Decentralized contract trading platform Orbits shares market-making revenue with users

TechFlow Selected TechFlow Selected

Decentralized contract trading platform Orbits shares market-making revenue with users

Since the frequent collapse of crypto industry giants represented by FTX in 2022, decentralization and transparency in crypto trading markets have increasingly drawn attention.

Since 2022, major collapses in the crypto industry—epitomized by FTX—have intensified scrutiny around centralization and transparency in cryptocurrency trading. Traders have become increasingly aware of the drawbacks of traditional centralized exchanges (CeFi), making the migration from CeFi to decentralized finance (DeFi) not a question of "if," but "when."

Beyond security, decentralized exchange (DEX) liquidity incentive mechanisms now allow ordinary users to experience the passive income benefits traditionally reserved for exchange operators. Today, beyond just spot DEXs, even derivative and futures products—once exclusive strengths of centralized exchanges (CEX)—are being gradually overtaken. Decentralized contract trading platforms are now entering a period of rapid growth, offering users new ways to earn returns beyond trading itself.

Next, we introduce Orbits—a decentralized trading platform with strong technological and product advantages. Orbits achieves an excellent balance between cost, efficiency, decentralization, and security, while innovatively allowing users to participate in liquidity provision and share in market makers’ liquidity revenues and transaction fees. This enables everyday users to experience the financial rewards typically reserved for top-tier players like exchanges and market makers.

Orbits: A ZK-SNARK-Powered Decentralized Exchange

Orbits is a multi-chain order-book-based decentralized exchange built on ZK-SNARK technology, supporting both spot and perpetual contract trading. It delivers fast, secure, and low-cost decentralized trading experiences. Orbits enables liquidity aggregation and strategy-driven trading for both spot and perpetual contracts, sharing trading fees and market-making liquidity revenue with all users.

Leveraging Ethereum Layer-2 technology and ZK-SNARKs, Orbits ensures high security and efficiency while significantly reducing transaction costs and optimizing execution speed. Notably, Orbits is the first L2-based DEX to support strategic trading, empowering users to generate enhanced returns through active trading strategies.

Product Advantages of Orbits

The team clearly understands trader psychology, recreating a seamless trading experience within the decentralized on-chain environment, complete with depth aggregation, liquidity supplementation, and active trading strategies.

An Order-Book DEX with CEX-Level Experience

Orbits uses an order-book model for both spot and perpetual contracts, supporting both market and limit orders. Limit orders incur zero price slippage, and the user experience mirrors that of centralized exchanges (CEX). Market makers employ grid and quantitative strategies with full flexibility. Unlike AMM-model DEXs, Orbits market makers do not suffer impermanent loss. The platform supports both spot and perpetual contracts with familiar CEX-style functionality, including stop-loss and take-profit features. Perpetual contracts support up to 20x leverage.

Contract Depth Aggregator

Orbits' aggregator unifies liquidity from platforms such as Orbits and Binance to achieve optimal trade execution prices. This feature is a key differentiator, filling a market gap for contract-trading-focused DEX aggregators.

Multi-Chain Support

As a multi-chain, ZK-SNARK-powered decentralized exchange, Orbits supports both spot and perpetual contract trading across multiple blockchains. This enables cross-chain interoperability, satisfying user demand for seamless trading across chains and improving capital efficiency.

Liquidity Provision + Fee Sharing: Massive Earnings for Users

Exchanges sit at the top of the cryptocurrency industry food chain. Contract trading has long been their most profitable business, generating revenue primarily from trading fees and substantial counterparty gains. Historical trader performance shows that in most cases, traders lose while the house wins. During liquidations, most of the losing users’ assets are captured by the exchange and its market makers providing liquidity.

Orbits aims to break this concentration of profits among large capital holders by redistributing both trading fees and liquidity/market-making gains—essentially sharing counterparty and execution revenue with regular users.

High-Frequency Trading Revenue

Orbits partners with users who contribute funds to its liquidity provision system, using high-frequency trading APIs to automate rapid order placement. This provides robust liquidity while executing user orders, enhancing platform liquidity and generating significant fee revenue. As a result, contributing users effectively become market makers, enjoying high returns similar to Binance’s official market makers. Losses incurred by other traders directly translate into profits for these “mini market makers.” Each funding user can monitor real-time, minute-by-minute and hour-by-hour trading activity and individual profit/loss data from the DEX’s high-frequency accounts. All high-frequency liquidity provision earnings are aggregated and distributed daily to contributors.

Active Strategy Trading Revenue

Unlike other contract DEXs, Orbits goes beyond earning liquidity fees via high-frequency APIs. The platform collaborates with funding users to deploy active trading strategies that capture excess market returns—leveraging technical analysis to profit from future market movements. For example, grid trading strategies enable automatic buy-low-sell-high operations within predefined price ranges.

