AI Rise and Shift Eastward: How Can the Crypto World Emerge from Its Funding Downturn?

TechFlow Selected TechFlow Selected

AI Rise and Shift Eastward: How Can the Crypto World Emerge from Its Funding Downturn?

Undoubtedly, cryptocurrency venture capital is experiencing a bear market just like crypto assets.

Written by: Kadeem Clarke

Compiled by: TechFlow

In the first quarter of 2023, venture capital investment in cryptocurrency and blockchain startups declined by 80% year-on-year, a period now referred to as the "dark season." According to PitchBook data, private funding for crypto startups hit a new low in Q1 2023—the lowest level since 2020.

Globally, venture capital funding for crypto startups dropped 80% in the first quarter of 2023, falling from $12.3 billion during the same period in 2022 to $2.4 billion.

Robert Le, a cryptocurrency analyst at PitchBook, said the broader decline across multiple sectors made the drop in VC funding for the crypto industry unsurprising.

In addition to rising interest rates, this quarter also saw the collapse of Silicon Valley Bank—a financial institution relied upon by many venture-backed companies—further contributing to the funding downturn.

As Le noted, the FTX collapse slowed down fundraising rounds and highlighted the importance of due diligence. Venture capitalists are reportedly being more cautious in their investment decisions, preferring to conduct extensive questioning and investigation of founders before committing to deals rather than rushing in.

Despite the overall decline in global VC funding for crypto startups, there was a slight increase in February and March 2023, suggesting the worst may be behind us.

-

According to analysts, venture investors still have capital available to support crypto startups. There remains strong interest in investing in infrastructure startups, data analytics firms, and development platforms.

-

The report indicates that firms are choosing to participate in more deals while reducing the amount invested per deal. This is not surprising, given that no company would rush into the crypto market after hearing about major bankruptcies in 2022. Companies are now engaging with the market more cautiously and prudently.

-

Moreover, with rising interest rates, VC firms may be less inclined to invest in highly volatile industries.

-

This is not good news for crypto startups; they can only hope the market improves and attracts more VC funding than it currently does.

The good news is that the market is gradually improving, and there's a strong possibility that VC funding will increase later this year.

A recovery in the cryptocurrency market could attract more venture capital. This article explores the close relationship between venture activity and cryptocurrency prices.

Historically, the blockchain and cryptocurrency sector has attracted substantial VC funding, especially during the boom periods of 2017–2018 and 2020–2021. However, funding levels can fluctuate due to market conditions, regulatory changes, and other factors.

As the crypto landscape evolves, so too have funding strategies. Particularly for blockchain and cryptocurrency projects, there is a connection between venture investment activity and crypto asset prices. When the value of crypto assets rises, investment in related startups and projects tends to increase as well.

Conversely, when crypto asset values fall, investment activity in the space may decline.

However, it’s important to note that this correlation isn’t necessarily causal. Other factors such as regulatory shifts or market sentiment can also influence VC activity in the crypto space. Additionally, across any industry, venture investment is affected by factors beyond asset prices, including team quality, business model strength, and growth and profitability potential.

The Role of Investors

Venture capital is key to the growth and development of crypto companies. Due to increasing popularity and mainstream acceptance of cryptocurrencies, the industry has seen rapid expansion in recent years. Despite its immense potential, crypto companies still face challenges such as regulatory uncertainty, technological barriers, and high capital requirements.

VC funding drives the growth of crypto firms. These investments enable startups to expand their product offerings and deliver innovative solutions. With VC backing, crypto companies can invest in critical areas like R&D, marketing, and talent acquisition. As a result, they remain competitive and meet growing market demand.

Furthermore, venture capital provides not just financial support but also valuable expertise, mentorship, and networking opportunities. VC firms bring years of experience identifying promising startups, assessing their potential, and guiding their growth. Their industry knowledge and connections help crypto companies navigate the complex and rapidly evolving crypto landscape.

Investment Support

Venture capital also plays a crucial role in attracting further investment into the crypto industry. When prominent VCs invest in crypto startups, they validate their potential and signal to others that the sector is worth investing in. This, in turn, draws more capital, creating a virtuous cycle of growth.

Additionally, VC funding stimulates innovation and creativity within crypto companies. The crypto industry is still in its early stages, holding vast potential for novel solutions. However, these companies require significant capital to bring those solutions to market. Venture capital provides the necessary funds to drive innovation and develop new products and services that could transform how we live and work.

