Why is it urgent for NFT marketplaces to crack down on wash trading?

TechFlow Selected TechFlow Selected

Why is it urgent for NFT marketplaces to crack down on wash trading?

With intensifying cutthroat competition among NFT trading platforms and rapidly increasing industry regulation, 2023 will be the last chance for platforms rife with rampant wash trading to survive by taking strict measures.

We analyzed the current state of NFT wash trading—especially in relation to trading mining—and conducted an in-depth study of the strategies employed by top wash traders and their profit and loss. In this article, we also present a model that demonstrates how the existing trading mining reward mechanisms can be easily exploited for arbitrage, increasing the probability of gains while reducing the risk of losses. Finally, we offer several insights highlighting how wash trading is severely threatening the very survival of these NFT marketplaces.

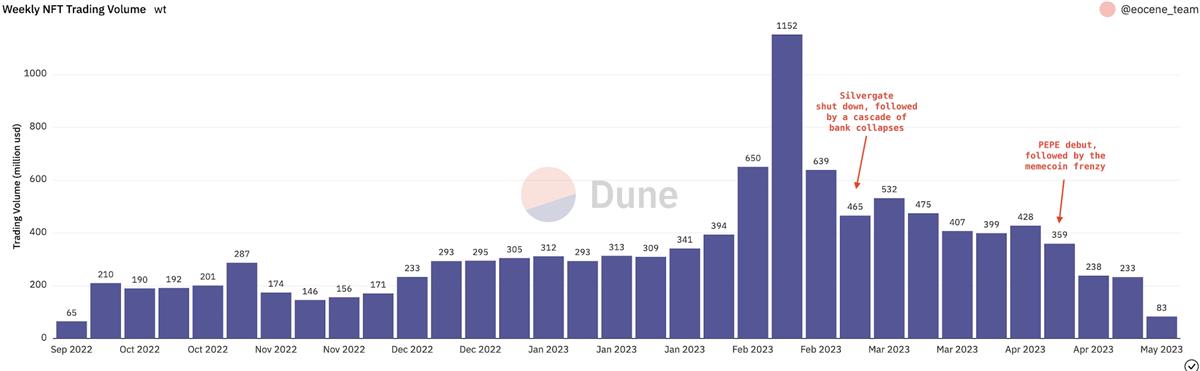

After enduring the long crypto winter of 2022, the NFT sector, having remained sluggish for some time, finally regained momentum in 2023. Since January, overall NFT market volume has been on the rise, with weekly trading volume peaking at $11.5 million—the highest level unseen since the Terra collapse triggered the last bear market. Although volumes declined due to the collapses of Silvergate and SVB, as well as capital shifting toward memecoins, the NFT market still outperformed Q4 of the previous year, maintaining bullish prospects.

However, the outlook is far less optimistic for those who have long profited from the industry’s lack of regulation.

Weekly NFT Trading Volume

The most notorious behavior in the NFT market is undoubtedly wash trading. Sometimes used to create artificial value for specific NFTs, it is more commonly adopted as a strategy by users to earn token rewards through trading mining platforms like X2Y2 and LooksRare, which distribute incentives based on trading volume. Most wash trading flagged on on-chain data platforms falls into the latter category, whereas the former typically involves larger-scale, organized market manipulation that is harder to detect.

While using wash trading to claim token rewards may seem relatively “harmless” compared to outright market manipulation, such practices are neither reasonable nor legal. In traditional finance, wash trading is strictly defined as illegal activity, yet it continues to thrive unchecked in the NFT space. However, as the crypto industry grows increasingly significant globally, government regulators will inevitably step in. We have already seen regulatory scrutiny intensify rapidly since 2022, and it is only a matter of time before NFT markets face stricter oversight—with wash trading, one of its most glaring issues, likely to be targeted first.

Who Are the Largest Wash Traders?

