In-Depth Exploration of Worldcoin: UBI Economics and Challenges in Token Fair Distribution

TechFlow Selected TechFlow Selected

In-Depth Exploration of Worldcoin: UBI Economics and Challenges in Token Fair Distribution

When broken down, Worldcoin is not significantly different from most cryptocurrency projects in terms of DID, wallet, and token; the key differences lie in the project's implementation extending beyond blockchain, as well as its impact reaching far beyond the blockchain space.

Worldcoin is a free token distribution project with close ties to Sam Altman, co-founder of Open AI, although its day-to-day operations are primarily led by CEO Alex Blania. The project may face challenges related to legal regulation, privacy protection, and scalability. At the same time, as a manifestation of UBI (Universal Basic Income) economics, it boasts strong backing and an ambitious vision.

Overview

Worldcoin is a free token distribution project. It aligns incentives among all participants and aims for widespread adoption by allocating the majority of tokens to new users as an incentive to join the network.

The Worldcoin project represents a concrete embodiment of UBI economics, whose goal is to achieve unconditional basic income. In 2020, during the global spread of the COVID-19 pandemic, many governments chose to distribute consumption vouchers or cash directly to citizens to stabilize their economies—a practical example of UBI economics. However, this approach also brought significant issues, such as inflation and reduced labor motivation.

Currently, UBI economics relies on centralized governments to handle wealth redistribution, funded either through government spending cuts or monetary expansion—neither of which truly creates new wealth. Therefore, genuine UBI economics might only become viable when artificial intelligence reaches a high level of maturity. Sam Altman, co-founder of OpenAI and Worldcoin, may view both AI and Worldcoin as expressions of his vision for the future world.

The biggest current challenge for Worldcoin lies in whether tokens can be fairly distributed and what underpins the value of these tokens. The Worldcoin team claims that iris scanning and ZKML technologies enable them to prevent Sybil attacks, but real-world performance has been mediocre so far, raising user concerns about data privacy and regulatory oversight.

Historically, most projects with similarly grand visions have failed completely. For instance, Facebook's Libra faced intense regulatory pressure, Pi Network remains embroiled in accusations of being a pyramid scheme, and while Bitcoin appears successful, its speculative value still far exceeds its utility. Thus, one thing is clear: the success rate for such projects is extremely low.

Advantages of Worldcoin include:

1) Strong team background;

2) Grand vision with significant potential;

Disadvantages of Worldcoin include:

1) Potential for user privacy breaches;

2) Token distribution cannot fully eliminate Sybil attacks;

3) Possible regulatory risks and substantial development obstacles;

4) Low historical success rates for similar projects;

5) As a UBI initiative, the token lacks tangible backing, potentially harming individual investors.

Therefore, this project warrants cautious observation.

1. Basic Overview

1.1 Project Introduction

Worldcoin is a free token distribution project leveraging blockchain, biometrics, statistics, and other technologies.

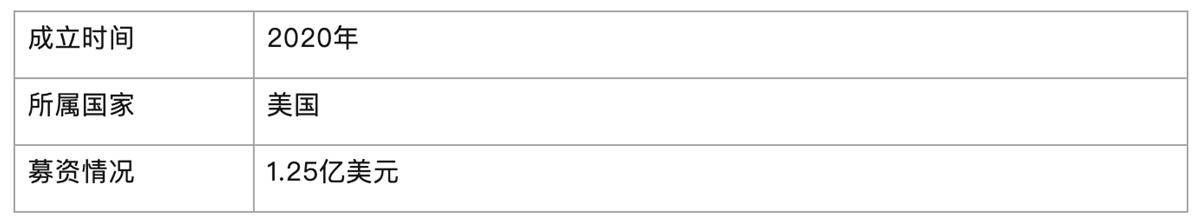

1.2 Basic Information

2. Project Details

2.1 Team

Alex Blania: Researcher at Caltech from 2019 to 2020; CEO and Co-founder of Tools for Humanity, the operating company behind Worldcoin, since 2020.

Matthieu Jobbé-Duval: Head of Oil Options Trading at Barclays Investment Bank from 2009 to 2017; worked on digital asset initiatives at Barclays in 2018; Financial Products Lead at Coinlist from 2019 to 2021; Group Product Manager at Coinbase in 2021; Financial Products Lead at Dapper Labs from 2021 to 2023; Advisor at Tribal since 2021; joined Worldcoin as CEO and Co-founder starting April 2023.