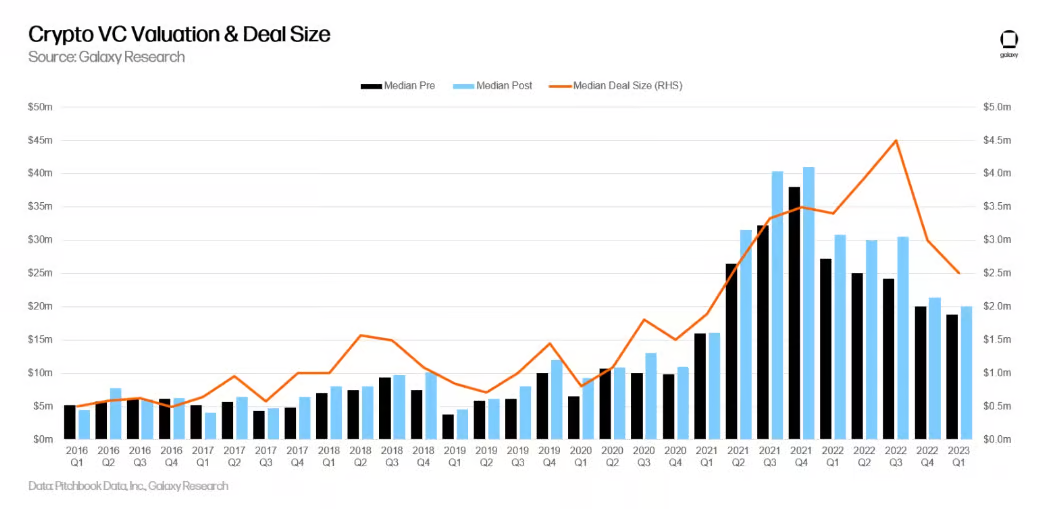

In Q1 2023, both the size of crypto VC funding rounds and pre-money valuations hit their lowest levels since early 2021. During the first quarter of 2023, the median crypto VC deal size was $2.5 million, with a median pre-money valuation of $18.8 million.

The decline in deal sizes and valuations reflects a broader downturn in the venture capital market.

Crypto Market Recovery

While a recovery in the crypto market may attract more venture capital and investors, other factors beyond market performance can influence investment decisions.

Before investing in any asset—including cryptocurrencies—investors typically consider several factors. These may include the underlying technology, the strength of the development team, the potential market size, and the regulatory environment.

Moreover, many investors and VCs continue to actively invest in crypto even during market downturns. Many take a long-term view, seeing current market conditions as an opportunity to acquire assets at lower prices.

Although market recovery may draw more investors, market performance is just one of many factors affecting investment decisions.

VCs Have Already Invested Billions in 2023

Venture investment often slows during bear markets, yet several major investments in crypto and Web3 have already occurred this year.

Investors don’t appear deterred by regulatory uncertainty or direct pressure from U.S. authorities on the industry.

On April 18, DeFi Investor highlighted some of the most significant fundraising events in the crypto and Web3 space this year.

LayerZero raised $120 million from institutions including a16z and Sequoia Capital. The protocol simplifies building interoperable cross-chain dApps. After a $135 million Series A in March 2022, it reached a valuation of approximately $3 billion.

Scroll ZKP secured $50 million from investors including Polychain Capital and Sequoia, achieving an $1.8 billion valuation. The project enables creation of Ethereum Virtual Machine smart contracts.

Eigenlayer, an Ethereum restaking platform, completed a $50 million round led by Blockchain Capital. The protocol allows ETH to be restaked on other networks to enhance their security and cryptoeconomics.

Market maker and investment firm DWF Labs provided $40 million to Fetch.ai, a platform aiming to use AI to automate tasks like trade execution.

Other crypto and Web3 projects receiving VC funding this year include social platform Plai Labs ($32 million) and trading optimization platform Sei Network ($30 million).

Shift in Focus Toward Asia

Additionally, companies in the crypto space are becoming increasingly wary of the United States and are turning their attention toward Asia.

Several multi-million-dollar funds have been established to invest in Web3 and crypto startups across Asia. This includes the $100 million Bitget Web3 Fund announced earlier this month.

According to Bitget, this Asia-focused fund aims “to foster a positive attitude toward the digital currency economy and support the development of the Web3 ecosystem.”

Hong Kong-based investment firm ProDigital Futures announced in late March plans to invest $100 million in crypto and Web3 startups across the region.

When Hong Kong launches its crypto framework in June, it could become a hotspot for VC investment. A significant amount of capital from mainland China is expected to flow legally into the industry through this channel.