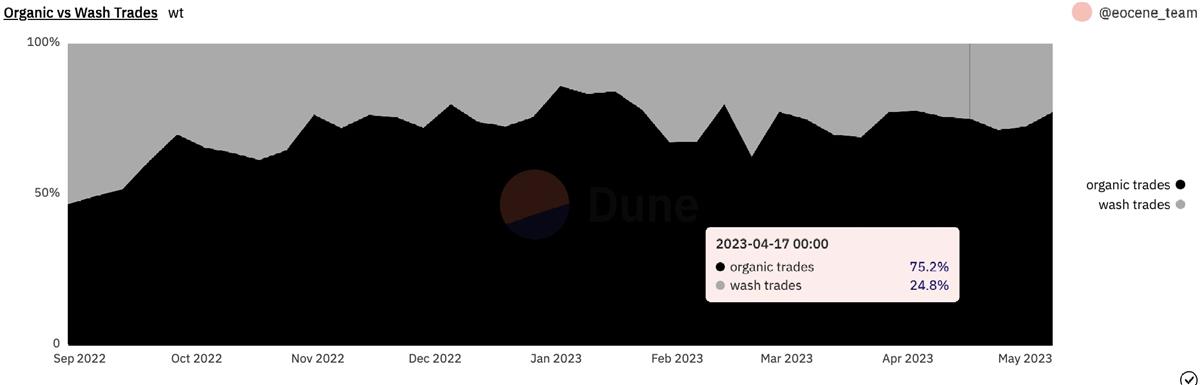

On average, wash trading accounts for roughly one-quarter of daily NFT trading volume. Nearly all of this wash trading occurs on X2Y2 and LooksRare1.

1. Since the launch of BLUR tokens and Season 3 rewards in March 2023, wash trading volume on Blur has surged. While related to trading mining, Blur’s reward mechanism differs significantly from X2Y2 and LooksRare; wash trading on Blur appears more as an unintended consequence of user risk-taking rather than deliberate manipulation. Ongoing debate continues over whether such activity should even be classified as wash trading. In this article, we focus exclusively on intentional wash trading, primarily dominated by X2Y2 and LooksRare.

Proportion of Genuine vs. Wash Trading

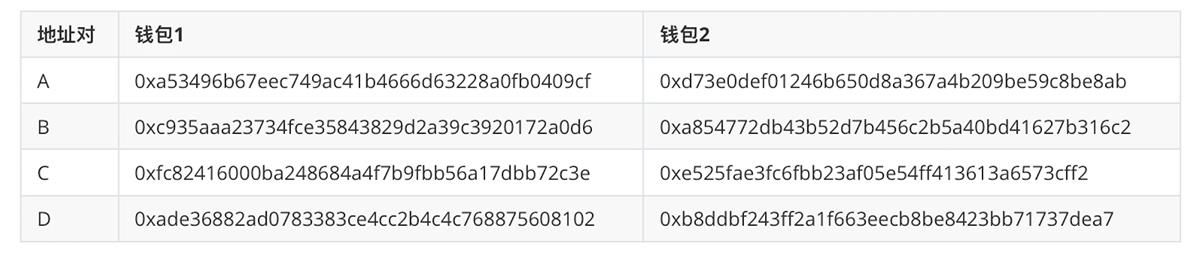

Interestingly, four pairs of addresses (eight total) account for nearly 80% of all wash trading volume in the market. We examined the strategies of these eight wallets and calculated their profits from trading mining2.

Addresses Involved in the Highest Volume of Wash Trading

All four address pairs employ the same strategy—repeatedly trading the same NFT between two wallets at prices reaching hundreds of ETH (far above floor price):

-

Pair A trades More Loot #666688 on X2Y2;