Saturnin Pugnet: Studied Computer Science at Imperial College London from 2014 to 2018; Software Development Engineer at Amazon in 2017; Software Development Engineer at TransferWise from 2017 to 2018; returned to Amazon as a Software Development Engineer from 2018 to 2019; founding member of Worldcoin in 2020.

Michal Oginski: Bachelor’s degree in Civil Engineering from the University of Bath (2014–2018); Master’s in Management from the University of Cambridge (2018–2019); Consulting Associate at The Boston Consulting Group in 2018; Consulting Director at 180 Degrees Consulting SRCC from 2018 to 2019; Consulting Associate at Bain & Company from 2019 to 2021; VP at Daftcode from 2021 to 2022; Business Operations Manager at Worldcoin since September 2022.

Samuel Barnes: Business Manager at Likeable, a 10Pearls Company in 2015; Brand Strategy Consultant at Whiteboard Pictures from 2016 to 2017; founded Sun Rose Strategy between 2015 and 2017; Social Media Director at New York Open Center in 2017; Contributing Writer at Well from 2017 to 2018; Liaison Officer at Singularity University from 2018 to 2019; Product Lead at RegeNFT from 2021 to 2022; Community Lead at Forta Foundation from 2021 to 2023; Community Manager at Worldcoin since 2023.

The most notable aspect of the Worldcoin team is Sam Altman, co-founder of OpenAI. However, Alex Blania serves as the actual CEO responsible for daily operations, while Sam Altman remains primarily focused on OpenAI. Investors should not overestimate the influence of ChatGPT-related hype around Altman.

2.2 Funding

To date, Worldcoin has raised $125 million: $25 million in Series A funding and $100 million in initial token sale financing.

2.3 Codebase

Figure 2-1: Worldcoin code repository status

According to its GitHub page, the Worldcoin project primarily uses programming languages including C++, C, Python, M4, Makefile, and Shell, with a total of 694 contributors.

2.4 Product

Worldcoin is an open-source protocol designed to help everyone access the global economy. It aligns participant incentives and focuses on distributing most tokens to new users as an incentive for joining the network to drive broad adoption. Currently, Worldcoin is operated by two entities: the Worldcoin Foundation and Tools for Humanity. The Worldcoin Foundation is a non-profit organization aimed at supporting and growing the Worldcoin community until it becomes sufficiently decentralized. It achieves this by fostering developer communities, offering grants, and establishing governance participation mechanisms. Tools for Humanity is a technology company focused on accelerating the transition toward a more equitable economic system. It led the initial development of the Worldcoin protocol and operates the World App, in addition to building tools that support the broader ecosystem.

Worldcoin consists of three main components:

1) World ID — A privacy-preserving digital identity designed to solve critical identity-based problems, including proving individual uniqueness;

2) World Token — A globally distributed token provided free of charge, used for utility and governance;

3) World App — A fully self-custodial application enabling payments, purchases, and transfers using Worldcoin Tokens, digital assets, stablecoins, and traditional currencies worldwide.

Among these, World ID is the most crucial component, providing proof-of-personhood. The team argues that rapid advancements in AI have intensified the need to distinguish humans from AI-generated online content. Proof-of-personhood addresses two key considerations in the age of AI:

1) Preventing Sybil attacks;

2) Minimizing the spread of misinformation generated by AI.

World ID is an open, permissionless identity protocol functioning as a global digital passport. It enables anonymous verification of uniqueness and humanness, along with selective disclosure of credentials issued by third parties. Proof-of-personhood establishes an individual's humanity and uniqueness, serving as a foundational module for digital identity. It primarily solves two issues: eliminating large-scale Sybil attacks through authentication, and filtering content or accounts confirmed or unconfirmed as human—helping combat AI-generated disinformation. Overall, World ID, World Token, and World App resemble familiar concepts like DID (Decentralized Identifiers), tokens, and wallets. However, unlike typical blockchain approaches, Worldcoin integrates biology and statistics alongside blockchain, which plays only one role within the system.