Orbits also supports trend-following strategies, maximizing user profitability. By setting entry prices, exit triggers, and maximum drawdown thresholds, users can fully capture trending market moves. Combined with trading signals derived from monitoring fund flows across major centralized and decentralized exchanges, these strategies enhance short-to-medium-term returns. Profits generated from active strategies are also shared with participating users.

Order Hedging Revenue

In addition to providing immediate liquidity, Orbits actively hedges positions against top centralized exchanges like Binance to ensure fast execution of market orders. While maintaining normal liquidity, if the real-time price difference between Orbits and Binance exceeds 10 USDT, API bots automatically execute trades and hedge on Binance, bringing prices back into alignment—and capturing arbitrage profits in the process. These hedging gains are retained by the platform and ultimately shared with users.

Platform Fee Subsidies

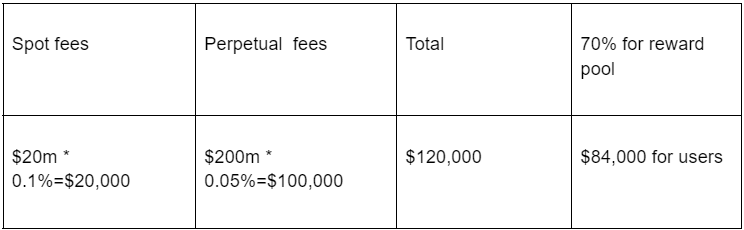

Beyond market-making profits, Orbits generously shares its transaction fee revenue. Specifically, 70% of all user trading fees are allocated to a reward pool and distributed to liquidity providers who co-market-make with the platform via its liquidity protocol.

Orbits charges a 0.1% fee for spot trading and 0.05% for perpetual contracts. Assuming $200 million in daily trading volume, this translates to $84,000 in daily subsidy payouts. More importantly, users also benefit from substantial counterparty gains.

High User Returns Are Achievable

Exchange and market maker revenues are enormous. During relatively stable markets, 24-hour liquidation volumes hover around $200 million; during volatile periods, they can exceed $1 billion. Coinbase reported a quarterly net profit of $771.5 million, averaging $8.57 million per day. Binance, the world’s largest exchange, earned $3 billion in profit during the same quarter. A significant portion of these profits comes from spot and derivatives trading fees. Orbits redistributes much of this revenue—traditionally captured only by market makers—to all liquidity-providing users.

In summary, users receive subsidies from 70% of total platform fees. Funding users gain additional returns by leveraging Orbits’ high-frequency liquidity APIs and active strategy trading tools, earning market-making profits and inter-exchange hedging gains. In the future, they may also receive governance token incentives and early access to discounted token allocations via Orbits’ upcoming launchpad. Through these mechanisms, Orbits enables every user to experience the passive income joy of being a market maker.

Comparison With Similar Platforms

Compared to leading decentralized derivatives platforms DYDX and GMX, Orbits offers distinct advantages.

GMX’s main drawback lies in its reliance on oracles to determine prices, leaving liquidity providers (LPs) in a passive role. LPs cannot control their market-making strategies and earn only minimal trading and borrowing fees. During extreme market conditions—such as sharp rallies or crashes—large imbalances in open long or short positions accumulate. Since LPs act as counterparties, they effectively assume the opposite position (short during bull runs, long during bear markets), exposing them to losses akin to impermanent loss in standard AMMs. GMX mitigates this by charging hourly funding fees to both long and short sides, increasing trading costs for perpetual contract users.

Orbits avoids this issue by supporting active market-making strategies. More importantly, within Orbits’ order-book DEX model, users can go beyond passive liquidity provision. By employing grid and trend-following strategies, they can actively profit from price volatility, gaining greater control and unlocking higher profit margins to share with users.

Orbits offers lower trading fees and shares 70% of fee revenue with users—significantly more than GMX’s 30% fee split for LPs. It supports a wider range of tokens and trading pairs, including limit orders for both spot and derivatives. With deeper order books and lower fees, Orbits attracts more traders, which enhances platform liquidity and revenue. This, in turn, increases potential returns for funding users—an upward spiral of growth and profitability.

Orbits Development Roadmap

Since launching in September 2022, Orbits has attracted widespread attention from the crypto community, partnering with numerous KOLs and prominent projects. It maintains enthusiast communities in English, Korean, Japanese, Indonesian, and Chinese, and has amassed over 30,000 followers on Twitter and other social media platforms—with continued growth. Orbits’ global outreach events have already taken place in Romania, the Philippines, Vietnam, and other countries.

Currently, Orbits’ technical framework has been validated, and its testnet is live, supporting full decentralized spot and contract trading functionality. An upcoming trading competition will soon be launched. Although Orbits entered the market later than some competitors, its superior product features and “profit-sharing” model—distributing fees and market-making gains to users—position it well to capture market share and deliver greater value to users.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News