-

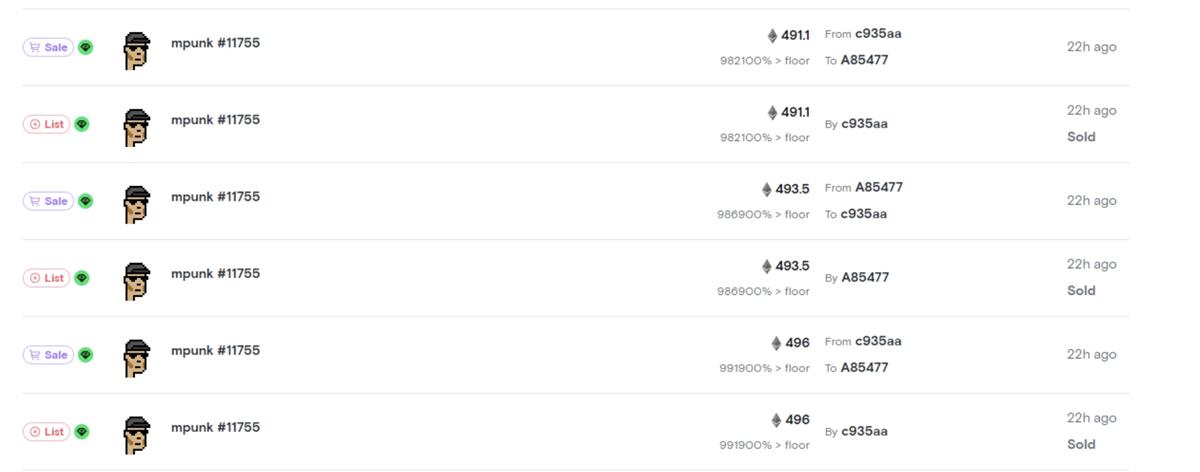

Pair B trades mpunk #11755 on LooksRare;

-

Pair C trades Dreadfulz #164 on X2Y2;

-

Pair D trades More Loot #1022020 on LooksRare.

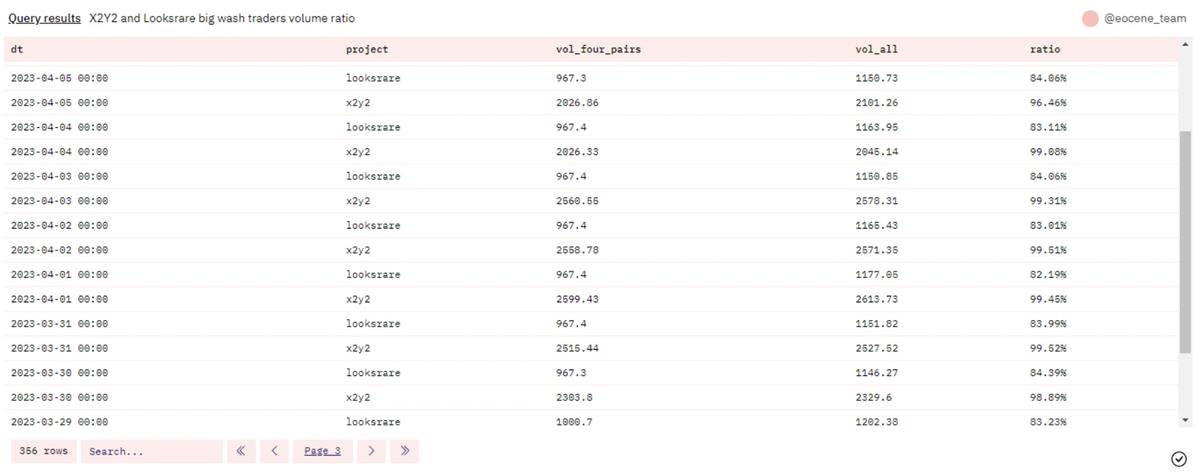

Across all transactions on X2Y2 and LooksRare, approximately 90% of trading volume comes from these four pairs (excluding private trades):

These eight addresses account for about 90% of trading volume on X2Y2 and LooksRare

Some notable observations:

-

Address pairs A and B are actually controlled by the same entity, indicating that the group of wash traders significantly influencing the market is highly concentrated.

-

All NFTs used for wash trading have zero royalty fees. This further underscores the importance of royalties—not only do they fairly distribute value to creators, but they also deter malicious trading behaviors and support the healthy development of NFT ecosystems.

How Profitable Are Wash Traders?

We calculated the profits earned by these four address pairs from wash trading between November 1, 2022, and April 6, 2023, using X2Y2 or LOOKS token rewards as income (both platforms primarily reward sellers), and platform fees and gas costs as expenses.

PnL = Trading Rewards – Platform Fees – Gas Fees

Trading Rewards

-

X2Y2: Since October 5, 2022, 400,000 X2Y2 tokens are distributed daily, with 95% allocated to sellers based on transaction fees and 5% to buyers.

-

LooksRare: From May 12, 2022, to January 3, 2023, 437,458 LOOKS tokens were distributed daily; after January 3, 2023, this was reduced to 236,650 per day. Since October 28, 2022, 95% of rewards go to sellers and 5% to buyers (prior to that, rewards were split evenly).

