Looking for the "Shovel" in the Gold Rush: Five Projects That Will Benefit Long-Term from the AI Narrative

TechFlow Selected TechFlow Selected

Looking for the "Shovel" in the Gold Rush: Five Projects That Will Benefit Long-Term from the AI Narrative

This article introduces five "picks and shovels" investment opportunities that allow you to follow the artificial intelligence trend.

Written by: Emperor Osmo

Compiled by: TechFlow

In 2023, Crypto+AI was one of the hottest topics. However, most tokens dropped over 60%, reaching historic lows. The potential returns in this space could be enormous! Some have achieved significant gains by speculating on AI-related crypto narratives, but such short-term gold rush returns are unsustainable. To find sustainable artificial intelligence investment opportunities, you need to look for the "picks and shovels" enabling the AI gold rush.

Below are five "picks and shovels"-type investment opportunities that can ride the AI trend.

Akash Network ($AKT)

Akash Network is a network that allows users to securely and efficiently buy and sell computing resources. The network aims to decentralize the cloud computing market—a multi-billion dollar opportunity.

The bullish case for $AKT can be summarized as follows:

-

Growth in AI will increase demand for GPUs;

-

New $AKT tokenomics model;

-

Renting GPU computing power.

We've already seen NVIDIA's massive surge due to excess GPU demand—the potential here is enormous.

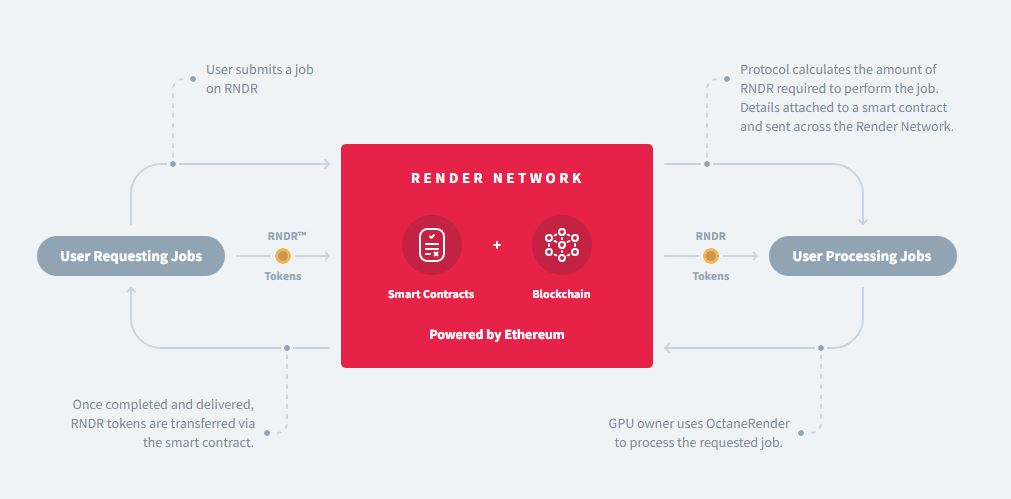

Render ($RNDR)

Render focuses on creating a network that connects users seeking rendering execution with individuals who have idle GPUs available to process these tasks. As AI usage grows, Render aims to make GPU rendering more accessible and affordable.

RenderToken represents an investment opportunity in GPU scalability, allowing node operators to earn fees for providing GPU power for graphic rendering computations. More GPU usage = greater demand for $RNDR.

Bittensor ($TAO)

Bittensor is an interesting technology—it is essentially building a decentralized machine learning model network. $TAO is used to reward contributors and grant them access to the network.

Ocean Protocol ($OCEAN)

Web2 profits from data you provide to networks like Facebook, Instagram, and even Twitter. Ocean breaks the mold by injecting AI learning into its models to create a decentralized data marketplace.

The bullish case for $OCEAN:

The launch of $H2O, a stablecoin developed in partnership with $RAI, using $OCEAN as collateral. This stablecoin will serve as a medium for data transactions, making trading easier while simultaneously driving demand for the $OCEAN token.

