, AA has a clear edge. That’s why GoPlus plans to collaborate with wallet providers to develop security plugins—so users get automatic protection without needing to learn complex security concepts.

Luke:

Difference between Native AA and Ethereum 4337:

-

Native AA means that from the start of a blockchain’s design, all accounts are treated as smart contract accounts—eliminating the distinction between EOA (Externally Owned Accounts) and CA (Contract Accounts). On a native AA chain, all accounts—user and contract—are smart contract accounts capable of executing code. All transactions, whether simple transfers or complex calls, are smart contract executions.

-

Ethereum 4337 is an upgrade to Ethereum’s existing account model, aiming to eliminate the difference between EOA and CA so all accounts behave like smart contract accounts, achieving effects similar to native AA. However, this is an enhancement built atop Ethereum’s current infrastructure—not a blockchain designed from scratch as native AA.

Pushing AA on non-native chains like Ethereum is challenging because developers are less familiar with AA, and most of the ecosystem remains EOA-centric. Ethereum 4337 is a non-native AA solution—an indirect, somewhat imperfect compromise. I believe Ethereum may achieve true native AA in 3–5 years. (This is also Vitalik’s goal.)

Most Layer 2s are EVM-compatible and prioritize full compatibility, so they adopt schemes similar to 4337—meaning they're also non-native AA.

Cobo is building a product similar to a smart contract wallet and has deeply felt the insufficient market support—for example, message signing isn’t supported, and many DApps don’t support ERC-721.

Still, we’ve identified interesting use cases—especially delegation. Users can grant specific permissions—like auto-trading, auto-liquidation, or automated trading strategies—to other accounts. This level of programmability is only possible with AA wallets and is highly valuable for experienced DeFi users, allowing automatic investments or emergency withdrawals during hacks.

Therefore, we continue exploring new use cases for native AA and smart active wallets. Our product is an extension module built on top of smart active wallets, not a wallet itself—so we can partner with various AA wallets to expand their utility.

User Appeal and Expansion Strategy for AA

TechFlow: Earlier, we mentioned that AA wallets support advanced scenarios like delegation—which is a strong selling point for some users. But we also care about user and market feedback, as this is crucial for understanding demand. What are your views on the market appeal of AA wallets? How can we attract more and broader users?

NingNing:

As Vitalik said, AA, ZK, and stablecoins are the three pillars for mass adoption of Web3/blockchain. But these pillars aren’t primarily serving today’s native Web3 users—they’re being built for the next wave, laying the foundation for widespread adoption.

DeFi yield-enhancement protocols often require users to create smart contract wallets. Considering gas fees and related transaction costs, setup can cost around $50—this is a barrier for both Web2 and Web3 users. In the future, AA wallets will likely reside mostly on Layer 2, not the mainnet.

Currently, most user feedback suggests wallets like Argent are hard to use—they add complexity. For example, Argent keeps upgrading along with Starknet’s fast iterations. Many users are confused: Why does the wallet address need upgrades? Why can’t they use it if not upgraded? During upgrades, many users lost assets. These are real production issues AA faces.

There’s also a big difference between AA and EOA: interacting with contracts increases gas consumption. Every AA transaction costs more gas than EOA. So AA trades higher learning and gas costs for composability and programmability.

As Vitalik described, if Web3 aims for mass adoption and seamless switching from Web2, AA must serve as foundational infrastructure—paired with ZK, the Cancun upgrade, and further gas fee reductions.

Right now, AA is in a “nice to have, but not necessary” state—neither projects nor users strongly demand AA wallets.

At ETHCC, we saw some AA-related apps—for example, Bob the Solver, an infrastructure based on “intend”-based transactions. It’s essentially an AI bot + AA wallet combo that lets Web2 users enter Web3 smoothly and effortlessly. Users just tell Bob their needs, and the AI automatically formulates appropriate DeFi trades and executes them via the AA wallet.

Twitter Campaigns leveraged AA and Twitter SDK to help X (formerly Twitter) monetize content.

Although AA wallets aren’t widely adopted yet, their innovation and experimentation are highly valuable—they create opportunities and pave the way for more users. Long-term, AA wallets will transform the industry and hold immense potential.

Calman.eth:

From an average user’s perspective, I believe AA wallets have potential. Currently, OKX Exchange has nearly implemented this functionality—allowing users to select a Web3 wallet within the centralized exchange wallet and include an AA wallet. While this process may still be somewhat cumbersome, if we can simplify it in the future, it could become a very smooth onboarding path.

I envision a scenario: when a user selects a Web3 wallet on OKX, they can choose a Light, Premium, or Pro version. Selecting Premium would automatically set up both a private key wallet and an AA wallet. Then, next time, the user just clicks a button to unlock the wallet—no need to import an existing EOA or generate a new one.

If these issues are resolved, the whole process becomes extremely simple. Users can buy crypto on OKX and transfer it to their AA wallet to perform desired actions. Of course, regulatory compliance is another factor to consider.

From an ordinary user’s standpoint, solving this could make either exchanges or wallet projects the hottest in the next bull market.

AkaFish:

A wallet is just a management tool—an infrastructure piece. Unlike projects that explode overnight and gain instant adoption, wallet development takes considerable time. After upgrades, the entire ecosystem needs to adapt—DApps included—and the journey from launch to mass adoption is relatively long.