Fees

-

X2Y2: Fixed at 0.5%

-

LooksRare: Starting October 27, 2022, the fee for all NFTs opting out of royalties was set at 1.5%. (As of April 6, 2023, all NFT trading fees were reduced to 0.5%)

Overall, all four address pairs achieved positive returns from wash trading, with Pair B earning particularly substantial profits.

Profitability of Wash Traders

A Concrete Example of Wash Trading Execution

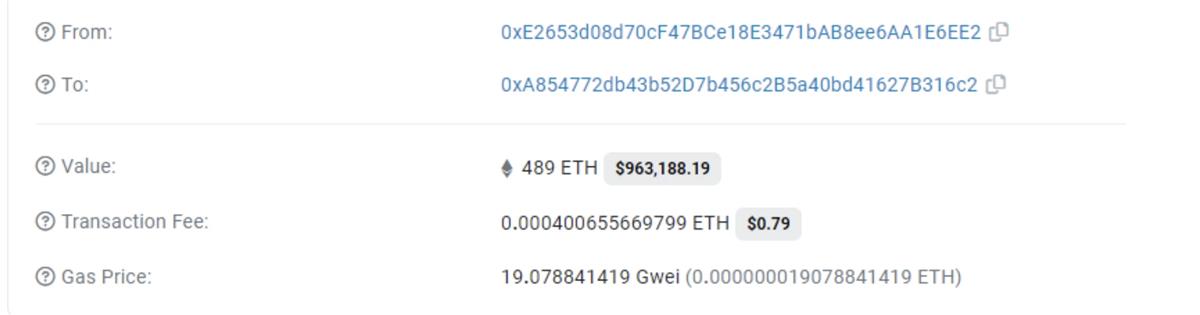

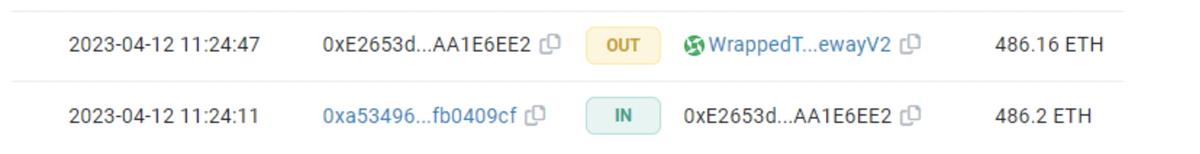

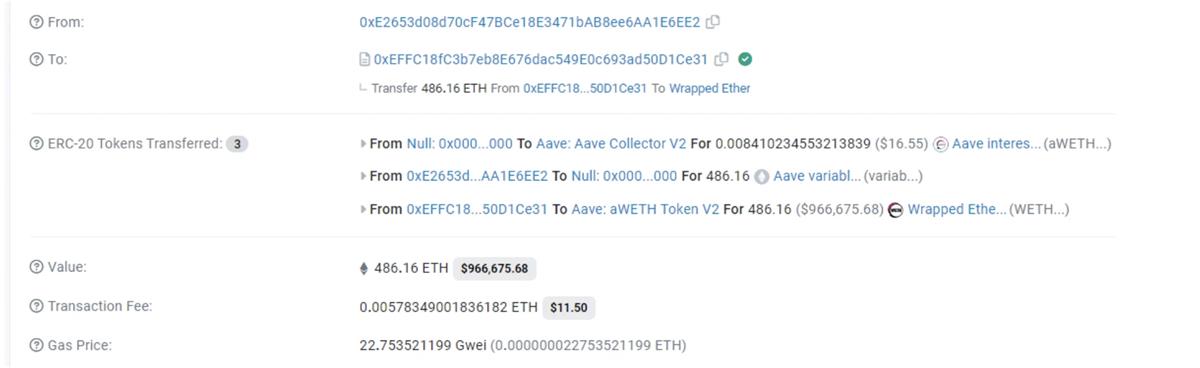

Below is a step-by-step demonstration of how Pairs A and B conduct wash trading. Both pairs receive funding from the same source: 0xE2653d08d70cF47BCe18E3471bAB8ee6AA1E6EE2.