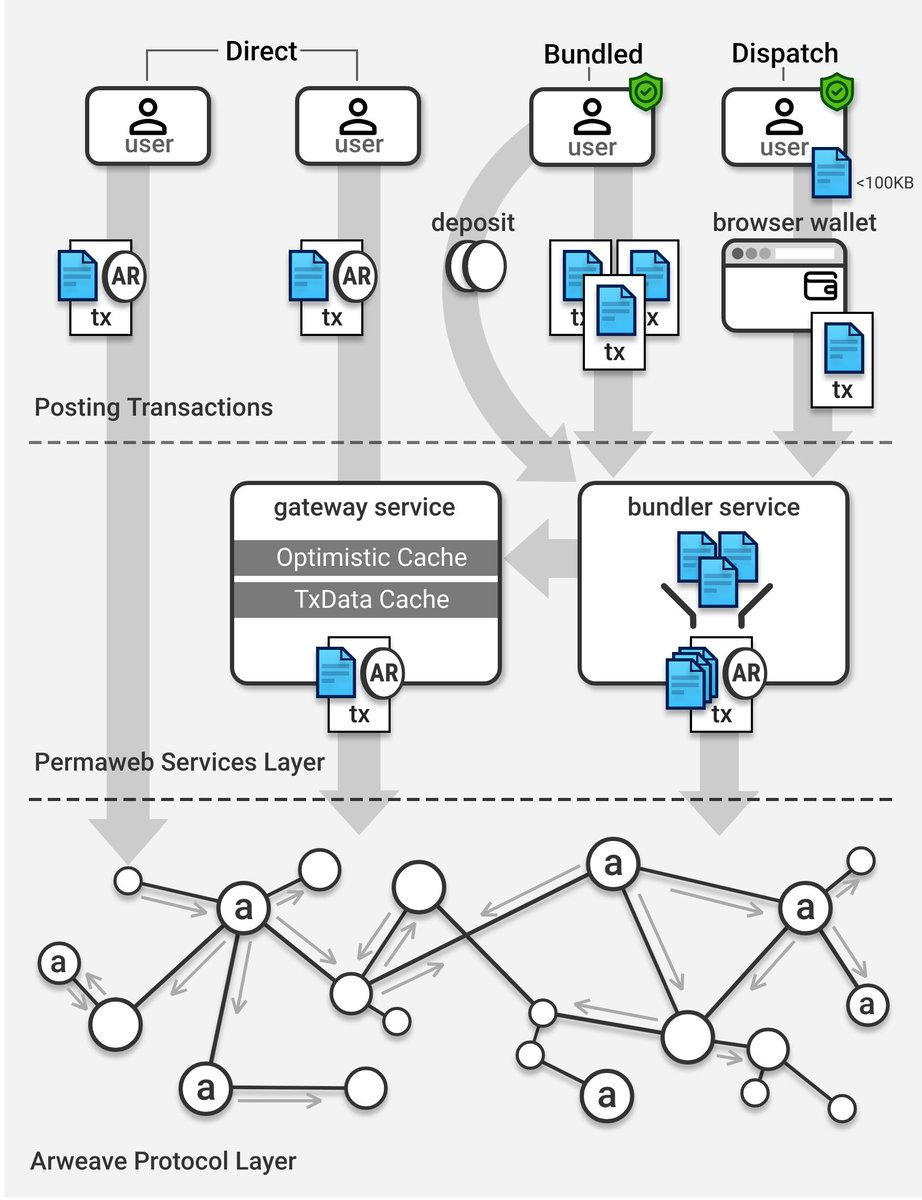

Arweave ($AR)

The data storage market is a $200 billion behemoth, controlled by a few centralized entities. Arweave is a decentralized storage network aiming to provide a platform for indefinite data storage by matching buyers with sellers.

The bullish case for $AR:

Advancements in AI are driving increased demand for data storage providers like Arweave and the $AR token, leading to more partnerships. So far, its partner list is quite impressive, including:

• Solana;

• NEAR;

• Avalanche;

• Polkadot;

• Cosmos.

When major trends emerge—such as the rise of AI—developers may try to capitalize by creating products. However, sustainable profits lie in the tools (the "shovels") that make these products possible.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News