Flashbots Launches Mev-Share: Ushering in a New Era for the MEV Landscape

TechFlow Selected TechFlow Selected

Flashbots Launches Mev-Share: Ushering in a New Era for the MEV Landscape

This article provides an in-depth analysis of MEV and MEV-Share, along with an outlook on the MEV landscape.

Flashbots recently launched Mev-Share, marking a new era for this sector. MEV is expected to contribute no less than 70% of ETH staking income during bull markets—could this be the next LSD-level赛道?

This article provides an in-depth analysis of MEV and MEV-Share, along with outlooks on the future of the MEV sector.

MEV & MEV-Share

The term MEV (Maximal Extractable Value) refers to the maximum value that validators can extract by manipulating transactions and their order within blocks.

For example, consider a profitable arbitrage trade between Uniswap and Sushi: buying ICE for 6.17E on Uniswap and selling it for 8.73E on Sushi. The searcher pays a bribe of 2.52E to the block builder, leaving only a slim profit of 8.73 - 6.17 - 2.52 - 0.01 (Gas) = 0.03E. The builder is expected to pass most of this bribe on to the validator.

Why the bribe? Because transaction ordering is effectively controlled by validators ("controlled" here is simplified for understanding). Since the price difference between Sushi and Uniswap is public knowledge, many participants (Searchers) compete to execute this trade. Validators, who hold the power to decide transaction order, naturally capture the largest share—this manipulation to maximize profits defines MEV.

To get prioritized by validators (miners before The Merge), Searchers escalate gas fees in Ethereum’s “dark forest.” Multiple searchers submitting identical trades results in only one success, causing massive resource waste.

Searchers may privately collude with miners, or miners might simply copy and replace submitted arbitrage transactions to cut out intermediaries. In short, as illustrated below:

End users also suffer from issues like sandwich attacks (commonly known as "sandwiching"). On DEXs, traders set slippage tolerance—for instance, buying ETH at $1,000 with 1% slippage allows execution up to $1,010. Searchers can first push the price to $1,008, wait for your order to clear at $1,010, then sell immediately for profit—increasing your effective purchase cost.

Flashbots rapidly grew under these conditions by enabling Searchers to privately coordinate via its auction system—avoiding costly on-chain competition. Users can submit transactions directly to Flashbots instead of broadcasting publicly, avoiding being sandwiched.

Once transaction data becomes exclusive to Flashbots, the MEV revenue derived from those transactions becomes theirs alone—creating a win-win dynamic.

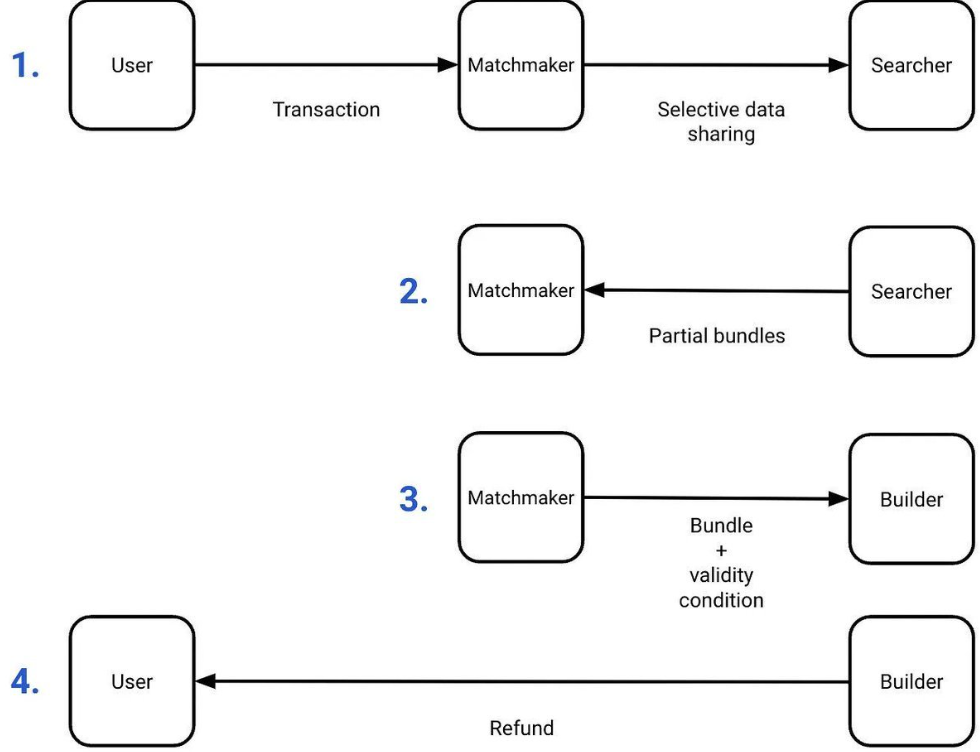

As for MEV-Share, it means users send their transaction data to Flashbots, and 90% of any resulting MEV revenue is returned to them.

Of course, front-running is not allowed—so this isn't about getting a cut after being sandwiched. Instead, if you overpay due to poor execution—say, trading a large amount on a small DEX and moving the price—the subsequent arbitrage profit generated by others can return 90% to you.

For example, previously a user mistakenly traded $2M worth of 3CRV for just $0.05. An arbitrageur nearly bought $2M of 3CRV risk-free. Had the user used MEV-Share, they could have recovered approximately $1.8M instantly.