The larger their fund, the more fees they can charge

According to Marc Weinstein of crypto investment firm Mechanism Capital, late-stage venture investment is declining across the entire tech industry—not just in crypto.

Rising interest rates have altered the fair value of late-stage growth equity firms. He said money is tighter now, and his advice to startup founders is to avoid raising funds at inflated valuations to prevent damage in the next bear market.

“If you caught the bull market cycle and raised your seed round at a $50 million to $100 million valuation, and now you’ve launched your product, but the market has fallen due to retail investor pessimism and institutional caution, and you’re not hitting growth metrics—you’re now in a position where you need to raise your next round,” he said.

A down round means a company raises funds at a lower valuation than the previous round, diluting everyone’s ownership. According to Weinstein, this situation can leave founders feeling “desperate.”

When this happens, it’s not always the founder’s fault. Weinstein explained that VC firms are asset management businesses that earn fees based on assets under management. The larger their fund, the more fees they can collect.

This dynamic affects startups because “VCs often persuade founders to raise more capital…at higher valuations.” He added that VCs push them to accept dilution.

“I think this was standard practice during bull markets, and in hindsight, we’ll say, ‘It wasn’t a great idea for founders to follow that advice.’”

Weinstein’s recommendation: Raise enough capital to cover 12 to 18 months of expenses, build a minimum viable product, find your customers, and iterate toward a product or service people are willing to pay for.

a16z Collaborates with UK Treasury on Future of Crypto Regulation

Venture capital firm Andreessen Horowitz (a16z) has submitted a comprehensive response to the UK Treasury’s consultation paper on the financial services regulatory regime for crypto assets. Released on February 1, 2023, the consultation seeks public input on emerging regulatory frameworks for blockchain and Web3 technologies.

A16z manages $35 billion in committed capital, including over $7.6 billion dedicated to crypto funds, and is a leading investor in seed, venture, and late-stage tech companies across various sectors. The firm has a strong presence in the blockchain ecosystem and has made significant investments in Web3 companies developing diverse products and services.

In its April 29, 2023 response letter, a16z praised the Treasury’s transparent policy-making approach. It expressed intent to collaborate with international officials and regulators to address unique risks and opportunities within the blockchain and Web3 ecosystems. The firm emphasized that not all cases require identical regulation to achieve equivalent outcomes, referencing the consultation’s core principle: “same risk, same regulatory outcome” applied to crypto assets.

In the context of DeFi, a16z observed that while services resemble traditional finance and centralized crypto finance, the risk profile differs due to DeFi’s unique structure.

The firm advocates for tailored regulatory frameworks for DeFi rather than applying a “one-size-fits-all” extension of existing rules. They also highlighted how Web3 protocols often achieve decentralization in practice and stressed the need for regulations that do not unduly burden these protocols.

VC Investors Continue Pouring Significant Capital Into the Sector

Cryptocurrencies are rising again. The macroeconomic environment has shifted, with Bitcoin now targeting $30,000.

Crypto VC funding is quickly following suit. According to CryptoRank.io, a rebound is underway.

“Despite the inherently high volatility of the crypto market, venture investors have not backed down and continue injecting significant capital into the sector, recognizing its immense long-term growth potential,” stated CryptoRank’s analysis team in notes prepared for CoinDesk.

According to CryptoRank analysts, confidence in the VC market has strengthened, evidenced by a notable increase in funding rounds observed over recent months—indicating growing interest and optimism in the industry.

“Many funds reported losses in 2022 and now must scale back their investment activities,” analysts noted. “Other VCs that were more cautious last year are now seizing opportunities using retained capital.”

Banking Will Remain a Challenge

Just days before Bitcoin’s plunge, it was trapped between Silvergate and China. The stress faced by major crypto banks dragged down prices and increased selling pressure. Meanwhile, looser policies in Hong Kong and narratives around retail trading regulations in China pushed prices up.

Then came the bank term funding program, involving large-scale printing by the Federal Reserve. Risk assets have returned to the market.

Banking remains a challenge, but other financial institutions—some outside the U.S. and not bound by its regulatory system—are stepping up.

This presents another independent issue for VCs—they need a bank familiar with the space. Many banks refuse to serve crypto firms, tech startups, and small VC funds, deeming them too risky.

“The implications go far beyond stablecoins temporarily losing their peg. We expect to see a decline in VC activity, which will have ripple effects on crypto fundraising,” analysts wrote. “SVB offered one of the most popular banking infrastructures for VC investors. Now they’ll have to seek alternatives, but the strain on crypto-friendly banks is a serious warning.”

