What are the differences between Hong Kong's SFC and the U.S. SEC in terms of revenue, expenditure, regulation, etc.?

TechFlow Selected TechFlow Selected

What are the differences between Hong Kong's SFC and the U.S. SEC in terms of revenue, expenditure, regulation, etc.?

Will the Hong Kong SFC go crazy defining securities and then regulating, investigating, and imposing fines like the US SEC?

Author: 0xLoki

Earlier in a Space discussion, we touched on a topic: Will the Hong Kong SFC act like the U.S. SEC—aggressively defining securities and then regulating, investigating, and imposing fines?

The key to this question lies not just in what they say (organizational goals), but also in what they actually do (practical actions). There's a simple way to answer it: understand the operational structures and staffing of both the SEC and the SFC.

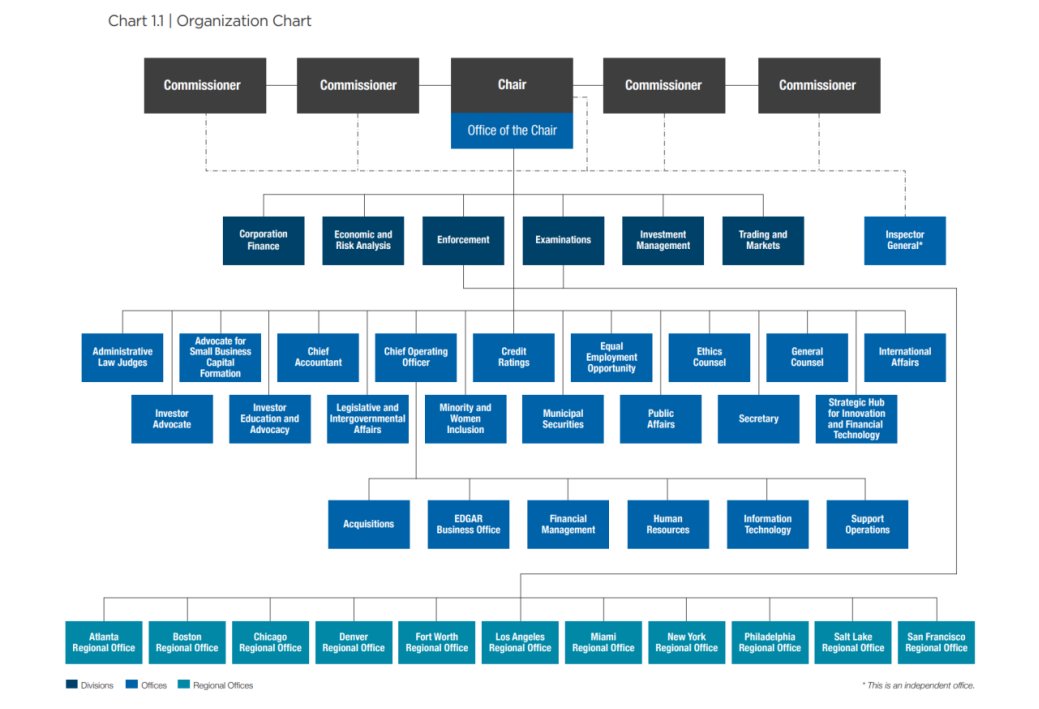

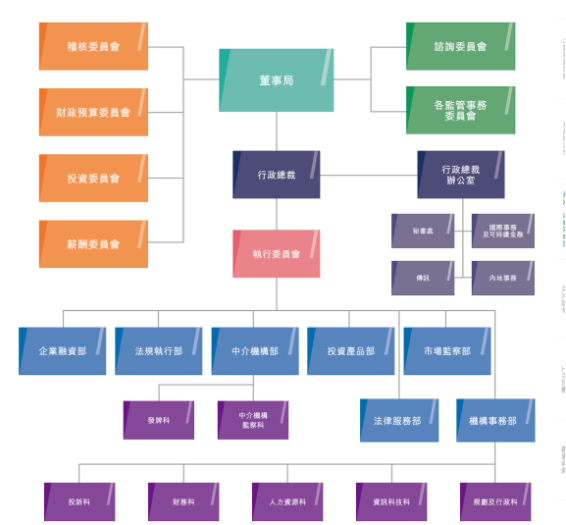

SEC Structure

First, let's examine the SEC’s organizational structure. At the top is a Commission composed of the Chair and four Commissioners. Under it are six divisions, one Office of the Inspector General, and eleven additional offices. In addition, there are 11 regional offices. Notably, these 11 regional offices report directly to both the Division of Enforcement and the Division of Examinations.