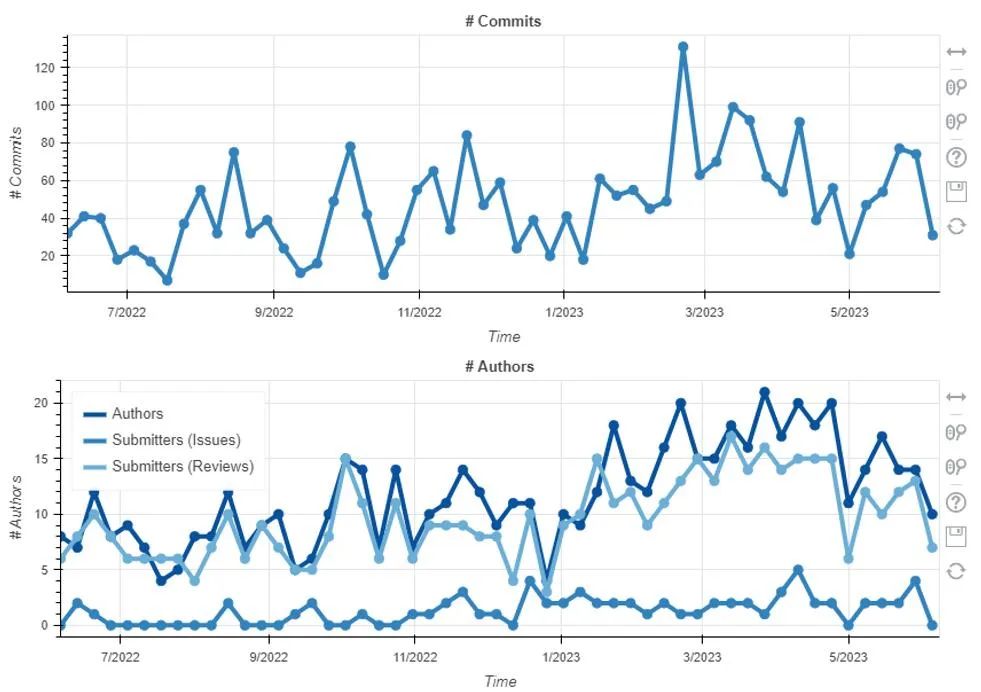

World ID provides a World ID SDK for developers. World ID acts as a digital passport allowing users to prove they are unique and real individuals without revealing personal information, enabled via zero-knowledge proofs (ZKP) and other privacy-preserving cryptographic techniques. To integrate and use World ID, developers must first register on the developer portal, create their first app, and configure it. Use cases for World ID include voting, social media, and fund distribution. A user’s World ID resides solely on their personal device. Users install a compatible identity wallet, generating a unique private key stored locally on the device, which may include recovery mechanisms.

Based on the user’s private key, a file is created and published on-chain—this is known as an identity commitment. Each verification generates a ZKP from the user’s wallet, ensuring verifications cannot be linked across apps or sessions, thereby protecting privacy. The principle of proof-of-personhood allows someone to digitally verify they are a unique human being. Building a global, scalable, and inclusive proof-of-personhood system is central to World ID. Crucially, it only needs to confirm someone is human—not who exactly they are.

To serve external applications, World ID functions as an OpenID Connect provider. The diagram below outlines the general authentication flow for integrated apps:

Figure 2-3: World ID login process

Worldcoin operates in three steps:

1) Download the World App

Downloading the World App allows users to set up a Worldcoin account and access a digital wallet connected to Worldcoin, Bitcoin, Ethereum, and other digital and traditional currencies (including stablecoins). The World App is operated by Tools for Humanity, a contributor to the Worldcoin system.

2) Register a World ID

Users can use the World App without registering a World ID. However, to receive a free share of Worldcoin and other cryptocurrencies, users must visit a Worldcoin operator and complete Orb verification.

3) Receive a Free Share of Worldcoin and Other Cryptocurrencies

Each World App user receives a smart contract-based Ethereum wallet deployed on-chain. The World App leverages account abstraction to enhance overall wallet security, using the Safe-developed account abstraction stack underneath. Peer-to-peer payments support ENS usernames for more user-friendly ERC-20 transfers, and token swaps are facilitated via Uniswap.

Key elements of the project include:

Zero-Knowledge Machine Learning (ZKML)

Zero-knowledge proofs (ZKP) are a well-known concept in the blockchain industry—an encryption protocol where a prover can convince a verifier that a statement is true without revealing any additional information beyond the truth of the statement itself. ZK offers two primary "primitives": the ability to generate computational integrity proofs for certain computations, which are easier to verify than to compute. Generating ZK proofs requires significantly more computation than the original task—sometimes making it impractical due to excessive time requirements. ZK technology can be applied to identity verification and data provenance. Worldcoin aims to build World ID, a privacy-preserving proof-of-personhood protocol that allows anyone with a World ID to cryptographically prove their uniqueness without exposing their identity.

Machine learning, a subfield of AI, involves developing algorithms that allow computers to learn and adapt autonomously from data, improving performance iteratively. Large language models like GPT-4 and Bard represent cutting-edge natural language processing systems trained on vast datasets to generate human-like text. Text-to-image models such as DALL-E 2, Midjourney, and Stable Diffusion convert textual descriptions into highly realistic visual outputs.