This could be Singapore’s moment to shine. Dollar-supporting banks are expected to step in and fill the gap. DBS is considered a contender, given its operation of a crypto exchange. Or it might be something entirely different.

“Crypto fundraising for VCs is being driven by a generation of young alternative fund managers who are breaking away from traditional financial institutions and raising their own capital in Asia,” said Katherine Ng, General Manager at TZ APAC and lead Tezos blockchain incubator in Asia.

U.S. banks dominate the field and wield enormous influence globally. But now may be the time for other institutions to rise.

Lowest Web3 Startup Funding Since Q4 2020

Crunchbase data shows VC funding for Web3 startups fell 82% year-on-year, dropping from $9.1 billion in Q1 2022 to $1.7 billion in Q1 2023.

In a report on April 20, Crunchbase News noted that the $1.7 billion figure for Q1 2023 was also the lowest level since Q4 2020 ($1.1 billion), when Web3 was largely unknown to most people.

Web3 startups are early-stage companies directly working with cryptocurrency and blockchain technology.

Deal volume—the total number of transactions between VCs and Web3 startups—also declined sharply, with 333 deals recorded in Q1 2023, down 33% year-on-year.

Additionally, the report noted that nine-figure mega-rounds for Web3 startups have nearly dried up over the past year.

While acknowledging a recent cooling of interest in Web3 startups, the business information platform emphasized that VC funding has declined across almost every industry.

Crunchbase attributes much of the decline in Web3 funding to investors adopting a risk-averse stance in recent months, favoring familiar opportunities like cybersecurity or SaaS over the promise of the next-generation internet—Web3.

However, there are encouraging signs, such as the significant price increases in Bitcoin and Ethereum since the beginning of the year. Only time will tell if this will lure more venture capitalists back into the space.

In a report released on April 11, Galaxy Research surveyed total venture investment in all crypto companies over the past 12 months.

Similar to recent Web3 funding trends, investment in all crypto companies totaled $2.4 billion in Q1 2023, down 80% from $13 billion in Q1 2022.

Notably, the report states that while capital investment declined significantly year-on-year, the number of VC crypto deals in Q1 2023 rose approximately 20% compared to Q4 2022.

Artificial Intelligence Is Taking a Share of Crypto VC Funding

According to Evan Cheng, founder of Mysten Labs, as blockchain and crypto startups struggle to raise funds post-FTX, artificial intelligence is now capturing a larger share of venture capital.

Despite the challenges, Cheng sees this as an opportunity for developers to build open and transparent infrastructure. For startups, however, securing late-stage funding has become more difficult, with only exceptional companies able to gain support.

Regarding VC funding, Cheng believes early-stage capital is still accessible—but valuations have been impacted. Once startups reach Series A and B stages, growth capital becomes extremely scarce. Only truly outstanding startups can secure funding; you must be part of the current generative AI hype wave, and fundraising will become harder for any startup.

Complex M&A processes explain why some VCs feel responsible for guiding portfolio companies through acquisitions. It also explains why some firms’ portfolios include more acquisitive startups.

According to Crunchbase, Insight’s portfolio companies are notably acquisitive. Since 2020, the firm has acquired at least 110 companies across software fields ranging from cybersecurity to logistics to grammar correction tools.

Notably, the firm is one of over a dozen active lead investors whose portfolio companies engage heavily in M&A. Below is a chart showing the 14 firms with the most acquisition-prone startups:

As shown above, Tiger Global Management has a particularly acquisitive portfolio. This is partly because the firm is a major investor in many early-stage companies—some of which are known serial acquirers.

For example, Brex has conducted at least six known acquisitions, most recently acquiring financial planning tool provider Pry Financials for $90 million last year. Hopin, a virtual and hybrid event platform provider that raised over $1 billion in VC funding in 2020 and 2021, has also completed six acquisitions.

SoftBank’s portfolio also includes many active acquirers. These include delivery services DoorDash, Gopuff, and Rappi, which together have completed at least 17 known acquisitions.

Meanwhile, among Insight’s portfolio companies, OpenWeb—a provider of software tools for online publishers—stands out as a recent active buyer. Since last year, it has made three acquisitions, including Jeeng, a personalization messaging startup, for $100 million in January.

Executing M&A deals isn’t the ultimate goal for growth-stage startups and their investors. The objective is usually to add value by filling gaps that the acquirer cannot or chooses not to develop internally.