From the organizational chart, it's evident that the Division of Enforcement and the Division of Examinations appear to be the most critical among all departments. As we'll see later in the breakdown of each department, Enforcement and Examinations rank first and second respectively.

SEC Financials

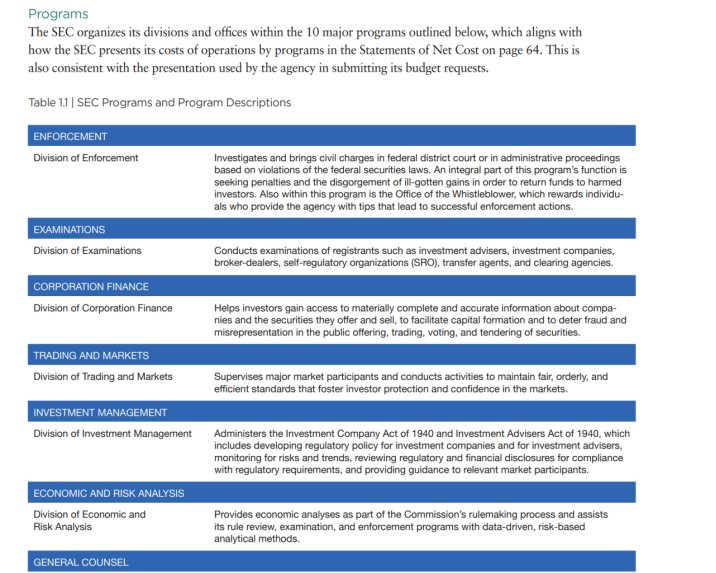

There is another more compelling set of data: financials. The SEC's funding comes roughly from three sources:

1) Government budget appropriations;

2) Transaction fees and application charges;

3) Monetary penalties and forfeitures.

Penalty income is further divided into two parts:

A. When victims need compensation, penalty income goes toward compensating victims and is deposited into the U.S. Treasury’s General Fund.

B. When no victims require compensation, penalty income is allocated to the Investor Protection Fund, whistleblowers (those who provide investigative leads), and funding for investigations conducted by the Office of the Inspector General.

