ZK and AI-Powered New Project: How Does Noya Maximize Yield in Liquidity Mining?

TechFlow Selected TechFlow Selected

ZK and AI-Powered New Project: How Does Noya Maximize Yield in Liquidity Mining?

Noya will help everyone easily and profitably execute cross-chain strategies by leveraging AI and ZKML.

Author: Salazar

Translation: TechFlow

Participating in early-stage projects can yield significant returns, and you are an early participant in this one. In this article, crypto researcher Salazar introduces an innovation—Liquidity Mining 2.0. This project leverages ZK and AI (ZKML) technologies to deliver optimal yield farming opportunities.

Problems with current liquidity mining:

-

Low yields: Over-saturated mining pools lead to low returns.

-

Overly complex: Liquidity provider ranges are too technical for most users.

-

Expensive: High gas fees and cross-chain bridge costs.

-

Limited mining capacity: Restricted to using a single protocol.

-

Basic algorithms: Simple auto-compounding.

How does Noya solve these problems?

-

Multi-chain: Noya operates across multiple chains simultaneously, extracting value from all of them at once.

-

Composable: Deposits made into Noya can be reused within the DeFi ecosystem like Lego blocks.

-

Predictive: Powered by artificial intelligence, Noya proactively predicts yields, rewards, slippage, and more, ensuring users always mine in the most optimal way, around the clock.

-

Trustless execution: Using ZKML, Noya executes strategies in a trustless manner.

What is ZKML?

Zero-Knowledge (ZK) is a computational method where one party proves the accuracy of certain data to another without revealing any additional information.

Machine Learning (ML) is a subfield of artificial intelligence focused on developing algorithms that enable computers to learn and adapt autonomously from data, improving performance through iterative processes.