A potential application of ZKML in the context of Worldcoin is iris code upgradability. World ID users would store their signed biometric data securely on their mobile devices, download machine learning models used for iris code generation, and locally produce zero-knowledge proofs demonstrating that their iris codes were correctly generated from signed images using the proper model. These iris codes could then be permissionlessly added to the registry of verified Worldcoin users. Smart contracts would be able to validate the zero-knowledge proofs associated with each iris code creation.

Operator

Users can apply to become operators. The process includes four steps: 1) Fill out an application form; 2) Attend an interview; 3) Receive an Orb device; 4) Begin promotion. Operators earn revenue for every successful user registration via the Orb. Becoming an operator requires building a promotional team and choosing high-traffic locations for outreach.

Figure 2-2: Operator application form

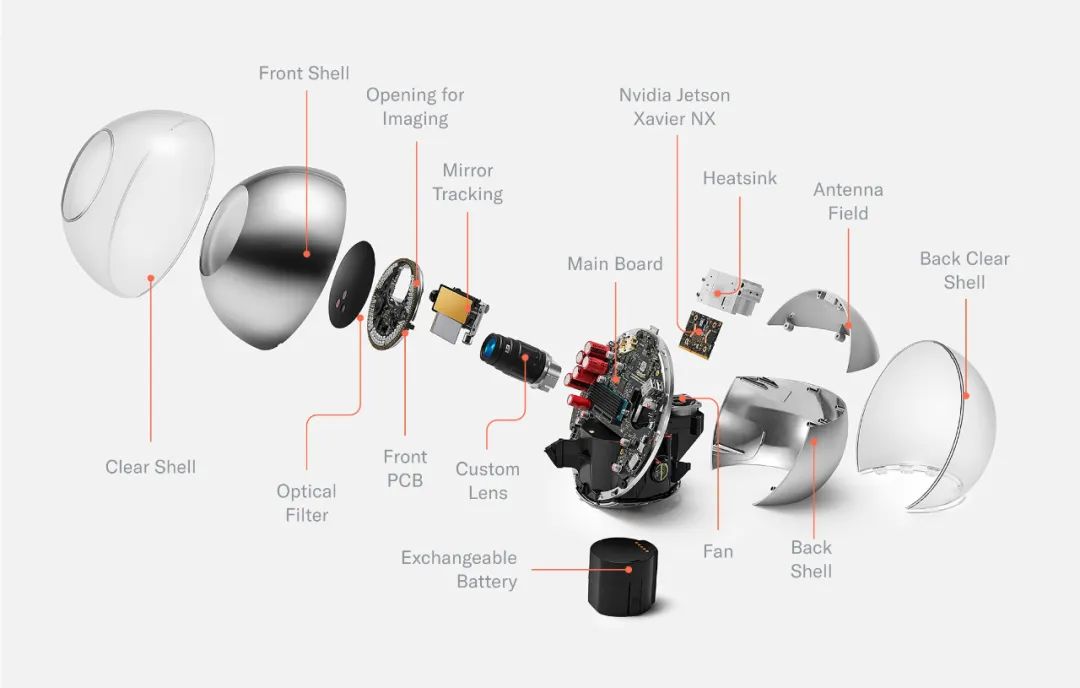

Orb

Orb is Worldcoin’s iris-scanning technology used for identity verification. It is a compact device that verifies a user’s identity by scanning their iris. This technology aims to enhance the security and reliability of identity verification and enable fair cryptocurrency distribution through a crypto-based universal basic income. Since its inception, Orb has sparked controversy, with many concerned about the safety and privacy implications of iris scanning. In response, the Worldcoin team states that existing commercial iris imaging devices do not meet their technical or security standards. They spent years developing custom hardware to achieve universal access to the global economy in the most inclusive and privacy-preserving way possible. Orb is part of the World Protocol, verifying whether a person is a real and unique human. Using highly specialized sensors, it ensures the user is physically present, captures and processes iris images—and typically deletes them immediately afterward—to generate an iris code. Messages containing the iris code are sent from the Orb and compared against previously scanned codes. Successfully verified users receive a proof of identity in a compatible digital wallet. Worldcoin promises robust privacy protections, claiming the Orb prevents spoofing, tampering, or hacking. Each Orb contains a private key stored in secure hardware, used to authenticate the device and sign important messages. Anti-fraud algorithms based on multispectral sensors run locally on the device to maximize privacy. By default, iris images are deleted immediately after iris code generation. Additionally, dedicated teams continuously test and improve Orb’s security.