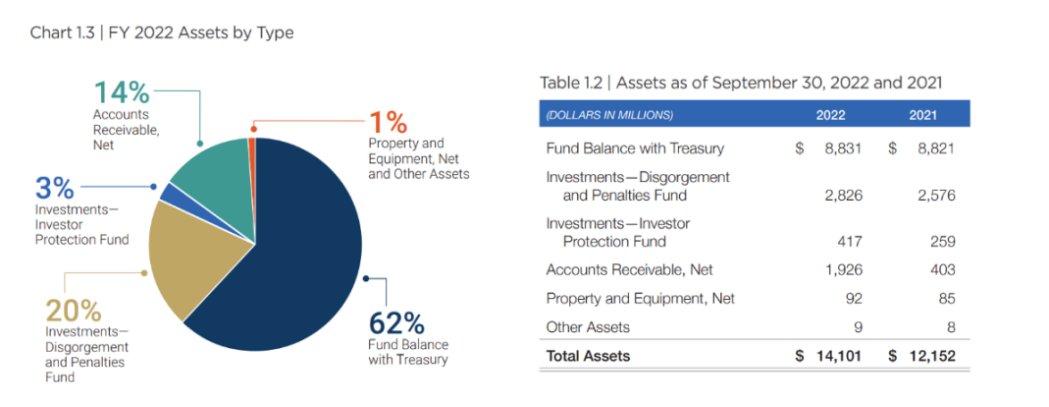

Balance Sheet

Now let's look at the SEC’s balance sheet. According to its FY2022 annual report, the SEC’s total assets grew from $12.2 billion to $14.1 billion—an increase of $1.9 billion. Of this, investment accounts rose by $400 million, and accounts receivable increased by $1.5 billion. The vast majority of these two categories consist of penalty income, with investment figures already netting out regulatory expenses.

Beyond penalty income, OMB approved $50 million in reserve funding and $390 million for the Investor Protection Fund in FY2022. SEC transaction fees amounted to approximately $1.8 billion, while application fees totaled $640 million. It’s clear that penalty income has become a pillar of revenue.