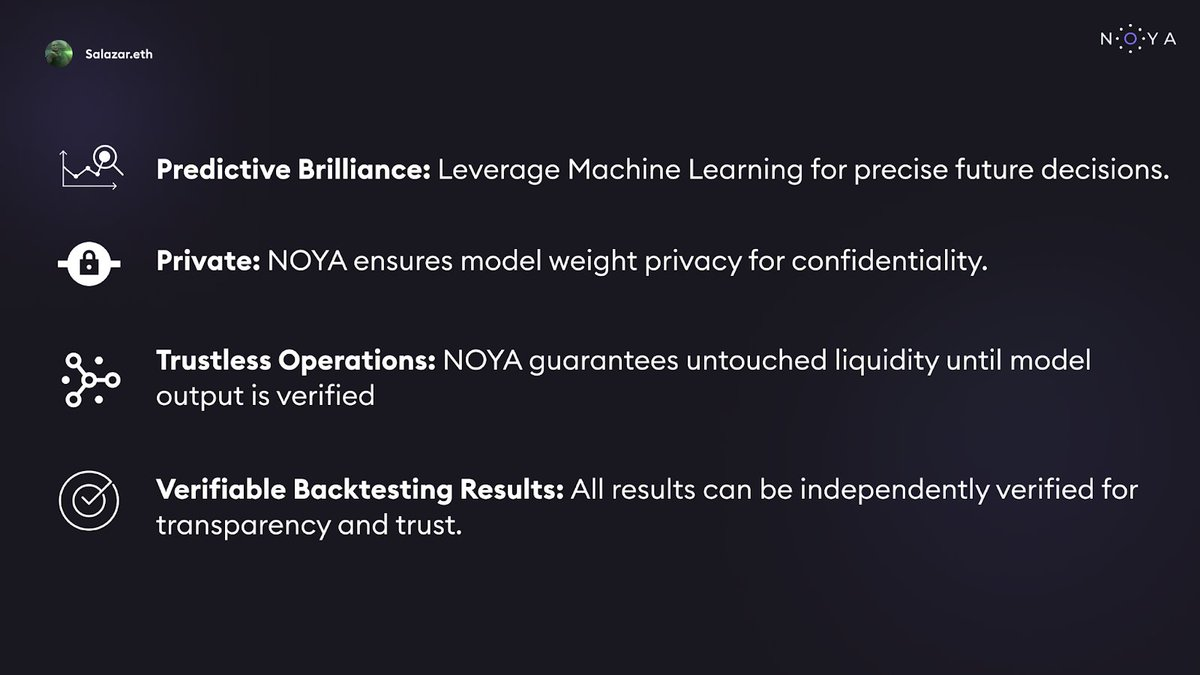

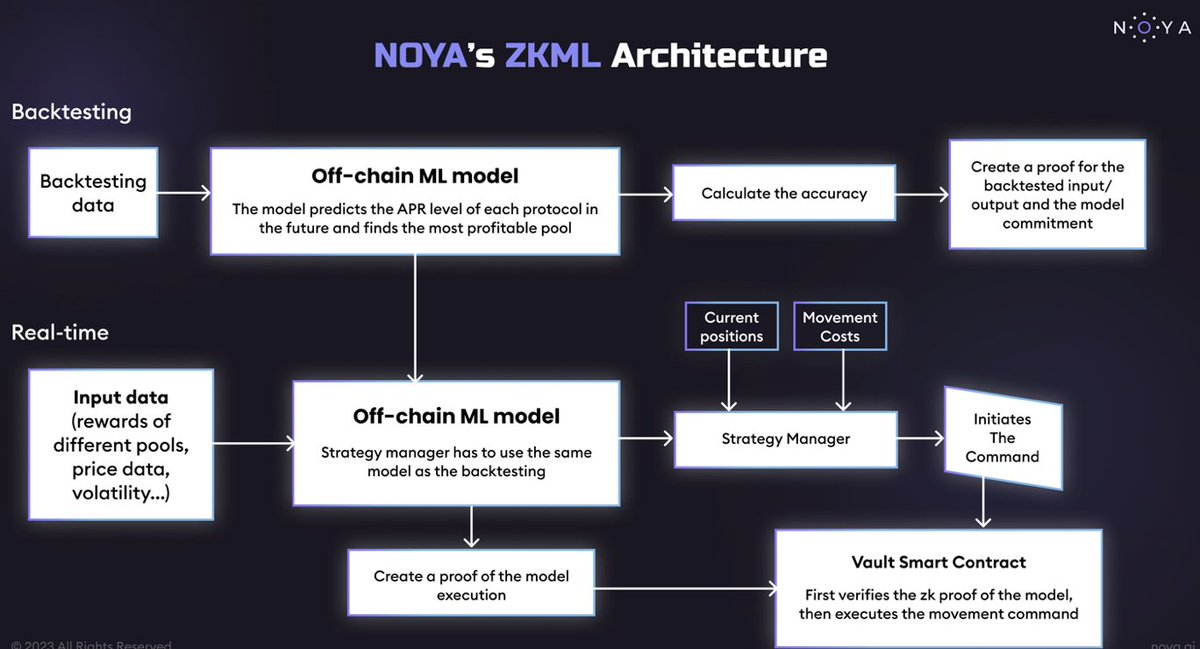

Noya is the first DeFi application enabling AI models to fully exist on-chain. Liquidity is only transferred after the model’s output has been sent on-chain and verified. This allows Noya to introduce several innovations, such as:

But how is this achieved?

ZKML, implemented via zkSnark circuits, enables on-chain verification of model outputs. It protects against fraudulent transactions and enhances system security and reliability. Noya uses Halo2 for security and the ezkl library for seamless operation.

Halo2 was chosen because it's a proving system suitable for very large circuits. Unlike Circom, Halo2 provides a Rust API for defining circuits with polynomial constraints. EZKL overcomes capacity limitations in Halo2's data tables, allowing AI models to use more parameters.

Now, let’s examine Noya’s building blocks—Omnivaults, which automate yield generation strategies.