Since acquired startups are typically absorbed into the acquiring company, determining whether an acquisition leads to long-term success can be difficult. Failures are easier to identify, though often stem from mistakes made by the acquiring company. The clearest example is FTX, which according to Crunchbase acquired nine companies between 2020 and 2022—all now part of a massive bankruptcy case.

Due to sharp declines in valuations for tech and growth companies, many prices paid in 2020 and 2021 now appear excessive. According to Bouck, aside from pricing errors, acquisitions often fail “either because the acquirer integrates too quickly or too slowly.”

A recent report shows the crypto venture capital market has demonstrated resilience during economic downturns, suggesting the sector may soon bounce back.

-

The top 300 global crypto VC firms manage $83.9 billion in capital, with San Francisco leading in capital concentration, followed by New York, Hong Kong, Singapore, Austin, London, and Shanghai.

-

In February 2023, $872 million was invested in crypto and blockchain companies, up 52% from $574 million in January 2023.

-

The report states that crypto VC investment continues to exceed 2019 levels.

-

From January–February 2019 to January–February 2023, VC investment in the sector grew 3.1 times, indicating the digital asset industry is maturing and attracting more institutional capital.

A16Z Crypto, Binance Labs, Multicoin, Pantera, and Paradigm—the largest crypto-focused VC firms by fund size—are preparing for Bitcoin’s halving in April 2024 and the potential crypto bull run in 2025.

Meanwhile, Coinbase Ventures, DCG, NGC, AU21, and Animoca lead in total crypto investments.

Over the past 12 months, the most active crypto VC firms have been Big Brain Holdings, Shima Capital, Infinity Ventures, GSR, and MH Ventures. Additionally, according to PitchBook data, Q1 2023 is expected to receive about $1.8 billion in new investment—the lowest level since Q4 2020.

However, the upward trend in February 2023 suggests a positive outlook heading into the second quarter of 2023.

The report also notes that as valuations fall, savvy VCs are betting on Web3, GameFi, DeFi, infrastructure, and distributed ledger technologies. As the market recovers, technologies like smart contracts, distributed ledgers, and tokenized financial assets are expected to shape the future of global finance—and these investments are poised to yield returns.

Analysis and Conclusion

Undoubtedly, crypto venture capital, like crypto assets, is experiencing a bear market. However, the decline in crypto VC activity (deal count, investment amount, and capital raised) mirrors broader trends in the venture capital industry, driven by rising interest rates. Additional key insights from Q1 2023 crypto VC data include:

Crypto VC activity is double that of the previous crypto bear market.

Although VC activity has significantly declined from historical highs in 2021 and 2022, it remains elevated compared to the last crypto winter, even amid rising interest rates dampening investor enthusiasm. If current pace continues—which is highly unlikely—2023 will see more capital invested than in 2018, the most significant year for crypto VC prior to the last bull run.

VCs face a challenging fundraising environment.

Without question, rising interest rates have reduced investor appetite for long-tail risk assets like venture funds compared to the zero-interest-rate decade. Combined with the crypto asset price bear market and lingering trauma from the painful failures of several VC-backed companies in 2022, VCs will struggle to raise new funds in 2023.

For founders, the continued need for substantial new venture capital will remain a pressure point. At least for now, the “growth-at-all-costs” era is over. Venture-backed startups must quickly adapt to a tougher fundraising climate. Founders must focus on revenue and sustainable business models, and be willing to raise smaller rounds and give up more equity. The founder-friendly environment of recent years is now behind us.

Seed rounds are becoming increasingly popular.

After a disappointing Q4 2022, both relative and absolute seed-stage deals are rising. In Q1 2023, 20% of all completed crypto VC deals went to early-stage companies, signaling entrepreneurs are actively moving and VCs are paying attention. As many abandon crypto entirely during the bear market, savvy investors may uncover hidden gems during these challenging times—just as they did in the last bear market.

The U.S. crypto startup ecosystem remains dominant.

Despite uncertain and sometimes hostile regulatory conditions, U.S.-based crypto startups still attract the vast majority of VC activity. Overall, the crypto ecosystem is led by U.S. companies. Policymakers seeking to retain top talent, advance technological and financial modernization, and extend American leadership into the future economy should wisely craft forward-thinking policies that promote growth and innovation.

Both new and established categories are growing.

While crypto trading, exchanges, investment, and lending firms have historically dominated the space, newer categories like Web3, NFTs, DAOs

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News