Outlook for the Second Half of 2023: Risk Control Platforms, CeFi+DeFi, Decentralized Data Labeling...

TechFlow Selected TechFlow Selected

Outlook for the Second Half of 2023: Risk Control Platforms, CeFi+DeFi, Decentralized Data Labeling...

Compared to last year, the market appears quieter overall, with fewer new directions emerging, as it awaits fresh narratives or high-quality project launches.

Author: Zixi.eth

A brief mid-year review, reflection, and some personal views on opportunities (personal opinion only, does not represent institutional views):

2022 investments: Questn, Blocksec, Footprint, Xterio, Solv Protocol, Swords and Dungeon, Chainbase.

2023 investments: Risk management platform (Almanak), CeFi+DeFi derivatives trading platform (Gravity), decentralized data labeling (QuestLab).

Industry Trends

1. Regulatory pressure in North America has intensified, while Hong Kong has become increasingly open to crypto. There is a clear shift—Western decline and Eastern rise—in policy trends. North American investors are now visibly embracing and investing in Asia-Pacific startup teams.

2. Few new narratives have emerged. Current projects mainly revolve around ZK (web3 native) and AI (web2 native).

3. Wall Street capital, represented by Citadel, Fidelity, and Sequoia, is building its own compliant exchange EDX, signaling the modularization of capital markets.

4. Wall Street players like BlackRock and Fidelity have started filing for Bitcoin/crypto ETFs, which is a key driver behind the recent market recovery.

Market Overview

1. Although BTC has recovered to 30K, the overall market remains quieter compared to last year, with few new directions (ZK/AI) and a wait for fresh narratives or high-quality project launches.

2. The main contradiction has shifted. In 2020–21, the issue was the lack of quality infrastructure to support applications. Now, the challenge lies in finding a compelling direction to bring web2 users into web3.

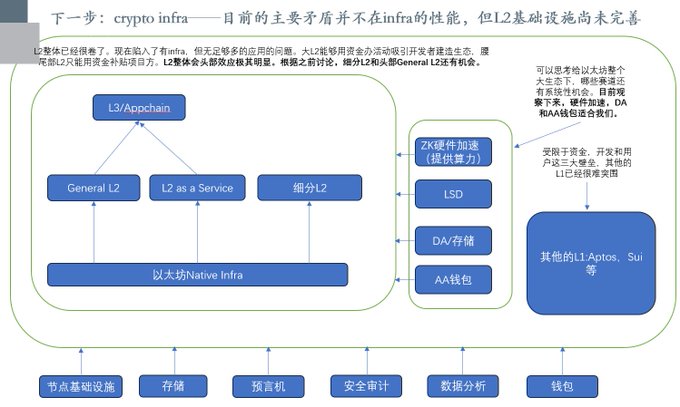

3. In crypto infra, L2s and modular blockchains remain hot. Major capital continues to invest, with several already launched and delivering smooth user experiences.

4. For user onboarding, gaming remains central. However, new strategies are emerging to convert web2 users in niche sectors into web3. We’ve begun exploring this path (Questn, Xterio, Swords, Questlab).

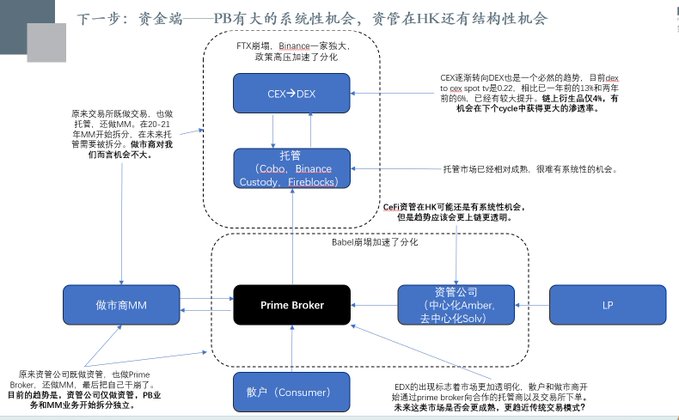

5. For developer onboarding, there’s no new story. New customer acquisition is low, and survival rates are declining. Still, the core logic remains valid and worth investing in (Chainbase). 6. For capital onboarding, due to the collapse of FTX, regulatory pressure on Binance, and the launch of EDX, major opportunities may emerge in Dex, asset management, and prime brokerage (Solv, Gravity)—areas to watch closely in H2.