The team admits they initially did not want to develop hardware due to the significant human and financial resources required. However, they believe iris scanning is the most effective method to combat Sybil attacks. Iris patterns offer strong anti-fraud properties and rich data characteristics. The Orb comprises three main parts:

1) Sphere disassembly;

2) After removing the casing, the motherboard, optical system, and cooling system become visible;

3) Mechanical design.

The Orb can be divided into four core sections:

1) Front-end: Optical system;

2) Middleware: Motherboard dividing the device into two hemispheres;

3) Back-end: Host computing unit and active cooling system;

4) Bottom: Replaceable battery

Figure 2-3: Orb internal breakdown diagram

How does Orb protect user privacy?

The team guarantees no data will be sold. The most critical challenge for Worldcoin’s token distribution is ensuring each person receives tokens only once. To address this, the team uses iris biometrics—an individual’s unique biological identifier. To safeguard this sensitive data, images collected by the Orb are immediately deleted unless explicitly requested otherwise by the user. By default, the only personal data leaving the Orb is a digitally represented summary of the image’s key features—used solely to verify uniqueness—known as the World ID. The World ID is designed to be completely disconnected from raw biometric data. Using zero-knowledge proofs, users can share specific information (e.g., proof of uniqueness) without disclosing anything else. World ID currently uses an open-source protocol called Semaphore to ensure anonymity and unlinkability during verification. Semaphore is a zero-knowledge protocol allowing users to signal group membership (e.g., voting or endorsing) without revealing identity. It also provides a simple mechanism to prevent double-spending.

According to BlockBeats, users in certain regions were unable to claim tokens upon launch, leading to a new phenomenon: scalpers collecting villagers’ iris scans in Southeast Asia and selling verified registrations for $30 or less to international crypto users. A Worldcoin spokesperson acknowledged this issue but stated it was limited to “a few hundred cases.” The spokesperson added: “Through ongoing threat monitoring and awareness measures, the Worldcoin team has identified suspicious and potentially fraudulent activities involving individuals registering verified World IDs and transferring them to third-party World Apps instead of keeping them personally.”

Meanwhile, Worldcoin’s handling of privacy continues to face regulatory scrutiny. Worldcoin has a registered subsidiary in Germany. Under GDPR principles, any entity operating in the EU or processing data of EU residents falls under EU jurisdiction. There is a de facto conflict between Worldcoin’s global operations and EU regulations. For example, the team claims 1% of Portugal’s population are already users, yet how global data is managed remains inadequately explained. According to GDPR, “failure to adequately protect data may result in fines up to 4% of global revenue or €20 million, whichever is higher.”

Additionally, whether Worldcoin can achieve truly fair token distribution remains questionable. Due to varying national regulations, residents of countries like China and the U.S. can register the app but cannot complete World ID verification. Official data shows most registrants come from poorer nations—Africa and Latin America. Of the 24 countries and regions participating in testing, 14 are developing nations, with 8 located in Africa. Specific distribution includes:

Africa: Benin, Ghana, Nigeria, South Africa, Sudan, Zimbabwe, Kenya, Uganda;

Latin America: Brazil, Chile, Colombia, Mexico;

Europe: France, Germany, Italy, Netherlands, Portugal, Spain, UK, Norway;

Asia: India, Indonesia, Israel, Turkey

There is skepticism regarding the global rollout of its token. Moreover, Worldcoin exhibits relatively low in-house R&D capability, relying heavily on partnerships with established projects. At the infrastructure layer, it collaborates with Optimism; for wallets, it partners with Safe; for transactions and transfers, it uses ENS and Uniswap. While reinventing the wheel isn't always necessary, overall, Worldcoin cannot be considered a highly innovative project.

Summary: Worldcoin is an open-source protocol aiming to promote global adoption of its native token. Its biggest highlight is the association with OpenAI founder Sam Altman, which has driven investor interest. Worldcoin attempts to verify users’ humanity and uniqueness via iris scanning, but current results show limited effectiveness in preventing abuse (“farmers”), while raising serious privacy concerns and attracting regulatory attention. Upon closer inspection, Worldcoin’s architecture—with DID, wallet, and token—is not fundamentally different from most cryptocurrency projects. Key distinctions lie in its implementation methods, extending beyond pure blockchain, and its ambitions reaching beyond the crypto sphere. However, its self-developed capabilities are modest, with most components built through collaborations with major players.