1. 0xE265 first borrows ETH from Aave

2. Then 0xE265 sends the borrowed ETH to one of the four addresses

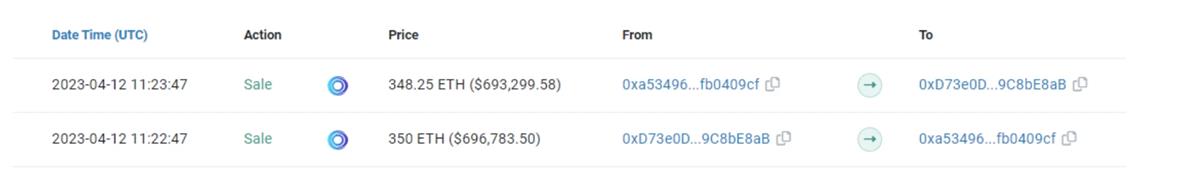

3. After receiving funds, these addresses begin wash trading the same NFT back and forth at extremely high prices on X2Y2 and LooksRare

4. After completing trades, the addresses send ETH back to 0xE265, which then repays the Aave loan

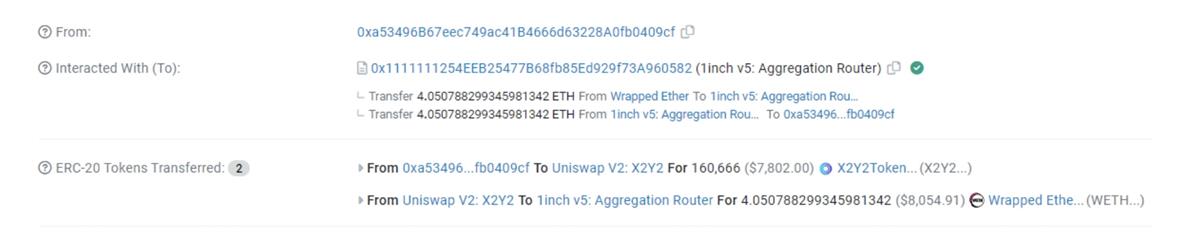

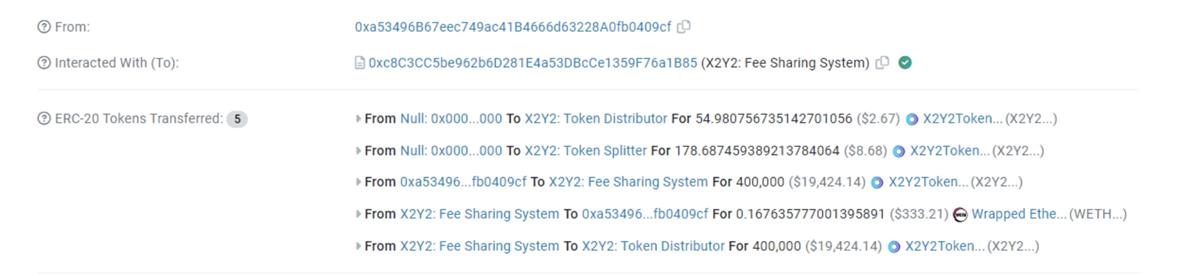

5. Both marketplaces settle trading rewards at the end of each day. After receiving the tokens, these addresses either swap them for ETH,

or stake part of the rewards in fee-sharing contracts to earn additional trading fees and token rewards.

This process may appear rational at first glance, but several aspects raise suspicion. First, how do wash traders determine their trading prices? While higher prices could lead to greater rewards, why trade at 400 ETH instead of 200 or 1,000? Second, the timing of trades is puzzling—why not execute trades closer to the daily reward settlement to better estimate the optimal trading volume needed to maximize profits?

Trading Strategies and the Game Theory Among Wash Traders

Achieving actual profits is not as simple as it seems. Higher trading volume does not always yield higher rewards. In fact, once the market's daily total volume exceeds a certain threshold, every trader incurs losses that day. Given this threshold, entering the market earlier provides a strategic advantage—it prevents other reward-seeking traders from participating effectively (assuming others are equally sophisticated).

1) Calculating the Profitability Threshold

For example, on March 9, 2023, the profitability threshold on X2Y2 was: (380,000 × 0.0617) / (1,438 × 0.5%) = 3,262 ETH

This threshold fluctuates daily with changes in reward token and ETH prices. The key point is: as long as the market’s total daily volume (excluding private trades) remains below this threshold, every trader earns a net profit from trading mining that day—i.e., reward income exceeds fee costs.