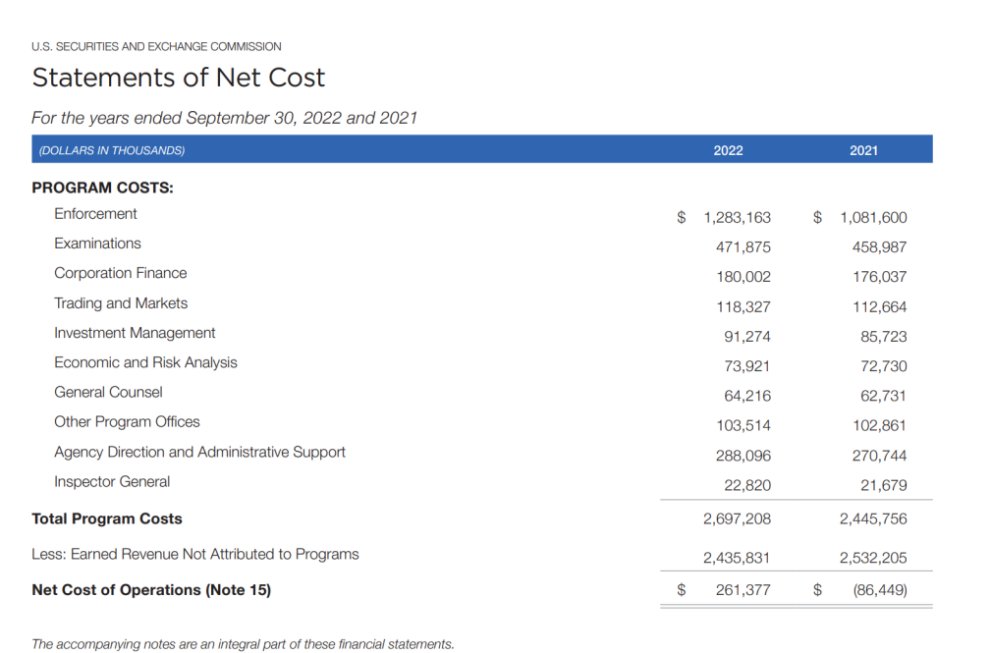

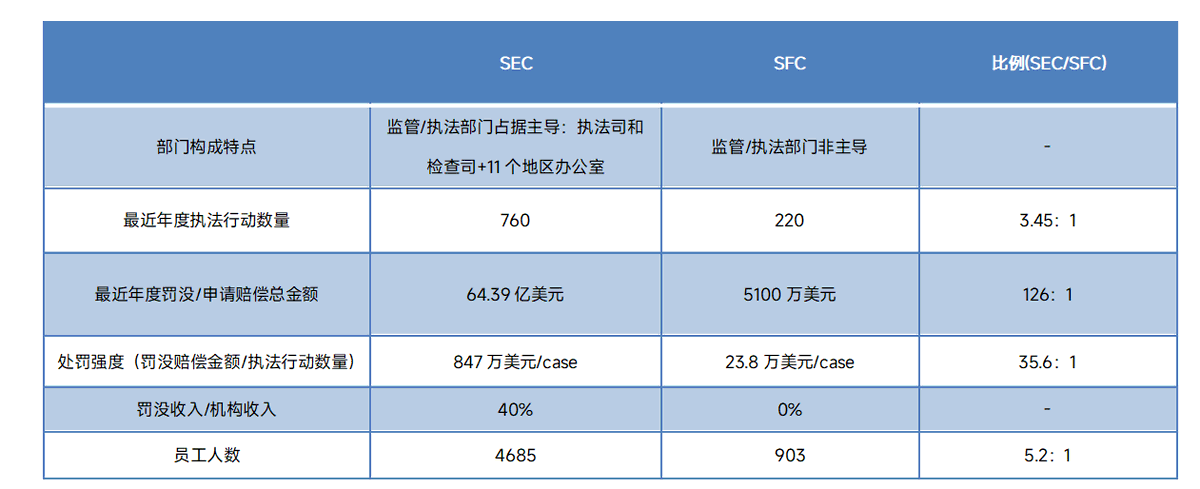

Looking at expenditures, the Divisions of Enforcement and Examinations had the highest net spending—$1.75 billion combined, accounting for 65% of total expenses. These expenditures translated directly into enforcement actions: according to another public report, the SEC initiated 760 enforcement actions in FY2022, a 9% increase from the previous year, including 462 new or “standalone” enforcement actions.

These enforcement actions generated substantial revenue: total ordered payments reached $6.439 billion—including civil penalties, disgorgement, and pre-judgment interest—the highest in SEC history, up from $3.852 billion in FY2021. Of this amount, civil penalties alone totaled $4.194 billion, also a record high.

Under this system, the SEC awarded generous incentives to whistleblowers. In FY2022, it paid approximately $229 million across 103 awards—the second-highest amount and number in history. Meanwhile, the number of whistleblower tips received in FY2022 hit an all-time high of 12,300. This makes Chairman Gensler’s request during congressional hearings—for resources to grow SEC staffing from 4,685 to 5,139 employees—entirely reasonable.

In summary, the SEC’s behavior is not difficult to understand: it follows a model of ex-post enforcement. Allow as many players as possible to enter and act, then investigate, gather evidence, prosecute, and penalize. Thus, the SEC’s stance that “everything except BTC is a security” becomes easier to comprehend—expanding enforcement targets is step one. Of course, whether to actually enforce, and whether prosecutions succeed, depends on many factors.

SFC Structure

Having discussed the SEC, let’s turn to the SFC. The SFC’s structure differs significantly from the SEC’s. Only the Market Surveillance Department and the Intermediaries Supervision Division under the Intermediaries Department appear relevant to potential regulation.

Additionally, the Intermediaries Department includes a Licensing Division, closely tied to the well-known licensing regime.

According to the SFC’s 2021–2022 Annual Summary of Operations, the SFC conducted 220 individual case investigations, initiated 168 civil proceedings, and imposed a total of HK$410.1 million in fines on licensed institutions and individuals.

Beyond enforcement, another important metric is the 7,163 license applications received during the year, with over 38,000 license-related document reviews processed through WING.

In terms of enforcement focus, although the SFC stated, “where appropriate, we will take firm enforcement action against unlicensed platform operators,” actual enforcement cases remain primarily centered on traditional financial misconduct—insider trading and market manipulation, corporate fraud and misconduct, intermediary failures, and inadequate internal controls.