3. Development

3.1 History

Table 3-1: Major events in Worldcoin history

3.2 Current Status

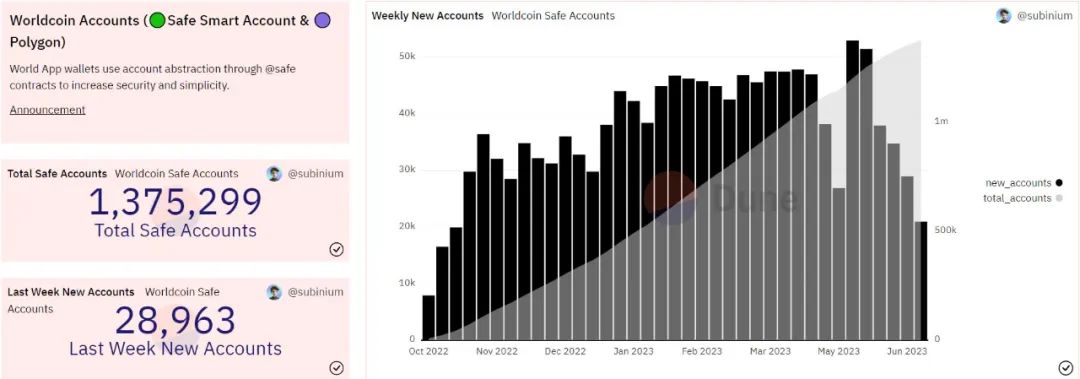

Figure 3-1: Worldcoin account creation data

As of now, Worldcoin has registered 1,375,299 accounts on Polygon, with 28,963 new accounts added last week. Based on the stacked chart, the growth rate has slowed compared to previous periods.

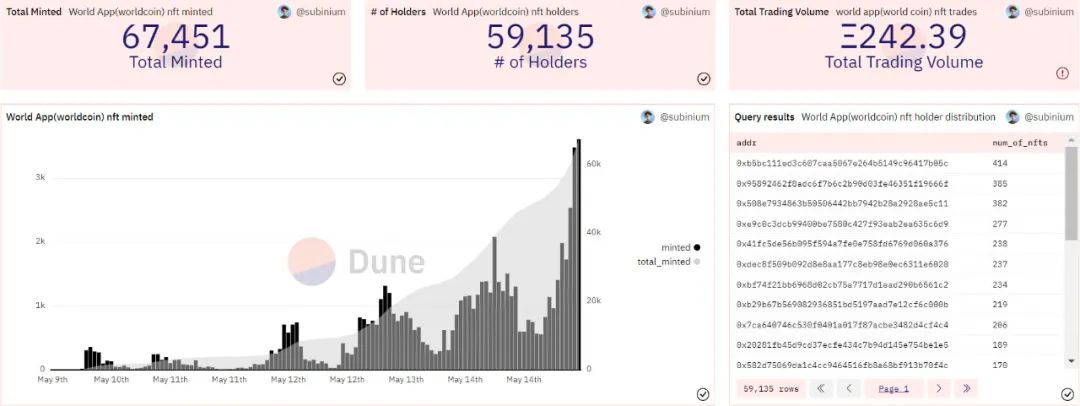

The Worldcoin App previously issued commemorative NFTs, now tradable on OpenSea, with a floor price of 0.008 ETH.

Figure 3-2: Worldcoin NFT minting data

A total of 67,451 World App NFTs have been minted, held by 59,135 unique addresses. The top holder owns 414 NFTs, and the lowest among the top ten holds 189. Total trading volume stands at 242.39 ETH (OpenSea reports 246 ETH).

3.3 Future Outlook

The project has not yet released a roadmap.

Figure 3-3: Worldcoin Discord response regarding Roadmap

4. Economic Model

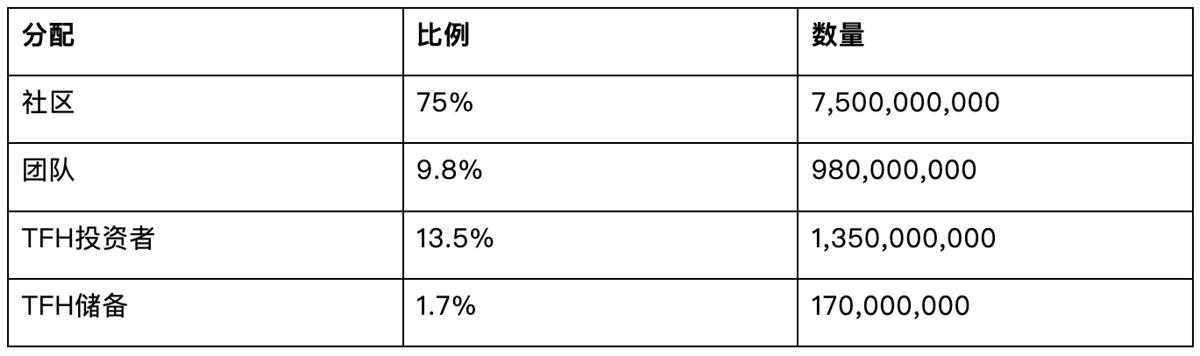

Token name: $WLD, total supply 10 billion.