Therefore, it makes perfect sense for traders to enter early rather than late—whoever enters first gains more control over trade scale and reward allocation. Conversely, traders entering near the end of the day have little room left to earn rewards, as they cannot push total volume beyond the profitability threshold without causing collective losses. Of course, many traders may not be sophisticated enough to understand this mechanism, and some may genuinely care about real NFT trading rather than token farming. These uncontrollable factors mean early entry still offers a distinct advantage.

2) Estimating Daily Market Volume

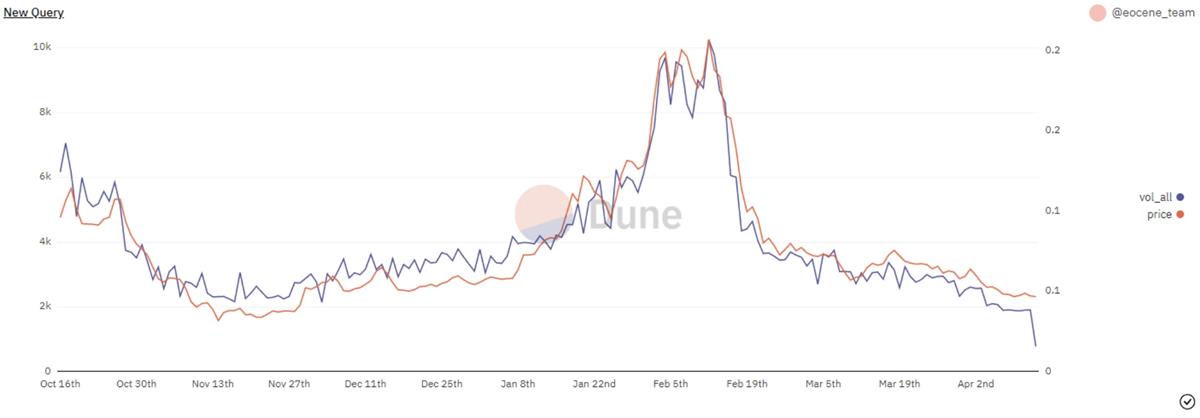

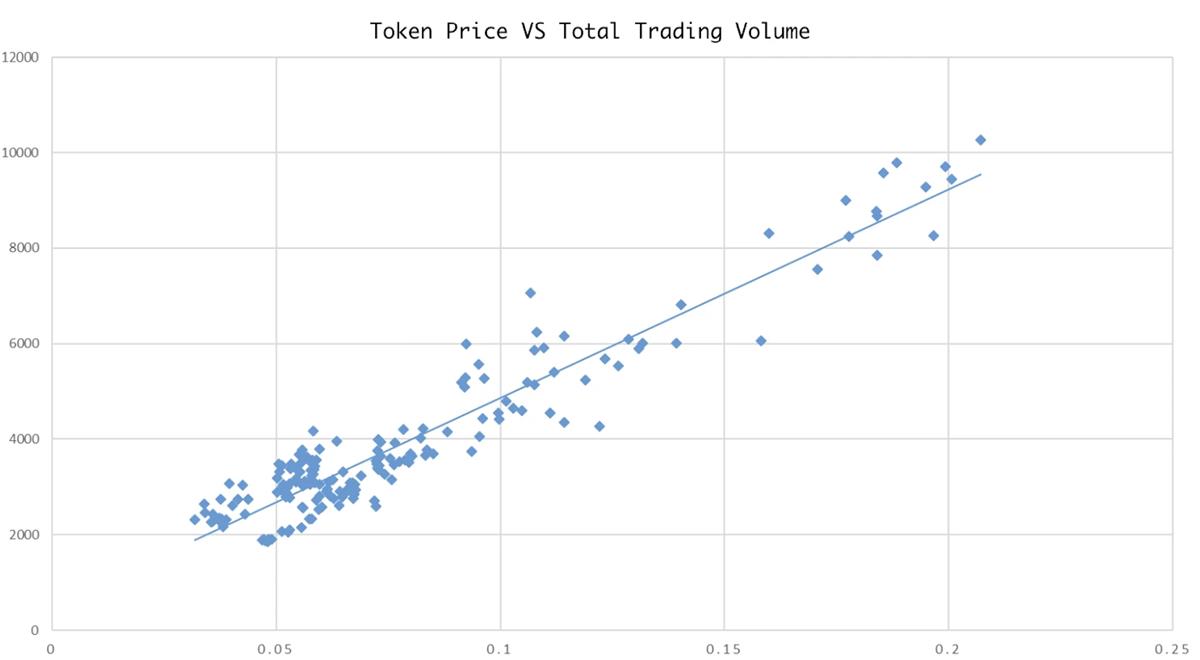

Next, traders must estimate the likelihood that the day’s total market volume (excluding private trades) will remain below the profitability threshold. Taking X2Y2 as an example, we found a strong linear correlation between total volume and reward token price.

Platform Volume vs. Reward Token Price Trend

Strong Linear Correlation Between Volume and Reward Token Price

Daily volume can thus be estimated based on current token price:

For instance, on March 9, 2023, the estimated total volume was: 43,617 × 0.0617 + 499.63 = 3,191 ETH

If this number is below the profitability threshold, traders can confidently participate and expect positive profits.

3) Determining Trade Size Based on Target Profit

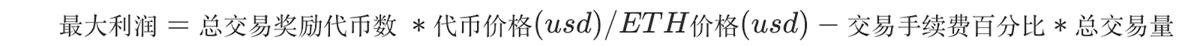

Maximum possible profit can be calculated as:

For example, on March 9, 2023, maximum profit was: (380,000 × 0.0617) / 1,438 – 0.5% × 3,191 = 0.35 ETH

If a trader aims for 0.1 ETH in profit—29% of maximum—they should set their trade size at:

For example, 29% × 3,191 = 925 ETH

Traders can achieve this in a single transaction or multiple ones, though the latter increases gas costs.

Of course, larger trade sizes may yield higher rewards, but they also carry greater risk. As mentioned earlier, uncontrollable factors—such as less-sophisticated wash traders or genuine traders unaware of or indifferent to the profitability threshold—can cause total volume to exceed the threshold. In such cases, the larger the trade size, the greater the potential loss.

Nevertheless, genuine trading activity on X2Y2 and LooksRare is minimal (we’ll explain later why these platforms lack authentic trading). Even less-sophisticated wash traders will eventually realize their strategies are unprofitable after sustained losses. Our analysis clearly shows that with basic mathematical modeling, the trading mining reward systems on both platforms can be easily manipulated for arbitrage.