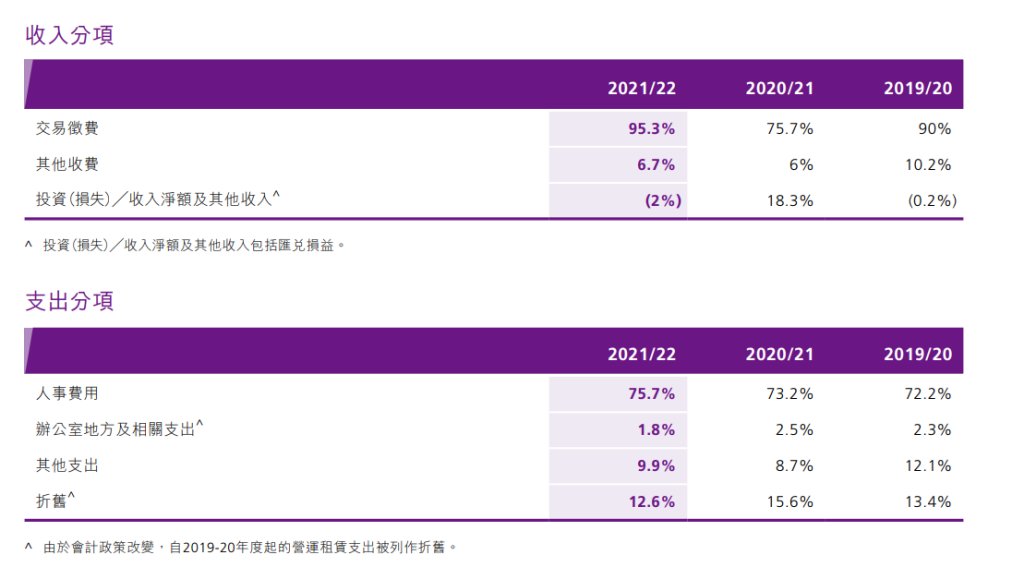

Revenue and Expenditure

Regarding revenue and expenditure, the SFC’s financial structure is straightforward. In FY2021–2022, the SFC’s total revenue was HK$2.247 billion, with transaction levies accounting for 95.3%. Other income made up 6.7% (mainly fees collected from market participants). Penalty income does not appear in the SFC’s revenue breakdown. Personnel costs accounted for 75.7% of total expenditures. According to the report, the SFC employed 913 staff as of 2022.

Moreover, based on these figures, the claim that the SFC profits from “licensing” is inaccurate. Market transactions contribute the overwhelming majority of its income. With licensing application and annual fees ranging from HK$4,700 to HK$129,700 per activity for corporations, and HK$1,790 to HK$5,370 per activity for representatives, even with 3,231 licensed entities and over 40,000 licensed individuals, the revenue generated is relatively small.

From historical data, the SFC clearly lacks the same incentive structure as the SEC.

Furthermore, the SFC does not possess enforcement capabilities comparable to the SEC. With only 913 employees, these staff must handle complex operations related to the Stock Exchange and Futures Exchange, process massive volumes of licensing applications, conduct maintenance and inspections—and even engage in initiatives to “promote goodwill and make the world better.” It would be extremely difficult to divert significant manpower and resources toward proactive enforcement.

Based on the above data, we can conclude:

-

The SFC does not share the SEC’s policy inclination; fundamentally, both operate under the principle of “same business, same risks, same rules”;

-

The SEC exhibits strong regulatory tendencies toward cryptocurrency—but it applies similar intensity to other financial institutions;

-

Likewise, the SFC is unlikely to single out cryptocurrency for special treatment.

In conclusion, I believe the likelihood of the SFC conducting large-scale enforcement actions akin to the SEC is very low.

For entrepreneurs, so long as they do not explicitly violate current Hong Kong laws and regulations, regulatory pressure should not be a major concern.

However, I don’t believe the “Hong Kong market” and “proactive licensing” are suitable for every project team. After all, applying for and maintaining licenses involves considerable cost. Even without a license, many Web3-related activities can still be conducted in Hong Kong.

While regulatory pressure like that from the SEC isn’t a concern, I’d still urge every eager participant to pause and ask themselves one question—do we really need a license?

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News