Table 4-1: Worldcoin token allocation

5. Competition

5.1 Industry Overview

The Worldcoin project embodies UBI economics—the study of the concept, principles, impacts, and implementation methods of unconditional basic income. UBI refers to regular cash payments made by governments or organizations to all members unconditionally, without work requirements, to ensure a basic standard of living and dignity. UBI economics touches on multiple dimensions: theoretical foundations, funding sources, distribution effects, incentive structures, social welfare, economic growth, and social stability. It also examines the feasibility and adaptability of UBI across different countries and regions, as well as coordination with other social policies. UBI economics resembles historical utopian socialism. While rising productivity and AI advancements lend some theoretical plausibility to such ideas, UBI risks triggering inflation, debt crises, weakened work incentives, and loss of social responsibility—leading to resource waste and inefficiency. Furthermore, UBI faces implementation and sustainability challenges concerning funding sources, disbursement criteria, and oversight mechanisms. Overall, UBI projects are ahead of current societal development—they redistribute wealth rather than creating it.

Projects like Worldcoin argue that existing economic models are flawed and aim to improve human life. Whether these projects genuinely benefit society or merely seek a slice of the massive financial sector is difficult to quantify. We lack metrics to assess whether such macro-level interventions truly solve systemic problems. Hence, we can only evaluate their likelihood of success through logical and theoretical analysis.

5.2 Competitor Comparison

Libra

In 2019, internet giant Facebook launched Libra—a plan to create a simple global currency and financial infrastructure. Managed by the independent nonprofit Libra Association, composed of Facebook and several other companies and institutions, Libra was a stablecoin pegged to a basket of fiat currencies, enabling fast, low-cost cross-border payments on supported platforms. The project gained unprecedented attention after releasing its white paper in June 2019, but also triggered global regulatory skepticism over threats to financial stability and monetary sovereignty. Some founding members withdrew under political pressure. To address regulatory hurdles, Libra released version 2.0 of its white paper in April 2020, introducing major changes:

1) Abandoned the single stablecoin model, shifting to multiple single-currency-backed stablecoins (e.g., LibraUSD, LibraEUR) plus a composite coin (Libra Coin);

2) Strengthened reserve safety and transparency, committing to store reserves in reputable central banks or international institutions with audit and oversight;

3) Enhanced anti-financial crime and consumer protection measures, requiring compliance with local laws and risk verification via compliant network interfaces (VAN);

4) Gave up on achieving a permissionless network, maintaining a permissioned structure with future transitions subject to association votes.

Despite these adjustments, the Libra project ultimately failed due to several reasons:

1) Regulatory resistance: Since its white paper launch in June 2019, Libra faced strong opposition from governments and regulators worldwide, fearing threats to financial stability, monetary sovereignty, consumer protection, data privacy, AML, and counter-terrorism financing. The U.S. Congress demanded Facebook halt the project and held multiple hearings questioning David Marcus, head of Libra. The project encountered strict regulatory barriers in the U.S. and Europe, failing to obtain necessary approvals;

2) Loss of partners: Initially led by Facebook and backed by 28 prominent organizations forming the Libra Association, key members like PayPal, Visa, Mastercard, eBay, and Stripe eventually exited under governmental pressure. This eroded the project’s credibility and influence;

3) Asset sale: Despite rebranding as Diem, the project never gained U.S. approval and faced competition from other crypto initiatives. In January 2022, the Diem Association announced the sale of intellectual property and assets related to the Diem payment network to Silvergate Bank and began winding down subsidiaries—marking the official end of Facebook’s cryptocurrency dream.