NFT Marketplaces’ Tolerance of Wash Trading Is Putting Their Own Survival at Risk

In discussions about NFT wash trading, X2Y2 and LooksRare often become focal points, yet neither has taken meaningful action to address the issue. An obvious reason is that wash trading generates tangible revenue, which superficially outweighs the reputational cost of rampant manipulation.

However, we firmly believe the negative impact of wash trading goes far beyond reputation—it poses a serious threat to the growth and even survival of these marketplaces:

Inability to Attract Professional High-Volume Traders

Professional traders seeking large transactions on X2Y2 and LooksRare cannot benefit from token rewards, as the artificial volume generated by wash traders easily pushes total volume beyond the profitability threshold. In contrast, these traders can trade on other NFT platforms like Blur, where they pay no fees and still earn points rewards.

Stagnant Trading Volume

With genuine traders lacking incentives to use these platforms, and the reward system inherently flawed (once volume exceeds a threshold, rewards become meaningless relative to fees), these two factors together form a major barrier to volume growth.

Reward Token Prices Are Easily Manipulated

Most reward tokens are distributed to only a few addresses skilled in wash trading. Such extreme concentration makes token prices highly vulnerable to actions by these few holders. If they dump large amounts of reward tokens, prices will plummet rapidly.

Conclusion

Marketplaces’ inaction toward wash trading stems from a dilemma: wash traders generate significant fee revenue, and eliminating them immediately risks losing that income without guaranteeing replacement.

Yet these platforms are placing themselves in grave danger—the vast majority of their trading volume depends on just a handful of wash traders. If these actors suddenly stop trading—because reward tokens lose appeal, or because regulators intervene to curb wash trading (which is inevitable)—most of their volume will vanish overnight. Having failed to attract real users due to prolonged tolerance of manipulation, any attempt at recovery will come too late.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News