They utilize assets from different chains and are managed by AI models.

Noya will initially launch ETH and stablecoin vaults, each offering three risk profiles. Many other innovative vaults will be announced soon. Retail users aren’t Noya’s only audience; DAOs and protocols can also leverage Noya in various ways.

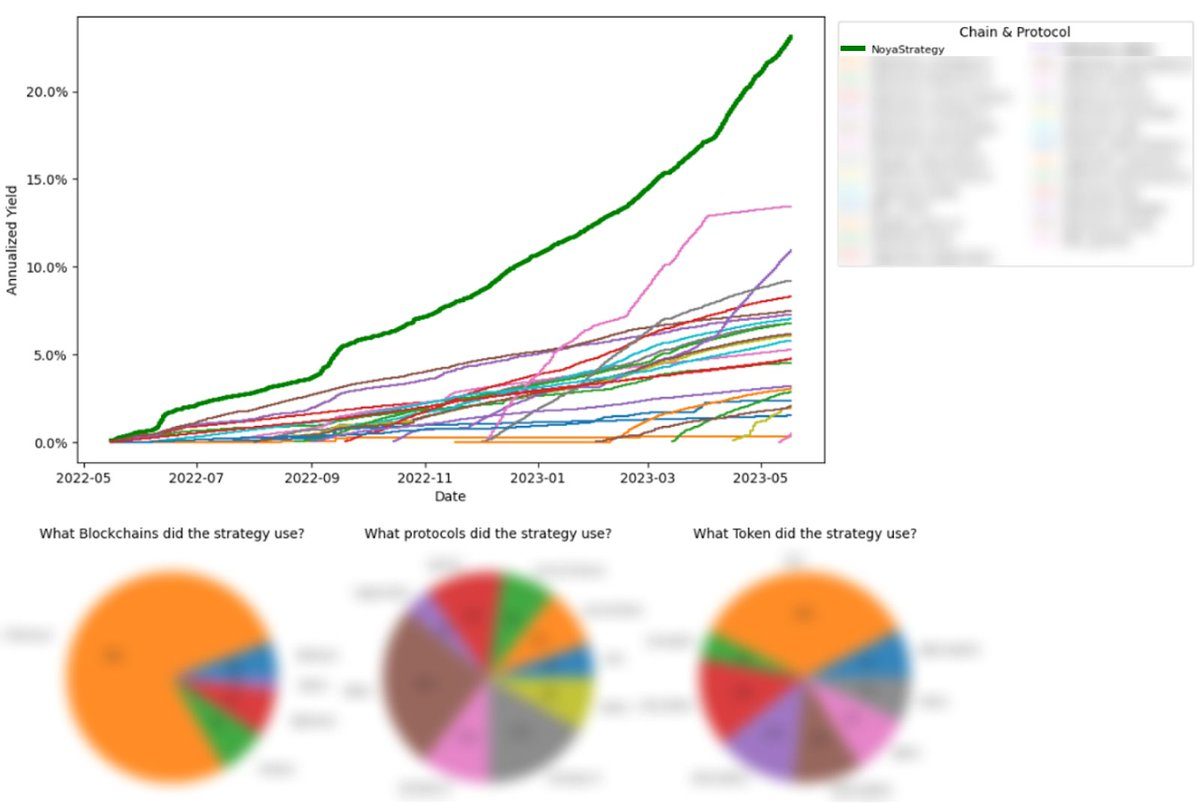

Their AI algorithms deliver unprecedented high yields compared to other protocols:

Noya’s smart contract architecture: Enables strategy providers to securely interact with the protocol.

Noya’s base chain handles user shares, deposits, and withdrawals. Through relayers and user signatures, operations on the base chain are gas-free for users. Deposits made on other chains are updated on the base chain, enabling consistent and secure tracking of investments.

By leveraging AI and ZKML, Noya will make cross-chain strategies easy and profitable for everyone.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News