For all parties involved:

1. Users using Flashbots avoid sandwich attacks and reduce losses from inefficient trades;

2. Flashbots gains exclusive access to transaction data, giving it greater profit potential than competitors;

3. Searchers save money and gain access to more transaction data through Flashbots.

More users bring more exclusive transaction data, which leads to larger profit margins, which in turn enables higher revenue sharing with users—allowing Flashbots to leverage economies of scale to attract even more users and searchers.

Outlook on the MEV Sector

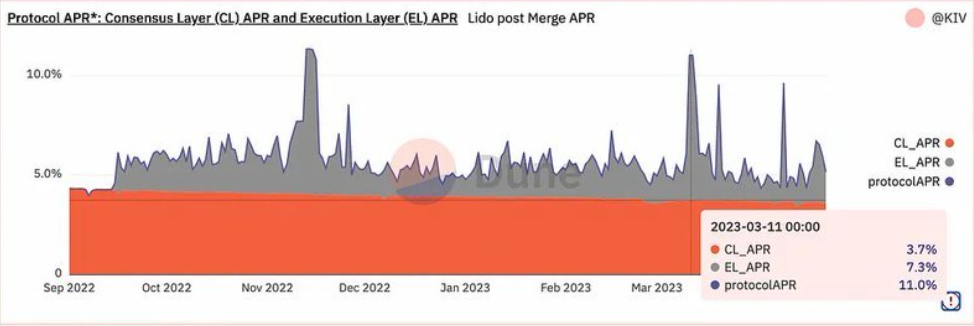

As shown below, since The Merge, EL APR driven primarily by MEV has accounted for roughly one-third of stETH’s total yield, peaking close to 70% during high network activity.

During bull markets, MEV contributing up to 70% of staking income could become the norm—making this market segment highly significant in size.

Given the strong network effects described earlier, leading projects in this space could eventually earn profits comparable to LSD protocols—meaning this may indeed evolve into an LSD-tier sector. Moreover, since MEV revenue grows non-linearly during bull markets, the ceiling here is exceptionally high.

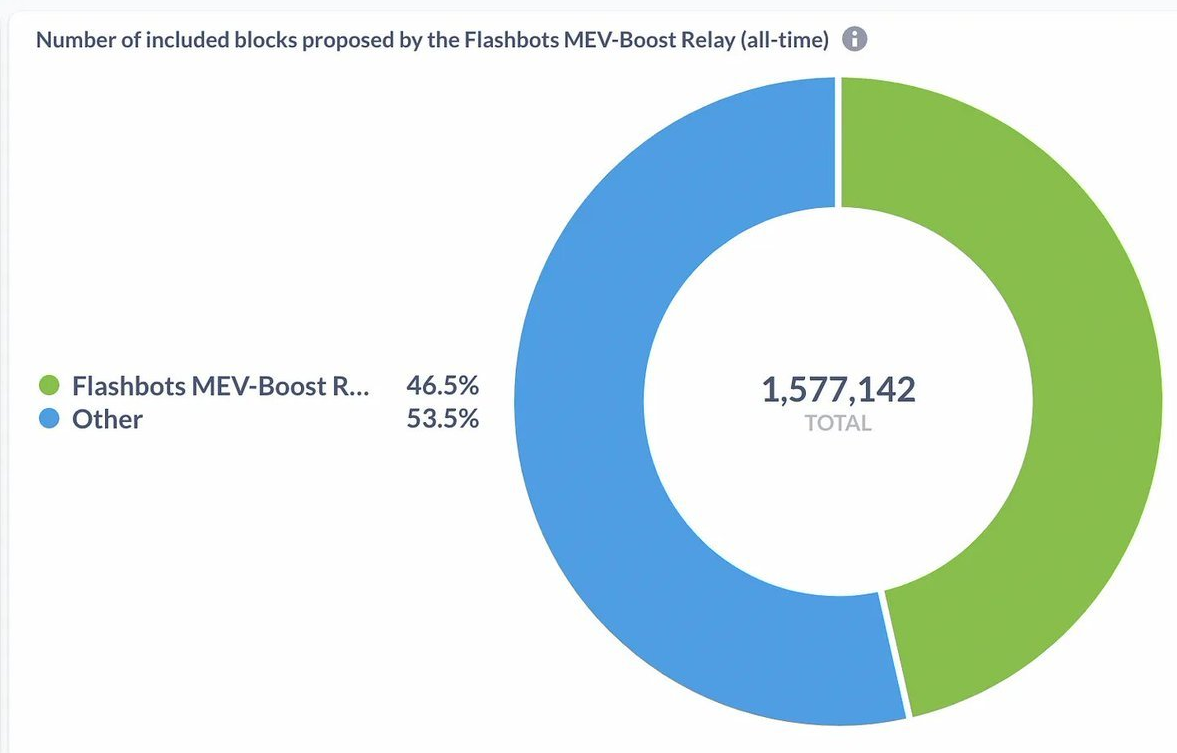

Since The Merge, nearly half of all blocks have been submitted via Flashbots—its dominance even surpasses Lido’s. While Lido controls about 70% of the LSD market, it holds only around 30% of total Ethereum staking.

Hasu, co-founder of Flashbots, also serves as an advisor to Lido and brings strong credentials—but there has been little disclosure so far regarding token issuance.

Mev-Share has already established the foundation for flywheel growth. Latecomers attempting to fork the protocol and launch tokens may still capture some market share, but the technical barrier is significantly higher compared to typical LSD-Fi projects—one might say they're worlds apart.

Additionally, Flashbots has yet to achieve full trustlessness and faces several unresolved challenges—leaving considerable room for innovation and opportunity.

Conclusion

The MEV sector holds vast potential and remains in its early stages.

Flashbots currently dominates the space, and Mev-Share lays the groundwork for rapid expansion—but significant opportunities remain for future players.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News