Bitcoin

Bitcoin is a cryptocurrency and decentralized digital currency不受任何 government or financial institution control. Created in 2009 by an individual or group using the pseudonym Satoshi Nakamoto, Bitcoin enables peer-to-peer transactions without intermediaries like banks. Transactions are recorded and verified via blockchain technology—a distributed database storing all transaction records. Each block contains multiple transactions cryptographically linked to the previous one, forming an immutable ledger. On-chain data indicates over 1 billion wallet addresses, approximately 250,000 daily transactions, and around 1 million active addresses per day. Assuming five unique addresses correspond to one user and a 30% overlap with Ethereum users, Bitcoin’s total user base is estimated at roughly 3.89 million. In comparison, Visa, a digital payment company, has over 426 million active user and merchant accounts, operates in over 200 markets, and supports 25 currencies. Clearly, Bitcoin still lags significantly behind traditional payment systems.

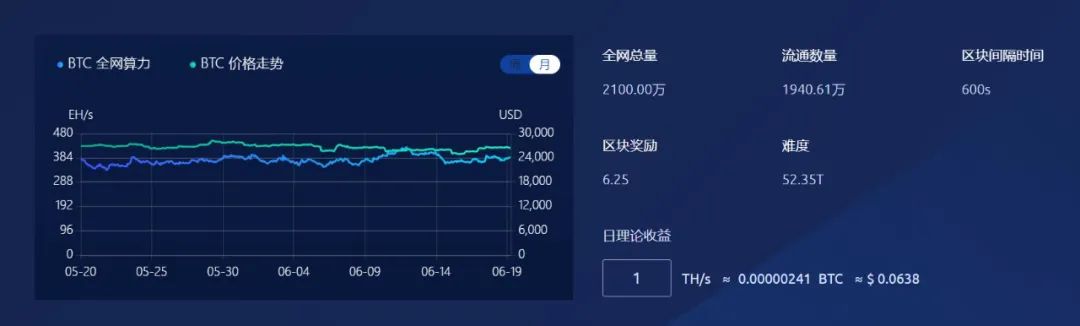

Figure 5-1: Bitcoin hashrate network

Pi Coin

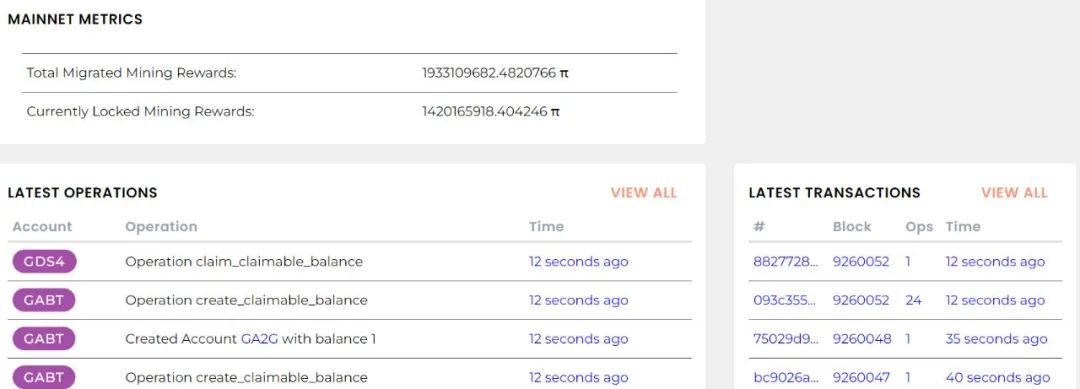

Pi Coin is the native currency of Pi Network, mineable via the Pi app. It uses the Stellar Consensus Protocol, originally developed for the Stellar blockchain. Pi Network aims to build a cryptocurrency and smart contract platform securely operated by ordinary people. It offers a developer platform called Pi Apps Platform, featuring the Pi Browser interface for rapid development, testing, and deployment of decentralized Pi apps. Users access these apps by downloading the Pi Browser and logging in via the Pi mining app. Mining Pi is free. Pi Coin has long been criticized as a pyramid scheme due to its invitation-only model, though the team denies this, stating their goal is to build a decentralized cryptocurrency network that makes digital money more accessible to everyday users.

Figure 5-2: Pi Coin blockchain explorer

Crypto industry practitioners generally believe the current monetary system suffers from several flaws:

1) Centralization: The current system is centrally controlled by governments and financial institutions, limiting individual autonomy and exposing users to political and economic instability;

2) Inflation: The system is prone to inflation. When governments increase money supply, purchasing power declines and prices rise;

3) Unequal opportunity: The system may be unfair. Financial institutions’ control over credit limits access to loans and economic opportunities;

4) High costs: Cross-border remittances and transfers can be expensive, hindering global trade and investment.

Cryptocurrencies attempt to solve these issues by offering decentralized, secure, transparent, and low-cost alternatives. Overall, projects aiming to overhaul the current economic model have very low success rates—even Bitcoin’s

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News