Existing users are already comfortable with MetaMask and don’t urgently need a smart wallet to upgrade their asset management. Among smart wallets, Argent performs relatively well with higher intelligence, but its UX hasn’t created a strong sense of necessity.

However, as Ethereum and the broader ecosystem evolve, this infrastructural shift may gradually become mainstream, drawing in more users. Over time, AA wallets could become dominant and attract wider adoption.

Will:

From an average user’s viewpoint, AA wallets have market potential.

-

For newcomers outside the crypto world, AA lowers the entry barrier. Traditional EOA wallets impose many restrictions—trust issues and complicated processes may cause many to abandon them.

-

For existing EOA users, AA offers more convenient interactions—one-click swap, one-click farming—and products like OKX Wallet have impressed users.

How to Achieve Widespread Adoption of AA Wallets?

-

First, an ecosystem supporting AA wallets must be built—integrating AA into L2s, dApps, and decentralized exchanges, adding more features and services to enhance convenience and attract users.

-

Second, besides OKX, other CEXs should consider integrating AA wallets to retain existing users and attract new ones.

-

Third, AA wallets must continuously iterate on user experience. Smart contract code must undergo rigorous audits and testing to prevent vulnerabilities and attacks. Risks must be controllable.

OKX’s Timing for Launching AA

TechFlow: Was there a specific strategic consideration behind OKX’s recent timing for launching its AA solution?

DegenYin:

OKX originally planned to launch the AA wallet last month, but the release was delayed due to heavy focus on advancing BRC initiatives. However, the current timing is actually good—just as Vitalik promoted AA smart contract wallets again at EthCC in Paris.

OKX didn’t precisely time the launch because the crypto industry evolves so quickly—we’re constantly iterating and adapting our product.

We’ve been researching AA for a while and finally had the resources to push forward and launch quickly. While the current product may not be perfect, we have many optimizations and improvements scheduled and will keep iterating over the next six months.

Going forward, we’ll engage directly with the Ethereum Foundation and the core 4337 team to optimize user experience. The 4337 team also has a major plan underway—still under wraps. But one thing is certain: within the next year, AA wallets will become increasingly known and embedded across various domains.

Metrics for Wallet Success

TechFlow: When evaluating a wallet, what metrics matter most?

Allen:

When assessing wallet metrics, I think Alipay is a great reference. For average users, wallet evaluation can focus on several aspects.

-

First is security—users care whether their assets are well protected.

-

Second, during various transactions and investment strategies, users want seamless protection and risk controls to trade more confidently.

-

Third, protection against scams and malicious risks is also crucial.

Another key metric is usability. Users want to get started easily, without spending too much time learning. Current Web3 wallets still have room for improvement here.

From a developer’s perspective, wallets serve as infrastructure for the entire ecosystem. In Web3, wallets need open ecosystems to meet diverse developer needs. This means wallet providers should enable various built-in functions while allowing developers to customize their own. MetaMask has already experimented with this via MetaMask Snaps—letting developers build plugins, with users voting on which features get merged into the main version. This isn’t widely recognized yet, but I believe it will become increasingly important.

Luke:

Although the crypto industry involves many novel concepts, many can be understood through Web2 analogies. Wallet success hinges on identifying a core metric. Different wallet types should track different KPIs.

For example, ToB (business-facing) wallets can focus on TVL (Total Value Locked). Shape Wallet, one of the largest smart contract wallets in Ethereum’s ecosystem, manages $6 billion in assets. Yet its transfer frequency is low—each wallet averages just a few transfers per week.

From an activity standpoint, you might rate it poorly. But from a ToB wallet’s perspective—where the primary goal is holding large volumes—the product is actually very successful. This kind of metric—scale and capacity—is likely the North Star for most ToB wallets.

For ToC (consumer-facing) wallets, focus on user activity, growth across different lifecycle stages, new user retention, long-term engagement, and even user tenure.

AkaFish:

Wallet success can be measured by user count—usage is the core indicator. To achieve massive user adoption, profitability is essential. For example, TP Wallet succeeded due to excellent user experience. Future wallets will be key gateways—OKX Wallet, integrating exchange features and DApp access with smooth UX, is strategically powerful. The current bear market may dampen visibility, but when the market rebounds, combined with profit incentives and traffic, OKX Wallet is poised to capture a significant share.

Calman.eth:

For average users, wallets should be simple, streamlined, and security-focused. From an industry standpoint, the key is bridging the traditional world into Web3 to unlock new prosperity.

Simplifying UX and rapidly guiding users into the space is the future trend. Including OKX Wallet, centralized exchanges are actively leveraging their existing user bases to onboard them into Web3.

NingNing:

First, consider the network and ecosystem the wallet operates in—what apps and ecosystems it connects to, and its position within the broader network.

Second, assess the scale of assets and users it supports. For example, a wallet like OKX, with vast assets and users, can smoothly guide users toward enhanced services.

Will:

Core wallet functions include asset storage, transfer, and seamless interaction. Security and user experience are paramount.

Regarding assets, wallets must safeguard private keys and assets against leaks and attacks.

For experience, users expect convenient asset operations and interactions on both mobile and desktop.

DegenYin:

I believe the future of wallets hinges on improving three key metrics: security, user experience, and lowering barriers to entry.

On security, beyond monitoring and effort, OKX plans to launch a Security Center so users can monitor asset safety and mitigate potential risks. We also value user feedback and will continuously improve wallet security and usability.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News