H1 Summary and Reflection

1. In H1, we closed 3 deals totaling over $4M—down in both number and amount from last year. This reflects our more cautious approach, as well as fewer new narratives and fewer standout teams aligned with our investment thesis.

2. Our investment style is evolving. Last year’s deals were conservative—from Blocksec to Almanak—focused on developer/conservative projects, a sound strategy during the bear market. But with macro interest rate hikes pausing at year-end, BTC recovering to 30K, and major institutions becoming active on the capital side, we should now focus on higher-growth potential projects on the user and capital fronts.

Focus Areas for H2

1. Crypto infra still warrants attention, but it should no longer be the core focus.

2. Capital-side developments deserve close attention. With EDX's emergence, trading models will become increasingly traditional, creating systemic opportunities for Prime Brokers, as well as structural opportunities in Hong Kong CeFi asset management.

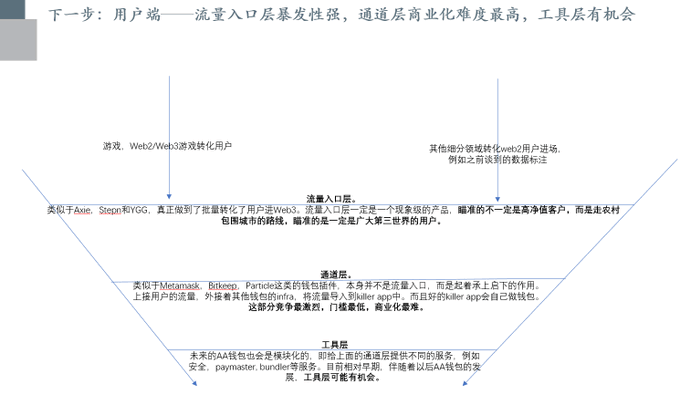

3. User-side developments also need attention—whether the current approaches (gaming as general onboarding vs. vertical-specific user conversion) are valid. If strong teams emerge, they should be prioritized for investment.

4. The rationale for developer-side investments remains sound. While the direction is correct, adoption is slower than expected. Currently, there aren’t enough users to sustain new project startups. Developer-focused projects will likely trend toward stability, with relatively lower risk.

The emergence of EDX signals that crypto trading will gradually shift toward traditional exchange models—where institutions/market makers/retail users place orders via Prime Brokers to custodians holding exchange funds.

Additionally, today Singapore’s MAS required exchanges to custody funds within trading platforms. Therefore, I remain bullish long-term on Prime Brokers, HK CeFi, and on-chain derivatives exchanges.

User-facing strategies can be broadly categorized into three layers: traffic entry points (e.g., Axie, StepN), channels (various wallets), and tools (AA infra as a service). Traffic entry points offer high breakout potential—converting users through mainstream games and niche verticals (with priority on developing markets). Channel layer monetization is most challenging. Given intense competition in the channel space, tool-layer projects have a chance to stand out.

Currently, I find the crypto infra direction awkward. The main bottleneck is no longer the lack of solid infrastructure to support mass users—it’s that there’s simply nothing compelling enough to attract people in the first place. That said, I believe vertical-specific L2s, ZK hardware acceleration (especially if it serves Web2 giants), AA wallets (and their infra), and DA still present structural opportunities.

The primary market has become increasingly dull lately. All we can say is—the revolution isn't over yet; comrades must keep striving. I hope the teams I believe in (and even some I didn’t invest in but deeply admire) can deliver strong results in 2024–2025, bringing warmth to the industry and confidence to all.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News